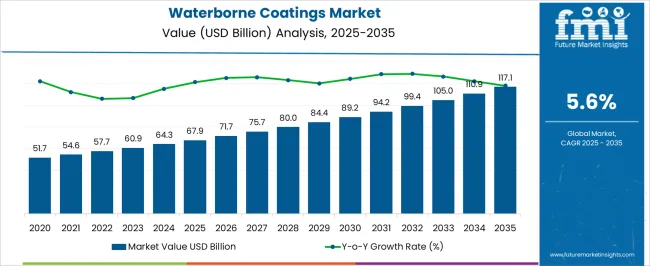

The waterborne coatings market is estimated to be valued at USD 67.9 billion in 2025 and is projected to reach USD 117.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The global waterborne coatings market is projected to expand from 67.9 USD billion in 2025 to 117.1 USD billion by 2035, achieving a CAGR of 5.6%. Analysis of market share dynamics indicates a gradual gain in adoption relative to traditional solvent-based coatings, driven by increasing regulatory focus on low-VOC formulations and rising environmental awareness among manufacturers and consumers. In the initial phase, from 2025 to 2028, incremental market share gains are observed as industries such as automotive, construction, and industrial applications begin transitioning from conventional coatings to waterborne alternatives. Mid-period, between 2029 and 2032, accelerated adoption occurs due to technological improvements enhancing durability, performance, and cost efficiency, prompting further erosion of solvent-based coatings’ dominance.

Minor fluctuations in share are noted in certain regions due to slower infrastructure modernization or higher initial investment costs, yet overall, waterborne coatings continue to capture additional market presence. By 2035, market share gains become more pronounced, supported by expansion in emerging economies, the growth of DIY and professional renovation projects, and greater emphasis on product safety and regulatory compliance. The yearly progression from 67.9 USD billion to 117.1 USD billion reflects steady incremental gains, illustrating that the market is increasingly favored over alternatives. Overall, the market demonstrates a consistent upward trajectory with clear share growth, influenced by environmental policy, performance innovation, and growing consumer preference for safer, high-quality coatings.

| Metric | Value |

|---|---|

| Waterborne Coatings Market Estimated Value in (2025 E) | USD 67.9 billion |

| Waterborne Coatings Market Forecast Value in (2035 F) | USD 117.1 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The waterborne coatings market is shaped by interconnected parent segments, each contributing differently to demand and growth. The building and construction sector holds the largest share at 36%, as low-odor, quick-drying coatings are increasingly preferred for urban residential, commercial, and public infrastructure projects, meeting green-building and environmental standards. The automotive industry contributes 25%, with OEM mandates and regulatory requirements for low-VOC primers, basecoats, and clearcoats driving the adoption of waterborne polyurethane and acrylic formulations. The general industrial segment accounts for 20%, where applications in coil, packaging, agriculture, and machinery benefit from durable, environmentally compliant waterborne coatings.

The wood coatings segment holds 10%, with UV-resistant and aesthetically appealing formulations gaining traction in furniture, cabinetry, and millwork markets. Finally, the marine coatings segment represents 8%, driven by demand for corrosion-resistant and UV-stable coatings for ships, offshore platforms, and marine infrastructure. Collectively, building and construction, automotive, and general industrial segments account for 81% of overall demand, highlighting that infrastructure development, vehicle refinishing, and industrial applications remain the primary growth drivers, while wood and marine coatings provide steady, complementary demand across regions globally.

The waterborne coatings market is experiencing steady growth driven by increasing environmental regulations, rising demand for low-VOC solutions, and heightened awareness about sustainable construction and industrial practices. Adoption is being fueled by the need for coatings that combine performance with reduced environmental impact, particularly in architectural, automotive, and industrial applications. Technological advancements in formulation chemistry are improving adhesion, durability, and resistance properties, making waterborne coatings a viable alternative to traditional solvent-based coatings.

Government policies in key regions are actively promoting eco-friendly coatings through incentives and mandatory compliance standards, encouraging manufacturers to expand product portfolios. The market is also being supported by the growing construction and infrastructure sectors in emerging economies, where aesthetic quality and protective performance are prioritized.

Increasing investments in building renovation and urban development projects are further driving demand As sustainability becomes a key focus for architects, contractors, and end users, the market is poised for long-term growth, with waterborne coatings emerging as a preferred choice for both new construction and maintenance applications.

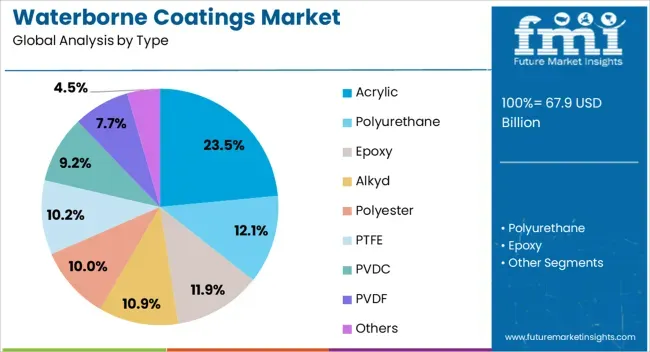

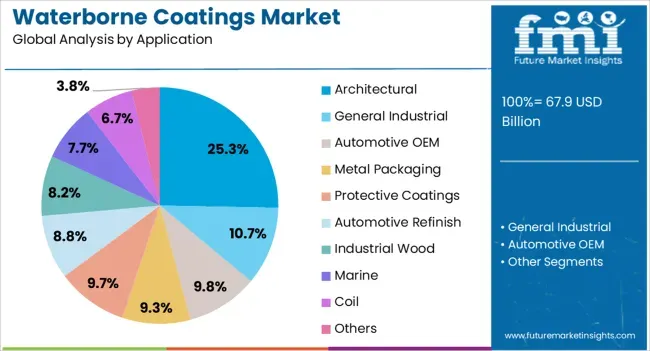

The waterborne coatings market is segmented by type, application, and geographic regions. By type, waterborne coatings market is divided into acrylic, polyurethane, epoxy, alkyd, polyester, PTFE, PVDC, PVDF, and others. In terms of application, waterborne coatings market is classified into architectural, general industrial, automotive OEM, metal packaging, protective coatings, automotive refinish, industrial wood, marine, coil, and others. Regionally, the waterborne coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The acrylic type segment is projected to hold 23.5% of the waterborne coatings market revenue share in 2025, making it the leading product type. This leadership is being driven by the versatility of acrylic formulations, which provide strong adhesion, color retention, and UV resistance across a variety of surfaces. Acrylic coatings are particularly valued for their ability to deliver consistent performance in both indoor and outdoor applications while meeting stringent environmental and safety standards.

Manufacturers are increasingly adopting acrylic waterborne formulations due to their ease of application, fast drying times, and compatibility with multiple substrates. The segment is also benefiting from rising demand in architectural applications where aesthetics, durability, and low environmental impact are critical.

Continued research in polymer chemistry has enabled enhanced mechanical properties and chemical resistance, further reinforcing acrylic coatings as a preferred choice for high-performance and sustainable projects Adoption is expected to grow as both commercial and residential construction sectors increasingly prioritize eco-friendly and efficient coating solutions.

The architectural application segment is anticipated to account for 25.3% of the waterborne coatings market revenue share in 2025, establishing it as the leading application area. Its dominance is being driven by growing construction activities in residential, commercial, and institutional projects, where high-performance and environmentally safe coatings are required. Waterborne coatings in architectural applications are preferred due to low odor, minimal volatile organic compounds, and easy maintenance, which meet regulatory and consumer expectations.

The segment is also supported by increased renovation and remodeling projects, where eco-friendly coatings are being adopted to enhance interior and exterior surfaces while complying with energy efficiency and sustainability mandates. Rising urbanization, coupled with a focus on building aesthetics and long-term durability, is fueling the demand for waterborne solutions.

Innovations in formulation, including improved weather resistance, color retention, and substrate compatibility, are further reinforcing adoption As sustainability becomes integral to building standards and construction practices, the architectural sector is expected to continue driving the growth of the waterborne coatings market globally.

The waterborne coatings market is experiencing growth driven by demand for low-emission, eco-conscious, and high-performance coatings across multiple industries. Regulatory compliance and safety standards are shaping formulation and application strategies. Advances in resin technologies and performance enhancements, including durability, adhesion, and aesthetic finish, support wider adoption. Strong growth in construction, automotive, industrial, and furniture sectors underpins demand. Manufacturers are emphasizing environmentally compliant, durable, and versatile solutions to meet diverse end-user requirements.

The waterborne coatings market is witnessing steady growth as consumers and industries prioritize low-VOC and low-odor coatings. These coatings are preferred for residential, commercial, and industrial applications due to reduced environmental impact and improved indoor air quality. Decorative and protective coatings in construction, furniture, and automotive segments are driving demand. Waterborne formulations offer fast drying, easy application, and enhanced durability, making them attractive for both professional and DIY users. The shift from solvent-based alternatives is supported by stricter regulations on emissions and workplace safety. Manufacturers are focusing on improving performance, color variety, and finish quality to appeal to diverse end-use segments.

Regulatory frameworks governing emissions, volatile organic compounds, and chemical safety significantly influence the market. Compliance with international and regional environmental and safety standards is crucial for manufacturers and suppliers. Certification requirements, labeling guidelines, and permissible chemical limits ensure product reliability and consumer safety. These regulations are promoting adoption of waterborne coatings as environmentally safer alternatives. Manufacturers are investing in research and development to meet evolving standards while maintaining performance and finish quality. Regulatory adherence is also enhancing brand credibility, particularly in regions with strict environmental oversight, driving acceptance across commercial, industrial, and residential applications.

Advancements in waterborne coating formulations are shaping market growth. Improved resin technologies, enhanced adhesion, scratch resistance, chemical resistance, and UV protection are driving product preference. Specialty coatings for automotive, furniture, and industrial machinery provide both protective and aesthetic benefits. Multi-layer and hybrid formulations allow performance comparable to solvent-based coatings while maintaining low emissions. The development of customizable finishes, faster curing, and anti-corrosive properties is widening application areas. Manufacturers focus on balancing performance with eco-compliance to meet the increasing demands of architects, contractors, and OEMs. These innovations are crucial for addressing the functional and decorative needs of end-users globally.

The waterborne coatings market is being propelled by increasing construction activity and automotive production. Residential, commercial, and infrastructure projects are major consumers due to ease of application, low odor, and environmental compliance. Automotive OEMs and aftermarket segments are increasingly adopting waterborne paints for body panels, interior components, and protective coatings. Industrial machinery, metal, and furniture sectors are also expanding usage due to improved performance and durability. Distribution through e-commerce, wholesale, and direct-to-industry channels ensures wide availability. Growth is further supported by awareness campaigns, professional training on application techniques, and collaborations between chemical suppliers and coating manufacturers to develop region-specific solutions.

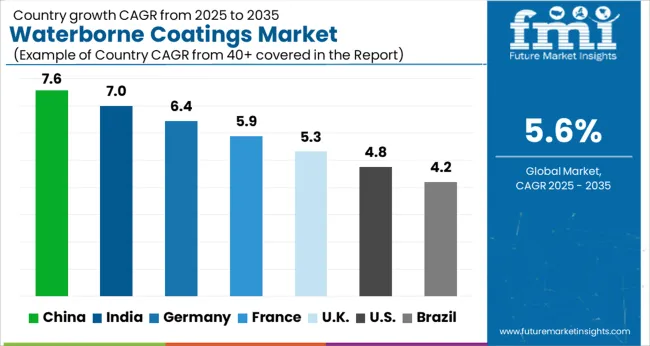

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| U.K. | 5.3% |

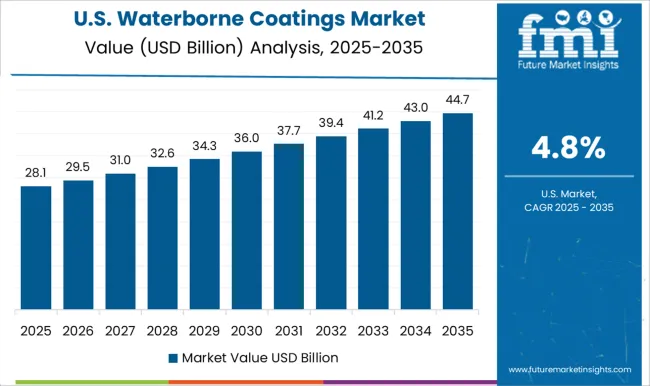

| U.S. | 4.8% |

| Brazil | 4.2% |

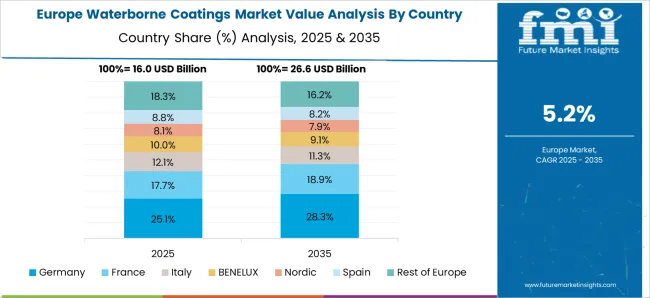

The global waterborne coatings market is projected to grow at a CAGR of 5.6% from 2025 to 2035. China leads expansion at 7.6%, followed by India at 7.0%, Germany at 6.4%, the U.K. at 5.3%, and the U.S. at 4.8%. Growth is fueled by increasing demand for environmentally friendly coatings, stricter regulatory standards, and rising adoption across construction, automotive, and industrial segments. China and India are driving large-scale production and consumption due to industrial expansion and urban housing demand, while Germany, the U.K., and the U.S. emphasize advanced formulation technologies, high-performance coatings, and eco-compliant solutions to meet evolving market needs. The analysis covers over 40 countries, with the leading markets detailed below.

The waterborne coatings market in China is projected to grow at a CAGR of 7.6% from 2025 to 2035, driven by increasing regulatory focus on low-VOC and eco-friendly products across industrial and decorative applications. Automotive, construction, and furniture sectors are adopting waterborne formulations to meet environmental standards and consumer expectations for safer, high-performance coatings. Investments in advanced coating technologies, automated spraying systems, and research collaborations with global suppliers support innovation and quality enhancement. The rising demand for corrosion-resistant, durable, and aesthetically versatile coatings further propels market growth.

The waterborne coatings market in India is expected to expand at a CAGR of 7.0% from 2025 to 2035, fueled by rapid industrialization, increasing construction activity, and rising automotive production. Domestic and international coating manufacturers are introducing waterborne variants that combine durability, low odor, and compliance with environmental norms. Evolving consumer preferences toward safer and environmentally responsible products are driving adoption in residential and commercial sectors. Modern application technologies, such as electrostatic spraying and automated coating lines, are being implemented to enhance efficiency and coating performance.

The waterborne coatings market in Germany is projected to grow at a CAGR of 6.4% from 2025 to 2035, supported by stringent environmental regulations and a strong preference for sustainable industrial practices. Automotive OEMs, furniture manufacturers, and construction firms increasingly use waterborne coatings to meet low-VOC standards without compromising on performance. Advanced research in polymer chemistry and resin technology is driving product innovation, including improved adhesion, faster drying, and enhanced durability. Partnerships between European coating suppliers and industrial manufacturers facilitate large-scale adoption and process optimization.

The UK waterborne coatings market is anticipated to grow at a CAGR of 5.3% from 2025 to 2035, propelled by regulatory pressure and consumer preference for safer, environmentally responsible coatings. Adoption is driven by architectural, industrial, and automotive segments seeking high-performance, low-VOC solutions. Manufacturers are emphasizing advanced waterborne resin technologies, faster curing times, and enhanced coating aesthetics. Retail and distribution channels are expanding availability of ready-to-use formulations for both professional and DIY applications. Strategic partnerships with chemical and equipment suppliers support adoption and process efficiency.

The U.S. waterborne coatings market is estimated to grow at a CAGR of 4.8% from 2025 to 2035, with increased adoption in automotive, aerospace, industrial machinery, and residential construction applications. Regulatory compliance with low-VOC and emission standards is a key factor driving adoption of waterborne systems. Innovations in coating formulations, including improved chemical resistance, color stability, and surface finish, support expanded usage. Partnerships with technology providers and distributors enable efficient application, scalability, and cost-effectiveness across professional and consumer segments. Consumer preference for environmentally responsible coatings reinforces market growth.

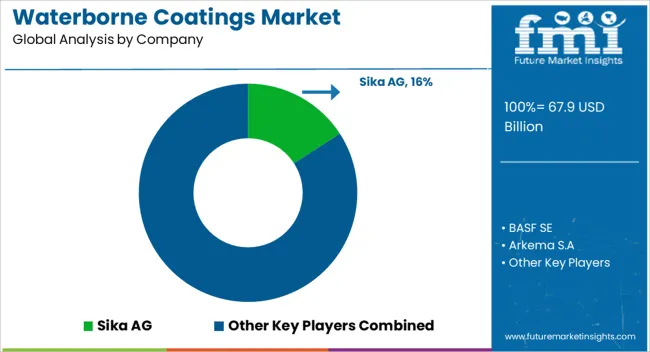

Competition in the waterborne coatings market is shaped by environmental compliance, performance optimization, and product versatility. AkzoNobel N.V. leads with low-VOC architectural and industrial coatings, emphasizing durability, color consistency, and regulatory compliance. BASF SE and PPG Industries compete with high-performance automotive and protective coatings, focusing on resin innovations, rapid drying, and resistance to abrasion and corrosion. Sherwin-Williams Company leverages global distribution and brand recognition to offer eco-friendly and decorative coatings, while Axalta Coating Systems targets industrial and automotive segments with high-quality, waterborne formulations.

Regional players such as Asian Paints, Berger Paints, and Kansai Paint Co. Ltd. differentiate with localized manufacturing, cost-effective solutions, and market-specific formulations. Specialty manufacturers provide niche solutions including marine coatings, coil coatings, and wood finishes, emphasizing substrate compatibility and extended service life. Strategies prioritize formulation advancements, environmental safety, and market expansion. Companies highlight low-emission technologies, compliance with international VOC regulations, and durability in extreme conditions. Research and development investments focus on innovative resins, pigment dispersion, and multifunctional coatings. Partnerships, acquisitions, and joint ventures are used to broaden product portfolios and strengthen regional presence. Companies emphasize product customization for industrial, architectural, and decorative applications, catering to both large-scale projects and individual consumer requirements.

Product brochure content is detailed and informative. Specifications cover resin types, gloss levels, drying times, adhesion properties, chemical resistance, and VOC compliance. Packaging formats include cans, pails, and drums for bulk applications, as well as ready-to-use containers for consumer convenience. Application guidelines, substrate preparation instructions, and safety precautions are described. Color charts, mixing ratios, and usage recommendations are provided to ensure optimal performance. Performance in humidity, UV exposure, and abrasion conditions is highlighted. Accessories such as spray systems, brushes, and rollers, along with storage and shelf-life guidance, are included, reflecting a market focused on performance, regulatory adherence, and application versatility.

| Items | Values |

|---|---|

| Quantitative Units | USD 67.9 billion |

| Type | Acrylic, Polyurethane, Epoxy, Alkyd, Polyester, PTFE, PVDC, PVDF, and Others |

| Application | Architectural, General Industrial, Automotive OEM, Metal Packaging, Protective Coatings, Automotive Refinish, Industrial Wood, Marine, Coil, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sika AG, BASF SE, Arkema S.A, Hempel, RPM International Inc, AkzoNobel N.V, Teknos, DuPont, PPG Industries Inc, and Nippon Paints Co. Ltd |

| Additional Attributes | Dollar sales by resin type and application (industrial, architectural, automotive), share by region and end-use segment, growth trends, regulatory standards, performance attributes, emerging formulations, and competitive positioning. |

The global waterborne coatings market is estimated to be valued at USD 67.9 billion in 2025.

The market size for the waterborne coatings market is projected to reach USD 117.1 billion by 2035.

The waterborne coatings market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in waterborne coatings market are acrylic, polyurethane, epoxy, alkyd, polyester, ptfe, pvdc, pvdf and others.

In terms of application, architectural segment to command 25.3% share in the waterborne coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Automobile Coating Market - Trends & Forecast 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Smart Coatings Market Size and Share Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Marine Coatings Market Size and Share Forecast Outlook 2025 to 2035

Filter Coatings Market Size and Share Forecast Outlook 2025 to 2035

Rubber Coatings Market Growth - Trends & Forecast 2025 to 2035

Textile Coatings Market Size and Share Forecast Outlook 2025 to 2035

Stealth Coatings Market Size and Share Forecast Outlook 2025 to 2035

Medical Coatings Market Growth & Demand 2025 to 2035

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

Sputter Coating Market Growth – Trends & Forecast 2022 to 2032

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA