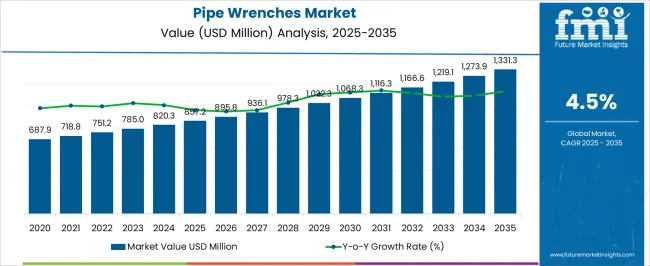

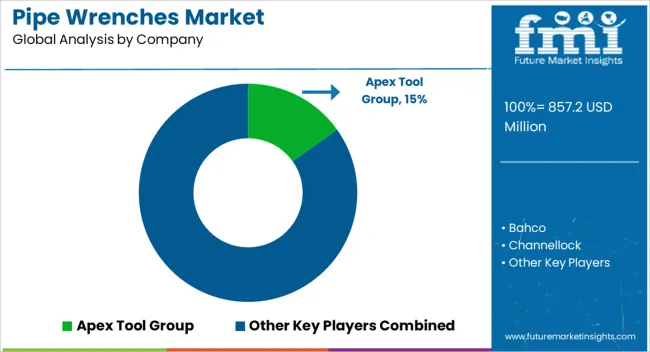

The pipe wrenches market is projected to rise from USD 857.2 million in 2025 to USD 1,331.3 million in 2035 at a 4.5% CAGR. Demand is being anchored by plumbing contractors, water utilities, HVAC installers, refinery turnarounds, and pipeline construction. Product usage is being reinforced by torque reliability, jaw hardness, tooth retention, and slip resistance on steel, copper, and PVC.

| Metric | Value |

|---|---|

| Pipe Wrenches Market Estimated Value in (2025 E) | USD 857.2 million |

| Pipe Wrenches Market Forecast Value in (2035 F) | USD 1331.3 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The pipe wrenches segment is estimated to account for about 6% of the hand tools market, roughly 22% of the plumbing tools and supplies market, close to 8% of the construction tools and equipment market, nearly 5% of the industrial MRO tools market, and around 18% of the oil and gas pipeline maintenance tools market. Taken together, these proportions aggregate to approximately 59% across the listed parent categories. This footprint should be viewed as durable because pipe wrenches anchor torque-heavy fastening in plumbing repair, HVAC installation, refinery turnarounds, and pipeline integrity work. Selection is typically guided by jaw strength, tooth geometry, handle leverage, and weight balance, with aluminum and alloy steel bodies preferred for repetitive tasks. Reliability under wet, oily, or gritty conditions is prized, which elevates attention to knurl precision, heel jaw alignment, and replaceable tooth sets. Pipe wrenches set the baseline for threaded pipe joining where chain tongs or strap wrenches are not justified, creating consistent demand across trade counters and industrial distributors. Growth has been supported by maintenance schedules in utilities, fire sprinkler retrofits, and commercial build-outs where predictable clamping and controlled slip are required. Procurement teams often prioritize ANSI conforming designs, spare availability, and ergonomic grips that reduce fatigue across long shifts. With service contractors standardizing kit lists and oilfield crews favoring high durability SKUs, pipe wrenches are expected to retain meaningful weight within parent markets, reinforcing their position as a core fastening and pipefitting tool across construction sites, mechanical rooms, and energy infrastructure.

The pipe wrenches market is experiencing steady growth, supported by rising demand from construction, plumbing, oil and gas, and maintenance industries. Increasing infrastructure development projects and the expansion of water distribution networks are contributing to the steady consumption of pipe wrenches globally. The market is benefiting from continuous improvements in tool ergonomics, material durability, and manufacturing precision, which enhance efficiency and user safety.

Growing adoption of high-performance tools that reduce operator fatigue is also boosting demand. The industry is witnessing a shift toward advanced steel alloys and improved gripping mechanisms, ensuring long-lasting performance in demanding applications. Urbanization, combined with the replacement of aging pipeline infrastructure, is driving the need for high-quality wrenches capable of withstanding frequent and intensive use.

Furthermore, the expansion of the industrial maintenance sector and the increasing number of residential renovation projects are expected to create sustained opportunities. As manufacturers focus on product innovation, ergonomic designs, and distribution network expansion, the market is poised for stable long-term growth with rising adoption across both professional and do-it-yourself applications.

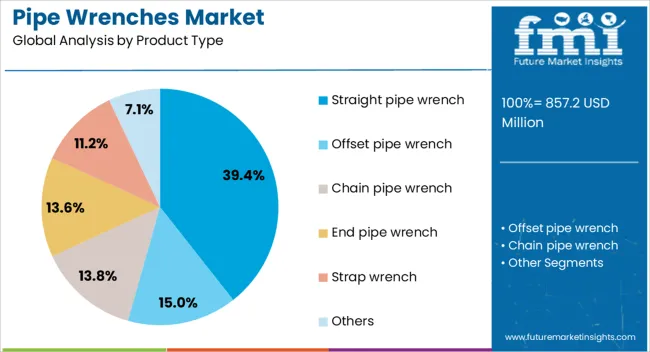

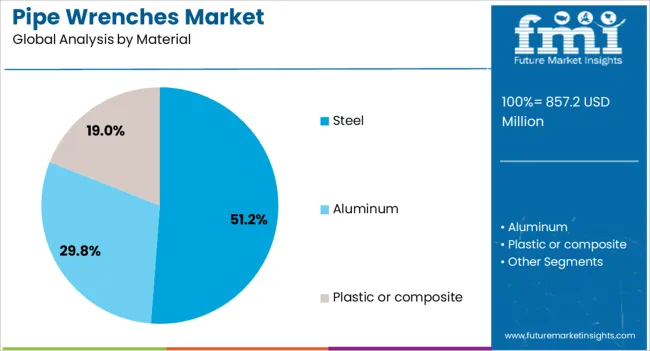

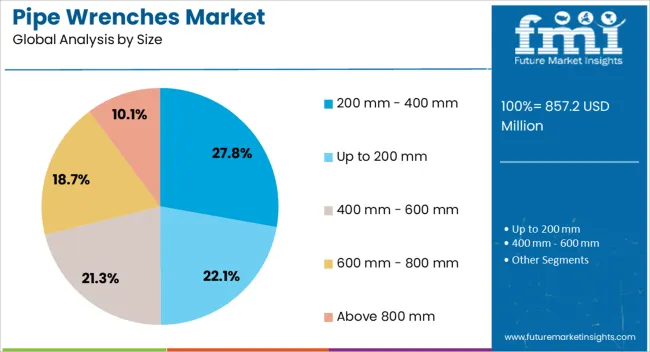

The pipe wrenches market is segmented by product type, material, size, end user, pricing, distribution channel, and geographic regions. By product type, pipe wrenches market is divided into Straight pipe wrench, Offset pipe wrench, Chain pipe wrench, End pipe wrench, Strap wrench, and Others. In terms of material, pipe wrenches market is classified into Steel, Aluminum, and Plastic or composite. Based on size, pipe wrenches market is segmented into 200 mm - 400 mm, Up to 200 mm, 400 mm - 600 mm, 600 mm - 800 mm, and Above 800 mm. By end user, pipe wrenches market is segmented into Industrial, Residential, and Commercial. By pricing, pipe wrenches market is segmented into Medium, Low, and High. By distribution channel, pipe wrenches market is segmented into Offline and Online. Regionally, the pipe wrenches industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The straight pipe wrench segment is projected to account for 39.4% of the pipe wrenches market revenue share in 2025, making it the leading product type. Its dominance is being supported by its versatility and widespread application in general plumbing, mechanical repairs, and pipeline assembly. The straight design provides strong jaw alignment, delivering consistent gripping power on round surfaces and threaded pipes.

Its adaptability for use in both residential and industrial environments has made it a preferred choice for professionals and maintenance crews. Enhanced manufacturing techniques and the availability of different jaw sizes in this segment are improving its suitability for a variety of pipe diameters. Demand is further reinforced by its proven reliability in heavy-duty applications, where consistent torque and minimal slippage are required.

The segment’s growth is also being supported by cost efficiency, ease of repair, and availability across global distribution networks As construction and maintenance activities expand, the straight pipe wrench is expected to retain its market leadership due to its durable design and wide utility range.

The steel material segment is anticipated to hold 51.2% of the pipe wrenches market revenue share in 2025, establishing itself as the leading material category. Its leadership is driven by the superior strength, durability, and resistance to wear that steel offers, ensuring reliable performance in heavy-duty applications. Steel construction enables the tool to withstand high torque and repeated use without deformation, which is essential for demanding industrial and construction environments.

Manufacturers are increasingly using heat-treated and alloy steels to enhance toughness and corrosion resistance further, extending tool lifespan. The material’s ability to maintain its structural integrity under challenging conditions makes it highly suitable for professional-grade applications.

The segment also benefits from the ease of integrating ergonomic handle designs and precision-machined jaws into steel frames, improving user comfort and operational efficiency As industries prioritize tools that deliver long-term value and consistent performance, the steel segment is expected to maintain its dominant position in the market.

The 200 mm to 400 mm size segment is expected to capture 27.8% of the pipe wrenches market revenue share in 2025, making it the leading size category. This range is favored for its balance between maneuverability and gripping capacity, allowing users to work effectively in confined spaces while maintaining sufficient leverage for secure tightening and loosening of pipes. It is widely used in both professional and household applications, making it one of the most versatile size options available.

The segment’s growth is being reinforced by its suitability for small to medium diameter pipes, which are commonly found in residential plumbing, light construction, and maintenance tasks. Manufacturers are producing a wide variety of models within this size range, featuring ergonomic grips, lightweight designs, and enhanced jaw configurations for improved efficiency.

The portability and ease of use associated with this category are further contributing to its adoption. As demand for practical, high-performance tools continues to rise, the 200 mm to 400 mm size segment is expected to sustain its leading position in the global market.

The pipe wrenches market is projected to expand steadily as plumbing contractors, HVAC technicians, oil and gas crews, and municipal utilities maintain broad demand for reliable gripping tools. Replacement cycles, code-driven retrofits, and service contracts are reinforcing purchases across cast iron, aluminum, and specialty strap or chain formats. Opportunities are opening in ergonomic handles, quick-adjust knurls, and bundled kits for MRO fleets and apprenticeship programs. Trends emphasize lighter frames with strong bite, corrosion-resistant finishes, and replaceable jaw components. Challenges persist around price compression, counterfeit products, uneven distributor training, and competition from multipurpose gripping tools in budget-sensitive channels.

Demand has been strengthened by steady work in residential plumbing, commercial HVAC retrofits, and municipal water maintenance where dependable torque and bite are essential on steel, black iron, and galvanized pipe. Service companies favor classic straight and offset pipe wrenches for tight mechanical rooms, while chain and strap variants are chosen to avoid marring polished fittings or composite couplings. Oilfield and refinery turnarounds keep large sizes in rotation for flanged connections and temporary spools. Building engineers and property managers round out recurring purchases through MRO programs that standardize handle lengths and jaw styles across crews. The strongest pull comes from predictable service jobs where a robust hook and heel, deep serrations, and fast-knurl adjustment reduce rework and knuckle injuries. With drain lines, hydronic loops, and gas risers constantly serviced, pipe wrenches remain nonnegotiable tools that protect schedule, safety, and warranty outcomes.

Opportunities in the residential solar energy storage market are emerging through storage-as-a-service models, smart home integration, and grid-connected storage solutions. Homeowners are increasingly interested in subscription-based services that eliminate high upfront costs, offering battery storage solutions without long-term commitments. Integrating storage systems with smart home platforms allows homeowners to optimize energy use based on real-time data, enhancing efficiency and control. Expanding grid connection services also present opportunities, as some regions offer compensation for energy fed back into the grid. These developments point to a future where energy storage is more accessible and adaptable, driving adoption in the residential sector.

Trends point to lighter frames without sacrificing clamp integrity, with manufacturers refining tooth geometry and hardening processes to extend jaw life on schedule-40 and schedule-80 pipe. Replaceable jaw inserts, pinned heels, and improved spring tension are trending to preserve parallelism and reduce slippage. Corrosion-resistant coatings and sealed knurls are being specified for coastal, wastewater, and food-service sites where grime and brine degrade tools. Technicians are adopting offset and end-pipe patterns to reach close-quarter unions behind boilers and in ceiling racks, while chain and strap wrenches gain favor on chrome or plastic fittings where tooth marks are unacceptable. Color-coded size systems help truck inventory control, and QR-linked manuals support quick field reference for jaw maintenance. The decisive shift is toward dependable bite at lower user effort, since fewer resets, cleaner threads, and reduced worker fatigue deliver real jobsite productivity.

Challenges arise from aggressive price competition by low-cost imports that look similar but underperform under torque, creating safety concerns and higher breakage rates. Counterfeit branding and misrepresented alloys erode trust, forcing reputable vendors to invest in authentication labels and distributor audits. Supply variability in alloy steels and handle castings has been noted, pushing lead times and complicating uniform hardness targets. Training gaps persist, with misuse of valves or square fasteners leading to tooth roll-off and bent hooks that users blame on tool quality. Big-box channels compress margins, while specialized SKUs for hazardous locations carry limited volumes and demanding certifications. Moisture, grit, and lack of oiling shorten knurl life in municipal fleets. We believe winners will pair transparent metallurgy data, serialized parts, and ready jaw spares with clear use guidance. Without these, returns, warranty claims, and safety incidents will continue to dilute brand equity and profitability.

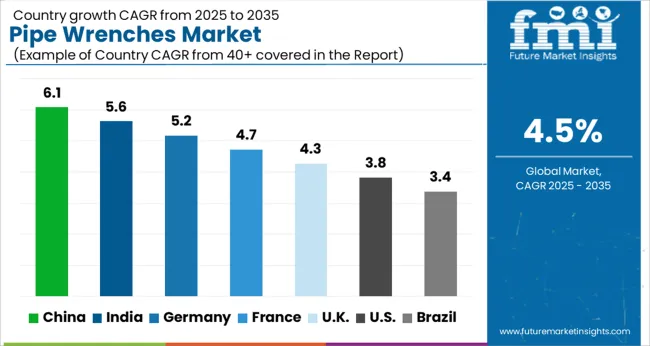

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global pipe wrenches market is projected to grow at 4.5% from 2025 to 2035. China leads at 6.1%, followed by India 5.6% and France 4.7%; the United Kingdom 4.3% and United States 3.8% follow. Demand is being pulled by plumbing and HVAC maintenance, refinery shutdowns, municipal water work, and contractor preference for lighter aluminum bodies with replaceable jaws. E-commerce, dealer networks, and hire shops are being used to refresh kits and standardize brands across crews. Non-sparking bronze units for petrochemical sites and compact models for tight plant rooms are gaining share. Asia’s cost discipline and broad distribution will set the pace, Europe will emphasize standards and ergonomics, and the USA will advance through steady MRO cycles and premium lifetime-warranty niches. This report includes insights on 40+ countries; the top markets are shown here for reference.

The pipe wrenches market in China is expected to expand at 6.1%. Demand is being supported by city infrastructure upgrades, mixed-use builds, and energy projects where high-duty jaw grip and fast size changes are valued. Local makers have scaled die-forged bodies, hardened serrations, and aluminum frames to lower fatigue for installers. National distributors are pushing bundle packs that pair straight, offset, and chain wrenches, while safety teams specify tether points for work at height. Quick fulfillment through marketplaces is keeping crews supplied during peak fit-out windows. With widespread service depots and competitive tooling, China is likely to retain a price–performance edge while growing exports into Asia and Africa. Confidence in torque consistency and spare-jaw availability is seen as a differentiator in large procurement rounds.

The pipe wrenches market in India is projected to grow at 5.6%. Orders are being pulled by affordable-housing plumbing, campus utilities, refinery turnarounds, and irrigation lines. Contractors favor aluminum straight wrenches for long shifts, with offset heads used under sinks and in congested risers. Dealer credit and EMI plans are spreading purchases across MSME installers, while e-commerce meets demand in tier-2 clusters. Training through ITI centers and OEM roadshows is raising care routines for jaw replacement and knurl cleaning to maintain bite. Given rising maintenance backlogs and frequent shutdown schedules, steady replacement and upsizing of kits are expected. domestic casting and machining capacity, paired with BIS-aligned quality checks, will keep India on a firm growth track across residential and industrial trades.

The pipe wrenches market in France is anticipated to rise at 4.7%. Activity is being shaped by renovation, hospitality refits, and district heat loops where tight clearances favor compact offset designs. Buyers place weight on ergonomics—knurl feel, anti-slip grips, and balanced aluminum bodies—alongside documented torque ratings. Petrochemical and maritime sites are specifying bronze or copper-beryllium models for spark-risk zones, while service firms keep sets dedicated to potable-water work. Purchasing cooperatives and wholesalers are curating European brands with traceable batch tests and spare-jaw programs. With attention to conformity (NF/EN) and technician comfort, France is viewed as a premium-leaning market that rewards durable serrations, precise rack-and-pawl action, and clean coating systems suited to damp environments.

The pipe wrenches market in the UK is forecast to expand at 4.3%. Social-housing maintenance, boiler swaps, and commercial refurbishments are leading demand. Hire shops and merchants are standardizing assortments, straight for general use, chain for large-diameter steel, and smooth-jaw models for chrome fittings. Brands with British-standard conformity and clear jaw-opening markings are being preferred to reduce errors on fast jobs. Click-and-collect and weekend depot hours are keeping crews supplied around tight programs. Given variable project pipelines, flexible bundles, and quick-change jaws are being viewed as prudent. Steady replacement cycles and careful tool governance will support growth, with asset tagging and calibration logs gaining traction on facilities contracts.

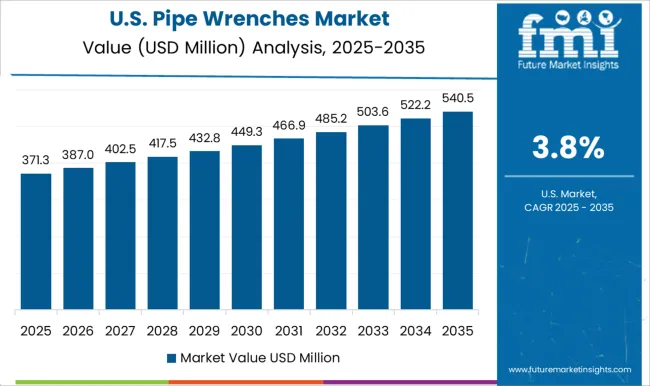

The pipe wrenches market in the United States is projected to grow at 3.8%. Facility MRO, industrial maintenance, and oil-and-gas work continue to anchor demand, while union training centers shape brand familiarity early. Premium USA-made lines retain mindshare for lifetime-warranty assurance, with aluminum frames and replaceable jaws favored for daily carry. Distributors are bundling inspection routines—jaw tooth checks, knurl lubrication, and frame sighting, to extend service life. Compliance with ASME tolerances and clear jaw-opening stamps is being emphasized in safety audits. With predictable refurbishment cycles and strong after-sales support, a measured but durable outlook is indicated, particularly in regions with active petrochemical, food-processing, and utilities maintenance programs.

Competition in pipe wrenches has been defined by brochures that convert metallurgy, jaw geometry, and torque control into clear buying logic. RIDGID and Milwaukee Tool set the tempo with heavy duty steel and aluminum bodies, induction hardened teeth, and fast knurl threads that resist clogging. Milwaukee highlights adaptable shaft lengths and overbite jaws for secure bite on rounded surfaces. Stanley Black and Decker, Apex Tool Group through Crescent, and Gedore emphasize broad size ladders from 6 to 60 inches, with offset, end, chain, and strap variants documented in neat spec tables. Snap on and Matco Tools leverage truck based distribution, pairing premium lines with service and same day spares. Channellock and Wright Tool focus on US made credibility, replaceable hook and heel jaws, and ergonomic I beam handles that trim fatigue. Bahco and Teng Tools promote European precision and slim heads for tight chases. Klein Tools and Husky address trades and retail with value skus that still list jaw capacity, weight per size, and ASME B107.110 conformity. Messaging is concise and technical. Grip under load, durability under grit, and cleaner threads after abuse. Strategy has centered on specification density rather than slogans. Brochures foreground jaw hardness, handle alloys, corrosion protection, and torque guidance, then map each variant to use cases such as gas fitout, fire protection, refinery shutdowns, and MRO. Teeth patterns are drawn at scale so users can compare bite angle and clearance at the wall. Aluminum frames are positioned for overhead work where grams matter, while ductile iron is framed for high shock environments. Warranty terms, spare jaw part numbers, and calibration advice are printed plainly. Distribution models are spelled out. Pro truck routes for rapid swaps, distributors for industrial bids, retail aisles for immediate need, and ecommerce for kit building. The brands that win make the decision instant. One glance at jaw capacity, handle length, and weight. One check of ASME compliance and parts availability. When a brochure reads like a work instruction that will survive grit, oil, and cold mornings, procurement teams place the order with confidence.

| Item | Value |

|---|---|

| Quantitative Units | USD 857.2 Million |

| Product Type | Straight pipe wrench, Offset pipe wrench, Chain pipe wrench, End pipe wrench, Strap wrench, and Others |

| Material | Steel, Aluminum, and Plastic or composite |

| Size | 200 mm - 400 mm, Up to 200 mm, 400 mm - 600 mm, 600 mm - 800 mm, and Above 800 mm |

| End User | Industrial, Residential, and Commercial |

| Pricing | Medium, Low, and High |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Apex Tool Group, Bahco, Channellock, Footprint Tools, Gedore, Husky, Klein Tools, Matco Tools, Milwaukee Tool, RIDGID, Snap-on, Stanley Black & Decker, Teng Tools, TTI Group, and Wright Tool |

| Additional Attributes | Dollar sales by wrench type (straight, offset, end, chain, strap, aluminum), Dollar sales by application (plumbing, oil and gas, HVAC, water utilities, industrial MRO), Trends in lightweight alloys, ergonomic grips, quick adjust jaws, Role in pipe installation and maintenance with high torque grip, Growth from infrastructure rehab and utility upgrades, Regional demand across North America, Europe, Asia Pacific. |

The global pipe wrenches market is estimated to be valued at USD 857.2 million in 2025.

The market size for the pipe wrenches market is projected to reach USD 1,331.3 million by 2035.

The pipe wrenches market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in pipe wrenches market are straight pipe wrench, offset pipe wrench, chain pipe wrench, end pipe wrench, strap wrench and others.

In terms of material, steel segment to command 51.2% share in the pipe wrenches market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pipeline Integrity Market Size and Share Forecast Outlook 2025 to 2035

Pipe Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Pipetting Robots Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Safety Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Products Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pipette Tips Market Size and Share Forecast Outlook 2025 to 2035

Pipe Screw Extruder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pipette Controller Market – Trends & Forecast 2025 to 2035

Pipe Inspection Robot Market Growth – Trends & Forecast 2025 to 2035

Pipe Flange Market Analysis by Material Type, Facing, End-Use Industry, and Region through 2035

Market Leaders & Share in the Pipe Insulation Products Industry

Pipe Marking Tapes Market Growth - Demand, Trends & Forecast 2024 to 2034

Pipe Wrapping Machines Market

Piperylene Market

Oil Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Gas Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA