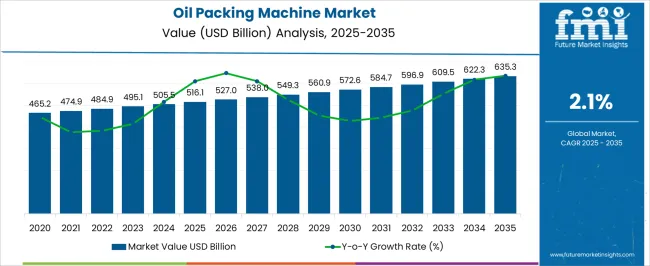

The Oil Packing Machine Market is estimated to be valued at USD 516.1 billion in 2025 and is projected to reach USD 635.3 billion by 2035, registering a compound annual growth rate (CAGR) of 2.1% over the forecast period.

The Oil Packing Machine market is experiencing steady growth, driven by increasing demand for packaged edible oils in both retail and industrial sectors. Rising consumer awareness about hygiene, convenience, and quality standards is accelerating the adoption of automated packing solutions. Automation technologies are enhancing efficiency, reducing manual labor, and minimizing operational errors, thereby improving productivity and reducing downtime in packing operations.

Form, fill, and seal machines are being increasingly adopted due to their ability to perform multiple functions in a single unit, ensuring faster processing and higher throughput. Vertical form fill seal machines are preferred for their compact design, consistent packaging accuracy, and adaptability to different packaging sizes and formats. The growing trend toward standardized, tamper-evident, and sustainable packaging is further supporting market expansion.

Manufacturers are also focusing on integrating smart sensors and IoT-based monitoring systems to enhance operational visibility and maintenance efficiency With increasing demand for packaged oils and regulatory emphasis on safety and quality, the market is poised for sustained growth and technological advancement over the coming years.

| Metric | Value |

|---|---|

| Oil Packing Machine Market Estimated Value in (2025 E) | USD 516.1 billion |

| Oil Packing Machine Market Forecast Value in (2035 F) | USD 635.3 billion |

| Forecast CAGR (2025 to 2035) | 2.1% |

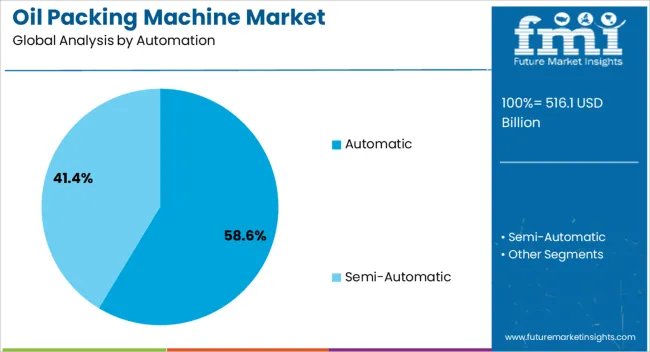

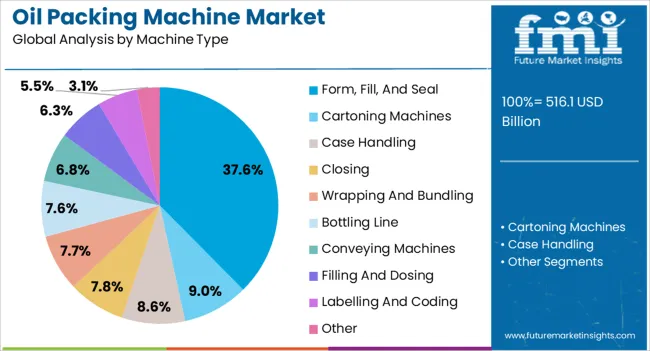

The market is segmented by Automation, Machine Type, Orientation, and End Use and region. By Automation, the market is divided into Automatic and Semi-Automatic. In terms of Machine Type, the market is classified into Form, Fill, And Seal, Cartoning Machines, Case Handling, Closing, Wrapping And Bundling, Bottling Line, Conveying Machines, Filling And Dosing, Labelling And Coding, and Other. Based on Orientation, the market is segmented into VFFS Machine and HFFS Machine. By End Use, the market is divided into Food, Cosmetic And Personal Care, Pharmaceutical, and Oil And Lubricant. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic automation segment is projected to hold 58.6% of the market revenue in 2025, establishing it as the leading automation category. Its dominance is driven by the ability to perform complex packing operations with minimal human intervention, which reduces labor costs and improves consistency in production. Automatic machines provide precise control over filling, sealing, and labeling processes, which enhances efficiency and minimizes material waste.

Integration with advanced monitoring systems and sensors allows real-time tracking of production metrics and predictive maintenance, reducing downtime and operational risks. The increasing demand for large-scale, high-volume packing operations in edible oil production has reinforced the preference for automatic automation.

Flexibility in handling various packaging formats and sizes further strengthens its adoption As the market continues to prioritize operational efficiency, productivity, and compliance with hygiene standards, the automatic automation segment is expected to maintain its leadership position, supported by continuous technological improvements and growing industrial adoption.

The form, fill, and seal machine type segment is anticipated to account for 37.6% of the market revenue in 2025, making it the leading machine type category. Growth is driven by the ability of these machines to perform multiple functions simultaneously, including shaping the package, filling with oil, and sealing for distribution, which reduces production time and enhances throughput.

The versatility of these machines in handling different bag sizes, materials, and configurations makes them suitable for small-scale and large-scale operations alike. Manufacturers benefit from reduced labor dependency and improved packaging precision, which ensures consistent product quality and minimizes waste.

The integration of automatic controls and sensors further optimizes performance, reduces errors, and supports compliance with hygiene and safety regulations With the growing demand for packaged edible oils, especially in retail markets, form, fill, and seal machines are expected to remain the preferred choice for operators seeking efficient, scalable, and high-performance packaging solutions.

The vertical form fill seal VFFS machine orientation segment is expected to hold 62.4% of the market revenue in 2025, establishing it as the leading orientation category. Its growth is being driven by the ability to handle a wide range of packaging sizes and materials while maintaining high accuracy and speed. VFFS machines provide a compact design that optimizes floor space and allows easy integration into automated production lines.

The orientation supports consistent sealing, precise filling, and minimal product wastage, which are critical for operational efficiency. Increasing demand for tamper-evident, hygienic, and consumer-friendly packaging in the edible oil industry is further boosting adoption.

VFFS machines also enable easy adjustment for various bag formats, supporting flexibility in product offerings As manufacturers continue to invest in automation and high-throughput packing solutions, the VFFS orientation segment is expected to sustain its leadership position, driven by efficiency, adaptability, and reduced operational costs.

The automation and industrial development trends in food and beverages stimulate the oil packing machine adoption to ramp up the productivity and efficiency of production. The strict rules imposed by regulatory bodies and quality standards organizations on food packaging and safety force oil packing machine manufacturers to invest in advanced packaging equipment to assure product integrity.

The oil packing machine vendors strive to lower production costs and flourish product efficiency. Investing in advanced oil packing machines aids in streamlining the production process, cutting down wastage, and entailing cost savings.

Expanding retail distribution channels, like hypermarkets and e-commerce platforms, are spurring the need for diverse packaging solutions to cater to assorted consumer demands. This factor escalates the adoption of oil packing machines.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 476.40 million |

| Market Value for 2025 | USD 505.50 million |

| Market CAGR from 2020 to 2025 | 1.30% |

Installing and maintaining sophisticated, automated oil-packing machinery involves a sizable upfront cost. This is a significant deterrent for small and medium-sized oil producers to enter the market and constrain their capacity to use cutting-edge packaging techniques.

Certain oil packing machines are unable to adjust to variations in the sizes, materials, or forms of packaging. This rigidity inhibits the widespread adoption of oil packing machine producers to adapt to evolving market conditions, and customer preferences, which result in inefficiencies and lost opportunities.

The segmented oil packing machine market analysis is included in the following subsection. Based on exhaustive report, the automatic sector is controlling the automation category of the oil filling machine market. Likewise, the oil packing machine producer trends suggest that the form, fill and seal machine segment is dominating the machine type category.

| Segment | Automatic |

|---|---|

| Share (2025) | 58.63% |

The automatic oil packing machine has the potential to command the global market and create revenue opportunities of USD 516.1 million from 2025 to 2035. The high preference for automatic oil packing machines is due to their attributes such as better-quality control, minimized labor costs, enhanced productivity, dependability, and flexibility.

The increasing adoption of automatic oil packing machines owes to their surging efficiency and potency amplifying the growth of the oil packing machine market.

| Segment | Form, Fill and Seal Machine |

|---|---|

| Share (2025) | 37.6% |

The form, fill, and seal machine has surged in adoption as the products created by it are easy to handle. The form, fill, and seal machines deliver better product quality, density, and safety, ensuring precision and luring end users' demands.

There is a high demand for form, fill, and seal machines, since they minimize labor costs with their flexible and fast production processes.

The oil pouch packing machine market is surveyed in the following tables, which concentrate on the dominating regions in North America, Europe, and Asia Pacific. An all-inclusive assessment illustrates that Asia Pacific has tremendous market opportunities for oil packing machines.

Sales Analysis of Oil Packing Machine in North America

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 0.70% |

| Canada | 0.40% |

The United States extends a profitable landscape for oil packing machine producers offering to varied consumer demand, because of the presence of a strong food and beverage sector. The technological progression and automation usher the efficiency and productivity in the United States oil pouch packing machine market.

The surging consumer demand for speciality oils trigger the innovation of packaging design and material in Canada oil packing machine market. Digitization and smart technology adoption picks up speed in the Canada oil filling machine market, owing to the resource optimization and cost-effectiveness.

Market Overview of Oil Packing Machine in Europe

| Country | CAGR (2025 to 2035) |

|---|---|

| Spain | 2.40% |

| France | 1.20% |

| Italy | 0.90% |

| United Kingdom | 0.80% |

| Germany | 0.50% |

The concerns about environmental sustainability trigger the adoption of environment-friendly packaging materials and energy-efficient equipment in the Spain oil pouch packing machine market. Spain oil packing machine manufacturers are emphasizing customization and versatility in packaging solutions to serve the varied consumer demands.

Integrating smart technologies, such as the Internet of Things and Artificial Intelligence, in oil packaging machines is catapulted by research and development investments to optimize manufacturing processes in France. The French oil packing equipment market is spurring changes in flexible and modular packaging design due to the transition toward smaller batch sizes and specialty oil products.

The Italian oil packing sector is adopting energy-efficient machinery and environment-friendly packaging materials due to sustainability concerns, stirring up the adoption of oil packing machines. To respond to the booming need for effective packaging solutions, Italian oil packing machine manufacturers are utilizing innovative automation technology to streamline their manufacturing processes.

Emerging Trends of Oil Packing Machine Market in Asia Pacific

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.40% |

| China | 4.70% |

| Thailand | 4.10% |

| South Korea | 2.40% |

| Japan | 1.90% |

The government schemes encouraging food safety and hygiene standards escalate the adoption of oil packing machine in India. The flourishing investments in technological advancements and automation develop the competitive landscape of the Indian oil pouch packing machine market. The surging e-commerce bolsters the need for productive and adaptable oil-packing solutions in India liquid filling machine market.

The demand for packaged oils is advocated by rising disposable income and convenience, which is promoting China to clutch cutting-edge oil packing machines. The oil packing machine market in China is reshaping due to technological breakthroughs like IoT integration and smart packaging solutions.

The packaging industry of Thailand witnessed the adoption of oil packing machines at a swift pace because of convenience and shelf-stable product demand. The Thailand oil filling machines market observes an upsurge in sustainability initiatives adoption and eco-friendly packaging solutions.

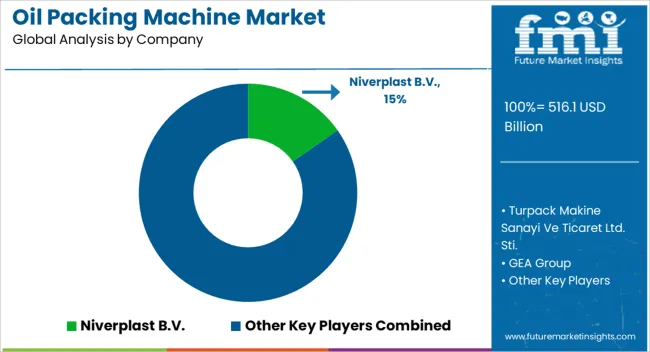

Many prominent oil packing machine manufacturers play a significant part in carving out the market's competitive landscape. The essential oil packing machine vendors operate on technological innovations and are widely recognized for reliability.

LPE (Levapack), APACKS, Unitech Engineering Company, Bestar Packaging Machine Co., Ltd., Ruian RunLi Machinery Co., Ltd., and Wenzhou Wimach Machinery Co., Ltd. diversify their product portfolio as a key to oil packing machine market success.

Nichrome Packaging Solutions, Foshan Land Packaging Machinery Co. Ltd., Siklmx Co. Ltd., and Turpack Packaging Machinery are eminent providers, bestowing their expertise and diverse solutions.

Vendors of oil packing machines are always on the look out to improve their technology and competence to fulfill consumer demands. As the competition toughens, the pivotal differentiator is innovation, which spurs evolution in the oil filling machine market and determines its future track.

Novel Strides

| Company | Details |

|---|---|

| Hassia-Redatron | Hassia-Redatron announced in June 2025 that would be teaming up with Alratech Group to expand its capacity in the Asia Pacific market. In the Indian market, Alratech Group to cater as Hassia-Redatron's authorized sales representative. |

| Matrix Packaging Machinery | Matrix Packaging Machinery and Cetec Industries formed an agreement to deliver customers an all-inclusive application solution commencing from March 2025. |

| Filpack Servo SMD | Filpack Servo SMD is a new device that Nichrome added to its cooking oil packaging machines in July 2024. The Filpack Servo SMD is a PLC-controlled oil-packing machine that is light in weight, sturdy, and easy to use and maintain. |

The global oil packing machine market is estimated to be valued at USD 516.1 billion in 2025.

The market size for the oil packing machine market is projected to reach USD 635.3 billion by 2035.

The oil packing machine market is expected to grow at a 2.1% CAGR between 2025 and 2035.

The key product types in oil packing machine market are automatic and semi-automatic.

In terms of machine type, form, fill, and seal segment to command 37.6% share in the oil packing machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oil Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Coil Winding Machine Market Growth – Trends & Forecast 2024 to 2034

Foil Embossing Machine Market Size and Share Forecast Outlook 2025 to 2035

Case Packing Machines Market from 2025 to 2035

Tray Packing Machine Market

Tablet Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Powder Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Tablet Packing Machine Industry

Leading Providers & Market Share in Powder Packing Machines

Garment Packing Machine Market Trends & Forecast 2024-2034

Motorized Decoiler Machine Market Growth - Trends & Forecast 2025 to 2035

Liquid Pouch Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Liquid Pouch Packing Machine Companies

Inline Foil Punch and Seal Machines Market Size and Share Forecast Outlook 2025 to 2035

Commercial Oil Extraction Machine Market Size and Share Forecast Outlook 2025 to 2035

Side Load Case Packing Machines Market Size and Share Forecast Outlook 2025 to 2035

PLC Controlled Packing Machine Market Trends – Forecast 2024-2034

Tray and Sleeve Packing Machines Market Size and Share Forecast Outlook 2025 to 2035

Kitchen/ Toilet Roll Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA