The oil and gas seal market is experiencing sustained growth, driven by the increasing complexity of upstream and midstream operations and the rising demand for robust sealing technologies capable of withstanding extreme conditions. Industry reports and company disclosures have highlighted that the expansion of deepwater drilling activities and unconventional resource extraction has intensified the need for high-performance seals with enhanced durability and resistance to chemical exposure and temperature fluctuations.

Technological advancements in drilling tools and pressure control systems have necessitated innovations in seal design, material formulation, and reliability standards. Additionally, the global push toward improving operational efficiency and reducing leakage in hydrocarbon handling systems has further elevated the importance of advanced sealing solutions.

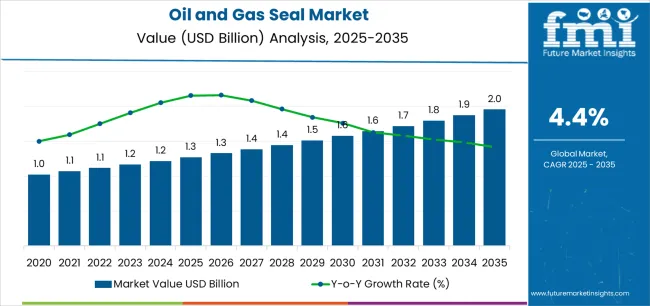

| Metric | Value |

|---|---|

| Oil and Gas Seal Market Estimated Value in (2025 E) | USD 1.3 billion |

| Oil and Gas Seal Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

Regulatory mandates on equipment safety and environmental compliance continue to guide seal adoption across critical application areas. Looking ahead, the market is expected to benefit from sustained investments in oilfield infrastructure, refinery upgrades, and exploration in extreme environments, reinforcing the role of seals in ensuring system integrity and operational continuity.

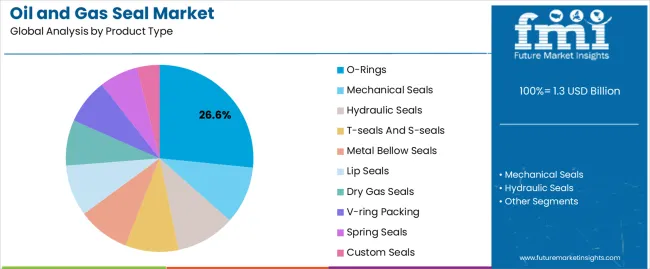

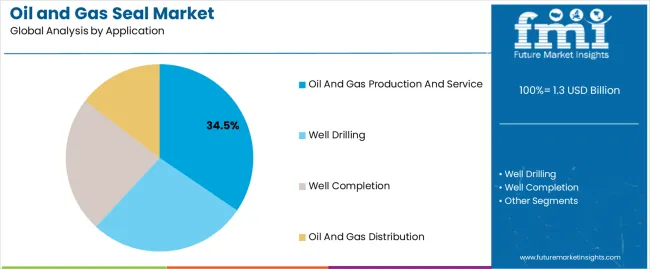

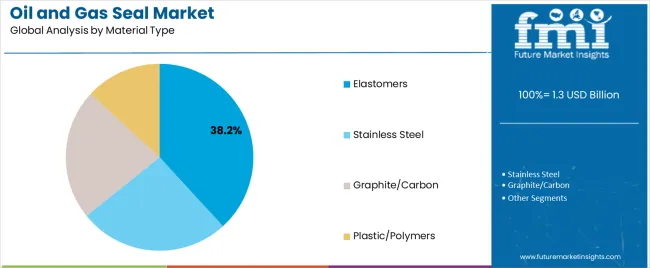

The market is segmented by Product Type, Application, Material Type, and Process Type and region. By Product Type, the market is divided into O-Rings, Mechanical Seals, Hydraulic Seals, T-seals And S-seals, Metal Bellow Seals, Lip Seals, Dry Gas Seals, V-ring Packing, Spring Seals, and Custom Seals. In terms of Application, the market is classified into Oil And Gas Production And Service, Well Drilling, Well Completion, and Oil And Gas Distribution. Based on Material Type, the market is segmented into Elastomers, Stainless Steel, Graphite/Carbon, and Plastic/Polymers. By Process Type, the market is divided into Upstream, Midstream, and Downstream. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The O-Rings segment is projected to contribute 26.6% of the oil and gas seal market revenue in 2025, maintaining its leadership as the most widely used sealing product. This dominance has been supported by the simplicity, cost-efficiency, and versatility of O-Rings across a wide spectrum of oilfield equipment and pipelines.

Their circular design and ease of installation have enabled widespread usage in static and dynamic sealing conditions, including high-pressure valves, pumps, and wellhead components. Industry sources have underscored the role of material innovations in improving O-Ring performance, with new compounds enhancing chemical compatibility and temperature resistance.

Additionally, manufacturers have focused on precision-engineered O-Rings for extreme service environments, further driving adoption in offshore and deepwater applications. The segment’s high volume demand, combined with its adaptability to custom specifications and widespread availability, is expected to sustain its stronghold in the product category.

The Oil and Gas Production and Service segment is anticipated to account for 34.5% of the market revenue in 2025, establishing itself as the leading application segment. This growth has been driven by the increasing deployment of seals in upstream operations, including drilling rigs, completion systems, and well service equipment.

Industry press releases and operational updates have highlighted rising investments in unconventional oilfields and EOR (enhanced oil recovery) technologies, which require seals that can perform reliably under cyclical thermal and pressure conditions. Seals have been essential in reducing downtime, preventing fluid contamination, and ensuring the integrity of well components in harsh environments.

Moreover, the growing adoption of high-efficiency fracturing and stimulation techniques has expanded the application base for advanced sealing systems. As producers continue to modernize field equipment and enhance safety compliance, demand for precision-engineered seals in oil and gas production and service operations is expected to remain robust.

The Elastomers segment is projected to hold 38.2% of the oil and gas seal market revenue in 2025, leading the material type category due to its superior sealing flexibility and resistance to aggressive operating conditions. Elastomer-based seals have been favored for their ability to maintain tight sealing under variable pressures and temperatures, a critical requirement in oilfield and refining operations.

Technical documentation and polymer development reports have documented the progress in developing high-grade elastomers such as HNBR, FKM, and Aflas, which offer improved resistance to hydrocarbons, sour gas, and drilling fluids. Their adaptability to complex geometries and compressibility has made them ideal for dynamic sealing environments, including reciprocating motion components and rotating shafts.

Additionally, elastomers offer a cost-effective balance between performance and manufacturability, making them the preferred material across high-volume applications. As material research advances and field trials validate their reliability in extreme conditions, the Elastomers segment is expected to continue dominating the seal material landscape.

Increasing Investments in Research and Development to Spur Sales

Demand for innovative seal solutions in oil and gas operations is increasing due to high pressures, temperatures, and corrosive environments. Companies that develop seals with superior performance characteristics, such as extended lifespan, reliability, and environmental sustainability, are gaining traction.

Investing in research and development, along with developing next-generation seal technologies, materials, and manufacturing processes, are set to fuel growth.

Sustainability to Step Forward in the Industry

Demand for seals that contribute to environmental sustainability is on the rise due to increasing environmental regulations and carbon emissions concerns.

Companies offering eco-friendly seal solutions or using recycled or renewable materials are expected to capitalize on this trend. Oil and gas companies are also seeking seals that provide enhanced reliability and durability, minimizing downtime and maintenance costs.

Increasing Technological Advances to Boost Growth

Digital technologies and IoT integration in oil and gas operations enable seal manufacturers to create smart seals with sensors, optimizing maintenance schedules, reducing downtime, and preventing costly failures. Offering aftermarket services like seal maintenance and repair are profitable, providing a steady revenue stream and developing strong customer relationships.

Oil Price Fluctuations to Hamper Growth

Oil price fluctuations are set to significantly impact investment decisions and operational expenditures in the oil and gas landscape. Low prices are projected to cause companies to reduce exploration and production activities, dipping demand for seals.

The highly competitive oil and gas seal market, with numerous global and regional players, is set to lead to price pressures and reduced profit margins. Established players with strong brand recognition and customer relationships are further expected to make it challenging for new entrants to gain traction.

The oil and gas seal sector grew at a CAGR of 1.8% from 2020 and 2025. The market reached USD 1.3 million in 2025. The oil and gas seal sector has its roots in the early days of the oil industry, where basic sealing solutions were used to prevent leaks in drilling equipment, pipelines, and storage tanks.

Industrialization has LED to the development of advanced sealing solutions made from synthetic elastomers, thermoplastics, and metal alloys. The growth of exploration and production activities in oil-rich regions increased demand for seals in drilling rigs, wellheads, pumps, valves, and other oilfield equipment.

The oil and gas industry is characterized by cycles of boom and bust, propelled by factors such as geopolitical events, supply-demand dynamics, and economic conditions. High oil prices stimulate investment in exploration and production activities, leading to increased demand for seals. Equally, downturns in oil prices resulted in reduced investment and lower demand for seals.

Regulatory changes and environmental concerns between 2020 and 2025 have influenced the development of seals that minimize leaks, emissions, and environmental impact.

The oil and gas seal market has witnessed continuous innovation in materials, design, and manufacturing processes to meet evolving business requirements. Trends such as advanced sealing technologies, digitalization, IoT integration, and sustainability have further pushed seal development and growth.

The oil and gas seal sector is experiencing significant growth due to consolidation and globalization as companies seek to develop new product portfolios. Companies are increasingly selective in choice of seals, favoring solutions that offer long-term performance, durability, and cost-effectiveness over the product lifecycle.

As the world transitions towards renewable energy sources and decarbonization, the oil and gas seal landscape is set to experience shifts in demand patterns. Over the forecast period, the sector is poised to exhibit healthy growth, reaching USD 2 million by 2035.

Tier 1 oil and gas seal companies, leveraging technological innovation, digitalization, and sustainability, are thriving in the global energy sector. Opportunities for tier 1 companies lie in increasing presence, strategic partnerships, and utilizing smart technologies for predictive maintenance and environmental stewardship.

Tier 1 players in the industry include Freudenberg Group, Parker Hannifin Corporation, Trelleborg AB, SKF Group, and John Crane (Smiths Group). Freudenberg Group, a Germany-based company, produces a wide range of products, including housewares, automobile parts, textiles, building materials, and telecommunications.

Tier 2 oil and gas seal manufacturers utilize niche expertise, agility, and regional focus for growth. Key trends driving growth among tier 2 companies include customization, material innovation, and partnerships. Flowserve Corporation, James Walker Group Ltd., Halliburton, EagleBurgmann, and Technetics Group are a few leading Tier 2 companies.

Tier 3 oil and gas seal companies influence specialization, agility, and niche sectors for future opportunities. Tier 3 companies include Seal Innovations, American High-Performance Seals, Bal Seal Engineering, Inc., Greene Tweed, and Teadit Group.

The following table shows the estimated growth rates of the leading sectors. The United States is anticipated to remain at the forefront in North America, with a CAGR of 2.5% through 2035. In South Asia and Pacific, India is projected to witness a CAGR of 6.6% by 2035, followed by China at 4.9% in East Asia.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 2.5% |

| Italy | 2.9% |

| China | 4.9% |

| Japan | 1.8% |

| India | 6.6% |

Over the assessment period, demand in the United States is set to rise at 2.5% CAGR. The oil and gas industry is enhancing seal materials and manufacturing processes to withstand high pressures, temperatures, and corrosive environments in drilling, production, and transportation operations.

Environmental sustainability is gaining attention due to increasing regulatory scrutiny and ecological concerns in the United States. Companies are investing in eco-friendly seal solutions to reduce carbon footprint and comply with environmental regulations.

The resurgence of offshore exploration in the Gulf of Mexico is presenting seal manufacturers with opportunities to supply seals for drilling rigs, subsea equipment, and production facilities.

The United States shale upgrade has transformed the energy landscape, creating opportunities for seal manufacturers in hydraulic fracturing operations and shale drilling rigs. Additionally, investments in upstream and midstream infrastructure development are driving demand for seals in equipment and components vital to oil and gas transportation and processing.

The United Kingdom is embracing digital technologies and IoT integration to improve seal industry trends. Smart seals with sensors and monitoring systems improve operational efficiency by enabling real-time condition monitoring, predictive maintenance, and performance optimization, reducing downtime.

Companies are prioritizing cost optimization strategies, including balancing performance and cost-effectiveness over the product lifecycle and aftermarket services like maintenance, repair, and refurbishment. Regulatory changes at federal, state, and local levels continue to influence sales, driving demand for seals that meet safety, environmental, and quality standards.

Government initiatives like the Belt and Road and Made in China 2025 strategy are driving infrastructure investments and increasing demand for seals in oil and gas projects. China's efforts to address environmental pollution and emissions reduction are driving the adoption of eco-friendly seal solutions.

Industry liberalization and foreign investment are attracting international companies and technology providers to the market, driving collaboration, technology transfer, and innovation in the oil and gas seal sector. Ensuring the integrity and reliability of oil and gas infrastructure through the use of high-quality seals is essential for safeguarding China's energy supply and national security.

The country’s growing economy and industrialization have significantly increased energy consumption, resulting in surging demand for oil and gas seals in various sectors. Furthermore, growth of shale gas reserves presents opportunities for seal manufacturers to supply seals for drilling, hydraulic fracturing, and infrastructure in China.

The section below analyzes the leading segment of the business. In terms of product type, the o-ring segment is estimated to account for a share of 26.6% in 2025. Based on application, the oil and gas production and service segment is anticipated to follow by holding a share of 29.4% in 2025.

| Segment | O-rings (Product Type) |

|---|---|

| Value Share (2025) | 26.6% |

Increasing demand for oil and gas is driving investments in exploration and production activities, leading to a high demand for O-rings for sealing vital equipment and components. Offshore and deepwater exploration requires seals that withstand high pressures, temperatures, and corrosive environments, driving demand for O-rings in subsea equipment, wellhead systems, and offshore platforms.

Technological advancements in O-ring materials and manufacturing processes improve performance, reliability, and longevity, making these suitable for demanding oil and gas applications. Compliance with industry standards and regulations mandates the use of high-quality seals like O-rings to ensure safety and environmental protection.

O-rings play a vital role in asset integrity and reliability, preventing fluid leaks and minimizing downtime. The growth of unconventional resources and increasing adoption of subsea production systems also fuel demand for O-rings in subsea equipment and infrastructure.

| Segment | Oil and Gas Production and Service (Application) |

|---|---|

| Value Share (2025) | 29.4% |

Demand for high-performance seals in oil and gas production and service applications is on the rise due to the ability to withstand harsh conditions. The focus is on improving equipment reliability, minimizing downtime, and enhancing operational efficiency. Advancements in seal technology, digitalization, and IoT integration are being made by leading companies to address these challenges.

Integration of digital technologies and IoT capabilities is being used to monitor and optimize equipment performance. Rising adoption of seals that minimize leaks, emissions, and environmental impact is set to drive the segment's growth. Furthermore, demand for customized sealing solutions is increasing, tailored to specific requirements and operating conditions, fueling demand.

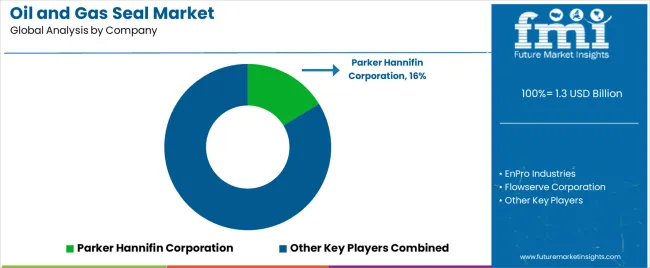

Parker Hannifin Corporation, EnPro Industries, Flowserve Corporation, Datwyler Holding Inc., Freudenberg Group, and John Crane are the key players in the oil and gas seal industry.

The oil and gas seal sector is highly competitive, dominated by global companies offering cost-competitive products. The landscape is characterized by a large supplier base, strong B2B networks, and robust partnerships throughout the value chain.

Leading companies are collaborating with end users and regional distributors to meet the growing customer base. Brand consciousness and aggressive marketing make it challenging for new entrants, while the advent of online sales channels is expected to create positive growth prospects.

The market is characterized by several multinational corporations and regional players, with industry giants and strong customer relationships to maintain leadership. Smaller and niche companies offer specialized scale inhibition solutions tailored to specific applications and regional requirements, adopting competition and innovation.

The business is characterized by competition from established players, emerging companies, and technological innovators to capture share and meet global offshore demands.

Industry Updates

As per product types, the sector has been categorized into mechanical seals, hydraulic seals, O-rings, t-seals and s-seals, metal bellow seals, lip seals, dry gas seals, v-ring packing, spring seals, and custom seals.

On the basis of applications, the sector is divided into well drilling, well completion, oil and gas production and service, and oil and gas distribution. The segment is further segmented into refining and distillation units, transportation pipelines, and carrier vessels.

The sector is divided into stainless steel, graphite/carbon, elastomers, and plastic/polymers. The plastic and polymer segment is further bifurcated into PTFE and PEEK.

The sector is trifurcated into upstream, midstream, and downstream.

Based on region, the sector is spread across North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East and Africa.

The global oil and gas seal market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the oil and gas seal market is projected to reach USD 2.0 billion by 2035.

The oil and gas seal market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in oil and gas seal market are o-rings, mechanical seals, hydraulic seals, t-seals and s-seals, metal bellow seals, lip seals, dry gas seals, v-ring packing, spring seals and custom seals.

In terms of application, oil and gas production and service segment to command 34.5% share in the oil and gas seal market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Growth – Trends & Forecast 2025 to 2035

Oil & Gas Terminal Automation Market Growth – Trends & Forecast 2025-2035

Gasket Seal Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Hose Assemblies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Oil And Gas Electric Submersible Pump Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Fittings Market Growth - Trends & Forecast 2025 to 2035

Oil and Gas Valve Market Growth – Trends & Forecast 2024-2034

Oil and Gas Data Monetization Market

Oil and Gas Pipeline Management Software Market

Oil And Gas Security And Services Market

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA