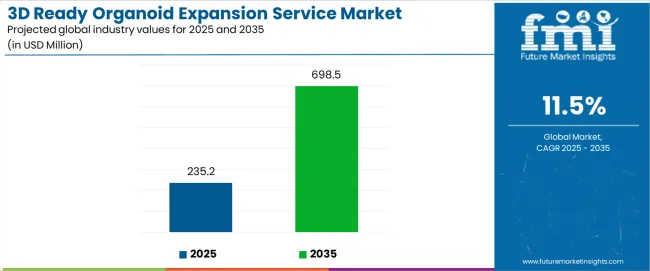

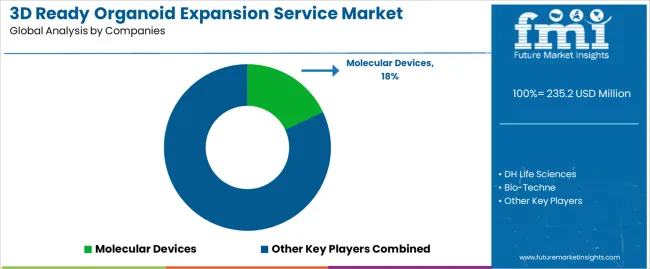

The global 3D ready organoid expansion service market is valued at USD 235.2 million in 2025 and is projected to reach USD 698.5 million by 2035, recording an absolute increase of USD 463.3 million. This reflects a CAGR of 11.5% and a total growth of 197%, with the overall market size expected to expand nearly 3.0X. Examining historical patterns alongside forecast developments provides clarity on how organoid expansion services are evolving as a core component of biomedical research, drug discovery, and personalized medicine.

Historical trends prior to 2025 highlight the early adoption phase of organoid technology. From 2015 to 2020, growth was modest, driven primarily by academic research institutions experimenting with three-dimensional cell culture methods for disease modeling and developmental biology. The limited scalability of organoid cultures, high costs, and lack of standardized protocols constrained widespread uptake. Between 2020 and 2025, adoption accelerated as pharmaceutical and biotech companies began integrating organoid models into preclinical workflows. Demand was reinforced by the search for more predictive alternatives to animal models, particularly in oncology and neurology. Service providers responded by investing in automation, bioreactor-based expansion, and cryopreservation techniques, laying the foundation for commercial scalability. The historical phase is thus characterized by gradual adoption, innovation-led growth, and proof-of-concept validation across early-stage drug testing and regenerative therapy research.

Forecast trends between 2025 and 2030 point to a transition toward structured commercial adoption. Approximately 40% of total forecast growth is expected in this phase, reflecting rising demand for patient-derived organoid models in personalized medicine. Pharma pipelines will increasingly rely on organoid expansion services for high-throughput drug screening, toxicity testing, and biomarker identification. Demand from academic and contract research organizations will remain steady, but greater revenue will come from partnerships with pharmaceutical firms seeking tailored disease models. Services focused on gastrointestinal, liver, and oncology organoids will dominate early forecast growth, while standardization of culture methods will reduce variability and enable larger-scale deployment.

Between 2030 and 2035, the 3D ready organoid expansion service market is expected to record the strongest growth momentum, capturing around 60% of forecast expansion. Advancements in automation, imaging, and artificial intelligence-based data analysis will enable high-throughput organoid expansion at reduced costs. Broader applications in regenerative medicine, transplantation research, and patient-specific therapy development will drive adoption beyond drug discovery. Regional expansion in Asia Pacific and Europe will add further scale, supported by growing investments in precision medicine and public-private partnerships. Service providers capable of integrating organoid expansion with downstream applications, such as CRISPR-based gene editing or advanced biobanking, will capture larger shares.

Between 2025 and 2030, the 3D ready organoid expansion service market is projected to expand from USD 235.2 million to USD 363.5 million, resulting in a value increase of USD 128.3 million, which represents 27.7% of the total forecast growth for the decade. This phase of development will be shaped by increasing pharmaceutical industry adoption of organoid screening platforms, rising investment in precision medicine research, and growing demand for standardized organoid expansion protocols that enable reproducible disease modeling and therapeutic testing. Biotechnology companies and research institutions are expanding their organoid culture capabilities to address the growing demand for physiologically relevant and scalable three-dimensional cell models that ensure experimental accuracy and translational relevance.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 235.2 million |

| Forecast Value in (2035F) | USD 698.5 million |

| Forecast CAGR (2025 to 2035) | 11.5% |

From 2030 to 2035, the 3D ready organoid expansion service market is forecast to grow from USD 363.5 million to USD 698.5 million, adding another USD 335.0 million, which constitutes 72.3% of the overall ten-year expansion. This period is expected to be characterized by the expansion of clinical translation programs and regenerative medicine applications, the development of automated organoid culture platforms and high-throughput screening systems, and the growth of specialized applications for cancer research, infectious disease modeling, and organ-on-chip integration. The growing adoption of artificial intelligence-guided organoid analysis and multi-omics characterization will drive demand for 3D ready organoid expansion services with enhanced reproducibility, quality control, and biological fidelity.

Between 2020 and 2025, the 3D ready organoid expansion service market experienced steady growth, driven by increasing recognition of organoid technology as essential tools for understanding human biology and growing pharmaceutical industry interest in more predictive preclinical models. The 3D ready organoid expansion service market developed as researchers and drug developers recognized the potential for three-dimensional organoid cultures to recapitulate organ architecture, maintain genetic stability, and predict clinical responses while addressing limitations of traditional two-dimensional cell cultures and animal models. Technological advancement in culture media formulation and biomaterial scaffolds began emphasizing the critical importance of maintaining stem cell characteristics and tissue-specific differentiation in long-term expansion protocols.

Market expansion is being supported by the increasing global investment in precision medicine and personalized therapy development driven by genomic medicine advances and patient-centric healthcare trends, alongside the corresponding need for physiologically relevant model systems that can capture individual patient biology, predict therapeutic responses, and enable targeted treatment strategies across drug development, disease research, and regenerative medicine applications. Modern pharmaceutical companies and research institutions are increasingly focused on implementing organoid-based approaches that can reduce drug development timelines, improve preclinical-to-clinical translation, and provide mechanistic insights into disease pathogenesis.

The growing emphasis on alternatives to animal testing and ethical research practices is driving demand for human-relevant organoid models that can provide superior translational value, reduce animal use, and address species-specific biological differences. Researchers' preference for culture systems that combine physiological relevance with experimental reproducibility and scalability is creating opportunities for innovative organoid expansion service implementations. The rising influence of regulatory acceptance and pharmaceutical industry validation is also contributing to increased adoption of standardized organoid platforms that can provide reliable results without compromising biological complexity or experimental throughput.

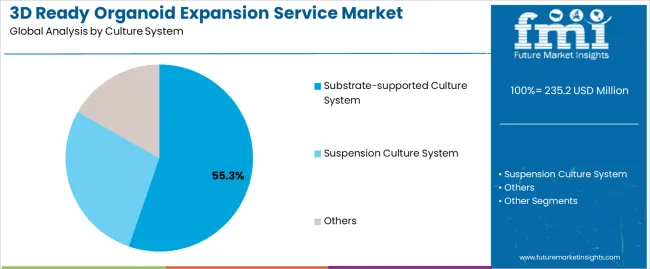

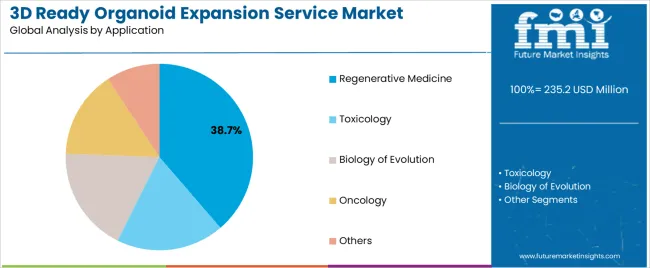

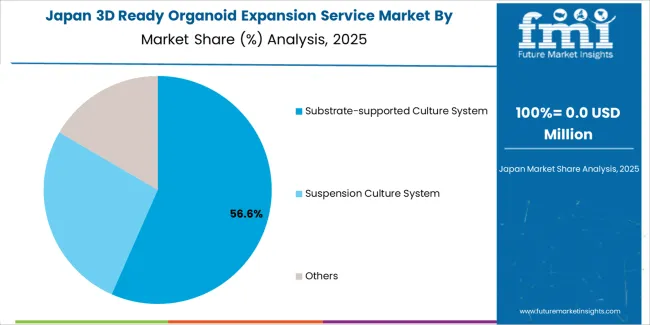

The 3D ready organoid expansion service market is segmented by culture system, application, and region. By culture system, the 3D ready organoid expansion service market is divided into substrate-supported culture system, suspension culture system, and others. Based on application, the 3D-ready organoid expansion service market is categorized into regenerative medicine, toxicology, biology of evolution, oncology, and others. Regionally, the 3D ready organoid expansion service market is divided into East Asia, Europe, North America, South Asia, Latin America, the Middle East & Africa, and Eastern Europe.

The substrate-supported culture system segment is projected to maintain its leading position in the 3D ready organoid expansion service market in 2025 with a 55.3% market share, reaffirming its role as the preferred culture platform for patient-derived organoid expansion and long-term maintenance applications. Research institutions and pharmaceutical companies increasingly utilize substrate-supported systems for their superior cell attachment characteristics, excellent nutrient exchange properties, and proven effectiveness in maintaining organoid viability while supporting complex tissue architecture. Substrate-supported technology's proven effectiveness and biological fidelity directly address the research requirements for stable organoid cultures and reproducible experimental models across diverse tissue types and disease conditions.

This culture system segment forms the foundation of modern organoid research, as it represents the platform with the greatest contribution to standardized protocols and established performance record across multiple organoid types including intestinal, liver, brain, and tumor organoids. Biomedical research investments in three-dimensional culture technologies continue to strengthen adoption among academic laboratories and pharmaceutical screening facilities. With increasing demands for physiologically relevant models and reproducible results, substrate-supported culture systems align with both scientific rigor and practical workflow requirements, making them the central component of comprehensive organoid research strategies.

The regenerative medicine application segment is projected to represent the largest share of 3D ready organoid expansion service demand in 2025 with a 38.7% market share, underscoring its critical role as the primary driver for organoid technology adoption across stem cell therapy development, tissue engineering approaches, and organ transplantation research applications. Regenerative medicine researchers prefer organoid expansion services due to their exceptional ability to generate patient-specific tissues, maintain regenerative capacity, and model developmental processes while supporting therapeutic cell production and transplantation studies. Positioned as essential tools for advancing regenerative therapies, 3D ready organoid expansion services offer both biological authenticity and clinical translation potential.

The segment is supported by continuous innovation in stem cell biology and the growing availability of defined culture conditions that enable controlled organoid differentiation with enhanced maturation and functional integration. Additionally, regenerative medicine researchers are investing in comprehensive organoid characterization programs to support increasingly stringent regulatory requirements and growing clinical trial activities for cell-based therapies. As regenerative medicine advances and personalized treatment approaches expand, the regenerative medicine application will continue to dominate the 3D ready organoid expansion service market while supporting advanced organoid culture optimization and therapeutic translation strategies.

The 3D ready organoid expansion service market is advancing steadily due to increasing pharmaceutical industry investment in predictive preclinical models driven by high drug attrition rates and growing emphasis on patient-derived research platforms that provide physiologically relevant cellular environments and genetic diversity representation across drug screening, disease mechanism studies, and personalized medicine applications. However, the 3D ready organoid expansion service market faces challenges, including high service costs and technical complexity, standardization gaps in culture protocols and quality control metrics, and scalability limitations for commercial production and high-throughput applications. Innovation in automated culture systems and artificial intelligence-guided quality assessment continues to influence service development and market expansion patterns.

The growing adoption of precision oncology is driving demand for patient-derived tumor organoid services that address cancer heterogeneity challenges including individual genetic variations, tumor microenvironment complexity, and therapeutic response prediction for personalized treatment planning. Cancer research applications require advanced organoid expansion protocols that preserve tumor characteristics across multiple passages while maintaining clonal diversity and drug sensitivity profiles. Pharmaceutical companies and cancer centers are increasingly recognizing the competitive advantages of organoid-based drug screening for clinical trial patient selection and therapy optimization, creating opportunities for specialized expansion services specifically designed for oncology applications and companion diagnostics development.

Modern organoid service providers are incorporating microfluidic culture platforms and organ-on-chip systems to enhance physiological relevance, enable dynamic culture conditions, and support comprehensive functional analysis through integrated sensors, perfusion control, and multi-organ connectivity. Leading companies are developing organoid-on-chip platforms with automated media exchange, implementing vascularization strategies for improved nutrient delivery, and advancing culture systems that replicate organ-level functions and inter-tissue communication. These technologies improve experimental capabilities while enabling new research opportunities, including pharmacokinetic modeling, systemic toxicity assessment, and complex disease modeling involving multiple organ systems. Advanced integration also allows researchers to investigate organ-organ interactions and systemic responses beyond isolated tissue behavior.

The expansion of drug discovery programs, large-scale screening campaigns, and industrial organoid applications is driving demand for automated organoid expansion services with robotic liquid handling, standardized quality control, and high-throughput analytical capabilities. These advanced service platforms require specialized automation systems with stringent reproducibility specifications that exceed manual culture standards, creating premium market segments with enhanced throughput propositions. Service providers are investing in artificial intelligence-guided imaging analysis and automated culture monitoring to serve pharmaceutical screening applications while supporting innovation in phenotypic drug discovery and compound library evaluation.

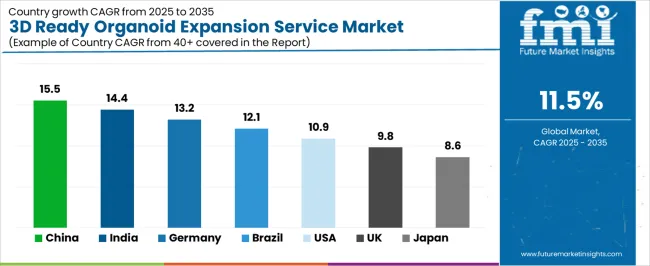

| Country | CAGR (2025-2035) |

|---|---|

| China | 15.5% |

| India | 14.4% |

| Germany | 13.2% |

| Brazil | 12.1% |

| USA | 10.9% |

| UK | 9.8% |

| Japan | 8.6% |

The 3D ready organoid expansion service market is experiencing solid growth globally, with China leading at a 15.5% CAGR through 2035, driven by massive investment in biotechnology research, expanding pharmaceutical industry, and strong government support for regenerative medicine and precision medicine initiatives. India follows at 14.4%, supported by growing contract research organization sector, expanding biotechnology capabilities, and rising pharmaceutical R&D investment. Germany shows growth at 13.2%, emphasizing stem cell research leadership, pharmaceutical excellence, and advanced biomedical engineering capabilities. Brazil demonstrates 12.1% growth, supported by expanding academic research infrastructure, growing biotechnology sector, and increasing healthcare research investment. The United States records 10.9%, focusing on pharmaceutical industry leadership, advanced cancer research programs, and regenerative medicine innovation. The United Kingdom exhibits 9.8% growth, emphasizing biomedical research excellence, pharmaceutical industry presence, and stem cell research leadership. Japan shows 8.6% growth, supported by aging population research needs, regenerative medicine initiatives, and advanced cell culture technology development.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from 3D ready organoid expansion services in China is projected to exhibit exceptional growth with a CAGR of 15.5% through 2035, driven by massive government investment in biotechnology and life sciences research, rapidly expanding pharmaceutical industry with growing drug discovery capabilities, and strong policy support for precision medicine and regenerative therapy development programs. The country's comprehensive research infrastructure and increasing emphasis on biomedical innovation are creating substantial demand for advanced organoid culture services. Major research institutions, pharmaceutical companies, and contract research organizations are establishing extensive organoid research capabilities to serve both domestic research needs and international collaborations.

Revenue from 3D ready organoid expansion services in India is expanding at a CAGR of 14.4%, supported by the country's growing contract research organization sector, expanding biotechnology and pharmaceutical industries, and rising investment in advanced cell culture capabilities driven by both domestic research demand and international outsourcing opportunities. The nation's cost-competitive research infrastructure and growing technical expertise are driving sophisticated service offerings throughout biotechnology sectors. International pharmaceutical companies and domestic research organizations are establishing organoid research facilities to address growing demand.

Revenue from 3D ready organoid expansion services in Germany is expanding at a CAGR of 13.2%, supported by the country's stem cell research leadership, world-class pharmaceutical industry, and advanced biomedical engineering capabilities enabling sophisticated organoid culture platform development. Germany's scientific excellence and innovation ecosystem are driving demand for high-specification organoid services throughout research sectors. Leading research institutions and pharmaceutical companies are investing extensively in organoid technology development and application optimization.

Revenue from 3D ready organoid expansion services in Brazil is expanding at a CAGR of 12.1%, supported by the country's expanding academic research infrastructure, growing biotechnology sector, and increasing investment in healthcare research and biomedical innovation programs. Brazil's developing life sciences capabilities and research funding growth are driving demand for advanced cell culture services. Research institutions and emerging biotechnology companies are investing in organoid research capabilities.

Revenue from 3D ready organoid expansion services in the United States is expanding at a CAGR of 10.9%, driven by the country's pharmaceutical industry leadership, extensive cancer research infrastructure, and strong emphasis on precision medicine and regenerative therapy development supported by federal research funding and biotechnology innovation ecosystem. The nation's advanced biomedical research capabilities and regulatory environment are driving innovation in organoid applications. Leading pharmaceutical companies, biotechnology firms, and academic medical centers are investing in comprehensive organoid research programs.

Revenue from 3D ready organoid expansion services in the United Kingdom is growing at a CAGR of 9.8%, driven by the country's biomedical research excellence, strong pharmaceutical industry presence, and stem cell research leadership supported by research councils and charitable foundation funding. The UK's scientific expertise and collaborative research environment are supporting investment in organoid technologies. Academic institutions, pharmaceutical companies, and research charities are establishing organoid research programs and service capabilities.

Revenue from 3D ready organoid expansion services in Japan is expanding at a CAGR of 8.6%, supported by the country's aging population creating demand for regenerative therapies, government initiatives supporting regenerative medicine commercialization, and advanced cell culture technology expertise. Japan's regulatory framework for cell therapy approval and quality consciousness are driving demand for standardized organoid services. Leading research institutions and pharmaceutical companies are investing in organoid technology for therapeutic development.

The 3D ready organoid expansion service market in Europe is projected to grow from USD 86.8 million in 2025 to USD 326.0 million by 2035, registering a CAGR of 14.2% over the forecast period. Germany is expected to maintain leadership with a 28.9% market share in 2025, moderating to 28.5% by 2035, supported by stem cell research excellence, pharmaceutical industry strength, and biomedical engineering innovation.

The United Kingdom follows with 23.4% in 2025, projected at 23.1% by 2035, driven by biomedical research leadership, pharmaceutical industry presence, and stem cell research capabilities. France holds 17.8% in 2025, rising to 18.2% by 2035 on the back of academic research strength and pharmaceutical R&D investment. Netherlands commands 13.6% in 2025, reaching 14.0% by 2035, while Switzerland accounts for 10.2% in 2025, rising to 10.4% by 2035 aided by pharmaceutical industry concentration and research excellence. Sweden maintains 6.1% in 2025, up to 5.8% by 2035 due to strong stem cell research programs. The Rest of Europe region, including other Western European nations, Nordic research centers, and emerging Central & Eastern European biotechnology hubs, is anticipated to hold 0.0% in 2025 and 0.0% by 2035, with growth distributed across listed markets reflecting concentration in established research economies.

The 3D ready organoid expansion service market is characterized by competition among specialized biotechnology service providers, life sciences tools companies, and contract research organizations. Companies are investing in culture protocol optimization, automation platform development, quality control system implementation, and application-specific service offerings to deliver reproducible, scalable, and biologically relevant organoid expansion solutions. Innovation in automated culture systems, artificial intelligence-guided quality assessment, and standardized differentiation protocols is central to strengthening market position and competitive advantage.

Molecular Devices provides advanced imaging and analysis systems for organoid research with focus on high-content screening and automated culture monitoring capabilities supporting organoid expansion service workflows. DH Life Sciences offers comprehensive cell culture services and reagents with emphasis on three-dimensional culture systems and custom organoid development programs. Bio-Techne delivers extensive portfolio of cell culture reagents, growth factors, and analytical tools supporting organoid expansion and characterization applications.

Corning specializes in advanced cell culture surfaces, three-dimensional culture systems, and laboratory plasticware optimized for organoid culture with industry-leading Matrigel extracellular matrix products. Merck provides comprehensive life science solutions including cell culture media, supplements, and equipment for organoid research applications. JSR Corporation offers specialized biomaterials and culture substrates for three-dimensional cell culture and organoid expansion. Sartorius AG delivers bioprocessing equipment, cell culture consumables, and laboratory automation systems supporting scalable organoid production. Alithea Genomics specializes in single-cell analysis and organoid characterization technologies enabling quality control and functional assessment.

3d ready organoid expansion services represent an innovative biotechnology segment within pharmaceutical research and regenerative medicine, projected to grow from USD 235.2 million in 2025 to USD 698.5 million by 2035 at a 11.5% CAGR. These specialized culture services-primarily substrate-supported and suspension-based systems for tissue-specific organoids-serve as critical research tools in drug discovery, disease modeling, regenerative therapy development, and personalized medicine applications where physiological relevance, genetic stability, and experimental reproducibility are essential. Market expansion is driven by pharmaceutical industry adoption, precision medicine advancement, regenerative therapy development, and increasing recognition of organoid superiority over traditional research models.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 235.2 million |

| Culture System | Substrate-supported Culture System, Suspension Culture System, Others |

| Application | Regenerative Medicine, Toxicology, Biology of Evolution, Oncology, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Molecular Devices, DH Life Sciences, Bio-Techne, Corning, Merck, JSR Corporation |

| Additional Attributes | Dollar sales by culture system and application category, regional demand trends, competitive landscape, technological advancements in organoid culture, automation development, quality control integration, and therapeutic translation progress |

The global 3D ready organoid expansion service market is estimated to be valued at USD 235.2 million in 2025.

The market size for the 3D ready organoid expansion service market is projected to reach USD 698.5 million by 2035.

The 3D ready organoid expansion service market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in 3D ready organoid expansion service market are substrate-supported culture system, suspension culture system and others.

In terms of application, regenerative medicine segment to command 38.7% share in the 3D ready organoid expansion service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Somatosensory Virtual Fitting Market Size and Share Forecast Outlook 2025 to 2035

Ready-to-eat Canned Tuna Market Size and Share Forecast Outlook 2025 to 2035

Organoids LNP Market Size and Share Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

Ready to Drink (RTD) Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Organoids Market Size and Share Forecast Outlook 2025 to 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Expansion Valve Market Size and Share Forecast Outlook 2025 to 2035

Ready to Use Intermittent Catheters Market Size and Share Forecast Outlook 2025 to 2035

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

ServiceNow Tech Service Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA