The antioxidant skincare market is expanding steadily owing to rising consumer awareness of skin health, increasing demand for preventive skincare solutions, and growing preference for natural and scientifically backed formulations. The current market scenario is characterized by rapid innovation in product development, integration of advanced antioxidant compounds, and strong marketing efforts emphasizing long-term skin protection.

Changing lifestyles, higher exposure to pollution, and ultraviolet radiation have intensified the need for antioxidant-rich skincare routines. The future outlook remains positive as continuous research in dermatological science and biochemistry leads to more potent and stable antioxidant blends.

Premiumization trends, digital brand engagement, and product diversification across age groups are expected to further strengthen market growth The growth rationale is supported by consumers’ shift toward high-performance formulations that address oxidative stress, coupled with manufacturers’ focus on personalized skincare solutions and sustainable ingredient sourcing, ensuring consistent expansion of the global antioxidant skincare market.

| Metric | Value |

|---|---|

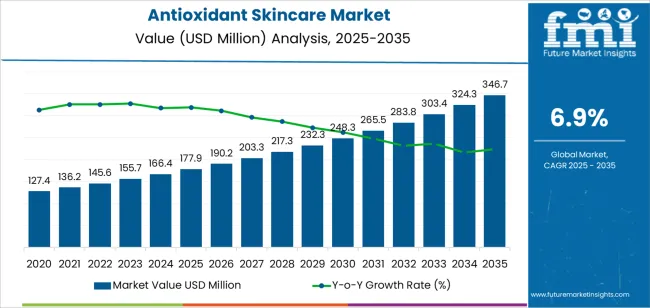

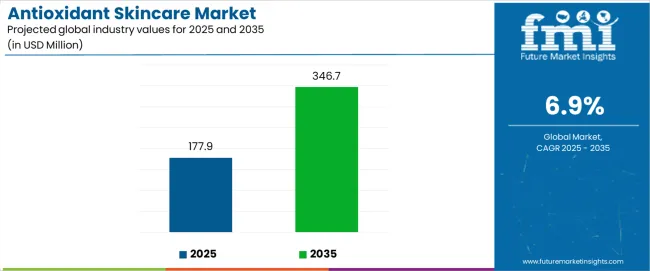

| Antioxidant Skincare Market Estimated Value in (2025 E) | USD 177.9 million |

| Antioxidant Skincare Market Forecast Value in (2035 F) | USD 346.7 million |

| Forecast CAGR (2025 to 2035) | 6.9% |

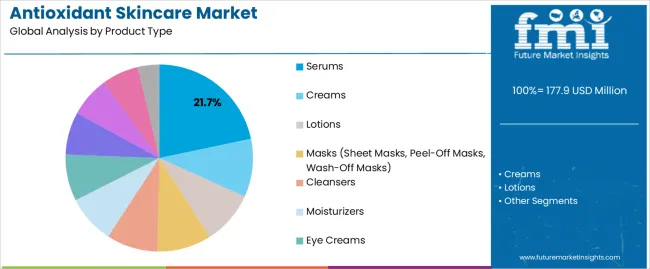

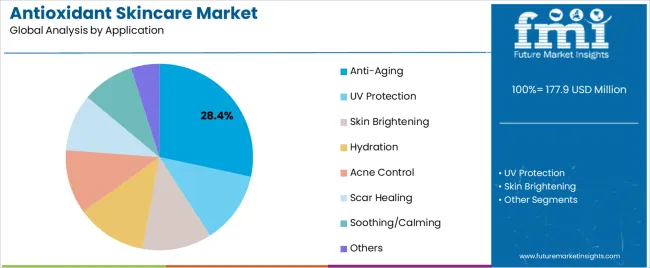

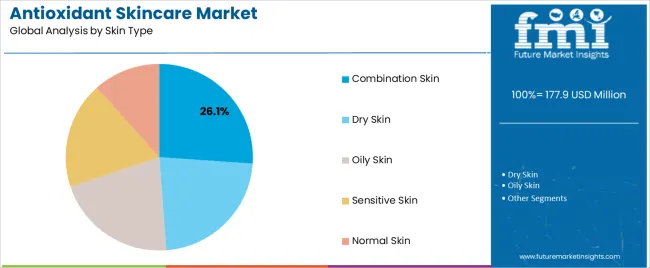

The market is segmented by Product Type, Application, Skin Type, and Distribution Channel and region. By Product Type, the market is divided into Serums, Creams, Lotions, Masks (Sheet Masks, Peel-Off Masks, Wash-Off Masks), Cleansers, Moisturizers, Eye Creams, Sunscreens, Toners, Oils, and Supplements. In terms of Application, the market is classified into Anti-Aging, UV Protection, Skin Brightening, Hydration, Acne Control, Scar Healing, Soothing/Calming, and Others. Based on Skin Type, the market is segmented into Combination Skin, Dry Skin, Oily Skin, Sensitive Skin, and Normal Skin.

By Distribution Channel, the market is divided into Online Retail (E-Commerce Platforms), Hypermarkets/Supermarkets, Specialty Stores (Beauty Stores, Skincare Boutiques), Department Stores, Pharmacies/Drugstores, Direct Sales (Company-Owned Stores), Beauty Salons/Spas, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The serums segment, accounting for 21.70% of the product type category, has maintained its leading position due to its high concentration of active ingredients and superior skin absorption properties. Its formulation versatility and proven effectiveness in delivering antioxidants directly into the skin have driven consistent consumer preference. Growth has been reinforced by expanding product lines targeting hydration, radiance, and protection from environmental damage.

Technological advancements in encapsulation and delivery systems have improved ingredient stability and performance. The segment also benefits from premium positioning within skincare routines and its compatibility with multiple skin types and treatment regimens.

Increased promotion through online retail channels and influencer-driven marketing has broadened accessibility and awareness The serums category is expected to sustain its market share as innovation in lightweight, multifunctional products continues to meet evolving consumer expectations for efficacy and convenience.

The anti-aging segment, representing 28.40% of the application category, remains dominant as antioxidant formulations are widely recognized for their role in reducing fine lines, improving skin elasticity, and combating oxidative stress. Market leadership is supported by increasing adoption among middle-aged consumers and younger demographics seeking preventive skincare.

Product innovation combining antioxidants with peptides and vitamins has enhanced efficacy, ensuring higher customer retention. The growing presence of dermatologically tested and clinically validated products has strengthened consumer confidence.

E-commerce expansion and subscription-based skincare models have further accelerated adoption Continuous investment in R&D to discover new antioxidant compounds and advanced formulations is expected to reinforce the segment’s share and maintain its strategic importance in driving the overall antioxidant skincare market growth.

The combination skin segment, holding 26.10% of the skin type category, leads the market due to its broad consumer base and requirement for balanced formulations that address both oiliness and dryness. Antioxidant products designed for this skin type emphasize hydration control, sebum regulation, and protection from environmental aggressors.

Market growth has been supported by the availability of customizable formulations and dermatologist-recommended products tailored for dual-zone skincare needs. Consumer preference for lightweight, non-comedogenic, and multi-benefit products has further enhanced adoption.

Manufacturers are focusing on developing adaptive antioxidant solutions that adjust to seasonal and hormonal variations, ensuring consistent performance With continuous improvements in formulation science and rising global awareness of personalized skincare, the combination skin segment is expected to maintain its leadership position and contribute significantly to overall market expansion.

| Attributes | Details |

|---|---|

| Historical Value in 2020 | USD 124.55 million |

| Historical Value in 2025 | USD 156.65 million |

| Market Estimated Size in 2025 | USD 166.4 million |

| Projected Market Value in 2035 | USD 324.2 million |

The period from 2020 to 2025 witnessed a remarkable surge in the antioxidant skincare market, characterized by escalating consumer awareness of skincare benefits and a growing emphasis on natural, sustainable beauty solutions.

Brands embraced innovative formulations enriched with antioxidants, harnessing the power of nature to combat skin aging and environmental stressors.

Looking ahead to 2025 to 2035, industry forecasts project exponential growth and transformative trends. With advancing research and technology, the market is poised to witness a proliferation of cutting edge formulations and delivery systems, enhancing antioxidant efficacy and skincare performance.

Evolving consumer preferences towards personalized skincare experiences and holistic wellness drive the development of tailored solutions catering to diverse skin concerns and lifestyles.

The forecasted period promises dynamic shifts in market dynamics, marked by intensified competition, strategic partnerships, and geographical expansions. Emerging markets offer untapped opportunities for industry players, fostering innovation and diversification in product offerings.

Regulatory developments and sustainability initiatives propel brands towards transparency and eco conscious practices, shaping the landscape of antioxidant skincare towards a more ethical and responsible future.

As the antioxidant skincare market continues its ascent, fueled by consumer demand for effective, nature inspired beauty solutions, the journey from historical analysis to future projections heralds a new era of radiant, resilient skin health and timeless beauty.

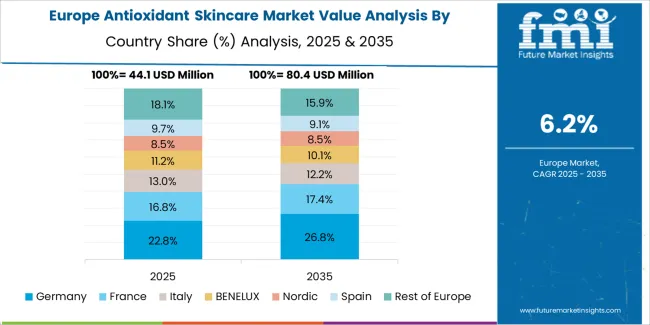

In the antioxidant skincare industry, India leads with a projected CAGR of 12.20% from 2025 to 2035, followed by China at 10.10%. France forecasts a CAGR of 5.90%, while Canada and the United States anticipate growth rates of 6.20% and 5.10%, respectively, during the same period.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| India | 12.20% |

| China | 10.10% |

| France | 5.90% |

| Canada | 6.20% |

| United States | 5.10% |

India emerges as a significant driving force in the antioxidant skincare industry, projecting a robust CAGR of 12.20% until 2035. With a burgeoning consumer base and increasing disposable incomes, India showcases a growing appetite for skincare innovations, embracing antioxidant rich formulations to address diverse skin concerns.

Its vibrant beauty culture and rising awareness of skincare benefits propel market expansion, fostering collaborations and investments in research and development. As India continues to lead the charge, it sets new standards for skincare excellence and cements its position as a key player in the global antioxidant skincare landscape.

China plays a pivotal role in shaping the antioxidant skincare market, projecting a substantial CAGR of 10.10% until 2035. Fueled by a burgeoning middle class and rising consumer sophistication, China witnesses a surge in demand for skincare products enriched with antioxidants.

With increasing emphasis on beauty and wellness, Chinese consumers seek innovative formulations to combat environmental stressors and promote skin health. As China continues its economic growth trajectory, it emerges as a key driver in the global skincare industry, setting trends, and influencing the future of antioxidant skincare solutions on a global scale.

France assumes a pivotal role in charting the antioxidant skincare market, boasting a projected CAGR of 5.90% until 2035. Renowned for its rich beauty traditions and sophisticated skincare culture, France fosters a demand for antioxidant rich formulations that promote skin health and vitality.

With an emphasis on luxury and innovation, French skincare brands lead the charge in delivering premium products infused with potent antioxidants, catering to discerning consumers worldwide.

As France continues to set trends and redefine beauty standards, it remains a cornerstone in the global skincare landscape, shaping the future of antioxidant skincare with elegance and expertise.

Canada emerges as a driving force in the antioxidant skincare market, projecting a robust CAGR of 6.20% until 2035. With a focus on natural beauty and wellness, Canadian consumers seek skincare solutions enriched with antioxidants to combat environmental stressors and promote radiant skin.

As Canada fosters innovation and sustainability in skincare, it paves the way for cutting edge formulations and eco conscious practices, resonating with global trends towards clean and ethical beauty. Positioned as a key player in the global skincare arena, Canada shapes the future of antioxidant skincare with its commitment to quality, authenticity, and environmental stewardship.

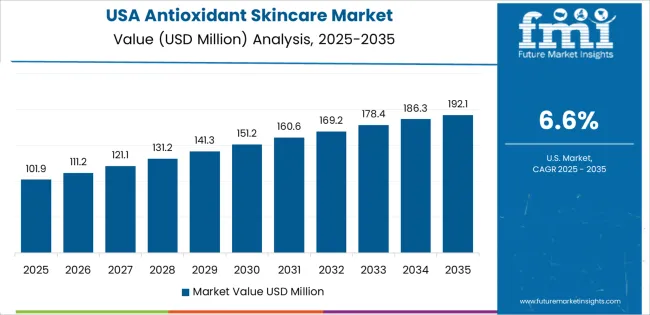

Innovative forces propel the United States to leadership in the antioxidant skincare market, forecasting a robust CAGR of 5.10% until 2035. With a dynamic consumer landscape and a penchant for cutting edge beauty trends, the United States pioneers advancements in antioxidant skincare formulations and delivery systems.

The market thrives on a culture of innovation, fueled by research and development initiatives, consumer insights, and technological advancements. From breakthrough ingredients to sustainable packaging, the United States continually redefines skincare standards, driving market growth and shaping the future of antioxidant skincare on a global scale, solidifying its position as an industry leader.

Until 2025, natural products dominated the antioxidant skincare market, holding an impressive 42.6% market share. By 2025, specialty stores are set to capture a significant 27.2% market share in the antioxidant skincare sector, reflecting consumers growing preference for tailored skincare solutions and expertise driven shopping experiences.

| Category | Market Share in 2025 |

|---|---|

| Specialty Stores | 27.2% |

| Moisturizers | 32.5% |

By 2025, specialty stores are poised to seize a substantial 27.2% market share in the Antioxidant Skincare sector. Their curated selections, knowledgeable staff, and personalized service resonate with consumers seeking high quality antioxidant rich skincare solutions.

This trend underscores the significance of tailored shopping experiences and the growing demand for specialized skincare expertise in navigating the complex landscape of antioxidants and skincare formulations.

As specialty stores continue to thrive, they solidify their position as trusted destinations for skincare enthusiasts, offering a diverse array of premium products that cater to individual needs and preferences in the ever evolving antioxidant skincare market landscape.

In the antioxidant skincare market, the moisturizers segment dominates poised to capture a substantial market share of 32.5% through 2025. With increasing consumer focus on hydration and skin health, antioxidant infused moisturizers emerge as essential skincare staples, driving growth and shaping market dynamics in the coming years.

In the competitive landscape of the antioxidant skincare market, numerous brands vie for consumer attention and market share. Established players compete with emerging startups, each offering unique formulations enriched with antioxidants. Factors such as product efficacy, brand reputation, pricing, and marketing strategies shape the competitive dynamics.

With growing consumer awareness of skincare benefits and the demand for natural, effective products, innovation and differentiation become crucial for brands to stay competitive. Continuous research, development, and strategic partnerships allow companies to stay ahead, navigate regulatory landscapes, and meet evolving consumer preferences in the dynamic antioxidant skincare market.

Product Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 177.9 Million |

| Projected Market Valuation in 2035 | USD 346.7 Million |

| Value-based CAGR 2025 to 2035 | 6.90% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Industry Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Industry Segments Covered | Product Type, Application, Skin Type, Gender, Distribution Channel, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | L'Oréal Group; The Estée Lauder Companies Inc.; Johnson & Johnson; Unilever; Procter & Gamble Co.; Shiseido Company Limited; Beiersdorf AG; Avon Products Inc.; Amorepacific Corporation; Coty Inc. |

The global antioxidant skincare market is estimated to be valued at USD 177.9 million in 2025.

The market size for the antioxidant skincare market is projected to reach USD 346.7 million by 2035.

The antioxidant skincare market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in antioxidant skincare market are serums, creams, lotions, masks (sheet masks, peel-off masks, wash-off masks), cleansers, moisturizers, eye creams, sunscreens, toners, oils and supplements.

In terms of application, anti-aging segment to command 28.4% share in the antioxidant skincare market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antioxidant-Rich Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antioxidant and Stabilizer Agents Market Size and Share Forecast Outlook 2025 to 2035

Antioxidants Cosmetic Market (Personal Care Actives) Analysis - Size and Share Forecast Outlook 2025 to 2035

Antioxidant-Rich Fruit Oils Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antioxidant Premix Market Size and Share Forecast Outlook 2025 to 2035

Antioxidant Drinks Market Size and Share Forecast Outlook 2025 to 2035

Antioxidant-Rich Sea Buckthorn Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antioxidants Market Size, Growth, and Forecast for 2025 to 2035

Antioxidants Reagent Market Analysis – Trends & Future Outlook 2024-2034

Food Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Food Antioxidants Market Analysis by Product, Application and Form Through 2035

Super Antioxidant Supplement Market Size and Share Forecast Outlook 2025 to 2035

Natural Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Phenolic Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Moringa Oil Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Antioxidants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Tocopherol-Rich Antioxidants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Blueberry Extract Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA