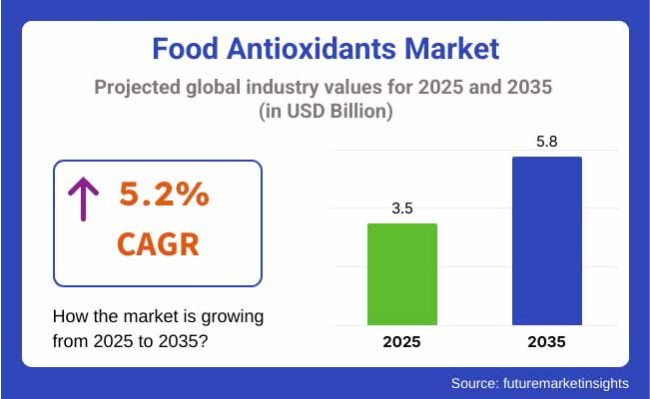

The market size for food antioxidants across the world in 2023 was USD 3.16 billion. Yearly growth of using food antioxidants was 5.2% in 2024, and hence the worldwide size in 2025 will be USD 3.5 billion. Top-line world revenues for the years to be projected in this study (2025 to 2035) will grow at a rate of 5.2% CAGR, and the sales will be USD 5.8 billion in 2035.

Consumers are predominantly relying on the health trend and embracing food that may be the reason behind their health throughout their life cycle and thus driving demand for food and beverage antioxidants. Among the top food antioxidant industry trends has been the thrust toward natural and clean-label products.

As the consumers bid adieu to preservatives and artificial additives, the trend to accept natural antioxidants was an escape from vegetable, herbal, and plant material. Being at their command, these natural compounds with such health effects, food processors now adopted them on a gigantic scale.

Food antioxidant market is also being spurred by growing demands for long-shelf life convenience food. Foods are preserved with the help of antioxidants by preventing them from getting spoiled and by enhancing their shelf life.

Growing needs for functional food and beverages being utilized for providing health benefits as well as due to the in-built level of nutrition are also driving the application of food antioxidants. Food like fortified food, supplements, and snack foods will preferably apply antioxidants in order to lend credibility to their health benefit claims.

Public health consciousness of the merits of healthy living with antioxidants has resulted in their inclusion in an incredible array of foods, ranging from beverages to cake. Besides that, expansion in the food antioxidant industry is also prompted by expanding research on the so-called healthy advantages of antioxidants such as improved brain function, improved immunity, and improved healthy aging.

Following half-yearly comparison of CAGR fluctuation from base year (2024) to reporting date (2025) of food antioxidant market is presented below. The above table captures indiscriminate fluctuation in performance and realization trend of revenues and therefore is a better reflection of overall growth pattern in the period for stakeholders.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.0% |

| H2 (2024 to 2034) | 5.1% |

| H1 (2025 to 2035) | 5.1% |

| H2 (2025 to 2035) | 5.3% |

During H1 of the 2025 to 2035 decade, the industry will have a 5.1% CAGR growth rate, while in H2 of the 2025 to 2035 decade, growth will be slightly higher at 5.3%. The company will see consistent build-up of growth with 2025 to 2035 to grow 10 BPS and H2 of the decade to grow 20 BPS.

Plant food innovation in natural, health, and ethics trend is also the cause of increasing demand for plant antioxidants. Meat alternatives, snack foods, and plant milks are being fortified with antioxidants at a greater pace to deliver other health benefits.

Increasing consumer demand for natural origin foods for health foods and increasing demand for the health benefit of antioxidants led the company towards long-term success. While food demand is rising and customers seek foods that have functional features, food and beverage consumption of antioxidants will be a key growth force.

Global market for food antioxidants is dominated by a worldwide universe of indigenous as well as multinationals companies producing and providing natural and chemical food antioxidants in the form of drug grade food antioxidants and food additives. It is stratified on different levels based on manufacturing capacity, global promotion in the international market, and technology.

Tier 1 Players control Asia-Pacific, European, and North American markets with top-class R&D facilities, massive manufacturing plants, and well-settled supply chains. They manufacture natural and synthetic food antioxidants that filter down to mass food and beverage manufacturers.

Tier 1 companies are large innovator spenders, i.e., creating clean-label, plant-based antioxidants to meet more evolved consumer needs for natural food preservatives. Their investments and financial backing in a secure manner allow them to retain competitive ground and nurture their market share in the scenario of strategic partnerships as well as mergers.

Tier 2 Players are food processing giants at regional levels and wish to sell food antioxidants to medium-scale food processing and specialty health products companies. They are strongest in food processing city centers, i.e., Europe, China, and India.

Tier 2 players are focused on production at low costs and have control over the use of natural antioxidants such as rosemary extracts, tocopherols, and polyphenols. They emerge as growth markets by conducting research partnerships with research institutions and suppliers of food ingredients in order to provide enhanced product performance and a green environment. Tier 3 Players

Tier 3 consists of small-scale producers, one-firm companies, and specialty food retailers who sell natural antioxidants to organic and craft foods. They mainly distribute to specialty food retailers like final consumers, health food companies, and organic food companies. Since they are involved in small-scale production, Tier 3 players occupy the market niche with quality and locally made antioxidants green consumers seek.

From Synthetic to Natural Antioxidants

Shift: People are turning towards learning about synthetic antioxidants such as butylated hydroxyanisole (BHA) and butylated hydroxytoluene (BHT) due to their health effect on them. Synthetic preservatives have been found to lead to hormonal disruption and carcinogenicity by studies, and thus mass myth of shift towards natural antioxidants such as rosemary extract, tocopherols (Vitamin E), green tea polyphenols, and acerola cherry extract.

Clean-label is the strongest trend with more than 68% of global consumers demanding natural food preservatives. Even North America and European regulatory authorities are tightening the noose on man-made additives, compelling firms to reformulate.

Strategic Response: Players in the industry substitute man-made antioxidants with natural plant substitutes without affecting product stability. Kellogg's substituted BHA/BHT with rosemary extract and tocopherols to avoid spoilage in breakfast cereals. Nestlé substituted its infant formula brand by the use of green tea polyphenols as chemical-free replacement for chemical antioxidants, providing not just the long shelf life but also perceived benefits to the immune system.

Tyson Foods had already manufactured rosemary extract-enriched meat items, where it can provide a nitrate-free product but cannot provide long shelf life. These re-brandings allow companies to obtain regulatory approval under the assurance of being attractive to health-conscious consumers seeking "free-from" status.

Greater Demand for Antioxidant-Rich Functional Foods and Liquid Beverages

Shift: Functional foods and liquids with supplemented added antioxidants are gaining greater shelf space, consumers ever more demanding for products which have the ability to enhance immunity, mental clarity, protection against aging, and heart health. Several of the ingredients such as quercetin, flavonoids, astaxanthin, and resveratrol are being added to foods, drinks, and milk drinks in a bid to capitalize on expanding demand.

Sales of functional foods have risen 22% over the past three years, it is said, and antioxidants are one of the top drivers of the trend. Other lifestyle concerns and chronic disease have also been a propellant for the identification of the trend in antioxidant additive foods.

Strategic Response: Category leaders in the food and beverage market are being compelled to new launches by this trend with antioxidant benefit through plant extracts. Danone introduced a line of antioxidant-benefit probiotic yogurt that used pomegranate and blueberry polyphenols for immune and gastrointestinal well-being.

PepsiCo introduced antioxidant water with vitamins as a health-conscious daily drink. Nature Valley introduced green tea catechin-fortified granola bars to address time-sensitive consumers looking for healthy, nutritious products. They satisfy higher health needs and enable manufacturers to stand out amidst a crowded marketplace with over-saturating foods because consumers are prioritizing nutritional value and health.

Processed Seaweed-Based Antioxidant Foods: Expanding Application

Shift: Seaweed antioxidants such as fucoxanthin, microalgae-derived astaxanthin, and fish peptides are increasingly recognized as better natural preservatives with enhanced oxidative stability.

These possess extremely high application potential for preventing cooked meat, milk, and edible fats and oils' lipid oxidation and become the new favorite to replace conventional preservatives. With sustainability trend gaining momentum, marine-derived antioxidants are gaining popularity as the first choice of a green consumer because they are highly upcycled from seafood by-product.

Strategic Response: Marine antioxidants are being introduced by launch managers to deliver an enhancement in the nutritional and shelf life quality of products. Unilever revamped its vegetable spreads and incorporated fucoxanthin into brown seaweed to introduce an oxidative stability boost, along with other benefits to health. Astaxanthin is also being added by Norwegian fish processors to frozen fish feed to maintain the quality level of the omega-3 fatty acids and color for a longer period.

Japanese dairy businesses have made sea peptide-enriched cheese that has already found entry into the growing consumer demand for functional dairy with anti-inflammatory worth. Besides the support towards enhancing food quality, the trend allows for achievement of the circular economy goals as well as food wastage prevention since it employs food harvested from the sea.

Plant Antioxidant Boost in Meat Support

Shift: Plant antioxidants are on the agenda among manufacturers as healthy additives with growing need for nitrates and nitrites in meat. Amongst the ingredients utilized to attain shelf life improvement, antioxidation protection has been attained with, and color stability of meat without the negative health impact of synthetic preservatives from grape seed extract, acerola cherry powder, and olive leaf polyphenols. Clean-label meat products are trending these days, and thus demand for nitrate-free products is growing.

Strategic Response: Hormel Foods substituted artificial preservatives with acerola cherry extract for substituting the use of nitrite and stabilizing the meat. Nestlé added grape seed extract as a natural origin preservative to prevent oxidative rancidity and target health segment market.

Tyson Foods reformulated part of the deli meat with olive leaf polyphenols and introduced nitrate-free meat products with 12% incremental sales of clean-label product sales. It is among the strongest of the high-end meat products trends where natural preservation technology is a product one would pay more for so they can eat clean food and nutrition.

Greater Demand for Antioxidant-Derived Edible Films for Greener Packaging

Shift: As there are growing needs for sustainability and plastic waste, manufacture of antioxidant-carrying, biocompatible, edible chitosan-derived, seaweed extract-derived, and plant polyphenol-derived films has been promoted. Edible films keep the freshness of fresh meat, dairy, and fruits intact by avoiding oxidation and microbial growth. As there is mounting regulatory pressure to offer plastic-free alternatives, the food industry is seeing a shift towards investment in antioxidant-derived biodegradable packaging material.

Strategic Response: Walmart piloted antioxidant wraps of chitosan for fresh fruit and produce, 10% waste reduction. Nestle has introduced edible milk coating based on seaweed to offer extended shelf life plastic-free.

Mondelez innovated biodegradable packaging of snacks filled with polyphenol to facilitate food with long "shelf life of reduced freshness" and discovering solutions for green-conscious consumers' causes. Business firms are enabled by the innovation to achieve smaller carbon footprint while achieving globally sustained objectives, as well as return of market share by green-conscientious consumers.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 4.2% |

| Germany | 3.9% |

| China | 5.1% |

| Japan | 4.3% |

| India | 5.7% |

USA Food Antioxidants Market: Overview The USA food antioxidants market is likely to observe significant expansion due to rising consumer acceptance for food antioxidants in the food industry. There is a growing concern among consumers for synthetic additives and their negative effects on human health [98]; hence, food manufacturers have focused their interest towards the development of natural antioxidants based on plant-derived sources like tocopherols, vitamin C and flavonoids.

The antioxidant market is also being driven by growing health-conscious consumers and the increase of functional foods supplemented with antioxidants. Approval process under the legislation of the depositary evolved the FDA compliance ensures meeting the guidelines to ensure market stability and generate the revenue.

As the consumers in Germany are refusing to consume food possessing artificial preservatives, the German food antioxidants market is most likely set in the direction of clean-label products. The local market is also supported by stringent food safety and high-standard regulations as well as an established organic food industry in the area.

To address this issue, manufacturers are foisting natural antioxidants - and including rosemary extract, carotenoids and polyphenols - into processed foods and beverages. The new generation of plant-derived antioxidants not only responds to changing consumers’ preferences, but also resonates with sustainability concerns, as more companies adopt sustainable sourcing and production practices.

Food antioxidants are witnessing rapid growth in China, primarily due to the rise of processed food in China, as well as growing consumer demand for food safety and shelf life extension. As a part of food safety law, the government has predicted strict food safety laws which has enabled food manufacturers to adopt high quality antioxidants in biological process to avoid spoilage and contamination.

Moreover, the growth of disposable incomes and urbanization has further aggravated the consumption of packaged food thus propelling the market growth. The large agriculture sector also allows for the production and supply of natural antioxidants.

The growing trend of functional foods and beverages, which provide health benefits beyond basic nutrition, is potentially pushing up the Japan food antioxidants market strongly in response. Antioxidants including catechins, astaxanthin, and flavonoids are used in traditional Japanese diets and more recently have been included in modern food products.

Nanotechnology-based innovations, when incorporated into food processing, add to the stability and bioavailability of antioxidants, which in turn, improve their efficacy in food preservation. And an aging population in Japan is creating demand for antioxidants that have anti-aging and immune-boosting properties.

Food Antioxidants Market in India has a promising future, as the consumers in India are becoming more aware about the benefits of antioxidants in their body and prevention of diseases related to lifestyle. The growing consumption of processed and convenience foods has also increased the demand for food preservative, as the food manufacturing industry is adding natural antioxidants including spice, vitamin E and ascorbic acid. Government initiatives towards food safety and clean label products add more to the markets.

The high growth of retail sector with expanding online grocery platform providing convenience to the consumers whether urban or rural is likely to easily make antioxidant-rich foods accessible to the consumers.

| Segment | Value Share (2025) |

|---|---|

| Food Antioxidants as Natural (By Product) | 58.7% |

Natural food antioxidants demand is booming as consumers are considering clean-label and minimally processed food products. In light of increasing public concern due to synthetic additives and preservatives, there is also little interest in natural antioxidants (such as rosemary extract, tocopherols (vitamin E) and ascorbic acid (vitamin C)). Such antioxidants help in making food products not only long-lasting, but also ensure that such products retain their nutritional value, which makes them preferred by health-conscious consumers.

In response, food processors are replacing synthetic antioxidants with those derived from plants, especially in the organic and functional foods sectors. The increase in demand for antioxidants comes from the growing awareness of health-promoting properties of these substances, particularly in terms of reduction of oxidative stress and prevention of chronic diseases.

Moreover, the implementation of strict regulations by various governments regarding the use of synthetic additives and the growing preference of consumers for food products with acceptable natural characteristics are some other factors boosting the demand for natural antioxidants over synthetic additives. As a result, players are spending on R&D for enhancing the stability as well as efficacy of natural antioxidants in diverse food application.

| Segment | Value Share (2025) |

|---|---|

| Processed Foods (By Application) | 42.1% |

Food antioxidants are primarily used in processed foods to promote shelf stability and inhibit rancidity, thereby enhancing food quality. With the availability of more and more packaged and convenience foods, food manufacturers also heavily use antioxidants for prolonged product life without sacrificing taste, texture or nutrition.

Increased consumption of frozen food and ready-to-eat meals, as well as snack products have bolstered the growth for food antioxidants. Synthetic antioxidants BHA (butylated hydroxyanisole) and BHT (butylated hydroxytoluene) have traditionally been used in processed foods, but a consumer-driven shift is happening away from that. Antioxidants are also necessary in segments of growing plant-based and functional foods to stabilize alternative protein and fortified food products.

Food safety laws and a growing critical focus on food additives are responding manufacturers toward products assembled with safer and more economical cytoprotectant arrangements. This changing consumer preferences, coupled with technological advancements, such as advance food preservation technologies, are projected to be parallel to the uptake of food antioxidants in prepared food items in the years to come.

The Global food antioxidant market is highly competitive, with the presence of many major players. Booming concerns about natural antioxidants, clean-label ingredients and shelf-life extension in the food and beverages industry is stimulating companies to invest in R&D activities.

Sustainable sourcing and advanced production techniques are among other areas of focus that firms are pursuing as they seek to drive product quality and also respond to changing consumer habits and preferences.

Moreover, adhere to regulations and raising awareness about health benefits with antioxidants has encouraged players to come up with functional and non-toxic antioxidant solutions. The demand for alternative proteins is growing as consumption of healthier foods and government support is on the rise, prompting emerging markets to respond; the competitive playing field is shifting as some markets are entering partnerships with food manufacturers to work together on product formulation and increasing research efforts in extraction and formulation technologies.

For instance

Food antioxidants are categorized into natural antioxidants and synthetic antioxidants, used to extend shelf life and maintain product quality.

These antioxidants are widely applied in processed foods, meat products, fats & oils, bakery & confectionery, and beverages helping to prevent oxidation and enhance food stability.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global food antioxidant market is projected to reach USD 3.5 billion in 2025.

Sales increased at a CAGR of 5.3% between 2020 and 2024.

Some key players in the industry include BASF SE, Archer Daniels Midland Company, Kemin Industries, Koninklijke DSM N.V., Eastman Chemical Company, Camlin Fine Sciences, Barentz, DuPont.

Asia Pacific is projected to lead the market, holding a revenue share of 45% in 2025, driven by increasing demand for natural antioxidants in food processing.

The market is expected to grow at a CAGR of 5.2% from 2025 to 2035, supported by rising consumer preference for clean-label and natural food products.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Europe Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 32: Europe Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Asia Pacific Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Asia Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 40: Asia Pacific Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: MEA Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: MEA Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 48: MEA Market Volume (Tons) Forecast by Form, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Form, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Form, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Europe Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 90: Europe Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Europe Market Attractiveness by Form, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Form, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: MEA Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: MEA Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 138: MEA Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product, 2023 to 2033

Figure 142: MEA Market Attractiveness by Application, 2023 to 2033

Figure 143: MEA Market Attractiveness by Form, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA