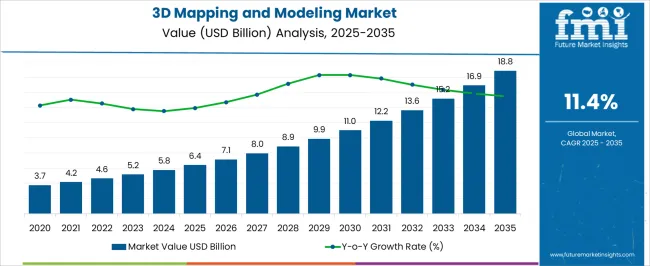

The 3D Mapping and Modeling Market is estimated to be valued at USD 6.4 billion in 2025 and is projected to reach USD 18.8 billion by 2035, registering a compound annual growth rate (CAGR) of 11.4% over the forecast period.

| Metric | Value |

|---|---|

| 3D Mapping and Modeling Market Estimated Value in (2025 E) | USD 6.4 billion |

| 3D Mapping and Modeling Market Forecast Value in (2035 F) | USD 18.8 billion |

| Forecast CAGR (2025 to 2035) | 11.4% |

The 3D mapping and modeling market is expanding rapidly due to increasing adoption of visualization technologies across industries such as construction, urban planning, entertainment, and autonomous vehicles. Advancements in geospatial data collection, LiDAR integration, and photogrammetry have improved accuracy and scalability of 3D models.

The growing need for immersive experiences in gaming and media, coupled with the application of digital twins in infrastructure and manufacturing, is accelerating demand. Governments and enterprises are investing in smart city projects and digital transformation initiatives, creating strong growth opportunities.

Cloud integration, AI enabled automation, and improved rendering capabilities are further driving innovation. The outlook remains highly favorable as businesses seek precise and interactive mapping solutions to enhance operational efficiency, decision making, and user engagement.

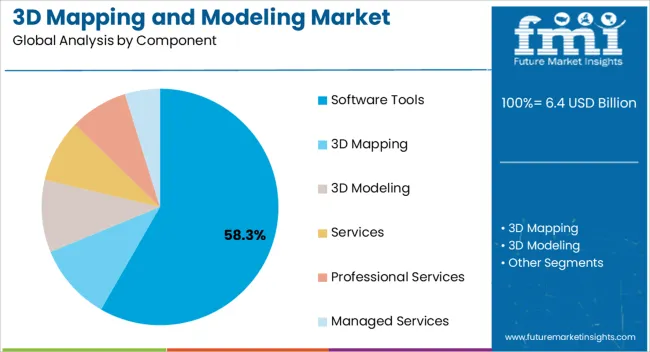

The software tools segment is expected to represent 58.30% of total revenue by 2025 within the component category, establishing itself as the leading segment. Growth in this segment is supported by rising adoption of software solutions that enable real time visualization, data analysis, and 3D rendering across industries.

The ability of software tools to provide advanced customization, simulation, and integration with other digital platforms has strengthened their deployment. Increasing demand for flexible and scalable solutions in design, planning, and engineering processes has further enhanced adoption.

Continuous innovation in cloud based modeling and AI powered analytics is solidifying the dominance of this segment.

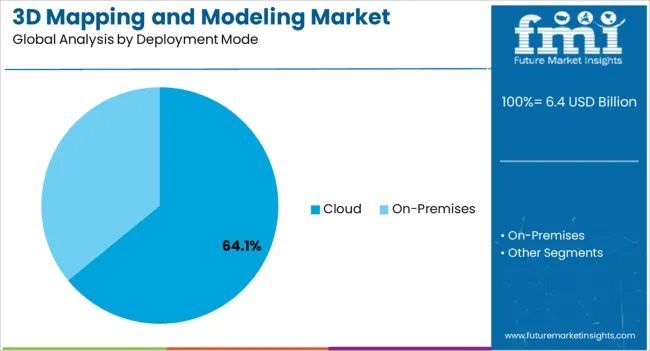

The cloud segment is projected to account for 64.10% of overall revenue by 2025 within the deployment mode category, making it the most significant contributor. Cloud based solutions provide scalability, cost efficiency, and ease of access, which are critical for enterprises managing large data volumes generated by 3D mapping applications.

Collaboration across geographies, integration with real time data sources, and lower infrastructure costs have accelerated cloud adoption. Furthermore, enterprises benefit from seamless updates, enhanced security protocols, and compatibility with mobile devices, strengthening reliance on cloud platforms.

The shift toward digital ecosystems and smart infrastructure continues to reinforce the dominance of this segment.

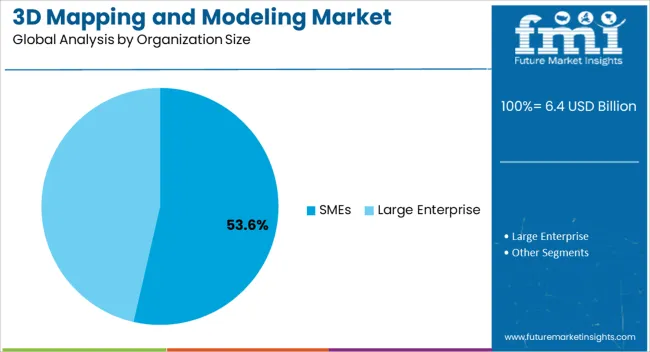

The SMEs segment is projected to hold 53.60% of market revenue by 2025 within the organization size category, positioning it as the leading segment. This growth is attributed to the increasing affordability and accessibility of 3D mapping tools, enabling smaller organizations to leverage advanced visualization for design, planning, and marketing applications.

SMEs are using these technologies to enhance competitiveness, streamline operations, and improve customer engagement. Cloud based deployment and subscription pricing models have made these tools more accessible to smaller firms.

As digital adoption accelerates among SMEs across diverse sectors, this segment is expected to sustain its market leadership.

As per the 3D mapping and modeling industry research by Future Market Insights, the market value of the 3D mapping and modeling industry increased at around 21.7% CAGR. Wherein, countries such as the United Kingdom, the United States, China, and Japan held a significant share in the global market.

The 3D mapping and modeling market reached a valuation of USD 5,126.7 million in 2025. FMI estimates that 3D mapping and modeling revenue is likely to grow 3.6X from 2025 to 2035, reaching nearly USD 13,001.4 million in 2035.

Software tools 3D mapping and modeling held a leading share of the market. The market in Japan is expected to grow significantly for 3D mapping and modeling, with a CAGR of 12.0%.

The cloud shows the highest potential for growth in the 3D mapping and modeling industry in the deployment mode segment. It is expected to grow at a rate of about 13% during the next ten years.

The growing demand for 3D mapping and modeling in the construction industry is one of the key factors driving the market growth. Different areas like medical, civil, and automotive, among others, further contribute to the increasing sales of 3D mapping and modeling solutions.

3D mapping and modeling utilized in plotting streets and buildings, spans, and its expanding attachment with augmented reality applications have kept the demand aloft. Furthermore, entertainment and gaming end-uses have additionally affected the sales of the 3D mapping and modeling market. Increasing demand for 3D Animation used in smart technologies may also contribute towards the growth of 3D mapping and modeling revenue during the forecast period.

Applications of 3D mapping are further expected to increase in the coming years due to the need for custom-designed maps and open-source navigation. Rising interest in driverless vehicles, metros, as well as other vehicle frameworks has prompted the expanded reception of 3D mapping, which has led the 3D mapping and modeling industry to grow.

Different variables for the market development incorporate the rising interest from the application area owing to the rising utilization of 3D activity, games, and films, and the presentation of 3D empowered show gadgets.

The 3D mapping and modeling industry is expected to be driven by the progressions and simple admittance to 3D gears, including sensors, scanners as well as different GPS parts. Moreover, 3D geospatial information in existing cell phones and cell phones is expected to contribute towards market growth.

The key factors that affect the market include high installation costs and a lack of skilled workforce. Customers are required to pay an additional cost for lasers and scanners. Users need to spend the extra sum on projectors, media servers, and hard drives for enhanced video content. These factors are expected to limit the development of 3D mapping and modeling innovation.

Software tools in 3D mapping and modeling held the market's prominent share of 67.5% in 2025. It is expected to grow at a CAGR of 13.3% in the next ten years. Software devices are utilized in different areas like IT, Medical Engineering area and so forth which are contributing critical growth rate of software tools.

3D mapping and modeling software are used by architects to create three-dimensional models of buildings. 3D mapping and modeling software are like a map of a city. It can show the layout of the city, its streets, and buildings, and help you find the way around.

Cloud deployment shows significant potential for growth in the 3D mapping and modeling industry among deployment modes. The market through cloud deployment is expected to grow at a rate of about 13% during the next ten years.

Cloud deployment of 3D mapping and modeling can provide a business with the ability to visualize its data in a new and innovative way. It also allows for easier collaboration between team members.

The United States influenced the market in 2025 with a market value of over USD 1.6 billion. Media and entertainment industry in the country is massive in the world. The increase in the production of colossal 3D movies and 3D gaming in the country is expected to continuously increase the growth rate of the 3D mapping and modeling market in the country.

3D mapping and modeling are becoming increasingly popular in the United States. For example, a recent study found that the use of 3D mapping and modeling increased by nearly 50% between 2014 and 2024. Besides, 3D mapping and modeling are used by many businesses in the United States for various purposes such as creating prototypes and displaying products.

The United Kingdom, Germany, and France are among the leading countries in Europe, all of which are contributing to the market's expansion.

European governments are actively supporting the implementation of 3D mapping and modeling technologies. Initiatives such as the European Spatial Data Infrastructure (ESDI) aim to improve spatial data accessibility and interoperability, facilitating the use of 3D mapping data for various applications. European countries foster collaboration among industry stakeholders, including government bodies, technology providers, and end-users. These collaborations facilitate knowledge sharing, standardization efforts, and the development of best practices in 3D mapping and modeling.

The market during the forecast period spurt in interest in 3D mapping and modeling in emerging countries, particularly Japan and China.

China is likely to record an upward growth trajectory of 10.5% during the analysis period. 3D mapping and modeling are used extensively in China for a variety of purposes including engineering, architecture, and city planning.

For example, the city of Shanghai uses 3D mapping to help plan new developments. Furthermore, The Beijing Institute of Technology is a world-renowned leader in 3D mapping and modeling technology. Their research and development in this field have led to breakthroughs in applications such as medical imaging.

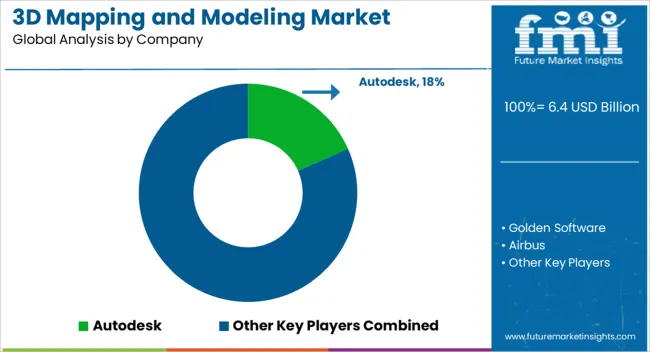

The 3D mapping and modeling market is highly competitive, with several key players vying for market share. These companies are actively involved in research and development activities, strategic partnerships, and product innovations to gain a competitive edge.

| Attributes | Details |

|---|---|

| Growth Rate | CAGR of 11.9% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | Component, Deployment Mode, Organization Size, Vertical, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; The Middle East & Africa; Oceania |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, Italy, France, The United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Autodesk; Golden Software; Airbus; Trimble; Topcon; Saab ab; Bentley Systems; Dassault Group; Apple |

| Customization & Pricing | Available upon Request |

The global 3D mapping and modeling market is estimated to be valued at USD 6.4 billion in 2025.

The market size for the 3D mapping and modeling market is projected to reach USD 18.8 billion by 2035.

The 3D mapping and modeling market is expected to grow at a 11.4% CAGR between 2025 and 2035.

The key product types in 3D mapping and modeling market are software tools, 3D mapping, 3D modeling, services, professional services and managed services.

In terms of deployment mode, cloud segment to command 64.1% share in the 3D mapping and modeling market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Somatosensory Virtual Fitting Market Size and Share Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Clear Dental Aligners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA