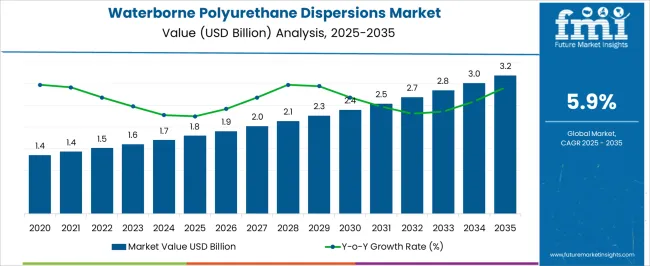

The waterborne polyurethane dispersions (PUD) market is expected to grow from USD 1.8 billion in 2025 to USD 3.2 billion by 2035, registering a 5.9% CAGR and generating an absolute dollar opportunity of USD 1.4 billion. Growth is driven by increasing demand in coatings, adhesives, textiles, and automotive applications, where waterborne PUDs offer environmental compliance, low volatile organic compound (VOC) content, and superior performance characteristics such as flexibility, abrasion resistance, and durability.

Rising regulatory pressures for eco-friendly coatings in North America, Europe, and Asia Pacific further support adoption. Peak-to-trough analysis highlights fluctuations in market momentum over the forecast period. From 2025 to 2027, early growth peaks moderately as developed markets in North America and Europe adopt waterborne PUDs for industrial and automotive coatings, benefiting from regulatory incentives and replacement of solvent-based systems. Between 2028 and 2031, growth experiences a minor trough as supply chain constraints, raw material price fluctuations, and slower adoption in price-sensitive regions temporarily moderate market expansion. From 2032 to 2035, the market rebounds, reaching the peak of the forecast period, driven by rising industrial activity in Asia Pacific, increased adoption in emerging economies, and technological improvements enhancing dispersion stability and performance.

The USD 1.4 billion opportunity illustrates cyclical growth patterns, with periods of moderate deceleration offset by peaks driven by regulatory support, regional expansion, and application diversification.

| Metric | Value |

|---|---|

| Waterborne Polyurethane Dispersions Market Estimated Value in (2025 E) | USD 1.8 billion |

| Waterborne Polyurethane Dispersions Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The waterborne polyurethane dispersions (PUDs) market is primarily driven by the coatings and paints sector, which accounts for approximately 42% of the market share, as these dispersions are widely used for protective, decorative, and functional coatings. The adhesives and sealants segment contributes around 25%, leveraging waterborne PUDs for bonding, lamination, and sealing applications in construction, automotive, and packaging. The textile and leather industry represents close to 15%, using dispersions to enhance fabric durability, flexibility, and finish. The automotive interior and exterior components segment accounts for roughly 10%, where PUDs provide scratch resistance and aesthetic appeal. The remaining 8% comes from specialty applications in furniture, paper coatings, and electronics, which require tailored polyurethane formulations for performance and environmental compliance. The waterborne polyurethane dispersions market is evolving with innovations in eco-friendly formulations, performance enhancement, and multifunctional coatings. Low-VOC and solvent-free dispersions are increasingly adopted to comply with environmental regulations and reduce emissions. High-solid and fast-drying formulations are improving application efficiency and durability.

Functional additives are being incorporated to enhance UV resistance, abrasion protection, and flexibility. Manufacturers are developing bio-based and renewable feedstock dispersions to reduce environmental impact. Integration with advanced coating technologies and automated application systems is expanding market adoption. Growing construction, automotive, textile, and industrial activity, coupled with regulatory focus on greener products, continues to drive demand for waterborne PUDs globally.

The Waterborne Polyurethane Dispersions (PUDs) market is experiencing substantial growth, driven by increasing environmental awareness and regulatory emphasis on low-VOC and sustainable coating solutions. Current market trends indicate a strong preference for waterborne systems across various end-use industries due to their eco-friendly profile, lower toxicity, and improved compliance with environmental regulations. Growth is also influenced by the expanding use of high-performance coatings in automotive, wood, textile, and industrial applications, where durability, flexibility, and chemical resistance are essential.

The market outlook is shaped by ongoing innovations in polymer chemistry, which allow waterborne dispersions to match the performance of solvent-based alternatives. Rising consumer demand for safer and environmentally responsible products has encouraged manufacturers to invest in scalable, waterborne solutions.

Furthermore, increasing urbanization and industrialization in emerging economies are creating opportunities for coatings, adhesives, and textile finishes that utilize waterborne PUDs As sustainability becomes a core business imperative, the market is expected to benefit from both regulatory support and growing adoption of high-performance waterborne polyurethane technologies.

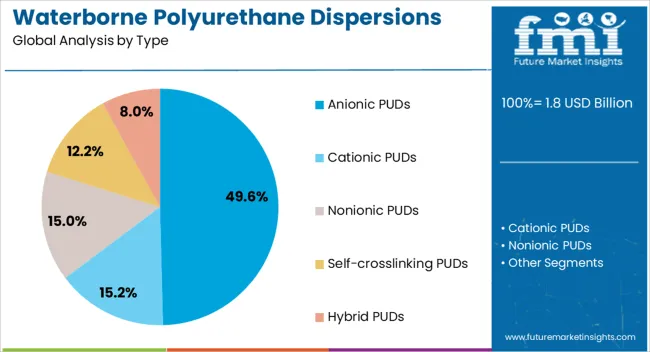

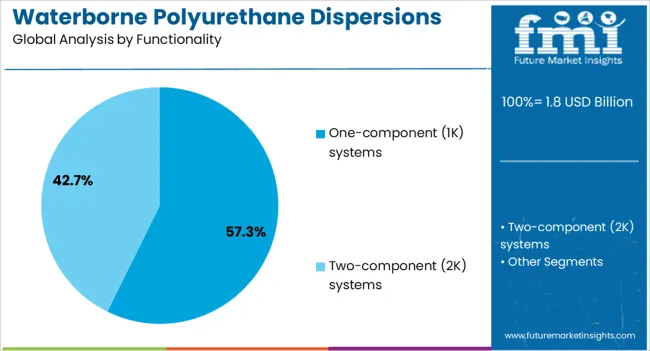

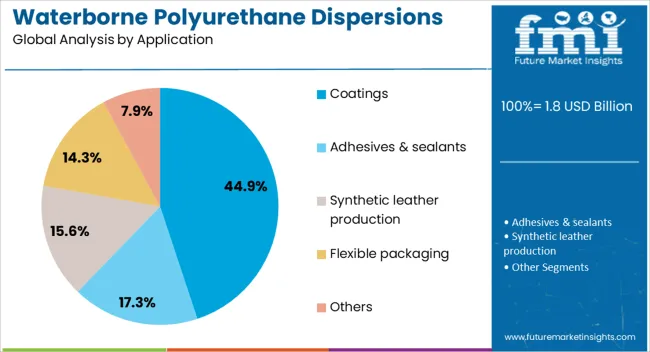

The waterborne polyurethane dispersions market is segmented by type, functionality, application, end-user industry, and geographic regions. By type, waterborne polyurethane dispersions market is divided into Anionic PUDs, Cationic PUDs, Nonionic PUDs, Self-crosslinking PUDs, and Hybrid PUDs. In terms of functionality, waterborne polyurethane dispersions market is classified into One-component (1K) systems and Two-component (2K) systems. Based on application, waterborne polyurethane dispersions market is segmented into Coatings, Adhesives & sealants, Synthetic leather production, Flexible packaging, and Others. By end-user industry, waterborne polyurethane dispersions market is segmented into Automotive, Construction, Textile, Furniture, Packaging, and Others. Regionally, the waterborne polyurethane dispersions industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Anionic waterborne polyurethane dispersions are expected to account for 49.6% of the overall market revenue in 2025, representing the leading type segment. This dominance is being driven by their superior stability in aqueous media and excellent compatibility with a wide range of additives, which allows formulation of high-performance coatings, adhesives, and textile finishes.

The growth of this segment has been reinforced by the increasing demand for environmentally friendly alternatives to solvent-based polyurethanes, particularly in regions with strict emissions regulations. The ability to achieve uniform film formation, excellent mechanical properties, and chemical resistance has made anionic PUDs highly attractive for industrial and commercial applications.

Additionally, their adaptability in modifying chain architecture to achieve targeted functionalities has contributed to their market leadership As manufacturers continue to develop high-solid and low-VOC variants, anionic PUDs are positioned to maintain their dominant position in the waterborne polyurethane dispersions market, supporting both sustainability objectives and high-performance requirements.

One-component systems are projected to hold 57.3% of the market revenue in 2025, establishing them as the leading functionality segment. This growth is being attributed to the ease of application and the reduced processing complexity associated with 1K systems, which eliminates the need for multi-component mixing and enhances operational efficiency.

The ability to cure at ambient temperatures while maintaining excellent mechanical and chemical resistance has made these systems highly suitable for coatings and adhesives in industrial, automotive, and commercial applications. Furthermore, one-component PUDs facilitate faster deployment in manufacturing environments, reducing labor costs and minimizing the risk of errors during application.

The segment has been further reinforced by innovations enabling higher solid content and improved performance, aligning with sustainability and efficiency goals Continued demand for simplified, high-performance coating solutions is expected to sustain the leading share of one-component systems in the waterborne polyurethane dispersions market.

The coatings application segment is anticipated to contribute 44.9% of the Waterborne Polyurethane Dispersions market revenue in 2025, making it the largest application area. This growth is being driven by the increasing demand for durable, low-VOC, and environmentally compliant surface finishes in sectors such as automotive, furniture, industrial equipment, and construction.

Waterborne PUDs provide superior flexibility, chemical resistance, and adhesion properties, which enhance the performance of protective and decorative coatings. The segment has benefited from the rising focus on sustainability and stricter regulations limiting solvent-based formulations, prompting manufacturers to adopt waterborne technologies.

Additionally, the ability to develop tailored formulations for specific end-use requirements has increased the adoption of waterborne PUDs in high-performance coatings As industries continue to prioritize environmentally responsible solutions while maintaining performance standards, the coatings segment is expected to sustain its leadership, supporting the broader growth of the Waterborne Polyurethane Dispersions market.

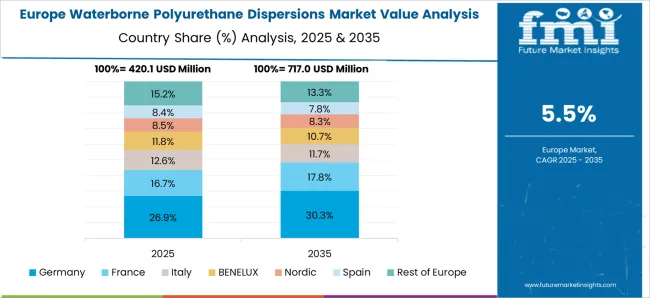

The waterborne polyurethane dispersions market is growing due to rising demand for eco-friendly coatings, adhesives, and textile finishing solutions. Asia Pacific leads with 40% adoption, driven by China (20%), India (12%), and Japan (8%). Europe contributes 30%, led by Germany (12%), France (9%), and UK (9%). North America accounts for 25%, primarily the USA, while the rest of the world represents 5%. Key applications include coatings (35%), adhesives (25%), textile finishes (20%), and leather coatings (20%). Increasing regulations on VOC emissions and preference for waterborne technologies in industrial sectors are driving adoption worldwide.

Market growth is fueled by environmental regulations, growing industrial demand, and sustainability initiatives. Coatings account for 35% of usage, adhesives 25%, textile finishes 20%, and leather coatings 20%. Asia Pacific leads at 40%, Europe 30%, and North America 25%. Rising demand in architectural coatings, automotive, and furniture sectors supports adoption. Waterborne PU dispersions reduce VOC emissions by 50–60% compared to solvent-based alternatives, making them preferred for environmentally conscious industries. Technological improvements, such as enhanced adhesion, flexibility, and chemical resistance, further accelerate growth. Adoption in textile finishing improves fabric durability and washability, strengthening the market in Asia Pacific and Europe.

Key trends include bio-based polyols, high-solid formulations, and advanced crosslinking technologies. Bio-based WPU dispersions account for 10–15% of global adoption, offering renewable alternatives. High-solid dispersions reduce water content, improving drying time and reducing energy consumption, representing 20% of new formulations. Crosslinking and functionalized WPU systems enhance abrasion resistance, elasticity, and chemical stability, adopted in 25% of coatings applications. Integration with digital textile printing and automotive interior applications is increasing, particularly in Asia Pacific and Europe. Research on sustainable formulations and low-temperature curing systems is also shaping market innovation, enabling broader adoption across industrial and decorative applications globally.

Opportunities exist in architectural coatings, automotive paints, furniture finishes, adhesives, and textile treatments. Coatings contribute 35% of adoption, adhesives 25%, textile finishes 20%, and leather coatings 20%. Asia Pacific accounts for 40%, Europe 30%, and North America 25%. Expansion in automotive interior coatings and furniture laminates supports market growth. Growing preference for low-VOC solutions in Europe and North America drives adoption of WPU dispersions. Integration in textile finishing improves fabric performance and lifecycle. Partnerships with paint, coating, and textile manufacturers offer revenue opportunities. Rising construction and automotive sectors in China, India, Germany, and USA further accelerate global adoption.

Challenges include high production costs, formulation complexities, and regulatory compliance. WPU dispersions have 10–15% higher manufacturing costs than solvent-based alternatives. Achieving optimal viscosity, particle size, and stability requires technical expertise. VOC regulations vary across regions, increasing compliance costs for chemical manufacturers. Cold storage requirements for certain dispersions add logistical challenges. Performance limitations in extreme weather conditions and solvent compatibility issues can restrict adoption in some applications. Supply chain constraints for raw materials, including polyols and isocyanates, may delay production. Price sensitivity in emerging markets limits widespread adoption, despite strong demand in Asia Pacific, Europe, and North America.

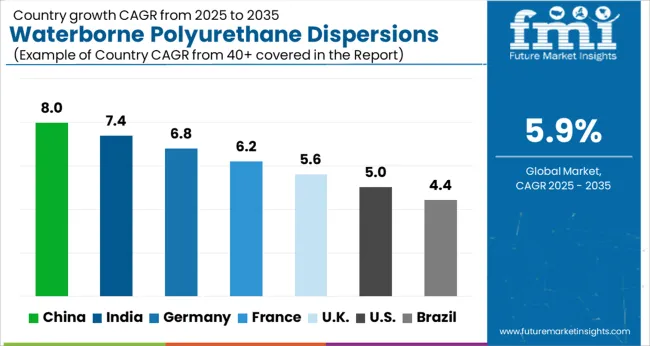

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The waterborne polyurethane dispersions market is projected to grow at a global CAGR of 5.9% through 2035, driven by increasing demand for eco-friendly coatings, industrial applications, and specialty adhesives. China leads at 8.0%, a 1.36× multiple over the global benchmark, supported by BRICS-driven expansion in coatings, construction, and automotive applications. India follows at 7.4%, a 1.25× multiple of the global rate, reflecting rising industrial production, urban infrastructure projects, and adoption in paints and adhesives. Germany records 6.8%, a 1.15× multiple of the benchmark, shaped by OECD-backed innovation in high-performance dispersions, sustainable coatings, and specialty industrial applications. France posts 6.2%, 1.05× the global rate, with demand focused on automotive coatings, decorative paints, and environmentally compliant solutions. The United Kingdom stands at 5.6%, 0.95× the benchmark, with adoption concentrated in commercial and industrial coatings, adhesives, and niche applications. The United States records 5.0%, 0.85× the global rate, with steady uptake in specialty coatings, adhesives, and industrial applications. BRICS economies drive most of the market volume, OECD countries emphasize technological advancement and regulatory compliance, while ASEAN nations contribute through growing construction and industrial sectors.

The waterborne polyurethane dispersions market in China is projected to grow at a CAGR of 8.0%, supported by increasing demand in coatings, adhesives, and textile finishing applications. Domestic producers such as Wanhua Chemical and Huntsman Chemical focus on high-performance, eco-friendly WBPUD solutions with low VOC content. Technological developments emphasize enhanced film-forming properties, durability, and chemical resistance. Growth is driven by industrial coatings, automotive applications, and expanding construction projects requiring environmentally compliant dispersions.

The WBPUD market in India is expected to grow at a CAGR of 7.4%, supported by rising construction activity, automotive manufacturing, and growing textile exports. Key suppliers such as BASF India and Lubrizol provide waterborne polyurethane dispersions with low VOC content and enhanced mechanical properties. Technological advancements focus on adhesion improvement, flexibility, and chemical resistance. Adoption is driven by industrial coatings, textile finishing, and increasing awareness of environmentally safe solutions.

Germany’s WBPUD market is projected to grow at a CAGR of 6.8%, influenced by demand for eco-friendly coatings, automotive production, and industrial adhesives. Suppliers such as Covestro and BASF focus on high-performance, waterborne dispersions with chemical resistance and UV stability. Adoption is concentrated in automotive, construction, and industrial coating applications. Technological developments emphasize durability, low environmental impact, and compliance with European chemical regulations.

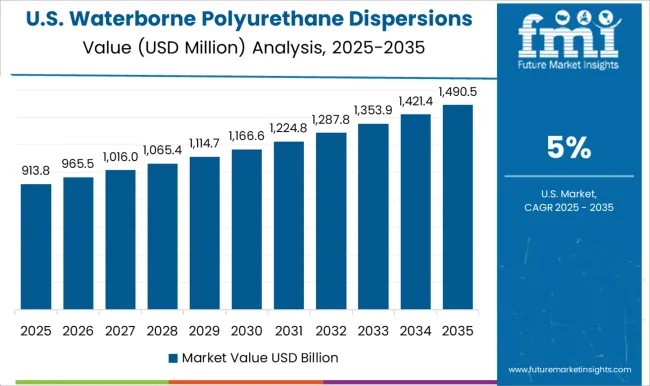

The WBPUD market in the United States is projected to grow at a CAGR of 5.0%, driven by demand from industrial coatings, automotive, and textile finishing sectors. Key suppliers such as BASF, Covestro, and Lubrizol provide high-performance, waterborne polyurethane dispersions with low VOC content. Technological improvements focus on chemical resistance, adhesion, and environmental compliance. Adoption is concentrated in automotive refinishing, industrial coatings, and textile applications.

The WBPUD market in the United Kingdom is projected to grow at a CAGR of 5.6%, supported by demand from construction, industrial coatings, and automotive sectors. Suppliers focus on waterborne dispersions with enhanced durability, low VOC content, and chemical resistance. Adoption is influenced by eco-friendly initiatives, regulatory compliance, and increasing industrial coating applications. Technological developments emphasize high-performance coatings for indoor and outdoor applications.

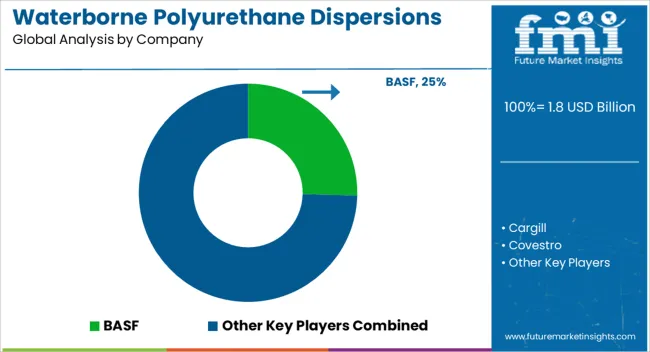

Competition in the waterborne polyurethane dispersions market is being shaped by product performance, environmental compliance, and application versatility for coatings, adhesives, textiles, and specialty industrial uses. Market positions are being reinforced through advanced polymer formulations, global supply networks, and research-driven innovations that ensure high durability, flexibility, and chemical resistance. BASF and Cargill are being represented with dispersions engineered for superior adhesion, abrasion resistance, and eco-friendly production. Covestro and DIC Corporation are being promoted with products structured for textile coatings, flexible films, and high-performance adhesives. Dow and Evonik are being applied with solutions optimized for protective coatings, industrial laminates, and waterborne formulations that reduce volatile organic compound emissions. HMG Paints and Huntsman are being showcased with dispersions designed for decorative coatings and specialty finishes. Lanxess and Nippon Polyurethane are being advanced with high-solid dispersions structured for industrial applications requiring chemical and thermal resistance. PPG Industries, RPM International, Toyo Kasei, and Wacker Chemie are being represented with formulations engineered for automotive coatings, construction materials, and specialty adhesives. Strategies in the market are being centered on environmental compliance, product innovation, and expanding industrial applicability. Research and development are being allocated to improve polymer stability, film formation, hardness, flexibility, and compatibility with diverse substrates. Product brochures are being structured with specifications covering solid content, viscosity, pH range, particle size, and recommended applications. Features such as low VOC content, high chemical resistance, fast drying, and flexibility are being emphasized to guide procurement and formulation planning. Each brochure is being arranged to present technical performance, safety compliance, and application guidance. Information is being provided in a clear, evaluation-ready format to assist manufacturers, formulators, and procurement teams in selecting waterborne polyurethane dispersions that meet performance, environmental, and operational requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Type | Anionic PUDs, Cationic PUDs, Nonionic PUDs, Self-crosslinking PUDs, and Hybrid PUDs |

| Functionality | One-component (1K) systems and Two-component (2K) systems |

| Application | Coatings, Adhesives & sealants, Synthetic leather production, Flexible packaging, and Others |

| End-User Industry | Automotive, Construction, Textile, Furniture, Packaging, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, Cargill, Covestro, DIC Corporation, Dow, Evonik, HMG Paints, Huntsman, Lanxess, Nippon Polyurethane, PPG Industries, RPM International, Toyo Kasei, and Wacker Chemie |

| Additional Attributes | Dollar sales by dispersion type and end use, demand dynamics across coatings, adhesives, textiles, and footwear, regional trends in eco-friendly material adoption, innovation in durability, flexibility, and low-VOC formulations, environmental impact of production and disposal, and emerging use cases in functional coatings and sustainable composites. |

The global waterborne polyurethane dispersions market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the waterborne polyurethane dispersions market is projected to reach USD 3.2 billion by 2035.

The waterborne polyurethane dispersions market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in waterborne polyurethane dispersions market are anionic puds, cationic puds, nonionic puds, self-crosslinking puds and hybrid puds.

In terms of functionality, one-component (1k) systems segment to command 57.3% share in the waterborne polyurethane dispersions market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Coatings Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Automobile Coating Market - Trends & Forecast 2025 to 2035

Polyurethane Coating Market Size and Share Forecast Outlook 2025 to 2035

Polyurethane (PU) Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Polyurethane Precursor Market Size and Share Forecast Outlook 2025 to 2035

Polyurethane Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Polyurethane Adhesives Market Trends 2025 to 2035

Polyurethane Foam Market Size & Trends 2025 to 2035

Polyurethane Resins Paints & Coatings Market Growth – Trends & Forecast 2025 to 2035

Polyurethane Composites Market

Market Share Breakdown of Leading Polyurethane Dispersions Manufacturers

Spray Polyurethane Foam Market Size and Share Forecast Outlook 2025 to 2035

Exterior Polyurethane Varnish Market Size and Share Forecast Outlook 2025 to 2035

Soft Touch Polyurethane Coatings Market Trends 2025 to 2035

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Demand for Exterior Polyurethane Varnish in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Exterior Polyurethane Varnish in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Marine-grade Polyurethane in UK Size and Share Forecast Outlook 2025 to 2035

Solvent-Free Natural Color Dispersions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA