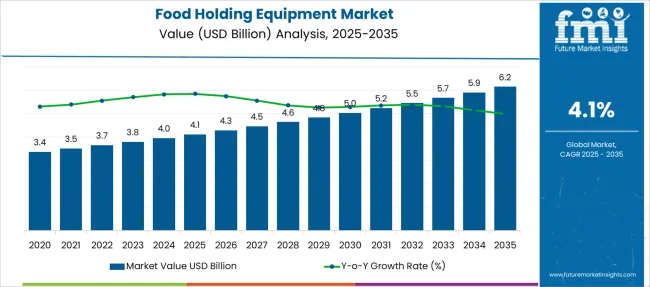

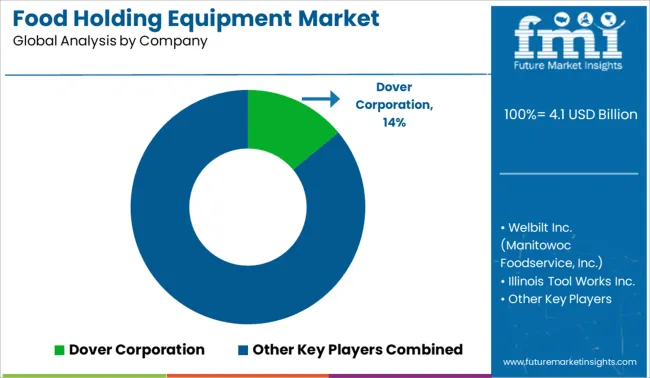

The Food Holding Equipment Market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 6.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Food Holding Equipment Market Estimated Value in (2025 E) | USD 4.1 billion |

| Food Holding Equipment Market Forecast Value in (2035 F) | USD 6.2 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The Food Holding Equipment market is gaining strong momentum, fueled by the growing need for efficient food preservation, temperature control, and streamlined service operations across commercial foodservice settings. Demand is being accelerated by rapid urbanization, rising consumer expectations for quick service, and an increased focus on operational consistency in both standalone and chain food establishments.

Industry press releases and operator-focused journals have reported that modern foodservice formats are prioritizing equipment that supports batch preparation, waste reduction, and food quality maintenance. Companies are focusing on energy efficiency and modular design, which aligns with sustainability and cost-saving goals set by commercial kitchens and quick service brands.

The future outlook remains positive as technological enhancements such as humidity controls, smart temperature sensors, and IoT connectivity are being integrated into holding equipment Growing investments in the hospitality and foodservice sectors, along with an emphasis on hygiene and regulatory compliance, are expected to further contribute to the market’s continued expansion globally.

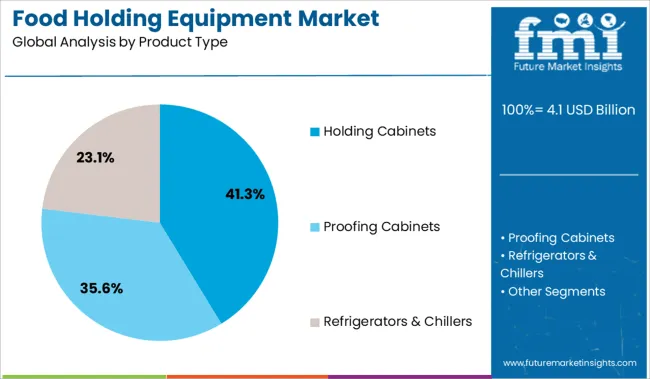

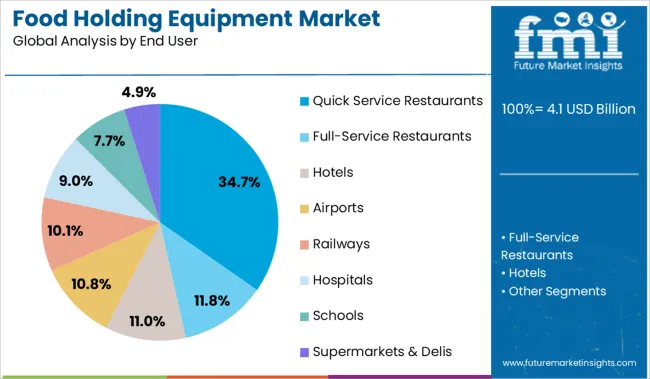

The market is segmented by Product Type and End User and region. By Product Type, the market is divided into Holding Cabinets, Proofing Cabinets, and Refrigerators & Chillers. In terms of End User, the market is classified into Quick Service Restaurants, Full-Service Restaurants, Hotels, Airports, Railways, Hospitals, Schools, and Supermarkets & Delis. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The holding cabinets segment is projected to account for 41.3% of the Food Holding Equipment market revenue share in 2025, making it the dominant product type. This leadership is being driven by the segment’s critical role in maintaining food at safe serving temperatures without compromising quality or texture. Holding cabinets have been widely adopted in foodservice operations due to their ability to support batch cooking, reduce turnaround time during peak hours, and minimize food spoilage.

Their temperature stability and moisture retention features have made them essential in operations where food must be held for extended periods before service. Industry publications have highlighted that advancements in cabinet insulation, energy-saving technologies, and space-efficient designs have significantly contributed to the segment’s growth.

Additionally, their adaptability for both front-of-house and back-of-house usage has made them an ideal choice for a variety of establishments These combined benefits have positioned holding cabinets as a foundational element in the modern foodservice workflow, supporting their continued dominance in 2025.

The quick service restaurants segment is expected to contribute 34.7% of the Food Holding Equipment market revenue share in 2025, securing its position as the largest end-use category. Growth in this segment has been shaped by the increasing demand for speed, consistency, and scalability in food delivery and on-site service. Quick service restaurants have shown a strong preference for food holding equipment that enhances efficiency and reduces dependency on real-time cooking, especially during peak hours.

Equipment that supports advanced meal staging and temperature control has become critical in meeting rising order volumes while maintaining food safety standards. Operator-focused reports have indicated that chains are investing in compact, multi-functional holding units to optimize kitchen space and improve service speed.

The ability to standardize food quality across locations using smart and programmable holding systems has further accelerated adoption These operational advantages, along with the pressure to maintain customer satisfaction and regulatory compliance, have made this segment the top contributor to the overall market.

During the historical period from 2020 to 2025, the global food holding equipment market witnessed steady growth at a CAGR of 3.2%. Numerous end users of commercial food warming & holding equipment are consistently focusing on enhancing the safety of large quantities of cooked food items.

Warming equipment has emerged as one of the most effective tools to ensure protection from harmful bacteria and pathogens. Pathogens are set to multiply in numbers between 5 ºC and 63 ºC and therefore, demand for warming equipment is poised to grow at a rapid pace during the forecast period.

The Food Safety Regulations 1995 and similar other regulations have been implemented by government agencies to ensure the safety of consumers. Foodservice participants are also continually putting efforts to ensure that the cooked food is free from harmful bacteria and remains at the desired temperature level, which is set to push the use of food holding and warming equipment. Owing to the aforementioned factors, the global food holding equipment market is anticipated to exhibit a CAGR of 4.1% from 2025 to 2035.

A number of influential factors have been identified to play a significant role in the food-holding equipment market. Analysts at FMI have also analyzed the restraining factors, lucrative opportunities, and upcoming threats that can pose a challenge to the progression of the food-holding equipment market.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

Fast Food Outlets in the USA to Look for Advanced Food Preparation Equipment

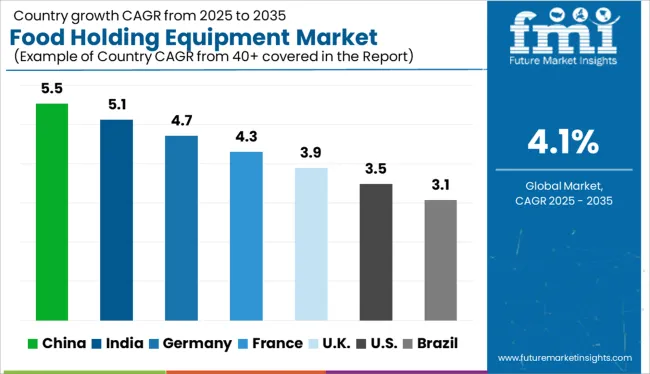

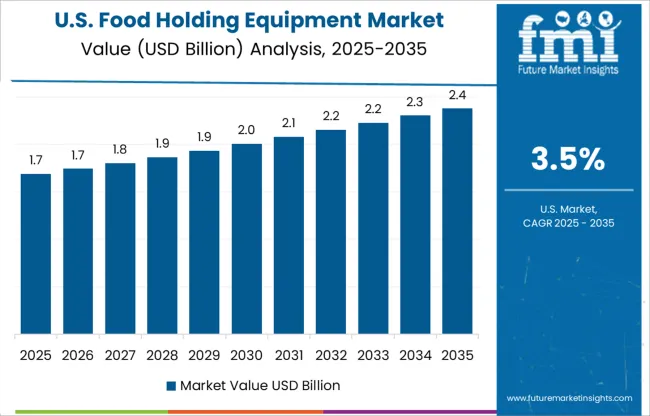

As per FMI, the food holding equipment market in the United States is estimated to be worth about USD 6.2.0 million by 2035 and account for nearly 56% of the North American market during the evaluation period. An increasing number of fast food chains and restaurants across the US is set to push the food industry in the country.

Also, the rising supermarket culture in the USA would help fuel sales of food-holding equipment in the next ten years. The ability of food-holding equipment to extend the shelf life of food and maintain its optimum temperature is another crucial factor that is projected to aid growth.

UK-based Companies to Look for Food Equipment to Maintain Overall Temperature

In the next ten years, it is expected that the UK will experience rapid growth. The food-holding equipment market in the country is anticipated to grow as more people are becoming aware of the advantages of holding food products. They are striving to maintain the overall temperature to preserve numerous food items.

Furthermore, advancements in the food holding sector such as merging all process equipment into one to save human labor and increase sanitation standards, are projected to propel the UK food holding equipment market. The UK is expected to be valued at nearly USD 491.0 million and accounts for 34% of the Europe food holding equipment market share in the forecast period.

Rising Demand for Poultry Products in China to Spur Sales of Food Warming Tables

According to FMI, China is set to be worth over USD 313,5 million and account for 33% of the Asia Pacific food holding equipment market share in the assessment period. Growth is attributed to the ever-increasing population with a wide range of socioeconomic and cultural characteristics. Furthermore, as Western countries have increased their investments in China to develop their food industry, demand for food holding equipment has increased, production levels have advanced, and processing times have decreased.

In addition, market expansion has been aided by population growth and rising awareness about the benefits of consuming high-quality food products. The strong presence of various producers, particularly in China is another crucial factor that would drive the market. Due to the rising consumption of poultry products in urban areas and the urgent need for processed food products, demand for food holding equipment is surging across China.

Quick Service Restaurants to Demand Kitchen Holding Equipment by the End of 2035

By end user, the quick service restaurants segment is expected to remain at the forefront in the global food holding equipment market in the next ten years. Changing lifestyle of millennials and the rising shift towards convenience food are two of the major factors pushing the segment. Besides, the rising penetration of e-commerce channels, as well as the emergence of various smartphone applications providing home delivery and other quick assistance to enhance user experience to suit the ongoing modernization would bode well for the segment in the global food holding equipment market.

The global food holding equipment market is estimated to be highly fragmented with the presence of a large number of small- and large-scale companies. They are mainly focusing on new product launches to expand their portfolios and cater to a wide range of end-use industries. A few other key players are engaging in mergers and acquisitions, as well as partnerships with leading companies to co-develop novel products.

For instance,

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 4.1 billion |

| Projected Market Valuation (2035) | USD 6.2 billion |

| Value-based CAGR (2025 to 2035) | 4.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value (USD Million) |

| Key Regions Covered |

North America; Latin America; Europe; Asia Pacific; Oceania; Middle East & Africa (MEA) |

| Key Countries Covered |

The USA, Canada, Mexico, Germany, The UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered |

Product TypeType, End User, Region |

| Key Companies Profiled |

Dover Corporation; Welbilt Inc. (Manitowoc Foodservice, Inc.); Illinois Tool Works Inc.; Hatco Corporation; Ali Group S.r.l.; MKN Maschinenfabrik Kurt Neubauer GmbH & Co KG; Al-Halabi Refrigeration & Steel LLC; Fujimak Corporation; Duke Manufacturing; Conagra Brands; Greencore Group; Nestlé S.AOlam International; The Kraft Heinz Company; PepsiCo Inc.; AGRANA Group; Bonduelle; Dole Food; SVZ International B.V.; Sahyadri Farms; Diana Group S.A.S.; RAJE AGRO FOODS PRIVET LIMITED |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global food holding equipment market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the food holding equipment market is projected to reach USD 6.2 billion by 2035.

The food holding equipment market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in food holding equipment market are holding cabinets, proofing cabinets and refrigerators & chillers.

In terms of end user, quick service restaurants segment to command 34.7% share in the food holding equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Holding and Warming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA