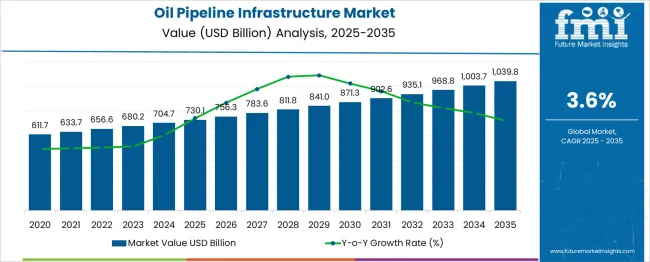

The Oil Pipeline Infrastructure Market is estimated to be valued at USD 730.1 billion in 2025 and is projected to reach USD 1039.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

This growth reflects a steady CAGR of 3.6%, driven by rising global energy demand, the need for pipeline network expansion, and aging infrastructure replacement. In the first five-year phase (2025–2030), the market is expected to grow from USD 730.1 billion to USD 904.6 billion, adding USD 174.5 billion, which accounts for 56.3% of the total incremental growth, driven by investments in pipeline modernization and new pipeline projects in emerging markets. The second phase (2030–2035) contributes USD 135.2 billion, representing 43.7% of incremental growth, reflecting continued demand for oil pipeline infrastructure driven by the growing need for energy security and regional pipeline expansions. Annual increments will rise from USD 30 billion in early years to USD 45 billion by 2035, as major oil-producing regions focus on infrastructure upgrades and expansion to meet demand. Manufacturers and operators focusing on advanced materials, automation, and pipeline monitoring systems will capture the largest share of this USD 309.7 billion opportunity.

| Metric | Value |

|---|---|

| Oil Pipeline Infrastructure Market Estimated Value in (2025 E) | USD 730.1 billion |

| Oil Pipeline Infrastructure Market Forecast Value in (2035 F) | USD 1039.8 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The Oil Pipeline Infrastructure market is experiencing steady expansion driven by rising demand for crude oil and refined products globally alongside energy security concerns. Investments in midstream infrastructure are being supported by governmental policy focus on pipeline safety and emissions control and private sector pursuit of enhanced throughput and reliability. Aging pipeline networks are being upgraded via modernization projects that incorporate automated monitoring and corrosion resistance technologies.

System operators are deploying inline inspection tools and advanced coatings to adhere to stringent regulatory requirements while reducing leak risks. Increasing demand for long distance transport solutions in emerging markets is creating growth opportunities for new pipeline routes.

Integration of digital twins and remote sensing platforms is enabling predictive maintenance and asset optimization across large networks. Future expansion is expected in capacity expansion initiatives pipeline reinforcement and strategic interconnections between key production and consumption regions.

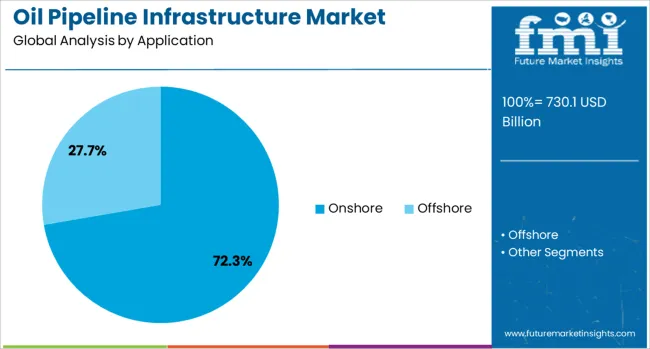

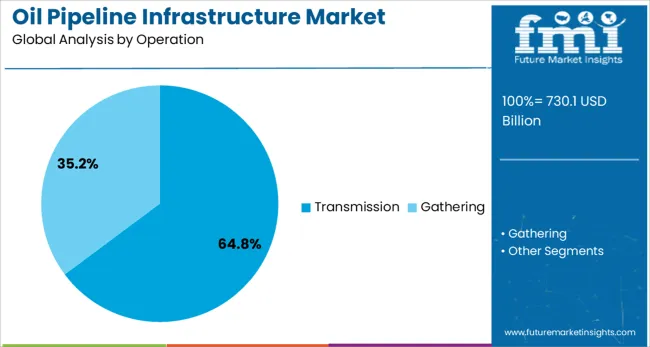

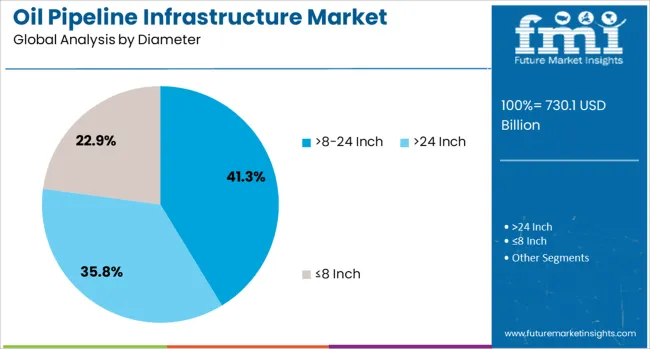

The oil pipeline infrastructure market is segmented by application, operation, diameter, and geographic regions. By application of the oil pipeline infrastructure market is divided into Onshore and Offshore. By Operation, the market is classified into Transmission and Gathering. Based on diameter of the oil pipeline infrastructure market is segmented into >8-24 Inch, >24 Inch≤8 Inch. Regionally, the oil pipeline infrastructure industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The onshore application segment is projected to command 72.3% of market revenue in 2025. This performance is being driven by simpler regulatory approval processes and lower initial capital expenditure relative to offshore options. Construction timelines have been shortened through established right of way procedures and modular pipeline components.

Onshore pipelines have also been prioritized to support domestic distribution networks and cross border energy corridors. Environmental and social impact mitigation strategies have improved permitting success and community acceptance.

Additionally operators have been deploying flexible materials coatings and leak detection systems tailored to onshore seismic and climatic zones. As a result the onshore classification has consolidated its position by balancing cost efficiency reliability and strategic infrastructure development needs.

The transmission operation segment is forecast to secure 64.8% of infrastructure market revenue in 2025. This dominance is being attributed to the critical role of long haul transport in moving crude and refined products from production hubs to consumption centers.

Operators have been investing in high capacity pump stations advanced SCADA systems and pipeline pressure optimization to maximize throughput. Regulatory emphasis on pipeline integrity and risk based inspection has driven adoption of smart pigging inline monitoring and real time telemetry across transmission routes.

Additionally economies of scale associated with bulk transport have enabled cost reductions per barrel carried. As a consequence the transmission classification has continued to expand supported by demand for efficient interregional and international oil delivery networks.

The greater than eight to twenty four inch diameter segment is projected to capture 41.3% of market revenue in 2025. This sizing has been favored due to its balance between capacity and construction cost enabling efficient movement of large volumes without excessive infrastructure spending.

Its integration into both trunk transport and gathering networks has supported diverse applications from long distance crude delivery to interfacility interconnects. Engineering advances in wall thickness optimization and high strength steel grades have improved pressure tolerance and safety performance for this diameter bracket.

Operators have also favored this size for retrofit and expansion projects due to compatibility with existing meter pump and valve systems. The result is sustained growth in this diameter classification driven by its cost effective capacity and modular deployment advantages.

The oil pipeline infrastructure market is growing, driven by rising global demand for efficient oil transportation systems and the expansion of oil networks, particularly in emerging regions. Automation and real-time monitoring systems are emerging trends shaping the market. However, regulatory challenges and environmental concerns may slow down development. By 2025, addressing these issues will be key to ensuring sustained market growth.

The oil pipeline infrastructure market is growing due to the increasing global demand for efficient and secure oil transportation systems. Pipelines offer a reliable and cost-effective solution for moving large volumes of oil over long distances, reducing transportation costs. The rising need for energy, particularly in emerging economies, is driving investments in new pipeline projects. By 2025, the market will continue to expand, fueled by the growing need for infrastructure to support global energy consumption.

Opportunities in the oil pipeline infrastructure market lie in expanding oil transportation networks, particularly in regions with increasing energy consumption. The development of new pipelines in regions like Africa, Asia, and Latin America is expected to open up growth opportunities. The rising demand for oil in these regions, coupled with government support for energy projects, presents opportunities for new investments. By 2025, the market will likely benefit from the global expansion of oil transportation networks.

Emerging trends in the oil pipeline infrastructure market point towards the increased adoption of automation and real-time monitoring systems. Automation helps improve pipeline efficiency, while advanced monitoring technologies enhance safety by identifying leaks and reducing the risk of failures. These innovations are expected to drive growth by improving operational efficiency and minimizing environmental risks. By 2025, the integration of IoT and AI-based monitoring systems is expected to dominate, ensuring more efficient and safer pipeline operations.

The oil pipeline infrastructure market faces challenges stemming from regulatory barriers and environmental concerns. Stringent regulations surrounding the construction and operation of pipelines, particularly in ecologically sensitive areas, pose hurdles. Additionally, environmental risks such as oil spills and their potential impact on surrounding ecosystems continue to create public opposition to pipeline projects. These constraints may hinder market growth, especially in developed countries with strict environmental standards. By 2025, these challenges must be addressed to ensure smooth pipeline development.

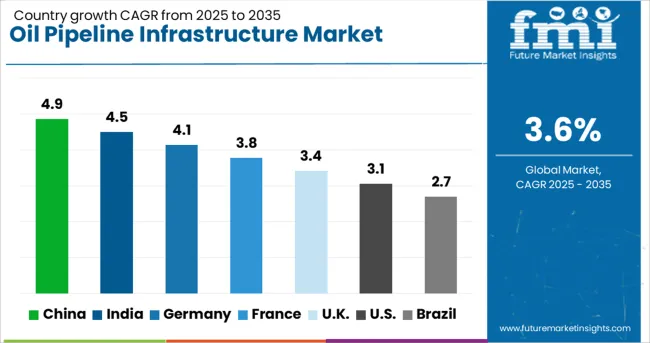

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| France | 3.8% |

| UK | 3.4% |

| USA | 3.1% |

| Brazil | 2.7% |

The global oil pipeline infrastructure market is projected to grow at a 3.6% CAGR from 2025 to 2035. China leads with a growth rate of 4.9%, followed by India at 4.5%, and Germany at 4.1%. The United Kingdom records a growth rate of 3.4%, while the United States shows the slowest growth at 3.1%. These differences in growth rates are driven by factors such as industrial demand for oil, expansion of transportation networks, and government infrastructure projects. Emerging markets like China and India are witnessing higher growth due to increased industrialization, demand for energy, and the expansion of their oil and gas sectors, while more mature markets like the USA and the UK experience steady growth due to market maturity and existing infrastructure. This report includes insights on 40+ countries; the top markets are shown here for reference.

The oil pipeline infrastructure market in China is growing at a projected CAGR of 4.9%. China’s rapidly expanding oil and gas sector, along with its growing industrial and transportation demands, are key drivers behind the need for enhanced pipeline infrastructure. The country’s investments in expanding oil reserves, refining capacities, and cross-country pipeline projects significantly contribute to market growth. Additionally, China’s focus on increasing domestic energy supply and the development of regional oil pipelines, as well as efforts to improve energy security, are supporting the growth of the oil pipeline infrastructure market.

The oil pipeline infrastructure market in India is projected to grow at a CAGR of 4.5%. India’s increasing industrialization, combined with rising domestic energy demand, is driving the expansion of its oil pipeline infrastructure. The government’s focus on improving energy security and increasing oil import capacities is contributing to the growth of the market. Additionally, the ongoing development of energy-efficient pipelines and transportation networks to connect major refineries, ports, and industrial hubs is supporting market growth. As India’s energy consumption continues to rise, investments in pipeline infrastructure are expected to expand, ensuring more efficient and secure oil distribution.

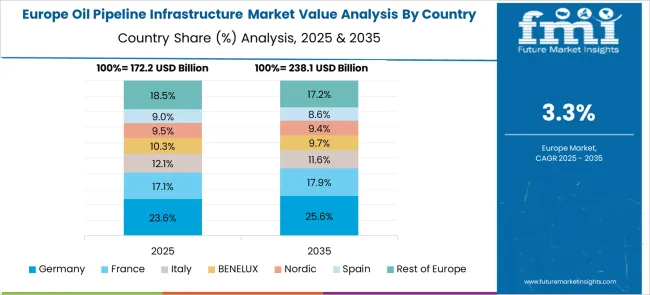

The oil pipeline infrastructure market in Germany is projected to grow at a CAGR of 4.1%. Germany’s industrial and manufacturing sectors, coupled with its need for reliable oil supply chains, are significant drivers of demand for oil pipeline infrastructure. The country’s investments in expanding its energy distribution networks, as well as increasing adoption of renewable energy sources, are contributing to the modernization of its oil pipeline systems. Germany’s strong regulatory framework and commitment to energy security further fuel market growth, ensuring that oil pipelines meet the high standards required for efficiency and safety in energy distribution.

The oil pipeline infrastructure market in the United Kingdom is projected to grow at a CAGR of 3.4%. The UK continues to focus on maintaining and upgrading its existing oil pipeline infrastructure to meet growing energy demands and improve energy security. The demand for oil pipeline infrastructure is driven by the country’s investments in refining capacity, along with the need for secure transportation networks that can support both domestic and international oil supply chains. However, market growth in the UK is slower due to the maturity of its infrastructure and a shift toward renewable energy sources, which may reduce long-term reliance on traditional oil pipelines.

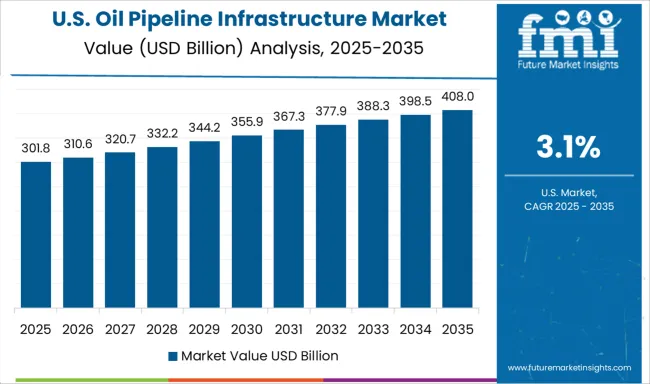

The oil pipeline infrastructure market in the United States is expected to grow at a CAGR of 3.1%. Despite the USA market being mature, the ongoing need for pipeline infrastructure due to the country’s vast oil production, refining capacities, and consumption ensures steady growth. The market is driven by the increasing demand for oil distribution systems that can support both traditional energy sources and renewable energy projects. Ongoing regulatory changes and technological advancements in pipeline construction are ensuring that USA oil infrastructure remains competitive and efficient, contributing to the demand for oil pipelines in both new and established energy systems.

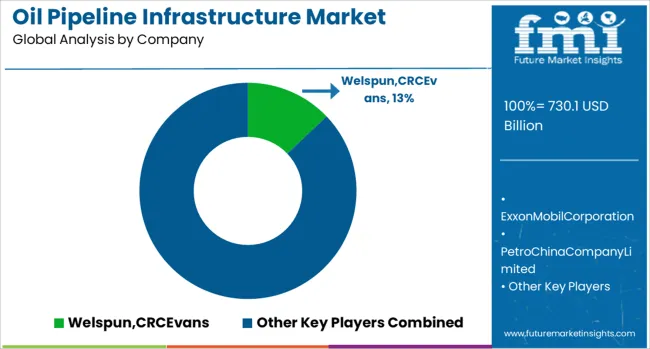

The oil pipeline infrastructure market is dominated by Welspun, CRC Evans, which leads with its extensive expertise in pipeline construction, installation, and maintenance services, offering advanced infrastructure solutions for oil and gas transmission networks globally. Welspun’s dominance is supported by its strong global network, advanced pipeline technologies, and strategic partnerships with key oil companies. Key players such as ExxonMobil Corporation, Chevron Corporation, and PetroChina Company Limited maintain significant market shares by providing comprehensive pipeline infrastructure solutions for efficient transportation of crude oil, refined products, and natural gas. These companies focus on ensuring high reliability, safety, and cost-effective solutions in pipeline construction and operation.

Emerging players like General Electric, DCP Midstream LLC, NOV, and EUROPIPE GmbH are expanding their market presence by offering specialized pipeline infrastructure services, including engineering, supply chain management, and advanced monitoring systems for pipeline operations. Their strategies include enhancing operational efficiency, reducing environmental impact, and offering integrated solutions for energy infrastructure projects. Market growth is driven by increasing global energy demand, the rising need for efficient energy transport networks, and significant investments in oil infrastructure. Innovations in pipeline materials, automated monitoring technologies, and eco-friendly practices are expected to continue shaping competitive dynamics in the global oil pipeline infrastructure market.

Recent Development

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Application | Onshore and Offshore |

| Operation | Transmission and Gathering |

| Diameter | >8-24 Inch, >24 Inch, and ≤8 Inch |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Welspun, CRCEvans, ExxonMobilCorporation, PetroChinaCompanyLimited, GeneralElectric, ENBRIDGEINC, DCPMidstreamLLC, NOV, EUROPIPEGmbH, ChevronCorporation, EnLinkMidstreamLLC, Petrobras, IndianOilCorporationLtd, and BRAZOSMIDSTREAM |

| Additional Attributes | Dollar sales by pipeline type and application, demand dynamics across oil transportation, storage, and distribution sectors, regional trends in pipeline infrastructure development, innovation in corrosion-resistant materials and leak detection technologies, impact of regulatory standards on safety and environmental concerns, and emerging use cases in smart pipeline monitoring and digital twin technologies. |

The global oil pipeline infrastructure market is estimated to be valued at USD 730.1 billion in 2025.

The market size for the oil pipeline infrastructure market is projected to reach USD 1,039.8 billion by 2035.

The oil pipeline infrastructure market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in oil pipeline infrastructure market are onshore and offshore.

In terms of operation, transmission segment to command 64.8% share in the oil pipeline infrastructure market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA