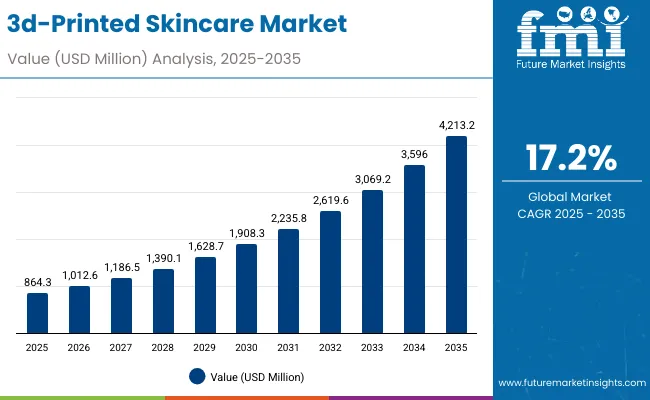

The global 3D-Printed Skincare Market is projected to surpass USD 4,213.2 million by 2035, rising sharply from USD 864.3 million in 2025-representing an absolute increase of USD 3,348.9 million, or a nearly 5X expansion over the decade. This exceptional growth reflects a CAGR of 17.2%, driven by technological convergence, shifting consumer behavior, and personalization in skincare solutions.

3d-Printed Skincare Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 864.3 Million |

| Market Forecast Value in (2035F) | USD 4,213.2 Million |

| Forecast CAGR (2025 to 2035) | 17.20% |

As the market transitions from a niche innovation to mainstream adoption, its value trajectory is anticipated to follow an accelerated curve across two distinct phases of growth.

Between 2025 and 2030, the market is forecasted to expand from USD 864.3 million to USD 1,908.3 million, contributing USD 1,044 million, which accounts for nearly 31.2% of the total 10-year growth. This period is expected to be characterized by foundational adoption of bioprinting technologies, increased demand for personalized skincare masks, and commercialization of on-demand patch systems in North America and Asia-Pacific. Bioprinting is projected to contribute a sizable share early on, as dermatology clinics and premium beauty brands integrate advanced skin diagnostics and printed formulations.

The second growth phase from 2030 to 2035 is expected to deliver USD 2,304.9 million, or 68.8% of the total incremental growth, driven by high-volume deployment of 3D-printed creams, smart refills, and AI-enhanced beauty solutions. Emerging markets such as China and India are anticipated to outpace mature economies, owing to higher CAGR projections of 16.3% and 18.3%, respectively. By 2035, this shift is likely to make Asia the epicenter of scalable, tech-driven skincare manufacturing.

The segment’s growth is forecasted to remain robust, underpinned by personalization, sustainability, and AI-3D convergence.

From 2020 to 2024, rapid advancements in personalized skincare formulation were enabled through innovations in bioprinting and digital customization tools. Market traction was primarily driven by single-use masks and on-demand creams, which were promoted by both dermatology clinics and premium skincare brands. A clear consumer shift toward hyper-personalized, tech-enabled beauty solutions was observed.

By 2025, the market is expected to be valued at USD 864.3 million, with robust adoption in the USA and China. Personalized masks and cartridge-based refill formats are anticipated to dominate application growth. Bioprinting is projected to contribute over 41% of the total market revenue by the same year.

Over the next decade, digital interfaces and at-home diagnostics are expected to transform delivery models. By 2035, a value of USD 4.21 billion is projected to be reached, supported by recurring purchases of refill cartridges, AI-powered skin mapping, and cloud-enabled customization platforms.

The competitive edge is forecast to favor companies that integrate bioprinting hardware with real-time skin diagnostics, cloud databases, and dermatologist-backed formulations. Strategic alliances between consumer beauty brands and 3D tech firms are likely to shape ecosystem dominance. Leading firms are expected to shift from standalone hardware models to hybrid, subscription-driven personalization ecosystems.

Growth in the 3D-Printed Skincare Market is being fueled by technological breakthroughs in bioprinting precision, material customization, and AI-based facial scanning. Consumer expectations for hyper-personalized skincare have been reshaped by the ability to analyze skin in real-time and deliver tailor-made formulations through 3D printing. Demand has been elevated as custom masks and dermal patches allow active ingredients to be deposited with anatomical accuracy, improving efficacy and user satisfaction.

Adoption has been supported by dermatology clinics and tech-forward beauty brands, which have integrated smart diagnostics with formulation engines. A growing preference for eco-conscious and refillable formats has aligned well with 3D-printing’s on-demand production capabilities, minimizing waste. The market’s momentum is further propelled by Asia-Pacific’s rapid adoption, especially in China and India, due to affordability and innovation scaling.

With personalization, sustainability, and digital integration converging, 3D-printed skincare is expected to transition from luxury to essential, redefining future skincare delivery systems.

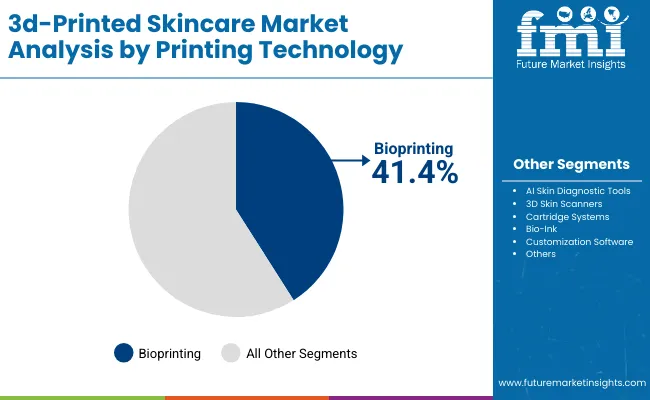

The 3D-Printed Skincare Market has been strategically segmented into printing technology, application, and product form, each offering distinct growth dynamics and innovation potential. These segments reflect how 3D printing is being embedded into skincare personalization at both clinical and consumer levels. By printing technology, segmentation includes bioprinting and others (powder jetting, extrusion), highlighting hardware-led precision and cellular-level formulations.

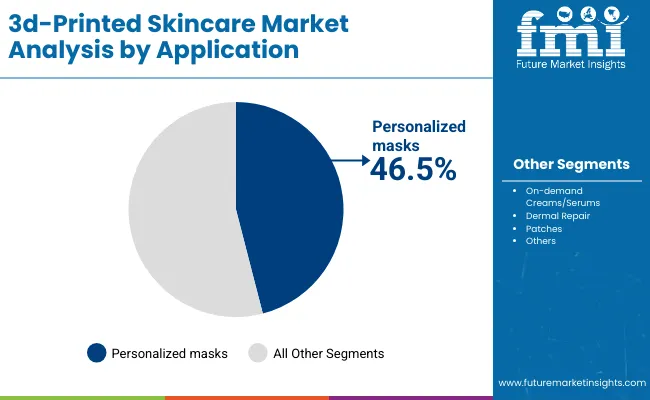

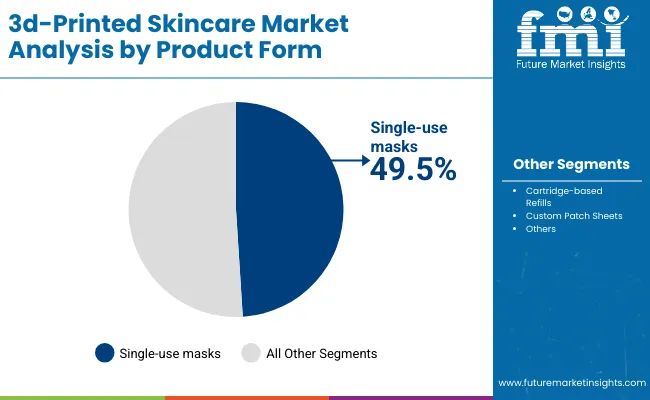

The application segment captures usage diversity, such as personalized masks, on-demand serums, and dermal repair patches. Product form segmentation includes single-use masks and refillable formats like cartridges and patch sheets, emphasizing sustainability and usability. This structure enables deeper insights into consumer demand patterns, technological shifts, and business model evolution within a rapidly transforming beauty-tech landscape.

| Printing Technology | Market Value Share, 2025 |

|---|---|

| Bioprinting | 41.4% |

| Others | 58.6% |

Bioprinting is projected to contribute 41.4% of the total value in 2025, equal to USD 357.94 million. This segment is being driven by demand for cell-compatible formulations, enabling precision delivery of active ingredients. In dermatology clinics, bioprinting is being applied for hyper-customized skin patches that match facial contours and skin conditions. Its growth is further supported by rising investment in bio-inks and 3D skin simulation models, making bioprinting a critical enabler of future-ready skincare platforms.

| Application | Market Value Share, 2025 |

|---|---|

| Personalized masks | 46.5% |

| Others | 53.5% |

The personalized masks segment is forecasted to generate USD 401.59 million in 2025, accounting for 46.5% of total application revenue. This dominance is being driven by strong consumer demand for custom-fitted facial solutions that address hydration, aging, pigmentation, and sensitivity on an individual level. Real-time skin scanning paired with app-enabled personalization is enabling mass-market scalability for this category. Strategic alliances between tech firms and skincare brands are also enhancing the formulation and delivery of ingredients. As consumers shift from generic to algorithm-guided routines, personalized masks are expected to remain the cornerstone of product innovation.

| Product Form | Market Value Share, 2025 |

|---|---|

| Single-use masks | 49.5% |

| Others | 50.5% |

Single-use masks are anticipated to lead the product form segment in 2025, contributing USD 427.78 million, or 49.5% of the total value. Adoption has been driven by ease of use, hygienic application, and cost-effectiveness for consumers seeking fast, visible skincare results. Although sustainability concerns are being raised, innovations in biodegradable materials are allowing continued growth in this category. Dermatologists and wellness retailers are favoring single-use formats for precision dosage and enhanced treatment efficacy. As user expectations evolve toward convenience without compromising performance, this format is projected to maintain significant relevance across both premium and mass-market channels.

While personalization is accelerating adoption, the 3D-Printed Skincare Market continues to be shaped by shifts in consumer diagnostics, clinic integration challenges, and the sophistication of bio-formulation software that demands real-time interoperability between skin imaging, AI analytics, and print delivery systems.

Emergence of AI-Powered Skin Diagnostics as Input Feedstock

The evolution of AI-driven skin diagnostics is being recognized not just as a feature, but as the foundational input layer for 3D-printed skincare systems. Skin texture, hydration levels, UV damage, and melanin distribution are now being analyzed at micro-resolution using computer vision and neural networks. These insights are being algorithmically translated into precise ingredient maps for real-time 3D printing, ensuring dosage alignment with physiological needs. With APIs linking skin scanners, mobile apps, and printers, a closed-loop system has been created where biological data becomes digital design, then printed reality. This paradigm shift is fueling commercial interest among dermatology chains and tech-native beauty startups aiming to deliver quantifiable results at scale.

Material Compatibility Challenges in Bio-Ink Formulation

Formulation of skin-safe, printable bio-inks remains a key bottleneck in the scale-up of 3D-printed skincare products. Bio-inks must meet dermatological safety standards, possess rheological properties suitable for extrusion, and maintain stability under varied climate conditions all without compromising bioavailability of actives. Incompatibility between printer hardware and emerging bio-ink classes often results in clogging, uneven layering, or delayed curing. As ingredient personalization expands, so too does the complexity of chemical interactions during the print process. Without universal material-machine harmonization, product consistency across geographies and consumer skin types remains a high-risk constraint for mass deployment.

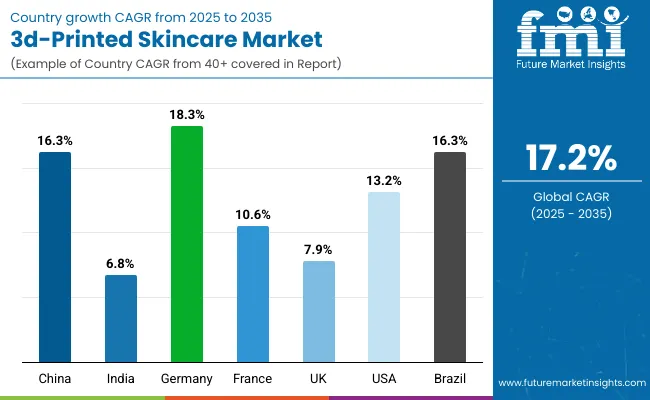

| Countries | CAGR |

|---|---|

| China | 16.3% |

| India | 6.8% |

| Germany | 18.3% |

| France | 10.6% |

| UK | 7.9% |

| USA | 13.2% |

| Brazil | 16.3% |

The global 3D-Printed Skincare Market demonstrates a clear geographical divergence in growth patterns, shaped by factors such as digital healthcare infrastructure, consumer openness to tech-based personalization, and regulatory adaptability in cosmetic innovation. Asia-Pacific is emerging as the most dynamic region, led by India (18.3% CAGR) and China (16.3% CAGR), where high mobile penetration, growing middle-class spending, and government-backed biotech innovation are catalyzing market readiness. In these countries, startups and conglomerates alike are investing in AI-skin analysis tools integrated with 3D-printable formulations, offering hyper-localized beauty solutions to an increasingly health-conscious population.

Japan, with a 13.2% CAGR, is benefiting from a deeply ingrained skincare culture and strong institutional support for dermatological R&D, driving faster clinic-based adoption. The UK (10.6% CAGR) and Germany (7.9% CAGR) continue to show steady expansion, influenced by Europe's leadership in regulatory compliance, sustainability mandates, and clinical validation of beauty-tech devices.

Meanwhile, the USA, at 6.8% CAGR, reflects a more mature and segmented landscape, where growth is being driven by premium consumer preferences, dermatology-led platforms, and wellness tech integration. Despite slower macro-level adoption, the USA continues to lead in innovation pipelines, strategic partnerships, and connected beauty ecosystems fostering value creation through personalization-as-a-service models.

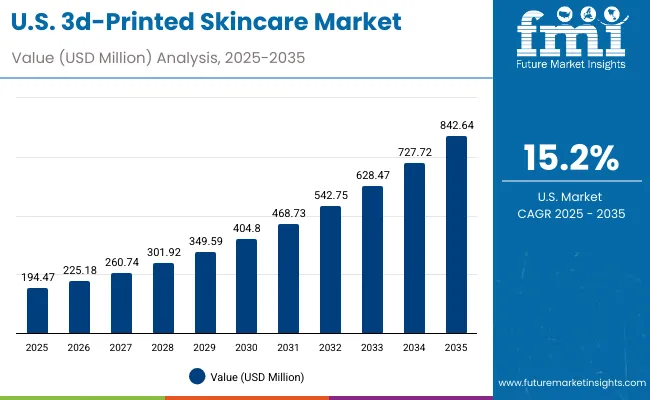

| Year | USA 3D-Printed Skincare Market (USD Million) |

|---|---|

| 2025 | 194.47 |

| 2026 | 225.18 |

| 2027 | 260.74 |

| 2028 | 301.92 |

| 2029 | 349.59 |

| 2030 | 404.80 |

| 2031 | 468.73 |

| 2032 | 542.75 |

| 2033 | 628.47 |

| 2034 | 727.72 |

| 2035 | 842.64 |

The 3D-Printed Skincare Market in the United States is projected to expand at a CAGR of 15.2%, increasing from USD 194.47 million in 2025 to USD 842.64 million by 2035. This growth is being enabled by the rise of dermatology-grade bioprinting, greater AI-driven diagnostics adoption, and custom formulation labs being integrated into skincare clinics and luxury retail experiences.

Consumer preference has shifted toward evidence-based personalization, leading to increasing use of facial mapping and skin simulation before 3D-printed mask or patch generation. A growing number of skin-tech startups have partnered with dermatologists and medical spas to roll out device-based treatment personalization platforms, which are enhancing treatment efficacy and clinical confidence.

The 3D-Printed Skincare Market in the UK is projected to expand at a CAGR of 10.6% between 2025 and 2035, driven by a clinical-grade approach to cosmetic personalization and a highly regulated innovation environment. Adoption has been led by medical spas, dermatology clinics, and luxury skincare houses offering AI-assisted diagnostics and patch printing in-office. Regulatory support from the MHRA has accelerated the pilot testing of dermal bioprinting for skin recovery and anti-aging treatments.

Bioprinting is being leveraged for formulation matching based on genomic data and allergy profiles, a trend visible in London’s skin-tech accelerators. Consumer demand for transparent ingredient sourcing and sustainability is further promoting refillable and printed-on-demand formats.

India’s 3D-Printed Skincare Market is expected to grow at a CAGR of 18.3%, the highest among major markets, driven by urban consumer adoption, startup-led innovations, and affordability-focused printing models. Mobile-first skin diagnostics are being scaled across metros and Tier 2 cities, where consumers are offered customized skincare routines through AI + 3D printing kiosks.

Dermatology chains and D2C beauty platforms have begun offering on-demand personalized face masks, utilizing skin scans uploaded via app or in-store consultation. Regional skin needs such as pigmentation and acne are being addressed through customized patch printing linked with Ayurvedic and cosmeceutical integrations.

China’s 3D-Printed Skincare Market is forecasted to grow at a CAGR of 16.3%, led by ecosystem integration across e-commerce, social commerce, and in-store experiences. Beauty-tech brands have deployed mini printing stations in major cities, offering on-the-spot customization through facial recognition and dynamic skin condition tracking.

Tmall and JD platforms have begun partnering with skin-tech startups to deliver diagnose-to-doorstep solutions, wherein masks are printed based on scanned data and shipped within hours. Regulatory guidance by NMPA is enabling safe commercialization of bioprinted consumables, with increasing product approvals.

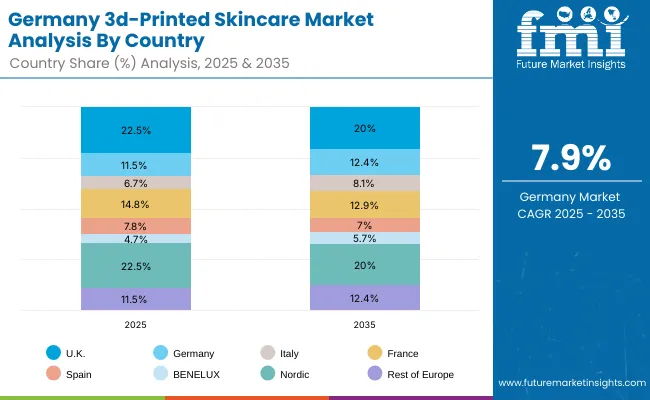

| Countries | 2025 |

|---|---|

| UK | 22.5% |

| Germany | 11.5% |

| Italy | 6.7% |

| France | 14.8% |

| Spain | 7.8% |

| BNELUX | 4.7% |

| Nordic | 22.5% |

| Rest of Europe | 11.5% |

| Countries | 2035 |

|---|---|

| UK | 20.0% |

| Germany | 12.4% |

| Italy | 8.1% |

| France | 12.9% |

| Spain | 7.0% |

| BNELUX | 5.7% |

| Nordic | 20.0% |

| Rest of Europe | 12.4% |

Germany’s 3D-Printed Skincare Market is expected to grow at a CAGR of 7.9%, shaped by clinical precision, sustainability norms, and rigorous product validation. Integration with cosmeceutical labs and university dermatology departments is driving early-stage adoption of dermal repair patches and AI-matched serums printed in clinical settings.

Growth has been supported by Germany’s preference for ingredient traceability, which is driving interest in real-time printed products that eliminate preservatives. Clinical trials funded through public-private innovation funds are validating the efficacy of 3D-printed skincare for sensitive skin and post-laser recovery protocols.

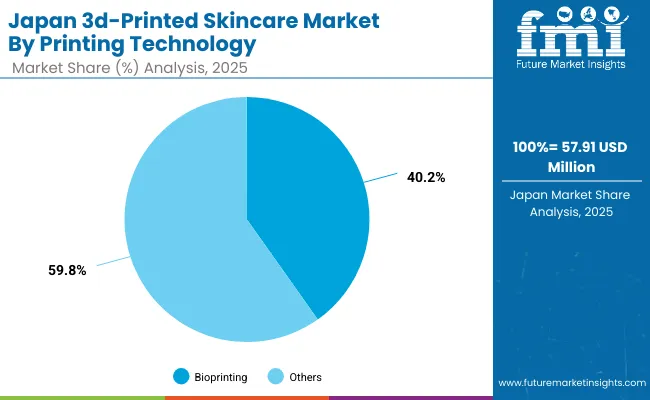

| Printing Technology Segment Share (2025) | Market Value Share, 2025 |

|---|---|

| Bioprinting | 40.2% |

| Others | 59.8% |

The 3D-Printed Skincare Market in Japan is projected at USD 57.91 million in 2025, representing 6.7% of the global market. Bioprinting is expected to contribute 40.2%, or approximately USD 23.28 million, while other printing technologies dominate the remaining 59.8%, or USD 34.63 million. This reflects Japan’s clinical precision focus, where deep integration between hardware design and software diagnostics defines innovation.

Growth is being driven by age-focused skincare, a segment prioritized by Japan’s aging population and skin health-conscious consumers. Dermatology clinics are increasingly adopting AI-enabled skin analyzers linked to on-site bioprinting stations, offering customized facial patches and anti-aging masks. Regulatory trust, especially in medical-cosmetic crossovers, is high, encouraging adoption across urban centers like Tokyo and Osaka.

| Printing Technology Segment Share (2025) | Market Value Share, 2025 |

|---|---|

| Bioprinting | 43.5% |

| Others | 56.5% |

The 3D-Printed Skincare Market in South Korea is projected at USD 42.35 million in 2025, accounting for 4.9% of global market value. Bioprinting is estimated to contribute 43.5% (USD 18.42 million), while other printing technologies represent the remaining 56.5% (USD 23.93 million). This share reflects South Korea’s advanced positioning in K-beauty innovation, where hyper-personalized, tech-integrated skincare has already moved into commercial phase.

AI-enabled diagnostics and mobile-integrated 3D skin printers have been widely adopted by leading cosmetics brands, with real-time mask printing already deployed across dermatology clinics and flagship stores. Urban tech centers such as Seoul and Busan are driving pilot projects around dermal repair patches and bio-printed actives, often linked with AR-based skin monitoring.

Supported by government initiatives in biotech R&D and personalized healthcare exports, the South Korean market is expected to scale quickly into East Asian and global channels. Integrated consumer experiences combining diagnostics, data, and real-time formulation are defining the next wave of competition.

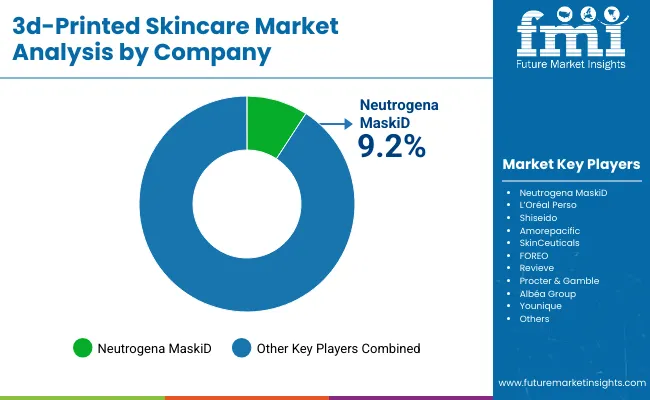

The 3D-Printed Skincare Market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused digital beauty disruptors competing across highly personalized skincare applications. Leading global brands such as Neutrogena (MaskiD), L’Oréal (Perso), and Shiseido are actively investing in AI-integrated diagnostic engines, skin scanning apps, and bioprinting devices. Neutrogena MaskiD dominates the global market with a 9.2% value share in 2025, and an estimated 8.7% in 2024, attributed to early-mover advantage and mass-market product accessibility.

These large players are setting benchmarks by integrating real-time diagnostics with at-home printing, thus creating an end-to-end ecosystem that combines device hardware, digital consultation, and refillable cartridges. Mid-sized innovators like Amorepacific, SkinCeuticals, FOREO, and Revieve are gaining traction by offering dermatologist-grade formulations, customizable facial masks, and regional ingredient personalization. Their strength lies in agile R&D and targeted offerings across East Asia and North America.

Meanwhile, companies like Younique, Albéa Group, and Procter & Gamble are developing application-specific solutions through private-label printing platforms and retail-personalization models. Their strategies are focused on embedding 3D-printing capability into existing brand ecosystems.

Competitive differentiation is shifting from printing hardware to subscription-based personalization services, cloud-linked diagnostic data, and AR-enabled skincare simulations. Success is being increasingly defined by interoperability between mobile diagnostics, bio-ink chemistry, and printing fidelity.

Key Developments in 3d-Printed Skincare Market

| Item | Value |

|---|---|

| Quantitative Units | USD 864.3 million (2025 baseline), projected to reach USD 4,213.2 million by 2035 |

| Component | Bioprinting Devices, AI Skin Diagnostic Tools, 3D Skin Scanners, Cartridge Systems, Bio-Inks, Customization Software |

| Application | Personalized Masks, On-demand Creams/Serums, Dermal Repair Patches |

| Product Form | Single-use Masks, Cartridge-based Refills, Custom Patch Sheets |

| End-use Channel | E-commerce, Beauty Specialty Stores, Dermatology Clinics, Medispas |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Neutrogena (MaskiD), L’Oréal Perso, Shiseido, Amorepacific, SkinCeuticals, FOREO, Revieve, Procter & Gamble, Albéa Group, Younique |

| Additional Attributes | Real-time diagnostics and personalization; bio-ink and skin-matching advancements; rise of home-use 3D printing devices; subscription models; refillable mask systems; regulatory and dermatology integration trends |

| Quantitative Units | USD 864.3 million (2025 baseline), projected to reach USD 4,213.2 million by 2035 |

The global 3D-Printed Skincare Market is estimated to be valued at USD 864.3 million in 2025.

The market size for the 3D-Printed Skincare Market is projected to reach USD 4,213.2 million by 2035.

The 3D-Printed Skincare Market is expected to grow at a CAGR of 17.2% between 2025 and 2035.

The key product types in the 3D-Printed Skincare Market include bioprinting devices, AI-powered diagnostic tools, 3D skin scanners, cartridge-based systems, and customization software.

In terms of application, personalized masks are expected to dominate with a 46.5% market share in 2025, reflecting strong demand for tailor-made skincare solutions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Ceramide Skincare Market Insights – Trends & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA