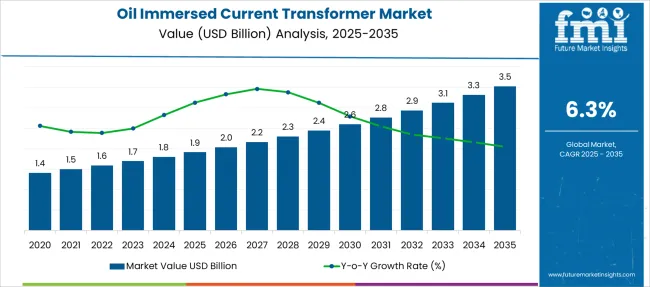

The Oil Immersed Current Transformer Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Oil Immersed Current Transformer Market Estimated Value in (2025 E) | USD 1.9 billion |

| Oil Immersed Current Transformer Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The oil immersed current transformer market is progressing steadily, backed by the increasing need for efficient power measurement and monitoring systems across transmission and distribution networks. These transformers offer superior insulation, durability, and thermal stability, making them highly suitable for high-voltage and outdoor applications.

The growing demand for grid modernization and the integration of renewable energy sources into national grids are also encouraging the deployment of advanced oil-immersed technologies. Favorable infrastructure investments and the rising emphasis on substation automation further support the market's upward trajectory.

Additionally, the ability of oil-immersed transformers to function reliably in extreme environments positions them as essential components in power-critical installations. The market outlook remains favorable, supported by growing energy consumption in emerging economies and continuous efforts to minimize transmission losses and enhance grid reliability.

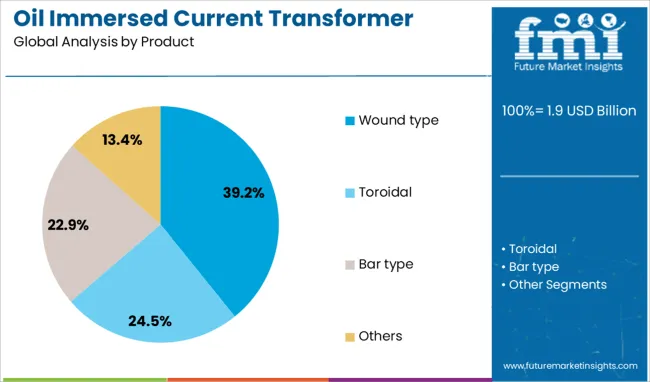

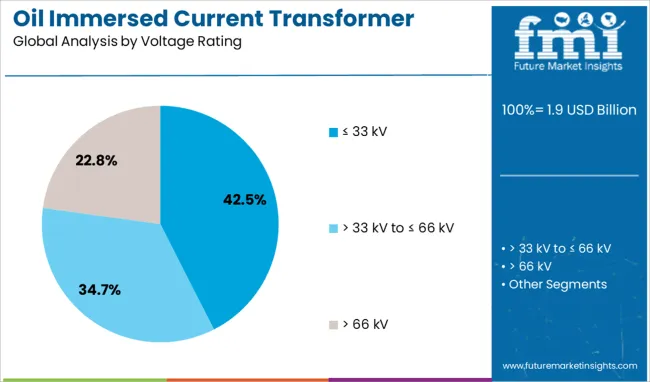

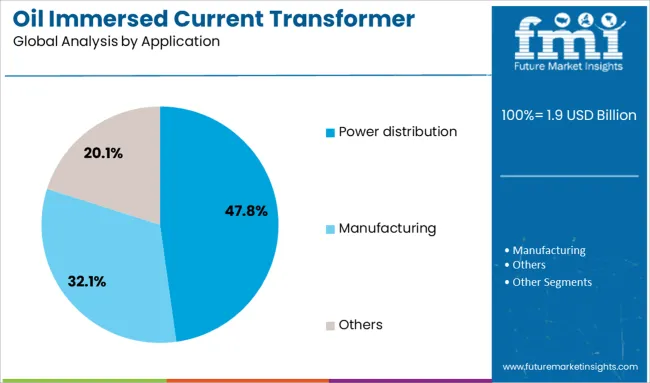

The oil immersed current transformer market is segmented by product, voltage rating, application and geographic regions. The product of the oil-immersed current transformer market is divided into Wound type, Toroidal, Bar type, and Others. In terms of voltage rating, the oil-immersed current transformer market is classified into ≤ 33 kV, > 33 kV to ≤ 66 kV, and > 66 kV. Based on the application of the oil-immersed current transformer market, it is segmented into Power distribution, Manufacturing, and Others. Regionally, the oil-immersed current transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wound type segment leads the product category with a 39.2% share, driven by its adaptability for medium- and high-current measurement in power systems requiring precise accuracy. This design offers superior mechanical strength and insulation properties, making it ideal for applications where safety and performance stability are critical.

The segment has seen increased adoption in grid infrastructure projects, particularly in urban and industrial zones where compact yet robust solutions are necessary. Wound type transformers are also favored for their ease of customization, allowing utilities to meet specific technical requirements across diverse network conditions.

Manufacturers continue to enhance these units with improved oil insulation and better fault detection capabilities. As infrastructure upgrades and substation expansions continue globally, the demand for wound type oil-immersed transformers is expected to remain strong across utility and industrial sectors.

The ≤ 33 kV segment commands a 42.5% share in the voltage rating category, driven by widespread deployment in medium-voltage distribution networks and secondary substations. This voltage class is particularly vital for local transmission and distribution operations, where reliable current measurement is essential for grid stability and operational safety.

The segment's growth is fueled by increasing investments in power infrastructure across both urban and rural settings, especially in emerging markets focusing on electrification and grid strengthening. Oil immersed transformers rated ≤ 33 kV are preferred for their longevity, overload resistance, and ability to perform under fluctuating load conditions.

As utilities prioritize modernizing mid-voltage networks to reduce losses and improve service continuity, the ≤ 33 kV segment is expected to retain its relevance and grow steadily.

The power distribution segment leads the application category with a significant 47.8% market share, reflecting the critical role oil immersed current transformers play in measuring, monitoring, and protecting downstream power systems. These transformers are essential components in substations and distribution grids, ensuring accurate current flow data, fault detection, and system efficiency.

As energy demand rises and distributed generation becomes more prevalent, the need for precise and durable instrumentation within distribution networks grows. Investments in smart grid initiatives and infrastructure upgrades across developing and developed regions are reinforcing demand within this segment.

Additionally, aging electrical grids in several countries are being replaced or retrofitted with updated oil-immersed transformer units. The segment is expected to remain a primary growth driver, underpinned by ongoing improvements in distribution network reliability, automation, and safety.

The oil-immersed current transformer market is growing due to increased investments in grid expansion, substation upgrades, and high-voltage transmission projects. Opportunities are rising in digital current transformers integrated with monitoring systems for utilities seeking predictive maintenance solutions.

Key trends include compact designs for space-constrained substations and integration of IoT-based diagnostics for real-time performance insights. However, restraints such as volatile oil prices, long installation cycles, and competition from dry-type alternatives continue to challenge market penetration. Manufacturers prioritizing cost-efficient designs, safety compliance, and long-life insulation systems are expected to maintain a competitive edge in 2025 and beyond.

Growth in the oil-immersed current transformer market is driven by rising demand for high-accuracy measurement in transmission systems. In 2024, utilities in Asia-Pacific and North America accelerated substation modernization programs to support renewable power integration, increasing procurement of oil-immersed transformers rated above 245 kV.

These devices were selected for their reliability in harsh outdoor conditions and proven insulation properties. It is widely believed that ongoing investment in HV and EHV grid networks will sustain strong adoption, as utilities aim to ensure grid stability under growing electrification and distributed generation demands.

Opportunities are emerging in intelligent oil-immersed current transformers offering integrated sensors for real-time monitoring of oil temperature, dielectric strength, and secondary circuit performance. In 2025, European utilities awarded contracts for such transformers in interconnection projects to improve asset reliability and predictive maintenance strategies. Demand from utilities seeking digital substations for improved lifecycle management has further enhanced the relevance of these products. It is considered that manufacturers delivering smart transformers with automated diagnostics and modular design will capitalize on this transition toward data-driven asset management across high-voltage networks.

A key trend in 2024 and 2025 is the introduction of compact oil-immersed current transformers tailored for space-limited substations and offshore installations. Advanced models are being deployed with IoT-enabled diagnostic systems, allowing remote tracking of insulation quality and oil health. Several utilities in Asia implemented transformers equipped with wireless monitoring platforms for critical fault prediction. It is strongly believed that solutions combining space efficiency, digital connectivity, and low-maintenance features will define procurement strategies, particularly in regions emphasizing grid reliability and operational cost optimization under constrained land availability.

The market faces significant restraints due to the high cost of installation, oil handling requirements, and extended commissioning timelines. In 2024, multiple projects in Europe reported delays caused by oil leak compliance checks and complex safety procedures. Additionally, growing adoption of dry-type current transformers for indoor substations and GIS applications is intensifying competition.

It is considered that without cost-reduction measures and simplified installation practices, smaller suppliers will face challenges in maintaining margins and meeting procurement preferences that increasingly favor compact, maintenance-free alternatives in modern transmission environments.

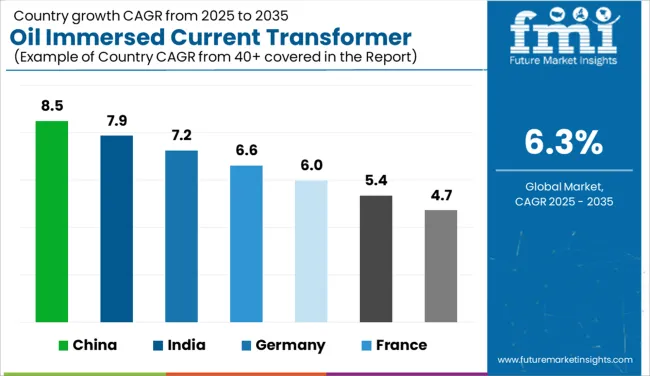

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The global oil immersed current transformer market is projected to grow at a CAGR of 6.3% from 2025 to 2035. China leads with 8.5%, followed by India at 7.9% and Germany at 7.2%. France posts 6.6%, while the United Kingdom records 6.0%. Growth is driven by increasing electricity demand, grid modernization projects, and renewable integration requiring high-accuracy transformers. China and India dominate due to large-scale substation expansions, while Germany emphasizes precision transformers for industrial applications. France and the UK focus on compact oil-immersed designs for urban grid upgrades and transmission system reliability.

The oil immersed current transformer market in China is projected to grow at 8.5%, driven by extensive grid expansion and high-voltage transmission projects. Medium and high-voltage transformers dominate installations for power utilities. Manufacturers integrate smart monitoring systems for real-time fault detection. Renewable energy integration further boosts demand for oil immersed current transformers in substations.

The oil immersed current transformer market in India is forecast to grow at 7.9%, supported by rapid urbanization and increasing industrial energy demand. Single-phase oil immersed units dominate distribution networks. Manufacturers develop cost-optimized designs to support state electrification programs. Government-backed renewable projects and substation upgrades accelerate adoption of oil immersed CTs nationwide.

The oil immersed current transformer market in Germany is expected to grow at 7.2%, driven by modernization of aging power infrastructure and Industry 4.0 initiatives. Three-phase oil immersed transformers dominate heavy industrial applications. Manufacturers prioritize oil insulation systems with advanced thermal stability. EU regulations supporting smart grid deployment further fuel CT adoption in industrial and commercial setups.

The oil immersed current transformer market in France is forecast to grow at 6.6%, supported by transmission line upgrades and renewable grid connections. Compact oil immersed designs dominate installations in urban substations. Manufacturers adopt eco-friendly insulating oils to meet EU sustainability targets. Rising investment in offshore wind projects further boosts CT integration in high-voltage systems.

The oil immersed current transformer market in the UK is projected to grow at 6.0%, driven by demand for stable power transmission in high-density regions. Modular transformer designs dominate deployment in flexible substations. Manufacturers integrate IoT-enabled diagnostics for predictive maintenance. Expansion of offshore renewable projects and interconnectors strengthens CT usage across transmission networks.

The oil immersed current transformer market is moderately consolidated, with ABB recognized as a leading player due to its extensive product portfolio, global presence, and expertise in high-voltage equipment for power transmission and distribution systems. ABB focuses on providing high-accuracy current measurement solutions with superior insulation and thermal performance, ensuring reliability in critical grid applications. Key players include Amran, ARTECHE, Automatic Electric, CG Power and Industrial Solutions, Dalian Huayi Electric Power Electric Appliances, General Electric, Guangdong Sihui Instrument Transformer Works, Hitachi Energy, Instrument Transformers, Macroplast, NISSIN ELECTRIC, Peak Demand, Samata Electricals, Siemens Energy, and Wenzhou Unisun Electric. These companies manufacture oil-immersed CTs designed for high-voltage and extra-high-voltage substations, power plants, and industrial applications, prioritizing safety, durability, and compliance with international standards such as IEC and ANSI. Market growth is driven by the increasing demand for grid stability, modernization of transmission infrastructure, and expansion of renewable energy projects requiring accurate current monitoring. Manufacturers are investing in advanced insulation technologies, optimized core designs for improved accuracy, and maintenance-free designs to reduce lifecycle costs. Emerging trends include the integration of digital sensors for real-time monitoring and smart grid compatibility, as well as the development of eco-friendly insulation oils to meet sustainability goals. Asia-Pacific dominates the market due to large-scale grid expansion, while North America and Europe continue to upgrade legacy infrastructure with technologically advanced solutions.

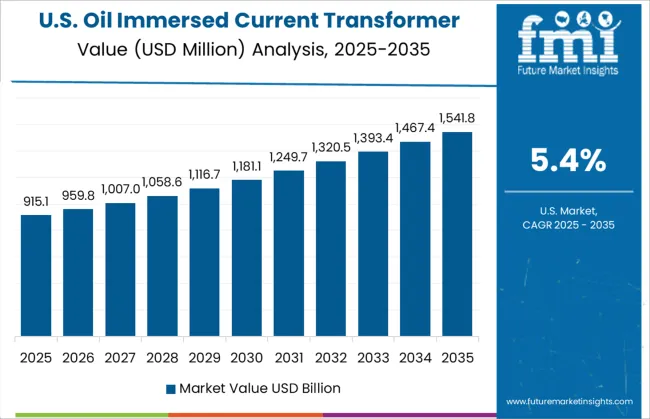

In February 2024, Siemens Energy invested USD 150 million to expand its Charlotte, North Carolina, transformer facility. The project aims to boost production capacity, enabling 57 large power transformers annually by 2026. This strategic move supports USA grid modernization and strengthens the domestic supply of critical electrical components.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Product | Wound type, Toroidal, Bar type, and Others |

| Voltage Rating | ≤ 33 kV, > 33 kV to ≤ 66 kV, and > 66 kV |

| Application | Power distribution, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Amran, ARTECHE, Automatic Electric, CG Power and Industrial Solutions, Dalian Huayi Electric Power Electric Appliances, General Electric, Guangdong Sihui Instrument Transformer Works, Hitachi Energy, Instrument Transformers, Macroplast, NISSIN ELECTRIC, Peak Demand, Samata Electricals, Siemens Energy, and Wenzhou Unisun Electric |

| Additional Attributes | Dollar sales categorized by product type (wound, toroidal, bar-type), voltage rating (low, medium, high), and application (utilities, industrial, commercial). Regional demand remains highest in Asia-Pacific, with Europe and North America showing steady adoption. Innovations include biodegradable insulating oils, IoT-enabled condition monitoring, and AI-driven diagnostic systems integrated into smart grid infrastructures. |

The global oil immersed current transformer market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the oil immersed current transformer market is projected to reach USD 3.5 billion by 2035.

The oil immersed current transformer market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in oil immersed current transformer market are wound type, toroidal, bar type and others.

In terms of voltage rating, ≤ 33 kv segment to command 42.5% share in the oil immersed current transformer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Oil Based Electric Drive Unit (EDU) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA