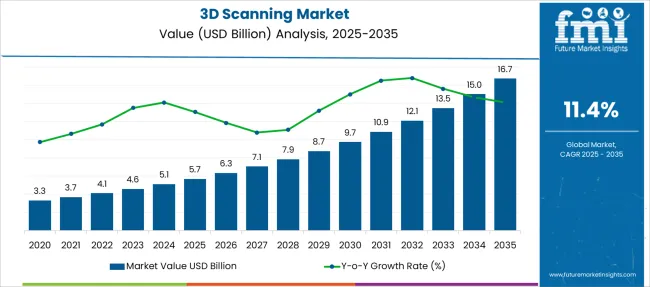

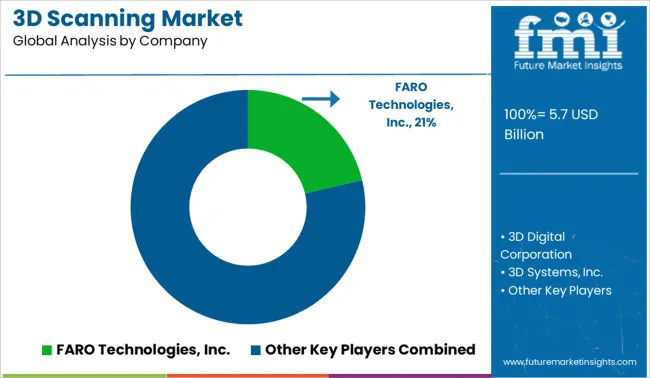

The 3D scanning market is expected to record a valuation of USD 5.7 billion in 2025 and USD 16.7 billion in 2035, with an increase of USD 11 billion, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 11.4% and a 2.93X increase in market size.

During the first five-year period from 2025 to 2030, the market increases from USD 5.7 billion to USD 9.7 billion, adding USD 4.0 billion, which accounts for 36.3% of the total decade growth. This phase records steady adoption in automotive prototyping, aerospace design, and healthcare imaging, driven by the need for precision. Short-range scanners dominate this period as they cater to over 50% of industrial applications requiring micron-level accuracy.

The second half from 2030 to 2035 contributes USD 7.0 billion, equal to 63.7% of total growth, as the market jumps from USD 9.7 billion to USD 16.7 billion. This acceleration is powered by widespread deployment of digital twins, AI-based inspection systems, and robotics-driven scanning in smart factories. Long-range and mid-range scanners together capture a larger share above 45% by the end of the decade. Software-led analytics and cloud platforms add recurring revenue, increasing the software share beyond 50% in total value.

From 2020 to 2024, the 3D scanning market grew from USD 3.3 billion to USD 5.1 billion, driven by hardware-centric adoption. During this period, the competitive landscape was dominated by equipment manufacturers controlling nearly 70% of revenue, with leaders such as Hexagon AB, Faro Technologies, and Creaform focusing on precision hardware for automotive and aerospace applications. Competitive differentiation relied on accuracy, speed, and cost efficiency, while software was often bundled as an auxiliary offering rather than a primary revenue stream. Service-based models had minimal traction, contributing less than 10% of the total market value.

Demand for 3D scanning will expand to USD 16.7 billion in 2025, and the revenue mix will shift as software and services grow to over 50% share. Traditional hardware leaders face rising competition from digital-first players offering AI-driven defect detection, cloud-based visualization, and subscription-based digital twin solutions. Major hardware vendors are pivoting to hybrid models, integrating analytics and remote workflow capabilities to retain relevance. Emerging entrants specializing in cloud interoperability, AR/VR integration, and industry-specific platforms are gaining share. The competitive advantage is moving away from hardware innovation alone to ecosystem strength, scalability, and recurring revenue streams.

| Metric | Value |

|---|---|

| 3D Scanning Market Estimated Value in (2025E) | USD 5.7 billion |

| 3D Scanning Market Forecast Value in (2035F) | USD 16.7 billion |

| Forecast CAGR (2025 to 2035) | 11.4% |

Advances in scanning hardware have improved accuracy and speed, allowing for more efficient data capture across diverse applications. Short-range scanners have gained popularity due to their suitability for detailed surface scanning and small object measurement. The rise of laser triangulation technology has contributed to enhanced resolution and real-time processing capabilities. Industries such as manufacturing, healthcare, and aerospace are driving demand for 3D scanning solutions that can integrate seamlessly into existing workflows.

Expansion of automated inspection and reverse engineering processes has fueled market growth. Innovations in portable and handheld scanning devices and software enhancements are expected to open new application areas. Segment growth is expected to be led by hardware components, short-range scanners in range categories, and laser triangulation technology due to their precision and adaptability.

The market is segmented by component, range, technology, type, end-use industry, and region. Components include hardware, 3D scanners, accessories, and software, highlighting the core elements driving adoption. Range classification covers short-range scanners, medium-range scanners, and long-range scanners to cater to different operational requirements. Based on technology, the segmentation includes laser triangulation, time-of-flight (ToF), structured light, photogrammetry, and laser pulse. In terms of type, categories encompass laser scanners, handheld, stationary, mobile, structured light scanners, optical scanners, contact scanners, and non-contact scanners. End-use industries include automotive, aerospace and defense, consumer electronics, healthcare, oil and gas, energy and power, and other specialized sectors. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

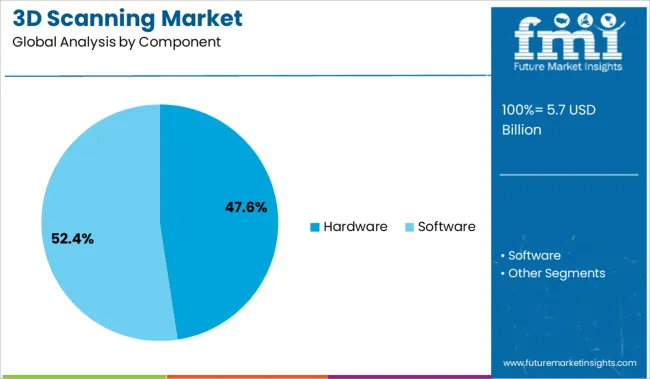

The hardware segment is projected to contribute 47.60% of the 3D scanning market revenue in 2025, maintaining its lead as the dominant component category. This is driven by ongoing demand for advanced scanning devices with improved sensors, optics, and processing power. Hardware investments have been prioritized by users seeking reliable, high-precision scanners that deliver consistent results across multiple industries.

The segment’s growth is also supported by the development of compact and portable devices that enhance usability in the field. As software integration and cloud connectivity become more prevalent, hardware manufacturers are enhancing device capabilities to support these trends. The hardware segment is expected to retain its position as the backbone of 3D scanning systems.

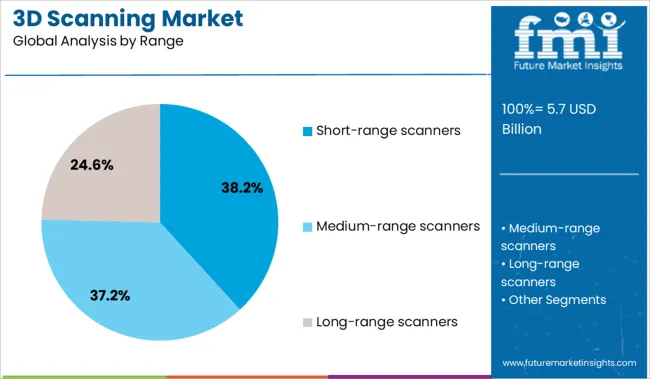

The short-range scanners segment is forecasted to hold 38.20% of the market share in 2025, led by its application in detailed inspections and scanning of small to medium-sized objects. These scanners are favored for their high resolution and ability to capture fine surface details, making them ideal for quality control, reverse engineering, and medical applications.

Their compact design and ease of use have facilitated widespread adoption in laboratories and production floors. The segment’s growth is bolstered by advancements in sensor technology that improve accuracy while reducing scanning time.

As industries increasingly require precise 3D models for design and analysis, short-range scanners are expected to continue their dominance in the market.

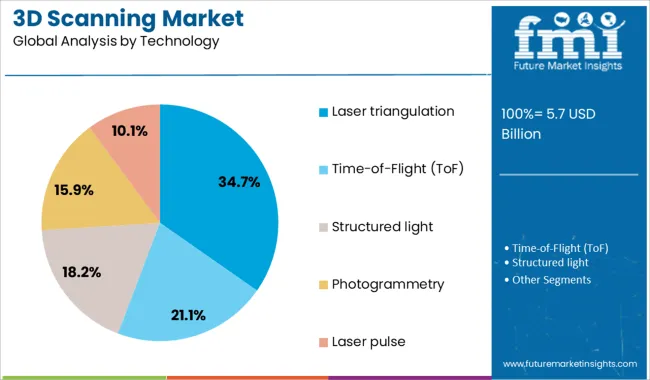

The laser triangulation technology segment is projected to account for 34.70% of the 3D scanning market revenue in 2025, establishing it as the leading technology type. This technology is preferred for its ability to deliver fast and accurate measurements by calculating the geometry of scanned objects based on laser light reflection angles.

Its suitability for capturing complex surface geometries and compatibility with various scanner designs have made it popular across automotive, aerospace, and healthcare sectors. Developments in laser sources and detectors have enhanced measurement speed and reduced noise, improving the overall scanning experience. Given its balance of accuracy and efficiency, laser triangulation is expected to maintain its leading role in the 3D scanning market.

Rising equipment costs and data complexity challenge 3D scanning adoption, even as demand grows in manufacturing, medical modeling, and design automation for high-precision, real-time digital replication across industries.

3D scanning technology is gaining traction across industries such as automotive, aerospace, and healthcare, where exact measurements and modeling accuracy are critical. Manufacturers use it for reverse engineering, rapid prototyping, and real-time quality control. The ability to integrate with CAD, simulation, and digital twin platforms streamlines workflows and shortens development cycles. In healthcare, 3D scanning supports personalized implants, prosthetics, and surgical planning. Advancements in structured light and laser scanning have improved scan resolution, portability, and scanning speed. As the need for accurate 3D models grows in construction, archaeology, and cultural heritage, demand for compact and field-ready scanners is rising.

While 3D scanning offers clear advantages, its adoption is limited by significant cost and operational challenges. High-performance scanners often require substantial investment, making them less accessible for small businesses. Beyond hardware costs, professional software licenses and periodic maintenance add to long-term expenses. Additionally, managing and processing dense point cloud data demands high computational power and skilled operators. Many users face difficulties in converting raw scans into workable 3D models for design or analysis. The learning curve associated with data cleanup, mesh generation, and format compatibility can be steep.

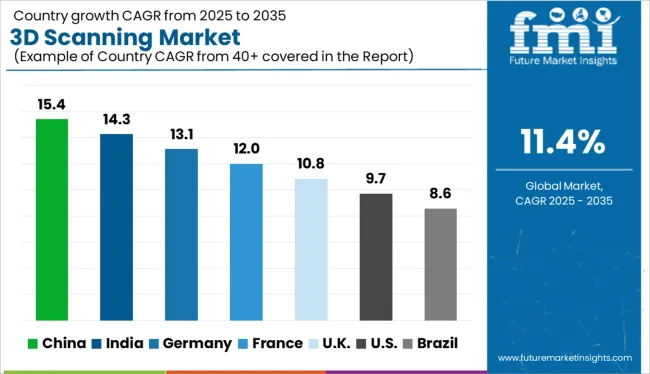

| Country | CAGR |

|---|---|

| China | 15.4% |

| India | 14.3% |

| Germany | 13.1% |

| France | 12.0% |

| UK. | 10.8% |

| USA | 9.7% |

| Brazil | 8.6% |

The global 3D scanning market shows a pronounced regional disparity in adoption speed, strongly influenced by electric vehicle (EV) penetration, manufacturing modernization, and compliance mandates.

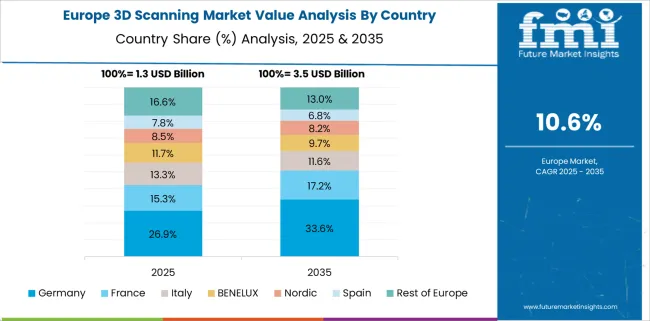

Asia-Pacific emerges as the fastest-growing region, anchored by China at 7.8% CAGR and India at 7.3%. This acceleration is driven by large-scale EV production ecosystems, aggressive investment in autonomous vehicle platforms, and government-backed mandates for precision manufacturing. China’s regulatory framework promoting digital manufacturing in automotive and aerospace further accelerates adoption of advanced scanning solutions for prototyping and quality assurance. India’s trajectory reflects rising integration of scanning technologies in automotive tier-1 suppliers and infrastructure sectors, supporting both cost competitiveness and export-oriented production. Europe maintains a strong growth profile, led by Germany at 6.7%, France at 6.1%, and the UK at 5.5%, supported by stringent quality compliance for automotive safety standards and sustainability reporting. High penetration of EVs and OEM investments in Industry 4.0 keep Europe ahead of North America, particularly in scanning for digital twin applications and additive manufacturing workflows. North America shows moderate expansion, with the U.S. at 4.9% CAGR, reflecting maturity in core industries and slower EV adoption relative to Europe and Asia. Growth in North America is more service-driven, with increasing demand for AR/VR-integrated inspection and cloud-based asset management rather than pure hardware installations.

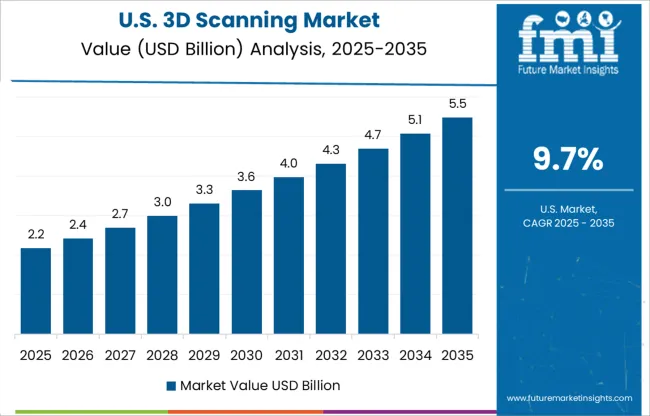

The 3D scanning market in the United States is projected to grow at a CAGR of 9.7%, led by increased investment across aerospace, automotive, and defense sectors. Reverse engineering applications recorded a notable year-on-year rise, particularly among aerospace component manufacturers. The healthcare segment, especially dental labs, has been integrating desktop scanners for faster digital workflows. Adoption is also rising in entertainment and education, with virtual modeling becoming more common. High precision requirements and software integration trends are creating opportunities for hardware-software bundling and service partnerships in industrial design and metrology.

The 3D scanning market in the United Kingdom is expected to grow at a CAGR of 10.8%, supported by applications in engineering design, restoration, and advanced manufacturing. Motorsport engineering firms have accelerated usage of high-resolution scanning to improve prototype testing and race part validation. Museums and heritage bodies have digitized artifacts and structures to create long-term preservation archives. In retail, 3D scanning is being integrated into AR-based home décor and fashion platforms. The combination of government grants, public-private innovation programs, and academic collaboration continues to fuel both enterprise and public-sector adoption.

India is witnessing rapid growth in the 3D scanning market, which is forecast to expand at a CAGR of 14.3% through 2035. A sharp increase in installations across tier-2 cities has been driven by cost reductions and rising awareness among MSMEs. Automotive suppliers are using scanning to validate component geometry and align CAD files with production. Educational institutes and vocational centers are introducing structured light and laser scanning into their digital manufacturing programs. Public infrastructure and archaeology departments are investing in 3D scans to digitally document national monuments and historic sites.

The 3D scanning market in China is expected to grow at a CAGR of 15.4%, the highest among leading economies. This momentum is driven by smart factory rollouts, city modeling programs, and competitive innovation by local tech firms. Industrial demand for automated inspection and rapid prototyping has accelerated across the electronics and automotive sectors. Municipal governments are increasingly using aerial scanning and LiDAR for digital twins and infrastructure planning. Affordable scanners produced by local firms are enabling widespread use in education, fashion, and e-commerce. Cross-sector digitization remains a key growth lever.

The 3D scanning market in Germany is projected to grow at a CAGR of 13.1%, underpinned by its leadership in precision engineering and industrial automation. Factory floors are integrating inline 3D scanners with robotic arms for dimensional inspection and live QA monitoring. CNC workshops are using structured light scanning to check complex geometries during milling operations. Dental and orthopedic labs are shifting to digital modeling using intraoral and handheld scanners. Compliance with EU manufacturing standards and growing demand for sustainable prototyping are further pushing scanner usage in traditional and additive manufacturing sectors.

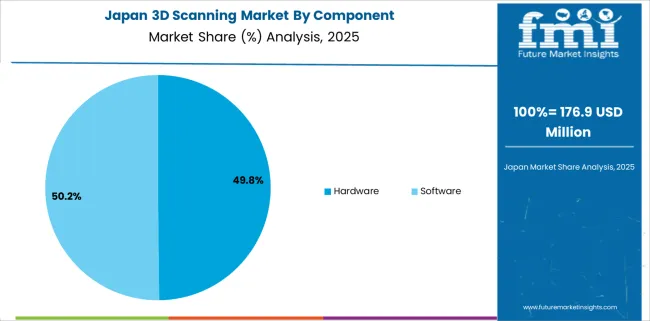

The 3D scanning market in Japan is projected at USD 176.9 million in 2025. Hardware contributes 49.8%, while software holds 50.2%, which shows a clear value transition toward digital platforms and data-driven solutions. This slight software dominance stems from the rising complexity of manufacturing workflows, where analysis, simulation, and real-time inspection require advanced digital capabilities beyond core scanning functions. Software provides recurring revenue streams through licensing, updates, and integration services, unlike hardware, which involves a one-time investment.

Growing use of digital twin technology in automotive and aerospace sectors is a major catalyst since these applications demand continuous data modeling and predictive analytics. Additionally, Japanese manufacturers emphasize seamless CAD interoperability and AI-driven defect detection, which further amplifies software adoption. As industrial automation deepens, integrated platforms combining scanning with analytics and visualization will define the competitive landscape.

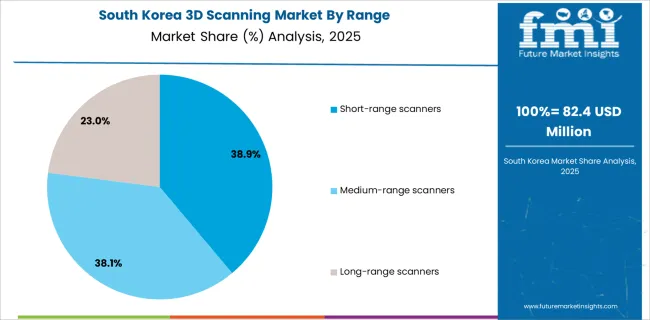

The 3D scanning market in South Korea is valued at USD 82.4 million in 2025, with short-range scanners leading at 38.9%, followed by medium-range at 38.1%, and long-range at 23%. The dominance of short-range systems is a direct outcome of South Korea’s industrial composition, where semiconductor fabrication, electronics assembly, and advanced medical device production require micron-level accuracy. These sectors demand close-proximity scanning for precision component validation, making short-range technology indispensable. Portability and compatibility with robotic arms further enhance adoption, allowing seamless integration into automated inspection lines.

This advantage positions short-range systems as an essential tool for zero-defect manufacturing and real-time quality control. Long-range solutions remain limited to infrastructure and automotive body scanning, where demand is smaller compared to electronics-driven applications. As Industry 4.0 frameworks expand, AI-powered analytics combined with short-range scanning will become a core enabler of connected, error-free production.

The 3D scanning market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists competing across diverse application areas. Global technology leaders such as FARO Technologies, Hexagon AB, and Nikon Corporation hold significant market share, driven by advanced laser scanning systems, high-precision performance, and deep integration with enterprise software. Their strategies increasingly emphasize AI-driven defect analytics, cloud-based data processing, and end-to-end solutions for industries like automotive, aerospace, and industrial metrology.

Established mid-sized players, including Artec 3D, Creaform Inc., and Carl Zeiss Optotechnik GmbH, cater to the demand for portable and user-friendly scanning solutions. These companies are accelerating adoption through handheld and structured-light scanners combined with hybrid software platforms, making them highly relevant for design validation, healthcare diagnostics, and reverse engineering.

Specialized providers such as 3D Digital Corporation, ShapeGrabber, and OGI Systems Ltd. focus on cost-effective, application-specific solutions for construction, cultural heritage preservation, and small-scale manufacturing. Their strength lies in customization and regional adaptability rather than global scale.

Competitive differentiation is shifting away from hardware specifications toward integrated ecosystems that include predictive analytics, AR/VR-enabled visualization, and subscription-based service models.

In 2025, ASML and the Van Gogh Museum collaborated using nanometer-precision 3D scanning, originally derived from semiconductor metrology, to create highly detailed digital twins of Vincent van Gogh’s paintings. Each scan generates approximately 100 GB of data, capturing the paintings’ micro-scale textures and brush strokes

| Item | Value |

|---|---|

| Quantitative Units | USD 5.7 Billion |

| Component | Hardware, 3D Scanners, Accessories, and Software |

| Range | Short-range scanners, Medium-range scanners, and Long-range scanners |

| Technology | Laser triangulation, Time-of-Flight (ToF), Structured light, Photogrammetry, and Laser pulse |

| Type | Laser scanners, Handheld, Stationary, Mobile, Structured light scanners, Optical scanners, Contact scanners, and Non-contact scanners |

| End-use Industry | Automotive, Aerospace & defense, Consumer electronics, Healthcare, Oil & gas, Energy and power, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FARO Technologies, Inc., 3D Digital Corporation, 3D Systems, Inc., Autodesk, Inc., Artec 3D, Automated Precision, Inc. (API), Carl Zeiss Optotechnik GmbH, Creaform Inc., Direct Dimensions Inc., GOM GmbH, Hexagon AB, Konica Minolta, Inc., NextEngine Inc., Nikon Corporation, OGI Systems Ltd, and ShapeGrabber |

| Additional Attributes | Dollar sales by scanner type and end-use industry, adoption trends in reverse engineering and quality control, rising demand for handheld and portable 3D scanners, sector-specific growth in aerospace, automotive, and healthcare, software and services revenue segmentation, integration with AR/VR and digital twin technologies, regional trends influenced by digitization initiatives, and innovations in laser triangulation, structured light, and photogrammetry methods. |

The global 3D scanning market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the 3D scanning market is projected to reach USD 16.7 billion by 2035.

The 3D scanning market is expected to grow at a 11.4% CAGR between 2025 and 2035.

The key product types in 3D scanning market are hardware, 3D scanners, accessories and software.

In terms of range, short-range scanners segment to command 38.2% share in the 3D scanning market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Orthopedic Scanning Systems Market

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA