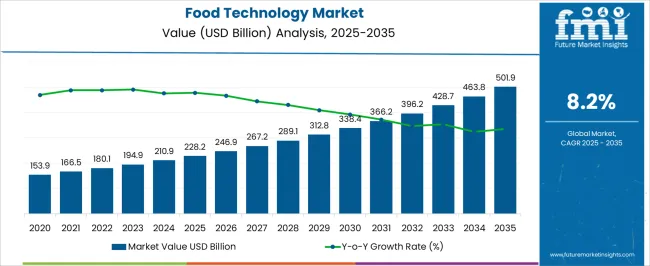

The global food technology market is projected at USD 228.2 billion in 2025 and is anticipated to reach USD 501.9 billion by 2035, growing at a compound annual growth rate (CAGR) of 8.2% over the forecast period. Analyzing market share erosion and gain provides insight into competitive dynamics and sectoral shifts over the decade. In the early phase, from USD 153.9 billion to USD 210.9 billion, established players retain a significant portion of market share due to their technological expertise, distribution networks, and strong brand presence, while smaller entrants experience limited penetration, highlighting relative share stability.

Moving into the mid-phase, spanning USD 228.2 billion to USD 312.8 billion, notable market gains are observed among innovators introducing advanced solutions such as plant-based alternatives, precision food processing, and digital food traceability, resulting in incremental erosion of the dominance of traditional companies. In the latter half of the forecast period, from USD 338.4 billion to USD 501.9 billion, market share shifts accelerate as startups and technology-driven companies capture demand in emerging regions, leverage IoT-enabled food systems, and offer scalable solutions for functional foods, alternative proteins, and automation in production. This period reflects a dynamic realignment of market positions, where agile players expand share while incumbents adapt or consolidate.

The erosion and gain analysis illustrates that while established entities maintain foundational control in the early years, disruptive innovation, digital integration, and evolving consumer preferences drive significant shifts in market composition, setting the stage for a more diversified competitive landscape by 2035.

| Metric | Value |

|---|---|

| Food Technology Market Estimated Value in (2025 E) | USD 228.2 billion |

| Food Technology Market Forecast Value in (2035 F) | USD 501.9 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The food technology market is closely influenced by five interconnected parent markets that collectively drive its adoption and long-term growth. The largest contributor is the processed and packaged food market, which accounts for about 35% share, as innovations in preservation, flavor enhancement, and shelf-life extension directly support large-scale food production and distribution. The agricultural biotechnology and crop science sector contributes around 25%, driven by the development of high-yield, nutrient-rich, and resilient raw materials that serve as inputs for advanced food processing technologies. The food safety and quality testing market holds close to 15% influence, supported by increasing regulatory standards and consumer demand for safe, traceable, and high-quality food products, which has accelerated adoption of testing technologies, sensors, and analytical solutions. The smart kitchen and food service technology sector adds nearly 12%, as restaurants, cloud kitchens, and catering services leverage automation, robotics, and IoT-enabled cooking solutions to enhance efficiency, consistency, and customer experience.

The functional foods and nutraceutical market contributes nearly 8%, as rising consumer awareness of health benefits drives innovation in fortified products, personalized nutrition, and the incorporation of bioactive ingredients. The distribution of market influence shows that processed food production and agricultural biotechnology form the backbone of this market, while food safety, smart kitchen innovations, and functional nutrition continue to expand commercial applicability.

The food technology market is expanding steadily, driven by a combination of evolving consumer demands, sustainability targets, and the growing need for efficiency and safety in food production. Increased awareness around food security, nutritional enhancement, and shelf-life improvement has elevated the role of innovative technologies across the entire value chain.

The convergence of automation, digitalization, and biotechnology is revolutionizing how food is processed, packaged, and preserved. With heightened focus on traceability, waste reduction, and clean-label products, food technology is becoming central to strategic growth initiatives across food enterprises.

In the future, the market is expected to benefit from advancements in AI-driven food analytics, smart manufacturing systems, and green processing technologies. Continuous investment from both public and private sectors further supports scalable innovations, reinforcing the market’s long-term trajectory as a cornerstone of modern food systems.

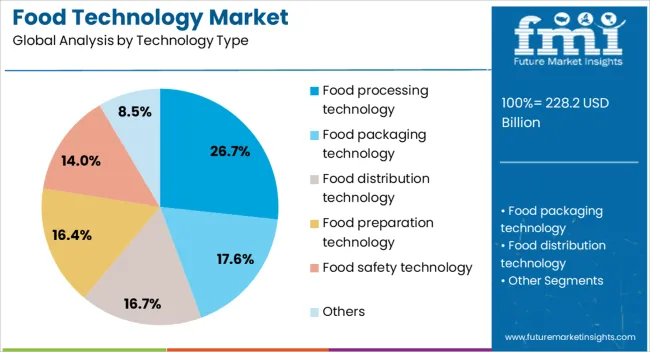

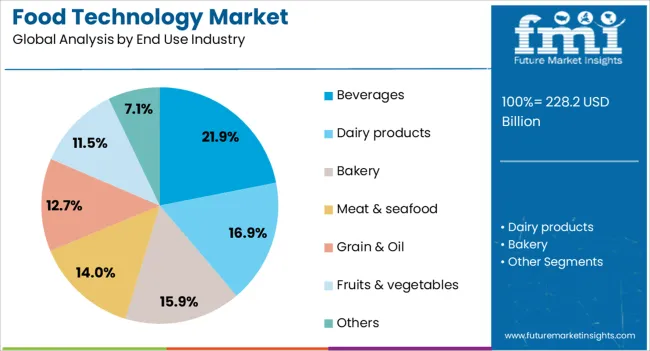

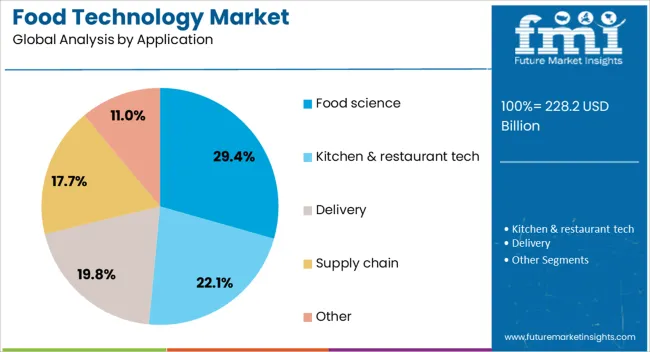

The food technology market is segmented by technology type, end use industry, application, component, and geographic regions. By technology type, food technology market is divided into Food processing technology, Food packaging technology, Food distribution technology, Food preparation technology, Food safety technology, and Others. In terms of end use industry, food technology market is classified into Beverages, Dairy products, Bakery, Meat & seafood, Grain & Oil, Fruits & vegetables, and Others. Based on application, food technology market is segmented into Food science, Kitchen & restaurant tech, Delivery, Supply chain, and Other. By component, food technology market is segmented into Hardware, Software, and Services. Regionally, the food technology industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The food processing technology segment leads with a 27% market share under the technology type category, signifying its critical importance in transforming raw ingredients into consumable food products while ensuring quality, consistency, and compliance. The adoption of advanced food processing methods, including high-pressure processing, extrusion, and enzymatic technologies, has accelerated due to their ability to enhance food safety, reduce waste, and improve shelf stability.

This segment’s growth is also propelled by the integration of automation and digital monitoring systems that increase production efficiency and minimize human error. As global food manufacturers expand product lines to meet diverse dietary preferences and regulatory standards, the demand for flexible and efficient processing technologies remains high.

Ongoing R&D efforts focused on energy-efficient and sustainable processing are expected to further consolidate the segment’s leadership in the food technology space.

The beverages segment accounts for 22% of the market under the end use industry category, reflecting its increasing reliance on food technology to meet rising consumer expectations for taste, health benefits, and innovation. Technological advancements are enabling beverage producers to introduce functional drinks, low-sugar formulations, and enhanced flavor profiles while maintaining consistency and scalability.

This segment benefits from strong demand for plant-based beverages, energy drinks, and fortified hydration solutions, all of which require precise formulation and processing techniques. Adoption of IoT-enabled quality control systems and aseptic packaging methods further supports growth by enhancing safety and shelf life.

As beverage companies pursue diversification and expand into niche categories, the role of food technology in maintaining speed-to-market and compliance is expected to become even more integral to the segment’s growth.

The food science segment leads within the application category, holding a 29% market share, driven by its foundational role in enabling innovation, quality control, and product development across the food industry. This application area supports the formulation of healthier products, improved flavor and texture profiles, and enhanced preservation techniques.

Food science also plays a vital role in developing allergen-free, gluten-free, and fortified foods that address specific dietary needs. Growth in this segment is propelled by advancements in nutritional profiling, ingredient functionality, and sensory analysis, which are essential to creating differentiated products in a competitive market.

Additionally, the integration of food science with digital tools such as AI and simulation models is accelerating research cycles and driving efficient commercialization. Continued emphasis on food safety, nutrition transparency, and scientific validation is expected to reinforce the segment’s pivotal position in the food technology market.

The food technology market is shaped by rising demand for processed and convenient foods, integration of advanced packaging and preservation methods, focus on health and functional ingredients, and regional market expansion. Consumer preference for ready-to-eat, nutritious, and safe food products is driving adoption across retail, foodservice, and industrial sectors. Technological innovations in preservation, cold chain, and packaging are improving shelf life and operational efficiency. Health-conscious trends are encouraging the incorporation of functional and nutrient-rich ingredients. Combined with regional growth and infrastructure development, these factors are promoting market expansion, fostering innovation, and reinforcing the critical role of food technology in modern food supply chains globally.

The market is being driven by increasing consumer demand for processed, ready-to-eat, and convenient food products. Busy lifestyles and changing dietary habits are encouraging manufacturers to adopt advanced food processing, preservation, and packaging technologies. These solutions enhance shelf life, maintain nutritional quality, and improve taste, allowing companies to deliver high-quality products to a growing consumer base. Retailers and foodservice operators are leveraging food technology to meet evolving preferences for ready meals, functional foods, and fortified products. The rising demand for convenience foods is fostering adoption of modern processing techniques, creating opportunities for investment and innovation in the sector.

Food technology solutions are increasingly integrating advanced packaging, preservation, and storage methods to ensure safety and extend shelf life. Techniques such as modified atmosphere packaging, vacuum sealing, and edible coatings are being employed to prevent spoilage and maintain product freshness. Cold chain logistics and smart packaging solutions are being incorporated to improve traceability, quality monitoring, and consumer transparency. These innovations help manufacturers meet regulatory compliance while reducing waste and optimizing distribution. Integration of these technologies is enhancing product appeal, minimizing operational losses, and supporting broader adoption of food technology solutions across retail, foodservice, and industrial segments.

Consumer awareness regarding health, wellness, and nutrition is driving innovation in the food technology market. Manufacturers are incorporating functional ingredients, natural additives, and nutrient-rich formulations into processed foods to meet evolving dietary preferences. Solutions targeting low-sugar, high-protein, plant-based, and fortified food products are gaining traction. Food technology enables precise formulation, quality control, and consistency, ensuring compliance with nutritional standards. The rising demand for functional and health-oriented foods is encouraging R&D investments in bioactive ingredients, novel processing techniques, and personalized nutrition solutions. By aligning with consumer health priorities, the market is expanding across both packaged foods and specialty product categories.

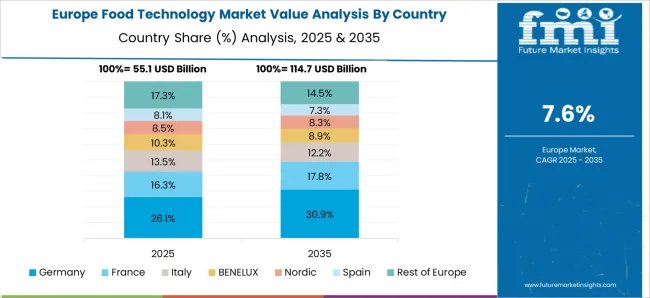

The food technology market is benefiting from industrial growth, urbanization, and rising consumption patterns in North America, Europe, and Asia-Pacific regions. Emerging markets are witnessing increased adoption due to improving infrastructure, cold chain logistics, and growing retail networks. Manufacturers are localizing production facilities to reduce costs, improve supply chain efficiency, and cater to regional tastes. Collaboration with research institutions, technology providers, and packaging firms is enhancing innovation and market reach. Regional expansion, coupled with increasing awareness of food quality, safety, and nutritional content, is creating new opportunities for food technology adoption and solidifying its role as a critical enabler of modern food production and distribution.

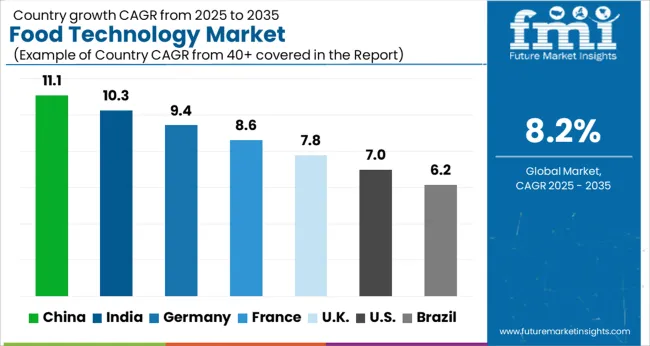

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The global food technology market is projected to grow at a CAGR of 8.2% from 2025 to 2035. China leads with 11.1%, followed by India at 10.3%, Germany at 9.4%, the UK at 7.8%, and the USA at 7.0%. Growth is driven by increasing demand for processed and convenience foods, adoption of innovative preservation techniques, and expansion of food safety regulations. BRICS countries, particularly China and India, are investing in automation, cold chain infrastructure, and ingredient innovations to meet rising consumer demand. OECD nations such as Germany, the UK, and the USA emphasize high-quality processing, smart kitchen technologies, and research in functional and alternative food products. The analysis spans over 40+ countries, with the leading markets detailed below.

The food technology market in China is projected to grow at a CAGR of 11.1% from 2025 to 2035, driven by rising consumer demand for processed, packaged, and convenience foods. Innovations in food processing, preservation, and safety technologies are being adopted to meet growing urban consumption and export requirements. Automation in food production lines, smart packaging solutions, and IoT-enabled monitoring systems are enhancing efficiency and quality control. Government regulations emphasizing food safety, traceability, and nutrition labeling further stimulate investment in advanced food technologies. Rapid growth in e-commerce platforms and modern retail channels supports the expansion of technologically advanced food products.

The food technology market in India is expected to grow at a CAGR of 10.3% from 2025 to 2035, supported by increasing urbanization, rising disposable incomes, and growing food processing activities. Adoption of advanced food processing equipment, preservation technologies, and smart packaging solutions is expanding across both large-scale and small-scale food manufacturers. E-commerce growth and modern retail penetration enhance demand for packaged and ready-to-eat food products. Regulatory standards for food safety, hygiene, and traceability encourage investment in technology-driven solutions. Rising consumer preference for nutritious, convenient, and safe food products is also driving innovation in processing and packaging technologies.

The food technology market in Germany is projected to grow at a CAGR of 9.4% from 2025 to 2035, fueled by high adoption of automation, smart processing equipment, and quality control systems. German food manufacturers are increasingly leveraging IoT, robotics, and AI-driven analytics to optimize production and ensure compliance with stringent food safety standards. Innovation in packaging, preservation, and traceability solutions supports both domestic consumption and export demand. Sustainability-focused food technology solutions, such as waste reduction and energy-efficient processing, are also gaining traction. Germany’s well-developed food processing sector and consumer preference for high-quality, safe, and convenient products drive consistent market growth.

The food technology market in the UK is expected to grow at a CAGR of 7.8% from 2025 to 2035, driven by increasing demand for packaged, ready-to-eat, and functional foods. Food manufacturers are investing in smart processing equipment, automated packaging, and real-time monitoring systems to ensure quality, safety, and operational efficiency. E-commerce and grocery delivery expansion further increase the demand for convenient and technologically enhanced food products. Compliance with regulatory standards on food safety, labeling, and traceability encourages adoption of advanced technologies. Innovations in processing and preservation solutions are enabling manufacturers to reduce waste and extend product shelf life.

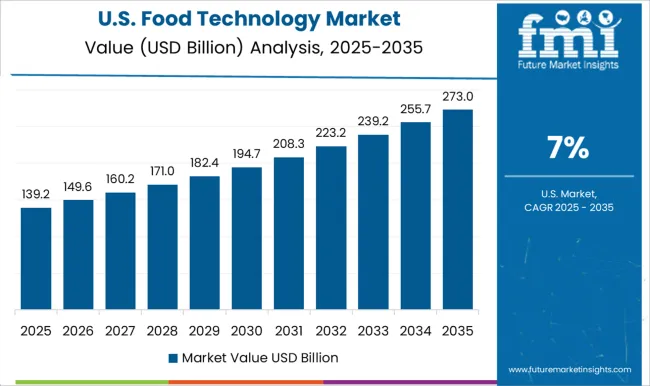

The food technology market in the USA is projected to grow at a CAGR of 7.0% from 2025 to 2035, supported by increasing consumer demand for processed, packaged, and functional foods. Automation, smart processing equipment, and real-time monitoring technologies are being implemented to enhance efficiency, safety, and quality control. E-commerce and direct-to-consumer food delivery services are expanding demand for shelf-stable and ready-to-eat products. Food safety regulations and traceability requirements drive investment in advanced processing and packaging technologies. Continuous innovation in preservation, packaging, and waste reduction ensures that manufacturers remain competitive while meeting evolving consumer expectations.

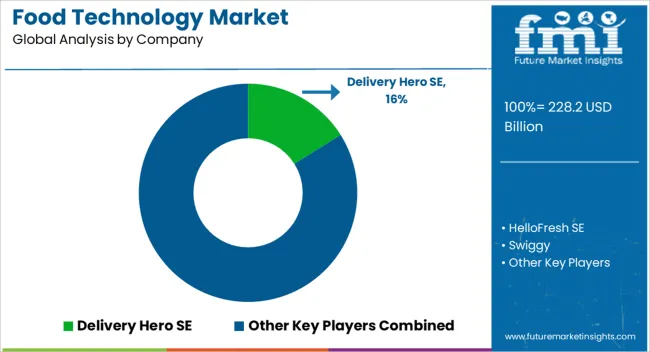

Competition in the food technology market is influenced by digital innovation, automation efficiency, and consumer convenience. Delivery Hero SE, HelloFresh SE, Swiggy, Flytrex Inc., Miso Robotics, Carlisle Technology, Nymble (Epifeast Inc.), LUNCHBOX, and Zomato lead by providing app-based ordering platforms, automated kitchen solutions, robotic cooking systems, and AI-powered food delivery management. Product differentiation is achieved through smart inventory management, automated cooking and packaging systems, predictive demand analytics, and drone-enabled delivery, ensuring faster, accurate, and cost-efficient service. Mid-tier and regional players focus on cloud-based order management, customizable menu platforms, and last-mile delivery optimization, catering to urban consumers and small-to-medium food service providers. These players emphasize modular, scalable solutions for kitchens and delivery networks, enabling rapid deployment with minimal operational disruption. Strategies across leading companies emphasize integration of AI, IoT-enabled kitchen devices, and predictive analytics to optimize workflow and reduce waste. Automated food preparation, real-time tracking systems, and data-driven menu personalization are leveraged as critical differentiators to enhance consumer experience and operational efficiency. Differentiation is further strengthened through seamless mobile app interfaces, contactless delivery systems, and smart loyalty programs that drive customer engagement. Companies aim to balance operational efficiency with service quality, ensuring food safety, timely delivery, and consistent taste while maintaining profitability and regulatory compliance. The market demonstrates intense competition based on technology adoption, consumer-centric solutions, and operational scalability, where global and regional players maintain leadership by offering innovative, automated, and user-friendly food platforms. Continuous enhancements in robotics, AI analytics, and cloud-based management support long-term growth, while flexible business models, subscription services, and integrated delivery networks reinforce market positioning. The food technology market reflects a dynamic landscape driven by convenience, efficiency, and technology-enabled service excellence.

| Item | Value |

|---|---|

| Quantitative Units | USD 228.2 Billion |

| Technology Type | Food processing technology, Food packaging technology, Food distribution technology, Food preparation technology, Food safety technology, and Others |

| End Use Industry | Beverages, Dairy products, Bakery, Meat & seafood, Grain & Oil, Fruits & vegetables, and Others |

| Application | Food science, Kitchen & restaurant tech, Delivery, Supply chain, and Other |

| Component | Hardware, Software, and Services |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Delivery Hero SE, HelloFresh SE, Swiggy, Flytrex Inc., Miso Robotics, Carlisle Technology, Nymble (Epifeast Inc.), LUNCHBOX, and Zomato |

| Additional Attributes | Dollar sales, share, product innovation, regional adoption, processing technology demand, competitor landscape, pricing trends, regulatory compliance, automation integration, clean-label trends, functional ingredients, supply chain efficiency. |

The global food technology market is estimated to be valued at USD 228.2 billion in 2025.

The market size for the food technology market is projected to reach USD 501.9 billion by 2035.

The food technology market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in food technology market are food processing technology, food packaging technology, food distribution technology, food preparation technology, food safety technology and others.

In terms of end use industry, beverages segment to command 21.9% share in the food technology market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Biotechnology Market Size and Share Forecast Outlook 2025 to 2035

Nanotechnology for food packaging Market

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA