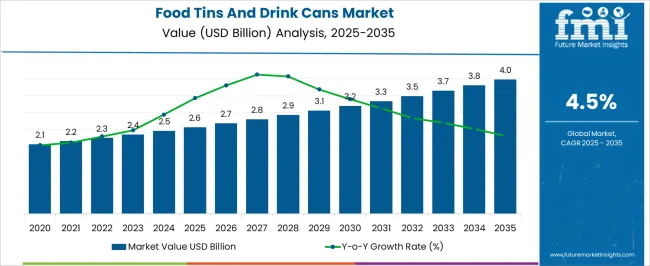

The Food Tins And Drink Cans Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 4.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Food Tins And Drink Cans Market Estimated Value in (2025 E) | USD 2.6 billion |

| Food Tins And Drink Cans Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The food tins and drink cans market is witnessing consistent growth due to increasing demand for extended shelf life, efficient storage, and recyclable packaging solutions across food and beverage industries. Rising consumer focus on convenience and sustainability is encouraging manufacturers to invest in lightweight, corrosion-resistant, and fully recyclable metal packaging options.

Steel and aluminum materials are being widely adopted due to their ability to preserve product integrity under variable temperature conditions while supporting branding through high-definition printing. Additionally, growth in ready-to-eat meals, dairy-based nutritional products, and functional beverages has amplified the need for rigid, tamper-proof packaging that aligns with safety and compliance standards.

Manufacturers are optimizing production lines for multi-format packaging to cater to SKU diversification across global and regional markets. As food safety regulations tighten and consumer awareness around environmental impact grows, the market is expected to expand through innovations in coatings, resealable mechanisms, and lightweight structural redesigns.

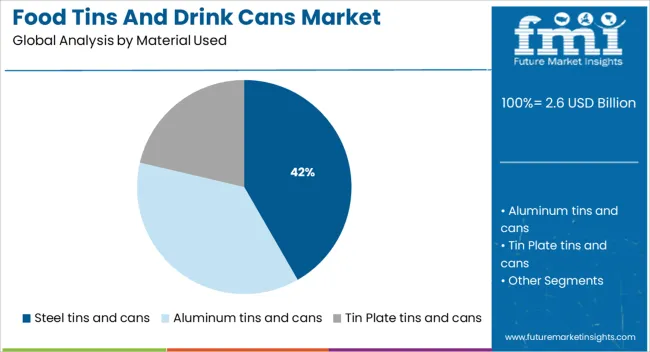

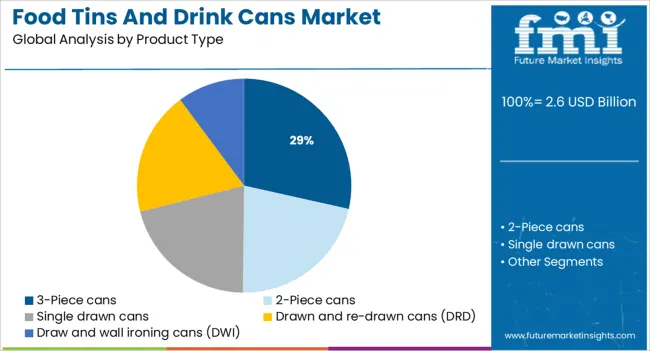

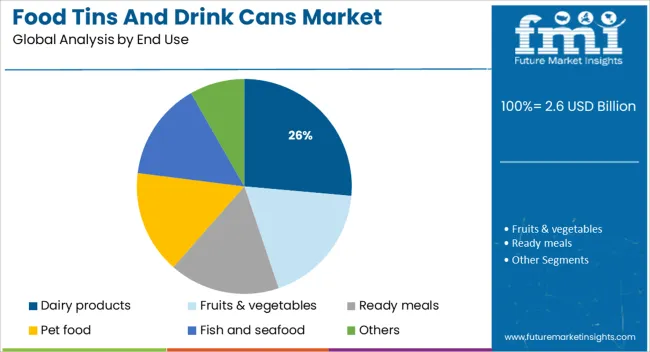

The market is segmented by Material Used, Product Type, End Use, and Packaging Types and region. By Material Used, the market is divided into Steel tins and cans, Aluminum tins and cans, and Tin Plate tins and cans. In terms of Product Type, the market is classified into 3-Piece cans, 2-Piece cans, Single drawn cans, Drawn and re-drawn cans (DRD), and Draw and wall ironing cans (DWI). Based on End Use, the market is segmented into Dairy products, Fruits & vegetables, Ready meals, Pet food, Fish and seafood, and Others. By Packaging Types, the market is divided into Round tins and cans, Bowl tins and cans, and Shaped tins and cans. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Steel tins and cans are anticipated to hold a 41.7% share of the total market by 2025, leading the material segment. This dominance is driven by steel's high tensile strength, recyclability, and barrier properties which effectively protect perishable contents from contamination and oxidation.

The structural integrity of steel supports high-speed manufacturing and stacking efficiency across food and beverage supply chains. Additionally, advanced lacquering and coating technologies have extended steel's applicability across acidic and dairy-based product categories.

The material's compatibility with shaping and embossing also supports brand visibility and differentiation on retail shelves. As sustainability goals continue to influence material choices, steel’s closed-loop recycling potential and regulatory acceptance reinforce its leading share in the market.

The 3-piece cans segment is projected to contribute 28.5% of revenue by 2025 within the product type category, marking it as the dominant structural format. Its sustained leadership is attributed to manufacturing scalability, strength under pressure, and versatility in size customization.

The ability to accommodate a wide variety of food products—ranging from soups and vegetables to meats and dairy—is a key advantage. 3-piece cans support easy labeling and in-line branding, making them popular among mid to high-volume food processors.

Improvements in seam sealing and internal coatings have also enhanced food safety and product longevity, driving continued preference. The format’s production efficiency and compatibility with automated filling lines make it a staple in large-scale canning operations, reinforcing its strong market presence.

Dairy products are expected to represent 26.4% of total market revenue in 2025, making this the leading end use category. The segment’s leadership stems from increased consumption of condensed milk, cream-based formulations, nutritional beverages, and ready-to-drink dairy items that require robust shelf-stable packaging.

Metal cans have proven effective in protecting dairy content against UV exposure, microbial contamination, and physical damage during transportation. Their excellent sealing properties ensure longer shelf life, particularly in regions with limited cold chain infrastructure.

Furthermore, the rising trend of fortified dairy products and global export of canned dairy goods has accelerated can usage. Metal packaging also aligns with food safety regulations in dairy processing, supporting hygiene, labeling compliance, and tamper evidence, all of which have helped position this segment as a major revenue contributor in the food tins and drink cans market.

Started from the developed countries and gradually adopted by consumers in developing countries, food consumption pattern witnessed dynamics shift over past decade.Meteoric growth in instant ready to eat and packaged food market, due to rise in dual income level, standard of living and convenience offered by newer format of food consumption. Canned food and beverages have integrated with urban lifestyle, particularly in developed as well as developing geographies.

Food tins and drink cans are most effective solution equipped with all features needed for storage and transportation. Food tins and drink can also preserve the nutrition value and flavor of the product. Food tins and drink cans are a good means of safely preserving of foodstuffs for longer duration without any microbiological deterioration as these tins and cans are made from corrosion resistant materials.

Most countries across globe have started to invest in infrastructure such as deep freezing mechanism which is required for proper storage of ready to consume food and keep food temper resistant with increased shelf life. Food tins and drink cans are becoming an asset in packaging for manufactures as they incur very less cost packaging solution and thus provide value to the manufacturers.

Also, these tins and cans can be manufactured in large quantity in any size and shapes. This all derives tins and cans market all across the globe. On the other hand, people across world has grown health conscious and thus avoids consumption of an industrial chemical called Bisphenol A or BPA which can seep into food and beverage stored in tins and cans leading to diseases such prostate and breast cancer thus hampering growth of food tin and drink can market.

Moreover, the inclination of manufacturers as well as customers towards new pouches and thin plastic packaging, hampers the growth of metal food tin and drink can market. Also, customers want packaging with features such as tins and cans to be used in the microwave, re-sealable packaging and also easy opening patterns. This has acted as the important restraining factors for the metal packaging container market.

The majority of cans and tins used for food and beverage packaging all over the world are made up of steel. Aluminum cans are mostly preferred in beverage packaging mostly for carbonated drinks.

Geographically, the food tins and drink cans market is segmented into seven regions, namely North America, Latin America, Western Europe, Eastern Europe, Asia Pacific Excluding Japan (APEJ), Japan and the Middle East and Africa (MEA).

Among regions mentioned above, North America bags a significant share and it is expected to maintain as market leader during the forecast period as it provides a better freezing facility for the storage of food tins and drink cans.

Asia’s Food and Beverages market shall experience an unprecedented growth taking half of the consumption by 2024 thus contributing to growth of global food tins and drinking can market. Overall, the global food tin and drink can market is expected to register a healthy CAGR during the forecast period.

Some predominant players identified across the globe are Crown Holdings, Cansmart, Silgan Containers LLC, Jamestrong Packaging, Kian Joo Can Factory Bhd, Perennial Packaging Group Pty Ltd, Allstate Can Corporation, TinPak (Pvt) Ltd. and BALL CORPORATION.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Global food tin and drink cans market has been segmented as follows

The global food tins and drink cans market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the food tins and drink cans market is projected to reach USD 4.0 billion by 2035.

The food tins and drink cans market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in food tins and drink cans market are steel tins and cans, aluminum tins and cans and tin plate tins and cans.

In terms of product type, 3-piece cans segment to command 28.5% share in the food tins and drink cans market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA