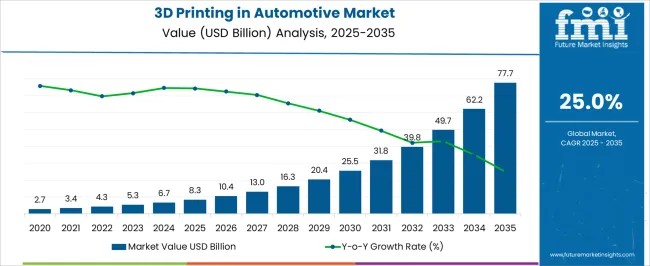

The 3D printing in automotive market is set to expand from USD 8.3 billion in 2025 to USD 77.7 billion by 2035, with a CAGR of 25.0%. A Growth Momentum Analysis reveals an initial period of rapid acceleration followed by continued strong growth. Between 2025 and 2030, the market increases from USD 8.3 billion to USD 25.5 billion, contributing USD 17.2 billion in growth, reflecting a CAGR of 25.1%. This phase shows significant momentum, driven by the increasing adoption of 3D printing for prototyping, lightweight components, and manufacturing efficiency in the automotive industry. The early-stage growth is supported by investments in additive manufacturing technologies, enabling faster production times, reduced costs, and greater design flexibility for automotive parts. From 2030 to 2035, the market continues its upward trajectory, expanding from USD 25.5 billion to USD 77.7 billion, contributing USD 52.2 billion in growth, with a slightly reduced CAGR of 24.0%. This continued acceleration is fueled by broader industry adoption, with 3D printing moving from prototyping to full-scale production of critical automotive components, including engine parts, frames, and interiors. The increased focus on customization, reduced material waste, and faster time-to-market further boosts demand.

| Metric | Value |

|---|---|

| 3D Printing in Automotive Market Estimated Value in (2025 E) | USD 8.3 billion |

| 3D Printing in Automotive Market Forecast Value in (2035 F) | USD 77.7 billion |

| Forecast CAGR (2025 to 2035) | 25.0% |

The 3D printing in automotive market is evolving rapidly as OEMs and Tier 1 suppliers integrate additive manufacturing to reduce development cycles, enhance customization, and streamline production workflows. Growing pressure to accelerate product innovation, lower tooling costs, and adopt lightweight materials has led to broader deployment of 3D printing across design, prototyping, and low-volume manufacturing.

Automakers are increasingly investing in digital fabrication labs and distributed manufacturing strategies to support on-demand production and inventory reduction. Regulatory support for emission reduction and the global push toward electric vehicles are also driving demand for intricate components made from advanced polymers and composites.

Advancements in metal printing, multi-material capabilities, and post-processing automation are expected to unlock further opportunities for structural applications and supply chain efficiency over the coming years.

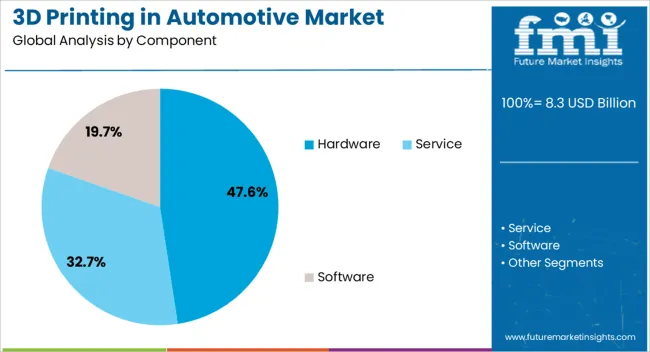

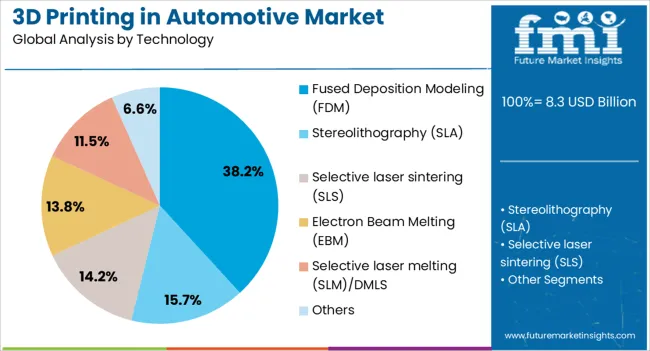

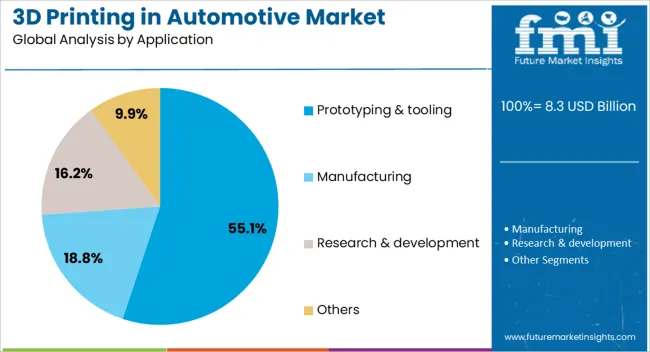

The market is segmented by component, technology, application, and region. By component: hardware; services; software. By technology: fused deposition modeling (FDM); stereolithography (SLA); selective laser sintering (SLS); electron beam melting (EBM); selective laser melting (SLM) / direct metal laser sintering (DMLS); others. By application: prototyping & tooling; manufacturing; research & development; others. By region: North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

Hardware is expected to account for 47.60% of the total revenue in the 3D printing in automotive market by 2025, making it the leading component segment. This growth is being driven by increased capital investments by automakers in industrial-grade printers for in-house use and outsourced production hubs.

A wide range of hardware solutions from desktop to high-volume production printers are being adopted for precision manufacturing of both polymer and metal parts. The scalability and cost-efficiency of newer printer models have allowed automotive firms to reduce reliance on external suppliers for functional prototypes and tools.

Additionally, technological advancements in build volume, print speed, and resolution are enabling production of complex parts that were previously unfeasible using traditional methods.

Fused deposition modeling is projected to hold 38.20% of the market share in 2025, ranking it as the most utilized technology in automotive 3D printing. This prominence is supported by the technology’s affordability, material versatility, and operational simplicity.

FDM has become a preferred choice for rapid prototyping and fixture development, particularly due to its compatibility with a broad range of thermoplastics, including engineering-grade materials. Automotive design teams are leveraging FDM for fast iterations, functional testing, and low-risk design validation.

As print speed and resolution continue to improve, FDM systems are being integrated into various stages of the automotive development pipeline. Their ease of operation, low maintenance, and growing ecosystem of compatible software and materials are further enhancing adoption.

Prototyping and tooling are expected to contribute 55.10% of the total revenue share in 2025, making it the dominant application area for 3D printing in the automotive sector. This segment’s strength lies in the ability to significantly reduce development time and costs through the creation of testable prototypes and custom tools.

Design validation, aerodynamic testing, and ergonomic modeling are being accelerated with the use of 3D-printed parts that closely replicate production-grade components. Additionally, the ability to produce jigs, fixtures, and assembly aids on demand has improved flexibility and efficiency on factory floors.

Automotive firms are also deploying 3D printing to localize production of specialized tooling and spares, reducing lead times and inventory costs. As the industry embraces lean and agile manufacturing, the role of prototyping and tooling through additive manufacturing is expected to remain central.

The adoption of 3D printing in the automotive sector is increasing due to its ability to accelerate prototyping, reduce costs, and streamline production processes. 3D printing allows for rapid prototyping of automotive parts, making it easier to test designs and create custom components. The technology is also being used to produce lightweight and durable parts, contributing to more fuel-efficient vehicles. Despite challenges such as high equipment costs and material limitations, the opportunities for innovation and market expansion, especially in electric vehicles and autonomous systems, are significant.

The increasing use of 3D printing in the automotive sector is primarily driven by its ability to reduce production costs and enhance efficiency in manufacturing processes. Traditional manufacturing methods for automotive parts can be expensive and time-consuming. 3D printing enables automakers to produce complex parts at a lower cost, while also reducing material waste. The ability to rapidly prototype designs and produce custom parts for specific vehicle models is also pushing the adoption of 3D printing. Furthermore, the growing demand for lightweight components to improve fuel efficiency and performance in vehicles is driving the development of advanced 3D printed materials. As manufacturers continue to seek innovative ways to streamline production and reduce costs, 3D printing technology offers a solution that aligns with industry goals.

Despite the benefits of 3D printing, there are several challenges facing the automotive sector. One of the primary barriers is the high initial investment required to adopt 3D printing technology. The cost of 3D printers, especially industrial-grade machines capable of producing high-quality automotive parts, can be prohibitive for smaller manufacturers. Additionally, the range of materials available for 3D printing, while growing, remains limited compared to traditional materials used in automotive manufacturing. The strength, durability, and thermal resistance of 3D printed parts can vary depending on the material used, making them unsuitable for certain applications. Moreover, the production speed of 3D printers can be slower than conventional manufacturing methods, which can limit their effectiveness in mass production environments. These factors present challenges for widespread adoption across the automotive industry.

3D printing presents significant opportunities in the automotive industry, particularly in the growing electric vehicle (EV) market. As EV manufacturers focus on reducing weight and improving efficiency, 3D printing offers the ability to create lightweight, complex components that traditional manufacturing methods cannot easily produce. Additionally, 3D printing enables greater customization of parts, allowing for the production of bespoke components tailored to specific vehicle models or customer needs. This is particularly valuable in the high-performance automotive and luxury car sectors, where custom designs are in high demand. As the technology continues to evolve, the development of more advanced 3D printing materials and faster production speeds will further unlock opportunities for automakers to integrate 3D printing into their supply chains, driving innovation and enhancing production flexibility.

The 3D printing in automotive sector is experiencing several key trends, with material science advancements playing a critical role in its growth. Manufacturers are focusing on developing new materials that offer improved strength, durability, and resistance to heat, which are essential for the automotive industry. New 3D printing materials such as carbon fiber-infused polymers, metal alloys, and high-performance plastics are expanding the potential applications of the technology. Another important trend is the integration of 3D printing with traditional manufacturing methods, which is enabling automakers to combine the benefits of both approaches. Hybrid production models, where 3D printing is used for prototyping or producing low-volume custom parts alongside conventional methods for mass production, are becoming increasingly common. This trend allows manufacturers to optimize production efficiency while leveraging the flexibility and innovation offered by 3D printing technology.

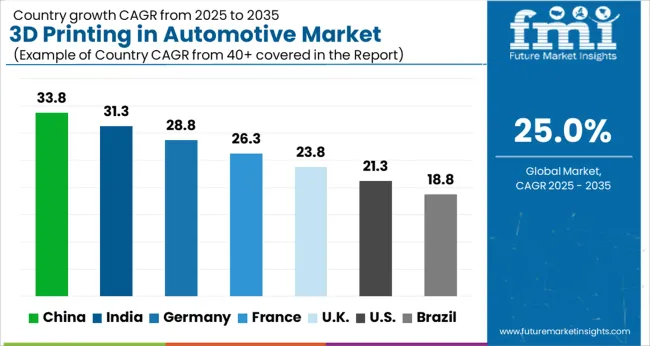

The 3D printing in automotive market is projected to grow at a global CAGR of 25% from 2025 to 2035. China leads with a CAGR of 33.8%, followed by India at 31.3%, and France at 26.3%. The United Kingdom records 23.8%, while the United States stands at 21.3%. The growing demand for custom, lightweight parts, and the need for more efficient manufacturing processes in the automotive sector drive market growth. The increasing adoption of 3D printing technologies in vehicle design, prototyping, and manufacturing is expected to continue expanding in all regions. The analysis spans 40+ countries, with the leading markets shown below.

France is projected to grow at a CAGR of 26.3% through 2035, with increasing adoption of 3D printing technologies in the automotive sector. The country is seeing a rise in the use of additive manufacturing for producing prototypes, components, and tooling in the automotive industry. French automotive manufacturers are leveraging 3D printing to create more customized, lightweight parts that enhance vehicle performance and reduce fuel consumption. The government’s support for digital transformation in manufacturing and the push for innovation in the automotive sector further contribute to the growth of 3D printing applications in this market.

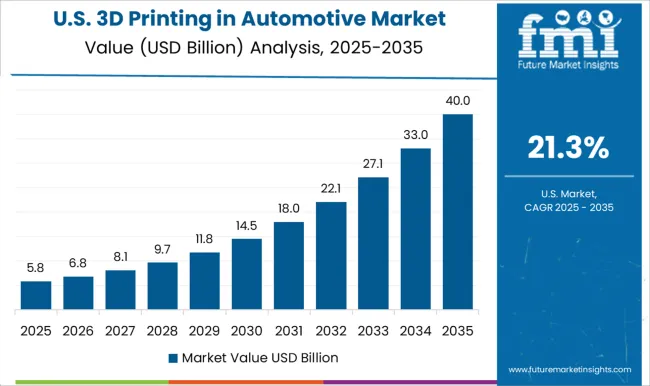

The United States is projected to grow at a CAGR of 21.3% through 2035, driven by the rapid adoption of 3D printing technologies in automotive manufacturing. The USA automotive sector has been quick to implement 3D printing for prototyping, tooling, and manufacturing components. The technology’s ability to reduce production time, lower costs, and create highly customized, lightweight vehicle parts makes it a preferred choice for many USA automotive manufacturers. In addition, the increasing emphasis on electric vehicles (EVs) and the need for more efficient components is expected to drive the demand for 3D printing in automotive applications. The focus on innovation and sustainable manufacturing technologies will continue to push the market forward.

The United Kingdom is projected to grow at a CAGR of 23.8% through 2035, driven by the increasing adoption of 3D printing technologies in the automotive industry. The UK automotive sector is leveraging additive manufacturing to create more efficient and lightweight components, reducing production costs and improving vehicle performance. The rise in electric vehicle (EV) adoption, coupled with the demand for customized and sustainable vehicle parts, is pushing the need for advanced manufacturing technologies. The UK government’s focus on innovation in manufacturing technologies and the development of smart cities further supports the growth of the market.

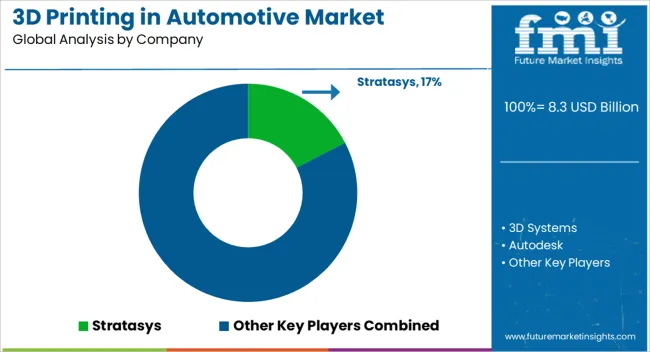

The 3D printing in the automotive market is driven by leading technology companies and manufacturers specializing in advanced 3D printing solutions for automotive design, prototyping, and production. Stratasys and 3D Systems are market leaders, offering cutting-edge 3D printing technologies that enable automotive companies to create complex, customized parts for prototypes and final products, reducing production time and costs. Autodesk plays a significant role in providing design software and solutions that facilitate the integration of 3D printing technologies in automotive manufacturing processes.

Exone specializes in binder jetting 3D printing technology for producing durable and high-precision automotive components, particularly in metal and sand printing. Hoganas AB provides high-quality metal powders and additive manufacturing services for automotive applications, improving part quality and performance. Competitive differentiation in this market is driven by technology innovation, material quality, speed, and cost-effectiveness. Barriers to entry include high equipment costs, technological expertise, and the need for customization in automotive production.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Component | Hardware, Service, and Software |

| Technology | Fused Deposition Modeling (FDM), Stereolithography (SLA), Selective laser sintering (SLS), Electron Beam Melting (EBM), Selective laser melting (SLM)/DMLS, and Others |

| Application | Prototyping & tooling, Manufacturing, Research & development, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Stratasys, 3D Systems, Autodesk, Arcam, Voxeljet AG, Exone, Hoganas AB, Ponoko Ltd., Hanhook Tires, and AI Design |

| Additional Attributes | Dollar sales by printing technology (FDM, SLA, SLS, binder jetting) and end-use segments (automotive prototyping, production parts, custom components). Demand dynamics are driven by the increasing need for rapid prototyping, reduced manufacturing costs, and the ability to produce customized, lightweight components in the automotive industry. Regional trends show strong growth in North America and Europe, with emerging opportunities in Asia-Pacific as automotive manufacturers invest in 3D printing for innovation and production efficiency. |

The global 3D printing in automotive market is estimated to be valued at USD 8.3 billion in 2025.

The market size for the 3D printing in automotive market is projected to reach USD 77.7 billion by 2035.

The 3D printing in automotive market is expected to grow at a 25.0% CAGR between 2025 and 2035.

The key product types in 3D printing in automotive market are hardware, _printer, _material, service and software.

In terms of technology, fused deposition modeling (fdm) segment to command 38.2% share in the 3D printing in automotive market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D Display Market Size and Share Forecast Outlook 2025 to 2035

3D Neuroscience Market Size and Share Forecast Outlook 2025 to 2035

3D Glasses Market Size and Share Forecast Outlook 2025 to 2035

3D Laser Scanner Market Growth - Trends & Forecast 2025 to 2035

3D Scanners Market Size and Share Forecast Outlook 2025 to 2035

3D Sensor Market Size and Share Forecast Outlook 2025 to 2035

3D Reconstruction Technology Market Analysis & Forecast by Component, Type, Enterprise Size, Deployment Model, Application, and Region Through 2035

3D Cell Culture Market - Demand, Size & Industry Trends 2025 to 2035

3D Motion Capture Market by System, Component, Application & Region Forecast till 2035

3D TSV Packages Market Analysis by Process Realization, Application, End Users, and Region through 2035

3D Metrology Market Insights – Growth & Industry Outlook 2025 to 2035

3D Camera Market Growth – Trends & Forecast 2025 to 2035

3D Secure Payment Authentication Market Insights by Components, Application, and Region - 2025 to 2035

3D Mobile Theater Market Demand & Trends 2024 to 2034

3D ICs Market

3D Display Module Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA