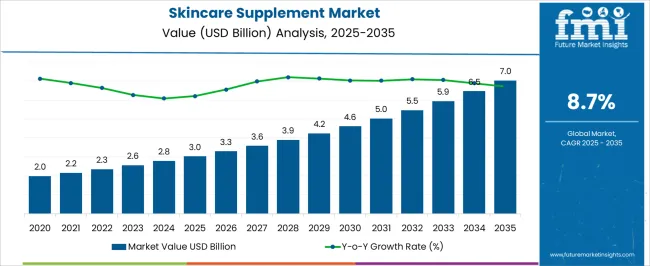

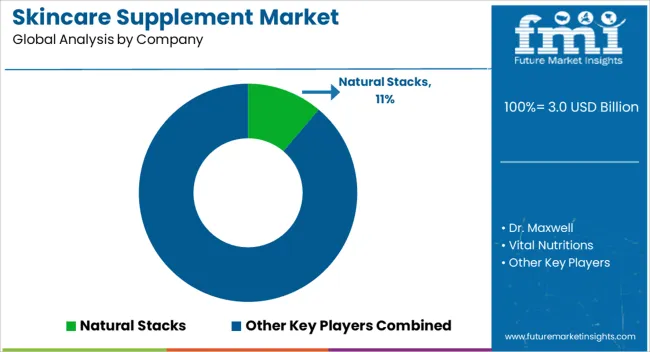

The Skincare Supplement Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 7.0 billion by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period.

| Metric | Value |

|---|---|

| Skincare Supplement Market Estimated Value in (2025 E) | USD 3.0 billion |

| Skincare Supplement Market Forecast Value in (2035 F) | USD 7.0 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

The skincare supplement market is expanding steadily, fueled by rising consumer interest in beauty-from-within solutions and increasing awareness of skin health as part of overall wellness. Functional supplements are gaining traction as consumers seek alternatives to topical products, with a focus on anti-aging, hydration, and skin repair benefits.

Demand is being further supported by advancements in nutraceutical formulations, which enhance bioavailability and efficacy of active ingredients. The market benefits from strong cross-industry synergies with cosmetics and healthcare, with product offerings positioned at the intersection of wellness and beauty.

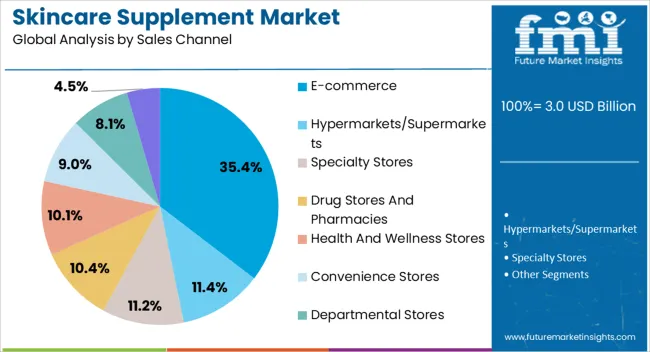

E-commerce platforms have amplified accessibility, while clean-label and natural ingredient trends are shaping product innovation. The future outlook is promising, with continued emphasis on preventive skincare and growing consumer willingness to adopt oral supplementation as part of daily routines.

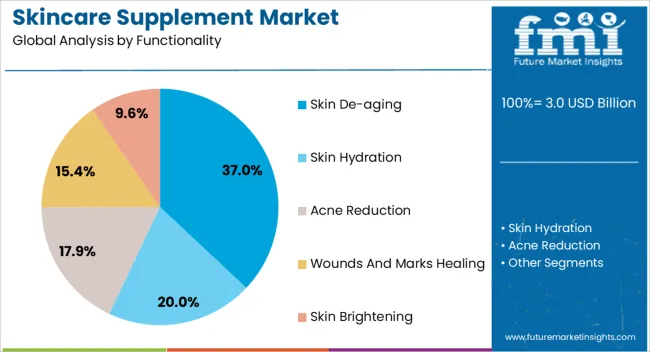

The skin de-aging segment dominates the functionality category with approximately 37.0% share, reflecting consumer demand for products targeting visible signs of aging. This segment’s leadership is driven by rising awareness of collagen degradation, oxidative stress, and the role of supplementation in supporting skin elasticity and firmness.

Anti-aging formulations enriched with collagen peptides, antioxidants, and vitamins are widely adopted across demographics seeking preventive and corrective solutions.

With strong alignment to consumer aspirations for youthful appearance and wellness, the skin de-aging segment is positioned for continued growth.

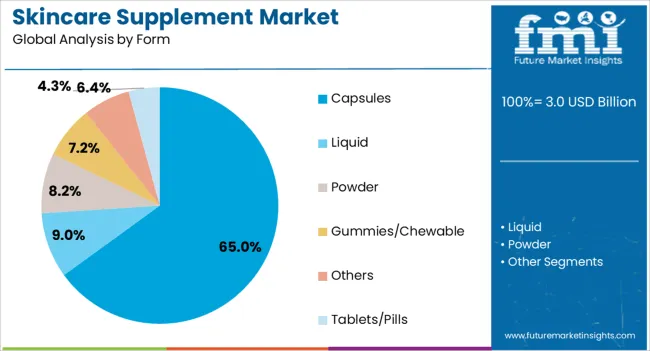

The capsules segment leads the form category with approximately 65.0% share, supported by convenience, precise dosing, and broad acceptance among consumers. Capsules offer enhanced stability for active ingredients such as vitamins, minerals, and botanicals, ensuring effective delivery and absorption.

The format’s portability and compatibility with daily routines have reinforced adoption in both developed and emerging markets. Manufacturers favor capsules due to scalability and ease of innovation, including combinations of multiple active compounds.

With consumer preference for practical and effective supplement formats, the capsules segment is expected to retain its leading market share.

The e-commerce segment accounts for approximately 35.4% share of the sales channel category, reflecting the rapid shift toward digital retail platforms in supplement purchasing. Online availability enables consumers to access a wide variety of skincare supplements, compare formulations, and benefit from promotional pricing.

Direct-to-consumer brands and subscription models have further driven adoption in this channel. Increased reliance on digital platforms for health and beauty purchases, particularly post-pandemic, has reinforced growth.

With ongoing consumer preference for convenience and expanding global e-commerce penetration, this segment is expected to strengthen its position in the years ahead.

Rising Celebrity-owned Supplement Brands to Fuel Sales

Today’s skincare routines don’t only include cleansers, toners, and moisturizers. These have come a long way in the past few years. Consumers have become increasingly aware of what they put on the skin as per individual skin types. Hence, every other brand in the world is coming up with new products that come with claims like ‘the best’ or ‘game-changer.’

New approaches by companies have given rise to supplements meant to prevent skin-based issues. Even celebrities are not backing away in this field with the constant launch of new supplement brands.

Stella McCartney, a renowned fashion designer, for instance, introduced an edible skincare supplement under her brand Stella in January 2025. The supplements contain ceramosides to help prevent damage to collagen.

Wellness Gummies Targeted at Consumers Looking to Enhance Skin are Trending

Supplements in the form of gummies are gaining immense popularity across the globe. As gummies provide high convenience in terms of consumption on the go, most individuals are demanding such products.

Tablets often require measurements, and this can be difficult when a person is traveling. Hence, gummies are gaining impetus and several brands are launching innovative formulations for the same.

In March 2025, for instance, United States-based The Vitamin Shoppe and Imaraïs Beauty, headquartered in Canada, launched a new range of gummies under the former’s ‘Beauty from Within’ approach. The companies claim that the gummies would be able to fulfill the beauty and wellness goals of consumers, offering strong nails and healthy skin.

Unclear Advertisements and Lack of Research to Decline Demand

Since the COVID-19 pandemic hit the world back in 2020, several companies have come up with new ranges of nutricosmetics to meet the rising demand for enhanced skin. Consumers usually make purchase decisions based on the claims of new supplements. Advertisement campaigns mainly target a specific group of audience and do not provide a clear picture of the ingredients.

Supplements often do not undergo stringent quality checks or safety checks, unlike medicines. Hence, the claims provided by several brands cannot be considered full proof. When taken without the guidance of healthcare professionals, individuals can face side effects like nausea, dizziness, or headaches.

In May 2025, for instance, Bloommy, Inc., a Connecticut-based company, recalled Bloommy Biotin Collagen Keratin Capsules for Skin, Joint, and Hair. The decision was made when the company discovered the presence of a fish allergen in the product. Consumption of the product by those having an allergy to fish-based products can cause life-threatening conditions.

The global skincare supplement market displayed a substantial CAGR of 7.8% in the historical period. Factors such as the continuation of new product launches despite stringent regulatory environments across South Asia and the Middle East and Africa bolstered demand. Continued growth in already well-developed regions such as Europe, North America, and East Asia also equated to a fast-growing industry.

In June 2025, for instance, Canada-based GnuSanté Creations Inc., a beverage brand, launched RA.D8, a new skincare beverage. There are four flavors of the innovative Collagen Sparkling Skin Support range, namely, Blueberry Vanilla, Cool Pineapple, Lemonade Thyme, and Green Apple Ginger.

RA.D8 is considered North America’s first supplement infused with lumenato and collactive collagen. The company focuses on providing its consumers with a new perspective on skincare and improving sales.

Skincare supplements are projected to remain extremely popular and continue to retain the dominance globally from 2025 to 2035. This growth is attributed to a range of factors, such as the importance of appearance among millennial consumers and the ease of availability of supplements.

Owing to increased potency of these products supported by research and development, today’s consumers are witnessing the effects of investments. The factor is anticipated to push the constant purchase of more such products, thereby boosting the worldwide demand for skincare supplements.

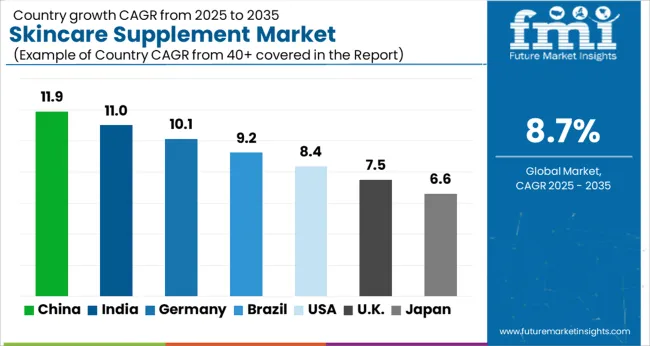

The table below shows the CAGRs of leading countries in the industry. Skincare supplement market opportunities in APAC are projected to rise in the forecast period, with India at the forefront. The country is estimated to witness a CAGR of 6.4% from 2025 to 2035.

Skincare supplement players in North America, on the other hand, are estimated to open new production hubs in the United States. The country is set to rise at a CAGR of 5.3% from 2025 to 2035. The United States, Germany, and India are set to remain dominant by holding shares of 23.7%, 11.4%, and 9.1%, respectively, in 2035.

The United States has recently reported declining birth rates and high aging populations. Elderly consumers who still aspire to look young and want to take care of skin are seeking effective and safe methods. This has propelled growth in the United States, and the country is anticipated to dominate North America.

As per America's Health Rankings, in the United States, around 17.3% of the total population belongs to the age group of 65 years and above. Maine tops the list with 22.5%, followed by Florida and Vermont with the same percentage of 21.6%. This high growth rate is anticipated to push demand for new supplements among the geriatric population.

The trend of effective natural supplements has reached countries in South Asia and the populations have been embracing skincare supplements. Owing to negative publicity of generic skincare creams and gels, consumers in India are opting for such supplements. The factor has further led to the launch of significant products in the skincare supplement market in India.

In April 2025, for instance, Hindustan Unilever’s OZiva, a popular plant-based nutrition company based in India, launched a new fizzy drink called Bioactive Gluta. The company focuses on preventing several common skin-related issues in the country.

Consumers in India are seeking products formulated with glutathione, a key antioxidant that helps boost the production of melanin. Hence, companies are focusing on launching new supplements with the ingredient.

The industry in Germany is anticipated to witness a considerable CAGR of around 3.9% through 2035. The country is witnessing a high demand for beauty supplements amid rising innovations in personalized skincare.

Holzminden-based Symrise introduced Diana Food, a new line of bioactives for beauty supplements. The company focuses on meeting the high demand from consumers for hair care, skin brightening, and anti-aging products. Symrise intends to create a strong presence in the field of active ingredients to offer skincare benefits.

The section below shows the leading segments in the global industry. By functionally, the skin de-aging category is projected to remain at the forefront by holding a share of 37% in 2035. The form segment is projected to be led by capsules, with a share of 65% in the same year.

Lastly, health and wellness stores are set to account for a share of 30% in 2035 based on sales channels. This information would provide leading skincare supplement distributors with deep insights into the right investment zones to gain profit.

| Segment | Skin De-aging (Functionality) |

|---|---|

| Value Share (2035) | 37% |

In the current virtual environment of social media platforms, looks have become increasingly important for young consumers. Looking young and trying to become youthful are prominent priorities for individuals from all age groups.

Companies have been strategically marketing skincare supplements as healthier and natural alternatives for generic skincare creams and gels, which often harm the skin. This astute marketing technique has shifted consumers more toward supplements. The factor has hence made skin de-aging the most prominent functionality.

| Segment | Capsules (Form) |

|---|---|

| Value Share (2035) | 65% |

Capsules are the most easy-to-carry and easy-to-consume form of supplement, making these a very convenient option for consumers. Also, capsules are considered a safer form than experimental newer forms like gummies and chewable.

These reasons have led capsules to be the leader in the form segment. Capsules are estimated to hold a significant share by the end of the forecast period with growing product launches.

In May 2025, Ritual, a health and wellness brand based in California, launched a vegan skincare supplement named HyaCera. This launch enabled the company to broaden its presence in the space of cosmeceuticals. The novel capsule contains phospholipids, glycolipids, and phytoceramides.

Research and development investments by key companies have played a key role in boosting the success of skincare supplements. Products that are effective in producing the results promised are gaining traction globally.

Key players are launching new products with several properties like anti-aging, anti-acne, and skin-brightening to bolster sales. The focus is on the promotion of beneficial properties of supplements to gain a wide consumer base.

Industry Updates

Few of the leading functionalities include skin de-aging, skin hydration, acne reduction, wound and mark healing, and skin brightening.

In terms of form, the industry is segregated into tablets/pills, capsules, liquid, powder, gummies/chewables, and others.

Hypermarkets/supermarkets, specialty stores, e-commerce, drug stores and pharmacies, health and wellness stores, convenience stores, and departmental stores.

Information about key countries across South Asia, East Asia, Oceania, North America, Latin America, Europe, and the Middle East and Africa is provided.

The global skincare supplement market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the skincare supplement market is projected to reach USD 7.0 billion by 2035.

The skincare supplement market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in skincare supplement market are skin de‑aging, skin hydration, acne reduction, wounds and marks healing and skin brightening.

In terms of form, capsules segment to command 65.0% share in the skincare supplement market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Ceramide Skincare Market Insights – Trends & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA