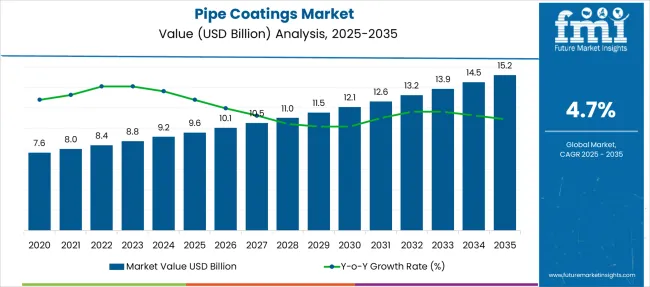

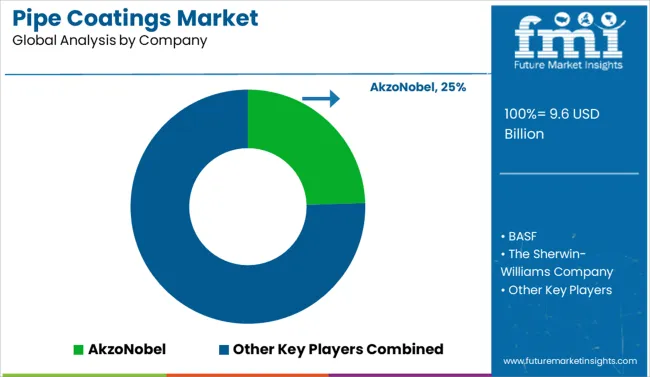

The Pipe Coatings Market is estimated to be valued at USD 9.6 billion in 2025 and is projected to reach USD 15.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

| Metric | Value |

|---|---|

| Pipe Coatings Market Estimated Value in (2025 E) | USD 9.6 billion |

| Pipe Coatings Market Forecast Value in (2035 F) | USD 15.2 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The pipe coatings market is experiencing consistent expansion due to the growing need for corrosion protection, flow efficiency, and extended service life of pipelines in both onshore and offshore infrastructure. Increasing investments in energy transportation networks and water distribution systems are creating sustained demand for high performance coating technologies.

Advances in materials science have led to the development of coatings with enhanced chemical resistance, thermal stability, and environmental compliance. Industrial focus on reducing maintenance costs and preventing material degradation is also driving the adoption of protective coatings across multiple sectors.

Environmental regulations mandating the use of low emission and long lasting coating systems have accelerated innovation in both solvent based and water based formulations. The market outlook remains positive as infrastructure modernization and oil and gas exploration continue to reinforce the need for durable and efficient pipe coating solutions.

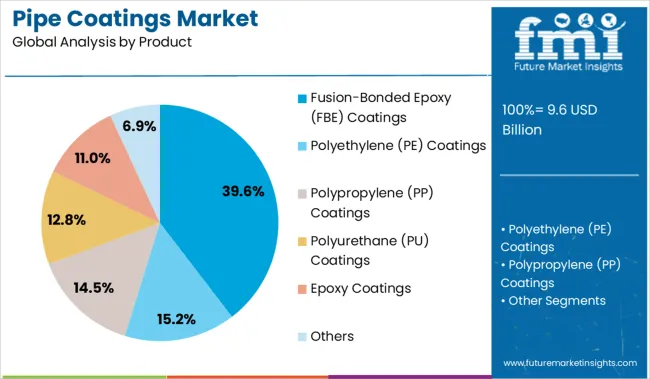

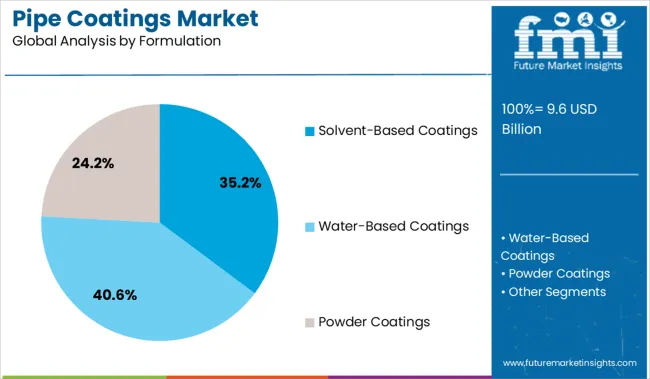

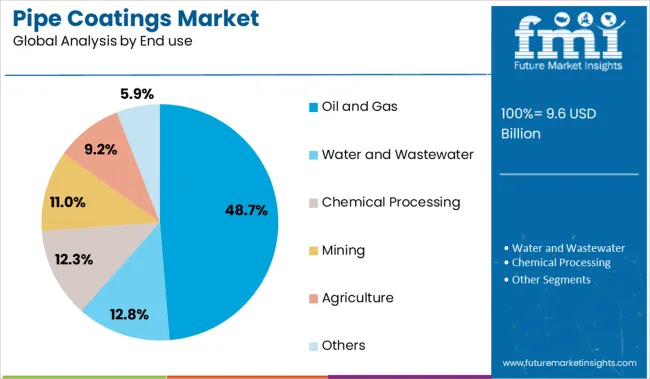

The pipe coatings market is segmented by product, formulation, end use, and functionality and geographic regions. The pipe coatings market is divided into Fusion-Bonded Epoxy (FBE) Coatings, Polyethylene (PE) Coatings, Polypropylene (PP) Coatings, Polyurethane (PU) Coatings, Epoxy Coatings, and Others. The pipe coatings market is classified into Solvent-Based Coatings, Water-Based Coatings, and Powder Coatings. Based on end use, the pipe coatings market is segmented into Oil and Gas, Water and Wastewater, Chemical Processing, Mining, Agriculture, and Others. The pipe coatings market is segmented by functionality into Corrosion Protection, Mechanical Protection, Thermal Insulation, Chemical Resistance, Abrasion Resistance, and Others. Regionally, the pipe coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fusion bonded epoxy coatings segment is projected to account for 39.60 percent of the total market revenue by 2025 within the product category, making it the leading segment. This dominance is driven by its exceptional adhesion properties, corrosion resistance, and thermal durability, particularly in buried and submerged pipeline applications.

These coatings are widely used due to their ability to form a tough and chemically resistant barrier that ensures pipeline integrity under harsh conditions. Fusion bonded epoxy coatings offer long term protection with minimal maintenance, making them highly preferred for oil, gas, and potable water transportation.

Their compatibility with automated application systems and rapid curing capabilities have further improved project efficiency. As demand for long lasting protective solutions rises in energy and infrastructure sectors, the use of fusion bonded epoxy continues to lead the product category.

The solvent based coatings segment is expected to contribute 35.20 percent of total market revenue by 2025 within the formulation category, establishing it as the most prominent segment. This growth is attributed to the superior film forming characteristics and robust chemical resistance of solvent based formulations.

These coatings are valued for their versatility and ability to provide consistent protection in environments where moisture or extreme temperatures are prevalent. Their application flexibility across a range of substrates and performance in demanding service conditions have sustained their adoption despite increasing regulatory scrutiny.

Continuous advancements in solvent technology aimed at reducing volatile organic compound emissions while maintaining durability have further supported their market presence. Their proven track record in field performance makes solvent based coatings a preferred choice in both industrial and commercial pipeline applications.

The oil and gas segment is projected to hold 48.70 percent of total market revenue by 2025 within the end use category, making it the dominant segment. This growth is being driven by rising pipeline installation projects and infrastructure upgrades across exploration, production, and distribution networks.

The critical need to prevent corrosion, abrasion, and chemical attack in extreme operating conditions has made advanced coatings indispensable in the oil and gas industry. These coatings extend the service life of assets, reduce operational downtime, and ensure compliance with stringent safety and environmental regulations.

Additionally, the growing emphasis on offshore exploration and deepwater drilling has amplified the demand for high performance protective coatings. The sector’s substantial capital investment and focus on asset protection continue to position oil and gas as the leading end use segment in the pipe coatings market.

Demand for pipe coatings is rising with increased cross-border pipeline construction and stricter anti-corrosion mandates. Sales of fusion-bonded epoxy and multi-layer polyethylene coatings are accelerating as oil & gas operators focus on asset longevity and reduced maintenance cycles.

Demand for pipe coatings climbed 22% in 2025, fueled by new pipeline infrastructure across Central Asia, Africa, and South America. Large-diameter transmission lines in Kazakhstan and Uganda required 3-layer polyethylene coatings for 25-year corrosion resistance. South American EPC contractors adopted liquid epoxy linings for buried gas lines, improving flow assurance and reducing scale buildup by 19%. Middle Eastern pipeline developers extended specification standards to require fusion-bonded epoxy coatings, driving supplier contracts with lead times under 45 days. Coating vendors offering turnkey plant-side application services saw a 15% increase in project bids, highlighting a preference for integrated surface preparation and application solutions.

Sales of internal pipe coatings rose 28% year-on-year as operators prioritized flow efficiency and fuel cost reduction. USA shale operators adopted epoxy-based internal linings to lower drag coefficients in gathering pipelines, improving throughput by 12%. LNG exporters in Qatar applied phenolic coatings in cryogenic transfer lines to reduce freeze-thaw fatigue cycles by 26%. Brazilian water utilities implemented cement mortar linings in urban mains, extending replacement intervals by over a decade. As pipeline operators shift from just corrosion control to performance optimization, suppliers with proven internal coating technologies and fast-cure formulations are gaining market share in high-pressure and high-temperature applications.

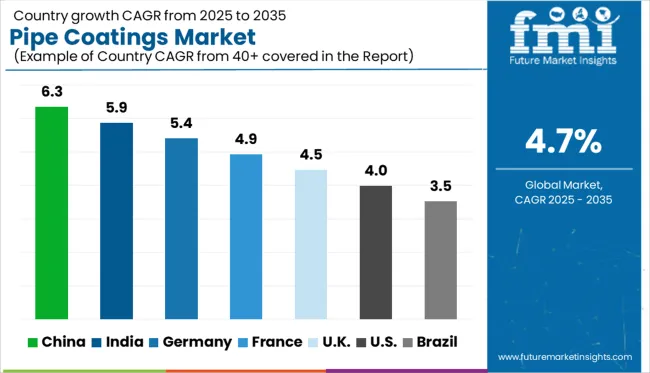

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

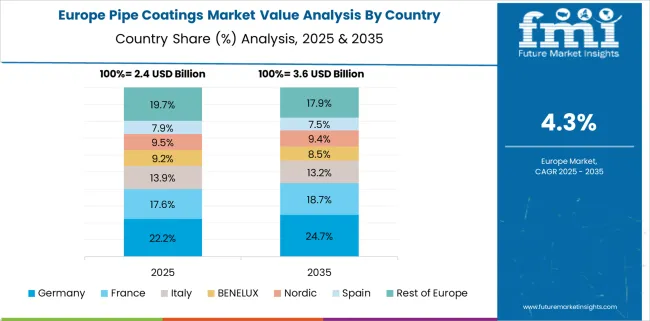

The global market is forecast to expand at a CAGR of 4.7% between 2025 and 2035. Leading the performance chart, China (BRICS) posts a CAGR of 6.3%, outpacing the global average by 1.6 percentage points, driven by aggressive investments in oil & gas pipelines, water infrastructure, and industrial expansion. India (BRICS) follows with 5.9% (+1.2 pp), supported by rising demand in municipal water systems and energy transportation networks. Among OECD nations, Germany records 5.4% (+0.7 pp), underpinned by pipeline renovation and environmentally compliant coating technologies. The UK grows at 4.5% (–0.2 pp), reflecting stable infrastructure development, while the United States lags at 4.0% (–0.7 pp), indicating slower upgrade cycles and higher reliance on existing networks. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to record a CAGR of 6.3% between 2025 and 2035, driven by ongoing investments in pipeline infrastructure and energy transmission. During 2020–2024, demand was primarily concentrated in oil and gas projects. Going forward, water distribution, chemical transport, and urban utilities are expanding their use of corrosion-resistant pipe coatings to meet longevity and safety standards.

India is expected to achieve a CAGR of 5.9% through 2035, fueled by smart city pipelines, water infrastructure upgrades, and refinery expansion. Between 2020 and 2024, market penetration remained modest due to price-sensitive buyers opting for basic anti-corrosion solutions. From 2025 onward, durability and environmental compliance will drive premium coating adoption.

Germany’s pipe coatings market is forecast to grow at a CAGR of 5.4% during the 2025–2035 period, supported by pipeline refurbishments and energy transition goals. In the 2020–2024 window, activity was concentrated in gas networks and district heating systems. Going forward, hydrogen pipeline projects and green utility infrastructure are opening new avenues for advanced coating solutions.

The UK market is set to expand at a CAGR of 4.5% from 2025 to 2035, driven by offshore energy projects and wastewater management upgrades. Between 2020 and 2024, traditional coating methods dominated the market. From 2025, the emphasis is shifting toward advanced coating technologies that enhance flow efficiency and reduce inspection costs.

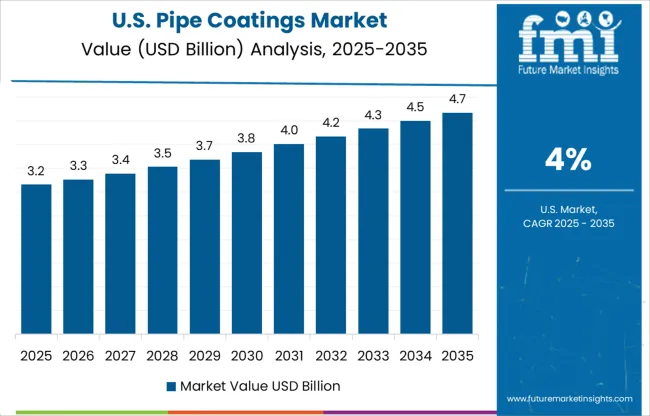

The USA is anticipated to grow at a CAGR of 4.0% over the 2025–2035 forecast, with demand anchored in oil & gas, petrochemical, and water sectors. Between 2020 and 2024, pipeline projects were delayed by permitting and regulatory headwinds. Now, federal infrastructure funding and ESG-focused investments are catalyzing the uptake of environmentally sustainable pipe coatings.

Demand for pipe coatings is steadily rising in 2025, supported by expansion in oil & gas, water infrastructure, and chemical transport sectors. AkzoNobel holds the largest market share, leveraging its strong global distribution and advanced epoxy and polyurethane technologies. BASF and Sherwin-Williams are focusing on high-performance anti-corrosion systems for offshore applications. Axalta and 3M are investing in thermoplastic powder coatings tailored for extreme temperature environments. PPG Industries and Jotun A/S continue to scale in Asia through pipeline infrastructure projects. Shawcor and Wasco Energy are strengthening turnkey coating services, while LyondellBasell and Solvay focus on polymer-based insulation. Sales of pipe coatings are being further driven by regulatory emphasis on asset longevity, especially across emerging markets in the Middle East and Southeast Asia.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.6 Billion |

| Product | Fusion-Bonded Epoxy (FBE) Coatings, Polyethylene (PE) Coatings, Polypropylene (PP) Coatings, Polyurethane (PU) Coatings, Epoxy Coatings, and Others |

| Formulation | Solvent-Based Coatings, Water-Based Coatings, and Powder Coatings |

| End use | Oil and Gas, Water and Wastewater, Chemical Processing, Mining, Agriculture, and Others |

| Functionality | Corrosion Protection, Mechanical Protection, Thermal Insulation, Chemical Resistance, Abrasion Resistance, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AkzoNobel, BASF, The Sherwin-Williams Company, Axalta Coating Systems, 3M Company, Shawcor Ltd., Arkema Group, LyondellBasell Industries, Valspar Corporation, PPG Industries, Inc., Wasco Energy Group of Companies, Solvay, Denso Group, The Bayou Companies, LLC, and Jotun A/S |

| Additional Attributes | Dollar sales by coating type (FBE, thermoplastic, powder/liquid) and end‑use industry, demand dynamics across oil & gas, water & wastewater, and chemical processing, regional trends in Asia‑Pacific vs North America, innovation in smart, self‑healing and low‑VOC coatings, environmental impact of VOCs and coating waste, and emerging use cases in pipeline monitoring and municipal infrastructure. |

The global pipe coatings market is estimated to be valued at USD 9.6 billion in 2025.

The market size for the pipe coatings market is projected to reach USD 15.2 billion by 2035.

The pipe coatings market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in pipe coatings market are fusion-bonded epoxy (fbe) coatings, polyethylene (pe) coatings, polypropylene (pp) coatings, polyurethane (pu) coatings, epoxy coatings and others.

In terms of formulation, solvent-based coatings segment to command 35.2% share in the pipe coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pipeline Integrity Market Size and Share Forecast Outlook 2025 to 2035

Pipe Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Pipetting Robots Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Safety Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Products Market Size and Share Forecast Outlook 2025 to 2035

Pipette Tips Market Size and Share Forecast Outlook 2025 to 2035

Pipe Screw Extruder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pipette Controller Market – Trends & Forecast 2025 to 2035

Pipe Inspection Robot Market Growth – Trends & Forecast 2025 to 2035

Pipe Flange Market Analysis by Material Type, Facing, End-Use Industry, and Region through 2035

Market Leaders & Share in the Pipe Insulation Products Industry

Pipe Marking Tapes Market Growth - Demand, Trends & Forecast 2024 to 2034

Pipe Wrapping Machines Market

Piperylene Market

Oil Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Gas Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA