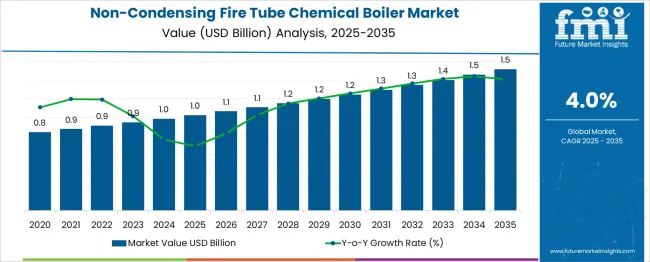

The Non-Condensing Fire Tube Chemical Boiler Market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 1.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

From 2025 to 2030, the market is expected to show modest growth, increasing from USD 1.0 billion to USD 1.2 billion, reflecting the mature nature of the segment. Year-on-year analysis indicates limited expansion, with values reaching USD 1.1 billion in 2026 and maintaining gradual gains through 2027, supported by continued use in industrial process heating where efficiency and reliability remain priorities.

By 2028, the market is forecasted to maintain steady progress at USD 1.2 billion, with similar levels through 2029 and 2030. Growth will largely be influenced by the refurbishment of older boiler units and compliance with operational safety regulations, rather than large-scale new installations. Limited adoption of advanced alternatives, such as condensing boilers in chemical plants, will sustain baseline demand for traditional fire tube designs. These dynamics position non-condensing fire tube chemical boilers as a niche yet essential component for specific process heating requirements in industries prioritizing durability and cost-effective maintenance over high-efficiency solutions.

| Metric | Value |

|---|---|

| Non-Condensing Fire Tube Chemical Boiler Market Estimated Value in (2025 E) | USD 1.0 billion |

| Non-Condensing Fire Tube Chemical Boiler Market Forecast Value in (2035 F) | USD 1.5 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The non-condensing fire tube chemical boiler market represents a key segment within industrial heating and process equipment categories. In the industrial boilers market, its share is approximately 8–10%, as water tube boilers and condensing systems dominate large-scale applications. Within the chemical processing equipment market, the share stands at 4–5%, as reactors, heat exchangers, and storage vessels occupy significant portions of the segment. In the fire tube boiler market, non-condensing variants account for nearly 30–35%, due to their cost-effectiveness, durability, and suitability for moderate pressure chemical applications.

For the steam and hot water generation systems market, the share is around 6–7%, reflecting their role in supplying process heat for chemical manufacturing. In the industrial heating equipment market, the contribution is about 3–4%, as a variety of heating technologies compete for adoption. Market growth is supported by demand for reliable steam generation in chemical plants, where process consistency and operational safety are critical.

Non-condensing fire tube boilers are favored for their lower initial cost, simpler design, and ease of maintenance compared to condensing alternatives. Although efficiency regulations encourage adoption of high-efficiency solutions, these boilers remain relevant for facilities prioritizing cost control and operational simplicity in medium-duty chemical processing environments.

The non-condensing fire tube chemical boiler market is observing sustained growth, driven by the need for reliable heat generation in chemical processing environments and the preference for lower maintenance solutions. The market is being influenced by stricter safety standards, energy efficiency goals, and demand for robust systems capable of withstanding corrosive and high-temperature operations.

Organizations are favoring non-condensing fire tube designs due to their durability, ease of repair, and suitability for specific chemical processes that require stable thermal output rather than maximum efficiency. Future outlook suggests that advancements in material science and control systems will enhance performance while aligning with environmental and regulatory compliance.

Growth opportunities are expected to emerge as companies upgrade legacy systems and prioritize operational continuity, while ongoing modernization of chemical plants continues to create demand for dependable boiler solutions.

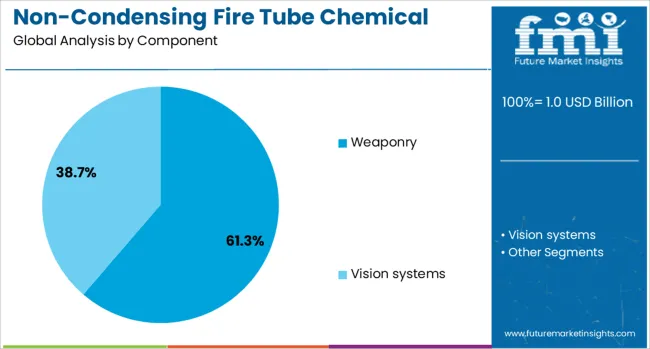

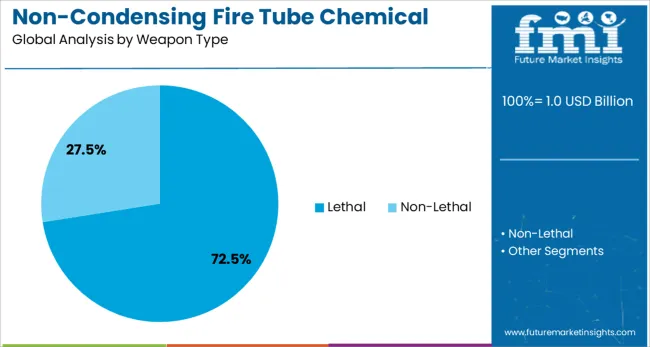

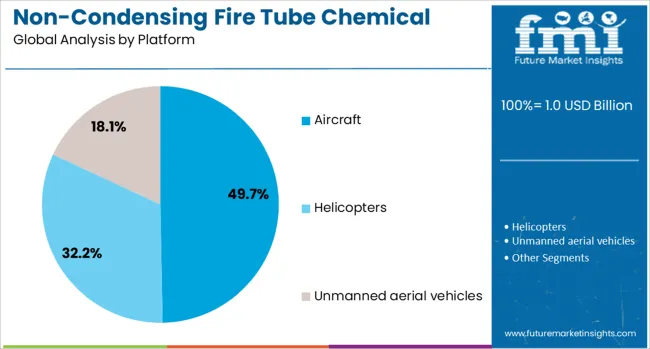

The non-condensing fire tube chemical boiler market is segmented by component, weapon type, platform, application, and geographic regions. The non-condensing fire tube chemical boiler market is divided into Weaponry and Vision systems. In terms of weapon type, the non-condensing fire tube chemical boiler market is classified into Lethal and Non-Lethal. The non-condensing fire tube chemical boiler market is segmented into Aircraft, Helicopters, and Unmanned aerial vehicles. By application of the non-condensing fire tube chemical boiler, the market is segmented into Military and Homeland security. Regionally, the non-condensing fire tube chemical boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by component, the weaponry segment is anticipated to hold 61.3% of the total market revenue in 2025, establishing itself as the dominant segment. This position has been reinforced by widespread demand for durable and integrated systems within chemical facilities, where weaponry-grade engineering ensures resilience under harsh operating conditions.

The ability of weaponry-grade components to maintain structural integrity, withstand thermal stress, and provide extended service life has driven their adoption.

Additionally, their compatibility with advanced monitoring and automation systems has improved operational reliability and reduced downtime, further supporting their leadership in the market.

In terms of weapon type, the lethal segment is projected to command 72.5% of the market revenue share in 2025, securing its place as the leading subsegment. This dominance has been attributed to its effectiveness in critical chemical applications where maximum thermal and structural performance is required.

The lethal type has been preferred due to its proven capability to handle high-pressure environments, deliver consistent heat transfer, and meet the stringent operational demands of chemical plants.

Enhanced by continuous innovations in manufacturing techniques and quality control, this segment has solidified its position by offering superior performance and reliability compared to alternatives.

Segmented by platform, the aircraft segment is expected to capture 49.7% of the market revenue in 2025, making it the top platform segment. This prominence has been supported by the unique operational requirements of chemical processes associated with aircraft manufacturing and maintenance facilities, where precise thermal management is critical.

The aircraft segment has benefited from its focus on high-capacity, dependable boiler systems that can meet exacting standards and sustain output in dynamic operating conditions.

Increased adoption of advanced boiler technologies tailored to aircraft-related applications has strengthened this segment’s leadership, supported by investments in modernization and compliance initiatives within the aerospace and chemical industries.

The non‑condensing fire tube chemical boiler market is experiencing steady expansion as chemical process industries seek reliable, high‑capacity hot water and low‑pressure steam generation. In 2024, demand increased in pharmaceutical, petrochemical, and process heating applications where proven design and simple operation were prioritized. By 2025, facility upgrades and maintenance-driven replacements further strengthened market adoption. Suppliers providing robust, easy‑to‑service fire tube boilers with consistent thermal output and compliance with industrial safety standards are positioned for leadership in this dependable equipment sector.

The established design and predictable operation of non‑condensing fire tube boilers have reinforced their selection in process-critical environments. In 2024, pharmaceutical plants and chemical processing facilities preferred such boilers for steady steam and hot water output, minimal fouling risk, and simplicity of maintenance. By 2025, focus on long‑term reliability and minimal operator training led to continued reliance on these boilers despite competitive alternatives. These patterns suggest that operational stability and low technical complexity are determining purchasing decisions. Manufacturers supplying field‑proven fire tube boilers with standardized configuration and easy parts access are expected to attract procurement preference in industrial settings.

A growing number of retrofit and replacement programs in aging chemical plant infrastructure are creating opportunities for boiler suppliers. During 2024, facility operators initiated replacement of legacy units with newer fire tube models to reduce downtime and align with safety protocols. In 2025, engineering firms specified updated non‑condensing fire tube designs to fit existing footprints and reduce integration complexity. This shift shows that replacement and upgrade use cases—not only new capacity additions—are fueling demand. Vendors offering retrofit‑ready boiler packages, with modular sizing and drop‑in compatibility, are well positioned to serve infrastructure renewal across chemical and process industries.

In 2024 and 2025, high upfront investment for non‑condensing fire tube chemical boilers emerged as a significant restraint. These systems require heavy-duty pressure vessels, advanced safety components, and certified materials, which collectively raise procurement costs. Smaller chemical plants and mid-scale operators in emerging regions were observed to delay adoption due to restricted capital budgets. Added expenses for installation and compliance further intensified the financial burden, creating hesitation among cost-sensitive buyers. Unless flexible financing options or modular cost-saving solutions are introduced, these financial barriers will continue to limit market expansion for this equipment category across critical chemical processing applications.

During 2024 and 2025, modular skid-mounted boiler units gained momentum in chemical processing environments due to faster installation and reduced civil work. These pre-assembled configurations allowed operators to minimize downtime, meet safety standards efficiently, and achieve operational readiness within shorter project timelines. Adoption was particularly evident in Europe and Asia-Pacific, where chemical manufacturers sought reliable yet space-optimized solutions. By offering scalable configurations, modular boilers addressed cost concerns without compromising performance or safety compliance. This shift highlights a clear opportunity for manufacturers to expand market share by emphasizing portability, standardization, and lower installation disruption as value propositions for end-users.

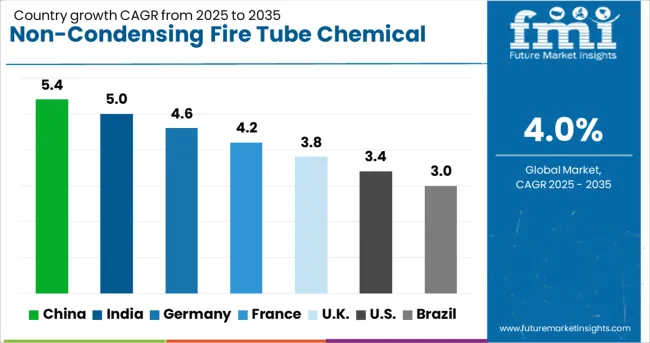

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

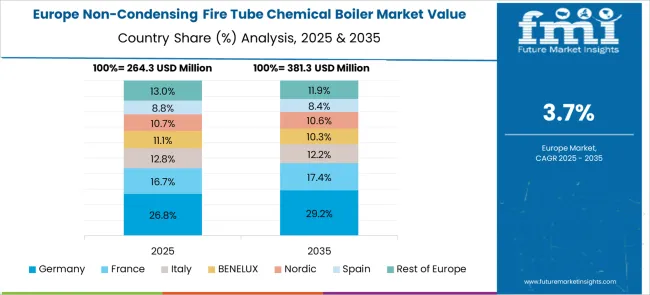

The global non-condensing fire tube chemical boiler market is projected to grow at a CAGR of 4% from 2025 to 2035. China leads with 5.4%, followed by India at 5.0% and Germany at 4.6%. France records 4.2%, while the United Kingdom posts 3.8%. Growth is supported by rising chemical manufacturing capacity, demand for reliable steam generation, and investments in process heating systems. China and India dominate adoption due to large-scale industrial expansion, while Germany focuses on energy-efficient designs for chemical plants. France and the UK prioritize modernization and compliance with safety standards in industrial heating applications.

The non-condensing fire tube chemical boiler market in China is forecast to grow at 5.4%, driven by rapid chemical sector growth and increased industrial heating requirements. Horizontal fire tube boilers dominate installations in large-scale processing plants. Manufacturers emphasize automation-enabled control systems for operational efficiency. Expansion of chemical export capacity further strengthens demand for high-capacity boilers.

The non-condensing fire tube chemical boiler market in India is projected to grow at 5.0%, supported by increasing chemical production and growing emphasis on cost-effective process heating solutions. Compact fire tube boilers dominate demand from mid-sized manufacturers. Producers invest in low-maintenance designs to reduce downtime. Expanding industrial clusters in Gujarat and Maharashtra strengthen regional adoption.

The non-condensing fire tube chemical boiler market in Germany is forecast to grow at 4.6%, driven by demand for robust heating systems in specialized chemical plants. High-pressure fire tube boilers dominate premium industrial applications. Manufacturers integrate advanced safety features and automated fault detection. Compliance with EU efficiency regulations enhances the development of durable, energy-optimized designs.

The non-condensing fire tube chemical boiler market in France is projected to grow at 4.2%, supported by modernization of older chemical facilities and demand for high-capacity heating solutions. Vertical fire tube boilers dominate installations in space-constrained environments. Manufacturers offer tailored solutions for fuel flexibility and emission control. Digital monitoring tools improve performance tracking and predictive maintenance.

The non-condensing fire tube chemical boiler market in the UK is expected to grow at 3.8%, driven by retrofitting initiatives and the need for reliable thermal energy systems in chemical plants. Modular fire tube boilers dominate small to medium plant installations. Manufacturers incorporate remote monitoring features to improve operational reliability. Strict safety and efficiency standards promote advanced automation integration.

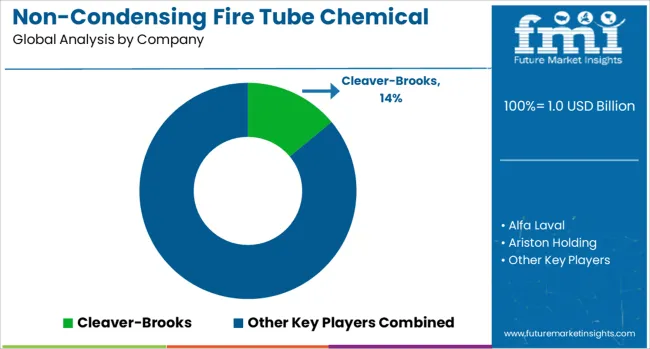

The non-condensing fire tube chemical boiler market is moderately consolidated, with Cleaver-Brooks recognized as a leading player for its extensive range of high-efficiency fire tube boilers designed for industrial and chemical processing applications. The company’s focus on robust designs, energy optimization, and integrated control systems has positioned it as a dominant supplier in this segment.

Key players include Alfa Laval, Ariston Holding, Babcock & Wilcox, Babcock Wanson, Bosch Industriekessel, Clayton Industries, Cochran, Forbes Marshall, Fulton, Hoval, Hurst Boiler & Welding, Miura America, Rakiro, Rentech Boiler Systems, Thermax, Thermodyne Boilers, and Viessmann. These companies deliver solutions catering to diverse operational requirements, emphasizing durability, safety compliance, and consistent steam generation under demanding conditions.

Market growth is driven by rising chemical production, modernization of industrial heating systems, and the growing need for reliable, cost-effective boiler solutions in manufacturing sectors. Manufacturers are focusing on product innovation, such as advanced combustion systems for fuel efficiency, automation for real-time monitoring, and modular designs for ease of installation.

Regional markets in Asia-Pacific are expected to see rapid expansion due to industrialization and investments in the chemical and petrochemical sectors, while North America and Europe maintain steady demand driven by plant upgrades and stringent operational standards.

Manufacturers are pioneering gas-fired and modular boiler configurations that enhance scalability and energy performance. Innovations include optimized combustion systems, improved heat exchanger designs, and digital integration for performance monitoring, all supporting reliability and efficiency in chemical and industrial steam applications..

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 Billion |

| Component | Weaponry and Vision systems |

| Weapon Type | Lethal and Non-Lethal |

| Platform | Aircraft, Helicopters, and Unmanned aerial vehicles |

| Application | Military and Homeland security |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cleaver-Brooks, Alfa Laval, Ariston Holding, Babcock & Wilcox, Babcock Wanson, Bosch Industriekessel, Clayton Industries, Cochran, Forbes Marshall, Fulton, Hoval, Hurst Boiler & Welding, Miura America, Rakiro, Rentech Boiler Systems, Thermax, Thermodyne Boilers, and Viessmann |

| Additional Attributes | Dollar sales by boiler configuration and capacity, Dollar sales by fuel and burner type, regional demand trends, competitive landscape, buyer preferences for reliability and safety certifications, integration with process control systems, innovations in modular skid-mounted designs, advanced thermal efficiency, and automated emissions control systems. |

The global non-condensing fire tube chemical boiler market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the non-condensing fire tube chemical boiler market is projected to reach USD 1.5 billion by 2035.

The non-condensing fire tube chemical boiler market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in non-condensing fire tube chemical boiler market are weaponry and vision systems.

In terms of weapon type, lethal segment to command 72.5% share in the non-condensing fire tube chemical boiler market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-Condensing Water Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Fire Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Apron Market Size and Share Forecast Outlook 2025 to 2035

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Sprinkler System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Suppression System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Materials Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire Door Market Size and Share Forecast Outlook 2025 to 2035

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Firearms Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA