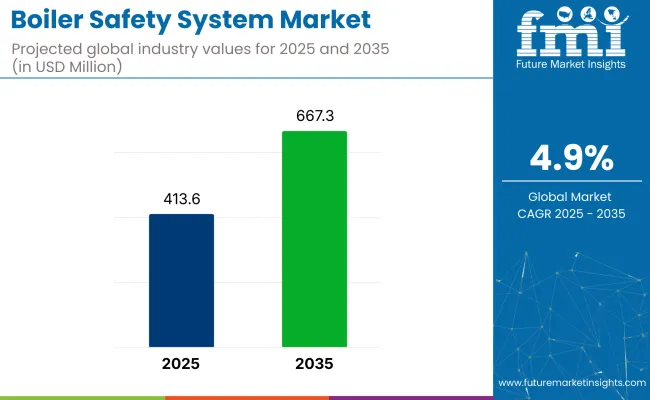

The boiler safety system market is expected to grow from USD 413.6 million in 2025 to USD 667.3 million by 2035, reflecting a CAGR of 4.9% over the forecast period. Growth is expected to be driven by increasing industrial compliance requirements, operational safety mandates, and rising awareness around fire prevention and explosion control in boiler systems.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 413.6 million |

| Industry Value (2035F) | USD 667.3 million |

| CAGR (2025 to 2035) | 4.9% |

In May 2025, China’s Special Equipment Inspection and Research Institute released new Technical Specifications for Intelligent Safety Monitoring of Boilers. The regulations mandate that new boilers incorporate multimodal AI early-warning systems. These systems combine acoustic imaging, infrared thermal scanning, and pressure fluctuation analytics to detect issues such as tube leaks or coking at least 24 hours in advance, with less than 0.5% false alarms.

Petrochemical zones in Saudi Arabia and Indonesia accelerated the adoption of multi-layered burner management systems to meet insurance-driven safety thresholds. Supply chains are shifting toward cloud-linked safety modules, with real-time diagnostics sent to centralized maintenance hubs. This digitization is reshaping spare parts procurement, lifecycle tracking, and technician response strategies across both industrial and commercial boiler installations.

As of 2025, the boiler safety system market holds a critical but targeted share within its broader industrial segments. Within the global industrial boilers market, it contributes around 5-7%, as safety mechanisms are essential in every boiler installation for regulatory compliance and risk mitigation. In the industrial safety systems market, its share is approximately 3-4%, primarily due to its specialized application compared to broader plant-wide safety controls.

Within the power plant equipment market, it accounts for 2-3%, especially in thermal power facilities where boiler integrity is vital. In the process automation and control market, the share is about 1.5-2.5%, as it integrates with automated shutdown systems. In the HVAC equipment market, it contributes roughly 1-2%, mainly in commercial boiler safety setups.

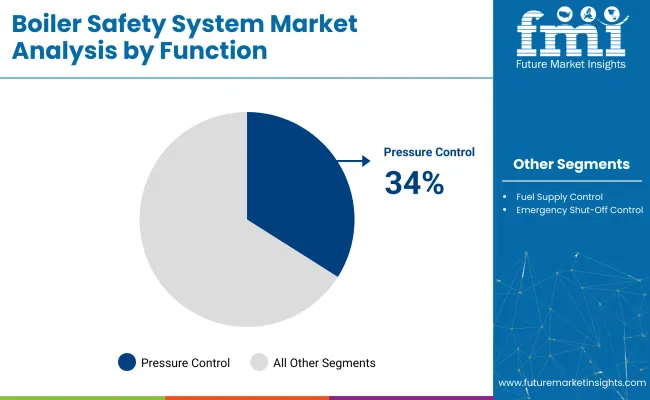

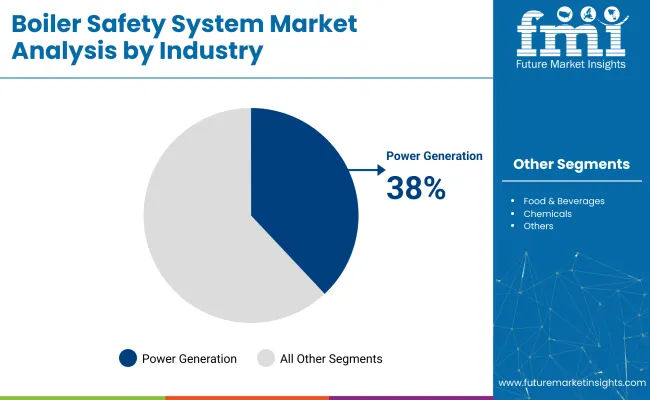

Pressure control is projected to lead the function segment with a 34% market share by 2025, while power generation is expected to dominate the industry segment with 38%. Electromechanical boiler safety systems will command the largest share by product type at 40%.

Pressure control systems are expected to dominate the function segment with a 34% market share in 2025, due to their essential role in preventing boiler overpressure incidents.

The power generation sector is anticipated to hold 38% of the market share in 2025, owing to its high reliance on industrial boilers for thermal energy production.

Electromechanical systems are projected to account for 40% of the product type segment in 2025, favored for their simplicity and reliability in critical boiler operations.

The boiler safety system market is growing due to increasing industrial safety regulations, growing energy demand, and the need for reliable thermal operations across manufacturing, chemical, and power generation sectors. Safety systems are critical in preventing overpressure, flame failure, and temperature fluctuations.

Strong Demand from Industrial Boilers and Power Plants

Industrial facilities and thermal power plants rely on safety systems to maintain operational control and protect equipment from dangerous failures. Pressure relief valves, flame detectors, water level sensors, and emergency shutdown systems are standard safety components. These systems ensure compliance with safety codes and reduce operational risk.

Rising Adoption in Commercial Buildings and Institutional Facilities

Hospitals, universities, and large commercial buildings use boiler safety systems to monitor heating infrastructure and ensure uninterrupted service. Demand is growing for intelligent systems that offer remote monitoring, fault detection, and automatic shutdown in emergency scenarios. These systems enhance safety in environments with continuous heating needs.

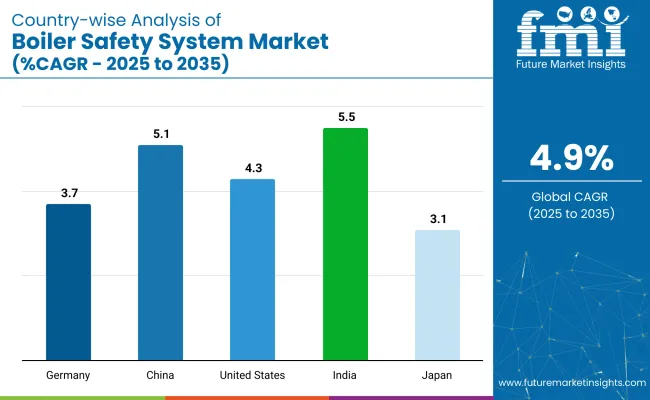

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 5.5% |

| China | 5.1% |

| United States | 4.3% |

| Germany | 3.7% |

| Japan | 3.1% |

India’s momentum is being driven by expansion in industrial boilers, thermal power capacity, and domestic manufacturing. China is advancing its safety system usage through upgrades in process industries and regulatory mandates. In contrast, developed economies such as the United States (4.3%), Germany (3.7%), and Japan (3.1%) are expanding steadily at 0.67-0.84x the global rate.

The USA emphasizes digital flame monitoring and pressure relief systems in large thermal facilities. Germany focuses on boiler automation and emission-reduction safety. Japan prioritizes compact safety modules for space-constrained commercial buildings. As regulatory enforcement tightens and industrial uptime becomes critical, both safety-led and compliance-driven countries are shaping this evolving market.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Indian market is projected to grow at a CAGR of 5.5% through 2035. Growth is being driven by rapid expansion in the textile, chemical, and sugar processing industries. State-run boiler inspectorates are tightening compliance in small and mid-size units.

Local manufacturers are supplying flame safeguard controls, low-water cutoffs, and pressure interlocks to support retrofit cycles. Government schemes promoting industrial safety have improved system adoption in Tier 2 and Tier 3 clusters. India’s position as a manufacturing hub and regulatory enforcer ensures continued spare and retrofit demand.

China’s market is expected to grow at a CAGR of 5.1% from 2025 to 2035. Industrial boilers used in the food, textile, and metal sectors are being upgraded with automatic shutdown systems and flame scanners. Government pressure on reducing boiler explosions and carbon emissions is accelerating replacement cycles.

Domestic automation firms are bundling safety systems with temperature sensors and digital controllers. Growth is being concentrated in Tier 1 and Tier 2 manufacturing zones. China’s scale and regulatory push make it a critical driver of system-level adoption.

The USA market is forecast to grow at a CAGR of 4.3% through 2035. Upgrades in institutional and commercial heating systems are creating demand for digital safety interlocks and dual-fuel flame sensors. Hospitals, universities, and federal buildings are retrofitting existing steam boilers with redundant safety protocols.

NFPA and ASME guidelines are pushing utilities and facility managers to adopt high-spec modules. Aftermarket demand for smart shutoff and high-limit control systems remains strong. USA growth is tied to maintenance-driven upgrades and regulatory compliance.

Germany’s market is projected to grow at a CAGR of 3.7% during the forecast period. Usage is rising in district heating plants, energy recovery boilers, and food processing units. Demand is focused on flame detectors, draft pressure regulators, and low-gas cutoffs in response to EU safety mandates.

Domestic automation companies are integrating safety modules into broader boiler control panels. Energy-efficiency targets are encouraging upgrades to oxygen-trimmed combustion and burner lockout systems. Germany’s market reflects its regulatory precision and focus on low-emission operation.

Demand in Japan is forecast to grow at a CAGR of 3.1% through 2035. Compact commercial boiler systems in hospitals, office buildings, and high-rise housing are adopting space-efficient safety modules. Urban safety codes require integrated shutdown and thermal overload systems.

Japanese OEMs are prioritizing reliability, noise suppression, and low-maintenance flame sensing. System demand is increasing in hospitality and food service sectors that rely on continuous boiler operation. Market growth is being shaped by aging infrastructure and urban space limitations.

The boiler safety system market is moderately consolidated, with major players such as Honeywell, Siemens, and Forbs Marshall setting industry benchmarks through advanced automation and monitoring technologies. These companies focus on integrating smart sensors, flame safeguard controls, and pressure regulation systems to improve safety compliance across industrial and commercial heating operations.

Honeywell leads with its scalable burner management systems, while Siemens delivers precision-engineered combustion controls for high-capacity boilers. Forbs Marshall has a strong presence in Asia, offering integrated safety and efficiency solutions.

Danfoss and Endress+Hauser contribute by providing critical components like pressure switches, flow meters, and temperature sensors that ensure operational reliability and prevent system failure under extreme conditions.

Recent Boiler Safety System Industry News

In October 2024, Siemens acquired Danfoss Fire Safety to enhance its fire suppression capabilities. The deal strengthens Siemens position in industrial safety, including boiler systems, by adding high-pressure water-mist technology. The acquisition supports energy-efficient, automated safety solutions and expands Siemens' footprint in the boiler safety system market.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 413.6 million |

| Projected Market Size (2035) | USD 667.3 million |

| CAGR (2025 to 2035) | 4.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Functions Analyzed (Segment 1) | Temperature Control, Pressure Control, Fuel Supply Control, Emergency Shut-off Control |

| Industries Analyzed (Segment 2) | Power Generation, Food & Beverages, Chemicals, Oil & Gas, Other Industrial Sectors, Commercial Use |

| Product Types Analyzed (Segment 3) | Electromechanical Controllers, Electronic Controllers |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | Honeywell, Siemens, Forbs Marshall, Danfoss, Endress+Hauser |

| Additional Attributes | Dollar sales by function and industry, increasing demand for advanced control systems, focus on industrial safety compliance, and widespread deployment across the power and process industries |

The market is segmented by function into temperature control, pressure control, fuel supply control, and emergency shut-off control.

Based on industry, the key application areas include power generation, food & beverages, chemicals, oil & gas, other industrial sectors, and commercial use.

By product type, the market comprises electromechanical controllers and electronic controllers.

Regionally, the market spans North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

The global market is valued at USD 413.6 million in 2025.

The market is expected to reach USD 667.3 million by 2035.

The market is projected to grow at a CAGR of 4.9% from 2025 to 2035.

Pressure control is the top function segment, holding a 34% share in 2025.

India is the fastest-growing country, with a projected CAGR of 5.5% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Safety Towing System Market Size and Share Forecast Outlook 2025 to 2035

Safety Reporting Systems Market Size and Share Forecast Outlook 2025 to 2035

Safety Motion Control System Market

Safety Instrumentation Systems Market – Trends & Forecast 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Public Safety In-Building Wireless DAS System Market

Safety Label Market Size and Share Forecast Outlook 2025 to 2035

Boiler Control Market Size and Share Forecast Outlook 2025 to 2035

Safety Bottle Tote Carriers Packaging Market Size and Share Forecast Outlook 2025 to 2035

Safety Syringe Market Size and Share Forecast Outlook 2025 to 2035

Boiler Water Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Safety Actuators Market Size and Share Forecast Outlook 2025 to 2035

Safety Needles Market Size and Share Forecast Outlook 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Boiler Market Size and Share Forecast Outlook 2025 to 2035

Safety Laser Scanner Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Safety Limit Switches Market Size and Share Forecast Outlook 2025 to 2035

Safety Eyewear Market Analysis - Size, Share, and Forecast 2025 to 2035

Safety Box for Syringe Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA