The water adventure tourism market is expanding steadily as experiential travel continues to gain traction among both domestic and international tourists. Rising disposable incomes, growing emphasis on health and wellness, and increased interest in nature-based and adventure activities are driving market growth. Current dynamics reflect strong participation in coastal, marine, and freshwater adventure destinations, supported by government initiatives to promote sustainable tourism and infrastructure development.

The market outlook remains positive as technological advancements in safety gear, underwater communication, and navigation systems enhance tourist confidence and accessibility. Travel operators are focusing on personalization, digital booking platforms, and eco-conscious packages to attract modern travelers seeking authentic experiences.

Growth rationale is rooted in the diversification of activity offerings, expansion of tourism infrastructure, and strategic marketing efforts targeting high-value adventure travelers Over the forecast period, the market is expected to experience consistent growth driven by favorable demographics, supportive policies, and an increasing global appetite for active and immersive travel experiences.

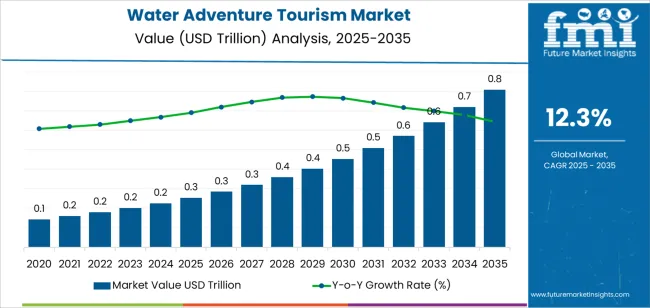

| Metric | Value |

|---|---|

| Water Adventure Tourism Market Estimated Value in (2025 E) | USD 0.3 trillion |

| Water Adventure Tourism Market Forecast Value in (2035 F) | USD 0.8 trillion |

| Forecast CAGR (2025 to 2035) | 12.3% |

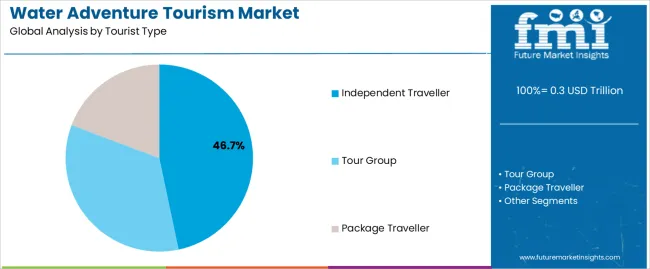

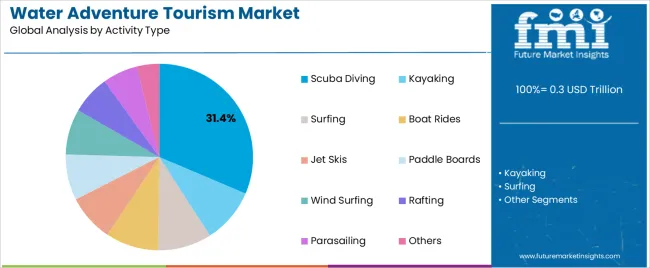

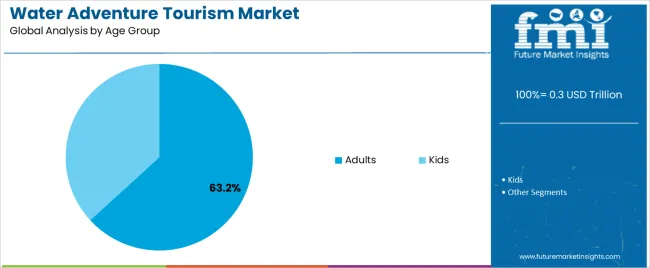

The market is segmented by Tourist Type, Activity Type, and Age Group and region. By Tourist Type, the market is divided into Independent Traveller, Tour Group, and Package Traveller. In terms of Activity Type, the market is classified into Scuba Diving, Kayaking, Surfing, Boat Rides, Jet Skis, Paddle Boards, Wind Surfing, Rafting, Parasailing, and Others. Based on Age Group, the market is segmented into Adults and Kids. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The independent traveller segment, holding 46.70% of the tourist type category, has emerged as the leading group due to the growing preference for personalized itineraries and flexible travel experiences. These travelers prioritize autonomy, cultural immersion, and unique adventure opportunities, leading to higher participation in self-guided water activities.

Market growth within this segment is being supported by the widespread use of online booking platforms and mobile applications that enable seamless planning and coordination. Social media engagement and digital storytelling have further encouraged solo and independent travel trends.

The expansion of low-cost travel options and improved safety standards at water adventure sites have also contributed to segment leadership Future growth is expected to be sustained by targeted offerings from tour operators catering to independent explorers seeking authentic and customizable aquatic adventure experiences.

The scuba diving segment, representing 31.40% of the activity type category, is dominating the market due to its high demand among both domestic and international adventure seekers. Its popularity is attributed to increasing availability of certified diving centers, improved underwater safety measures, and growing awareness about marine biodiversity.

Coastal regions across Asia-Pacific, the Caribbean, and the Mediterranean have witnessed strong participation, supported by favorable climatic conditions and eco-tourism initiatives. Equipment innovation and virtual training programs have enhanced accessibility, allowing more first-time participants to enter the market.

Sustainability practices, including reef conservation and responsible diving guidelines, have elevated the segment’s global image Continued investment in dive tourism infrastructure and marketing collaborations with travel agencies are expected to maintain the segment’s strong market share and attract repeat travelers.

The adults segment, accounting for 63.20% of the age group category, remains the leading demographic due to their higher disposable incomes, adventurous lifestyles, and interest in active leisure experiences. Adults tend to dominate participation in physically engaging water sports, including diving, surfing, kayaking, and sailing.

The segment’s leadership is supported by increasing travel frequency among working professionals and young couples seeking experiential vacations. Social media influence and wellness-oriented travel trends have further reinforced this group’s participation.

Enhanced safety standards, guided experiences, and luxury adventure packages have broadened the appeal among affluent adult travelers Over the forecast horizon, the adults segment is expected to retain its dominance, driven by expanding middle-class populations, rising awareness of sustainable tourism practices, and the growing popularity of experiential water-based travel worldwide.

| Historical Value in 2020 | USD 99.74 billion |

|---|---|

| Historical Value in 2025 | USD 184.99 billion |

| Market Estimated Size in 2025 | USD 216.07 billion |

| Projected Market Value in 2035 | USD 1.06 trillion |

The historical analysis of the water adventure tourism market from 2020 to 2025 showcased steady growth driven by increasing consumer interest in adventure travel. Tour operators expanded offerings, introducing diverse water based activities to meet evolving demands. Traditional destinations like coastal regions and tropical islands remained popular, attracting tourists seeking classic aquatic experiences.

Looking ahead to 2025 to 2035, industry forecasts project sustained growth albeit with nuanced shifts. Market players anticipate heightened competition as emerging destinations rise in prominence, offering unique water adventures beyond traditional hotspots. Specialized tour packages catering to specific interests gain traction, appealing to niche segments seeking tailored experiences.

In this forecast period, emphasis is placed on enhancing customer satisfaction through personalized services and immersive cultural encounters. Stakeholders prioritize environmental stewardship, incorporating eco-friendly practices and conservation initiatives to preserve fragile marine ecosystems.

While technological innovations continue to play a role in streamlining operations, the focus remains on authentic experiences and connection with nature. As the market matures, industry leaders anticipate a paradigm shift towards sustainable growth and responsible tourism practices, fostering long term viability while preserving the allure of water adventure tourism for generations to come.

In the water adventure tourism market, France leads with a promising 17.90% projected CAGR, closely followed by Singapore at 17.30%. Italy showcases a robust 16.90% CAGR, while Canada and the United States exhibit strong growth rates of 17.60% and 15.40%, respectively.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| France | 17.90% |

| Singapore | 17.30% |

| Italy | 16.90% |

| Canada | 17.60% |

| The United States | 15.40% |

France emerges as a formidable influencer in shaping the water adventure tourism market, projecting a remarkable CAGR of 17.90% until 2035. Renowned for its picturesque coastlines, historic rivers, and diverse aquatic landscapes, France captivates adventurers with its blend of natural beauty and cultural heritage.

With innovative offerings and sustainable practices, France positions itself as a premier destination for water based activities, attracting travelers from around the globe. As France continues to lead the charge in water adventure tourism, it sets new standards for excellence and enriches the global tourism landscape with its unparalleled experiences.

Singapore emerges as a driving force in the water adventure tourism industry, projecting a robust CAGR of 17.30% until 2035. Renowned for its innovative attractions and world class infrastructure, Singapore offers a diverse range of water based experiences, captivating travelers with its dynamic blend of urban sophistication and natural beauty.

With a strategic focus on sustainability and immersive offerings, Singapore positions itself as a premier destination for aquatic enthusiasts, leading industry growth and redefining the standards of water adventure tourism on a global scale.

Italy emerges as a prominent figure in charting the water adventure tourism market, projecting an impressive CAGR of 16.90% until 2035. Renowned for its stunning coastal landscapes, picturesque lakes, and historic waterways, Italy offers a rich tapestry of aquatic experiences that enchant travelers worldwide.

With its blend of cultural heritage, culinary delights, and scenic beauty, Italy stands as a premier destination for water adventure enthusiasts, driving industry growth and setting new benchmarks for excellence in aquatic tourism experiences. As Italy continues to innovate and captivate, it cements its position as a global leader in water based adventures.

Canada emerges as a powerhouse driving the water adventure tourism market, boasting a projected CAGR of 17.60% until 2035. With its stunning natural landscapes, expansive lakes, and rugged coastlines, Canada offers a diverse array of water based adventures. Innovative initiatives and sustainable practices position Canada as a leader in aquatic tourism, captivating travelers with unparalleled experiences and fostering industry growth.

As Canada continues to harness its natural wonders and embrace innovation, it solidifies its position as a global leader in water adventure tourism, shaping the future of aquatic exploration and discovery for generations to come.

The United States spearheads the water adventure tourism market, projecting a robust CAGR of 15.40% until 2035. With its diverse aquatic landscapes, from pristine coastlines to majestic rivers, the United States offers an array of thrilling water adventures.

Sustainable practices and technological innovations further propel its leadership, captivating travelers worldwide. As the United States continues to innovate and diversify its offerings, it cements its position as a premier destination for water based experiences, shaping its future and redefining standards for excellence in aquatic tourism on a global scale.

Until 2025, package travelers dominated the water adventure tourism market, commanding a substantial 48.00% market share. FMI anticipates the adults segment to significantly impact the market, projecting a substantial 52.00% market share by 2025, reflecting shifting demographics and evolving travel preferences within the industry.

| Category | Market Share in 2025 |

|---|---|

| Package Travelers | 48.00% |

| Adults | 52.00% |

Until 2025, package travelers held a commanding presence in the water adventure tourism market, securing an impressive 48.00% market share.

Their preference for pre-arranged itineraries and bundled offerings underscored the significance of convenience and value, shaping the landscape of water adventure travel experiences during that period.

The adults segment emerges as a pivotal force in the water adventure tourism market, forecasted to hold a substantial 52.00% market share by 2025.

Their influence underscores shifting demographics and evolving travel preferences, reshaping the landscape of water adventure experiences and driving industry growth in the coming years.

In the competitive landscape of the water adventure tourism market, a myriad of factors shape the industry dynamics. Established players vie for market share alongside emerging startups, each striving to offer unique experiences and cater to evolving consumer preferences. The competition intensifies as destinations compete to attract travelers with diverse aquatic landscapes and innovative activities.

Technological advancements, sustainability initiatives, and regulatory frameworks further influence the competitive arena. With a focus on differentiation and customer satisfaction, industry players continuously innovate to stay ahead, fostering a dynamic and vibrant marketplace that thrives on creativity, excellence, and the spirit of adventure.

Product Portfolio

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 0.3 trillion |

| Projected Industry Valuation in 2035 | USD 0.8 trillion |

| Value-based CAGR 2025 to 2035 | 12.3% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Industry Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Industry Segments Covered | Tourist Type, Activity Type, Age Group, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled |

Ace Adventure; Berber Rafting Adventures; Cardiff International White Water; 8Adventures; Orca Dive Club; Natural Travel Collection Ltd; PADI Travel; Dive The World; Fly & Sea Dive Adventures; World Dive and Sail International |

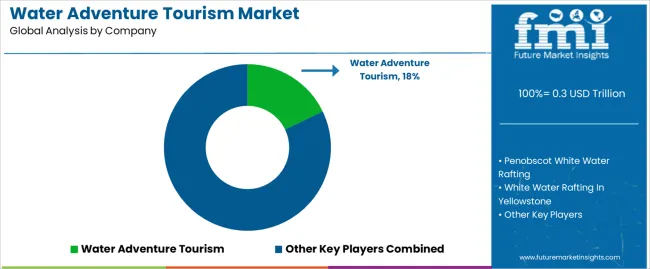

The global water adventure tourism market is estimated to be valued at USD 0.3 trillion in 2025.

The market size for the water adventure tourism market is projected to reach USD 0.8 trillion by 2035.

The water adventure tourism market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types in water adventure tourism market are independent traveller, tour group and package traveller.

In terms of activity type, scuba diving segment to command 31.4% share in the water adventure tourism market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Water Surface Conditioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water-based Inks Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA