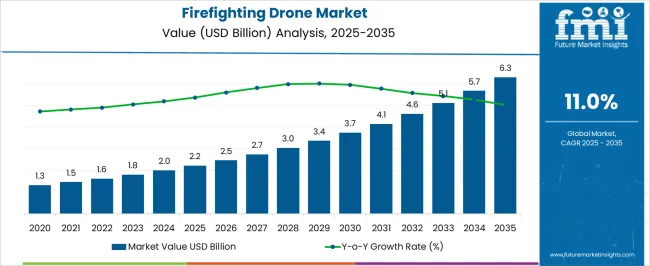

The firefighting drone market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 6.3 billion by 2035, registering a compound annual growth rate (CAGR) of 11.0% over the forecast period. The shift toward more efficient, tech-driven solutions in firefighting has been a key factor contributing to this growth. Firefighting drones provide critical advantages, including quick response times, reduced risks to human life, and enhanced monitoring of fire hazards in challenging environments. As fires become more complex and large-scale, these drones are increasingly seen as a crucial tool for modern firefighting operations.

The growing focus on disaster management and safety in both urban and rural areas is expected to drive significant demand for firefighting drones. With increased incidents of wildfires and urban fires, governments and emergency services are turning to advanced technologies to improve their firefighting capabilities.

Drones offer the added benefit of real-time aerial footage, which can help in strategic decision-making during fire operations. As the value of drone-based solutions becomes more evident, firefighting agencies are expected to adopt these tools at an accelerated pace. This shift will likely enhance the market's growth, ensuring that firefighting drones become an integral part of modern emergency response strategies.

| Metric | Value |

|---|---|

| Firefighting Drone Market Estimated Value in (2025 E) | USD 2.2 billion |

| Firefighting Drone Market Forecast Value in (2035 F) | USD 6.3 billion |

| Forecast CAGR (2025 to 2035) | 11.0% |

The firefighting drone market is estimated to hold a notable proportion within its parent markets, representing approximately 4-5% of the drone market, around 10-12% of the public safety drones market, close to 3-4% of the emergency response equipment market, about 2-3% of the aerial surveillance market, and roughly 1-2% of the unmanned aerial vehicles (UAV) market.

The cumulative share across these parent segments is observed in the range of 20-26%, reflecting the specialized role of firefighting drones within broader drone and emergency response sectors. The market has been influenced by the increasing demand for faster, safer, and more efficient firefighting solutions, where real-time data transmission, maneuverability, and payload capacity are highly prioritized. Adoption is guided by procurement decisions that focus on drone reliability, rapid deployment capabilities, and compatibility with various firefighting tools. Market participants have focused on developing drones with thermal imaging, water-dropping features, and real-time communication capabilities to ensure optimal performance in challenging fire response situations.

As a result, the firefighting drone market has not only captured a significant share within the public safety drones and emergency response sectors but has also impacted the aerial surveillance and UAV markets, highlighting its role in enhancing firefighting strategies, improving operational safety, and delivering rapid response capabilities across emergency situations.

The firefighting drone market is gaining significant traction due to the growing emphasis on advanced emergency response technologies that enhance safety and operational effectiveness during fire incidents. Increasing instances of wildfires, industrial accidents, and urban infrastructure fires are driving demand for rapid-deployment aerial systems capable of accessing hazardous or unreachable environments. Firefighting drones are being deployed to reduce risk to human personnel while improving the precision and coverage of fire suppression and situational assessment.

Technological advancements in drone propulsion, navigation, thermal imaging, and payload deployment are enhancing the reliability and functionality of these systems. Governments, fire departments, and private sector organizations are increasingly investing in drone-based firefighting units to strengthen disaster response infrastructure.

Additionally, the integration of AI and real-time data analytics in drone platforms is enabling more accurate fire mapping and decision-making As environmental challenges intensify and fire response strategies evolve, the market is expected to witness consistent growth, supported by rising awareness of drone advantages and continued innovations in drone hardware, control systems, and operational software.

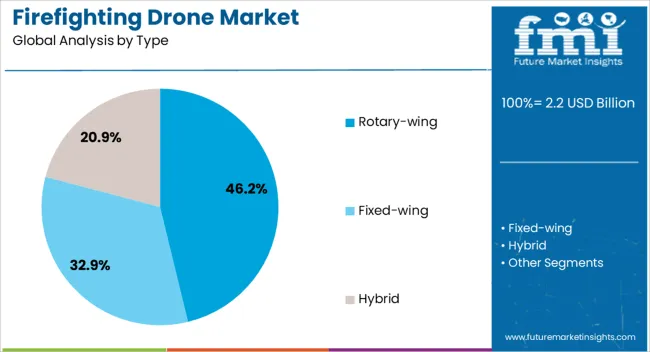

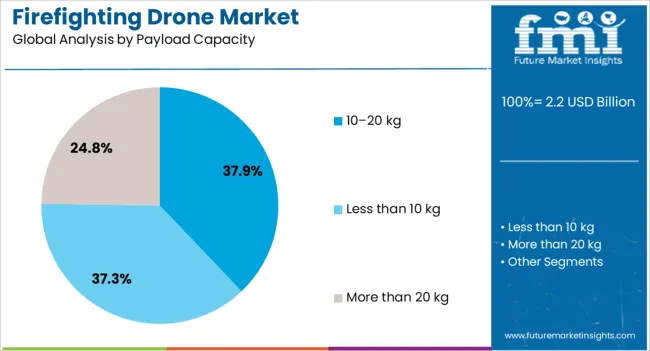

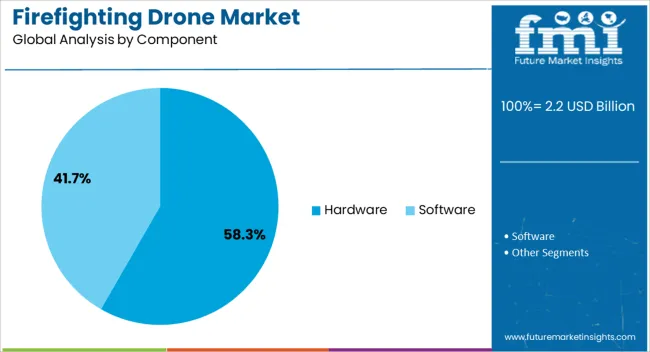

The firefighting drone market is segmented by type, payload capacity, component, application, end user, and geographic regions. By type, firefighting drone market is divided into Rotary-wing, Fixed-wing, and Hybrid. In terms of payload capacity, firefighting drone market is classified into 10–20 kg, Less than 10 kg, and More than 20 kg. Based on component, firefighting drone market is segmented into Hardware and Software. By application, firefighting drone market is segmented into Aerial firefighting, Fire detection, Monitoring, and Search and rescue.

By end user, firefighting drone market is segmented into Fire departments, Emergency services, Industrial enterprises, Forestry departments, Military and defense, and Others. Regionally, the firefighting drone industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rotary-wing segment is expected to account for 46.2% of the firefighting drone market revenue share in 2025, making it the leading type segment. Its dominance is being driven by superior maneuverability and stability, which enable precise control during fire suppression and surveillance missions. Rotary-wing drones are capable of vertical takeoff and landing, which allows operation in confined urban environments, dense forests, and mountainous terrains where fixed-wing drones face limitations.

The ability to hover steadily in place enhances their suitability for close-range monitoring, real-time data collection, and targeted water or fire retardant delivery. These systems are increasingly preferred by firefighting units due to their adaptability across diverse scenarios including industrial fires, forest fires, and search-and-rescue missions.

Ongoing improvements in rotor efficiency, battery life, and payload compatibility are expanding the operational scope of rotary-wing drones. Their effectiveness in dynamic and high-risk environments continues to drive adoption, securing their position as the primary drone type within the market for fire emergency applications.

The 10–20 kg payload capacity segment is projected to hold 37.9% of the firefighting drone market revenue share in 2025, establishing itself as the leading payload category. This leadership is supported by the segment’s optimal balance between operational range, payload weight, and flight duration. Drones in this capacity range are capable of carrying essential firefighting tools such as thermal cameras, fire retardants, sensors, and communication equipment, without significantly compromising flight performance.

The segment is being favored for its ability to support multipurpose missions, including fire detection, live video transmission, and deployment of extinguishing agents. Increasing demand for drones that can operate efficiently in both dense urban areas and open forest terrains is reinforcing their popularity. Additionally, its compatibility with modular payload systems enables mission-specific configuration flexibility.

This payload class is also gaining traction among government agencies and private contractors due to lower operational costs and enhanced reusability. As fire response teams seek versatile, mid-capacity drones, this segment is expected to continue leading market adoption.

The hardware component segment is anticipated to represent 58.3% of the firefighting drone market revenue share in 2025, positioning it as the dominant component category. This segment’s leadership is being fueled by the high cost and critical role of physical drone systems, including airframes, rotors, propulsion units, payload mounting systems, and embedded sensors. The reliability and performance of firefighting drones are heavily dependent on the quality and durability of hardware components, especially in extreme temperatures and turbulent environments.

The segment is further supported by continuous advancements in lightweight materials, heat-resistant coatings, and modular build designs that allow for customization based on specific firefighting scenarios. Demand is also being driven by the need for ruggedized systems capable of maintaining structural integrity during extended missions and under challenging conditions.

Hardware investments typically account for the majority of capital expenditure in firefighting drone procurement, explaining the segment’s dominant share. As fire response technologies evolve, the need for enhanced drone durability and real-time operational reliability will continue to support this segment’s growth trajectory.

The firefighting drone market is evolving rapidly, driven by the increasing demand for faster and more efficient firefighting methods. Drones' capabilities in aerial surveillance and fire monitoring open up considerable market opportunities. Integration with AI and automation offers enhanced performance, making drones more valuable for fire management. However, challenges related to regulatory barriers and operational limitations need to be addressed. As these issues are resolved, the market is poised for significant growth in firefighting and related applications.

The firefighting drone market is gaining momentum as the need for quicker and more effective firefighting solutions increases. Drones are being deployed in emergency situations to assess fire intensity and provide real-time data, enabling faster response times. The demand for such technology is rising as it offers the ability to reach difficult and dangerous locations that are inaccessible to human firefighters. The growing adoption of drones for various fire-related operations is expected to propel the market's growth.

One of the most promising opportunities in the firefighting drone market is their use in aerial surveillance and fire monitoring. Drones equipped with advanced sensors can monitor fire behavior, detect hotspots, and provide valuable information to ground teams, reducing risks. This capability is especially valuable in forest fires and large-scale industrial fires, where traditional methods may fall short. As these capabilities are expanded, the role of drones in firefighting and fire prevention becomes even more significant, offering large-scale market potential.

The firefighting drone market is increasingly shifting toward integration with artificial intelligence (AI) and automated systems. AI-powered drones can now analyze fire patterns, predict fire spread, and suggest optimal firefighting strategies. The increased focus on automation allows drones to operate autonomously, providing real-time data to control centers without manual input. As these trends continue, the market will likely see more autonomous and intelligent drones, further driving the adoption of this technology in firefighting.

Despite the growing interest in firefighting drones, significant challenges remain. Regulatory hurdles, including airspace restrictions, must be navigated to ensure the safe and legal use of drones in firefighting operations. Additionally, the operational limitations of drones, such as battery life and payload capacity, may hinder their full potential. Overcoming these challenges will be crucial to ensuring the broader deployment of drones for firefighting, limiting their current use to certain areas and situations.

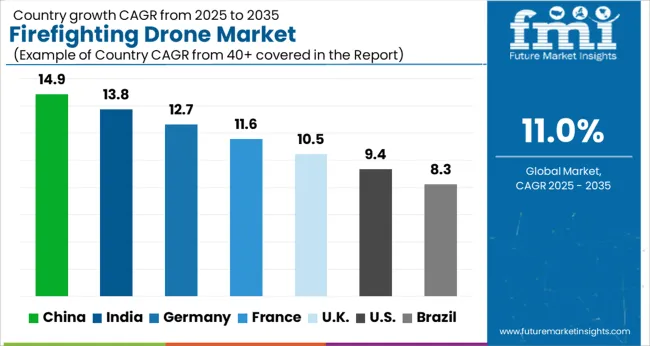

| Country | CAGR |

|---|---|

| China | 14.9% |

| India | 13.8% |

| Germany | 12.7% |

| France | 11.6% |

| UK | 10.5% |

| USA | 9.4% |

| Brazil | 8.3% |

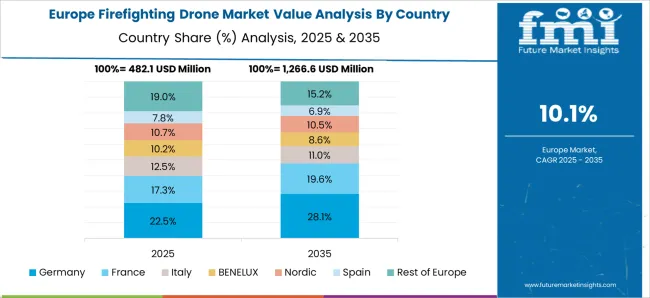

The global firefighting drone market is projected to grow at a CAGR of 11% from 2025 to 2035. China leads with a growth rate of 14.9%, followed by India at 13.8%, and France at 11.6%. The United Kingdom records a growth rate of 10.5%, while the United States shows the slowest growth at 9.4%. The growing importance of advanced firefighting technologies, especially in densely populated and hard-to-reach areas, is driving the demand for firefighting drones. Emerging markets like China and India benefit from government initiatives to modernize firefighting fleets, while developed economies focus on incorporating drones into broader emergency response frameworks. This report includes insights on 40+ countries; the top markets are shown here for reference.

The firefighting drone market in China is experiencing rapid growth, projected to increase at a CAGR of 14.9%. This growth is primarily driven by the country’s growing focus on modernizing its firefighting infrastructure and adopting technology for disaster management. As China grapples with frequent wildfires and urban fire emergencies, the demand for drones that can assist in fire detection, real-time monitoring, and firefighting operations is increasing. The government’s commitment to innovation in the public safety sector, combined with large-scale investments in drone technology, has made China one of the largest markets for firefighting drones. Moreover, China’s rapid urbanization and expansion of industrial zones require advanced solutions to manage fire risks efficiently. Drones help by covering inaccessible areas and ensuring a faster, more precise response.

The firefighting drone market in India is growing at a rate of 13.8%, driven by the increasing frequency of large-scale industrial and forest fires. With a rapidly growing urban population and increasing industrial activities, India faces a pressing need to modernize its firefighting operations. Drones offer significant advantages, including real-time surveillance, firefighting from above, and providing critical data to first responders. In addition, India’s government has been investing in upgrading its firefighting resources, including the integration of drones, as part of its broader emergency response initiatives. The rising awareness of the benefits of technology in disaster management, coupled with the Indian government’s support for innovation in public safety, is expected to further drive the growth of the firefighting drone market in the coming years.

The firefighting drone market in France is projected to experience a growth rate of 11.6% in its firefighting drone market, driven by increasing demand for advanced technology to combat the growing risk of wildfires. France’s extensive forests, particularly in the southern regions, are prone to wildfires, leading to a higher adoption of innovative firefighting technologies like drones. The country has also seen the integration of drones into emergency response teams to aid in fire monitoring, surveillance, and direct intervention. France’s support for technological advancements in firefighting and the integration of drones into national fire management strategies have created an expanding market for these devices. Additionally, drones are increasingly seen as a tool to reduce human exposure to dangerous firefighting environments, ensuring safety for personnel while improving operational efficiency.

The firefighting drone market in the United Kingdom is expected to grow at a rate of 10.5%, with drones increasingly being used to enhance fire detection, prevention, and suppression efforts. The UK faces a diverse range of fire risks, from urban fires to forest fires, and drones offer unique advantages in such situations. The UK government’s initiatives to incorporate advanced technology in public safety operations have facilitated the integration of drones into firefighting strategies. The growing emphasis on using drones for risk assessment, surveillance, and emergency response is contributing to the market expansion. Furthermore, drones in the UK can also assist in post-fire damage assessment, making them an indispensable tool for fire services.

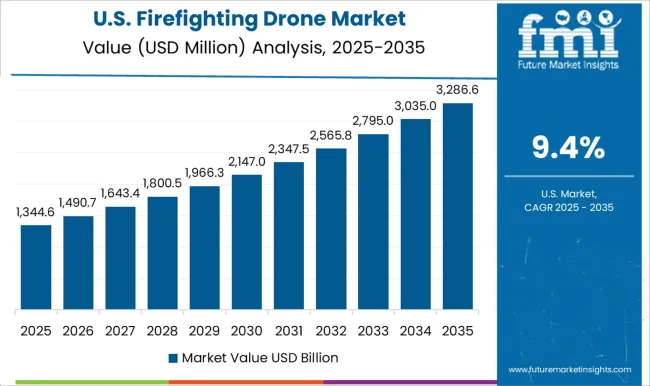

The firefighting drone market in the United States is seeing a slower growth in the firefighting drone market at 9.4%, but the adoption of these technologies is steadily increasing due to the country’s frequent fire emergencies and natural disasters. The USA government and private sector are investing in modernizing firefighting tools, with drones being a key component in aerial surveillance, firefighting operations, and hazard mitigation. Drones help the USA fire services monitor large-scale wildfires, especially in remote areas that are hard to access. Additionally, drones are used to provide situational awareness, which can assist first responders in making more informed decisions during critical firefighting operations. As the USA continues to face increasing wildfire threats, drones are poised to become an essential tool for managing fire risks.

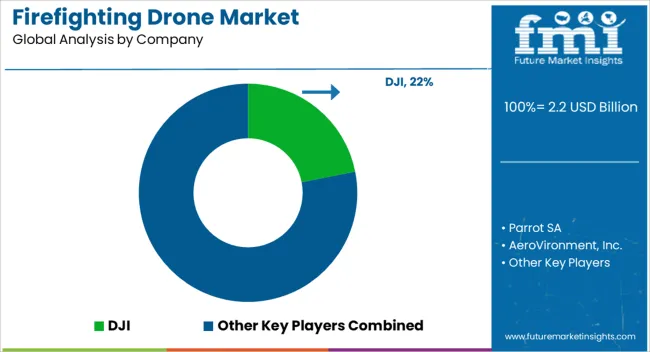

The firefighting drone market is gaining traction with advancements in drone technology that support fire detection, monitoring, and suppression. Leading companies like DJI, Parrot SA, and AeroVironment, Inc. are at the forefront, equipping drones with high-definition cameras, infrared sensors, and thermal imaging capabilities to assist in fire management. DJI has become a dominant player by providing drones with real-time monitoring features, enabling emergency responders to assess fire conditions and strategize interventions from a safe distance. Meanwhile, Parrot SA offers drones with specialized sensors for fire-related operations, providing critical data that supports firefighting efforts, particularly in hard-to-reach locations. These drones help reduce response times, improve safety, and provide more precise insights for decision-makers.

Other companies, including Yuneec, Elbit Systems Ltd., and Draganfly Inc., are expanding the capabilities of firefighting drones. Yuneec focuses on lightweight, portable drones that are ideal for quick deployment in emergency situations, enabling firefighters to assess situations rapidly. Elbit Systems Ltd. integrates advanced surveillance and detection systems, enhancing drone effectiveness in diverse fire scenarios. Draganfly Inc. specializes in drones capable of carrying fire retardants to assist ground crews in extinguishing fires, further elevating the role of drones in firefighting. Additionally, Lockheed Martin Corporation is exploring military-grade drone solutions that can handle large-scale operations in extreme environments. The increasing prevalence of wildfires and industrial accidents is driving demand for these specialized drones, which offer real-time data and enhance firefighting strategies, making them an integral part of modern firefighting efforts.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Type | Rotary-wing, Fixed-wing, and Hybrid |

| Payload Capacity | 10–20 kg, Less than 10 kg, and More than 20 kg |

| Component | Hardware and Software |

| Application | Aerial firefighting, Fire detection, Monitoring, and Search and rescue |

| End User | Fire departments, Emergency services, Industrial enterprises, Forestry departments, Military and defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DJI, Parrot SA, AeroVironment, Inc., Yuneec, Elbit Systems Ltd., Draganfly Inc., and Lockheed Martin Corporation |

| Additional Attributes | Dollar sales by drone type (fixed-wing, rotary-wing, hybrid) and application (forest fire, industrial fire, structural fire) are key metrics. Trends include rising demand for aerial firefighting solutions, growth in autonomous drone technologies, and increasing adoption for rapid response in hard-to-reach areas. Regional deployment, technological advancements, and regulatory support are driving market growth. |

The global firefighting drone market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the firefighting drone market is projected to reach USD 6.3 billion by 2035.

The firefighting drone market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in firefighting drone market are rotary-wing, fixed-wing and hybrid.

In terms of payload capacity, 10–20 kg segment to command 37.9% share in the firefighting drone market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Aerial Firefighting Market Size and Share Forecast Outlook 2025 to 2035

Drone Test Stand Market Size and Share Forecast Outlook 2025 to 2035

Drone Simulator Market Size and Share Forecast Outlook 2025 to 2035

Drones For Emergency Responders Market Size and Share Forecast Outlook 2025 to 2035

Drone Inspection and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Drone Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Drone Warfare Market Size and Share Forecast Outlook 2025 to 2035

Drone Analytics Market Size and Share Forecast Outlook 2025 to 2035

Drone Battery Market Size and Share Forecast Outlook 2025 to 2035

Drone Delivery Service Market Analysis by Delivery Distance, Propeller Type, End User, and Region, and Forecast from 2025 to 2035

Drone Sensor Market - UAV Advancements & Forecast 2025 to 2035

Drone Motor Market Growth - Trends & Forecast 2025 to 2035

Toy Drones Market Size and Share Forecast Outlook 2025 to 2035

Anti-Drone Technology Market

LiDAR Drone Market Size and Share Forecast Outlook 2025 to 2035

Counter Drone System Market Size and Share Forecast Outlook 2025 to 2035

Medical Drones Market Report – Growth & Forecast 2025-2035

Tethered Drone Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA