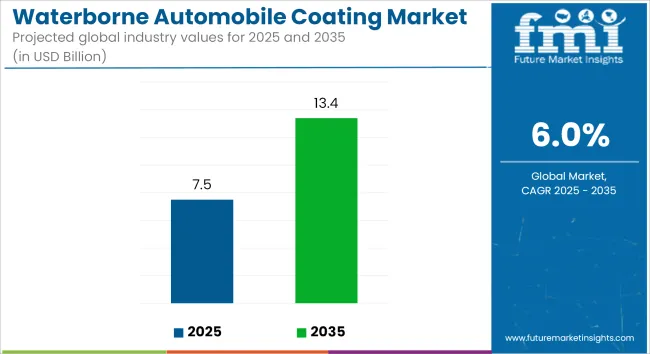

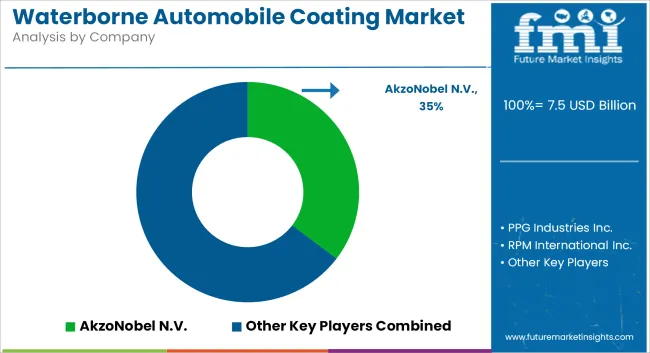

The global waterborne automobile coating market is anticipated to grow from USD 7.5 billion in 2025 to USD 13.4 billion by 2035, achieving a CAGR of 6.0% during the forecast period. Market growth is being driven by increasing environmental regulations, growing adoption of sustainable coating technologies, and rising demand for high-performance automotive finishes.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 7.5 billion |

| Market Value (2035F) | USD 13.4 billion |

| CAGR (2025 to 2035) | 6.0% |

Waterborne coatings are being selected over solvent-based systems due to their lower volatile organic compound (VOC) content, reduced environmental footprint, and compliance with regulatory mandates in key automotive manufacturing regions. These coatings are being applied in OEM and aftermarket applications for their corrosion resistance, color retention, and surface durability. The shift toward water-based systems is being reinforced by global trends in green manufacturing and life-cycle emission reduction.

Automotive OEMs are integrating waterborne technologies in basecoats, primers, and clearcoats to meet tightening environmental standards while maintaining finish quality and performance benchmarks. Enhanced resin systems and fast-drying formulations are being developed to reduce processing time and support energy efficiency in production lines.

The rise of electric vehicle production is contributing to demand for waterborne coatings, particularly for battery casings, lightweight composite panels, and underbody components. Investment in advanced coating solutions tailored to EV-specific requirements is enabling market penetration in next-generation automotive platforms.

Although regional market differences persist, the underlying trend toward VOC-free and low-emission materials is global. In markets with mature emission control policies, such as North America and Europe, demand is being reinforced by sustainability-focused consumers and OEM mandates. In manufacturing hubs across Asia, waterborne coatings are being introduced through modernization initiatives and multinational collaboration.

Market growth is also being supported by innovations in polymer science and strategic partnerships between chemical producers and automotive OEMs. Focused R&D investments are yielding coatings with improved adhesion, chemical resistance, and finish consistency. The continued evolution of green chemistry frameworks is expected to guide new product development across the next decade.

The waterborne automobile coating market is forecast to expand steadily through 2035, supported by industry sustainability targets, regulatory alignment, and ongoing technical innovation in surface finishing solutions.

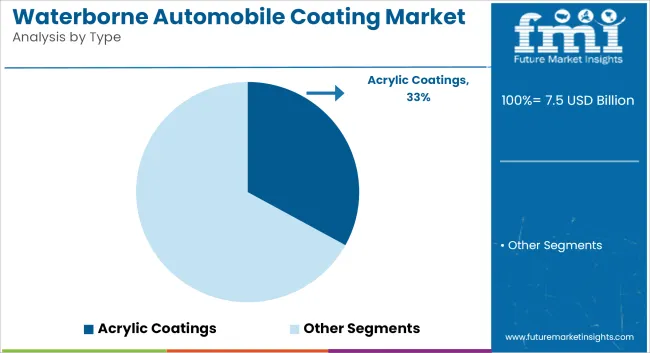

Waterborne automobile acrylic coatings are projected to hold the largest share 33.2% with CAGR 5.6% in 2025 among coating types, driven by their excellent adhesion, fast drying time, flexibility, ease of cleaning, and superior UV resistance. These properties make them highly suitable for automotive exterior applications, including OEM basecoats and refinishing.

The shift toward environmentally friendly and worker-safe manufacturing practices further enhances their adoption. Rising global awareness of the need to reduce volatile organic compound (VOC) emissions has accelerated the demand for waterborne acrylics, especially in regions enforcing strict air quality regulations such as the European Union and California. Their performance, combined with regulatory support, solidifies their position as a preferred choice in modern automotive coatings.

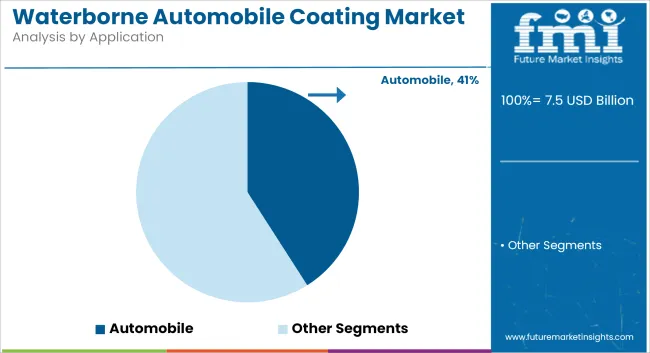

Waterborne coatings for automotive applications are projected to command a 41.6% market with CAGR 5.5% by 2025, driven by rising environmental regulations and the global push for low-VOC solutions. Major automakers like Ford, GM, and Volkswagen are transitioning to waterborne basecoats and clear coats across most of their production lines, reinforcing the sector’s move away from solvent-based systems.

In addition to OEM usage, the aftermarket is experiencing strong growth, particularly in urban areas with high vehicle density. Increased repair and refinishing activities are fueling demand for waterborne touch-up kits, further cementing the automotive sector’s dominance in this market.

Long Drying Time and Application Sensitivity

Difficulty in drying time compared to solvent-borne coatings is a key challenge to the growth of the waterborne automobile coating market. These coatings are very susceptible to environmental factors including humidity and temperature which can certainly affect the application performance.

In cases of high humidity or severe cold,it can be challenging to obtain the best coating properties, which may need special conditions and increase the environmental and operational cost. Furthermore, the transition from solvent-borne to waterborne solutions means extensive modifications in production lines, hindering adoption by small automotive OEMs and aftermarket service providers.

Regulatory Push and Rising Demand for Eco-Friendly Coatings

The increasing global focus towards minimizing emissions of volatile organic compounds (VOCs) is fueling the acceptance of waterborne automobile coatings. At the same time, tight environmental regulations in North America and Europe, and the growth of green certifications in Asia, are meshing to present new opportunities.

Novel advances in resin cross-linking chemistry, pigment dispersion, and cross-linking technologies are improving the performance, gloss and durability of waterborne coatings, making them viable alternatives to traditional solvent-based products. With electric vehicle (EV) production on the rise, manufacturers are looking for sustainable, low-emission solutions to meet their coating needs, creating new avenues for growth.

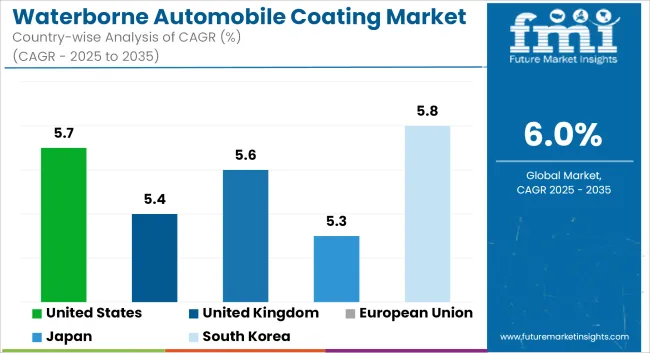

The USA is one of the dominant markets for waterborne automotive coatings as a result of strict environmental regulations coupled with large presence of major automotive OEMs. The shift toward low-VOC and eco-friendly coatings has driven fast adoption of waterborne alternatives.

Moving from solvent-based systems to waterborne systems is on the rise for OEMs and refinishers alike, particularly in states like California that have stringent environmental policies in place. Further driving demand are innovative technologies for added durability coatings and application processes.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.7% |

The UK waterborne automobile coatings market is seeing strong regulatory backing and an increasing focus toward sustainable automotive manufacturing. Demand is bolstered by the country’s expansive aftermarket services and refinish sector. Suppliers of automotive coatings are continually developing low-emission resins that pass EU requirements, while providing comparable performance, appearance, and corrosion protection characteristics.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.4% |

Due to an emphasis on lowering environmental impact level, waterborne auto coatings are growing steadily in the Europe, with the leading players of Germany, France, and Italy. Additionally, government incentives for sustainable manufacturing practices further strengthens the region’s cutting-edge status in automotive production and innovation.

This economic shift will see a marked increase in the use of both new (OEM) and repair coatings especially waterborne ones in the manufacture of more luxurious, electric vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.6% |

The Japanese waterborne automobile coating industry is evolving with the advancements in automotive technology and compliance with regulations. High-performance, precision-coated surfaces in the country’s auto manufacturers are driving manufacturers toward waterborne solutions delivering low VOCs and a superior finish. The increasing popularity of hybrid and EVs also supports the shift to sustainable coating systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

Owing to its strength in automobiles and stringent air quality standards in South Korea, Korea is contributing significantly to the waterborne automobile coating market. Even domestic manufacturers like Hyundai and Kia have been adopting waterborne coatings for both manufacturing and collision refinish work. Another contributor to the market's upward trend is the focus on exporting environmentally compliant vehicles to Europe and North America.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

The waterborne automobile coating market is becoming increasingly competitive, with major players focusing on product innovation, sustainability, and performance enhancement. Companies are launching new eco-efficient formulations and expanding their presence in key automotive hubs. Strategic collaborations with OEMs, technology providers, and research institutions are being pursued to develop next-generation coatings that meet performance and environmental benchmarks.

Supply chain integration, automation in application systems, and digital color-matching technologies are also gaining traction. As automotive OEMs prioritize carbon neutrality and VOC reduction, waterborne coatings are expected to become the industry standard, fueling continued investment and innovation across the value chain.

The market size in 2025 was USD 7.5 billion.

It is projected to reach USD 13.4 billion by 2035.

Key growth drivers include the global push toward sustainable and low-VOC automotive coatings, increasing vehicle production, and stringent environmental regulations favouring waterborne over solvent-based coatings.

The top contributors are China, United States, Japan, Germany, and India.

The waterborne automobile acrylic coatings and waterborne automobile coatings for automobile segment is anticipated to dominate, owing to the rising production of eco-friendly cars and the strong adoption of waterborne coatings in this category.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Coatings Market Size and Share Forecast Outlook 2025 to 2035

Automobile Accessories Market

Predictive Automobile Technology Market

Particle Reinforced Aluminum Matrix Composite Brake Disc for Electric Automobiles Market Size and Share Forecast Outlook 2025 to 2035

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Coating Auxiliaries Market Size and Share Forecast Outlook 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

Coating Additives Market Growth – Trends & Forecast 2025 to 2035

Coating Thickness Gauge Market

Coating Thickness Measurement Instruments Market

AR Coating Liquid Market Size and Share Forecast Outlook 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Nano Coating Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA