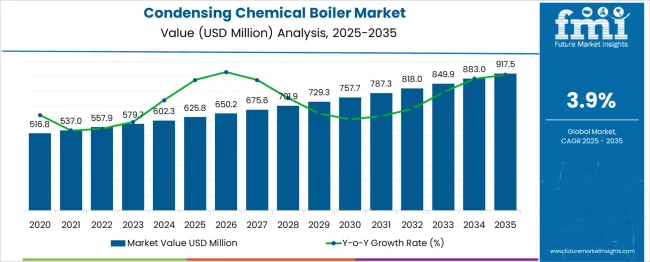

The Condensing Chemical Boiler Market is estimated to be valued at USD 625.8 million in 2025 and is projected to reach USD 917.5 million by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period. A rolling CAGR analysis across overlapping 5-year windows reveals a consistent but gradually tapering growth trend. From 2025 to 2030, the market is expected to grow from USD 625.8 million to USD 757.7 million, yielding a rolling CAGR of approximately 3.9%.

This period is projected to be driven by moderate demand for retrofitting in existing industrial plants and regulatory-driven upgrades favoring energy-efficient thermal systems. Between 2027 and 2032, the market expands from USD 675.6 million to USD 818.0 million, reflecting a rolling CAGR of around 3.9%, indicating stability in capital allocation toward low-emission boiler systems. In the final rolling window from 2030 to 2035, growth moderates slightly, moving from USD 757.7 million to USD 917.5 million with a rolling CAGR just under 3.8%.

This slight tapering suggests maturation in key markets such as Europe and East Asia, where most replacement cycles and efficiency transitions will have peaked. Overall, the rolling CAGR analysis points to steady long-term demand, with limited volatility and consistent baseline investment in emissions-compliant heating technologies.

| Metric | Value |

|---|---|

| Condensing Chemical Boiler Market Estimated Value in (2025 E) | USD 625.8 million |

| Condensing Chemical Boiler Market Forecast Value in (2035 F) | USD 917.5 million |

| Forecast CAGR (2025 to 2035) | 3.9% |

The condensing chemical boiler market contributes approximately 20% to the overall chemical boiler segment, supported by adoption in process industries requiring efficient heat recovery. Within the industrial boiler market, its share stands near 15–18%, reflecting the shift toward lower-emission heat sources in chemical and manufacturing plants. In the energy-efficient heating systems segment, condensing units occupy around 12–14% due to rising operational efficiency targets. This technology accounts for 5–7% of the industrial energy systems segment, where integration with facility-wide optimization is being prioritized. In building retrofits and modernization initiatives, the market holds about 8–10%, supporting replacements for aging thermal systems with compact, high-efficiency solutions. Manufacturers are prioritizing high-efficiency condensing models that reclaim latent heat from exhaust, often exceeding 90% thermal efficiency. New materials such as stainless steel and aluminum alloys are improving corrosion resistance and heat transfer rates. Predictive control systems are gaining traction, with embedded sensors and smart logic regulating fuel input and maintenance cycles. Fuel-flexible boiler designs are being developed to accommodate natural gas, biogas, and hydrogen, enabling smoother transitions in fuel sourcing. Compact modular units are preferred in plant upgrades where space constraints are critical. These strategies reflect a broader move toward optimized, automated, and lower-emission thermal systems in chemical processing environments.

The Condensing Chemical Boiler market is gaining significant traction as chemical manufacturers prioritize energy efficiency and emission reduction. This growth is being supported by the increasing adoption of sustainable thermal systems and stringent environmental compliance regulations across global markets. Condensing boilers, known for recovering latent heat from exhaust gases, have become the preferred choice in process industries seeking to lower operational costs and enhance thermal output.

Technological innovations enabling improved control systems, real-time monitoring, and compatibility with variable fuel types are further strengthening market adoption. As industrial operations scale and environmental performance becomes a core metric for competitiveness, investments in energy-optimized boiler solutions are accelerating.

The market is also experiencing strong momentum due to incentives supporting low-carbon technologies, along with increasing retrofitting demand in existing plants. Future opportunities are expected to emerge from the integration of smart systems and alternative fuel adaptability, positioning condensing boilers as a central component in sustainable industrial heat generation strategies..

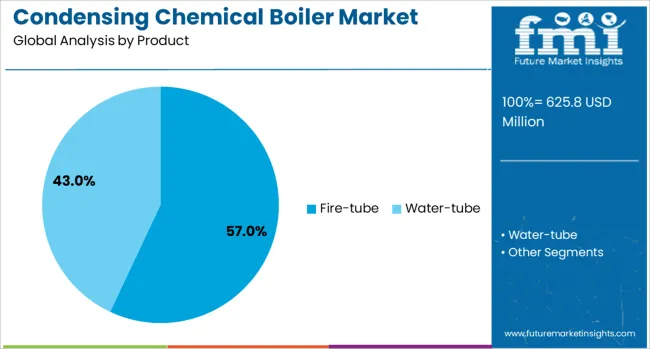

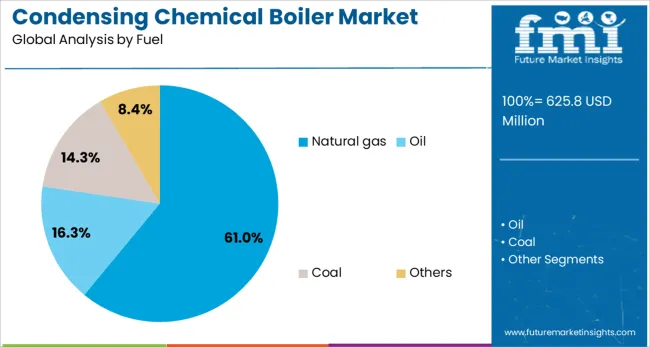

The condensing chemical boiler market is segmented by product, fuel, and geographic regions. A byproduct of the condensing chemical boiler market is divided into Fire-tube and Water-tube. The condensing chemical boiler market is classified by fuel type into Natural gas, Oil, Coal, and Others. Regionally, the condensing chemical boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fire-tube product segment is expected to hold 57% of the Condensing Chemical Boiler market revenue share in 2025, positioning it as the leading product type. This dominance has been driven by its simplified design, ease of maintenance, and high thermal efficiency at relatively lower operational costs. Fire-tube boilers have been favored in chemical processing environments where compact installation and consistent heat output are critical.

Their compatibility with condensing technology enables enhanced fuel utilization and reduced emissions, aligning with industry sustainability goals. The adoption of fire-tube systems has also been supported by their operational reliability, making them suitable for continuous process heating.

Additionally, improved safety features and lower installation complexity have contributed to their preference in both new installations and system upgrades. As manufacturers seek to minimize downtime and improve energy efficiency, fire-tube boilers have continued to offer a dependable solution, consolidating their position as the product of choice in the chemical sector..

The natural gas fuel segment is projected to account for 61% of the Condensing Chemical Boiler market revenue share in 2025, making it the dominant fuel type. This leadership position has been shaped by natural gas’s cost competitiveness, cleaner combustion profile, and widespread availability in industrial regions. Chemical processing industries have increasingly transitioned to natural gas as a preferred fuel due to its low carbon footprint and compatibility with condensing boiler systems that optimize heat recovery.

Regulatory support for decarbonization and emissions compliance has further incentivized the shift from oil-based systems to natural gas. The ease of control, consistent supply, and efficiency in high-load applications have also been key factors driving adoption.

Integration with digital control systems has enabled precise fuel management, improving overall system performance. As pressure mounts to align industrial heating processes with global climate commitments, the use of natural gas in condensing boilers is expected to remain a central component of the energy strategy in chemical manufacturing operations..

The condensing chemical boiler sector is expanding steadily as industries seek higher efficiency heating systems and reduced operational emissions. Growth is supported by energy cost pressures, stricter environmental compliance, and demand from sectors like pharmaceuticals, chemicals, and food processing. Integration with smart monitoring systems, modular designs, and hybrid fuel capabilities is enhancing operational flexibility. While high upfront installation costs and maintenance requirements present barriers, market adoption is aided by government incentives and corporate energy transition goals. Asia Pacific leads in deployment due to industrial expansion and modernization, while Europe and North America focus on replacing aging infrastructure with energy-efficient, low-emission systems.

Industrial operators are increasingly adopting condensing chemical boilers to achieve higher thermal efficiency and reduced fuel consumption. These boilers utilize latent heat recovery from exhaust gases, making them more energy efficient compared to conventional units. Industries such as chemicals, pharmaceuticals, and food processing benefit from their ability to handle variable loads while maintaining consistent output quality. Energy cost volatility is prompting process plants to opt for systems that minimize fuel wastage and lower lifecycle costs. Manufacturers are introducing modular boiler designs that allow phased capacity expansion, enabling better capital allocation. Government programs promoting clean industrial heating solutions are also accelerating adoption across both emerging and developed economies.

The installation of condensing chemical boilers requires significant capital investment, which can be a deterrent for small and mid-sized industrial facilities. Advanced heat recovery and control systems increase the initial price point compared to traditional boilers. Maintenance complexity is another challenge, as specialized components and water treatment requirements demand skilled technicians and regular inspections. In regions with limited technical expertise, these systems can face higher downtime risks and reduced efficiency over time. Additionally, fluctuations in industrial output can impact return on investment calculations, leading some operators to delay upgrades. These cost and maintenance considerations continue to influence the adoption rate in price-sensitive markets.

Integration of condensing chemical boilers with smart monitoring and control systems is improving efficiency and operational reliability. Real-time performance tracking allows operators to optimize fuel usage and detect issues before they cause downtime. Hybrid fuel compatibility, including natural gas, biogas, and hydrogen blends, is emerging as a differentiator in meeting corporate decarbonization targets. Modular, skid-mounted designs are being favored for faster installation and adaptability to changing production demands. Growing interest in industrial decarbonization is expected to further drive innovation in low-emission combustion technologies. Early adoption in sectors with high energy intensity will likely influence broader industry standards and best practices.

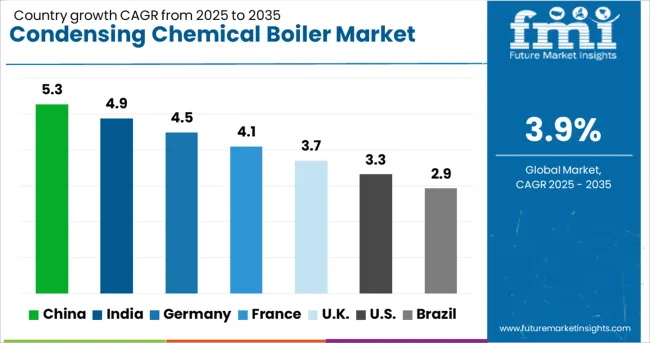

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

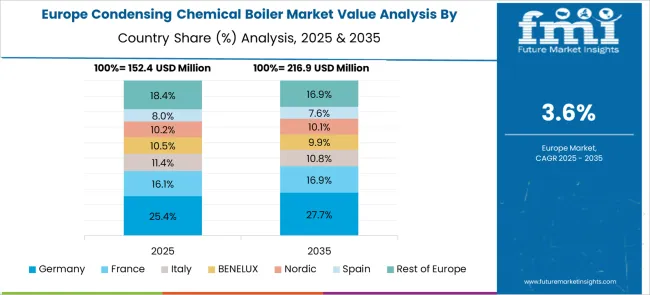

The global market for condensing chemical boilers is projected to grow at a CAGR of 3.9% between 2025 and 2035. China leads among the 40+ countries analyzed with a CAGR of 5.3%, followed by India at 4.9% and Germany at 4.5%. France remains slightly above the global average at 4.1%, while the United Kingdom and United States trail at 3.7% and 3.3% respectively. The faster growth in China and India is shaped by energy efficiency mandates and replacement of legacy systems. In contrast, slower adoption in the US and UK is linked to alternative energy preferences and limited chemical sector retrofits. The report includes detailed analysis of 40+ markets, with six countries highlighted here for comparison.

The condensing chemical boiler market in China is projected to grow at a CAGR of 5.3% through 2035. Policy push for energy optimization and stricter environmental compliance in Tier 1 and Tier 2 industrial zones are influencing replacement demand. Local manufacturers such as Zhejiang Lijiu Boiler and Fangkuai Boiler are scaling compact, high-efficiency models designed for chemical blending and extraction facilities. Steam cycle refinement and dual-fuel options are being prioritized in retrofitting initiatives. Upgrades are taking place in key chemical clusters in Jiangsu, Shandong, and Guangdong provinces, with local governments subsidizing high-efficiency installations.

In India, mechanical reciprocating engines have remained integral to decentralized power generation, backup systems, and agricultural pumping. Expansion in rural infrastructure and off-grid solar-diesel hybrid systems has increased reliance on smaller engines with improved thermal performance. Indian manufacturers have focused on compact diesel and CNG-powered models below 500 kW, particularly for irrigation and industrial welding segments. Government support for Make-in-India has led to component indigenization, particularly crankshaft machining and precision piston casting.

Germany is forecast to grow at a CAGR of 4.5% in the condensing chemical boiler market between 2025 and 2035. Growth is concentrated in replacement demand from aging industrial plants and energy efficiency directives within the EU Green Deal framework. Bosch Industriekessel and Viessmann are engineering condensing boilers tailored for low-emission chemical processing. Deployment is focused in North Rhine-Westphalia and Baden-Württemberg, with integration into combined heat and power systems. Customized automation and corrosion-resistant alloys are becoming key design differentiators in response to stringent emission norms.

The United Kingdom is expected to grow at a CAGR of 3.7% in the condensing chemical boiler market through 2035. The market is shaped by tightening building energy efficiency codes and pressure to reduce process emissions in older industrial estates. Worcester Bosch and Ideal Commercial are supplying hybrid-ready condensing units tailored for smaller batch-process chemical operations. Growth is strongest in Scotland and Northern England, with emphasis on replacing aging natural-draft systems. Industry preference for electrification remains a constraint for deeper penetration in the larger plants segment.

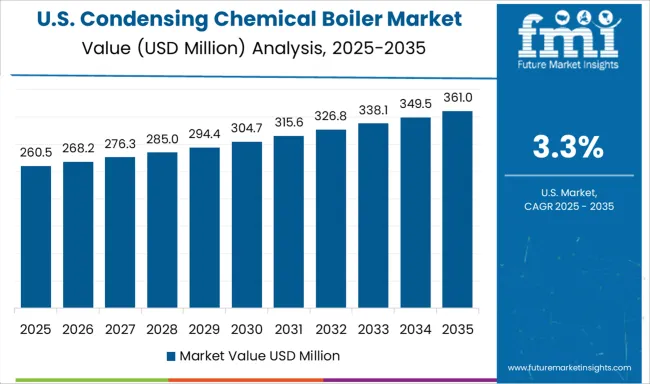

The United States is projected to grow at a CAGR of 3.3% in the condensing chemical boiler market from 2025 to 2035. Growth is restricted by limited infrastructure replacement in legacy chemical plants and preference for alternative heating technologies. Cleaver-Brooks and Miura America are offering compact condensing systems for low-volume, high-precision chemical processes. The Gulf Coast region leads demand, supported by regional emission caps and thermal energy credit schemes. Labor availability and complex permitting frameworks slow down retrofit timelines in older plants.

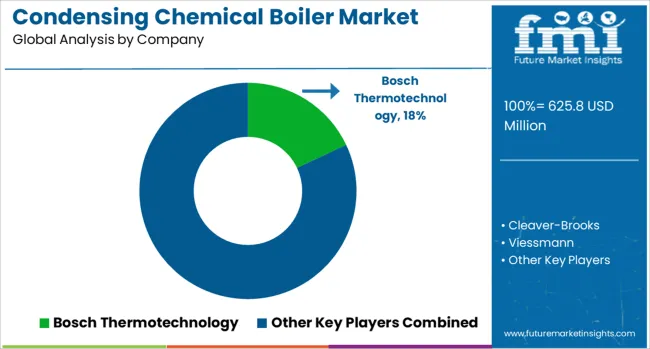

Bosch Thermotechnology has developed high-efficiency condensing boilers designed for chemical processing facilities requiring precise temperature control and consistent thermal output. Its strategy includes expanding modular boiler systems capable of handling variable process loads while maintaining low NOx emissions. Cleaver-Brooks targets large-scale chemical plants with custom-engineered condensing systems integrated into broader steam and hot water infrastructure.

The company focuses on flexible designs that support peak efficiency under demanding operational conditions. Viessmann offers condensing chemical boilers optimized for high thermal return applications, with a focus on compact system footprints and minimal maintenance requirements. Its emphasis on stainless steel heat exchangers enhances corrosion resistance in chemically intensive environments. Hurst Boiler & Welding supplies robust condensing systems designed for continuous duty in harsh industrial conditions.

Their offering includes firetube and watertube boilers configured for closed-loop heating and chemical reaction support. Fulton Boiler Works serves the small-to-medium chemical processing sector with compact vertical and horizontal condensing units. Its approach combines low installation overhead with high thermal efficiency, making it suitable for batch process heating and auxiliary applications. Collectively, these manufacturers deliver specialized systems engineered for process reliability, reduced fuel consumption, and compatibility with modern chemical production demands.

Water-tube configurations gained traction due to higher pressure capacity and compact modular design suitability. In early 2024, Miura launched the Miura Care preventative maintenance program in partnership with Hartford Steam Boiler, introducing IoT-based predictive services.

Babcock Wanson launched its Pack FM water-tube condensing boilers in 2023, offering high-pressure superheated steam. Manufacturers are integrating real-time monitoring, automation, and hybrid fuel readiness to support sustainability initiatives. Additional Attributes

| Item | Value |

|---|---|

| Quantitative Units | USD 625.8 Million |

| Product | Fire-tube and Water-tube |

| Fuel | Natural gas, Oil, Coal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch Thermotechnology, Cleaver-Brooks, Viessmann, Hurst Boiler & Welding, and Fulton Boiler Works |

The global condensing chemical boiler market is estimated to be valued at USD 625.8 million in 2025.

The market size for the condensing chemical boiler market is projected to reach USD 917.5 million by 2035.

The condensing chemical boiler market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in condensing chemical boiler market are fire-tube and water-tube.

In terms of fuel, natural gas segment to command 61.0% share in the condensing chemical boiler market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-Condensing Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Water Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Condensing Unit Market Trends-Growth, Demand & Forecast 2025 to 2035

Condensing Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Condensing Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Fire Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Industrial Condensing Units Market Size and Share Forecast Outlook 2025 to 2035

Evaporative Condensing Units Market Trend Analysis Based on Type, Operation, Application, and Region 2025 to 2035

Transportation Condensing Units Market Growth – Trends & Forecast 2025 to 2035

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA