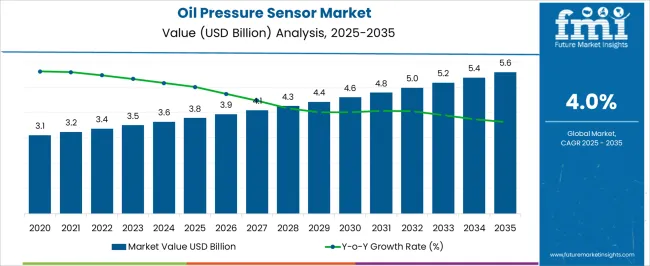

The oil pressure sensor market is estimated at USD 3.8 billion in 2025 and is projected to reach USD 5.6 billion by 2035, registering a CAGR of 4.0% over the forecast period. Growth is supported by rising adoption of advanced engine monitoring systems in automotive, aerospace, marine, and industrial machinery applications. Oil pressure sensors play a critical role in ensuring optimal lubrication, preventing engine wear, and enhancing safety, making them essential for modern vehicles and heavy equipment. Increasing regulatory emphasis on fuel efficiency and emission reduction is pushing manufacturers to integrate high-precision sensors into engine systems. The automotive sector remains the largest consumer, with growth fueled by passenger and commercial vehicle production, alongside increasing penetration of electronic control systems. Additionally, industrial applications such as hydraulic systems, compressors, and power generation equipment are contributing to steady demand. Technological innovations, including miniaturized designs and digital integration for real-time monitoring, are reshaping product offerings, while aftermarket replacement needs continue to reinforce consistent revenue streams across regions.

| Metric | Value |

|---|---|

| Oil Pressure Sensor Market Estimated Value in (2025 E) | USD 3.8 billion |

| Oil Pressure Sensor Market Forecast Value in (2035 F) | USD 5.6 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The oil pressure sensor market is growing steadily, supported by the increasing adoption of advanced engine monitoring systems and the global shift toward enhanced vehicle performance standards. Automotive industry reports and OEM updates have emphasized the critical role of oil pressure sensors in improving fuel efficiency, reducing emissions, and ensuring engine longevity. Rising production of passenger and commercial vehicles, along with stricter regulatory requirements for engine health monitoring, has further driven demand.

Advancements in sensor design, including miniaturization and enhanced accuracy, have improved their integration into both internal combustion engines and hybrid systems. Beyond automotive applications, industrial engines and heavy machinery have also contributed to market expansion.

Growth is expected to be reinforced by electrification trends in hybrid powertrains, increased fleet monitoring in logistics, and wider OEM integration of predictive maintenance technologies.

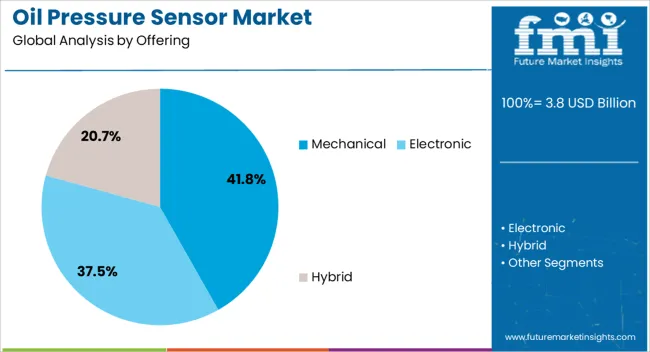

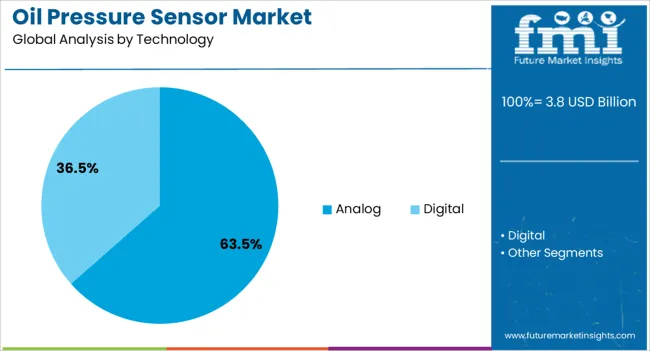

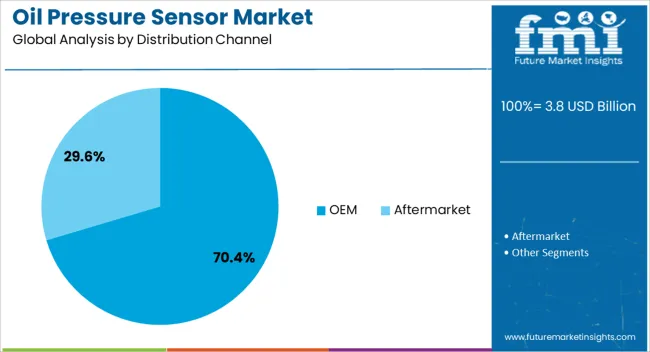

The oil pressure sensor market is segmented by offering, technology, distribution channel, application, and geographic regions. By offering, the oil pressure sensor market is divided into Mechanical, Electronic, and Hybrid. In terms of technology, the oil pressure sensor market is classified into Analog and Digital. Based on distribution channel, oil pressure sensor market is segmented into OEM and Aftermarket.

By application, the oil pressure sensor market is segmented into Automotive, Industrial, Marine, Aerospace, and Others. Regionally, the oil pressure sensor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Mechanical segment is projected to account for 41.8% of the oil pressure sensor market revenue in 2025, maintaining a substantial share due to its durability and cost-effectiveness. Mechanical oil pressure sensors have remained popular in applications where robust, long-lasting performance is prioritized over electronic complexity.

Their simple design and resistance to harsh operating conditions make them suitable for heavy-duty vehicles, industrial engines, and off-road equipment. OEMs have continued to specify mechanical sensors in certain product lines to ensure reliability in extreme environments.

Additionally, the segment benefits from low maintenance requirements and straightforward installation, which have helped preserve its market relevance despite the growth of electronic alternatives. As long-life components remain in demand for specific operational needs, the Mechanical segment is expected to retain a stable position.

The Analog segment is projected to contribute 63.5% of the oil pressure sensor market revenue in 2025, securing its leadership in technology adoption. Analog sensors are valued for their accuracy, real-time response, and compatibility with a wide range of vehicle and engine control systems.

These sensors provide continuous monitoring signals, enabling precise adjustments in oil circulation and engine operation. Their proven performance in automotive, marine, and industrial settings has encouraged OEMs to continue incorporating analog technology, particularly in applications where fast signal processing is critical.

The segment has also benefited from improvements in sensor materials and manufacturing precision, which have enhanced their operational lifespan and accuracy. Given their broad compatibility and established reliability, analog oil pressure sensors are expected to maintain dominance in both automotive and industrial applications.

The OEM segment is projected to hold 70.4% of the oil pressure sensor market revenue in 2025, reinforcing its position as the primary sales channel. OEM integration ensures that sensors are tailored to specific engine designs, providing optimal performance and compliance with manufacturer standards.

Automotive and industrial equipment manufacturers have increasingly prioritized factory-installed oil pressure sensors to meet regulatory requirements and enhance customer confidence in product reliability. The segment benefits from long-term supply agreements, which provide stability for sensor manufacturers and guarantee consistent quality for end users.

Furthermore, OEM-installed sensors are often paired with advanced diagnostics, offering value-added features for preventive maintenance and performance optimization. As vehicle production volumes grow globally and OEMs emphasize integrated engine monitoring, this segment is expected to remain the cornerstone of oil pressure sensor distribution.

The oil pressure sensor market is driven by increasing use in automotive engines, heavy machinery, aerospace systems, and marine equipment. These sensors are critical for monitoring lubrication levels, preventing mechanical failures, and ensuring compliance with fuel efficiency and emission norms. Growing production of passenger and commercial vehicles, combined with regulatory mandates on safety and performance, reinforces adoption. Industrial demand is also increasing, with oil pressure sensors widely deployed in compressors, hydraulic systems, and power generation units. The shift toward connected vehicles and smart factories enhances integration with digital control systems, boosting long-term market growth.

High cost of precision sensors, especially those designed for extreme conditions, poses a challenge in price-sensitive markets. Fluctuations in raw material prices and complex calibration processes increase production costs. Reliability concerns, including performance issues under high temperature, vibration, and contamination, also limit widespread adoption. In some industrial sectors, reluctance to upgrade legacy equipment further slows penetration. Intense competition from low-cost suppliers creates pricing pressure, affecting margins for established manufacturers.

Miniaturized oil pressure sensors with higher sensitivity and reduced power consumption are gaining traction. Integration of digital features such as real-time monitoring, diagnostics, and predictive maintenance is reshaping product development. Automotive manufacturers are adopting sensors compatible with advanced driver assistance systems and electric vehicles, where precision monitoring is essential. The aftermarket for sensor replacements is expanding, driven by maintenance cycles in automotive and industrial machinery. Eco-friendly designs with longer lifespans and improved durability are being prioritized to reduce waste and meet regulatory demands.

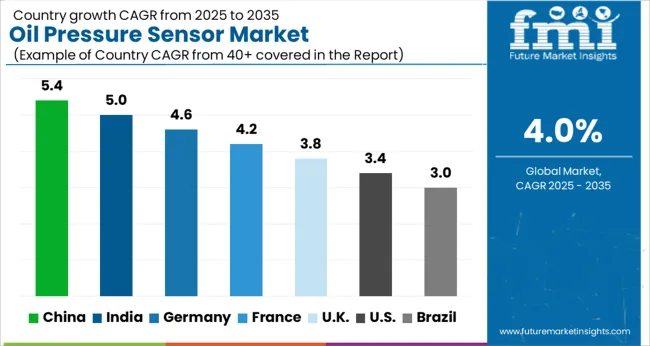

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

China’s oil pressure sensor market is projected to grow at a CAGR of 5.4%, supported by strong demand from the automotive, industrial machinery, and power generation sectors. Rising vehicle production and expansion of domestic OEMs have increased the use of advanced sensors for engine monitoring and emission control. Government regulations on fuel efficiency and safety standards are accelerating adoption in passenger and commercial vehicles. The country’s industrial sector, particularly heavy equipment and hydraulic systems, also contributes significantly to demand. Domestic manufacturers are expanding capabilities to produce cost-efficient sensors while global players focus on high-precision products for premium vehicles and export markets.

Vehicle production growth drives automotive sensor demand

Regulatory push enhances adoption in emission control systems

Industrial machinery and heavy equipment add steady growth

India’s oil pressure sensor market is expected to grow at a CAGR of 5.0%, driven by rising adoption in passenger cars, commercial vehicles, and industrial equipment. Rapid growth in automotive manufacturing, supported by domestic and foreign investments, has strengthened sensor demand. Stricter emission norms and safety regulations are encouraging OEMs to integrate high-performance oil pressure sensors into engine systems. The country’s growing construction and agricultural machinery markets also contribute to demand, as hydraulic and lubrication monitoring becomes essential. Local suppliers are expanding production to meet cost-sensitive requirements, while international firms target the premium segment with digital and miniaturized sensor technologies.

Stricter emission norms push OEM adoption in vehicles

Expansion in construction and agriculture machinery supports growth

Cost-sensitive demand met by local manufacturers’ offerings

Germany’s oil pressure sensor market is forecast to grow at a CAGR of 4.6%, supported by its strong automotive manufacturing base and leadership in industrial automation. German automakers are early adopters of advanced sensor technologies to ensure compliance with stringent EU emission standards and fuel efficiency goals. Industrial sectors such as machinery, aerospace, and energy systems also maintain steady demand for high-reliability sensors. German companies emphasize precision engineering, with R&D investments directed toward digital integration and predictive maintenance capabilities. Export demand for German-made sensors is rising, reflecting their reputation for quality and durability. Growth is reinforced by the country’s push toward Industry 4.0 and smart manufacturing practices.

German automakers drive high adoption for compliance needs

Precision engineering supports exports and premium segments

Industry 4.0 adoption boosts digital sensor integration

France’s oil pressure sensor market is projected to grow at a CAGR of 4.2%, supported by demand from automotive, aerospace, and industrial applications. French car manufacturers and component suppliers are adopting advanced sensors to improve vehicle safety and efficiency under EU regulations. Aerospace companies also use oil pressure sensors for critical monitoring in aircraft engines and hydraulic systems, enhancing reliability. Industrial use in compressors, turbines, and power equipment provides additional growth momentum. Domestic suppliers focus on niche applications, while global players supply advanced digital sensors for premium markets. The country’s strong emphasis on environmental standards ensures that precision monitoring solutions remain essential across sectors.

Automotive and aerospace sectors anchor demand growth

Industrial compressors and turbines drive steady adoption

Regulatory compliance ensures reliance on advanced sensors

The United Kingdom’s oil pressure sensor market is forecast to grow at a CAGR of 3.8%, reflecting stable demand in automotive, marine, and industrial sectors. Automotive adoption remains strong, with OEMs integrating sensors for compliance with emission and fuel efficiency norms. The UK’s marine industry also relies on oil pressure sensors for monitoring ship engines and propulsion systems. Growth in industrial automation and power generation further supports adoption. Domestic suppliers focus on supplying replacement sensors, while global manufacturers serve premium applications with digital and durable designs. Despite slower growth compared with Asia, the UK continues to maintain a steady aftermarket demand cycle.

Automotive and marine sectors remain key contributors

Industrial automation supports consistent sensor usage

Aftermarket replacements provide long-term revenue base

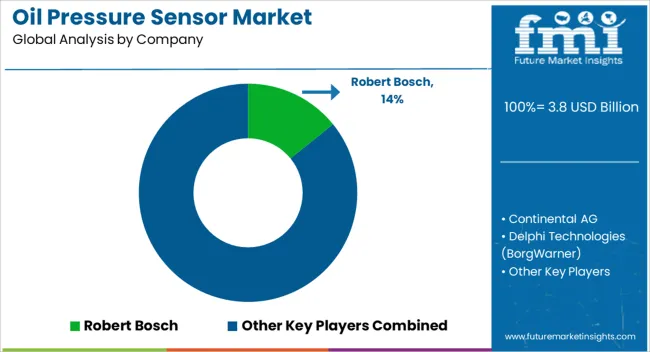

The competitive landscape of the oil pressure sensor market is characterized by a mix of global automotive component giants, specialized sensor manufacturers, and regional suppliers serving aftermarket and niche industries. Leading players such as Bosch, Denso, Continental, Delphi Technologies, Sensata Technologies, and Infineon dominate through their integration with automotive OEMs, leveraging scale, advanced R&D, and regulatory expertise. These companies provide high-precision, durable sensors tailored for compliance with emission norms and engine safety requirements. Mid-tier firms and niche players, including TE Connectivity and Hella, strengthen their position by offering specialized designs, miniaturized formats, and integration with digital monitoring systems.

Regional manufacturers in Asia and Latin America cater to cost-sensitive markets with affordable solutions, often focusing on replacement cycles in passenger and commercial vehicles. Competitive differentiation is achieved through sensor miniaturization, enhanced temperature resistance, and integration with vehicle telematics and predictive maintenance platforms. Pricing remains sensitive due to competition from low-cost suppliers, but premium adoption is growing where durability, compliance, and digital capabilities are prioritized. Consolidation trends and OEM partnerships continue to shape competitive intensity across global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Offering | Mechanical, Electronic, and Hybrid |

| Technology | Analog and Digital |

| Distribution Channel | OEM and Aftermarket |

| Application | Automotive, Industrial, Marine, Aerospace, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Robert Bosch, Continental AG, Delphi Technologies (BorgWarner), Denso Corporation, Emerson Electric Co., Honeywell International, NXP Semiconductors, Panasonic Corporation, Sensata Technologies, and TE Connectivity |

| Additional Attributes | Dollar sales vary by sensor type, including piezoelectric, capacitive, and resistive sensors; by application, such as automotive engines, industrial machinery, and marine equipment; by vehicle type, spanning passenger cars, commercial vehicles, and heavy-duty equipment; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising automotive production, demand for engine efficiency, and adoption of advanced monitoring systems. |

The global oil pressure sensor market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the oil pressure sensor market is projected to reach USD 5.6 billion by 2035.

The oil pressure sensor market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in oil pressure sensor market are mechanical, electronic and hybrid.

In terms of technology, analog segment to command 63.5% share in the oil pressure sensor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA