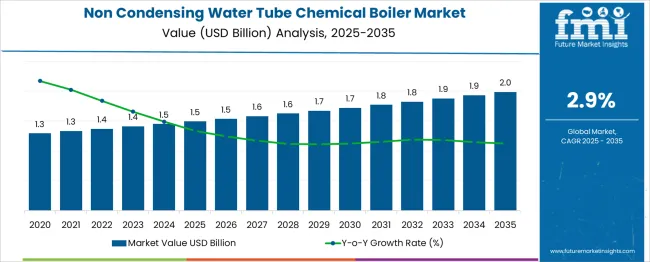

The non-condensing water tube chemical boiler market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.0 billion by 2035, registering a compound annual growth rate (CAGR) of 2.9% over the forecast period. Between 2025 and 2030, the market is expected to increase marginally from USD 1.5 billion to USD 1.7 billion, reflecting slow yet stable growth driven by sustained demand in chemical processing facilities for high-capacity steam generation. Year-on-year analysis shows minimal increments, with values holding at USD 1.5 billion in 2026, reaching USD 1.6 billion by 2027 and maintaining a steady trend due to long equipment life cycles and limited adoption of advanced alternatives.

By 2028, the market is forecasted to remain at USD 1.6 billion, advancing slightly to USD 1.7 billion in 2029 and continuing at USD 1.7 billion in 2030. Growth will primarily be influenced by replacement needs, periodic retrofitting, and compliance with operational safety standards rather than new installations. Market opportunities will rely on service-based revenue streams and aftermarket components rather than large-scale capacity additions. These dynamics position non-condensing water tube chemical boilers as a mature segment, essential for specific industrial heating processes but characterized by limited technological disruption and slow-paced adoption trends.

Process engineers evaluate non-condensing water tube specifications based on thermal efficiency ratings, tube metallurgy compatibility, and feedwater chemistry tolerance when replacing aging boiler systems in chemical processing plants requiring reliable steam generation for distillation columns, reactor heating, and solvent recovery operations. Equipment procurement involves analyzing heat transfer surface area, circulation pump reliability, and maintenance accessibility while considering corrosion resistance requirements, safety system integration, and environmental compliance features necessary for hazardous chemical environments. Capital investment decisions balance initial equipment costs against operational efficiency improvements including reduced fuel consumption, decreased maintenance intervals, and enhanced process reliability that justify replacement timing throughout plant lifecycle management.

Manufacturing operations require specialized tube fabrication, pressure vessel welding, and refractory installation that achieve stringent quality standards while maintaining dimensional accuracy throughout complex heat exchanger assemblies and pressure boundary components. Production coordination involves managing material specifications, welding procedure qualification, and non-destructive testing while addressing code compliance, inspection requirements, and certification protocols mandated by ASME boiler and pressure vessel standards. Quality assurance procedures encompass hydrostatic testing, radiographic examination, and metallurgical verification that ensure structural integrity while supporting warranty obligations and insurance requirements throughout extended operational periods.

| Metric | Value |

|---|---|

| Non-Condensing Water Tube Chemical Boiler Market Estimated Value in (2025 E) | USD 1.5 billion |

| Non-Condensing Water Tube Chemical Boiler Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 2.9% |

The Non Condensing Water Tube Chemical Boiler market is undergoing steady growth, driven by the increasing demand for energy-efficient and high-capacity steam generation in the chemical processing sector. Industrial expansion, particularly in emerging markets, is contributing to rising adoption as manufacturers seek robust systems capable of supporting intensive operations. These boilers are being increasingly selected for their ability to provide consistent performance under variable loads and for their suitability in high-pressure applications.

Environmental regulations are encouraging the use of cleaner fuels and modern combustion technologies, which non-condensing water tube boilers can accommodate effectively. The ability to integrate with natural gas and support modular capacity configurations further enhances their appeal.

As energy costs rise and operational efficiencies become central to chemical production processes, demand for these boilers is anticipated to grow. With increasing infrastructure investments and ongoing modernization of industrial plants, the market is positioned for long-term expansion across both developed and developing regions..

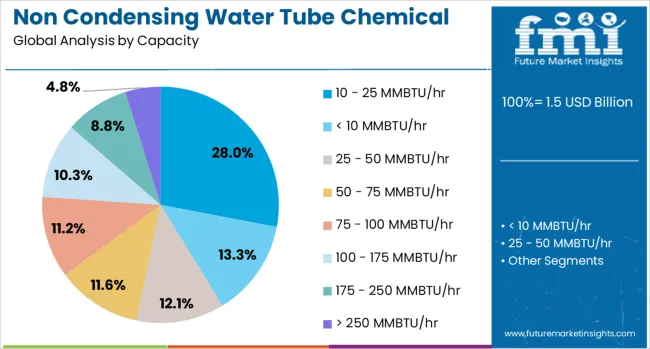

The non-condensing water tube chemical boiler market is segmented by capacity, fuel, and geographic regions. By capacity, the non-condensing water tube chemical boiler market is divided into 10 - 25 MMBTU/hr, < 10 MMBTU/hr, 25 - 50 MMBTU/hr, 50 - 75 MMBTU/hr, 75 - 100 MMBTU/hr, 100 - 175 MMBTU/hr, 175 - 250 MMBTU/hr, and> 250 MMBTU/hr.

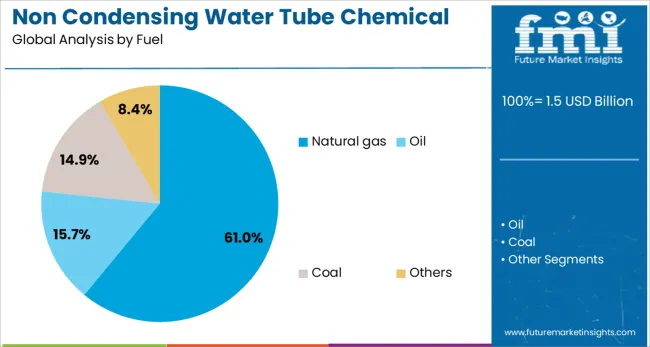

In terms of fuel, the non-condensing water tube chemical boiler market is classified into Natural gas, oil, coal, and others. Regionally, the non-condensing water tube chemical boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 10 to 25 MMBTU per hour capacity segment is projected to account for 28% of the Non Condensing Water Tube Chemical Boiler market revenue share in 2025. This capacity range has emerged as the leading choice due to its operational flexibility and alignment with medium-scale chemical processing requirements. It has been observed that boilers in this capacity bracket offer an optimal balance between energy efficiency and steam output, allowing for stable performance across varying production cycles.

Their compact footprint and lower initial investment costs have encouraged adoption in plants with limited installation space or budgetary constraints. Additionally, ease of maintenance and adaptability to automation systems have supported widespread integration in both existing and newly commissioned facilities.

As chemical manufacturers prioritize cost-effective solutions without compromising reliability, boilers within the 10 to 25 MMBTU per hour range have continued to gain traction. Their ability to scale production while maintaining performance metrics has reinforced their leadership position within the capacity segment..

The natural gas subsegment is expected to hold a dominant 61% revenue share of the Non Condensing Water Tube Chemical Boiler market in 2025. Its leadership has been attributed to the increasing shift toward cleaner and more cost-efficient fuel sources in industrial steam generation. The combustion efficiency and lower emissions associated with natural gas have positioned it as the preferred fuel for chemical boilers, particularly in regions with stringent air quality regulations.

Supply stability and the expansion of natural gas infrastructure have also enabled seamless integration of these systems in both urban and industrial zones. Moreover, compatibility with advanced burner systems and real-time control technologies has improved operational precision, further supporting its market share.

With industries seeking to reduce carbon footprints while maintaining thermal efficiency, natural gas has consistently demonstrated value across operational, environmental, and economic dimensions. The trend toward sustainable production practices and future regulatory compliance is expected to further solidify natural gas as the fuel of choice in the foreseeable future..

The non-condensing water tube chemical boiler market is witnessing robust growth driven by demand for reliable steam generation in industrial chemical processes. Opportunities are emerging in retrofitting old boilers and deploying energy-efficient control systems for process optimization. Key trends include automation integration, advanced monitoring systems, and modular boiler designs for flexible installations. However, restraints include high installation costs, operational complexity, and strict regulatory compliance for emissions and safety. Overall, the outlook suggests stable growth supported by industrial expansion and modernization strategies targeting performance enhancement in large-scale chemical plants.

The main growth driver is the increasing need for continuous steam supply in large chemical and petrochemical plants. In 2024 and 2025, production facilities in Asia-Pacific and the Middle East installed water tube boilers to meet higher process efficiency and operational safety standards. Their ability to handle high-pressure, high-capacity steam generation has made them preferred for demanding chemical environments. Refineries and fertilizer plants have shown significant adoption for maintaining uninterrupted production cycles. This trend underlines the critical role of non-condensing boilers in ensuring industrial reliability under extreme operational conditions.

Significant opportunities exist in retrofitting aging boiler systems with advanced components and integrating digital control systems. In 2025, chemical plants in North America and Europe initiated modernization programs to replace older fire tube units with water tube configurations offering higher pressure capabilities. Energy optimization through automated feedwater systems and improved combustion controls has attracted investments from major processing companies. These projects reflect a market shift toward solutions that reduce operational downtime, improve safety, and enhance fuel efficiency, creating room for suppliers focused on tailored retrofit packages and control integration.

The adoption of automated monitoring systems and modular boiler designs represents a major trend. In 2024, automation-enabled water tube boilers with remote diagnostics and predictive maintenance features gained prominence in high-capacity chemical plants. Modular boilers that allow scalability and rapid installation were introduced for facilities expanding production lines without full shutdown. Advanced material selection for higher corrosion resistance also became a focus area. These developments indicate the industry’s preference for smart, adaptable systems designed to reduce operational risk, lower maintenance intervals, and support plant expansion plans effectively.

Market restraints are primarily linked to elevated capital investment requirements and compliance challenges. In 2025, small and mid-sized chemical manufacturers delayed procurement of non-condensing water tube boilers due to high upfront costs and complex installation demands. Environmental regulations related to emission control added further compliance expenses, impacting project timelines. Shortage of skilled technicians for installation and maintenance also slowed adoption in emerging regions. These limitations highlight the need for cost-efficient manufacturing, financial leasing options, and comprehensive service programs to address barriers and maintain competitive growth in this sector.

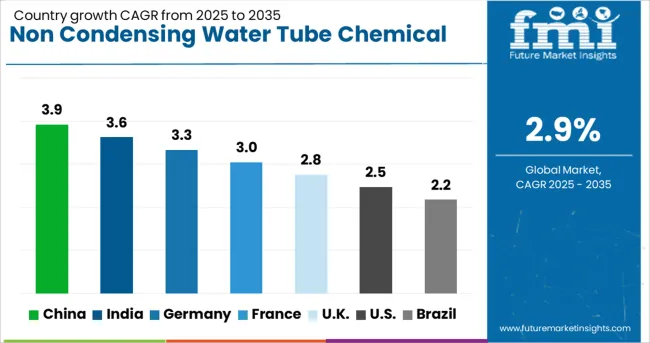

| Country | CAGR |

|---|---|

| China | 3.9% |

| India | 3.6% |

| Germany | 3.3% |

| France | 3.0% |

| UK | 2.8% |

| USA | 2.5% |

| Brazil | 2.2% |

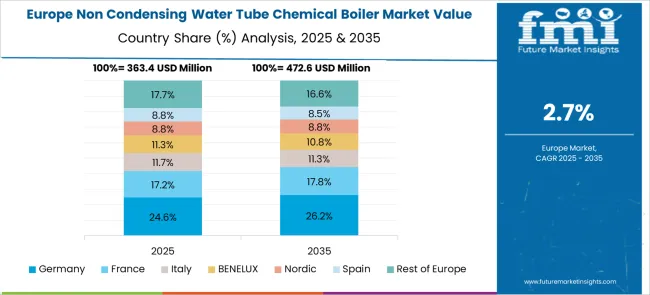

The global non-condensing water tube chemical boiler market is projected to grow at 2.9% CAGR between 2025 and 2035. China leads at 3.9% CAGR, supported by robust chemical manufacturing, energy-intensive processing, and government-backed industrial projects. India follows at 3.6%, driven by demand from fertilizer plants, petrochemical units, and specialty chemical industries. France posts 3.0% CAGR, focusing on modernization and stricter emission compliance for industrial boilers. The UK grows at 2.8%, while the United States records 2.5%, reflecting steady replacement demand in a mature industrial landscape with emphasis on efficiency upgrades. Asia-Pacific dominates growth due to rapid industrialization and heavy investments in chemical production, while Europe and North America prioritize sustainability-driven retrofitting and automation technologies.

China remains the top growth contributor with an expected 3.9% CAGR, propelled by large-scale chemical production and process industry expansion. Increasing deployment of water tube boilers in high-pressure applications enhances productivity in petrochemical and fertilizer plants. Government initiatives for upgrading industrial equipment and maintaining operational efficiency further drive demand. Domestic manufacturers offer cost-effective, large-capacity boiler systems, while global players introduce advanced automation and safety controls. Retrofitting older units for improved fuel efficiency and compliance with emission norms is a major trend in energy-intensive sectors.

The market in India is forecasted to grow at 3.6% CAGR, fueled by expansion in chemical processing, pharmaceuticals, and energy-intensive sectors. Rising investment in fertilizer and specialty chemical plants supports steady demand for non-condensing water tube boilers. Manufacturers focus on high-capacity units with improved heat transfer efficiency to reduce fuel costs. Government initiatives promoting industrial modernization and energy audits accelerate retrofitting and automation adoption. Local suppliers dominate low-cost segments, while global brands provide premium solutions with advanced performance monitoring and predictive maintenance capabilities.

France is projected to grow at 3.0% CAGR, reflecting steady adoption in the chemical, food processing, and paper manufacturing industries. EU emission regulations mandate modernization of boiler systems to improve efficiency and reduce carbon output. This drives demand for advanced combustion systems and optimized heat exchangers in new installations and retrofits. Digital monitoring tools integrated with boiler systems improve energy tracking and compliance reporting. Leading European suppliers focus on low-emission burners and adaptive control systems to meet strict regulatory standards.

The United Kingdom market is expected to expand at 2.8% CAGR, driven by industrial retrofits, modernization programs, and resilience planning in chemical plants. Replacement demand dominates as aging boiler systems are upgraded to improve efficiency and meet environmental standards. Adoption of smart boiler control systems enhances automation, energy savings, and predictive maintenance. Integration of water treatment solutions with boiler systems also gains traction to extend equipment lifecycle and reduce downtime. Premium demand comes from petrochemical clusters and energy-intensive processing units.

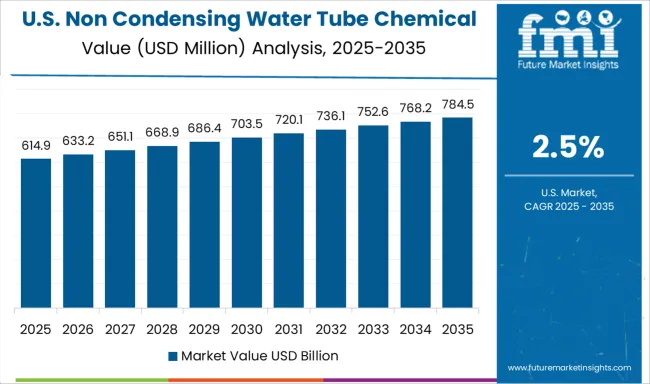

The United States market is forecasted to grow at 2.5% CAGR, reflecting slow but steady demand in a mature industrial setting. Growth is driven by replacement of outdated boilers, driven by energy efficiency targets and emission compliance. Adoption of water tube boilers in chemical and pulp industries continues for high-pressure applications. Manufacturers emphasize automation and connectivity for remote diagnostics and real-time monitoring. Partnerships between OEMs and industrial EPC contractors enhance project execution for large-scale boiler installations and retrofits.

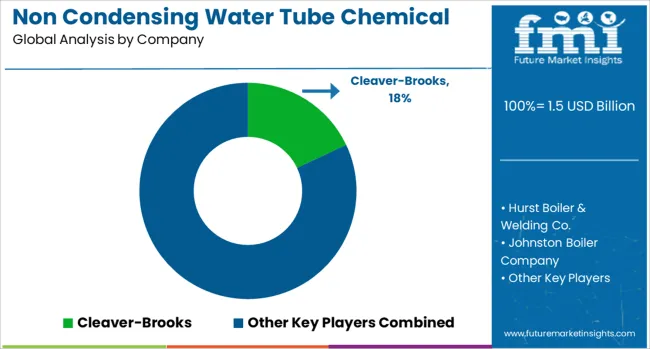

The non-condensing water tube chemical boiler market is defined by strong competition among established industrial boiler manufacturers emphasizing efficiency, reliability, and customization for chemical processing applications. Cleaver-Brooks Inc. and Hurst Boiler & Welding Co. Inc. lead the market through robust product portfolios featuring high-pressure, fire- and water-tube boiler systems engineered for consistent steam generation under demanding chemical plant conditions. Their focus on modular design and heat recovery integration enhances operational flexibility and thermal performance.

Johnston Boiler Company and Babcock & Wilcox Enterprises Inc. strengthen their market presence with heavy-duty boilers designed for large-scale chemical manufacturing, offering superior fuel-to-steam efficiency and low maintenance requirements. Babcock & Wilcox’s advancements in furnace design and combustion control systems enable precise temperature management and emission reduction in chemical processing environments.

Miura America Co. Ltd. brings innovation with compact, high-output water tube boilers that support rapid start-up and on-demand steam generation—key for modern chemical production requiring operational agility. Fulton Boiler Works Inc. complements the competitive landscape through advanced engineering in small to mid-capacity water tube systems known for consistent performance, energy optimization, and durability. Together, these players are driving modernization in chemical boiler technology through safety, automation, and enhanced process integration.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Capacity | 10 - 25 MMBTU/hr, < 10 MMBTU/hr, 25 - 50 MMBTU/hr, 50 - 75 MMBTU/hr, 75 - 100 MMBTU/hr, 100 - 175 MMBTU/hr, 175 - 250 MMBTU/hr, and > 250 MMBTU/hr |

| Fuel | Natural gas, Oil, Coal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Cleaver-Brooks Inc., Hurst Boiler & Welding Co. Inc., Johnston Boiler Company, Babcock & Wilcox Enterprises Inc., Miura America Co. Ltd., Fulton Boiler Works Inc. |

| Additional Attributes | Dollar sales by capacity (≤10 MMBtu/hr ~30% share, then 10–25, 25–50, 100–175, >250) and fuel (natural gas, oil, coal). Global market size ~USD 1.45 B in 2024, CAGR ~2.9% to 2034. Asia-Pacific fastest-growing, North America stable. Buyers prioritize high steam output, energy efficiency, low-NOx combustion, modular boilers, and IoT-based control integration. |

The global non-condensing water tube chemical boiler market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the non-condensing water tube chemical boiler market is projected to reach USD 2.0 billion by 2035.

The non-condensing water tube chemical boiler market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in non-condensing water tube chemical boiler market are 10 - 25 mmbtu/hr, < 10 mmbtu/hr, 25 - 50 mmbtu/hr, 50 - 75 mmbtu/hr, 75 - 100 mmbtu/hr, 100 - 175 mmbtu/hr, 175 - 250 mmbtu/hr and > 250 mmbtu/hr.

In terms of fuel, natural gas segment to command 61.0% share in the non-condensing water tube chemical boiler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-Condensing Fire Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Water Surface Conditioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA