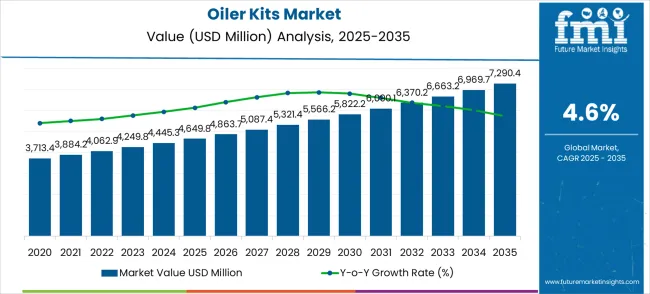

The oiler kits market is projected to grow from USD 2,890.4 million in 2025 to USD 4,649.87 million by 2035, reflecting an absolute dollar opportunity driven by steady adoption across automotive, industrial machinery, and construction equipment sectors. The demand is being reinforced by the critical role oiler kits play in ensuring consistent lubrication, reducing wear and tear, and extending the operational lifespan of mechanical systems.

Growth is influenced by increasing maintenance efficiency requirements, with organizations prioritizing preventive maintenance measures to avoid costly downtime. The rising deployment of automated lubrication systems and integration of oiler kits into standard maintenance schedules is creating sustained market expansion.

The market trajectory indicates that investment in reliable lubrication solutions is being recognized as a key factor for operational efficiency, which strengthens the overall value proposition of oiler kits across multiple heavy-use applications.

Over the forecast period, the CAGR of 4.6% indicates a steady but substantial increase in market penetration and adoption. Industrial and commercial operators are prioritizing solutions that reduce manual intervention while maintaining high performance and equipment reliability. OEMs and maintenance service providers are enhancing product availability, modularity, and compatibility, which further fuels demand.

Market dynamics are shaped by the growing emphasis on operational continuity, precision in machinery performance, and cost-effective maintenance practices. These factors collectively ensure that oiler kits maintain relevance as a critical component in equipment upkeep strategies.

As end-users increasingly recognize the economic benefits of reduced downtime and improved efficiency, the oiler kits market is expected to sustain significant absolute dollar growth throughout the 2025–2035 period, solidifying its position within industrial maintenance ecosystems.

The oiler kits market has been positioned as an essential subset across several industrial and automotive domains, holding around 6.4% of the industrial lubrication equipment market, 7.2% of the automotive maintenance tools market, 5.5% of the machinery maintenance market, 4.8% of the workshop tools market, and 3.9% of the mechanical equipment market.

Taken together, the combined share of the oiler kits market across these parent sectors is approximately 27.8%. This demonstrates how oiler kits are increasingly relied upon for precise lubrication, extended equipment life, and improved operational efficiency.

The market has gained recognition among manufacturers, workshop operators, and maintenance professionals, establishing its relevance as a practical solution in routine mechanical and industrial upkeep.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2,890.4 million |

| Market Forecast Value (2035) | USD 4,649.87 million |

| Forecast CAGR (2025 to 2035) | 4.6% |

Market expansion is being supported by the rapid industrialization across developing economies and the corresponding need for reliable lubrication and maintenance systems in manufacturing facilities. Modern industrial operations require precise lubrication management and equipment protection to ensure optimal production conditions and minimize downtime.

The superior reliability and automation capabilities of oiler kits make them essential components in demanding industrial environments where continuous operation is critical.

The growing emphasis on predictive maintenance and operational efficiency is driving demand for advanced lubrication technologies from certified manufacturers with proven track records of reliability and performance. Industrial operators are increasingly investing in automated oiler systems that offer reduced maintenance costs and improved equipment longevity over extended service periods.

Regulatory requirements and industry standards are establishing performance benchmarks that favor precision-engineered lubricator solutions with advanced monitoring capabilities.

The market is segmented by product type, application, and region. By product type, the market is divided into manual lubricator kit, automatic lubricator kit, and others configurations. Based on application, the market is categorized into automotive industry, industrial machinery, construction equipment, marine applications, aerospace, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

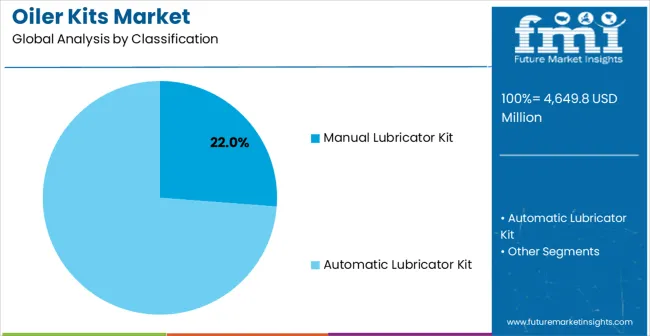

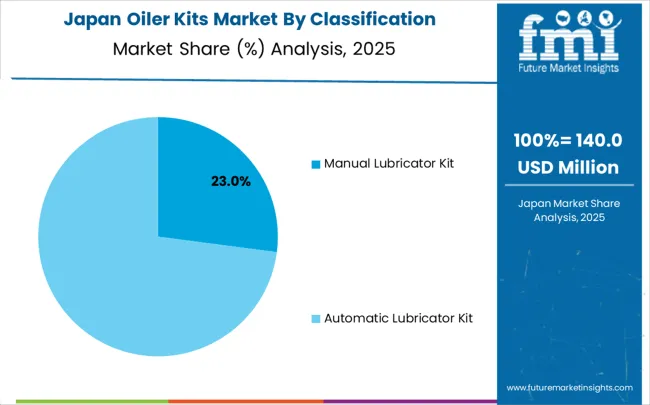

Automatic lubricator kit configurations are projected to account for 62% of the oiler kits market in 2025. This leading share is supported by the increasing demand for hands-free lubrication systems in industrial applications and growing automation requirements reducing manual intervention. Automatic oiler kits provide consistent lubrication schedules and eliminate human error in maintenance routines, making them the preferred choice for heavy machinery, automotive manufacturing, and continuous production environments. The segment benefits from technological advancements that have improved the precision and reliability of automated dispensing systems while reducing labor requirements.

Modern automatic lubricator kits incorporate advanced electronic controls, pressure regulation systems, and sophisticated monitoring technologies that ensure optimal lubrication delivery. These innovations have significantly improved operational efficiency while reducing total cost of ownership through extended equipment life and elimination of over-lubrication waste. The automotive and heavy machinery sectors particularly drive demand for automatic solutions, as these industries require consistent lubrication performance to maintain production schedules and equipment reliability.

Additionally, the construction and mining industries increasingly adopt automatic oiler kits to prevent equipment failure risks and meet operational efficiency targets. Environmental consciousness and sustainability initiatives further accelerate market adoption, as automatic systems reduce lubricant waste and improve resource utilization efficiency.

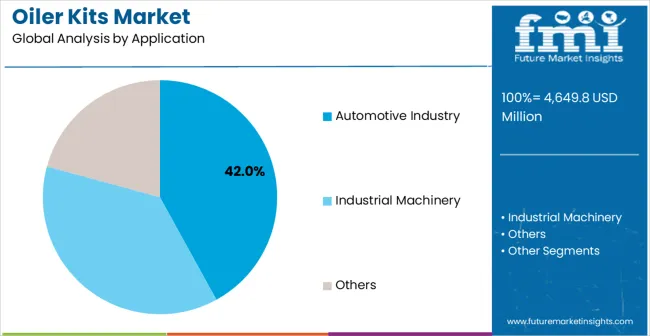

Automotive industry applications are expected to represent 42% of oiler kits demand in 2025. This dominant share reflects the critical role of lubrication systems in automotive manufacturing and assembly operations and the need for reliable oiler equipment capable of supporting high-volume production environments. Automotive facilities require precise and consistent lubrication for assembly line equipment, stamping presses, and robotic systems. The segment benefits from ongoing expansion of automotive production in developing countries and increasing quality requirements demanding enhanced lubrication reliability in manufacturing facilities.

Automotive production operations demand exceptional oiler performance to ensure adequate lubrication for high-speed machinery and continuous operation requirements. These applications require oiler systems capable of handling varying viscosity lubricants, precise dispensing volumes, and integration with automated production systems. The growing emphasis on manufacturing efficiency and quality standards, particularly in electric vehicle production facilities, drives consistent demand for high-performance lubrication equipment. Emerging markets in Asia-Pacific, Latin America, and Eastern Europe contribute significantly to market growth as automotive manufacturers invest in modern equipment to improve production efficiency and quality.

Additionally, the trend toward electric vehicle manufacturing creates opportunities for specialized oiler systems designed for new assembly processes and battery production equipment. The segment also benefits from increasing focus on lean manufacturing principles and total productive maintenance strategies driving adoption of automated lubrication solutions.

The oiler kits market is advancing steadily, primarily driven by the increasing industrial automation across manufacturing sectors and the growing awareness of the critical role of preventive maintenance systems in equipment reliability. Industrial plants and factories are adopting automated lubrication to minimize unexpected downtime, improve machinery longevity, and reduce operational costs. The rising emphasis on maintenance efficiency and asset management is encouraging industries to upgrade from manual lubrication to precise, automated oiler kits. Furthermore, continuous improvements in oiler kit designs and integration with industrial machines are supporting enhanced adoption rates and market growth.

Despite strong growth drivers, the market faces restraints such as high initial investment costs for automated oiler systems and the need for specialized technical expertise to install, maintain, and operate these kits effectively. Additionally, diverse lubrication requirements in different industrial applications complicate standardization and product compatibility. This variation requires customized solutions, which can increase costs and limit mass adoption. The complexity of lubrication needs across sectors, from heavy machinery to precision tools, poses challenges for manufacturers in developing universally adaptable oiler kits, contributing to market segmentation and restrained growth in some segments.

Key trends shaping the oiler kits market include the integration of smart monitoring technologies and IoT-enabled systems that facilitate real-time performance tracking and predictive maintenance. Smart sensors embedded in oiler kits optimize lubrication schedules, reduce lubricant waste, and extend equipment service life, proving invaluable in large-scale manufacturing operations. Simultaneously, the development of eco-friendly and high-performance solutions, including the use of biodegradable lubricants and precision dispensing technologies, aligns with global sustainability goals. Manufacturers are focusing on durable, corrosion-resistant components and waste reduction, creating differentiation and reinforcing demand for advanced oiler kits in environmentally conscious industries.

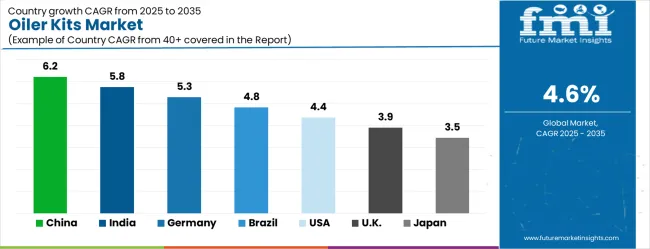

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| Brazil | 4.8% |

| United States | 4.4% |

| United Kingdom | 3.9% |

| Japan | 3.5% |

The oiler kits market is growing rapidly, with China leading at a 6.2% CAGR through 2035, driven by massive manufacturing expansion, automotive industry growth, and industrial modernization programs. India follows at 5.8%, supported by rising industrialization in automotive and machinery sectors and increasing investments in manufacturing infrastructure.

Germany records strong growth at 5.3%, emphasizing precision engineering, quality standards, and advanced manufacturing capabilities. Brazil grows steadily at 4.8%, integrating oiler systems into expanding automotive production and industrial facilities.

The United States shows moderate growth at 4.4%, focusing on equipment upgrades and automation improvements. The United Kingdom maintains steady expansion at 3.9%, supported by industrial modernization programs. Japan demonstrates stable growth at 3.5%, emphasizing technological innovation and manufacturing excellence.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The oiler kits market in China is projected to exhibit the highest growth rate with a CAGR of 6.2% through 2035, reflecting the country’s dominance in global manufacturing and continuous expansion of its industrial base. The nation’s rapidly growing machinery manufacturing sector and automotive production facilities are generating substantial demand for advanced lubrication technologies capable of supporting high-capacity production lines.

China’s automotive industry, supported by large-scale development programs and government-backed incentives, is emerging as the single largest consumer of advanced oiler systems, especially in factory environments where continuous operation and strict quality compliance are critical.

At the same time, manufacturing modernization initiatives across industrial sectors are encouraging the adoption of automated, high-performance oiler kits that minimize downtime, enhance efficiency, and extend the lifespan of machinery. Major global and domestic industrial producers are actively establishing large-scale lubrication installations across production hubs in China, aiming to meet both international standards and rising domestic performance requirements.

The integration of automation and smart technology within lubrication solutions further strengthens demand, offering predictive maintenance and data-driven operational capabilities. Overall, China’s combination of industrial growth, strong government support, and rising demand for efficiency positions it as the fastest-growing market for oiler kit systems globally.

The oiler kits market in India is expanding consistently, forecasted to grow at a CAGR of 5.8% through 2035, supported by the country’s fast-paced industrialization and growing prominence within global manufacturing supply chains. The machinery and automotive industries are at the forefront of demand, with automotive production emerging as a key growth driver as global manufacturers expand assembly capacity in the country.

India’s government-led initiatives to build world-class manufacturing infrastructure are also spurring the adoption of advanced oiler technologies designed for diverse applications across industrial facilities, ensuring optimal lubrication performance under varying operational conditions. Industrial players are increasingly investing in automated lubrication systems to improve machine efficiency, extend operational lifespans, and reduce long-term maintenance expenditures factors crucial in high-volume and cost-sensitive production environments.

Moreover, infrastructure development initiatives across steel, cement, and heavy machinery sectors are expected to boost demand for durable and adaptable oiler systems. With India’s strong focus on enhancing productivity, reducing operational risks, and meeting international quality benchmarks, demand for technologically advanced oiler solutions is surging. Large-scale production facilities are prioritizing reliable systems that ensure maximum uptime and efficient operations, positioning India as one of the most attractive markets for oiler kit adoption over the forecast period.

Germany demonstrates steady growth in its oiler kits systems market, projected to expand at a CAGR of 5.3% through 2035, anchored by its deeply established reputation for precision engineering and advanced manufacturing practices. The nation’s industrial sector, characterized by its focus on high standards of product quality, is increasingly deploying advanced lubricating systems across modernized production facilities to sustain long-term reliability and efficiency.

German industrial operators place high importance on operational excellence, regulatory compliance, and environmental standards, which collectively drive investments in durable, automated oiler solutions. In addition, industrial automation programs across automotive, machinery, and high-end equipment manufacturing are accelerating adoption of lubrication technologies that deliver continuous operation with minimal maintenance needs.

Companies within Germany’s diversified industrial base are leaning toward smart, sensor-integrated oiler systems capable of monitoring lubrication levels and providing predictive maintenance alerts. Such innovations not only improve equipment performance but also align with Germany’s commitments to sustainability and energy efficiency by reducing lubricant wastage and environmental risk.

As a result, the evolving demand reflects both the nation’s commitment to engineering precision and its global leadership in manufacturing technology adoption. This positions Germany as a mature yet growth-oriented market offering significant opportunities for technologically advanced oiler kits.

The oiler kits market in Brazil is projected to grow steadily at a CAGR of 4.8% through 2035, bolstered by expansion in both automotive and broad-based industrial development initiatives. The country’s well-established automotive sector, driven by demand from both domestic and export markets, is actively investing in advanced oiler technologies to strengthen efficiency and ensure global competitiveness.

Increased manufacturing output across machinery, industrial equipment, and consumer goods production is simultaneously creating demand for modernized lubrication systems that can support operations under high-volume conditions. Brazil’s industries are also transitioning toward automated production, adopting oiler kits equipped with features that improve machine longevity, reduce downtime, and align operations with international manufacturing standards.

Industrial modernization programs initiated across the country are prioritizing upgrades in lubrication infrastructure to meet stricter quality regulations, energy efficiency goals, and sustainability targets. This is generating consistent opportunities for suppliers of reliable, scalable, and automated oiler systems.

Furthermore, Brazil’s evolving industrial landscape is characterized by increased participation from multinational manufacturers, who bring with them a preference for high-performance lubrication technologies. This blend of local industrial capacity growth and global-standard requirements establishes Brazil as a key growth market for oiler kit adoption within Latin America, with long-term expansion opportunities in both automotive and manufacturing industries.

The United States oiler kits systems market is developing at a CAGR of 4.4% through 2035, primarily influenced by industrial modernization efforts and widespread adoption of automated lubrication technologies. The country’s industrial base, spanning automotive, heavy machinery, aerospace, and consumer products manufacturing, is increasingly integrating advanced oiler systems into existing facilities to drive performance upgrades.

Much of this growth is attributable to replacement demand, as older lubrication infrastructure is replaced with modern, automated systems capable of delivering superior precision and reliability. USA manufacturers place strong emphasis on improving operational efficiency, reducing costs, and adhering to strict industry standards, making advanced lubricating technologies an essential requirement.

Investments in smart factory automation and robotic machinery create additional demand for automated oiler kits that minimize human intervention, reduce maintenance-related downtime, and ensure consistent machinery functionality.

Alongside this, energy conservation programs and cost optimization initiatives are motivating industries to adopt lubricating solutions that minimize lubricant usage while maximizing output. Given the nation’s established industrial presence and commitment to high-quality operational performance, the USA market continues to present robust growth opportunities, especially for suppliers of advanced, automation-focused oiler technologies catering to large-scale industrial operators.

In the United Kingdom, the market for oiler kits systems is forecasted to grow at a CAGR of 3.9% through 2035, supported by extensive industrial modernization strategies and manufacturing upgrades across key production hubs. With a focus on improving industrial reliability, operators are investing in high-performance lubrication solutions that ensure uninterrupted operations and enhanced output quality.

The adoption of oiler kits in the UK is increasingly linked with programs aimed at increasing automation within industrial processes, aligning the country’s manufacturing sector with both efficiency goals and carbon-reduction commitments. Advanced oiler technologies are being deployed across manufacturing facilities to handle diverse production requirements, reduce operational downtime, and deliver significant cost savings over the long term.

Strong regulatory standards related to industrial safety, environmental sustainability, and equipment efficiency also play a pivotal role in driving updated lubrication infrastructure. Industrial players are focusing on innovative solutions capable of meeting stringent quality expectations that characterize the UK manufacturing environment.

While the market shows moderate growth compared to rapidly industrializing economies, consistent investments in modernization, combined with demand for contingent reliability, ensure long-term opportunities for suppliers of advanced and reliable oiler kits across multiple industrial applications.

The oiler kits market in Japan is demonstrating consistent momentum, expanding at a CAGR of 3.5% through 2035, built upon the country’s global reputation for technological innovation and precision manufacturing. Japanese industrial manufacturers are pioneers in developing advanced lubrication solutions, incorporating next-generation features such as sensor integration, automated monitoring, and predictive analytics to optimize performance.

The country’s strong focus on quality, continuous improvement, and manufacturing excellence ensures that demand for high-performance oiler systems is stable across multiple sectors, including automotive, electronics, and high-end machinery production. Industrial automation programs, underpinned by Japan’s strong robotics and smart manufacturing competencies, are fostering adoption of precision-engineered oiler kits that support seamless operational continuity with minimal human intervention.

Additionally, strict adherence to international environmental and safety standards enhances demand for systems that reduce lubricant waste while maintaining efficiency. Japan’s cultural emphasis on innovation and efficiency not only drives domestic adoption but also makes its technologies influential in global market trends. As demand for optimized manufacturing processes grows worldwide, Japan’s advancements in automated lubrication stand as benchmarks, positioning the country as both a consumer and a global leader in oiler kit innovation that delivers maximum reliability and productivity benefits.

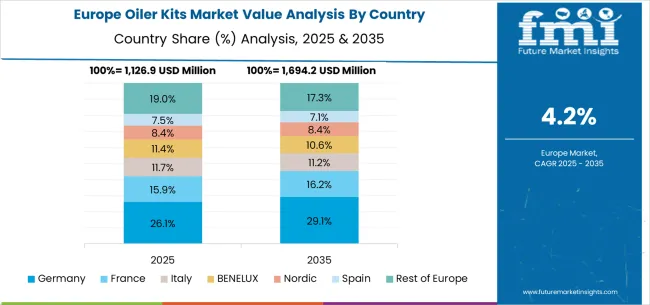

The oiler kits market in Europe is projected to grow from USD 712.3 million in 2025 to USD 1,140 million by 2035, registering a CAGR of 4.8% over the forecast period. Germany is expected to maintain its leadership with a 32.1% share in 2025, supported by its strong automotive manufacturing base and advanced industrial infrastructure.

The United Kingdom follows with 18.7% market share, driven by ongoing industrial modernization and manufacturing facility upgrades. France holds 16.2% of the European market, benefiting from automotive industry expansion and machinery manufacturing investments. Italy and Spain collectively represent 19.8% of regional demand, with growing focus on automotive production and industrial machinery applications. The Rest of Europe region accounts for 13.2% of the market, supported by industrial development in Eastern European countries and Nordic manufacturing sectors.

The oiler kits market is defined by competition among established industrial equipment manufacturers, specialized lubrication companies, and regional engineering firms. Companies are investing in advanced manufacturing technologies, product innovation, standardized quality systems, and technical support capabilities to deliver reliable, efficient, and cost-effective oiler solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

SKF, operating globally, offers comprehensive oiler kit solutions with focus on precision engineering, reliability, and technical support services. Trelleborg, multinational, provides advanced oiler systems with emphasis on material innovation and application-specific solutions. Graco, USA-based, delivers specialized oiler solutions for industrial applications with focus on automation and performance. NOK-Freudenberg offers comprehensive oiler technologies with standardized procedures and global service support.

Freudenberg Sealing Technologies provides industrial oiler systems with emphasis on sealing solutions and technical expertise. Lubcon delivers specialized oiler equipment with focus on high-performance lubrication applications. Technetics Group offers comprehensive oiler solutions for demanding industrial environments. John Crane provides advanced oiler systems with global manufacturing and service capabilities.

Eaton, Hutchinson, Sinoseal Holding Co., Ltd., Chengdu Yitong Seal Co., Ltd., Lincoln Industrial, Alemite, Bijur Delimon, Dropsa, SKF Lubrication Systems, Timken, Schaeffler, and Kluber Lubrication offer specialized oiler expertise, regional manufacturing capabilities, and technical support across global and regional networks.

The oiler kits market underpins industrial automation, manufacturing efficiency, equipment reliability, and sustainable production. With automation mandates, stricter maintenance requirements, and demand for predictive maintenance solutions, the sector must balance cost competitiveness, performance reliability, and digital integration. Coordinated contributions from governments, industry bodies, OEMs/technology integrators, suppliers, and investors will accelerate the transition toward smart, digitally monitored, and environmentally compliant oiler systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 2,890.4 million |

| Product Type | Manual Lubricator Kit, Automatic Lubricator Kit |

| Application | Automotive Industry, Industrial Machinery |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | SKF, Trelleborg, Graco, NOK-Freudenberg, Freudenberg Sealing Technologies, Lubcon, Technetics Group, John Crane, Eaton, Hutchinson, Sinoseal Holding Co., Ltd., Chengdu Yitong Seal Co., Ltd., Lincoln Industrial, Alemite, Bijur Delimon, Dropsa, SKF Lubrication Systems, Timken, Schaeffler, Kluber Lubrication |

| Additional Attributes | Dollar sales by product type and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established manufacturers and emerging suppliers, buyer preferences for automated versus manual systems, integration with digital monitoring and IoT technologies, innovations in materials and dispensing technologies for enhanced reliability and performance, and adoption of smart oiler solutions with embedded sensors and remote monitoring capabilities for improved operational efficiency. |

The global oiler kits market is estimated to be valued at USD 4,649.8 million in 2025.

The market size for the oiler kits market is projected to reach USD 7,290.4 million by 2035.

The oiler kits market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in oiler kits market are manual lubricator kit and automatic lubricator kit.

In terms of application, automotive industry segment to command 42.0% share in the oiler kits market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Boiler Control Market Size and Share Forecast Outlook 2025 to 2035

Boiler Water Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Boiler Market Size and Share Forecast Outlook 2025 to 2035

Boiler Safety System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Broiler Premix Market

Egg Boiler Market Size and Share Forecast Outlook 2025 to 2035

Charbroilers Market

Rear Spoiler Market Size and Share Forecast Outlook 2025 to 2035

Steam Boiler Market Size and Share Forecast Outlook 2025 to 2035

Combi Boiler Market Growth – Trends & Forecast 2025 to 2035

Office Boiler Market Size and Share Forecast Outlook 2025 to 2035

Marine Boiler Burner Market Size and Share Forecast Outlook 2025 to 2035

Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Active Spoiler Market Growth - Trends & Forecast 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Home Brew Boiler Market Size and Share Forecast Outlook 2025 to 2035

Industrial Boilers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA