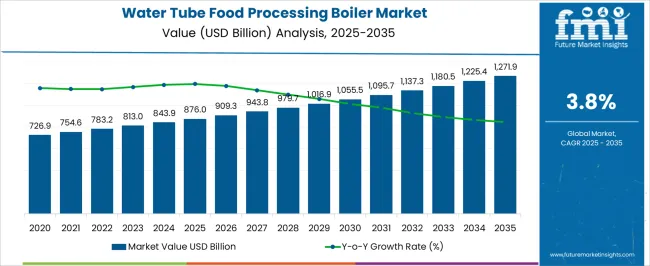

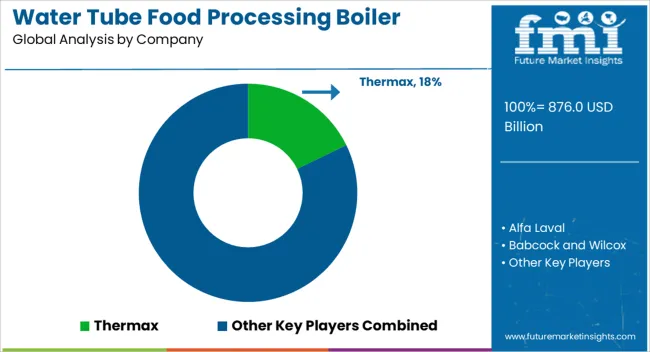

The water tube food processing boiler market is expected to rise from USD 876.0 billion in 2025 to USD 1,271.9 billion by 2035, reflecting a CAGR of 3.8% over the forecast period. In 2025, the market value is recorded at USD 876.0 billion, up from USD 843.9 billion in 2024, showing a consistent year-on-year increase. This steady expansion continues in 2026 when the market reaches USD 909.3 billion.

The incremental YoY rise in revenues demonstrates a stable demand environment, providing manufacturers and suppliers with the opportunity to align production schedules and maintain balanced growth across key applications in food processing. By 2035, the market will achieve USD 1,271.9 billion, an absolute increase of nearly USD 396 billion from the 2025 level, sustained by a CAGR of 3.8%.

These YoY increments emphasize reliability in market performance and provide stakeholders with a clear trajectory for long-term investments. The predictable yearly gains highlight ongoing capacity expansion opportunities, ensuring that demand for efficient boilers in food processing remains steadily upward throughout the decade.

| Metric | Value |

|---|---|

| Water Tube Food Processing Boiler Market Estimated Value in (2025 E) | USD 876.0 billion |

| Water Tube Food Processing Boiler Market Forecast Value in (2035 F) | USD 1271.9 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The water tube food processing boiler segment plays a critical role within the broader industrial food processing equipment market. In 2025, with a value of USD 876.0 million, it contributes nearly 14–15% of the total parent market, highlighting its significance in energy-intensive food production processes. By 2035, the segment is projected to reach USD 1,271.9 million, holding a stable share of around 14% of the overall market. This indicates that while the parent industry expands, water tube boilers continue to secure a consistent proportion of revenues, supported by their essential function in maintaining continuous processing and operational efficiency. Growing at a CAGR of 3.8% between 2025 and 2035, the water tube food processing boiler market maintains a steady share within the industrial food equipment ecosystem. Its 14–15% contribution emphasizes recurring demand across beverage, dairy, meat, and bakery processing operations where thermal energy is indispensable. The stable percentage indicates that even as the parent market diversifies, boilers will remain a fundamental backbone of production capacity. This predictable role provides clarity for manufacturers and investors, ensuring long-term opportunities in servicing, upgrading, and deploying efficient boiler systems aligned with broader food processing industry growth.

Growing regulatory emphasis on energy optimization and carbon emission reduction is prompting manufacturers to adopt cleaner and more efficient boiler technologies. The expansion of packaged food manufacturing facilities and the need for consistent steam output in large-scale operations further support the demand for water tube boilers. Additionally, technological advancements in condensing systems and fuel-flexible designs are enhancing return on investment, encouraging both retrofits and new installations.

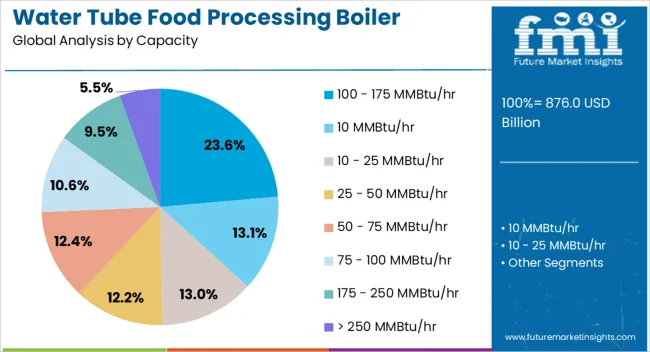

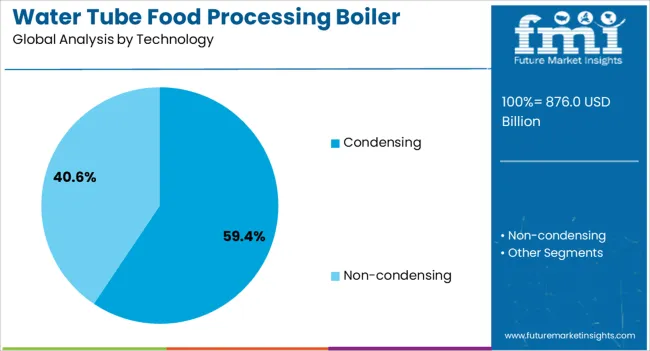

The water tube food processing boiler market is segmented by capacity, technology, fuel, and geographic regions. By capacity, water tube food processing boiler market is divided into 100 - 175 MMBtu/hr, 10 MMBtu/hr, 10 - 25 MMBtu/hr, 25 - 50 MMBtu/hr, 50 - 75 MMBtu/hr, 75 - 100 MMBtu/hr, 175 - 250 MMBtu/hr, and > 250 MMBtu/hr. In terms of technology, water tube food processing boiler market is classified into Condensing and Non-condensing.

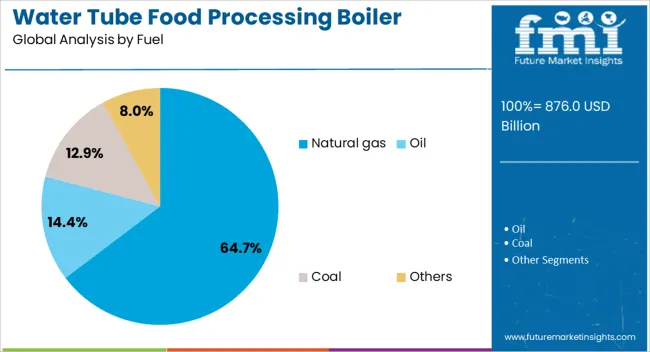

Based on fuel, water tube food processing boiler market is segmented into Natural gas, Oil, Coal, and Others. Regionally, the water tube food processing boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 100 – 175 MMBtu/hr capacity range is expected to lead the market with a 23.60% share in 2025. This segment benefits from its suitability for medium- to large-scale food processing plants that require reliable high-pressure steam.

The balance between capacity and footprint makes these systems ideal for optimizing both output and space utilization. Increasing automation in food production lines is also driving preference for boilers that can handle high load variability within this capacity range.

Moreover, the segment’s scalability and compatibility with modular system design enhance installation flexibility across diverse processing applications.

Condensing technology is projected to dominate the market with a 59.40% share by 2025. This segment’s growth is driven by its superior thermal efficiency, often exceeding 90%, and its ability to recover latent heat from exhaust gases.

In food processing environments, where energy cost is a major operational concern, condensing boilers offer substantial savings by minimizing fuel consumption. The technology also supports regulatory compliance by lowering NOx and CO2 emissions, aligning with green certification goals.

Widespread adoption is being fueled by long-term return on investment, reduced maintenance, and compatibility with both new builds and retrofits.

Natural gas is expected to lead the fuel category with a 64.70% market share in 2025. Its dominance is attributed to its clean combustion profile, cost efficiency, and consistent supply in industrial regions.

Food processors are increasingly transitioning from coal and oil to natural gas-fired boilers to meet stringent emission standards and reduce operational risks. The adaptability of water tube boilers to natural gas, combined with their low maintenance and operational simplicity, reinforces the preference for this fuel type.

Additionally, government incentives and infrastructure development for gas distribution continue to support this segment’s strong position.

The water tube food processing boiler market is expanding as demand grows for reliable, high-capacity, and energy-efficient steam generation in food and beverage manufacturing. Water tube boilers are preferred due to their ability to handle higher pressures, provide rapid steam generation, and maintain consistent temperature control, which is vital for processes such as sterilization, pasteurization, cooking, drying, and cleaning.

Growth in packaged food consumption, dairy processing, breweries, and meat production is fueling adoption. Additionally, technological innovations in fuel efficiency, automation, and low-emission designs are driving market expansion. Manufacturers that deliver boilers with improved energy performance, sustainability compliance, and adaptable modular designs are positioned to gain traction across food processing industries worldwide.

The market faces challenges from high operating costs, frequent maintenance needs, and infrastructure complexity. Water tube boilers require significant energy input, often relying on natural gas, biomass, or coal, which contributes to high fuel costs. Maintenance is also demanding because water tubes are exposed to scaling, corrosion, and thermal stress, necessitating periodic cleaning and part replacement to maintain efficiency. Skilled labor is essential for both operation and servicing, and shortages in technical expertise can lead to inefficiencies and downtime. Furthermore, compliance with strict food safety and equipment standards requires robust inspection protocols. These factors increase the total cost of ownership and present hurdles for smaller food processors with limited budgets.

The market is witnessing trends toward energy-efficient systems, low-emission designs, and greater automation. Manufacturers are increasingly adopting high-efficiency burners, waste heat recovery systems, and condensing technology to reduce fuel consumption. Boilers designed with low-NOx and carbon reduction technologies are becoming standard as food processors align with sustainability goals and carbon emission regulations. Automation and digital monitoring systems are being integrated to optimize temperature control, improve safety, and predict maintenance needs. Modular water tube designs are gaining popularity as they allow scalability, easier installation, and flexibility for different food processing capacities. These trends are enhancing both performance and compliance while reducing lifecycle costs for operators.

The market presents strong opportunities in expanding food processing industries, modernizing existing facilities, and adopting cleaner energy technologies. Rising demand for processed and packaged foods, particularly in emerging markets, is creating higher steam requirements for cooking, sterilizing, and cleaning. Facility upgrades in developed markets also drive demand for more efficient water tube boiler systems. Integration of renewable fuel sources such as biomass and hybrid boilers powered by solar or waste heat recovery is providing new growth avenues. Additionally, increasing government focus on food safety and sustainable industrial practices encourages companies to invest in modern, high-efficiency water tube boilers.

Market growth is restrained by regulatory pressure, high capital investment, and supply chain challenges. Food safety authorities impose strict compliance requirements regarding equipment design, sanitation, and energy use, which can delay procurement and increase costs. The high upfront cost of installing advanced water tube boilers can be prohibitive for small and medium-sized food processors. Supply chain issues in sourcing high-quality alloys, burners, and control systems may lead to delays in manufacturing and commissioning. Additionally, volatility in fuel prices and uncertainty in global energy markets create financial risk for food processors dependent on boiler-based systems. These restraints limit adoption among cost-sensitive operators, even as the demand for efficient processing equipment grows.

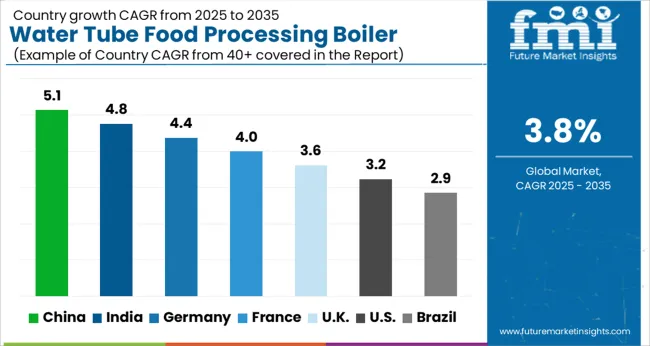

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

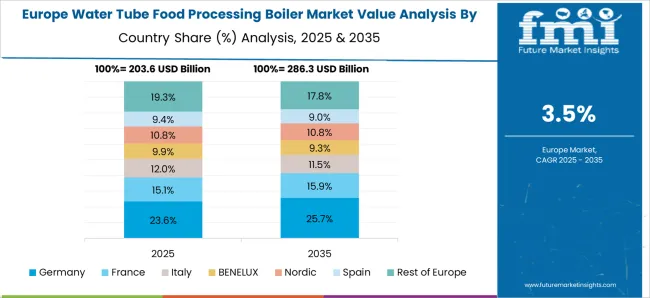

The global water tube food processing boiler market is projected to expand at a CAGR of 3.8% through 2035, supported by rising energy efficiency requirements and stricter food industry compliance standards. China has been recorded at 5.1%, where installations have been driven by rapid expansion of food and beverage processing facilities and a shift toward low-emission industrial heating systems. India has been observed at 4.8%, with growth supported by dairy, beverage, and packaged food processing industries where steam demand is steadily rising. In Europe, Germany has been measured at 4.4%, with adoption encouraged by stringent energy regulations and modernization of food processing plants. The UK has been noted at 3.6%, where usage in small and medium-sized food manufacturers has been steadily implemented. Meanwhile, the USA has been recorded at 3.2%, reflecting gradual replacement of aging boilers with high-efficiency water tube systems in large-scale food processing operations. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is leading the global adoption of water tube food processing boilers, with growth reaching a CAGR of 5.1%. Expanding food and beverage manufacturing facilities, combined with rising demand for high-capacity steam generation, are driving installations. Local manufacturers are emphasizing cost-effective boilers that integrate automation, energy recovery, and emission control features. Government support for energy-efficient technologies and sustainable food production practices is strengthening adoption. Pilot projects in large-scale dairy, beverage, and packaged food plants have showcased benefits such as reduced energy consumption, faster steam output, and improved safety standards. Collaborations between domestic boiler producers and international technology providers are further enhancing design innovations and efficiency benchmarks. With expanding food exports and strict food safety regulations, China’s market for water tube food processing boilers is expected to continue its strong trajectory.

Water tube food processing boiler market in India is recording strong momentum, with a CAGR of 4.8% supported by growth in packaged food and beverage industries. Food manufacturers are adopting water tube boilers due to their ability to provide high-capacity, efficient, and reliable steam generation. Government schemes encouraging modernization of food processing plants and improved energy efficiency are accelerating adoption. Pilot projects in confectionery, dairy, and beverage industries have shown significant reductions in operational costs and improved heat control. Local manufacturers are focusing on affordable solutions with added automation and safety features to suit mid-sized food processing plants. Partnerships between domestic producers, energy solution providers, and food companies are ensuring greater adoption across tier-1 and tier-2 cities. India’s expanding processed food consumption and rising exports continue to boost this market.

Germany is witnessing steady adoption of water tube food processing boilers, with a CAGR of 4.4%, backed by advanced food production systems and strict sustainability norms. Food processing companies are integrating energy-efficient boilers with advanced automation and emission control technologies. Government initiatives encouraging carbon reduction and efficient energy usage are driving market adoption. Case studies from meat processing, dairy, and bakery plants highlight benefits such as precise steam regulation, lower operating costs, and higher reliability. German manufacturers are also investing in innovative boiler designs that reduce water usage and enhance heat transfer efficiency. Collaboration between technology providers and food companies continues to create tailored solutions for specific food processing requirements. The emphasis on sustainable and precision-driven food production underpins Germany’s market growth.

The United Kingdom water tube food processing boiler market is expanding at a CAGR of 3.6%, supported by growing demand for efficient steam solutions in packaged food and beverage industries. Food companies are favoring boilers that combine compact designs with energy-saving capabilities and reduced emissions. Government-led sustainability campaigns and industry modernization programs are strengthening adoption across medium and large processing plants. Pilot projects in beverage bottling and bakery industries demonstrate improvements in steam output consistency, operational safety, and lower maintenance costs. Domestic manufacturers are focusing on compliance with environmental standards while enhancing design flexibility. The UK market is also witnessing partnerships with international suppliers to meet advanced technological requirements. Rising consumer demand for processed food products continues to drive boiler adoption across the country.

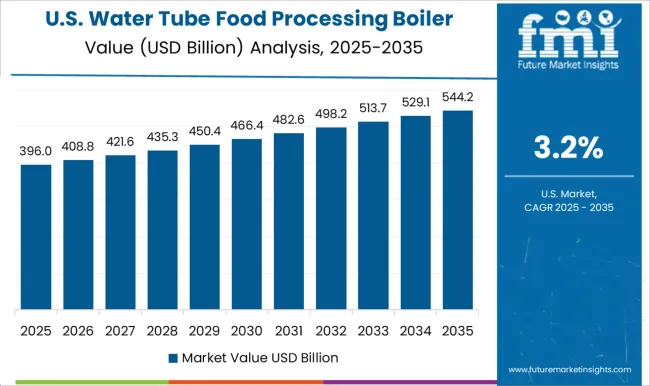

The United States market for water tube food processing boilers is advancing at a CAGR of 3.2%, propelled by large-scale industrial food and beverage operations. Manufacturers are supplying high-capacity, durable, and automated boilers that align with energy efficiency and emission reduction targets. Regulatory standards promoting sustainable industrial practices are boosting demand. Food processing plants in meat, beverage, and packaged food industries are adopting boilers that deliver consistent steam supply and cost savings. Pilot projects demonstrate reductions in energy consumption, increased safety compliance, and streamlined plant operations. USA manufacturers are also investing in R&D to produce boilers with improved fuel flexibility and digital monitoring systems. Collaborations between domestic producers, technology providers, and large food corporations are strengthening market growth.

Boiler selection in food processing is being determined by efficiency, hygiene compliance, and reliability under continuous load conditions. Thermax is recognized for high-capacity water tube boilers, with brochures highlighting steam output ranges, pressure ratings, and automated controls for food-grade environments. Alfa Laval positions its units with integrated heat recovery features, with literature emphasizing compact footprints, ease of cleaning, and reduced thermal losses. Babcock and Wilcox and Babcock Wanson provide heavy-duty systems, with brochures detailing furnace design, combustion stability, and emission levels. Bosch Thermotechnology and Clayton Industries present modular options, with technical sheets focused on flexible installation, short start-up times, and water treatment requirements.

Cleaver-Brooks, Forbes Marshall, and Fulton promote integrated boiler-room solutions, with brochures presenting system-level efficiency, condensate recovery, and service intervals. Hoval, Hurst Boiler, and Johnston Boiler emphasize robust construction, long service life, and fuel adaptability. Miura America differentiates itself with quick-start systems, as evidenced by brochures that highlight cycle efficiency, reduced downtime, and water management controls. Par Techno-Heat, Rentech Boilers, and Richard Kablitz provide region-specific solutions, with literature highlighting thermal performance, customizable dimensions, and after-sales support. Thermodyne Boilers and Viessmann focus on compact systems, with brochures detailing compliance with sanitary standards and suitability for medium-scale food producers. Strategic direction across the segment is guided by energy performance, reduced downtime, and alignment with regulatory frameworks. Investments are made in fuel flexibility, automation, and heat recovery technologies. Observed industry practice shows a preference for modularity, allowing production lines to scale without extensive redesign.

Partnerships with dairy, beverage, and packaged food producers are used to develop equipment specifications aligned with operational demands. Product portfolios are being expanded to include dual-fuel and biomass-compatible units, addressing cost variability and reliability concerns. Differentiation is pursued through maintenance-friendly layouts, extended service contracts, and documented safety compliance. Efficiency benchmarks, pressure stability, and sanitation certifications are consistently prioritized to secure adoption in processing facilities where downtime translates directly to lost throughput. Brochures and datasheets serve as decision tools for procurement and engineering teams. Thermax and Babcock literature present pressure curves, thermal efficiency charts, and combustion diagrams. Alfa Laval and Bosch brochures highlight installation layouts, CIP (clean-in-place) compatibility, and auxiliary equipment specifications. Clayton Industries and Miura materials provide data on start-up times, steam load response, and fuel-use metrics. Cleaver-Brooks, Hoval, and Fulton literature emphasize control system interfaces, safety cutoffs, and modular expansion options. Hurst, Johnston, and Rentech brochures include material specifications, refractory details, and lifecycle cost tables. Visuals such as schematics, exploded views, and flow diagrams are common, ensuring technical teams can assess integration quickly. Competitive strength is reinforced not only by boiler performance but by the clarity and precision with which product details are communicated.

| Item | Value |

|---|---|

| Quantitative Units | USD 876.0 Billion |

| Capacity | 100 - 175 MMBtu/hr, 10 MMBtu/hr, 10 - 25 MMBtu/hr, 25 - 50 MMBtu/hr, 50 - 75 MMBtu/hr, 75 - 100 MMBtu/hr, 175 - 250 MMBtu/hr, and > 250 MMBtu/hr |

| Technology | Condensing and Non-condensing |

| Fuel | Natural gas, Oil, Coal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thermax, Alfa Laval, Babcock and Wilcox, Babcock Wanson, Bosch Thermotechnology, Clayton Industries, Cleaver-Brooks, Forbes Marshall, Fulton, Hoval, Hurst Boiler, Johnston Boiler, Miura America, Par Techno-Heat, Rentech Boilers, Richard Kablitz, Thermodyne Boilers, and Viessmann |

| Additional Attributes | Dollar sales vary by boiler type, including oil-fired, gas-fired, coal-fired, and biomass water tube boilers; by capacity, spanning small, medium, and large-scale systems; by application, such as beverage processing, dairy, bakery, and packaged food production; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising food demand, energy efficiency needs, and stricter emission regulations in food processing industries. |

The global water tube food processing boiler market is estimated to be valued at USD 876.0 billion in 2025.

The market size for the water tube food processing boiler market is projected to reach USD 1,271.9 billion by 2035.

The water tube food processing boiler market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in water tube food processing boiler market are 100 - 175 mmbtu/hr, 10 mmbtu/hr, 10 - 25 mmbtu/hr, 25 - 50 mmbtu/hr, 50 - 75 mmbtu/hr, 75 - 100 mmbtu/hr, 175 - 250 mmbtu/hr and > 250 mmbtu/hr.

In terms of technology, condensing segment to command 59.4% share in the water tube food processing boiler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Condensing Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA