The oil filled transformer market is expected to grow steadily over the next decade, driven by rising energy demands, ongoing investments in transmission and distribution infrastructure, and increasing adoption of renewable energy sources.

Oil filled transformers are widely used in power generation, industrial applications, and utility networks, providing reliable performance, excellent thermal stability, and efficient energy transfer.

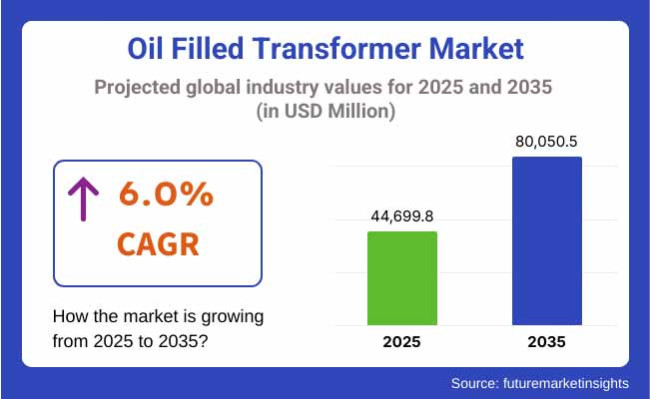

In 2025, the global oil-filled transformer market is estimated to be valued at approximately USD 44,699.8 Million. By 2035, it is projected to grow to around USD 80,050.5 Million, reflecting a compound annual growth rate (CAGR) of 6.0%.

With the expansion of grid networks, the integration of renewable energy projects, and the need for reliable and durable transformers to manage fluctuating power loads, the market is set to maintain a consistent growth trajectory. Advancements in transformer design, improved cooling technologies, and the development of eco-friendly insulating oils are further supporting the market’s expansion through 2035.

North America continues to be a prime market for oil filled transformers aided by the ongoing grid modernization programs, the growing investments in renewable energy, and a well-established power generation and distribution network. Utilities tend to be upgrading aging equipment and incorporating distributed energy resources, all of which is driving strong demand in the United States and Canada.

Europe is another major market because of an eye on energy efficiency, tough environmental laws, and strong renewable energy efforts. Advanced oil-filled transformers for a more reliable grid with less energy loss and higher renewable energy capacities are being installed in countries including Germany, the United Kingdom, and France.

The Asia-Pacific region is the fastest-growing market for oil-filled transformers, fueled by rapid urbanization, expanding industrial activities, and increasing electrification in developing countries. Countries like China, India, and Japan are witnessing rising demand for high-capacity transformers to support large-scale infrastructure projects, renewable energy installations, and industrial expansions. The region’s strong focus on grid reliability and sustainable energy development positions it as a key driver of global market growth.

Challenges: Environmental Risk, Fire Safety, and Maintenance Costs

Environmental and fire safety concerns are some of the challenges that the oil filled transformer market is currently dealing with. This is because, for example, mineral oil used as an insulating and cooling medium is flammable and presents risks of leakage, and in densely populated or industrial areas even small leaks can lead to expensive cleaning costs and regulation violations.

Furthermore, operational challenges include fire containment requirements and confined conditions in urban installations. Usual maintenance; oil testing, filtration, and monitoring raises lifecycle costs, notably in the aging grid structure and off-grid management. In addition, dry-type transformers, which are safer as well as eco-friendly alternative, are posing the threat in certain application segments, due to the increasing competition.

Opportunities: Grid Expansion, Renewable Integration, and Smart Monitoring

Despite these limitations, the oil filled transformer market is well positioned for significant growth, driven by ongoing power grid overhauls as well as rural electrification and renewable energy integration in both emerging and developed economies. OLTC are still the most economical transformers over short distance as it caters to high capacity utility substation, transmission networks and industrial loads where high efficiency, high overload capacity and longer life time are required.

Incorporation of smart transformer monitoring systems, such as thermal sensors, dissolved gas analysis (DGA) and real-time fault diagnostics, is making traditional transformers into digitally enabled grid assets. Increasing demand from solar and wind farm substations, electric railways and micro grids are further enlarging the global footprint of the market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with IEEE, IEC, and local fire/environmental safety codes. |

| Consumer Trends | Preference for long-life, low-loss transformers with traditional mineral oil insulation. |

| Industry Adoption | High use in utility substations, industrial parks, and thermal power plants. |

| Supply Chain and Sourcing | Dependent on copper, silicon steel, mineral oil, and ceramic bushings. |

| Market Competition | Dominated by ABB, Siemens Energy, Schneider Electric, GE Grid Solutions, and Toshiba. |

| Market Growth Drivers | Driven by grid reliability upgrades, power demand rise, and T&D infrastructure investments. |

| Sustainability and Environmental Impact | Initial adoption of vegetable-based oils and sealed tank systems. |

| Integration of Smart Technologies | Use of offline oil diagnostics and basic temperature sensors. |

| Advancements in Cooling Techniques | Use of natural oil circulation and radiator fins for cooling. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Adoption of low-flammability bio-oils, carbon disclosure, and smart asset monitoring mandates. |

| Consumer Trends | Shift toward smart, sensor-integrated transformers with eco-friendly insulating fluids. |

| Industry Adoption | Growing deployment in renewable integration hubs, urban substations, and smart grids. |

| Supply Chain and Sourcing | Transition to green oil sources, nanomaterial-enhanced cores, and modular factory-assembled units. |

| Market Competition | Entry of smart grid OEMs, IoT-focused transformer providers, and modular transformer system vendors. |

| Market Growth Drivers | Accelerated by decentralized energy systems, DERs, and HVDC expansion projects. |

| Sustainability and Environmental Impact | Full transition to biodegradable fluids, energy-efficient core materials, and closed-loop recycling models. |

| Integration of Smart Technologies | Expansion into IoT-enabled DGA, AI-based failure prediction, and grid-synchronized load balancing. |

| Advancements in Cooling Techniques | Innovation in forced oil cooling, compact cooling systems, and hybrid cooling designs. |

USA oil-filled transformer market is characterized by steady growth backed by the modernization of grid, replacement of aged infrastructure followed by increasing adoption of renewable energy. High-voltage and extra-high-voltage oil-immersed transformers are gradually being used by utilities and industrial facilities to improve transmission efficiency and reduce line losses. Demand is also being bolstered by government backing for energy infrastructure upgrades.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

The market in the United Kingdom is given a boost by growing electrification of transport, renewable energy programs, and upgrades to aging transmission networks. These electro insulating oils are commercially used in oil and gas transformers for substations, wind farms, and industrial power distribution networks, with increasing need for bio-based and low-flame point insulating oils for environmental compliance.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.9% |

The oil-filled transformer market is growing steadily over the European Union, powered by investments in transnational interconnectors and solar and wind integration, and industrial energy demand. The growing focus on smart grid deployment and sustainable power infrastructure is increasing the adoption of energy-efficient, hermetically sealed oil-filled transformers with high thermal management.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.0% |

Japan’s market is evolving with solid demand driven by the energy transition now taking place, substation round modernization, and the emergence of distributed energy systems. Oil-filled transformers are essential in cities or disaster-resilient grid segments, where quiet and compact designs are essential.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

South Korea as the market is growing with investments in smart grids, industrial electrification, and the expansion of power generation capacities. Sealed transformers and ester oil-filled transformers have also been adopted extensively across the country, in order to comply with eco-friendly and fire-safe infrastructure standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

The oil filled transformer market continues to grow is underpinned by both the rising investment in electric grid infrastructure, industrial electrification and renewable energy integration. Due to their high efficiency, long life, and excellent cooling properties, oil-filled transformers are extensively used in power generation, transmission, and distribution networks. These transformers are essential for load balancing and voltage regulation on urban and rural power networks. Breakup by Core Type: Berry Closed Shell Breakup by Winding: Auto-transformer Two Winding).

| Core Type | Market Share (2025) |

|---|---|

| Closed | 46.2% |

The closed core segment is expected to have the largest market share from 46.2% of the global share in 2025. Closed core transformers have a compact structure and lower magnetic flux leakage, resulting in increased efficiency, which are suitable for medium to high voltage transmission systems.

This allows better magnetic coupling between windings with lower losses and improved reliability due to their symmetrical magnetic path. This fundamental type is favored throughout utility substations, industrial areas, and renewable energy directories, especially in regions experiencing increasing needs for reliable and effective energy provision. However, with countries investing in the expansion of grids, energy access programs, and intelligent power distribution, the closed core segment is likely to retain its lead.

| Winding Type | Market Share (2025) |

|---|---|

| Two Winding | 58.7% |

The winding segment is mainly dominated by two winding transformers which is expected to hold around 58.7% by 2025. These transformers possess distinct primary and secondary windings, enabling electrical separation and voltage transformation over an extensive range of power applications. Harmonic compensation, and reactive power flow control for use in distribution networks, industrial loads, and renewable energy systems as needed.

The segment benefits from its design flexibility, ease of maintenance, and cost-effectiveness, particularly in medium-voltage and large-scale utility applications. With increasing power demand, infrastructure modernization, and energy diversification efforts, the adoption of two winding oil-filled transformers continues to rise globally.

Growing investments in power transmission and distribution (T&D) infrastructure in particular developing economies, renewable energy integration, and grid modernization projects provide a healthy foundation for the growth of the oil filled transformer market. For medium to high-voltage applications, these transformers are better thermally and can handle overloads better as well.

Manufacturers are increasingly focusing on bio-based insulating oils, as well as compact modular designs and digital monitoring systems to enhance operational safety, efficiency, and lifecycle performance.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Siemens Energy | 18–22% |

| ABB Ltd. (Hitachi Energy) | 16–20% |

| General Electric Company | 12–16% |

| Schneider Electric SE | 8–12% |

| Toshiba Energy Systems & Solutions | 6–9% |

| Other Companies (combined) | 25–30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Siemens Energy | In 2024, introduced digitally monitored oil-immersed transformers for renewable-heavy grids. In 2025, expanded offerings in eco-efficient insulation fluids and compact substations across Asia-Pacific. |

| Hitachi Energy (ABB Ltd.) | In 2024, rolled out TXpert™ Ecosystem for real-time performance insights of oil filled transformers. In 2025, introduced low-loss distribution transformers optimized for smart grid applications. |

| General Electric (GE) | In 2024, upgraded Autotransformer and Step-up transformer series with smart sensors and bio-based oil options. In 2025, increased presence in sub-Saharan Africa and Southeast Asia through grid partnership programs. |

| Schneider Electric | In 2024, launched Eco-design transformers with low-flammability ester oil for urban substations. In 2025, integrated thermal overload prediction AI models into its digital monitoring suite. |

| Toshiba Energy Systems | In 2024, expanded large oil-immersed transformer production for offshore wind and industrial power stations. In 2025, introduced customizable modular designs for quick deployment in disaster-prone areas. |

Key Company Insights

Siemens Energy (18-22%)

Siemens Energy offers a robust line of oil-filled power and distribution transformers, emphasizing smart diagnostics, grid resilience, and eco-friendly fluids. Its global manufacturing footprint allows deployment in both mature and emerging markets.

Hitachi Energy (16-20%)

A key innovator, Hitachi Energy (formerly ABB) integrates its TXpert™ platform to enable predictive maintenance and real-time grid response. It continues to lead in energy-efficient and IoT-enabled transformer systems.

General Electric (12-16%)

GE focuses on customizable oil-filled transformers for utilities, renewables, and industrial applications, backed by advanced analytics and bio-oil insulation options to reduce environmental impact.

Schneider Electric (8-12%)

Schneider is expanding in urban and commercial sectors, offering eco-conscious and fire-resistant transformer systems with compact footprints and smart grid-ready interfaces.

Toshiba Energy Systems (6-9%)

Toshiba delivers high-capacity oil-filled transformers for heavy-duty industrial and renewable projects, while investing in design flexibility and deployment speed through modular engineering.

Other Key Players (25-30% Combined)

The overall market size for the oil filled transformer market was USD 44,699.8 Million in 2025.

The oil filled transformer market is expected to reach USD 80,050.5 Million in 2035.

Growth is driven by the rising demand for efficient power transmission, increasing investments in grid infrastructure modernization, growing electrification in emerging economies, and the expansion of renewable energy integration into national grids.

The top 5 countries driving the development of the oil filled transformer market are China, India, the USA, Germany, and Brazil.

Power Transformers and Distribution Transformers are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Core, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Core, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Mode of Cooling, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Mode of Cooling, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Core, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Core, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Mode of Cooling, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Mode of Cooling, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Core, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Core, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Mode of Cooling, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Mode of Cooling, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Core, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Core, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Mode of Cooling, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Mode of Cooling, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Core, 2018 to 2033

Table 44: East Asia Market Volume (Units) Forecast by Core, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 46: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Mode of Cooling, 2018 to 2033

Table 48: East Asia Market Volume (Units) Forecast by Mode of Cooling, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 51: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia Market Value (US$ Million) Forecast by Core, 2018 to 2033

Table 54: South Asia Market Volume (Units) Forecast by Core, 2018 to 2033

Table 55: South Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 56: South Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 57: South Asia Market Value (US$ Million) Forecast by Mode of Cooling, 2018 to 2033

Table 58: South Asia Market Volume (Units) Forecast by Mode of Cooling, 2018 to 2033

Table 59: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: South Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 61: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: Oceania Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: Oceania Market Value (US$ Million) Forecast by Core, 2018 to 2033

Table 64: Oceania Market Volume (Units) Forecast by Core, 2018 to 2033

Table 65: Oceania Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 66: Oceania Market Volume (Units) Forecast by Product, 2018 to 2033

Table 67: Oceania Market Value (US$ Million) Forecast by Mode of Cooling, 2018 to 2033

Table 68: Oceania Market Volume (Units) Forecast by Mode of Cooling, 2018 to 2033

Table 69: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: Oceania Market Volume (Units) Forecast by Application, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Core, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Core, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Mode of Cooling, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Mode of Cooling, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Core, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Mode of Cooling, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Core, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Core, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Core, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Core, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Mode of Cooling, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Mode of Cooling, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Mode of Cooling, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Mode of Cooling, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Core, 2023 to 2033

Figure 27: Global Market Attractiveness by Product, 2023 to 2033

Figure 28: Global Market Attractiveness by Mode of Cooling, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Core, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Mode of Cooling, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Core, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Core, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Core, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Core, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Mode of Cooling, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Mode of Cooling, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Mode of Cooling, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Mode of Cooling, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Core, 2023 to 2033

Figure 57: North America Market Attractiveness by Product, 2023 to 2033

Figure 58: North America Market Attractiveness by Mode of Cooling, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Core, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Mode of Cooling, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Core, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Core, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Core, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Core, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Mode of Cooling, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Mode of Cooling, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Mode of Cooling, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Mode of Cooling, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Core, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Mode of Cooling, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Core, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Mode of Cooling, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Core, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Core, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Core, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Core, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Mode of Cooling, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Mode of Cooling, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Mode of Cooling, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Mode of Cooling, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Europe Market Attractiveness by Core, 2023 to 2033

Figure 117: Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Europe Market Attractiveness by Mode of Cooling, 2023 to 2033

Figure 119: Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Core, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Mode of Cooling, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) Analysis by Core, 2018 to 2033

Figure 131: East Asia Market Volume (Units) Analysis by Core, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Core, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Core, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 135: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 138: East Asia Market Value (US$ Million) Analysis by Mode of Cooling, 2018 to 2033

Figure 139: East Asia Market Volume (Units) Analysis by Mode of Cooling, 2018 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Mode of Cooling, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Mode of Cooling, 2023 to 2033

Figure 142: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Core, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Mode of Cooling, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ Million) by Core, 2023 to 2033

Figure 152: South Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 153: South Asia Market Value (US$ Million) by Mode of Cooling, 2023 to 2033

Figure 154: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ Million) Analysis by Core, 2018 to 2033

Figure 161: South Asia Market Volume (Units) Analysis by Core, 2018 to 2033

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Core, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Core, 2023 to 2033

Figure 164: South Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 165: South Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 168: South Asia Market Value (US$ Million) Analysis by Mode of Cooling, 2018 to 2033

Figure 169: South Asia Market Volume (Units) Analysis by Mode of Cooling, 2018 to 2033

Figure 170: South Asia Market Value Share (%) and BPS Analysis by Mode of Cooling, 2023 to 2033

Figure 171: South Asia Market Y-o-Y Growth (%) Projections by Mode of Cooling, 2023 to 2033

Figure 172: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 173: South Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 174: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 175: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 176: South Asia Market Attractiveness by Core, 2023 to 2033

Figure 177: South Asia Market Attractiveness by Product, 2023 to 2033

Figure 178: South Asia Market Attractiveness by Mode of Cooling, 2023 to 2033

Figure 179: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Core, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Product, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Mode of Cooling, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Core, 2018 to 2033

Figure 191: Oceania Market Volume (Units) Analysis by Core, 2018 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Core, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Core, 2023 to 2033

Figure 194: Oceania Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 195: Oceania Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 198: Oceania Market Value (US$ Million) Analysis by Mode of Cooling, 2018 to 2033

Figure 199: Oceania Market Volume (Units) Analysis by Mode of Cooling, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Mode of Cooling, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Mode of Cooling, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 203: Oceania Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Core, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Product, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Mode of Cooling, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Core, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Mode of Cooling, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Core, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Core, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Core, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Core, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Mode of Cooling, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Mode of Cooling, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Mode of Cooling, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Mode of Cooling, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Core, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Mode of Cooling, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Transformer Oil Market Growth - Trends & Forecast 2025 to 2035

Oil Immersed Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Transformer Market Growth – Trends & Forecast 2025 to 2035

Biobased Transformer Oil Market

Naphthenic Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Paraffinic Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Uninhibited Transformer Oil Market

Mineral Based Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Silicone Based Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Transformer Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Transformer Valve Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA