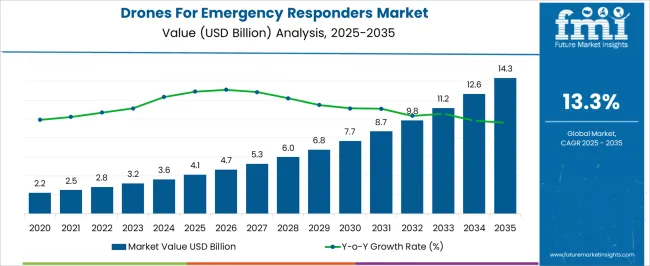

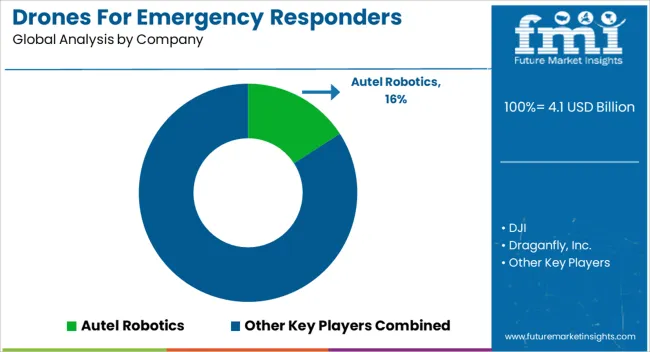

The drones for emergency responders market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 14.3 billion by 2035, registering a compound annual growth rate (CAGR) of 13.3% over the forecast period.

The drones for emergency responders market, estimated at USD 4.1 billion in 2025 and projected to reach USD 14.3 billion by 2035 with a CAGR of 13.3%, demonstrates a cost-structure and value-chain composition shaped by multiple interdependent components. The primary cost drivers in the market include the drone hardware itself, encompassing high-precision sensors, cameras, communication modules, and battery systems, which collectively account for the largest proportion of upfront expenditures.

Advanced imaging and navigation technologies such as LiDAR and thermal sensors contribute significantly to unit costs due to their critical role in search and rescue, fire monitoring, and disaster assessment operations. Software development and integration represent another substantial segment of the cost structure. Custom flight control platforms, AI-based analytics, and real-time data transmission solutions are essential for operational efficiency and reliability, impacting both initial investment and ongoing maintenance expenses. The regulatory compliance and certification procedures for emergency operations add incremental costs, particularly in regions with stringent aviation safety standards.

Operational and service costs, including pilot training, fleet management, and post-deployment maintenance, further influence the overall value chain. The supply chain is heavily influenced by component suppliers, system integrators, and software developers, with value distribution skewed toward high-technology hardware and software integration segments. As the market scales, economies of scale are expected to reduce unit costs, while increased adoption of modular designs and standardized software platforms could enhance margins. The combined effect of hardware, software, compliance, and services defines the cost structure and operational efficiency throughout the market’s value chain over the forecast period.

| Metric | Value |

|---|---|

| Drones For Emergency Responders Market Estimated Value in (2025 E) | USD 4.1 billion |

| Drones For Emergency Responders Market Forecast Value in (2035 F) | USD 14.3 billion |

| Forecast CAGR (2025 to 2035) | 13.3% |

The drones for emergency responders market represents a specialized segment within the global unmanned aerial vehicle and public safety technology industry, emphasizing rapid response, situational awareness, and operational efficiency. Within the broader UAV sector, it accounts for about 3.2%, driven by demand from fire departments, police, disaster management agencies, and search and rescue operations. In the public safety and emergency management technology segment, its share is approximately 4.1%, reflecting adoption for real-time monitoring, aerial reconnaissance, and incident mapping.

Across the first responder and disaster relief equipment market, it holds around 3.5%, supporting enhanced coordination and reduced response times. Within the critical infrastructure and emergency services technology category, it represents 2.9%, highlighting integration with communication networks, sensors, and data analytics platforms. In the overall smart public safety ecosystem, the market contributes about 2.6%, emphasizing improved efficiency, accuracy, and situational awareness in emergency operations. Recent trends in the drones for emergency responders market focus on autonomy, sensor integration, and data-driven decision-making. Groundbreaking developments include AI-powered flight control, thermal imaging, LiDAR mapping, and rapid deployment systems for firefighting, search and rescue, and disaster assessment.

Key players are partnering with public safety agencies, software providers, and sensor manufacturers to develop modular, mission-specific UAV solutions. Real-time data streaming, cloud-based analytics, and automated reporting are gaining traction to improve response times and operational efficiency. The regulations and training programs are evolving to enable safe drone operations in urban and disaster-stricken areas. These advancements demonstrate how technology, integration, and rapid deployment capabilities are shaping the market.

The drones for emergency responders market is gaining momentum as agencies and governments increasingly adopt unmanned aerial systems to enhance operational efficiency, situational awareness, and response times during critical incidents. These drones offer unique capabilities such as aerial surveillance, real-time data transmission, and access to hazardous or remote areas, making them invaluable in high-stakes emergency scenarios.

The market is benefiting from advancements in sensor technologies, flight control systems, and AI integration, which collectively improve mission reliability and precision. With the rising frequency of natural disasters, security threats, and large-scale accidents, emergency response teams are investing in scalable and rugged drone solutions.

Looking ahead, greater regulatory support, cross-agency collaborations, and funding for smart city infrastructure are expected to further accelerate adoption. As drone technology matures, its integration into emergency protocols is anticipated to become standardized, creating a stable and high-potential growth environment for the market

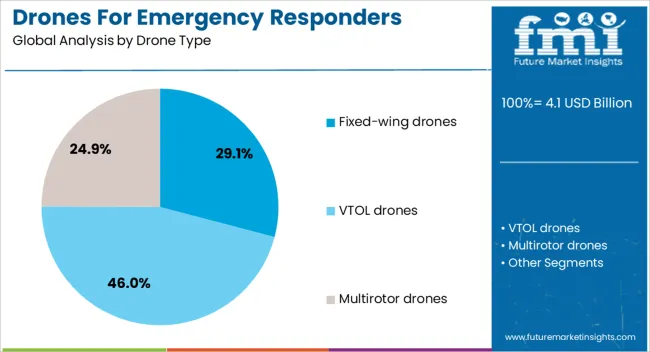

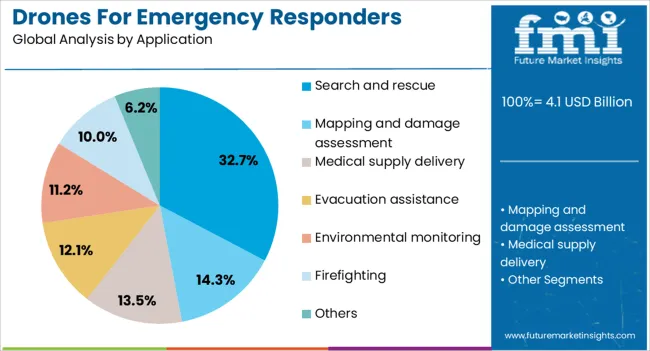

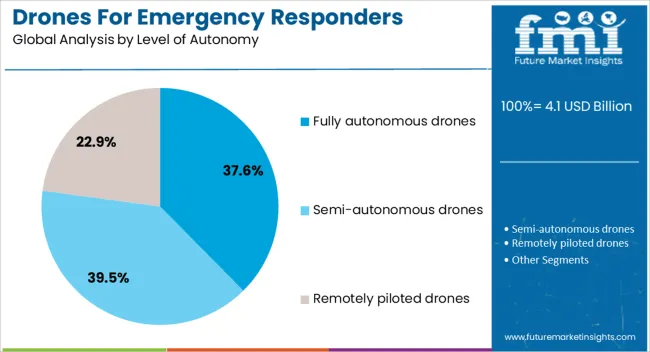

The drones for emergency responders market is segmented by drone type, application, level of autonomy, end-user, and geographic regions. By drone type, drones for emergency responders market is divided into fixed-wing drones, VTOL drones, and multirotor drones. In terms of application, drones for emergency responders market is classified into search and rescue, mapping and damage assessment, medical supply delivery, evacuation assistance, environmental monitoring, firefighting, and others. Based on level of autonomy, drones for emergency responders market is segmented into fully autonomous drones, semi-autonomous drones, and remotely piloted drones. By end-user, drones for emergency responders market is segmented into government, defense, industrial sites, and others. Regionally, the drones for emergency responders industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The VTOL drones segment holds a 46.0% share in the drone type category, attributed to its ability to take off and land vertically while maintaining efficient forward flight. These drones are particularly suited for emergency response operations in constrained environments, such as urban disaster zones, mountainous regions, and offshore platforms where runway access is limited or unavailable.

Their hybrid design combining the agility of rotor-based systems with the endurance of fixed-wing models makes them advantageous for missions requiring rapid deployment, flexible maneuverability, and stable hover capabilities. Demand for VTOL models is rising among emergency agencies seeking all-terrain adaptability and faster operational readiness.

While they are generally more complex and costly than conventional drone types, advancements in autonomous navigation, energy-efficient propulsion, and modular payload systems are mitigating these challenges. Continued improvements in battery density, AI-driven flight control, and resilient communication networks are expected to further enhance the VTOL segment’s utility in modern emergency response frameworks.

The search and rescue application segment commands a 32.7% share of the market, driven by the critical need for rapid, efficient, and safe location of missing or endangered individuals. Drones have revolutionized search and rescue efforts by enabling responders to cover challenging terrain quickly, access inaccessible zones, and identify victims through thermal imaging and high-resolution cameras.

This segment is expanding due to the rising incidence of natural disasters, wilderness accidents, and urban search operations where time-sensitive response is vital. Integration of geospatial mapping, AI-powered object detection, and night vision technologies is enhancing mission success rates and operational confidence.

Agencies are increasingly integrating drones into standard protocols to improve search efficiency and reduce personnel risk. The continued evolution of compact, weather-resistant drones with longer flight times and live-streaming capabilities is expected to solidify the search and rescue segment’s leadership in the market

The semi-autonomous drones segment represents 39.5% of the market within the level of autonomy category, highlighting their strong adoption due to the balance they offer between manual oversight and automated functions. These drones integrate AI-driven navigation, obstacle detection, and mission assistance tools, while still allowing operators to intervene when necessary for precision and safety.

Their utility in emergency scenarios lies in their ability to reduce pilot workload while maintaining human control for critical decision points, ensuring adaptability across diverse mission profiles. The segment has seen steady growth with advancements in intelligent flight assistance, automated stabilization systems, and integration with operator-friendly interfaces.

Semi-autonomous systems are particularly valuable in situations that demand both real-time human judgment and enhanced automation, such as disaster assessment, medical supply delivery, and coordinated search operations. As autonomy technology progresses and training frameworks expand, this segment is expected to maintain a dominant role in bridging the gap between manual and fully autonomous drones, reinforcing its importance in modern emergency response solutions.

The market for drones used by emergency responders has grown significantly due to their critical role in disaster management, search and rescue, and rapid response operations. These drones are equipped with thermal imaging cameras, high-resolution sensors, and communication modules that allow responders to assess hazards, locate victims, and provide real-time situational awareness. Governments, first responders, and private organizations are investing in drone fleets to improve operational efficiency and reduce response times during emergencies. Integration with GPS, AI-based navigation, and remote monitoring platforms has enhanced mission accuracy and safety. Increasing natural disasters, urban emergencies, and the need for rapid medical and disaster response have strengthened the adoption of drones in public safety and emergency management sectors.

Drones have become essential tools in search and rescue operations, particularly in challenging terrains and disaster-affected regions. Equipped with high-resolution cameras, LiDAR sensors, and thermal imaging, these drones allow responders to locate missing persons, assess structural damage, and map disaster zones in real-time. Their deployment reduces risk to human personnel by minimizing exposure to dangerous environments such as collapsed buildings, flood zones, or wildfire-affected areas. Additionally, drones can carry lightweight medical supplies or communication devices to isolated victims, improving survival rates. The integration of AI and machine learning algorithms enables automated detection and mapping, providing emergency teams with accurate situational intelligence. Increasing investment in these technologies has strengthened operational efficiency and scalability of search and rescue missions.

Drones are widely used for disaster assessment and management to provide rapid, accurate, and comprehensive situational data. Aerial imaging and sensor-equipped drones enable responders to monitor natural disasters such as floods, earthquakes, hurricanes, and wildfires, allowing for faster decision-making and resource allocation. High-resolution aerial footage supports risk evaluation, structural damage analysis, and the planning of evacuation or relief operations. Additionally, drones can be integrated with geographic information systems (GIS) to create real-time maps, monitor ongoing hazards, and track environmental changes. By enhancing the speed and precision of emergency response efforts, drones have become indispensable tools for disaster management agencies, improving overall preparedness and mitigation strategies.

Emergency responders increasingly utilize drones to deliver critical medical supplies, blood, vaccines, and life-saving equipment to remote or inaccessible areas. Drones provide rapid delivery capabilities during road closures, disaster scenarios, or congested urban regions where traditional logistics may fail. Their lightweight and battery-efficient designs allow for repeated, fast, and flexible missions without relying on ground transportation. Additionally, autonomous navigation systems ensure accurate delivery, while telecommunication links enable real-time tracking and monitoring. The adoption of drones for medical logistics reduces response times, enhances operational safety, and strengthens healthcare support during emergencies, particularly in rural or disaster-affected regions.

Advancements in drone technology, including AI navigation, autonomous flight control, and advanced sensors, have transformed emergency response capabilities. Integration with real-time monitoring platforms, GPS mapping, and communication networks allows responders to coordinate operations efficiently. Governments and regulatory bodies are providing approvals, frameworks, and training programs to enable safe deployment in emergency scenarios. Public-private collaborations are accelerating innovation in payload capacity, flight endurance, and AI-based detection systems. The manufacturers are developing specialized drones for firefighting, medical supply delivery, and disaster reconnaissance. Continuous improvements in technology, regulation, and operational protocols have reinforced the adoption of drones as essential tools for emergency response worldwide.

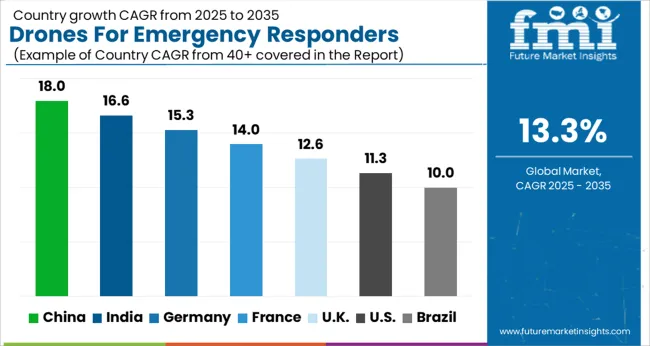

| Country | CAGR |

|---|---|

| China | 18.0% |

| India | 16.6% |

| Germany | 15.3% |

| France | 14.0% |

| UK | 12.6% |

| USA | 11.3% |

| Brazil | 10.0% |

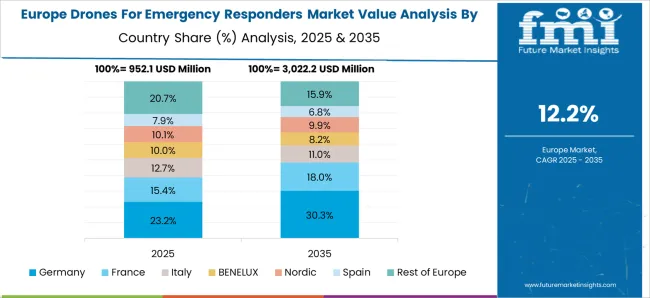

The market is projected to grow at a CAGR of 13.3% from 2025 to 2035. Expansion is fueled by the increasing use of drones for disaster management, medical deliveries, and search and rescue operations. China leads with 18.0%, reflecting extensive adoption across public safety departments and investment in drone technology. India follows at 16.6%, driven by emergency response modernization and government-backed drone initiatives. Germany records 15.3%, supported by advanced engineering capabilities and integration into civil protection systems. The UK stands at 12.6%, reflecting pilot programs and regulatory development, while the USA at 11.3% demonstrates steady deployment in first responder operations and private sector collaboration. The combined efforts indicate a global shift toward rapid, technology-enabled emergency response. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is experiencing a CAGR of 18.0%, driven by the need for rapid disaster response, firefighting support, and search-and-rescue operations. Drones equipped with thermal imaging, high-resolution cameras, and real-time data transmission are increasingly deployed by government agencies. Integration with AI and autonomous navigation systems enhances operational efficiency during emergencies. Domestic manufacturers, in collaboration with international technology providers, focus on developing specialized drones for urban, rural, and disaster-prone areas. Regulatory support and investment in emergency management infrastructure further propel adoption.

India is projected to grow at a CAGR of 16.6%, fueled by disaster-prone regions and increasing use of drones for medical supply delivery, search-and-rescue, and firefighting operations. Government and private agencies are adopting UAVs equipped with AI-enabled detection systems and thermal cameras. Start-ups and established drone manufacturers collaborate to improve operational range, payload capacity, and automation. Urban and rural emergency response programs are increasingly integrating drones to optimize efficiency and reduce human risk.

Germany is experiencing a CAGR of 15.3%, supported by stringent safety regulations, government-funded emergency programs, and integration of drones into disaster management and firefighting services. UAVs equipped with high-precision sensors, autonomous flight controls, and real-time monitoring systems are deployed across urban and rural areas. German drone manufacturers emphasize reliability, payload versatility, and integration with command centers. Collaborative projects with European agencies drive innovation for medical logistics and rescue operations.

The United Kingdom is projected to grow at a CAGR of 12.6%, driven by adoption in firefighting, law enforcement, and medical emergency services. UAVs with thermal imaging, night vision, and AI-based navigation improve operational efficiency. Partnerships between public safety agencies and technology providers help expand deployment, especially in urban centers. Focus on training programs and integration with emergency response infrastructure is enhancing market penetration.

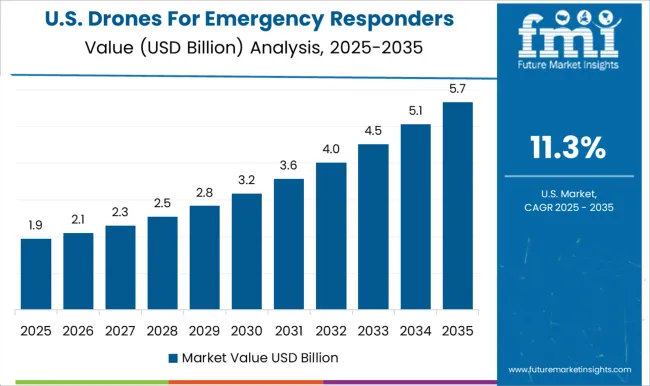

The United States is expanding at a CAGR of 11.3%, fueled by widespread use in firefighting, disaster relief, and emergency medical delivery. UAVs equipped with autonomous navigation, high-resolution imaging, and real-time communication systems support first responders. Federal initiatives and defense partnerships accelerate technology adoption. Emphasis on payload versatility, extended flight times, and integration with command and control systems strengthens market growth.

The market is dominated by established UAV manufacturers and specialized technology innovators, offering solutions for rapid response, disaster assessment, search and rescue, and public safety operations. DJI leads with a comprehensive portfolio of drones equipped with high-resolution imaging, thermal sensors, and AI-assisted flight modes, supported by global service networks and regulatory familiarity. Autel Robotics competes with versatile UAVs that emphasize durability, extended flight time, and modular payload options tailored for emergency scenarios.

Draganfly, Inc. focuses on mission-critical applications with fully integrated drone systems designed for law enforcement, firefighting, and disaster monitoring, combining ruggedized hardware and advanced analytics software. Skydio, Inc. leverages autonomous flight technology, obstacle avoidance, and AI-based navigation to enable responders to operate in complex or GPS-denied environments with minimal training. Specialized players such as Flyability and Teledyne FLIR LLC offer niche capabilities, including collision-tolerant designs for confined spaces and thermal imaging solutions for locating individuals in smoke, debris, or low-visibility conditions.

Parrot Drone SAS and Yuneec.org provide cost-effective, user-friendly platforms suitable for rapid deployment and situational awareness. The market competition is heavily driven by technological innovation, payload versatility, operational reliability, and integration with emergency management systems, with companies investing in AI, autonomy, and sensor technologies to enhance mission effectiveness and safety.

| Items | Values |

|---|---|

| Quantitative Units | USD 4.1 billion |

| Drone Type | Fixed-wing drones, VTOL drones, and Multirotor drones |

| Application | Search and rescue, Mapping and damage assessment, Medical supply delivery, Evacuation assistance, Environmental monitoring, Firefighting, and Others |

| Level of Autonomy | Fully autonomous drones, Semi-autonomous drones, and Remotely piloted drones |

| End-user | Government, Defense, Industrial sites, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Autel Robotics, DJI, Draganfly, Inc., Flyability, Parrot Drone SAS, Skydio, Inc., Teledyne FLIR LLC, and Yuneec.org |

| Additional Attributes | Dollar sales by drone type and application, demand dynamics across firefighting, medical, and disaster response sectors, regional trends in UAV adoption for public safety, innovation in real-time imaging, autonomous navigation, and payload capabilities, environmental impact of reduced human exposure and fuel use, and emerging use cases in search and rescue, hazardous material assessment, and rapid medical supply delivery. |

The global drones for emergency responders market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the drones for emergency responders market is projected to reach USD 14.3 billion by 2035.

The drones for emergency responders market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in drones for emergency responders market are fixed-wing drones, vtol drones and multirotor drones.

In terms of application, search and rescue segment to command 32.7% share in the drones for emergency responders market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Toy Drones Market Size and Share Forecast Outlook 2025 to 2035

Medical Drones Market Report – Growth & Forecast 2025-2035

Consumer Drones Market

Commercial Drones Market by Type ,Application ,End Use & Region Forecast till 2025 to 2035

Earth Observation Drones Market Size and Share Forecast Outlook 2025 to 2035

Formaldehyde Removal Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Fortified Dairy Products Market Size and Share Forecast Outlook 2025 to 2035

Form-Fill-Seal (FFS) Films Market Size and Share Forecast Outlook 2025 to 2035

Formable Films Market Size and Share Forecast Outlook 2025 to 2035

Forchlorfenuron Market Size and Share Forecast Outlook 2025 to 2035

Formalin Market Size and Share Forecast Outlook 2025 to 2035

Formalin Vials Market Size and Share Forecast Outlook 2025 to 2035

Foreign Trade Digital Service Market Size and Share Forecast Outlook 2025 to 2035

Forged and Casting Component Market Size and Share Forecast Outlook 2025 to 2035

Fortified Rice Market Size and Share Forecast Outlook 2025 to 2035

Fortifying Agent Market Size and Share Forecast Outlook 2025 to 2035

Forestry Equipment Market Size and Share Forecast Outlook 2025 to 2035

Forensic Imaging Market Size and Share Forecast Outlook 2025 to 2035

Forklift Battery Market Size and Share Forecast Outlook 2025 to 2035

Formulation Development Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA