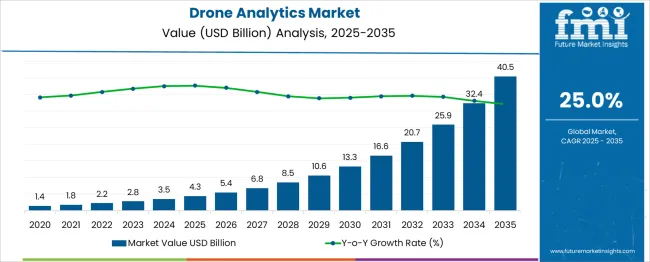

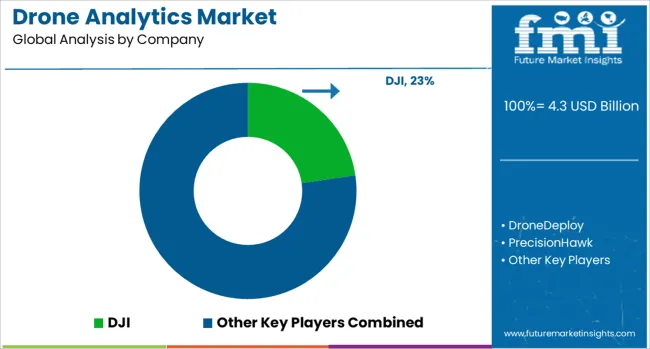

The Drone Analytics Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 40.5 billion by 2035, registering a compound annual growth rate (CAGR) of 25.0% over the forecast period.

The Drone Analytics Market reflects a strong growth trajectory, expanding from USD 1.4 billion in 2021 to USD 10.6 billion by 2030, representing an absolute dollar opportunity of USD 9.2 billion over the decade. This indicates an impressive CAGR of approximately 25.5%, driven by rapid adoption of drones across multiple sectors, including agriculture, construction, mining, energy, and defense. Year-wise progression shows steady acceleration, beginning with USD 1.4 billion in 2021, followed by USD 1.8 billion in 2022 and USD 2.2 billion in 2023, as industries increasingly leverage drones for aerial data capture, mapping, and inspection.

By 2024, the market reaches USD 2.8 billion, and climbs to USD 3.5 billion in 2025, signaling robust demand for analytics software integrated with AI and machine learning to process large-scale aerial data. The second half of the decade exhibits sharper growth momentum. In 2026, the market stands at USD 4.3 billion, rising to USD 5.4 billion in 2027, reflecting broader adoption in infrastructure monitoring and precision agriculture. By 2028, the market expands to USD 6.8 billion, driven by advancements in predictive analytics, automation, and cloud-based solutions.

Further acceleration sees the value reach USD 8.5 billion in 2029, culminating at USD 10.6 billion by 2030, as autonomous drone fleets and real-time analytics platforms become standard tools in industrial operations. This rapid expansion underscores the transformative role of drone analytics in optimizing operational efficiency, reducing inspection costs, and enhancing decision-making accuracy. Companies prioritizing AI-enabled analytics, data integration platforms, and compliance-driven solutions will gain a competitive edge in this evolving market.

| Metric | Value |

|---|---|

| Drone Analytics Market Estimated Value in (2025 E) | USD 4.3 billion |

| Drone Analytics Market Forecast Value in (2035 F) | USD 40.5 billion |

| Forecast CAGR (2025 to 2035) | 25.0% |

The drone analytics market holds a strong position within interconnected domains such as aerial imaging services, precision agriculture technologies, infrastructure monitoring systems, logistics and delivery solutions, and security and surveillance platforms. Within aerial imaging services, drone analytics contributes approximately 25 %, as real-time data processing and image interpretation are core functionalities.

In precision agriculture technologies, the share is about 20 %, driven by the adoption of drones for crop health assessment, yield optimization, and soil condition analysis. Infrastructure monitoring systems account for around 15 %, as construction, energy, and mining sectors leverage drones for site inspections, asset tracking, and progress mapping. In logistics and delivery solutions, drone analytics represents close to 10 %, with applications in route planning, operational safety, and predictive maintenance for autonomous delivery fleets.

For security and surveillance platforms, its share stands at 12 %, supporting perimeter security, crowd monitoring, and threat detection through advanced imaging analytics. This ecosystem integration underscores drone analytics as a transformative enabler in both commercial and industrial workflows. The demand surge is attributed to the convergence of AI, IoT, and machine learning with aerial platforms, enabling predictive insights and operational automation. Companies prioritizing scalable cloud-based analytics, real-time visualization, and compatibility with regulatory frameworks will gain competitive advantages as industries transition toward data-driven operational intelligence.

The integration of high-resolution imaging, thermal sensors, and AI-powered analytics platforms has enabled drones to transition from simple aerial imaging tools to intelligent surveillance and inspection assets.

Cloud computing infrastructure has become instrumental in scaling drone analytics by enabling real-time data processing, remote access, and centralized data management. In defense, construction, agriculture, and energy sectors, demand is rising for actionable insights derived from aerial data, such as terrain mapping, asset inspection, and movement tracking.

As governments and private enterprises expand their use of drones, compliance with airspace regulations, data privacy, and cybersecurity standards are shaping the development of software-defined drone analytics systems. The availability of 5G connectivity and edge AI accelerators is further expected to enhance the analytical capabilities of drones, making them essential tools for operational intelligence and risk mitigation in both public and private sector applications.

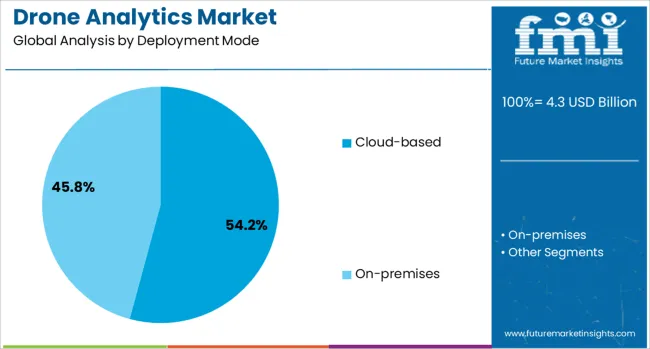

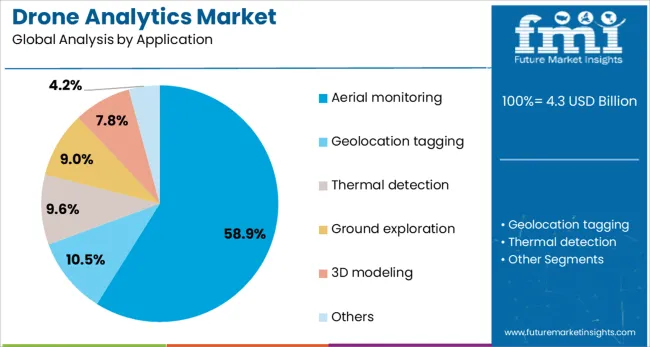

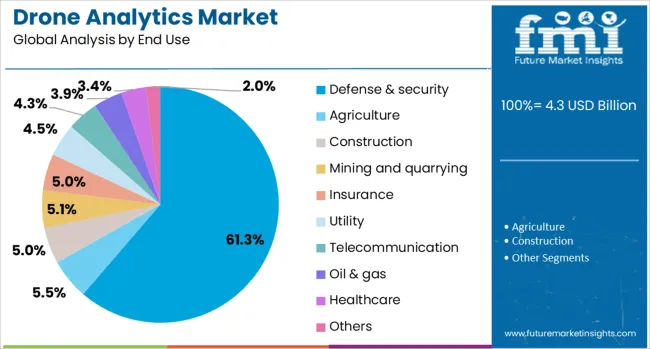

The drone analytics market is segmented by deployment mode, application, end use, and geographic regions. The drone analytics market is divided by deployment mode into Cloud-based and On-premises. The drone analytics market is classified into Aerial monitoring, Geolocation tagging, Thermal detection, Ground exploration, 3D modeling, and Others.

Based on end use, the drone analytics market is segmented into Defense & security, Agriculture, Construction, Mining and quarrying, Insurance, Utility, Telecommunication, Oil & gas, Healthcare, and Others. Regionally, the drone analytics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cloud based deployment mode segment is expected to hold 54.2% of the revenue share in the drone analytics market in 2025, making it the leading deployment approach. This dominance is being driven by the scalability, flexibility, and cost efficiency that cloud platforms provide for data-heavy drone operations.

Real-time access to large volumes of aerial imagery, telemetry, and geospatial data has been made possible through cloud infrastructure, which supports faster processing, storage, and distribution of analytics outcomes. The ease of integration with third-party analytics tools and AI frameworks has positioned cloud-based deployments as the preferred choice for organizations seeking advanced automation in mapping, surveillance, and predictive maintenance tasks.

Centralized data management, remote mission planning, and collaborative analysis have further strengthened adoption in industries with geographically dispersed operations. Moreover, the ability to push software updates, enforce security patches, and scale computing resources on demand has reinforced the role of cloud systems in supporting continuous improvement and regulatory compliance in drone analytics workflows.

The aerial monitoring segment is anticipated to account for 58.9% of the total revenue in the drone analytics market in 2025, underscoring its critical role in operational surveillance and situational awareness. This application has gained prominence across multiple sectors due to its ability to deliver wide-area coverage, high-resolution imagery, and time-sensitive insights with minimal human intervention.

Real-time aerial monitoring has become essential for environmental assessment, infrastructure inspection, disaster response, and resource tracking, where traditional methods fall short in terms of speed and accessibility. The integration of AI-powered analytics with drone feeds has enabled automated anomaly detection, movement tracking, and threat identification, significantly enhancing decision-making efficiency.

With increasing urbanization and infrastructure expansion, demand has surged for scalable monitoring solutions that offer operational safety and compliance with minimal on-ground presence. The continuous improvement of visual sensors, flight autonomy, and cloud integration has positioned aerial monitoring as the most impactful and widely implemented application in the drone analytics ecosystem.

The defense and security segment is projected to hold 61.3% of the total revenue share in the drone analytics market in 2025, reflecting its strategic importance in national security and tactical intelligence. Adoption in this sector has been propelled by the need for persistent surveillance, target acquisition, and real-time situational awareness across hostile or inaccessible environments. Drones equipped with advanced analytics capabilities are being utilized for border surveillance, convoy monitoring, and reconnaissance missions, significantly reducing risks to human personnel.

The integration of encrypted data transmission, AI powered threat detection, and geospatial analytics has made drone systems indispensable for modern defense strategies. Real-time image analysis, pattern recognition, and behavioral modeling have enhanced the precision and speed of military decision-making processes.

Additionally, increasing investments in UAV technology and defense modernization programs globally have accelerated the deployment of analytics-driven drone fleets. As asymmetric threats and complex terrains continue to evolve, the defense and security sector is expected to remain the most dominant end user of drone analytics systems.

Drone analytics adoption has accelerated due to its role in precision mapping, predictive maintenance, and real-time insights for cost efficiency and risk assessment. Integration with enterprise data ecosystems has been viewed as essential for scalability, compliance, and strategic agility across industries.

The demand for drone analytics has been elevated by its critical role in precision mapping, structural inspections, and agricultural yield optimization. Enterprises have adopted aerial data platforms for actionable insights in sectors such as construction, energy, and logistics. This transition has been linked to operational cost reduction as aerial monitoring reduces manual labor and accelerates site evaluation. Industries with dispersed assets, including utilities and oil fields, have leveraged drone-based analytics to enhance predictive maintenance and minimize downtime. The capability of integrating advanced imaging sensors with AI-driven software has been regarded as a strategic edge, enabling enterprises to analyze thermal anomalies, detect vegetation stress, and assess infrastructural risks with greater accuracy.

The growing requirement for real-time integration with enterprise resource planning systems and geographic information systems has reinforced the adoption of drone analytics. This trend has been observed as significant for stakeholders aiming to unify aerial insights with broader data workflows. Enterprise platforms have prioritized cloud-based analytical models that simplify data sharing across dispersed teams. Remote site management and compliance tracking have been interpreted as critical uses where drone analytics adds measurable value. The scalability of analytics platforms to manage increasing data loads has positioned them as essential in sectors emphasizing asset lifecycle management. This transformation has been seen as vital in ensuring strategic agility for organizations operating across multiple high-value projects.

The adoption of AI-powered analytical solutions in drone operations is rapidly accelerating, transforming raw aerial data into actionable insights across multiple industries. Advanced algorithms enable accurate object detection, predictive maintenance, and anomaly identification in real time, improving decision-making processes for sectors such as construction, energy, and agriculture. These capabilities reduce operational delays and enhance safety by automating data interpretation tasks previously handled manually. The increasing integration of machine learning models for trend forecasting and performance optimization positions drone analytics as a critical component of digital transformation strategies in industrial operations.

Infrastructure development and precision agriculture are emerging as major application areas driving drone analytics adoption. In construction and mining, drones equipped with analytics platforms facilitate structural integrity assessments, progress tracking, and compliance reporting, reducing downtime and operational costs. Similarly, in agriculture, real-time monitoring of crop health, irrigation patterns, and soil conditions through advanced analytics is enabling higher yield outcomes and resource efficiency. These applications are supported by rising investments in automated asset management systems and smart farming initiatives, pushing the demand for high-resolution imaging combined with data interpretation tools. This trend underscores drone analytics as an indispensable solution for industries seeking productivity improvements through advanced monitoring technologies.

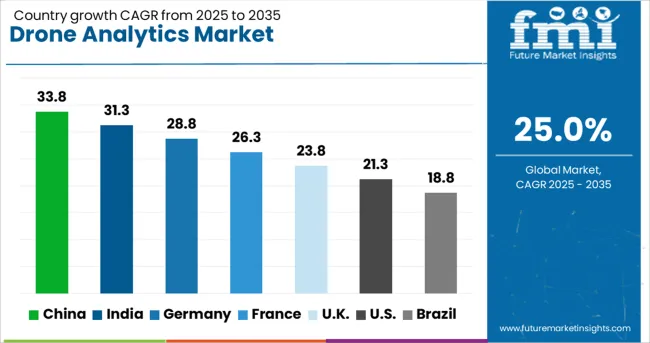

| Country | CAGR |

|---|---|

| China | 33.8% |

| India | 31.3% |

| Germany | 28.8% |

| France | 26.3% |

| UK | 23.8% |

| USA | 21.3% |

| Brazil | 18.8% |

The drone analytics sector, projected to expand at a global CAGR of 25.0% from 2025 to 2035, shows significant variations among leading countries. A 33.8% CAGR is being recorded in China, a BRICS member, where large-scale industrial automation and construction monitoring have been prioritized to boost operational visibility. India is posting a 31.3% CAGR, rapid adoption in agriculture, infrastructure planning, and logistics due to increased reliance on aerial intelligence platforms. Germany has demonstrated a 28.8% CAGR, supported by strong demand for industrial inspections and integration with enterprise digital workflows in energy and automotive sectors.

The United Kingdom is reporting a 23.8% CAGR as organizations invest in analytics for compliance management and asset lifecycle optimization in complex urban and offshore projects. The United States shows a 21.3% CAGR, attributed to extensive use in defense, public safety, and enterprise-grade mapping applications. While developed nations exhibit consistent adoption for compliance and operational control, a sharp opportunity lies in emerging markets like India and China, where data-driven decision-making is transforming asset management and infrastructure expansion. The report delivers an in-depth study of more than 40 countries, and the above five have been presented as references.

The CAGR for the drone analytics market in China advanced from nearly 18.6% during 2020–2024 to 33.8% in the 2025–2035 period. This acceleration has been linked to rapid deployment in infrastructure projects, utility asset monitoring, and smart city surveillance programs across multiple provinces. The market expansion was reinforced through large-scale adoption of aerial analytics in industrial automation, supported by government-backed digitization policies for energy and transportation sectors. Enterprises have relied on AI-based image processing for mining operations and crop health analysis, resulting in significant integration of drones with enterprise resource platforms. Major investments from regional drone manufacturers and partnerships with software firms have enabled China to dominate advanced analytics in logistics, mapping, and construction domains.

The CAGR for India’s drone analytics sector moved from about 16.2% during 2020–2024 to 31.3% for the 2025–2035 timeframe. Growth was influenced by demand for crop intelligence solutions and predictive maintenance analytics across renewable energy and transportation corridors. Agricultural monitoring accounted for early traction, with drone platforms being embedded into agri-tech ecosystems. Integration of data visualization dashboards and predictive modeling tools for irrigation and yield planning positioned India as a significant user of drone-powered analytics. Infrastructure development projects, including road and rail corridors, accelerated the need for photogrammetry and volumetric analysis. The participation of startups offering analytics-as-a-service expanded the ecosystem, alongside government schemes promoting drone utilization in mining and surveying.

Germany experienced a CAGR increase from nearly 14.8% in 2020–2024 to 28.8% during 2025–2035, driven by integration in automotive manufacturing plants, wind farm inspections, and compliance audits. Drone-based thermal imaging and 3D mapping tools were implemented for predictive maintenance in industrial assets, supporting productivity in automotive and heavy machinery sectors. Advanced photogrammetry software adoption grew in construction and urban planning workflows, leading to improved efficiency in large-scale infrastructure projects. Strategic emphasis on compliance tracking and safety inspections resulted in the deployment of drones across regulated energy sectors. Enterprises in Germany are increasingly integrating drone data into ERP and GIS platforms, highlighting a strong shift toward enterprise-level decision automation.

The CAGR for the United Kingdom rose from approximately 12.1% between 2020–2024 to 23.8% between 2025–2035, with expanded deployment in energy compliance, infrastructure audits, and maritime operations. Adoption has been propelled by the integration of drone data into asset lifecycle management for oil, gas, and renewable energy sectors. Remote inspection of offshore installations and construction sites became standard practice among operators to minimize downtime and improve safety performance. Analytics platforms offering high-resolution image interpretation for legal compliance reporting have gained traction among regulatory agencies and engineering firms. This surge is indicative of a gradual shift toward automation of site evaluations in heavily regulated environments across the UK.

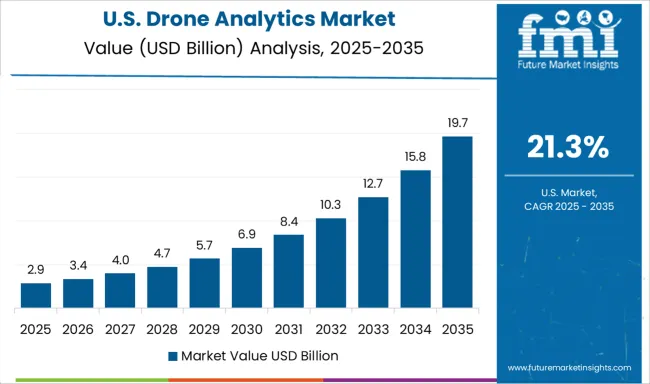

The CAGR for the United States market climbed from nearly 11.4% during 2020–2024 to 21.3% over 2025–2035, fueled by military-grade applications, large-scale utility inspections, and asset management systems. Defense agencies adopted analytics-driven drones for surveillance and tactical mapping, creating spillover benefits in commercial domains like construction and telecom infrastructure. Drone-based analytics platforms were used for vegetation encroachment monitoring across power grids and for disaster response planning in climate-sensitive regions. Cloud integration for geospatial data sharing across federal agencies and private contractors accelerated enterprise reliance on drone analytics tools. With strong venture capital inflows and tech partnerships, the US maintained leadership in developing advanced AI-driven predictive analytics for infrastructure resilience.

The drone analytics ecosystem is dominated by companies leveraging AI-driven data processing, geospatial modeling, and real-time visualization to enhance operational efficiency across diverse industries. DJI leads with advanced imaging technologies integrated into enterprise-grade analytics platforms, enabling detailed asset inspections, volumetric assessments, and precision mapping for energy, infrastructure, and agricultural applications.

DroneDeploy and PrecisionHawk are strengthening market presence through cloud-based analytics solutions that support crop health analysis, construction progress tracking, and environmental monitoring, offering seamless integration with GIS systems for enhanced spatial intelligence. Kespry and AgEagle Aerial Systems Inc. are focusing on tailored aerial intelligence for mining operations, crop performance assessments, and regulatory compliance audits, ensuring cost optimization for enterprise clients.

senseFly continues to dominate large-area mapping projects through fixed-wing drones optimized for surveying, infrastructure planning, and agricultural monitoring, delivering extended flight endurance and high-resolution data capture. Airware is recognized for enterprise-level cloud platforms combining predictive analytics with workflow automation for sectors such as utilities, telecommunications, and logistics, improving operational decision-making through real-time data insights.

These companies are increasingly forming strategic partnerships with ERP and construction software providers to create integrated ecosystems that streamline data flow from aerial capture to actionable intelligence. As AI, IoT connectivity, and predictive modeling converge, these players are setting new benchmarks for scalable, high-performance drone analytics solutions globally.

In February 2025, DJI launched the RS 4 Mini, a lightweight 890 g gimbal capable of supporting up to 2 kg payloads. Features include automated axis locks and fast setup for filmmakers and creators.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.3 Billion |

| Deployment Mode | Cloud-based and On-premises |

| Application | Aerial monitoring, Geolocation tagging, Thermal detection, Ground exploration, 3D modeling, and Others |

| End Use | Defense & security, Agriculture, Construction, Mining and quarrying, Insurance, Utility, Telecommunication, Oil & gas, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DJI, DroneDeploy, PrecisionHawk, Kespry, AgEagleAerialSystemsInc., senseFl, and Airware |

| Additional Attributes | Dollar sales, market share by hardware and software segments, competitive positioning, adoption trends in agriculture, energy, and defense, pricing benchmarks, regulatory impact, and AI integration opportunities. |

The global drone analytics market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the drone analytics market is projected to reach USD 40.5 billion by 2035.

The drone analytics market is expected to grow at a 25.0% CAGR between 2025 and 2035.

The key product types in drone analytics market are cloud-based and on-premises.

In terms of application, aerial monitoring segment to command 58.9% share in the drone analytics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drone Test Stand Market Size and Share Forecast Outlook 2025 to 2035

Drone Simulator Market Size and Share Forecast Outlook 2025 to 2035

Drones For Emergency Responders Market Size and Share Forecast Outlook 2025 to 2035

Drone Inspection and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Drone Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Drone Warfare Market Size and Share Forecast Outlook 2025 to 2035

Drone Battery Market Size and Share Forecast Outlook 2025 to 2035

Drone Delivery Service Market Analysis by Delivery Distance, Propeller Type, End User, and Region, and Forecast from 2025 to 2035

Drone Sensor Market - UAV Advancements & Forecast 2025 to 2035

Drone Motor Market Growth - Trends & Forecast 2025 to 2035

Toy Drones Market Size and Share Forecast Outlook 2025 to 2035

Anti-Drone Technology Market

LiDAR Drone Market Size and Share Forecast Outlook 2025 to 2035

Counter Drone System Market Size and Share Forecast Outlook 2025 to 2035

Medical Drones Market Report – Growth & Forecast 2025-2035

Tethered Drone Market Size and Share Forecast Outlook 2025 to 2035

Consumer Drones Market

Fumigation Drone Market Size and Share Forecast Outlook 2025 to 2035

Inspection Drone in Oil and Gas Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA