The 3D printed dental brace market is growing rapidly, driven by technological innovation in additive manufacturing and increasing demand for personalized orthodontic solutions. 3D printing enables precise, cost-efficient, and faster production of custom dental braces compared to conventional methods.

The market benefits from improved material biocompatibility, design flexibility, and digital workflow integration, enhancing patient comfort and treatment accuracy. Dental professionals are adopting 3D printing to streamline operations, reduce turnaround time, and improve scalability in treatment planning.

Rising consumer demand for aesthetic and functional orthodontic solutions, combined with growing dental care awareness, has accelerated market expansion. As digital dentistry becomes more prevalent, the market is expected to witness continued growth across both developed and emerging regions.

| Metric | Value |

|---|---|

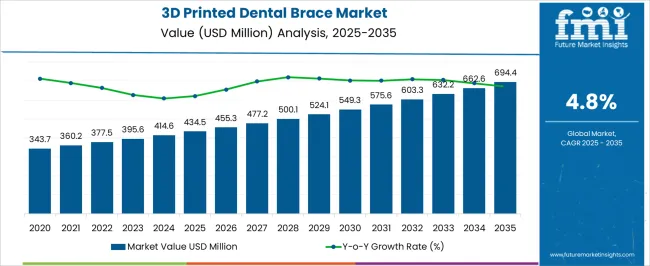

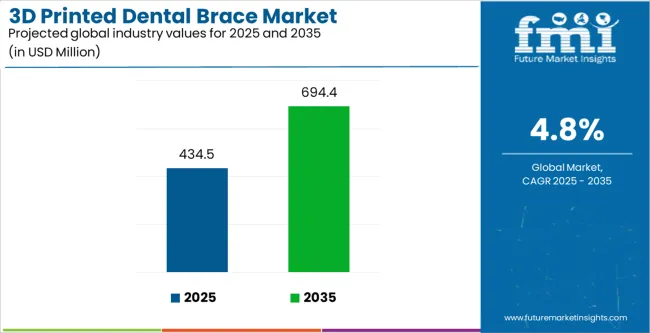

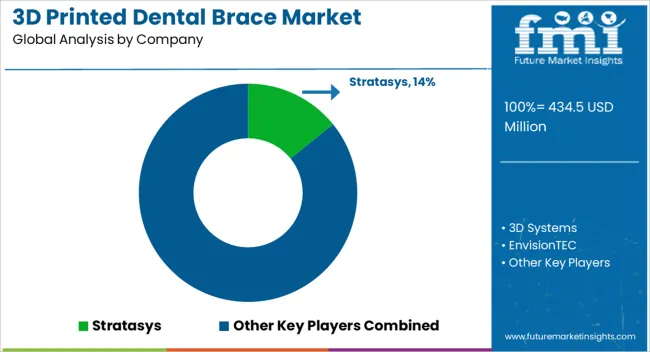

| 3D Printed Dental Brace Market Estimated Value in (2025 E) | USD 434.5 million |

| 3D Printed Dental Brace Market Forecast Value in (2035 F) | USD 694.4 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

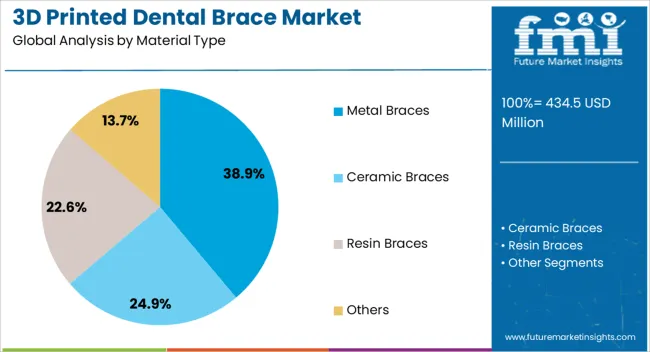

The market is segmented by Material Type and End User and region. By Material Type, the market is divided into Metal Braces, Ceramic Braces, Resin Braces, and Others. In terms of End User, the market is classified into Dental Clinics, Dental Laboratories, Academic & Research Institutes, Hospitals, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The metal braces segment holds approximately 38.90% share in the material type category, driven by its proven strength, durability, and affordability. Despite the growing preference for clear aligners, metal braces remain widely used due to their effectiveness in complex orthodontic cases.

The integration of 3D printing allows for improved bracket precision and customized archwire configurations, enhancing treatment outcomes. This segment benefits from high clinical reliability and compatibility with digital treatment planning software.

With continued improvements in 3D printing accuracy and material performance, metal braces are expected to retain their prominence in professional orthodontic applications.

The dental clinics segment dominates the end-user category, accounting for approximately 45.70% share of the market. This leadership is attributed to the widespread adoption of 3D printing technologies in clinical settings for rapid, in-house brace fabrication.

Clinics leverage digital design and additive manufacturing workflows to reduce dependency on external laboratories and shorten delivery times. Growing investment in digital dentistry equipment and skilled practitioner adoption further supports market expansion.

With rising patient demand for customized, efficient, and affordable orthodontic treatments, dental clinics are expected to remain the principal growth driver in the 3D printed dental brace market.

This section offers a thorough industry analysis over the previous five years, emphasizing the anticipated growth trends for the market for 3D printed dental braces. A 5.7% historical compound annual growth rate indicates a market decline. Up to 2035, the industry is expected to grow at a 4.8%.

| Historical CAGR | 5.7% |

|---|---|

| Forecast CAGR | 4.8% |

Global obstacles affecting the 3D printed dental braces market include medical device regulations and standards, the initial high costs associated with adopting 3D printing technology, and the requirement for extensive patient and dental professional education regarding the advantages and potential applications of 3D printed orthodontic solutions.

Vital factors that are anticipated to upset the demand for 3D printed dental braces through 2035.

Market participants are likely to need to be astute and adaptable during the anticipated period, as these assertive features position the industry for future growth.

Mounting Desire for Cosmetic Dentistry

Demand for 3D printed dental braces is driven by cosmetic dentistry as patients seek more aesthetically attractive and practical orthodontic treatments. The manufacturing of highly customized and aesthetically pleasing braces is made possible by 3D printing technology, which aligns with the growing need for individualized treatment experiences.

Because of its efficiency and capacity to produce precise, customized designs, 3D printing can potentially revolutionize the field of cosmetic dentistry. By combining cutting-edge technology with aesthetic preferences, orthodontics is changing, becoming more popular, and providing patients with more aesthetically pleasing and comfortable options to achieve a self-assured and striking smile.

Enlargement of Digital Dentistry Amalgamation

Orthodontic procedures are revolutionized by combining 3D printed dental braces with digital dentistry instruments, such as intraoral scanners and CAD software. Intraoral scanners provide exact digital imprints of a patient's teeth, supplying comprehensive information for fabricating a customized brace.

Brace models that are detailed and unique to each patient may be made with CAD software. From concept to fabrication, the whole manufacturing process is streamlined by this digital integration, guaranteeing accuracy and productivity. Digital design refinement allows dentists to optimize treatment regimens and minimize manual mistakes.

Combining digital dentistry with 3D printing is expected to increase treatment accuracy, speed up production, and elevate the bar for orthodontic care throughout the projected period.

Spurring Demand for Dental Aesthetic

Orthodontic treatment is changing due to the focus on patient comfort and aesthetics, with 3D printed dental braces emerging as a key component. These braces, which enable highly adjustable and aesthetically pleasing designs, are meeting the increased demand for orthodontic treatments that improve overall attractiveness and repair oral disorders.

In contrast to traditional braces, 3D printed braces offer a more streamlined and covert solution that alleviates worries about orthodontic hardware being visible. Owing to the precise precision made possible by 3D printing technology, the braces are tailored to each patient's unique dental anatomy, maximizing functionality and aesthetics.

When new materials are employed, thinner, stronger structures may be made, and patients are delighted with the cosmetic outcome of treatment and have a more comfortable orthodontic experience.

Comprehensive reviews of certain dental brace industry segments are presented in this section. The two primary topics of the present study are the dental laboratory and the metal braces segments.

| Attributes | Details |

|---|---|

| Top Material Type | Metal Braces |

| CAGR from 2025 to 2035 | 2.7% |

The demand for metal braces is likely to rule the 3D printed dental brace market, with a promising share of 38.9%; the metal braces segment is likely to develop with a sluggish CAGR of 2.7%. There are several reasons for this inclination for metal braces for the dental materials:

| Attributes | Details |

|---|---|

| Top End User | Dental Laboratories |

| CAGR from 2025 to 2035 | 4.7% |

The utilization of 3D printed dental braces in dental laboratories expands its market share to 39.2%, with a forecasted CAGR of 4.7% in the forthcoming decade. This superiority can be described as follows:

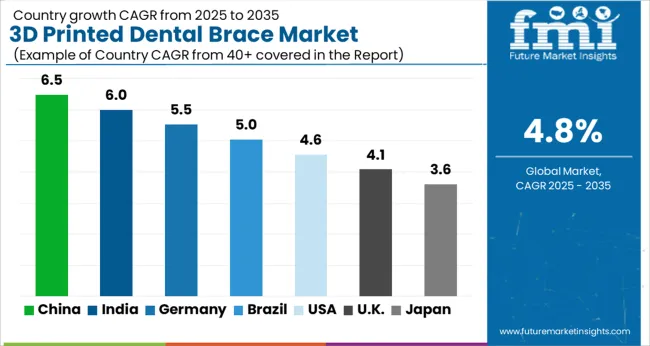

This section examines the 3D printed dental brace markets in many countries, such as the United States, China, India, Germany, and the United Kingdom. It explores the aspects influencing 3D printed dental braces' demand, acceptance, and sales in particular countries.

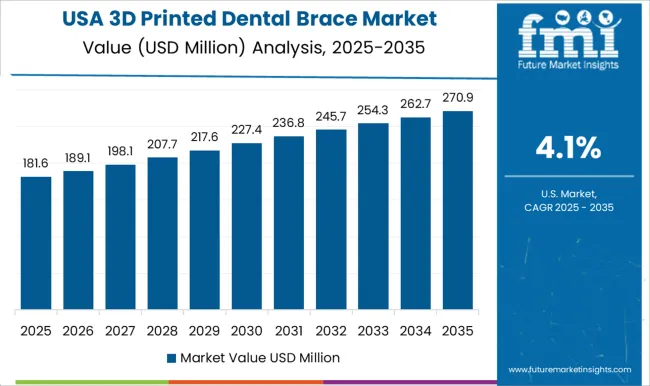

Through 2035, the demand for a 3D printed dental brace in the United States is anticipated to increase at a CAGR of 3.7%, acquiring a valuation of USD 120.2 million. Several of the key trends are as follows:

The demand for 3D printed dental braces in Germany is anticipated to expand at a compound annual growth rate of 4.5% through 2035, reaching a valuation of USD 24.9 million by that year. The following factors fuel this rapid growth:

China is experiencing a surge in demand for a 3D printed dental brace, with a valuation of USD 694.4 million alongside a predicted CAGR of 8.2% through 2035. Some of the primary drivers include:

The United Kingdom is seeing an increase in demand for 3D printed dental braces, estimated at USD 19.9 million, with a predicted CAGR of 4.0% through 2035. Among the main trends are:

The 3D printed dental brace market is expanding in India with an estimated CAGR of 9.4% and a valuation of USD 94.5 million through 2035. Here are a few of the ongoing trends:

Dental organizations play a pivotal role in shaping the outlook of the 3D printed dental brace industry through various key factors. Research and development institutions contribute significantly by driving innovation in materials and printing technologies, advancing dental braces' precision and customization capabilities.

Both independent and affiliated with healthcare institutions, dental laboratories serve as crucial manufacturing hubs, integrating 3D printing into their workflows to produce tailored orthodontic solutions.

Academic institutions and training centers play a role in educating dental professionals on the latest advancements, ensuring a skilled workforce capable of leveraging 3D printing technologies effectively.

Regulatory agencies and groups that set industry standards also contribute to developing policies that guarantee the effectiveness and safety of 3D printed braces. Together, these companies' cooperation and synergy impact the direction of the 3D printed dental brace market, driving developments, uptake, and expansion.

Recent Developments in the 3D Printed Dental Brace Industry:

The global 3d printed dental brace market is estimated to be valued at USD 434.5 million in 2025.

The market size for the 3d printed dental brace market is projected to reach USD 694.4 million by 2035.

The 3d printed dental brace market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in 3d printed dental brace market are metal braces, _non-precious metal alloys, _precious metal alloys, ceramic braces, resin braces and others.

In terms of end user, dental clinics segment to command 45.7% share in the 3d printed dental brace market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Printed Clear Dental Aligners Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3d-Printed Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Kit Market Analysis Size and Share Forecast Outlook 2025 to 2035

3D Printed Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Medical Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Surgical Models Market Analysis - Size, Share, and Forecast 2025 to 2035

3D Printed Hip and Knee Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Wearable Market - by Product Type, Material Type, Technology, Sales Channel, End-User, Application, and Region - Trends, Growth & Forecast 2025 to 2035

3D Printed Medical Devices Market is segmented by drug type, treatment and distribution channel from 2025 to 2035

Market Share Breakdown of 3D Printed Packaging Manufacturers

Market Share Breakdown of 3D-Printed Stickers & Labels Manufacturers

3D Printed Drugs Market Outlook – Growth, Demand & Forecast 2025-2035

3D-Printed Stickers & Labels Market Growth – Trends & Forecast 2024-2034

3D Printed Brain Model Market Analysis – Trends & Forecast 2024-2034

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Human Tissue Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA