The food portion pack market is projected to grow from USD 4.2 billion in 2025 to USD 6.1 billion by 2035, registering a CAGR of 3.8% during the forecast period. Sales in 2024 reached USD 50.6 billion, indicating a steady demand trajectory.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 4.2 billion |

| Industry Value (2035F) | USD 6.1 billion |

| CAGR (2025 to 2035) | 3.8% |

This growth has been attributed to the increasing demand for convenient, single-serve packaging solutions across various sectors, including food and beverage, healthcare, and personal care. The rise in on-the-go consumption and the need for portion control have further propelled the adoption of innovative portion pack solutions. Additionally, advancements in packaging technologies have enhanced the functionality and sustainability of these packs, aligning with the evolving needs of manufacturers and consumers alike.

In June 2024, the Member of the Executive Board (CCO) Marco Geith from PORTIONPACK GROUP said “The wording of the European Packaging and Packaging Waste Regulation has now been agreed between the EU institutions and no fundamental changes are to be expected.

In principle, we welcome this regulation with the aim of reducing the volume of packaging in general and promoting the reuse of materials. We already use sustainable packaging material for a large part of our portfolio and have set ourselves the realistic goal of adapting all our packaging accordingly in order to comply with all the requirements of the regulation.”

The food portion pack sales has been significantly influenced by the increasing demand for sustainable and environmentally friendly packaging solutions. Manufacturers have been transitioning towards recyclable and biodegradable materials to align with environmental sustainability goals and meet consumer preferences for eco-conscious products.

Food portion pack demand is poised for continued growth, driven by the ongoing expansion of various end-use industries and the increasing emphasis on sustainable packaging solutions. The market's trajectory suggests a steady rise in demand for innovative, eco-friendly portion packs that cater to both consumer preferences and regulatory requirements.

Companies investing in research and development to create durable, cost-effective, and environmentally friendly portion packs are expected to gain a competitive edge. The integration of advanced materials and ergonomic designs will likely play a crucial role in shaping the future of the food portion pack industry.

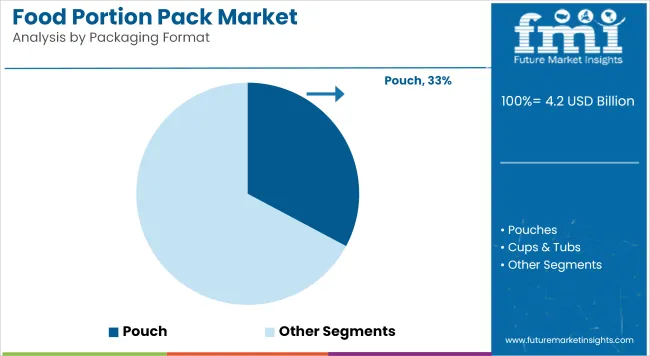

The market is segmented based on packaging format, material type, end-use application, and region. By packaging format, the market includes Pouch, pouches, cups & tubs, blister packs, stick packs, and bottles. In terms of material type, the market is categorized into plastic (PET, PP, PE), paper & paperboard, aluminum foil, laminates & multilayer films, and biodegradable materials.

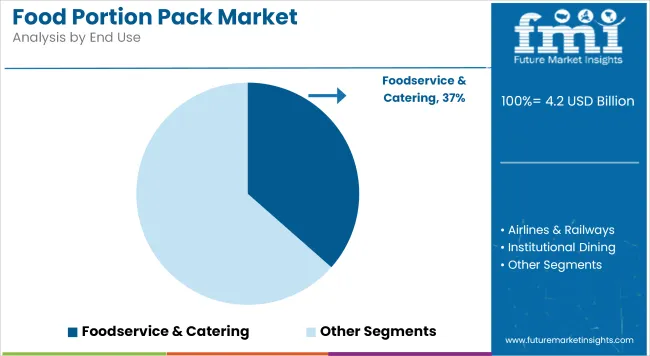

By end-use application, the market comprises foodservice & catering, airlines & railways, institutional dining, retail & supermarkets, and e-commerce meal kits. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Pouch have been projected to capture 32.8% of the global food portion pack market in 2025, due to their ease of use, low cost, and efficient portion control. Small quantities of sauces, seasonings, condiments, and spreads have been widely dispensed in single-use Pouch across foodservice outlets.

Lightweight structure and minimal material usage have contributed to low manufacturing and transport costs. Pouch have also supported hygiene standards by offering sealed, tamper-evident packaging. Brands have relied on Pouch for trial packs and promotional samples, facilitating customer engagement without compromising safety.

Flexible laminate materials with barrier properties have been adopted to extend shelf life and maintain freshness. Pouch have been preferred in emerging markets for affordability and adaptability to local packaging formats.

Sustainable innovations have been explored through recyclable and biodegradable sachet films to reduce environmental impact. Water-based inks and solvent-free laminates have been used to improve compost ability and reduce VOC emissions. Pouch have proven ideal for both wet and dry products, including salad dressings, sugar, creamer, and ready spices.

Their compact size has allowed easier integration into takeaway meals, meal kits, and delivery boxes. Growth in convenience food, delivery apps, and urban snacking behavior has driven the continued popularity of Pouch. Manufacturers have optimized filling and sealing speeds to meet high-volume demand from restaurants and institutional food providers.

The foodservice and catering sector has been estimated to account for 36.5% of the food portion pack market in 2025, owing to the need for speed, hygiene, and portion consistency. Operators have relied on pre-portioned Pouch, cups, and pouches to serve condiments, sauces, and snacks without manual handling. Compliance with food safety protocols has been enhanced through sealed, tamper-evident packaging.

Portion packs have also reduced food waste and improved inventory control across commercial kitchens. Buffets, QSRs, and institutional dining services have utilized portion packs for individual servings of butter, salad dressing, ketchup, and seasoning. These packs have been designed for stack ability and efficient cold chain storage, ensuring quick service with minimal contamination risk.

Customized formats tailored for breakfast boxes, school lunches, and business catering trays have improved user experience and meal presentation. Regulatory requirements on food labelling and allergen disclosure have been met through standardized portion packs.

Disposable single-serve packaging has also contributed to post-COVID hygiene priorities and consumer confidence. Cross-compatibility with microwaveable or chilled food trays has enabled wider utility in prepared meal offerings.

Large contract caterers and airline meal providers have supported growth in this segment by switching to low-footprint, recyclable portion formats. Sustainability efforts have focused on lightweight packaging and biodegradable material alternatives without compromising shelf life. Demand from hospitals, campuses, and travel foodservice providers has helped stabilize bulk ordering and long-term supply contracts.

Due to the accelerated pace of life and changes in eating habits, consumers' demand for packaged foods continues to increase, which may have a significant impact on the market. The product has a long and stable shelf life, high barrier properties and safety, which contributes to the growth of the food portion pack market. Factors such as convenience and the use of high-quality materials are designed to help the industry grow.

It is expected that longer shelf life and more effective prevention of content contamination will drive market growth. The increase in population, disposable income and the decrease in households have a positive impact on the market. Bargaining power of buyers is expected to remain high during the forecast period.

The trade is characterized by an outsized variety of patrons that are expected to extend throughout the forecast period; in addition, buyers are searching for innovative and tailored solutions for his or her products, they're terribly value sensitive, and sometimes resort to material changes.

Rising sales of retail products and the trend of online shopping is expected to have a positive influence over the market. Increased consumption of snacks rather than traditional foods is expected to stimulate demand for pre-packaged goods, thereby stimulating market growth.

Packaging may be the fastest growing part of the food industry and is constantly innovating. The recent advancement in Packaging Industry is Edible Packaging, Smart Packaging, Anti-microbial Packaging, Water Soluble Packaging, Self-Cooling and Self Heating Packaging, Flavor and Odor and Micro Packaging.

Tetra Pak has recently launched the Tetra Prisma Aseptic 500 Edge with DreamCap, which is a package specifically designed to meet the growing demand of consumers who want to enjoy their liquid dairy products, juices, nectars and still drinks on the go.

The USA market is expected to grow as the urban population increases, which will lead to increased consumption of pre-packaged foods and the increasing popularity of single packages. The market is also supported by a growing infrastructure of plastics, metals and glass processing. This will maintain product penetration during the forecast period.

In addition, packaging companies are expected to invest in the development of new products suitable for many foods, health, personal care and household products.

Due to large investments in packaging research and development, Germany will dominate the European market for food portion packs during the forecast period. The growing demand for confectionery and consumer demand for convenient packaging will drive the growth of the industry.

European Commission imposing strict regulations regarding usage of food packaging types and food contact materials, the market is expected to remain highly regulated. The market is shifting to more environmentally friendly packaging solutions, such as bio-plastics and thermoplastics, aimed at further driving market growth.

Some of the leading manufacturers and suppliers of Food Portion Pack include

Mondi Group along with cheese packaging company Hazeleger Kaas introduced innovative product in envelope form which offers barrier protection, fully recyclable polypropylene (PP) mono material solution.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments and geographies.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share & Competitive Positioning in Food Portion Pack

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Tester Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Market Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Food Packaging Film Providers

Food Packaging Equipment Market

Portion Packs Market Insights – Growth & Demand 2024-2034

Food Tub packaging Market Size and Share Forecast Outlook 2025 to 2035

Packaged Food Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Seafood Packaging Market Size, Share & Forecast 2025 to 2035

Food Grade Packaging Market Insights – Demand, Size & Industry Trends 2025-2035

Evaluating Seafood Packaging Market Share & Provider Insights

Food Powder Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Food Powder Packaging Machine Market Share & Industry Trends

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Food Re-Close Pack Market

Baby Food Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA