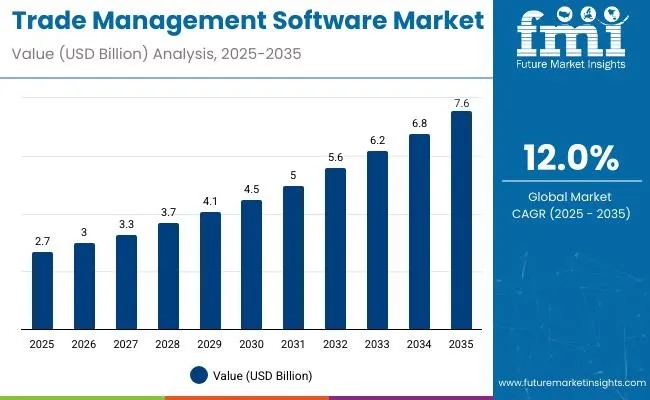

The global Trade Management Software market is projected to grow significantly, from USD 2.7 billion in 2025 to USD 7.59 billion by 2035 an it is reflecting a strong CAGR of 12.0%.

The TMS is an advanced software analyzing and doing streaming & optimization of all the trades & investment activities. The software is an important tool, one on which the essential software is that empowers traders and portfolio managers as well as entities operating in the financial sector. It helps to execute trades, monitoring positions, and managing risk also generates significant analytical data for the markets thereby enhances the growth of the trade management software market.

This software performs automation and optimizes execution on a trade. TMS incorporates live market data allowing its users to make quick yet accurate decisions to fill & complete trades without much chance of user error. It speeds up the speed at which you insert trades, which is very important in liquid, approaching markets. The timely execution of both can have meaningful impacts on the bottom line.

TMS provides the major facilities for the management of risks. It enables you to configure multiple risk factor parameters and alerts, including price and exposure limits. This proactive measure avoids losses. This makes portfolio management relatively easier in this scenario, which further enhances the trade management software market growth. To enable users discover more trading performance information, the software provides Advanced analytics as well as reporting capabilities. It could help them follow trends, re-evaluate strategies ahead of actually changing them based on data.

Government spending in the BFSI industry is a significant factor driving the trade management software market. In recognition of the fundamental impact of a strong financial infrastructure on the stability and growth of their economies, governments across the globe are investing heavily in the modernization & digitization of financial services. The majority of this investment is in the areas of technology development, regulatory infrastructure development, and financial innovation, which coupled together are expected to provide favorable conditions in the trade management software market.

In order to stimulate economic growth while safeguarding investors, governments have come up with strict rules & regulations. The driving force of this regulatory phenomenon instigates FIs to ease stringent compliance as well as tackle the complex trades and investments by incorporating sophisticated TMS. These solutions include regulatory compliance (automated reporting and real-time transaction monitoring) out of the box as fulfilling the new standard by the regulatory body.

Infrastructure projects funded by the government and public-private partnerships also help to grow TMS market. The financial ecosystem is expected to incorporate technological capability and advanced systems and building huge investments in digital infrastructure improves digital connectivity and data access, crucial to the working of TMS.

In 2025, trade management software is being reshaped by hard regulatory dates and digital-by-default rules rather than generic efficiency pitches. First, the EU’s Import Control System 2 (ICS2) is finishing its multi-year rollout: ICS1 is phased out and ICS2 safety and security data requirements become fully mandatory across all transport modes by 1 September 2025. Platforms need richer pre-arrival data capture, multi-party filing, and auditability to keep goods flowing into the EU.

At the border interface, “single window” has moved from vision to operating requirement. The IMO’s Facilitation Convention makes a Maritime Single Window mandatory in all ports from 1 January 2024, pushing carriers, ports, and logistics providers toward harmonized message sets and APIs—pressure that in 2025 continues to cascade into vendors’ product roadmaps.

Beyond maritime, the UN/CEFACT Single Window framework (Recommendation No. 33) is the lingua franca for national systems; UNECE’s latest guidance notes more than 90 economies implementing or piloting National Single Windows, which means software must interoperate with a patchwork of government gateways, not bespoke point-to-point links.

Carbon reporting has also become a trade-lane requirement. Under the EU Carbon Border Adjustment Mechanism, the 2023–2025 transitional phase requires importers to file quarterly embedded-emissions reports via the CBAM Transitional Registry, setting the data plumbing that precedes charges under the definitive system. Suites serving steel, cement, aluminum and other covered sectors are adding emissions attributes, supplier declarations, and reporting pipelines to stay compliant.

Documentation is going electronic in law, not just in pilots. The UNCITRAL Model Law on Electronic Transferable Records (MLETR) now underpins reforms in a growing set of jurisdictions; the UK’s Electronic Trade Documents Act gives electronic bills of lading and similar instruments the same legal status as paper, accelerating adoption across carriers, banks, and shippers. Software teams are prioritizing eBL support, digital possession controls, and straight-through handoffs to trade finance.

Finally, security governance is tightening. NIST’s Cybersecurity Framework 2.0 (February 2024) broadened scope beyond critical infrastructure and provides a common outcome-based approach many global buyers now reference in RFPs, nudging vendors to evidence controls across identity, supply-chain risk, and incident response.

| Company | SAP SE |

|---|---|

| Contract/Development Details | Partnered with a global logistics firm to implement a trade management software solution, aiming to enhance supply chain visibility and compliance with international trade regulations. |

| Date | March 2024 |

| Contract Value (USD Million) | Approximately USD 50 |

| Renewal Period | 5 years |

| Company | Oracle Corporation |

|---|---|

| Contract/Development Details | Secured a contract with a multinational manufacturing company to deploy its global trade management cloud service, focusing on automating trade processes and reducing operational costs. |

| Date | July 2024 |

| Contract Value (USD Million) | Approximately USD 40 |

| Renewal Period | 4 years |

Business chooses efficient processes in trade, minimizing human mistake, and advancing the openness of the transaction process. TMS streamlines order processing, documentation preparation, shipment tracking, and other administrative tasks, lowering reliance on manual data entry and minimizing the risk of costly delays due to errors.

It assists in streamlining a firm’s workflow and enhances its precision by having instant insight and centralized command of trade activities. Increasing visibility into trade activities simplifies the decision-making process and enables the prompt addressing of problems relating to such joint actions, subsequently promoting the trade management software market growth.

Regulatory pressurefrom national governments and NGOs is leading to more complex trade regulation globally, which firms are addressing with trade management software to guide them through ever more complex regulatory environments.

The trade rules are significant and are composed of many different types of trade regulations, such as import/export tariffs, import controls, export controls, customs procedures, etc., that can sometimes be cumbersome and differs from location to location. Failure to comply will be very costly in terms of high penalties, delays and other operational disruption.

The emerging trend in modern business operations in this regard is integrating the trade management software with supply chain management system. An integrated technology platform for procurement, logistics, and trade functions would enable seamless transfer of data between these functions. This capability into effect & efficiency optimization, and then connected of TMS with SCM systems will definitely provide an overview of the whole supply chain.

After integrating the TMS with SCM systems within the company, the access to vital information such as inventory levels, shipment statuses, and supplier performance would be available in real-time. The TMS Integration with SCM benefits businesses in gaining accurate visibility of their supply chain as well as managing supply chain processes more efficiently, thus minimizing disruptions and delays.

As an example, for procurement teams, real-time data is available regarding the status of the shipment and the level of goods in inventory that allow them to enhance purchasing decisions, helping to reduce overall overhead costs.

The coordination is the other big one. By working with SCM systems, TMS can ensure better synchronization of the procurement strategies and operations that take place at the logistics end. For instance, the procurement teams align their purchase plan with the logistics schedules to optimize the transport, ultimately leads to an optimization of lead time. This type of alignment however will yield the dual benefits of costs as well as enhancement of the service levels.

The growth of analytics features is likely to augment the trade management software market, as more organizations seek the ability to conduct predictive modeling or trend analysis. Predictive modeling is a technique that allowed the company to forecast the future state of the trade based on the historical data, present market specification, and other essential influencing factors.

Through this predictive analysis, companies can even forecast disruptions beforehand and align their inventory levels accordingly, taking more tactical decisions related to sourcing, logistics, etc. Advanced trend analysis allows for even more informed decision-making, as changes in demand and tariffs can show trends and shifts in trade dynamics.

Analytics In such advance analytics these features enable businessesWhyIn such a changing landscape of trade make it possible for businesses to adjust beforehand to a strategy, reduce risks and engage in any opportunity.

Data security and privacy is one of the key restraining tasks in the TMS market. The software is used to process sensitive trade data, such as financial transactions, details of suppliers, and compliance documents, but also makes them a soft target for cyber-attacks. Such data needs to be heavily secured - encryption, access controls, regular vulnerability assessments, and so forth.

Furthermore, data breaches and security incidents can even lead to an enormous loss to the financial and reputational assets. Therefore, stringent data protection and privacy needs can inhibit organizations from benefiting from TMS or even complicate the implementation and management process, impacting trade management software market growth.

Implementation costs are considered another major constraint in this trade management software market. TMS requires a lot of money to purchase the software itself, customize it, integrate it with other systems, and maintain it.

The cost is likely prohibitive for many businesses, particularly SMEs This not only refers to the upfront cost of buying but also has implications for the cost of technical support, training staff, upgrading or even replacing systems. Moreover, with each adjustment needed to fine-tune TMS to match your unique business processes or regulations the price skyrockets even higher.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter international trade compliance laws increased software adoption. |

| Automation & AI Integration | AI-driven analytics optimized trade workflows. |

| Blockchain Adoption | Initial implementations of blockchain in trade documentation gained traction. |

| Supply Chain Visibility | Enhanced real-time visibility in trade logistics reduced inefficiencies. |

| Market Growth Drivers | Increased global trade complexities drove demand for automation. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered regulatory tracking automates real-time compliance updates. |

| Automation & AI Integration | Autonomous decision-making AI reduces human intervention in trade logistics. |

| Blockchain Adoption | Widespread adoption of blockchain-based smart contracts ensures seamless cross-border transactions. |

| Supply Chain Visibility | Predictive analytics and quantum computing enhance global supply chain risk mitigation. |

| Market Growth Drivers | Expansion of decentralized and AI-driven trade ecosystems accelerates market growth. |

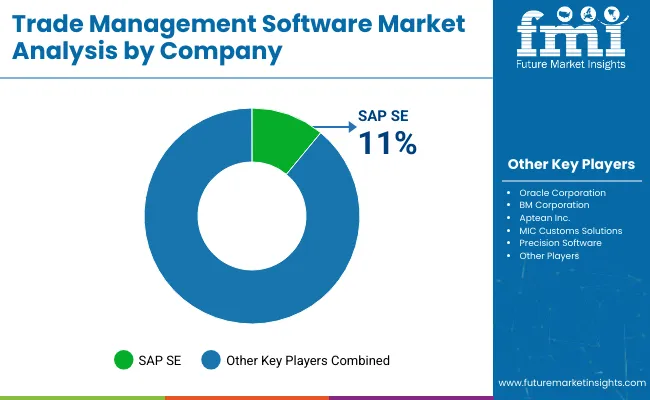

The market for global trade management software includes market leaders such as Tier 1 companies capturingmajor market share. They generally offer robust, full-featured platforms that seamlessly integrate with other systems for the enterprise, like their implementation of enterprise resource planning systems (ERP) and the SCM.

These firms often have extensive resources, worldwide sales networks, and ongoing innovations that define industry standards & propel technology progress. Top companies in tier 1 consist of Amber Road Inc., Aptean Inc., SAP SE, IBM Corporation, and Oracle Corporation.

Tier 2 companies are those which hold good market share. These are proven vendors that provide well-established solutions for trade management but do not provide the same scope and scale as Tier 1 providers. They usually offer niche functionality or vertical-specific answers to unique requirements within the domain of trade management. Some major players in tier 2 are MIQ Logistics, MIC Customs Solutions, Precision Software, QuestaWeb Inc., and Integration Point Inc.

Tier 3 Companies Tier 3 companies are small businesses or startups that are new to the trade management software market. They may provide less comprehensive or specialized services for a singular segment of a segment with less up front payment. Tier 3 players are typically nimble and creative, and they often offer novel approaches or targeted solution.

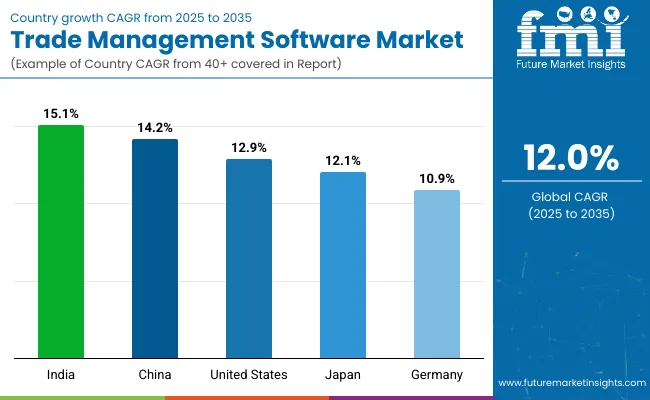

The section highlights the CAGRs of countries experiencing growth in the Trade Management Software market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 15.1% |

| China | 14.2% |

| Germany | 10.9% |

| Japan | 12.1% |

| United States | 12.9% |

China's cross-border e-commerce (CBEC) market booming, with total imports and exports USD 273 billion in 2021 and year-on-year increase of 15%. To protect compliance and security, the Chinese government has tightened digital trade regulations. In 2022, CBEC trade hit USD 60 billion in Q1, resulting in more stringent policies at the taxation, customs clearance, and foreign exchange settlement stages.

The new regulatory framework are being put in place to facilitate operations while preserving data transparency and protection. The General Administration of Customs implemented advanced digital tracking as well as AI-driven compliance verification with the aim of effectively monitoring e-commerce transactions. The Chinese government set up pilot CBEC zones to experiment with new systems to manage trade, giving businesses more flexible routes to compliance.

On compliance with new trade policies: With trade policies constantly evolving, companies need sophisticated trade management software to help them manage the complex compliance environment, automate documentation, and minimize the risk of trading violations. China is anticipated to see substantial growth at a CAGR 14.2% from 2025 to 2035 in the Trade Management Software market.

The Micro, Small, and Medium Enterprises (MSMEs) sector in India includes 63 million businesses and is one of the backbone of Indian economy. But several SMEs are coped with high operational cost, uncertainty in the demand, financing problem. SMEs are responding to these challenges in record numbers with the implementation of trade management platforms that help facilitate supply chain optimization, invoicing, and compliance automation at a fraction of the cost.

Initiatives such as the National Logistics Policy have been introduced by the Indian government to lower logistics costs and make exports more competitive. These customs procedures can be digitally enabled, which will help MSMEs access global trade by reducing the administrative overhead of closing trades. Individual features of cloud-based trade platforms with AI-powered compliance checks, assist SMEs to skillfully navigate complex tax structures and cross-border regulations.

Moreover, the blockchain-based trade finance solutions are on the rise and better, more secure transactions are being made at a faster pace. The digital transformation in trade management is additionally fueled by assistance from government led financing initiatives and technology exchanges for SMEs. India's Trade Management Software market is growing at a CAGR of 15.1% during the forecast period.

Factors such as complex regulatory environments and the onslaught of changing trade policies have led the USA to become one of the early adopters of AI-powered risk assessment tools in trade management. AI is changing risk assessment by allowing for real-time tracking of a global supply chain, the impact of tariffs, and compliance obligations.

In industries such as fashion and electronics, AI-based trade intelligence engines are assisting companies in forecasting the effects of tariffs, optimizing inventory, and recalibrating pricing strategies. AI algorithms can also analyze historical trade data to predict potential risks and suggest alternate sourcing strategies.

The government policies aimed at enhancing trade security have further spurred the adoption of AI in trade compliance after the execution of tighter import/export control. AI solutions help clear customs faster, as regulatory checks and documentation are taken care of by technology. Predictive analytics tools in particular are helping businesses minimize the financial risks of a shifting trade agreement landscape and supply chain disruptions.

AI-based trade compliance. The trend of AI explaining international trade compliance is bound to become even more common, as organizations are investing in intelligent automation to mitigate the complexity of international trade regulations. USA is anticipated to see substantial growth in the Trade Management Software market significantly holds dominant share of 74.3% in 2025.

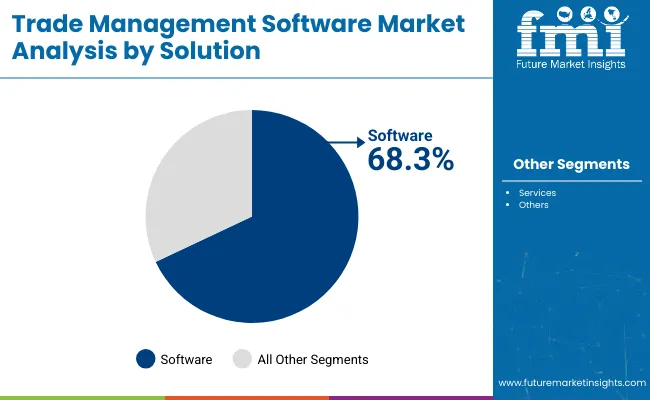

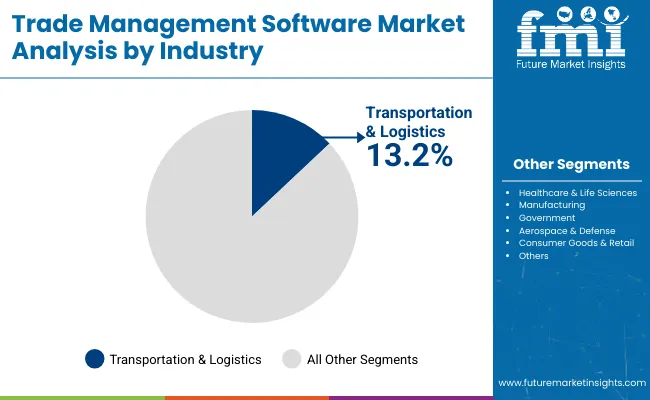

The section contains information about the leading segments in the industry. By solution, the services segment is estimated to grow at a CAGR of 13.5% throughout 2035. Additionally, by industry, manufacturing segment is projected to expand at 13.2% till 2035.

| Solution | Value Share (2025) |

|---|---|

| Software | 68.3% |

Software segment is expected to acquire share of 68.3% in the market in terms of solution in 2025. The complexity of global trade has fueled the advancement of trade management software solutions, given the ever more complex regulations, tariffs, and compliance requirements that companies must meet. Companies need sophisticated software to cope with this complexity as well as manage documentation and international trade laws, supporting the segment growth.

| Industry | Value Share (2025) |

|---|---|

| Transportation & Logistics | 13.2% |

The transportation & logistics segment is poised to capture share 13.2% in 2025. Many organizations in the transportation and logistics industry have adopted trade management software because it can meet adequately the complex operational challenges and regulation to the sector.

This industry has high volume shipments, diversities of transportation modes, and supply chains which are intricate. So, it is very important to have proper trade management. Solutions such as optimum routes and freight costing along with international trade compliance are facilitated through trade management software, driving the segment growth.

Trade management software market is competitive, with numerous vendors vying for market dominance, resulting from the growing complexity of regulations and the increasing need for automation in global trade operations. AI-enhanced compliance, real-time analytics, and cloud-based solutions are key differentiators for companies looking to improve supply chain visibility.

The market is faced with tough competition from major players and new innovators offering affordable and scalable options. Mergers and acquisitions along with strategic partnerships, technological advancements and geographic expansion are the key strategies adopted by organizations at these stages.

| Report Attributes | Details |

|---|---|

| Projected Market Size (2025) | USD 2.7 billion |

| Projected Market Size (2035) | USD 7.59 billion |

| CAGR (2025 to 2035) | 12.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value; Thousand software licenses for volume |

| Solutions Analyzed (Segment 1) | Software, Services |

| Enterprise Sizes Analyzed (Segment 2) | Small & Medium Enterprises, Large Enterprises |

| Industries Analyzed (Segment 3) | Transportation & Logistics, Healthcare & Life Sciences, Manufacturing, Government, Aerospace & Defense, Consumer Goods & Retail, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players Influencing the Market | Amber Road Inc., Aptean Inc., SAP SE, IBM Corporation, Oracle Corporation, MIQ Logistics, MIC Customs Solutions, Precision Software, QuestaWeb Inc., Integration Point Inc. |

| Additional Attributes | Dollar sales propelled by compliance automation tools, cross-border trade digitization, cloud-based license tracking, customs clearance optimization, SME software adoption, logistics visibility upgrades, and global trade orchestration. |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of solution, the segment is divided into software and services.

In terms of enterprise size, the segment is segregated into small & medium enterprises and large enterprises.

The industry is classified by segment as transportation & logistics, healthcare & life sciences, manufacturing, government, aerospace & defense, consumer goods & retail, and others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Trade Management Software industry is projected to witness CAGR of 12.0% between 2025 and 2035.

The Global Trade Management Software industry stood at USD 2.7 billion in 2025.

The Global Trade Management Software industry is anticipated to reach USD 7.59 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 13.6% in the assessment period.

The key players operating in the Global Trade Management Software Industry Amber Road Inc., Aptean Inc., SAP SE, IBM Corporation, and Oracle Corporation.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trade Surveillance Market Size and Share Forecast Outlook 2025 to 2035

Intradermal Injection Market Size and Share Forecast Outlook 2025 to 2035

Foreign Trade Digital Service Market Size and Share Forecast Outlook 2025 to 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Exam Management Software Market

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA