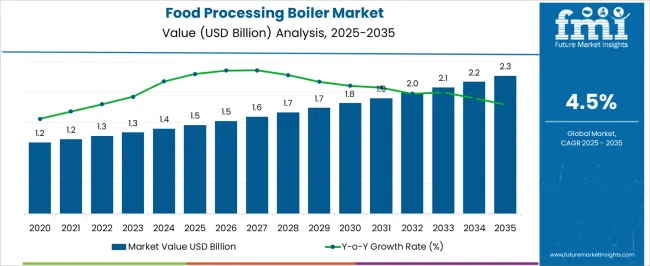

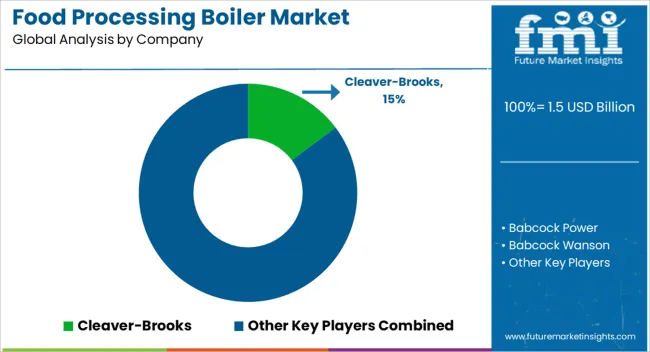

The food processing boiler market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. Boilers used in food processing are subject to stringent standards for safety, emissions, and energy efficiency, which govern design, installation, and operational practices. Compliance with regulations from authorities such as the USA Environmental Protection Agency, European Union Ecodesign Directives, and various national food safety agencies impacts both capital expenditure and operational costs, contributing to moderate market growth.

The forecasted incremental growth indicates that regulatory pressures are shaping technology adoption, favoring energy-efficient, low-emission, and automated boilers. Manufacturers are compelled to integrate monitoring systems, emissions control units, and standardized safety mechanisms to meet regulatory requirements, which in turn affects product pricing and market entry timelines. Additionally, periodic inspections, certifications, and documentation requirements drive adoption of digital compliance solutions within the supply chain. Emerging economies are gradually aligning with international safety and emission standards, which is expected to expand market penetration, particularly in Asia-Pacific.

The regulatory frameworks act as both a catalyst for innovation and a constraint on rapid expansion, leading to steady, compliant-driven growth. The market evolution demonstrates a balance between meeting stringent standards and achieving operational efficiency, highlighting the central role of regulatory compliance in shaping market trajectory.

| Metric | Value |

|---|---|

| Food Processing Boiler Market Estimated Value in (2025 E) | USD 1.5 billion |

| Food Processing Boiler Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The food processing boiler market represents a specialized share of the industrial boiler landscape, reflecting its critical role in ensuring energy efficiency and safe operations across food and beverage production. Within the global industrial boiler industry, it accounts for about 5.1%, supported by rising heat and steam demand for processing, cooking, and cleaning. In the food and beverage machinery sector, it secures 4.3%, highlighting integration with large-scale production systems. Across the thermal energy equipment market, it contributes nearly 3.7%, indicating its relevance in controlled heating processes. Within the broader food manufacturing infrastructure segment, it holds 3.2%, emphasizing its role in consistent product output. In the energy-efficient process equipment industry, it is positioned at 2.8%, underscoring its importance in reducing operational costs while maintaining compliance with safety standards. Recent developments in the food processing boiler market have highlighted efficiency improvements and stricter adherence to environmental guidelines. Manufacturers are focusing on high-capacity boilers with lower emissions, supported by natural gas and biomass as preferred fuel sources.

Hybrid and dual-fuel systems are gaining adoption, enabling flexibility in energy sourcing. The integration of IoT and smart control technologies has advanced, improving energy monitoring, predictive maintenance, and process reliability. Modular boiler systems are being introduced, offering scalability for medium and large-sized food processing units. The regulatory pressure has accelerated the shift toward low-NOx and condensing boilers, aligning with sustainability goals.

The food processing boiler market is expanding steadily, driven by increasing demand for energy-efficient and reliable steam generation systems in food production facilities. As manufacturers strive to meet stringent hygiene, safety, and production standards, boilers play a vital role in sterilization, cooking, drying, and cleaning processes.

The market is experiencing a shift towards systems that offer operational flexibility, low emissions, and compliance with environmental regulations. Rising consumption of processed and packaged foods globally, along with the establishment of new food manufacturing units in emerging economies, is fostering demand.

Additionally, manufacturers are investing in modernization and upgrading of existing boiler infrastructure to reduce energy costs and improve performance. As sustainability and carbon reduction goals gain prominence, the market is expected to see increased adoption of technologies aligned with cleaner combustion and fuel efficiency across various capacity ranges

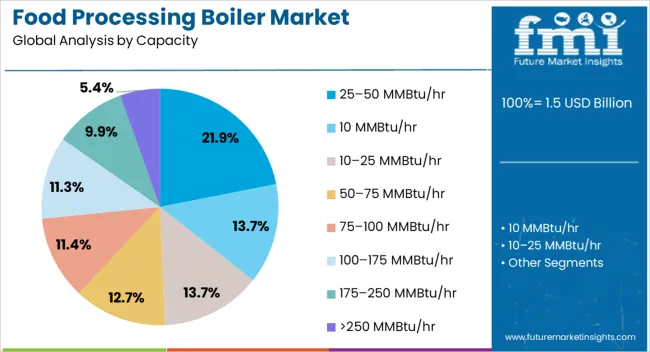

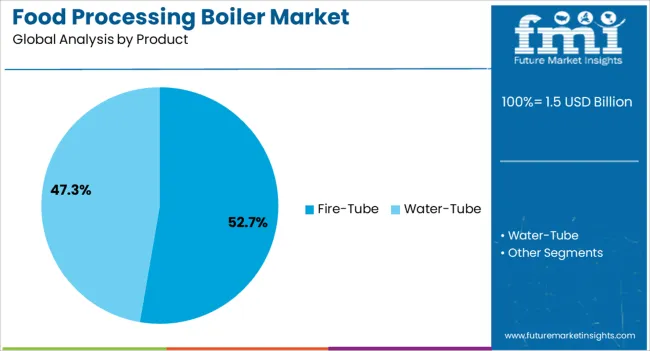

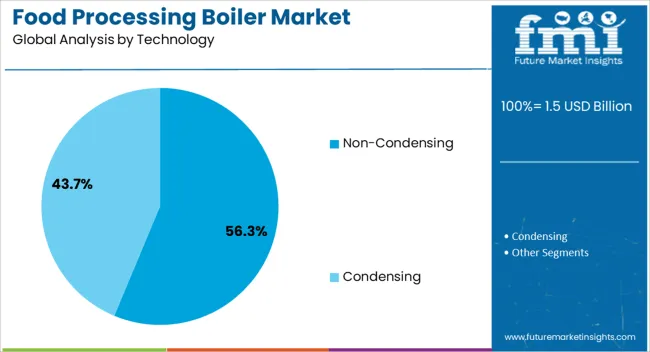

The food processing boiler market is segmented by capacity, product, technology, fuel, and geographic regions. By capacity, food processing boiler market is divided into 25–50 MMBtu/hr, 10 MMBtu/hr, 10–25 MMBtu/hr, 50–75 MMBtu/hr, 75–100 MMBtu/hr, 100–175 MMBtu/hr, 175–250 MMBtu/hr, and >250 MMBtu/hr. In terms of product, food processing boiler market is classified into Fire-Tube and Water-Tube. Based on technology, food processing boiler market is segmented into Non-Condensing and Condensing. By fuel, food processing boiler market is segmented into Natural Gas, Oil, Coal, and Others. Regionally, the food processing boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 25–50 MMBtu/hr capacity segment accounts for 21.9% of the food processing boiler market, reflecting its strong demand among mid-sized food processing plants requiring moderate steam loads. This capacity range offers an optimal balance between operational efficiency and scalability, making it suitable for diverse food applications such as baking, canning, and dairy processing.

Manufacturers in this category focus on compact design, fuel flexibility, and enhanced automation features to cater to evolving industry requirements. As energy management becomes a key focus, this segment benefits from retrofitting and upgrading activities that aim to improve thermal efficiency without major infrastructure changes.

The growing number of food SMEs and mid-scale processing units, particularly in Asia-Pacific and Latin America, is expected to drive sustained demand for this segment. Its adaptability to variable load demands and integration with hybrid fuel systems positions it as a reliable choice for medium-capacity processing operations

The fire-tube segment leads the product category with a 52.7% market share, highlighting its dominance in providing cost-effective and easy-to-operate steam generation solutions for the food processing industry. Fire-tube boilers are favored for their compact size, low initial investment, and ability to handle low to medium pressure applications, which are common in food production.

This segment is further supported by technological improvements that enhance heat transfer efficiency and reduce maintenance downtime. The straightforward design and lower risk of thermal shock make fire-tube boilers a preferred option for continuous operation environments.

Food processors seeking dependable and efficient solutions for pasteurization, sterilization, and cleaning processes continue to rely on fire-tube systems. With growing emphasis on process optimization and sustainability, fire-tube boilers are increasingly being upgraded with advanced control systems and energy recovery components, ensuring their sustained relevance across both existing and new installations

The non-condensing segment holds a dominant 56% share in the technology category, primarily due to its widespread use in facilities where exhaust heat recovery is not a core requirement. These systems are characterized by lower upfront costs, simpler installation, and robust performance in high-temperature applications, making them suitable for many food processing environments.

Non-condensing boilers are particularly effective in operations where consistent steam generation is needed without the complexity of condensate management. Their ability to operate efficiently with a variety of fuels and minimal retrofitting requirements makes them appealing to budget-conscious food processors.

Although energy efficiency standards are prompting interest in condensing technologies, non-condensing systems continue to command a strong presence in regions with less stringent emission regulations. Future growth for this segment is expected to be supported by ongoing refurbishments, especially in legacy food manufacturing plants that prioritize reliability and operational familiarity over advanced thermal efficiency

The market has gained importance as reliable steam and hot water generation remain essential for food and beverage industries worldwide. Boilers are utilized for cooking, sterilization, drying, pasteurization, and cleaning operations, ensuring consistency and safety in food products. Both fire-tube and water-tube designs are deployed depending on plant scale and energy requirements. Energy efficiency, cost optimization, and compliance with safety standards influence equipment selection. With increasing automation and demand for uninterrupted production, modern boilers integrate advanced monitoring systems, fuel flexibility, and emission control technologies.

Boilers serve a critical role in dairy and beverage industries by providing consistent steam for pasteurization, sterilization, and cleaning processes. In dairy processing, boilers ensure compliance with hygiene standards while maintaining efficiency in operations such as milk pasteurization and cheese production. Beverage producers, including breweries and juice manufacturers, rely on high-capacity boilers for fermentation and packaging processes. The increasing global demand for milk-based products, bottled beverages, and ready-to-drink formulations has amplified reliance on reliable boiler systems. With rising output in these sectors, food companies have prioritized advanced boilers that reduce downtime and enhance energy efficiency. This demand trend has been reinforced by stricter regulatory frameworks governing food safety and production standards in international markets.

Energy efficiency has become a key driver in food processing boiler adoption. Manufacturers are incorporating high-efficiency designs such as condensing boilers, biomass-fired boilers, and hybrid systems to reduce fuel consumption. Integration of digital monitoring systems enables real-time performance tracking, predictive maintenance, and optimization of steam generation. Variable fuel adaptability, including natural gas, biogas, and renewable fuels, has been introduced to lower operational costs while meeting emission standards. Advanced heat recovery systems are being implemented to capture and reuse waste heat, further enhancing efficiency. These technological innovations are influencing equipment choices across food processing facilities, as firms seek to minimize operational costs while adhering to energy regulations and achieving sustainability goals.

The global expansion of processed and packaged food industries has significantly impacted boiler demand. Production of frozen meals, bakery items, canned foods, and instant products requires reliable and continuous steam supply. Boilers facilitate drying, cooking, and sterilization processes that ensure product quality and extended shelf life. As consumer preference for convenience food continues to rise, production facilities have scaled up their operations, increasing demand for large-capacity and highly efficient boilers. Growing international trade of packaged food products has also created the need for compliant and reliable thermal systems. This expansion has strengthened the role of boilers as a critical component in meeting industrial-scale food processing requirements globally.

Stringent environmental regulations are reshaping the food processing boiler market. Policies targeting industrial emissions and energy consumption have encouraged the adoption of low-NOx burners, flue gas treatment systems, and boilers compatible with cleaner fuels. Governments across Europe, North America, and Asia are enforcing stricter compliance norms, leading to investments in eco-friendly boiler technologies. This regulatory environment has stimulated demand for natural gas-fired and biomass-based boilers, which provide reduced emissions compared to coal-fired systems. Companies are increasingly opting for equipment that balances productivity with compliance. These trends underline how regulatory frameworks are influencing procurement decisions and driving innovations in environmentally responsible boiler technologies.

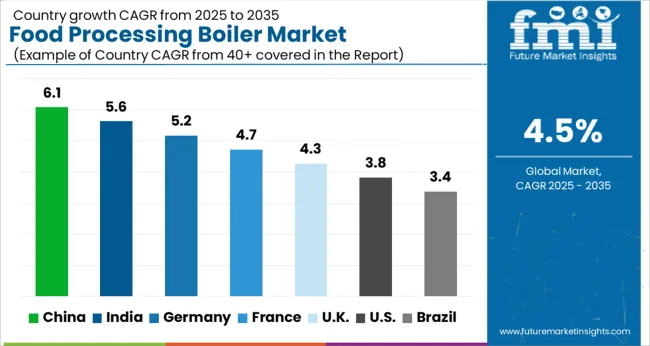

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The market is forecast to expand at a CAGR of 4.5% between 2025 and 2035, with growth linked to rising demand for efficient energy solutions in food manufacturing. China leads at 6.1%, supported by large-scale food processing and continuous investments in industrial infrastructure. India follows with 5.6%, where increasing packaged food production strengthens adoption. Germany records 5.2%, reflecting the presence of advanced equipment standards and consistent innovation in processing technologies. The UK posts 4.3%, driven by a shift toward modernized food production units. The USA registers 3.8%, where efficiency upgrades in processing plants continue to influence uptake. These figures highlight how regional food industry priorities shape boiler market development. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is advancing at a CAGR of 6.1%, driven by its large-scale food manufacturing and beverage processing industries. The rising demand for dairy, meat, and packaged foods has pushed investments in efficient and high-capacity boiler systems. Chinese manufacturers are focusing on energy-efficient and automated boiler technologies to reduce operational costs and comply with environmental regulations. The government’s focus on modernizing food safety infrastructure also encourages the adoption of advanced steam boilers that ensure hygienic processing. International suppliers are increasingly collaborating with local producers to provide integrated boiler systems tailored to large processing facilities.

India is witnessing growth at a CAGR of 5.6%, supported by the rapid expansion of packaged foods, confectionery, and beverage sectors. Boilers are essential in India’s dairy and sugar industries, where consistent steam supply is critical for production. The market is also influenced by the rising number of mid-sized processing units that are adopting cost-effective boilers with modern control systems. Energy efficiency is becoming a priority, leading to adoption of hybrid and biomass-fired boilers in several food clusters. Local manufacturers are emphasizing customization, offering compact and modular boilers suitable for small and medium enterprises.

Germany is progressing with a CAGR of 5.2%, led by its strong bakery, dairy, and brewing industries. German food processors are prioritizing advanced boiler systems with high fuel efficiency and reduced emissions to meet EU sustainability targets. Demand for automation, digital monitoring, and compact designs has increased significantly in recent years. The brewing industry in particular has adopted modern steam boilers for consistency and quality. German manufacturers are globally recognized for producing premium, energy-efficient boilers, and their expertise is increasingly exported to other European nations. This reflects a market driven by quality, compliance, and technology innovation.

The United Kingdom is expanding at a CAGR of 4.3%, with steady adoption in bakery, beverages, and processed meat industries. Modern boilers are being introduced to replace aging systems, with greater focus on efficiency and reduced carbon emissions. Food manufacturers are also investing in compact boilers suitable for smaller facilities while large-scale plants opt for advanced, high-capacity units. Rising demand for processed food exports has encouraged processors to adopt reliable steam supply systems that meet international standards. The UK market is characterized by niche innovation and increasing collaboration with European boiler suppliers.

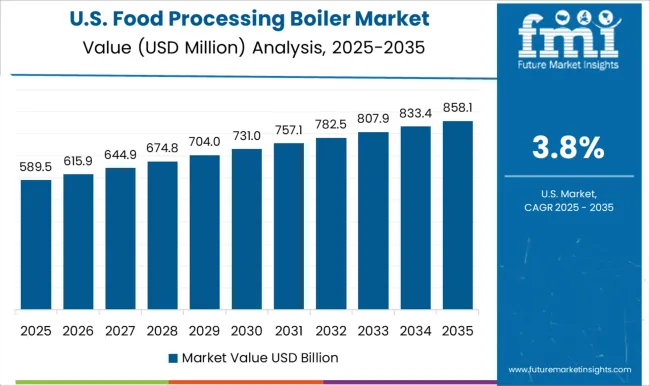

The United States is experiencing growth at a CAGR of 3.8%, supported by the large-scale packaged food, dairy, and beverage sectors. Boilers are critical for meat processing and frozen food industries, where steam plays an essential role in sterilization and preservation. The US market is increasingly adopting high-efficiency and low-emission boiler systems to comply with EPA regulations. The trend toward automation and remote monitoring has also accelerated in boiler adoption across food plants. Large multinational boiler companies maintain a strong presence, supplying customized systems to leading processors nationwide.

The market is defined by strong participation from global engineering groups and specialized boiler manufacturers that cater to the strict efficiency and safety requirements of the food and beverage industry. Cleaver-Brooks, Bosch Thermotechnology, Viessmann, and Babcock & Wilcox Enterprises maintain a dominant presence through comprehensive boiler solutions, advanced combustion technologies, and broad distribution networks. These companies emphasize energy efficiency, low-emission systems, and digital monitoring to align with industrial demand for operational optimization.

Specialized boiler producers such as Miura America, Hurst Boiler & Welding, Superior Boiler, and Johnston Boiler are recognized for modular designs, quick startup capabilities, and tailored solutions that suit diverse food processing applications. Their ability to offer flexible, space-efficient, and cost-effective systems supports strong adoption in regional markets. Regional and niche players including Thermax, Forbes Marshall, Clayton Industries, and Babcock Wanson enhance competition by offering integrated steam solutions, fuel-flexible systems, and after-sales service networks. Additionally, companies like FERROLI, Hoval, and Richard Kablitz contribute with specialized thermal systems and energy recovery solutions. The competitive landscape is shaped by increasing focus on sustainable fuel integration, automation, and compliance with food industry standards. Strategic partnerships, R&D in biomass and waste heat recovery, and lifecycle service offerings are expected to drive differentiation among these players.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Capacity | 25–50 MMBtu/hr, 10 MMBtu/hr, 10–25 MMBtu/hr, 50–75 MMBtu/hr, 75–100 MMBtu/hr, 100–175 MMBtu/hr, 175–250 MMBtu/hr, and >250 MMBtu/hr |

| Product | Fire-Tube and Water-Tube |

| Technology | Non-Condensing and Condensing |

| Fuel | Natural Gas, Oil, Coal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cleaver-Brooks, Babcock Power, Babcock Wanson, Babcock & Wilcox Enterprises, Bosch Thermotechnology, Clayton Industries, FERROLI, Forbes Marshall, Fulton, Hoval, Hurst Boiler & Welding, Johnston Boiler, Miura America, Nationwide Boiler, Richard Kablitz, Superior Boiler, Thermax, and Viessmann |

| Additional Attributes | Dollar sales by boiler type and application, demand dynamics across dairy, beverage, meat, and bakery processing sectors, regional trends in energy-efficient steam generation adoption, innovation in fuel flexibility, automation, and safety systems, environmental impact of fuel consumption and emissions, and emerging use cases in sustainable food production, clean steam applications, and renewable fuel integration. |

The global food processing boiler market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the food processing boiler market is projected to reach USD 2.3 billion by 2035.

The food processing boiler market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in food processing boiler market are 25–50 mmbtu/hr, 10 mmbtu/hr, 10–25 mmbtu/hr, 50–75 mmbtu/hr, 75–100 mmbtu/hr, 100–175 mmbtu/hr, 175–250 mmbtu/hr and >250 mmbtu/hr.

In terms of product, fire-tube segment to command 52.7% share in the food processing boiler market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fire Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Water Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Condensing Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Fire-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Condensing Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Fire Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA