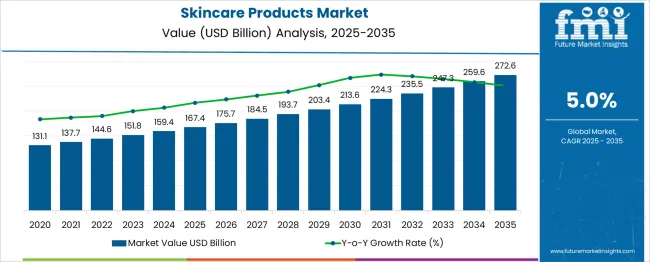

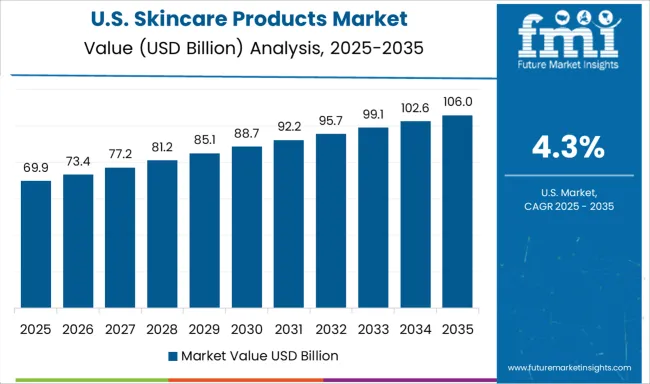

The skincare products market is estimated to be valued at USD 167.4 billion in 2025. It is projected to reach USD 272.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The annual absolute additions rise steadily, moving from USD 8.3 billion between 2025 and 2026 to USD 13.0 billion between 2034 and 2035. This consistent increase in yearly gains indicates positive momentum, supported by stable consumer demand, brand diversification, and growth in functional skincare categories such as anti-aging, barrier repair, and dermatology-grade formulations.

During the initial half of the forecast period, the market adds USD 46.0 billion in value, growing to USD 213.6 billion by 2030. In the second half, USD 59.0 billion is added, reaching USD 272.6 billion by 2035. This increase in absolute growth during the latter period confirms acceleration in value terms, even as the percentage growth rate remains consistent. Emerging economies, rising disposable spending on personal care, and consumer shifts toward specialized products are expected to reinforce this momentum. The trajectory is smooth and uninterrupted, with no signs of contraction or flattening. Growth momentum is distributed evenly across mass and premium segments, indicating long-term sustainability driven by product innovation, digital retail expansion, and rising wellness-oriented consumption behavior globally.

| Metric | Value |

|---|---|

| Skincare Products Market Estimated Value in (2025 E) | USD 167.4 billion |

| Skincare Products Market Forecast Value in (2035 F) | USD 272.6 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

A growing preference for preventive skincare routines and long-term dermatological wellness has shifted consumer focus toward daily-use skincare solutions. Technological advancements in product formulation and delivery systems have further contributed to market expansion, enabling better efficacy and product personalization.

The rise of online platforms, influencer-led marketing, and easy accessibility to dermatologist-recommended products have also expanded the reach of skincare brands across geographies. Additionally, rising concern over pollution, UV exposure, and aging signs has encouraged regular use of skincare products among all age groups. The introduction of multifunctional products with hydration, protection, and repair benefits continues to drive product innovation.

With regulatory authorities encouraging ingredient transparency and the clean label movement, consumer trust has become a major determinant in brand selection. These factors together are expected to sustain long-term growth and diversification across the global skincare landscape..

The skincare products market is segmented by product type, category, ingredients, distribution channel and geographic regions. The skincare products market is divided by product type into Facial care, Body care, Lip care, hair care, and Others (nail care, Fragrances, etc.). In terms of the category, the skincare products market is classified into Non-Luxury and Luxury. The skincare products market is segmented into Chemical and Natural. The distribution channel of the skincare products market is segmented into Offline and Online. Regionally, the skincare products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

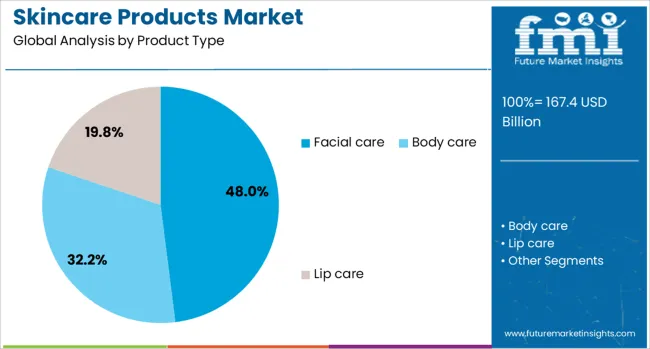

The facial care segment is projected to hold 48% of the Skincare Products market revenue share in 2025, making it the leading product type. This segment's dominance has been attributed to the consistent consumer demand for targeted solutions addressing aging, hydration, acne, pigmentation, and environmental damage. Daily-use products such as moisturizers, cleansers, serums, and sunscreens have been widely adopted due to their essential role in maintaining facial skin health.

The segment has also benefited from rapid innovation in lightweight textures, active ingredients, and science-backed formulations that appeal to a broad demographic. Consumers have shown a growing inclination toward self-care and preventative skincare, leading to increased product usage frequency.

The facial care category has continued to outperform others as it offers immediate and visible benefits, making it integral to both men’s and women’s grooming routines. The availability of facial care products across multiple price points and distribution channels has also reinforced its wide-scale penetration and market leadership..

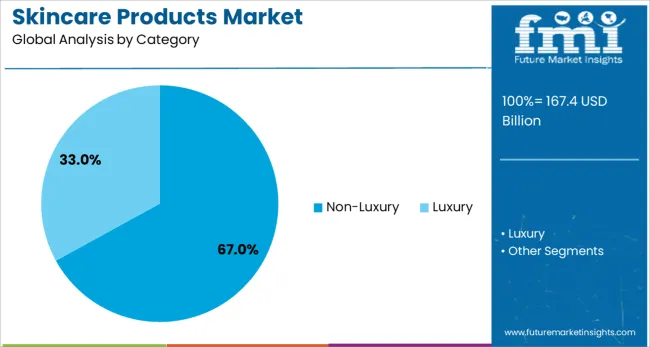

The non-luxury segment is anticipated to account for 67% of the Skincare Products market revenue share in 2025, making it the dominant category. This segment's growth has been driven by increasing affordability, mass-market accessibility, and strong consumer loyalty toward trusted mainstream brands. Non-luxury skincare products have gained popularity due to their value-for-money proposition, frequent promotional pricing, and availability in both physical and online retail channels.

The widespread use of non-luxury skincare has been supported by product effectiveness, dermatological validation, and consistent innovation in ingredients without high cost burdens. Emerging markets with price-sensitive consumers have significantly contributed to the expansion of this segment.

Consumers are seeking practical and reliable skincare solutions, and brands in the non-luxury segment have responded with scalable product lines that address broad-spectrum needs. The increased competition within this category has also encouraged continuous product enhancements, making it a sustainable and influential force in the overall skincare market..

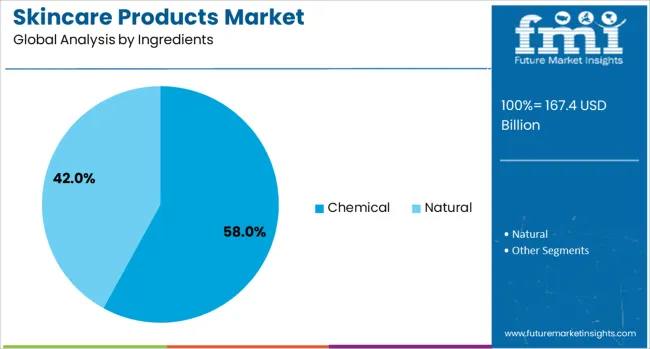

The chemical segment is expected to capture 58% of the Skincare Products market revenue share in 2025, establishing it as the leading ingredients category. The preference for chemical-based skincare formulations has been shaped by their proven efficacy in targeting specific skin concerns such as hyperpigmentation, acne, dullness, and aging. Ingredients like alpha hydroxy acids, retinoids, peptides, and chemical exfoliants have been widely adopted for their scientifically validated results.

The growth of this segment has been supported by increasing consumer familiarity with active ingredients and their functions, as well as dermatologist endorsements. Chemical formulations have demonstrated faster and more visible results, which has elevated their acceptance across both mass and premium product lines.

Despite the parallel rise of natural and organic trends, chemical-based skincare has retained consumer confidence due to its ability to deliver targeted outcomes with consistency. Advancements in formulation technologies have also improved skin compatibility and reduced irritation, further strengthening its market position..

Social media influence, e-commerce accessibility, and premiumization are accelerating adoption across both developed and emerging markets. However, intense competition, price sensitivity, regulatory complexities, and the prevalence of counterfeit products present notable restraints. Opportunities lie in premium, clean-label, and dermatologist-backed innovations, alongside niche offerings such as microbiome care and multifunctional solutions. Key trends include personalized formulations, clean beauty positioning, and integration of tech-enabled skin analysis tools, supported by sustainable packaging practices that cater to evolving consumer expectations.

The rising awareness of skin health and appearance has become a primary driver for skincare products worldwide. Consumers are increasingly investing in daily skincare routines, influenced by social media trends, beauty influencers, and dermatological recommendations. Expanding product availability across both premium and mass-market segments has broadened access, while demand for solutions targeting anti-aging, hydration, and skin barrier repair continues to grow. Emerging markets are witnessing higher adoption due to improving living standards and retail penetration. Dermatologically tested and clinically backed formulations are gaining trust, with companies innovating in textures, active ingredients, and packaging. E-commerce channels, subscription models, and direct-to-consumer strategies are further accelerating category expansion. Seasonal skincare ranges, male grooming lines, and multifunctional products also contribute to market momentum, making skincare one of the fastest-evolving categories within personal care.

Despite the growth, the skincare segment faces significant challenges from high competition and price-sensitive consumer segments. Intense rivalry among established brands, indie labels, and private-label offerings often leads to price wars, especially in emerging economies. Counterfeit products and misleading claims can undermine consumer confidence. Regulatory hurdles related to ingredient safety, labeling, and testing slow down new product launches in certain markets. Additionally, shifts in consumer preferences can quickly disrupt brand loyalty, forcing companies to constantly adapt product lines. For premium players, economic slowdowns can impact spending on high-value products. Rising costs for natural and specialty ingredients also pressure margins, making cost management critical. Distribution complexity across multiple retail formats and the need for constant promotional activity add to the operational challenges, particularly for mid-tier brands striving to maintain visibility.

The category is witnessing strong opportunities in premiumization and ingredient-led innovation. As consumers become more ingredient-conscious, brands are developing products with advanced actives like peptides, ceramides, retinoids, and plant-derived antioxidants. Opportunities exist in dermatologist-collaborated lines, hybrid skincare-makeup products, and solutions for specific skin concerns such as hyperpigmentation or sensitivity. Growth in wellness-driven beauty has increased demand for clean-label, vegan, and cruelty-free products. Functional packaging innovations like airless pumps and UV-protective bottles enhance product efficacy and appeal. Expanding into niche categories such as probiotic skincare, CBD-infused formulations, and microbiome-focused products can capture early adopters. Strategic collaborations with tech companies for AI-driven skin analysis and personalization offer a competitive edge. Emerging markets present white spaces for brands that can balance affordability with premium appeal, supported by localized marketing and culturally tailored formulations.

Personalized skincare is emerging as a strong trend, with consumers seeking products tailored to their specific skin type, lifestyle, and environment. Clean beauty continues to gain momentum, with transparency in ingredient sourcing and ethical production becoming major purchase drivers. Tech-enabled skincare solutions, including apps and devices that analyze skin conditions and recommend regimens, are becoming mainstream. Direct-to-consumer brands are leveraging social media engagement and influencer marketing to create loyal customer bases. Multifunctional products combining sun protection, hydration, and anti-aging benefits are seeing rising popularity. There is also a shift toward sustainable packaging solutions, including refillable containers and biodegradable materials, aligning with eco-conscious consumer behavior. Seasonal skincare launches, cross-border e-commerce expansion, and collaborations with dermatologists or beauty experts are shaping the future growth trajectory of the skincare products segment.

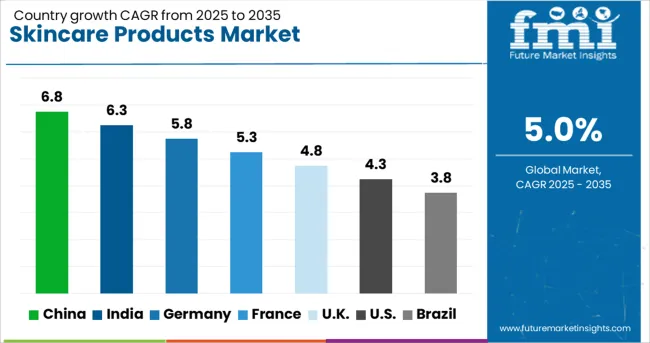

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

China, India, and Germany are leading growth within the skincare products market, posting CAGR values of 6.8%, 6.3%, and 5.8% respectively. These rates exceed the global CAGR of 5%, underlining faster product adoption and expansion in these regions. China is growing 1.36 times faster than the global average, supported by a rising middle-income population and increased spending on dermatology-driven products. India’s 1.26x multiplier reflects urban retail penetration and growing consumer awareness. Germany’s CAGR of 5.8%, 1.16x the global average, reflects clinical cosmeceutical demand and functional skincare innovations. The UK and USA fall slightly below the global CAGR, growing at 4.8% and 4.3%, respectively, due to market saturation and a mature retail landscape. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

In China, skincare product consumption has expanded due to increased usage frequency, growing male grooming interest, and ingredient-conscious consumer behavior. Hybrid formulas using traditional Chinese extracts and niacinamide or peptides have seen improved penetration across Tier 2 and Tier 3 cities. Dermatologically backed local brands have gained consumer trust, supported by mobile-first engagement strategies. Licensing of dermocosmetic lines for sensitive skin has expanded in southern provinces. E-commerce sales accounted for over 54% of total skincare volume in 2024. Strong demand has been recorded for whitening, hydrating, and anti-pollution formulations.

In India, skincare product demand has grown steadily due to increased awareness about daily skin routines and rising adoption in semi-urban areas. Ayurvedic and botanical ingredient-based formulations have been prioritized in creams, gels, and exfoliators. Multipurpose products with SPF, hydration, and anti-blemish properties have dominated new launches. Local brands expanded penetration through affordable SKUs and regional language campaigns across digital platforms. Skin tone-evening and acne-prevention lines have experienced higher reorder rates. Offline channels like pharmacies and modern trade have retained dominance in semi-rural sales.

In Germany, dermatologically approved and fragrance-free skincare products have maintained high consumer preference, especially among women aged 30–60. Retailers have prioritized clean-label brands with eco-certified ingredients and minimal packaging. Medical skincare and pharmacy-exclusive dermocosmetic ranges have increased penetration. Sensitized skin and anti-aging concerns have steered demand toward retinol and hyaluronic acid-based products. E-retailers and drugstore chains reported higher sales in refillable and concentrated skincare formats. Seasonal changes have also driven cyclic buying of creams and barrier-protection formulas.

In the United Kingdom, skincare consumption has expanded across hybrid beauty products combining skin hydration, UV protection, and light coverage. Anti-aging and sensitive skin solutions led growth in mature consumer segments. Major domestic brands have focused on “science-backed” formulas using ceramides, peptides, and SPF 30+. Value-conscious consumers shifted toward mid-tier brands offered through retail pharmacy chains. Acne management kits and glycolic acid-based exfoliants gained volume in Gen Z and millennial groups. Monthly skincare subscription boxes have seen stronger retention among working professionals.

In the United States, a higher shift toward ingredient-led skincare was recorded, with increased focus on ceramides, peptides, and retinoids. The aging population drove steady demand for hydration-focused and firming products. OTC dermatological brands with prescription-grade claims increased pharmacy shelf space. Retailers observed improved uptake of vitamin C serums and retinol-based night creams, particularly in sunbelt states. Clean beauty marketing and inclusive skincare lines expanded in Gen Z and Black-owned brand segments. Private label brands grew across mass retail and online platforms.

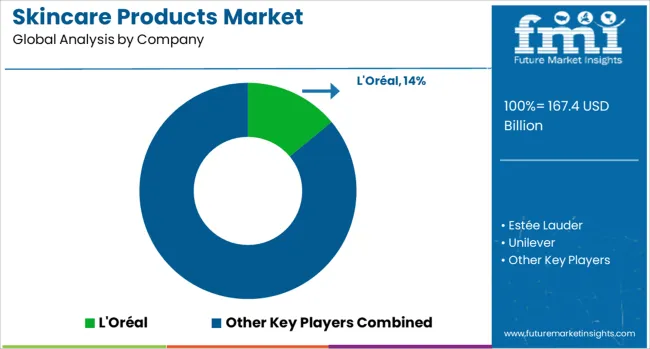

The market consists of brands delivering mass-market, premium, and dermocosmetic solutions spanning moisturizers, serums, cleansers, and treatments. L'Oréal remains a dominant global player through diverse portfolios under La Roche-Posay, CeraVe, and L'Oréal Paris, with strong demand in both pharmacy and retail channels. Estée Lauder targets premium and professional skincare segments, supported by product innovation across Estée Lauder, Clinique, and Dr.Jart+ for hydration, anti-aging, and sensitive skin. Unilever serves a broad consumer base with brands like Pond’s and Simple, distributing across Asia, Africa, and Latin America, where affordability and multipurpose usage drive sales. Procter & Gamble leverages Olay and SK-II to address mid- and high-tier skincare needs, especially across North America and East Asia. Beiersdorf AG, with Nivea and Eucerin, focuses on clinical efficacy and skin compatibility, appealing to both mass-market and pharmacy consumers.

Johnson & Johnson maintains a presence via Neutrogena and Aveeno, addressing dermatological concerns through science-backed ingredients. Shiseido caters to the premium category in Japan, China, and select global markets. Competitiveness hinges on ingredient transparency, skin-type targeting, dermatologist endorsements, and region-specific product formats such as gel-based moisturizers and brightening emulsions for Asian markets.

Between 2023 and mid 2025, the skincare market experienced high-profile acquisitions, celebrity-led launches, and growing investor focus on clinically backed brands. e.l.f. Beauty acquired Rhode in mid 2025, integrating it into its portfolio while retaining the founder’s creative leadership. L’Oréal moved to acquire premium dermatology brand Medik8 to strengthen its professional skincare lineup. Estée Lauder completed full ownership of Deciem (The Ordinary), enhancing access to its digitally native and science driven product base. Shiseido added Dr. Dennis Gross to its prestige roster, deepening its clinical skincare offering. In India, Unilever acquired Minimalist, while local D2C brands like Plum and Mamaearth secured major funding. Across the sector, monk-hearted indie names and professional skincare labels are gaining attention as investment targets.

| Item | Value |

|---|---|

| Quantitative Units | USD 167.4 Billion |

| Product Type | Facial care, Body care, Lip care, Haircare, and Others (Nailcare, Fragrances, etc.) |

| Category | Non-Luxury and Luxury |

| Ingredients | Chemical and Natural |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | L'Oréal, Estée Lauder, Unilever, Procter & Gamble, Beiersdorf AG (Nivea), Johnson & Johnson, Shiseido, and Others |

| Additional Attributes | Dollar sales by product type (cleansers, serums, moisturizers) and application (anti aging, acne, sun protection), demand driven by skincare routines, digital-native consumers, K Beauty trends, led by Asia Pacific with North America catching up, innovation in biotech actives, clean label formulations, and refillable sustainable packaging. |

The global skincare products market is estimated to be valued at USD 167.4 billion in 2025.

The market size for the skincare products market is projected to reach USD 272.6 billion by 2035.

The skincare products market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in skincare products market are facial care, _cleansers and toners, _moisturizers and creams, _face masks and serums, _sunscreen and suncare products, _others, body care, _body lotions & moisturizer, _body washes and shower gels, _body scrubs and exfoliants, _body oils and serums, _body butters and creams, _others, lip care, _lip balms, _lip scrubs, _lip masks, _others, haircare, _shampoo, _conditioner, _hair masks, _serum, _others (perfume, colors, etc.) and others (nailcare, fragrances, etc.).

In terms of category, non-luxury segment to command 67.0% share in the skincare products market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Moisturizing Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Anti-Fatigue Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Incontinence Skincare Products Market Analysis by Product Type, Price, End-User, Sales Channel and Region 2025 to 2035

Anti-Inflammatory Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Allantoin Extract for Skincare Products Market Analysis – Trends, Growth & Forecast 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA