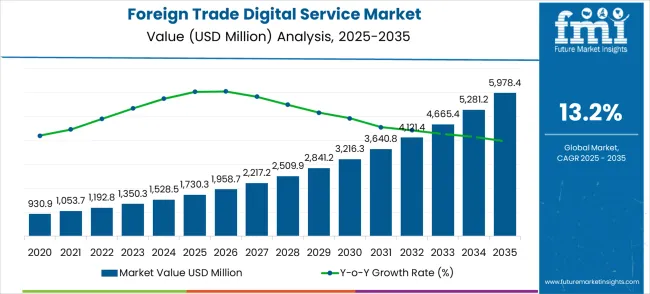

The foreign trade digital service market is valued at USD 1,730.3 million in 2025 and forecasted to reach USD 5,978.4 million by 2035, growing at a CAGR of 13.2%. The Growth Rate Volatility Index (GRVI) helps assess the stability of expansion by comparing year-on-year (YoY) growth fluctuations across the timeline. From 2020 to 2025, growth remains consistent, with revenue climbing from USD 930.9 million to USD 1,730.3 million. The YoY changes range between 12% and 15%, indicating moderate volatility but within a controlled band. This early stage highlights a strong, predictable trajectory where digital platforms supporting trade documentation, compliance, and cross-border payments gain adoption.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,730.3 million |

| Forecast Value in (2035F) | USD 5,978.4 million |

| Forecast CAGR (2025 to 2035) | 13.2% |

Between 2025 and 2030, the market expands from USD 1,730.3 million to USD 3,216.3 million, with YoY growth stabilizing around 12–13%. The GRVI during this period indicates low volatility, as adoption is driven evenly by mid-sized exporters, importers, and freight forwarders digitizing operations. Revenue increments show smoother year-to-year progression, supported by steady integration of AI-enabled trade management tools, customs automation, and global supply chain visibility platforms. The stability of the growth index suggests that the market has entered a consolidation phase, where adoption is less erratic and increasingly standardized across regions.

From 2030 to 2035, revenue rises from USD 3,216.3 million to USD 5,978.4 million, with YoY growth hovering near 13% throughout. The GRVI indicates minimal volatility in this final stage, showing that growth is predictable and largely uniform across geographies. This reflects a mature adoption environment where digital trade solutions have become integral to global commerce. Incremental gains are consistent, driven by expansion into emerging economies and deeper integration of compliance, finance, and logistics modules. Overall, the Growth Rate Volatility Index demonstrates that the market exhibits low volatility with stable growth momentum, ensuring a reliable and sustainable expansion path across the forecast horizon.

Market expansion is being supported by the increasing complexity of international trade regulations and the corresponding demand for automated compliance solutions. Modern businesses are increasingly focused on digital platforms that can handle multiple trade processes simultaneously, improve operational efficiency, and reduce the burden of manual documentation. The proven effectiveness of digital trade solutions in managing customs clearance, trade finance, and supply chain visibility makes them essential components of comprehensive international trade strategies.

The growing emphasis on real-time trade data analytics and predictive insights is driving demand for advanced digital service platforms that address specific business needs and regulatory requirements. Business preference for integrated solutions that combine trade management, financial services, and logistics coordination in single platforms is creating opportunities for innovative service development. The rising influence of government digitization initiatives and trade facilitation programs is also contributing to increased adoption of proven digital trade solutions across different industry sectors and geographic regions.

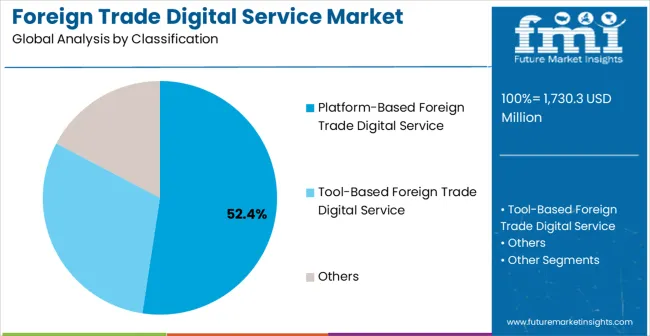

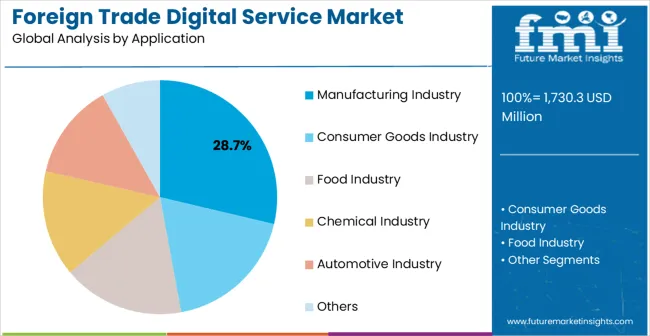

The market is segmented by classification and application. By classification, the market is divided into Platform-Based Foreign Trade Digital Service, Tool-Based Foreign Trade Digital Service, and Others. Based on application, the market is categorized into Manufacturing Industry, Consumer Goods Industry, Food Industry, Chemical Industry, Automotive Industry, and Others.

The Platform-Based Foreign Trade Digital Service is projected to account for 52.4% of the foreign trade digital service market in 2025, reaffirming its position as the category's dominant classification. Businesses increasingly recognize the comprehensive benefits of integrated platform solutions that combine multiple trade functions including documentation management, customs clearance, trade finance, and logistics coordination. These platforms address various aspects of international trade operations, providing end-to-end digital trade management capabilities.

This classification forms the foundation of most digital trade transformation strategies, as it represents the most comprehensive and widely accepted approach in international commerce digitization. Regulatory compliance features and extensive integration capabilities continue to strengthen confidence in these platforms. With increasing recognition of the complexity of global trade requiring multi-functional approaches, platform-based solutions align with both operational efficiency and long-term scalability goals. Their broad utility across multiple trade processes ensures sustained market dominance, making them the central growth driver of digital trade service demand.

Manufacturing Industry is projected to represent 28.7% of foreign trade digital service demand in 2025, underscoring its role as the primary application driving digital trade solution adoption. Manufacturing companies recognize that complex supply chain management, including raw material sourcing, production scheduling, and finished goods distribution, often requires sophisticated digital platforms that traditional trade methods cannot adequately address. Digital trade services offer enhanced visibility in managing multi-tier supplier networks and reducing supply chain disruptions.

The segment is supported by the global nature of manufacturing operations requiring extensive cross-border coordination and the growing recognition that digital platforms can improve supplier compliance and quality control. Additionally, manufacturing companies are increasingly adopting just-in-time production strategies that recommend specific digital solutions for optimal supply chain synchronization. As understanding of manufacturing supply chain complexity advances, digital trade services will continue to play a crucial role in comprehensive operational strategies, reinforcing their essential position within the foreign trade digital service market.

The foreign trade digital service market is advancing steadily due to increasing recognition of trade process inefficiencies and growing demand for automated compliance solutions. However, the market faces challenges including complex integration requirements, concerns about data security, and varying regulatory frameworks across different countries. Innovation in blockchain technology and AI-powered analytics continue to influence platform development and market expansion patterns.

The growing adoption of distributed ledger technology is enabling more secure and transparent trade finance management and transaction processing. Blockchain platforms offer immutable transaction records, automated smart contracts, and enhanced fraud prevention capabilities that are particularly important for high-value international trade transactions. These solutions provide improved trust and reduced settlement times between trading partners across different jurisdictions.

Modern digital trade service providers are incorporating AI technologies such as predictive analytics, automated document processing, and intelligent risk assessment to enhance trade management capabilities. These technologies improve trade decision-making, enable real-time compliance monitoring, and provide better optimization of shipping routes and trade finance options. Advanced AI platforms also enable personalized trade recommendations and early identification of potential supply chain disruptions or regulatory changes.

| Country | CAGR (2025-2035) |

|---|---|

| China | 17.8% |

| India | 15.2% |

| Brazil | 14.1% |

| Europe | 11.8% |

| USA | 10.5% |

| Japan | 9.7% |

| UK | 8.9% |

| Germany | 8.2% |

The foreign trade digital service market is experiencing varied growth globally, with China leading at a 17.8% CAGR through 2035, driven by massive e-commerce expansion, government digitization initiatives, and growing cross-border trade volumes. India follows with strong growth, supported by digital transformation programs, increasing export-import activities, and expanding fintech ecosystem. Brazil shows robust growth, emphasizing improved trade facilitation and digital infrastructure development. Europe records steady growth, focusing on regulatory harmonization and comprehensive digital trade frameworks. The USA demonstrates solid growth, representing a mature market with established technology adoption and advanced trade finance solutions.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Foreign trade digital services in China are forecasted to grow at the fastest pace with a CAGR of 17.8% through 2035, driven by the country's massive e-commerce ecosystem and comprehensive digital infrastructure development. China's position as the world's largest trading nation and its extensive Belt and Road Initiative are creating unprecedented opportunities for digital trade platform adoption. Major technology companies and international service providers are establishing comprehensive digital trade ecosystems to serve the growing demand for efficient cross-border commerce solutions across manufacturing, retail, and technology sectors.

India is witnessing expansion in foreign trade digital services at a CAGR of 15.2% through 2035, supported by increasing digital payment adoption, growing startup ecosystem, and expanding international trade volumes. The country's large manufacturing base and increasing services exports are driving demand for comprehensive digital trade management solutions. Both international technology companies and domestic service providers are establishing distribution networks to serve the growing demand for cost-effective trade digitization solutions.

The United States is projected to record expansion in foreign trade digital services at a CAGR of 10.5% through 2035, supported by well-established technology infrastructure and sophisticated trade finance systems. American businesses consistently utilize advanced digital platforms for supply chain optimization and regulatory compliance management. The market is characterized by mature integration capabilities, comprehensive data analytics solutions, and established relationships between technology providers and enterprise customers.

Brazil is projected to see expansion in foreign trade digital services at a CAGR of 14.1% through 2035, driven by expanding agricultural exports, growing manufacturing sector, and increasing focus on trade process modernization. Brazilian businesses are increasingly adopting digital solutions for customs clearance, trade finance, and logistics coordination, supported by government initiatives to improve trade facilitation.

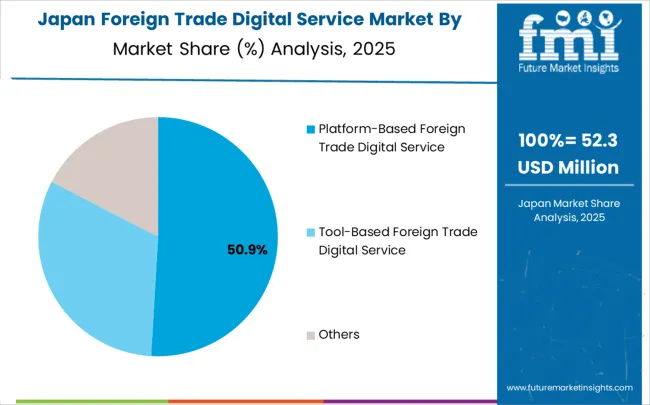

Japan is expected to record expansion in foreign trade digital services at a CAGR of 9.7% through 2035, supported by the country's advanced manufacturing ecosystem, sophisticated logistics infrastructure, and systematic approach to technology adoption. Japanese businesses emphasize precision and efficiency in digital trade solutions, driving demand for high-quality platforms with comprehensive integration capabilities.

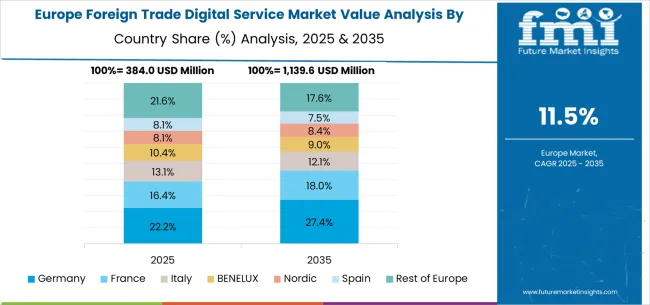

The foreign trade digital service market in Europe is projected to expand steadily through 2035, supported by increasing adoption of digital trade documentation, rising importance of sustainable supply chains, and ongoing regulatory harmonization across the European Union. Germany will continue to lead the regional market, accounting for 24.3% in 2025 and rising to 25.1% by 2035, supported by strong manufacturing exports, advanced logistics infrastructure, and comprehensive digitization initiatives. The United Kingdom follows with 18.9% in 2025, increasing to 19.4% by 2035, driven by post-Brexit trade digitization needs, fintech innovation, and expanding service sector trade.

France holds 15.2% in 2025, edging up to 15.7% by 2035 as luxury goods exports and agricultural trade increasingly adopt digital management platforms. Italy contributes 12.4% in 2025, remaining stable at 12.6% by 2035, supported by fashion industry digitization and growing e-commerce exports. Spain represents 9.8% in 2025, increasing to 10.2% by 2035, underpinned by expanding agricultural exports and tourism sector digital integration.

BENELUX markets together account for 8.7% in 2025, moving to 9.1% by 2035, supported by strategic port locations and advanced logistics digitization. The Nordic countries represent 6.2% in 2025, increasing to 6.4% by 2035, with demand driven by sustainable trade practices and early technology adoption. The Rest of Western Europe accounts for 4.5% in 2025, declining to 1.5% by 2035, as larger markets capture greater shares of digital trade platform investments and adoption.

The foreign trade digital service market is characterized by competition among established technology companies, specialized trade platform providers, and emerging fintech solutions. Companies are investing in artificial intelligence, blockchain integration, regulatory compliance automation, and user experience optimization to deliver comprehensive, secure, and scalable digital trade solutions. Platform development, market expansion, and strategic partnerships are central to strengthening service portfolios and market presence.

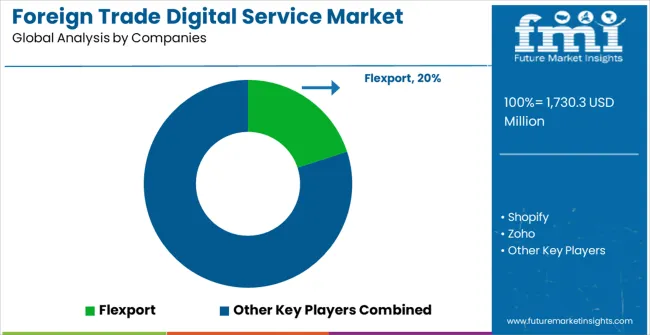

Flexport leads with comprehensive freight forwarding and supply chain digitization solutions, emphasizing end-to-end visibility and automated logistics management. Shopify provides integrated e-commerce and international shipping solutions with focus on small and medium business accessibility. Zoho offers comprehensive business management platforms including trade documentation and customer relationship management tools. PayPal delivers secure payment processing and trade finance solutions with emphasis on transaction security and global reach.

TradeIndia operates as a comprehensive B2B marketplace platform connecting international buyers and suppliers with integrated trade services. SEMrush provides digital marketing and trade analytics solutions for cross-border e-commerce optimization. XTransfer specializes in cross-border payment solutions and trade finance services for small and medium enterprises. DSTP, Panex, Hgj Logistics Technology, and Xiaoman Technology provide specialized logistics coordination, documentation management, and trade process automation solutions to enhance market accessibility and operational efficiency for businesses engaged in international trade.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,730.3 million |

| Classification | Platform-Based Foreign Trade Digital Service, Tool-Based Foreign Trade Digital Service, Others |

| Application | Manufacturing Industry, Consumer Goods Industry, Food Industry, Chemical Industry, Automotive Industry, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Flexport, Shopify, Zoho, PayPal, TradeIndia, SEMrush, XTransfer, DSTP, Panex, Hgj Logistics Technology, Xiaoman Technology |

| Additional Attributes | Dollar sales by service type and industry application, regional adoption trends, competitive landscape, business user preferences for specific platforms, integration with enterprise systems, innovations in blockchain and AI technologies, regulatory compliance automation, and operational efficiency optimization |

The global foreign trade digital service market is estimated to be valued at USD 1,730.3 million in 2025.

The market size for the foreign trade digital service market is projected to reach USD 5,978.4 million by 2035.

The foreign trade digital service market is expected to grow at a 13.2% CAGR between 2025 and 2035.

The key product types in foreign trade digital service market are platform-based foreign trade digital service, tool-based foreign trade digital service and others.

In terms of application, manufacturing industry segment to command 28.7% share in the foreign trade digital service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trade Surveillance Market Size and Share Forecast Outlook 2025 to 2035

Trade Management Software Market Size and Share Forecast Outlook (2025 to 2035)

Intradermal Injection Market Size and Share Forecast Outlook 2025 to 2035

Frameless Structural Glass Balustrade Market Size and Share Forecast Outlook 2025 to 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

ServiceNow Tech Service Market Size and Share Forecast Outlook 2025 to 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Service Trucks Market Size and Share Forecast Outlook 2025 to 2035

Service Resource Planning (SRP) SaaS Solutions Market Size and Share Forecast Outlook 2025 to 2035

Service Bureau Market Analysis - Size, Growth, and Forecast 2025 to 2035

Service Laboratory Market Analysis by Service Type, Deployment, Channel, End-user, and Region Through 2035

Service Integration & Management Market Report – Forecast 2017-2027

IT Service Management Tools Market Growth – Trends & Forecast through 2034

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA