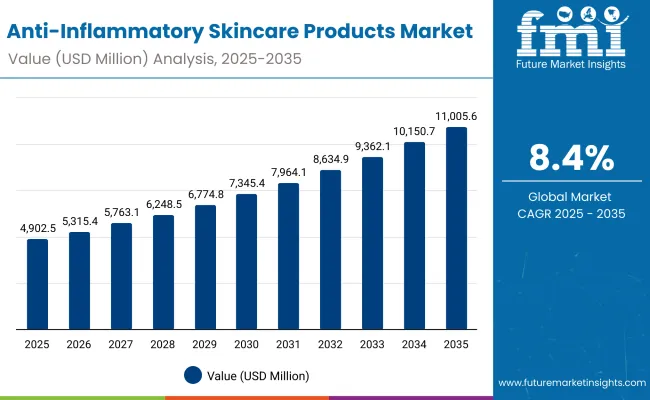

The Global Anti-Inflammatory Skincare Products Market is expected to record a valuation of USD 4,902.5 million in 2025 and USD 11,005.6 million in 2035, with an increase of USD 6,103.1 million, which equals a growth of nearly 193% over the decade. The overall expansion represents a CAGR of 8.4% and a 2X increase in market size.

Global Anti-Inflammatory Skincare Products Market Key Takeaways

| Metric | Value |

|---|---|

| Global Anti-Inflammatory Skincare Products Market Estimated Value in (2025E) | USD 4,902.5 million |

| Global Anti-Inflammatory Skincare Products Market Forecast Value in (2035F) | USD 11,005.6 million |

| Forecast CAGR (2025 to 2035) | 8.4% |

During the first five-year period from 2025 to 2030, the market increases from USD 4,902.5 million to USD 7,345.4 million, adding USD 2,442.9 million, which accounts for almost 40% of the total decade growth. This phase records steady adoption in pharmacies, dermatology clinics, and online retail, driven by rising consumer demand for sensitive-skin solutions and dermatologist-recommended brands.

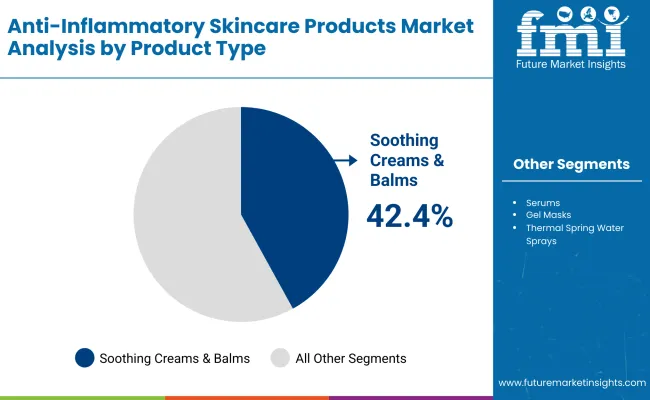

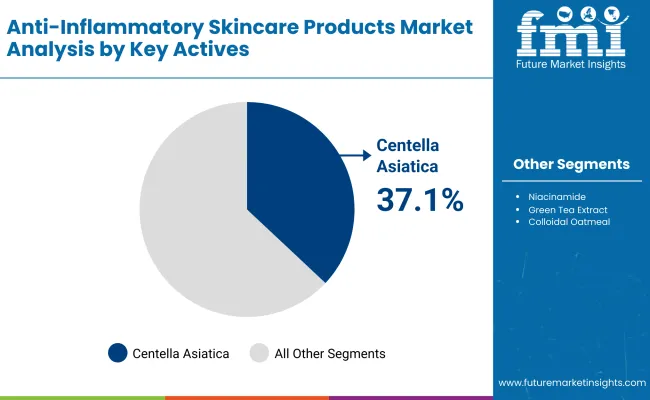

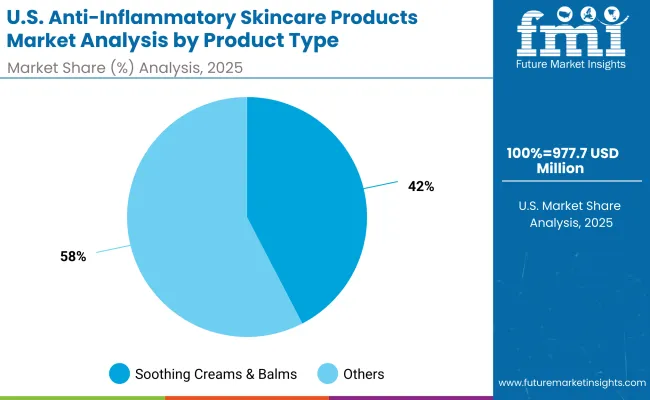

Soothing creams & balms dominate this period as they cater to over 42% of product demand, especially for irritated and redness-prone skin conditions. Centellaasiatica as a botanical active gains traction across Asia-Pacific and Europe, supported by consumer preference for natural solutions.

The second half from 2030 to 2035 contributes USD 3,660.2 million, equal to 60% of total growth, as the market jumps from USD 7,345.4 million to USD 11,005.6 million. This acceleration is powered by the surge in AI-driven skincare personalization, rapid e-commerce expansion, and broader acceptance of anti-inflammatory solutions beyond sensitive skin into preventive and wellness skincare.

Gel masks and thermal water sprays gain stronger adoption in the latter half of the decade, while online and specialty beauty retail channels capture a growing share above 50% by 2035. Botanical actives including green tea extract and colloidal oatmeal expand their base as consumer awareness of holistic and barrier-protecting skincare accelerates.

From 2020 to 2024, the Global Anti-Inflammatory Skincare Products Market grew steadily, supported by heightened awareness of skin barrier protection and dermatologist endorsements. During this period, the competitive landscape was dominated by European pharmacy skincare brands controlling nearly 30% of revenue, with leaders such as La Roche-Posay, Avene, and Eucerin focusing on science-backed formulations for eczema-prone and sensitive skin consumers.

Competitive differentiation relied heavily on dermatologist validation, hypoallergenic claims, and incorporation of soothing actives like niacinamide and Centellaasiatica. Direct-to-consumer distribution and subscription models had minimal traction, contributing less than 12% of total market value, as traditional pharmacy and clinic channels remained dominant.

Demand for anti-inflammatory skincare will expand to USD 4,902.5 million in 2025, and the revenue mix will shift as e-commerce grows to over 35% share by 2030. Traditional pharmacy leaders face rising competition from digital-first brands offering personalized regimens, subscription-based anti-redness kits, and AI-driven skin assessments.

Major incumbents are pivoting to hybrid models, combining dermatologist trust with omnichannel retail to maintain dominance. Emerging entrants specializing in natural and clean-label formulations are gaining share, particularly in India and China where consumer trust in herbal actives is accelerating. The competitive advantage is moving away from single product success to ecosystem strength, brand advocacy, and data-driven personalization.

Advances in dermatology-led skincare have improved consumer trust and accelerated adoption across sensitive and eczema-prone skin segments. Soothing creams & balms have gained popularity due to their suitability for everyday irritation management and rosacea-related redness.

The rise of Centellaasiatica has contributed to increased consumer preference for botanical-led actives with clinically proven calming properties. Other actives such as niacinamide and green tea extract enhance skin barrier protection, boosting adoption among adults and women, who form the largest end-user base.

Expansion of online pharmacies and specialty beauty retail has further fueled market growth. E-commerce platforms have amplified access to dermatologist-tested anti-inflammatory solutions, while dermatology clinics increasingly recommend OTC products alongside prescriptions, expanding consumer crossover.

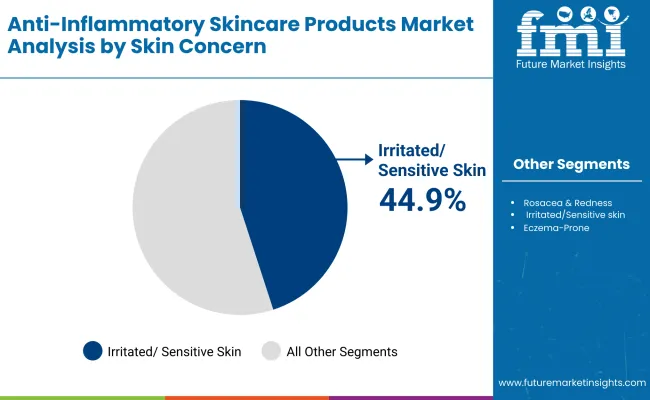

Segment growth is expected to be led by soothing creams & balms, Centellaasiatica as a key active, and the irritated/sensitive skin concern category, due to their precision in addressing widespread consumer needs.

The market is segmented by product type, key actives, skin concern, channel, end user, and geography. Product types include soothing creams & balms, serums, gel masks, and thermal spring water sprays, highlighting the breadth of formats designed for anti-inflammatory benefits. Key actives include Centellaasiatica, niacinamide, green tea extract, and colloidal oatmeal, which drive adoption based on their natural, barrier-repairing, and antioxidant properties. By skin concern, the market covers rosacea & redness, irritated/sensitive skin, and eczema-prone conditions, aligning with medical dermatology needs.

Channel classification spans pharmacies & drugstores, e-commerce, dermatology clinics, and specialty beauty retail, reflecting consumer access points and brand strategies. By end user, categories encompass adults, children, men, and women, with adults and women leading demand, while child-sensitive skincare is emerging as a fast-growth subsegment.

Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with India and China posting double-digit CAGR growth, while the USA and Europe remain the largest mature markets.

| Product Type | Value Share % 2025 |

|---|---|

| Soothing creams & balms | 42.4% |

| Others | 57.6% |

The soothing creams & balms segment is projected to contribute 42.4% of the Global Anti-Inflammatory Skincare Products Market revenue in 2025, maintaining its lead as the dominant product category. This dominance is driven by rising demand for daily-use skincare that addresses redness, irritation, and barrier damage. Consumers with sensitive skin conditions such as rosacea and eczema tend to prefer creams and balms due to their thicker textures and occlusive properties that provide instant soothing and protection.

The segment’s growth is further supported by increasing product availability across pharmacies, dermatology clinics, and e-commerce platforms, which have become central distribution channels for dermatologist-recommended creams. Additionally, formulators are increasingly combining emollients with actives such as niacinamide and colloidal oatmeal to enhance efficacy. The creams & balms category is expected to remain the backbone of anti-inflammatory skincare, as it offers trusted, multipurpose solutions for both adults and children with compromised skin barriers.

| Key Actives | Value Share % 2025 |

|---|---|

| Centella asiatica | 37.1% |

| Others | 62.9% |

The Centellaasiatica segment is forecasted to hold 37.1% of the market share in 2025, led by its application in creams, serums, and masks that target irritation and inflammation. Known as “Cica” in popular skincare terminology, Centellaasiatica has become one of the most trusted botanical actives in the global market, owing to its proven soothing, antioxidant, and barrier-repair properties. This active is particularly favored in East Asia and Europe, where consumers are highly receptive to plant-derived solutions with clinical validation.

Centella-based formulations are now widely marketed for rosacea-prone and sensitive skin, and product launches featuring this ingredient continue to expand in both mass retail and premium segments. The segment’s growth is bolstered by increased consumer awareness through social media and dermatology recommendations, highlighting its role in calming inflammation and strengthening the skin barrier. With its adaptability across multiple product types, Centellaasiatica is expected to continue driving innovation and remain a cornerstone of the anti-inflammatory skincare segment.

| Skin Concern | Value Share % 2025 |

|---|---|

| Irritated/sensitive skin | 44.9% |

| Others | 55.1% |

The irritated/sensitive skin segment is projected to account for 44.9% of the Global Anti-Inflammatory Skincare Products Market revenue in 2025, establishing it as the leading skin concern category. This segment has surged in importance due to the rising global prevalence of sensitive skin, which is linked to environmental stressors, pollution, lifestyle factors, and increased awareness of dermatological conditions. Consumers now seek products specifically formulated to reduce redness, discomfort, and barrier disruption associated with skin sensitivity.

Brands across the market are formulating dedicated product lines that target sensitive skin, incorporating dermatologist-tested claims and hypoallergenic certifications to appeal to this broad consumer base. The growth of this segment is also supported by children’s and baby skincare subcategories, where irritation and sensitivity are common triggers for product adoption. As awareness of the “skin barrier” trend expands globally, products for irritated/sensitive skin are expected to maintain their dominance, shaping brand strategies and innovation pipelines well into the next decade.

Rising Prevalence of Skin Sensitivity and Inflammation Disorders

One of the strongest demand drivers for the Global Anti-Inflammatory Skincare Products Market is the growing prevalence of sensitive skin and inflammatory conditions such as rosacea, eczema, and dermatitis. Studies show that nearly 60-70% of women and 40-50% of men globally report having sensitive skin.

Urban environments, high pollution levels, and stress-induced skin reactivity are intensifying this prevalence. Consumers in mature markets like the USA and Germany are increasingly adopting dermatologist-recommended creams and balms, while younger populations in Asia-Pacific are seeking preventive anti-inflammatory solutions early in their skincare journey.

This expanding consumer base makes inflammation-focused skincare a mainstream need rather than a niche category, driving sustained revenue growth across both mass and premium segments.

Medical-Dermatology and Clinical Endorsements Driving Consumer Trust

Another critical driver is the clinical validation and dermatologist endorsement of anti-inflammatory skincare products, which directly influences consumer adoption. Unlike generic moisturizers, anti-inflammatory skincare products often carry claims of being “dermatologist-tested,” “hypoallergenic,” or “clinically proven,” which build trust among risk-averse consumers.

In markets like the USA, France, and Japan, pharmacy brands such as La Roche-Posay, Avene, and Eucerin have leveraged strong medical backing to position themselves as safe, reliable, and effective for long-term skin conditions.

Dermatology clinics also increasingly recommend OTC soothing creams and Centella-based serums as complements to prescription treatments. This alignment between medical credibility and consumer demand amplifies adoption across pharmacies, e-commerce, and specialty beauty retail channels.

Regulatory Barriers Around Claims and Active Ingredient Approvals

A key restraint for the market is the stringent regulatory oversight around skincare claims and approval of active ingredients. Anti-inflammatory products often border between cosmetics and quasi-pharmaceuticals, which creates challenges in how they are marketed. For example, in the EU, claims such as “treats eczema” or “cures rosacea” are restricted, forcing brands to adopt softer language like “reduces redness” or “soothes irritation.”

Similarly, in the USA, FDA scrutiny over colloidal oatmeal and niacinamide usage in OTC products limits flexibility in innovation. These regulatory complexities delay product launches, increase compliance costs, and force global players to localize formulations, which slows market scalability.

High Price Sensitivity in Emerging Markets

While demand is growing in Asia-Pacific and Latin America, price sensitivity remains a significant barrier. Consumers in India, Brazil, and Southeast Asia often perceive dermatologist-recommended anti-inflammatory products as premium and unaffordable compared to traditional herbal or generic alternatives.

For example, Centellaasiatica is widely available in natural remedies at a fraction of the cost of branded Cica creams imported from Korea or Europe. This limits penetration of international players in mass segments and creates opportunities for local and private-label competitors. Unless brands tailor pack sizes, pricing strategies, and localized sourcing models, high prices may continue to restrain volume expansion in emerging markets.

Botanical Actives as the Core of Product Innovation

One of the most prominent trends shaping the market is the shift towards botanical and plant-derived actives such as Centellaasiatica, green tea extract, and colloidal oatmeal. Consumers now associate these ingredients with natural healing, reduced irritation, and sustainable skincare. In East Asia, Centella has transitioned from a niche K-beauty ingredient into a global powerhouse active, now integrated into creams, serums, and sprays across both mass and luxury lines.

Colloidal oatmeal, traditionally used in medical skincare, is experiencing renewed growth as brands highlight its barrier-strengthening benefits. This trend is reinforced by consumer distrust of synthetic chemicals, making botanical actives a central innovation pipeline for nearly all major brands in the market.

Expansion of Digital Dermatology and Personalized Anti-Inflammatory Regimens

Another defining trend is the rise of digital dermatology and AI-driven personalization in anti-inflammatory skincare. E-commerce platforms and D2C brands are leveraging digital skin analysis tools to recommend personalized anti-redness or anti-eczema routines, often combining soothing creams, serums, and sprays into tailored kits.

In China, for example, Centella-based products are marketed through livestream e-commerce sessions that include real-time skin consultations. In the USA and Europe, subscription-based models now allow consumers to receive dermatologist-approved sensitive-skin regimens delivered monthly.

This trend not only enhances consumer engagement but also strengthens recurring revenue streams for brands. Over the next decade, digital-driven personalization is expected to blur the lines between medical advice and consumer skincare, creating a hybrid model that integrates AI, dermatology, and retail.

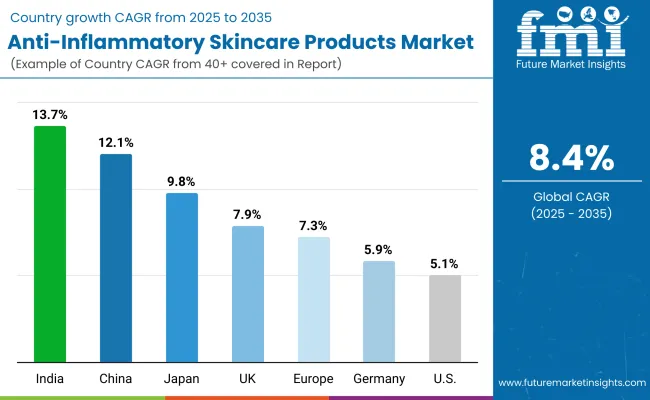

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 12.1% |

| USA | 5.1% |

| India | 13.7% |

| UK | 7.9% |

| Germany | 5.9% |

| Japan | 9.8% |

| Europe | 7.3% |

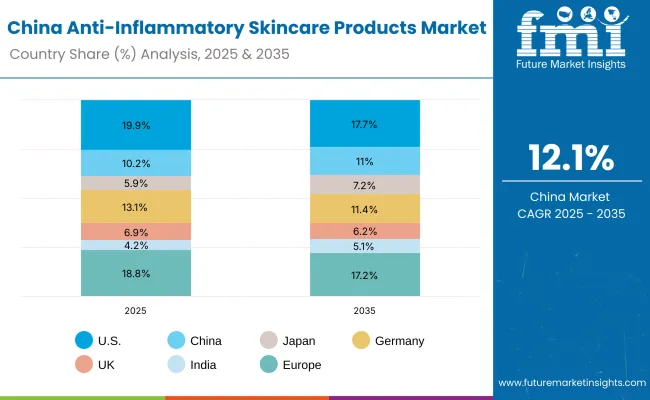

The Global Anti-Inflammatory Skincare Products Market demonstrates significant country-level variations in growth outlook between 2025 and 2035, reflecting differing consumer preferences, dermatological awareness, and retail maturity. India, with a CAGR of 13.7%, and China at 12.1%, are set to emerge as the fastest-growing markets, driven by rising disposable incomes, heightened consumer awareness of sensitive skin conditions, and an increasing reliance on botanical actives such as Centellaasiatica.

India’s strong heritage of Ayurveda and natural remedies provides a fertile ground for innovation, while China’s expansive e-commerce ecosystem and the popularity of K-beauty and C-beauty products fuel rapid adoption. Japan, with a projected CAGR of 9.8%, is also an important growth hub, supported by its advanced cosmetics industry, high consumer trust in dermatology, and preference for multifunctional products that combine anti-inflammatory benefits with anti-aging and hydration properties.

In contrast, the USA and European markets (Germany, UK, and the broader region) reflect steady but comparatively moderate growth, with CAGRs ranging between 5.1% and 7.9%. The USA, despite being the largest single market by value, will see slower expansion as it is already highly penetrated with established pharmacy brands like La Roche-Posay, Aveeno, and Cetaphil. Europe, growing at 7.3%, continues to be dominated by dermo-cosmetic leaders from France and Germany, where clinical endorsements and pharmacy-driven sales remain the cornerstone.

Germany’s growth at 5.9% reflects its mature but stable skincare ecosystem, while the UK’s 7.9% CAGR highlights strong consumer adoption of online retail and premium sensitive-skin brands. Overall, developed markets will remain high-value but slower-growing, while Asia will act as the engine of expansion, reshaping the competitive landscape of the Global Anti-Inflammatory Skincare Products Market over the next decade.

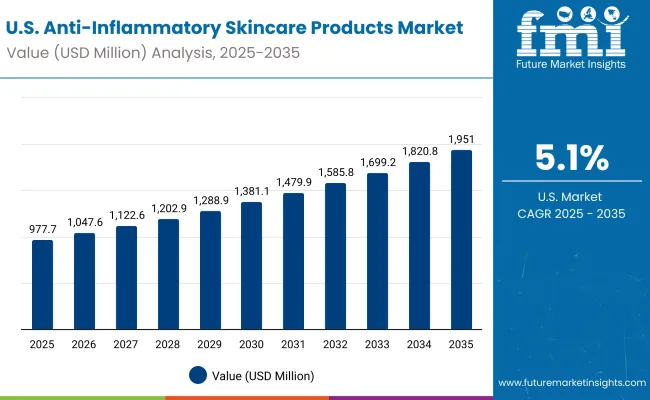

| Year | USA Anti-Inflammatory Skincare Products Market (USD Million) |

|---|---|

| 2025 | 977.74 |

| 2026 | 1047.68 |

| 2027 | 1122.62 |

| 2028 | 1202.92 |

| 2029 | 1288.96 |

| 2030 | 1381.16 |

| 2031 | 1479.96 |

| 2032 | 1585.82 |

| 2033 | 1699.25 |

| 2034 | 1820.80 |

| 2035 | 1951.04 |

The Global Anti-Inflammatory Skincare Products Market in the United States is projected to grow at a CAGR of 5.1%, led by strong adoption in pharmacies and e-commerce platforms. Dermatologist-backed brands such as La Roche-Posay, Aveeno, and Cetaphil continue to dominate, benefiting from high consumer trust in medical skincare.

Growth is reinforced by increased demand among consumers managing rosacea, eczema, and sensitive skin flare-ups, with soothing creams & balms representing over 42% of market demand in 2025. Online platforms are playing an expanding role, with Amazon and specialized dermo-cosmetic e-retailers widening accessibility. Rising awareness among men and children’s skincare categories is also contributing to gradual market diversification.

The Global Anti-Inflammatory Skincare Products Market in the United Kingdom is expected to grow at a CAGR of 7.9%, supported by widespread availability in pharmacy chains and a strong culture of dermatologist-recommended skincare. British consumers are increasingly turning to serums and thermal sprays for preventive care, particularly against redness caused by pollution and weather-related triggers.

Online retail growth, coupled with increased interest in vegan and clean-label claims, is fueling premium product expansion. Heritage pharmacy brands like Bioderma and Eucerin have strengthened their foothold by offering dermatologist-tested formulations tailored to sensitive skin.

India is witnessing rapid growth in the Global Anti-Inflammatory Skincare Products Market, which is forecast to expand at a CAGR of 13.7% through 2035, the highest among all countries analyzed. Rising disposable incomes, growing dermatological awareness, and preference for natural actives such as Centellaasiatica and green tea are fueling demand.

Distribution is expanding beyond metro cities into tier-2 and tier-3 regions, supported by aggressive e-commerce penetration and social media-driven product education. Domestic and international brands are launching cost-effective Cica creams and soothing serums tailored for Indian skin tones and climate.

The Global Anti-Inflammatory Skincare Products Market in China is expected to grow at a CAGR of 12.1%, among the highest globally. This momentum is fueled by the booming e-commerce landscape, where livestreaming platforms aggressively promote Centella-based serums and calming sprays.

Local C-beauty brands are innovating with botanically led formulations, competing directly with international players like La Roche-Posay and Avene. Municipal health campaigns encouraging preventive skincare and awareness of sensitive skin conditions have further boosted adoption. Affordable domestic products are enabling rapid penetration among younger demographics, while premium pharmacy brands continue to target urban professionals.

| Country | 2025 Share (%) |

|---|---|

| USA | 19.9% |

| China | 10.2% |

| Japan | 5.9% |

| Germany | 13.1% |

| UK | 6.9% |

| India | 4.2% |

| Europe | 18.8% |

| Country | 2035 Share (%) |

|---|---|

| USA | 17.7% |

| China | 11.0% |

| Japan | 7.2% |

| Germany | 11.4% |

| UK | 6.2% |

| India | 5.1% |

| Europe | 17.2% |

| USA By Product Type | Value Share % 2025 |

|---|---|

| Soothing creams & balms | 42.4% |

| Others | 57.6% |

The Global Anti-Inflammatory Skincare Products Market in the United States is projected at USD 977.7 million in 2025, expanding at a steady CAGR of 5.1% through 2035. Soothing creams & balms dominate the product type segment with a 42.4% share, reflecting their status as the most prescribed and recommended solutions for redness, rosacea, and eczema management. The USA market continues to rely on dermatology-driven trust, with brands like La Roche-Posay, Cetaphil, and Aveeno leveraging pharmacy-based distribution and dermatologist endorsements as competitive levers.

Growth is also supported by diversification into serums and sprays, as consumers seek lighter, layering-friendly solutions for daily routines. The expansion of tele-dermatology and subscription skincare models is reshaping access to anti-inflammatory products, offering bundled regimens through digital consultations. Sensitive skin is increasingly recognized as a mainstream concern rather than a niche segment, positioning this category at the intersection of medical credibility and consumer wellness.

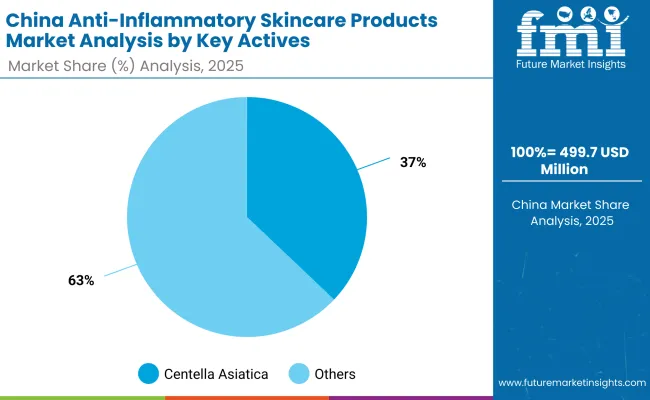

| China By Key Actives | Value Share % 2025 |

|---|---|

| Centella asiatica | 37.1% |

| Others | 62.9% |

The Global Anti-Inflammatory Skincare Products Market in China is valued at USD 499.7 million in 2025, with Centellaasiatica emerging as the leading active at 37.1% share. China is expected to post a CAGR of 12.1%, making it one of the fastest-growing markets globally. The dominance of Centella stems from its cultural familiarity and deep integration into K-beauty and C-beauty routines, where it is marketed under the “Cica” label across creams, serums, and sprays.

Livestream e-commerce has amplified product accessibility, with influencers and dermatologists showcasing calming solutions in real time. Domestic C-beauty brands are competing aggressively with global leaders by offering affordable Centella-based products tailored for younger consumers. Rising prevalence of sensitive skin conditions in urban populations due to pollution and lifestyle stressors adds urgency to demand. As China expands its dermo-cosmetic infrastructure, short-form digital campaigns and AI-driven personalization are expected to make Centella products even more indispensable.

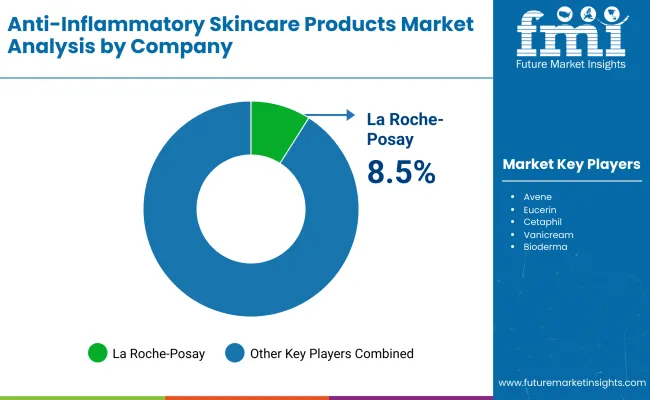

| Company | Global Value Share 2025 |

|---|---|

| La Roche- Posay | 8.5% |

| Others | 91.5% |

The Global Anti-Inflammatory Skincare Products Market is moderately fragmented, with pharmacy dermo-cosmetic leaders, premium clinical brands, and emerging digital-first players shaping competition. La Roche-Posay leads globally with an 8.5% market share, powered by its thermal water-based soothing products and strong dermatologist endorsements. Avene, Eucerin, and Bioderma remain entrenched in European and USA pharmacies, while Cetaphil and Aveeno command consumer trust in sensitive skincare through pediatric and family-oriented positioning.

Mid-sized innovators such as First Aid Beauty and Paula’s Choice have captured urban millennial audiences with clean-label and cruelty-free claims, leveraging e-commerce and direct-to-consumer sales models. Meanwhile, Vanicream specializes in hypoallergenic solutions that cater to highly sensitive and eczema-prone consumers, building loyalty through niche targeting.

Competitive differentiation is shifting from singular product efficacy to ecosystem strategies combining dermatologist advocacy, AI-driven personalization, subscription kits, and omnichannel retail presence. Global players are expanding into Asia-Pacific with localized formulations featuring Centellaasiatica and green tea extracts, while domestic Asian brands intensify competition by undercutting price points. This evolving competitive mix underscores the shift toward trust, accessibility, and personalization as defining market levers.

Key Developments in Global Anti-Inflammatory Skincare Products Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Product Type | Soothing creams & balms, Serums, Gel masks, Thermal spring water sprays |

| Key Actives | Centella asiatica , Niacinamide , Green tea extract, Colloidal oatmeal |

| Skin Concern | Rosacea & redness, Irritated/sensitive skin, Eczema-prone |

| Channel | Pharmacies & drugstores, E-commerce, Dermatology clinics, Specialty beauty retail |

| End User | Adults, Children, Men, Women |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | La Roche- Posay , Avene , Eucerin , Cetaphil, Vanicream , Bioderma , Clinique, First Aid Beauty, Paula’s Choice, Aveeno |

| Additional Attributes | Dollar sales by product type and skin concern, adoption trends in pharmacies and e-commerce, rising demand for Centella asiatica -based formulations, sector-specific growth in dermatology clinics and specialty retail, software-driven personalization and subscription models, integration with AI/AR skincare consultations, regional trends influenced by urban skin sensitivity, and innovations in botanical actives and clean-label claims. |

The Global Anti-Inflammatory Skincare Products Market is estimated to be valued at USD 4,902.5 million in 2025.

The market size for the Global Anti-Inflammatory Skincare Products Market is projected to reach USD 11,005.6 million by 2035.

The Global Anti-Inflammatory Skincare Products Market is expected to grow at a CAGR of 8.4% between 2025 and 2035.

The key product types in the Global Anti-Inflammatory Skincare Products Market are soothing creams & balms, serums, gel masks, and thermal spring water sprays.

In terms of skin concern, the irritated/sensitive skin segment is expected to command a 44.9% share in the Global Anti-Inflammatory Skincare Products Market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA