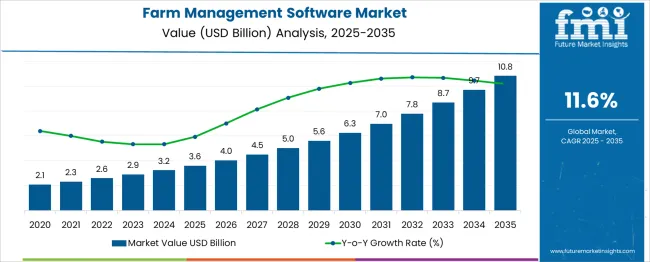

The Farm Management Software Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 10.8 billion by 2035, registering a compound annual growth rate (CAGR) of 11.6% over the forecast period. The farm management software market is projected to create an absolute dollar opportunity of USD 7.2 billion over the forecast period. This represents a growth multiplier of 3.0x, supported by a strong CAGR of 11.6%, driven by increasing adoption of precision agriculture, IoT-enabled monitoring, and advanced analytics to optimize yield and resource efficiency.

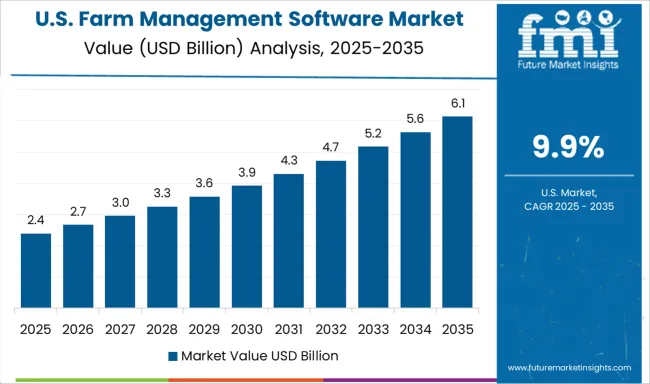

During the first five-year phase (2025–2030), the market is expected to reach USD 6.1 billion, adding USD 2.5 billion, which accounts for 34.7% of total incremental growth, fueled by cloud-based farm management platforms and integration of GPS tracking systems. The second phase (2030–2035) will contribute USD 4.7 billion, representing 65.3% of incremental growth, as AI-driven decision-support tools, drone-based field monitoring, and predictive analytics become mainstream in farm operations. Annual increments increase from USD 0.5 billion in early years to nearly USD 1.0 billion by 2035, reflecting accelerated digital transformation in agriculture. Vendors focusing on scalable SaaS models, interoperability with machinery, and data security will capture the most value within this USD 7.2 billion growth opportunity, particularly in emerging markets adopting smart farming practices to address food security challenges.

| Metric | Value |

|---|---|

| Farm Management Software Market Estimated Value in (2025 E) | USD 3.6 billion |

| Farm Management Software Market Forecast Value in (2035 F) | USD 10.8 billion |

| Forecast CAGR (2025 to 2035) | 11.6% |

The farm management software market occupies an emerging but influential share within several agricultural technology segments. In the Agricultural Technology (AgTech) Market, it accounts for around 10%, as digital platforms gain traction alongside equipment and biotech innovations. Within the Precision Farming Market, its share is approximately 15%, given its integral role in data-driven decision-making for yield optimization and resource efficiency. For the Farm Automation and Control Systems Market, it represents about 8%, as software complements hardware-based mechanization and robotics. In the Crop Production and Management Solutions Market, its share is close to 12%, driven by adoption in crop monitoring, irrigation scheduling, and field mapping.

Within the Livestock Management Solutions Market, it accounts for nearly 6%, where herd tracking and feed optimization are increasingly managed through integrated software platforms. Growth is fueled by rising demand for real-time analytics, sustainability compliance, and cost optimization in farming operations. Cloud-based systems, IoT integration, and AI-driven predictive tools are enhancing the value proposition of farm management software. Increasing focus on traceability, climate adaptation strategies, and smart farming initiatives further support adoption. This positions farm management software as a critical enabler of digital transformation in agriculture, improving productivity and profitability while minimizing operational risks across global farms.

The farm management software market is advancing steadily, driven by the growing need for data-backed decisions, regulatory compliance, and yield optimization in global agriculture. Increasing digitization of farm operations, combined with rising input costs and pressure to improve productivity, has elevated the role of cloud-based platforms in managing crop cycles, labor, logistics, and profitability.

Governments and agri-tech startups are actively promoting tech-enabled agriculture, particularly in emerging economies, where medium-scale farms form a critical portion of cultivated land. Further adoption is being supported by advancements in AI, IoT, and satellite imaging, which are being integrated into software suites to enable real-time monitoring and planning.

As climate risk intensifies, scalable digital tools that enhance resource use efficiency and sustainability are gaining prominence across varied farming models.

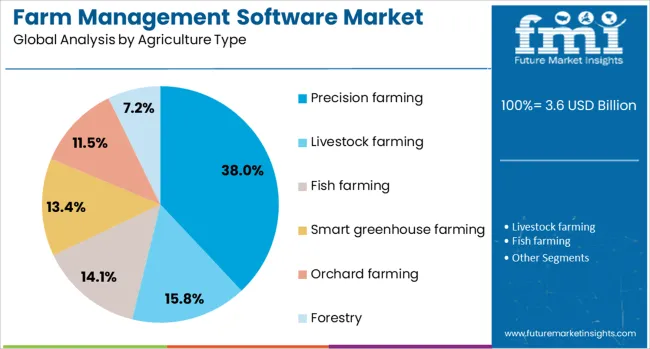

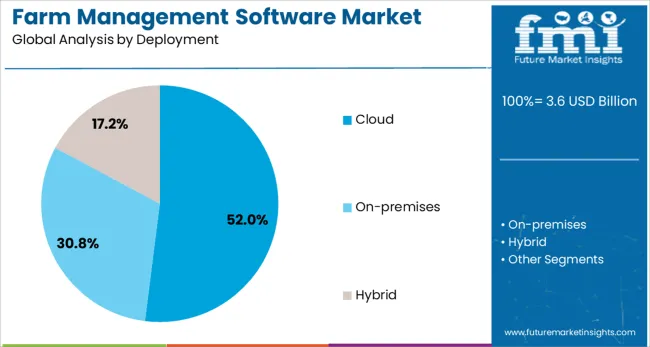

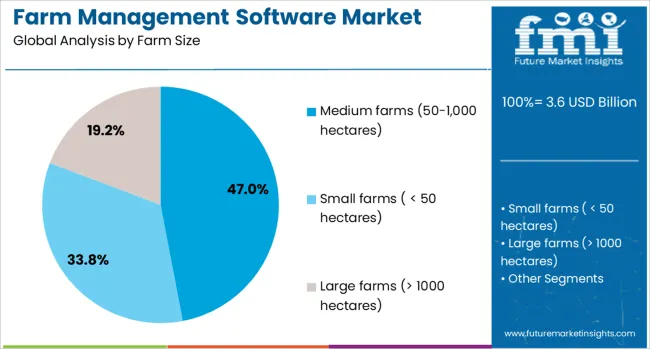

The farm management software market is segmented by farm size, deployment, agriculture type, application, end-user, and geographic regions. The farm size of the farm management software market is divided into Medium farms (50-1,000 hectares), Small farms (< 50 hectares), and Large farms (> 1000 hectares). In terms of deployment of the farm management software market is classified into Cloud, On-premises, and Hybrid. Based on the type of agriculture, the farm management software market is segmented into Precision farming, Livestock farming, Fish farming, Smart greenhouse farming, Orchard farming, and Forestry. The farm management software market is segmented into Crop management, Soil management, Financial management, Inventory management, Weather forecasting, Farm equipment tracking, Data analysis, and Others. The end-user market for farm management software is segmented into Corporate farms, Individual farmers, Farm managers, Agricultural consultants, and Government organizations. Regionally, the farm management software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Medium-sized farms are projected to account for 47.00% of the total farm management software market share in 2025, making them the dominant farm size category. Growth in this segment is being driven by a rising demand among mid-scale producers to digitize operations in response to tightening margins, environmental regulations, and competition.

These farms typically possess sufficient infrastructure and workforce to implement scalable software platforms and are more adaptable to integrating features like remote field monitoring, irrigation control, and financial tracking.

The need to manage multi-field operations and diversify crop production while maintaining compliance with sustainability standards has further encouraged the uptake of advanced farm management solutions in this segment.

Cloud-based deployment is expected to dominate with 52.00% revenue share in 2025, underscoring its critical role in expanding the accessibility of farm management software. This growth is attributed to lower upfront investment, seamless remote access, and real-time data synchronization across devices.

Cloud platforms enable automatic updates, centralized data storage, and integrations with weather APIs, GPS tools, and IoT sensors, offering farmers and cooperatives enhanced decision-making capabilities. Additionally, cloud infrastructure allows software vendors to deliver tailored features for various farming scales and types, while ensuring easier compliance with data security and regulatory standards.

Increasing rural internet connectivity and smartphone penetration are further reinforcing the appeal of cloud-based deployment models.

Precision farming is projected to lead with 38.00% market share in 2025, as the dominant agriculture type using farm management software. This growth is being driven by increasing reliance on sensor-based data, GPS-enabled equipment, and site-specific input application strategies.

Precision agriculture users are leveraging software to manage variable-rate seeding, fertilizer application, and disease detection, thereby optimizing yield per acre while reducing waste. Farm management platforms that offer geospatial analytics, predictive modeling, and integration with drones are particularly in demand among growers aiming to boost input efficiency and environmental sustainability.

The expanding availability of agri-tech support services and government-backed incentives is also expected further to cement precision farming as a key application area.

The farm management software market is expanding as digital tools enhance productivity, resource utilization, and operational transparency in agriculture. Growth in 2024 and 2025 was driven by increased mechanization and demand for real-time analytics in precision farming. Opportunities are rising in cloud-based platforms, livestock monitoring systems, and integration with autonomous machinery. Key trends include IoT-enabled sensors, predictive analytics for crop planning, and mobile application interfaces for small farmers. However, high implementation costs, lack of digital literacy among farmers, and inconsistent connectivity in rural areas remain major challenges restraining widespread adoption.

The primary growth driver is the rising adoption of precision agriculture practices supported by real-time data analytics. In 2024 and 2025, farmers leveraged software solutions for crop health monitoring, soil analysis, and irrigation control, enabling better resource efficiency and yield optimization. Agribusiness firms used integrated dashboards to plan field operations and manage input costs effectively. Demand was further fueled by government programs promoting smart farming tools in regions such as North America and Europe. These factors demonstrate how data-backed decision-making continues to accelerate the adoption of farm management systems globally.

Significant opportunities are emerging in cloud-based platforms offering scalability and remote access. In 2025, software providers introduced integrated modules for crop management and livestock monitoring, enabling centralized operations for mixed farming systems. Solutions designed for weather prediction and pest management gained popularity among commercial farms seeking risk mitigation. Partnerships between software companies and equipment manufacturers created seamless integration between digital tools and automated machinery. These developments suggest that cloud-enabled, modular platforms will remain a focal point for future market expansion, particularly in technologically advancing agricultural economies.

Emerging trends in the farm management software market include IoT-driven automation and mobile-friendly applications for small and medium-scale farmers. In 2024, connected sensors for soil moisture, nutrient monitoring, and climate data were widely integrated into software solutions, enabling precise control of farm inputs. Predictive analytics using machine learning algorithms gained traction for crop disease forecasting and yield estimation. Mobile app-based interfaces allowed easy access for farmers in remote regions, promoting digital inclusion. These advancements underscore a transition toward connected ecosystems that optimize productivity through actionable insights and automated processes.

Market restraints stem from high installation costs, limited awareness, and infrastructure challenges in rural areas. In 2024 and 2025, small-scale farmers in developing regions faced barriers to adoption due to upfront expenses for software licenses and sensor hardware. Inconsistent internet connectivity in rural belts restricted the functionality of cloud-based solutions, reducing operational efficiency. Digital literacy gaps further limited the utilization of advanced tools, despite government incentives in some markets. These constraints highlight the importance of affordable pricing models, offline functionality, and targeted training initiatives to drive wider adoption globally.

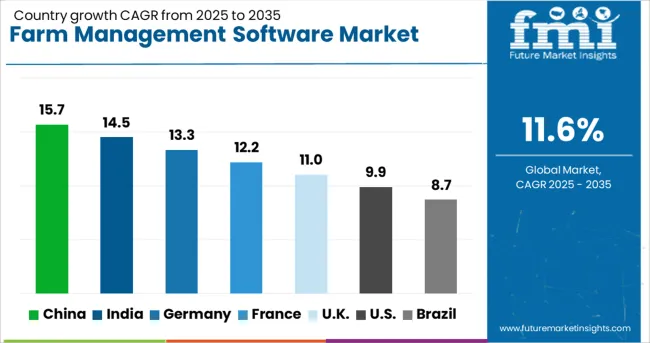

| Country | CAGR |

|---|---|

| China | 15.7% |

| India | 14.5% |

| Germany | 13.3% |

| France | 12.2% |

| UK | 11.0% |

| USA | 9.9% |

| Brazil | 8.7% |

The global farm management software market is projected to grow at 11.6% CAGR during 2025–2035. China leads with 15.7% CAGR, driven by rapid digitalization and integration of IoT in precision farming. India follows at 14.5%, supported by government subsidies and increasing mechanization in agriculture. Germany records 13.3% CAGR, emphasizing automation and sustainable farming solutions. The United Kingdom grows at 11.0%, while the United States posts 9.9%, reflecting steady adoption in mature markets focusing on advanced analytics and data-driven farming practices. Asia-Pacific dominates due to expanding smart agriculture initiatives, while Europe and North America lead in AI-powered platforms and subscription-based software services. This report includes insights on 40+ countries; the top markets are shown here for reference.

The farm management software market in China is forecasted to grow at 15.7% CAGR, driven by large-scale deployment of precision farming technologies and government-backed digital agriculture programs. Farmers adopt cloud-based platforms for real-time monitoring of crop health, soil conditions, and irrigation systems. Domestic tech firms collaborate with agribusinesses to provide localized solutions with AI-based predictive analytics. Integration with drones and IoT devices enhances data collection for better decision-making, improving yield and resource efficiency.

The farm management software market in India is projected to grow at 14.5% CAGR, fueled by increased mechanization and the need for cost-optimized farming solutions. Mobile-based farm management apps dominate adoption among small and mid-sized farmers. Government programs supporting digital agriculture and e-marketplaces drive usage of platforms for crop planning and financial tracking. Partnerships between agri-tech startups and fertilizer companies enable bundled offerings combining inputs, advisory, and farm software tools. AI-driven weather forecasting features gain traction for risk management.

The farm management software market in Germany is expected to grow at 13.3% CAGR, driven by sustainability targets and automation in modern farming systems. Advanced solutions integrating satellite imaging and GPS tracking improve field mapping and precision seeding. Demand for subscription-based software rises among commercial farms seeking data analytics for cost reduction. Government regulations on environmental compliance increase adoption of nutrient management modules. Manufacturers develop platforms compatible with machinery telematics and ERP systems for seamless data integration.

The farm management software market in India is projected to grow at 14.5% CAGR, fueled by increased mechanization and the need for cost-optimized farming solutions. Mobile-based farm management apps dominate adoption among small and mid-sized farmers. Government programs supporting digital agriculture and e-marketplaces drive usage of platforms for crop planning and financial tracking. Partnerships between agri-tech startups and fertilizer companies enable bundled offerings combining inputs, advisory, and farm software tools. AI-driven weather forecasting features gain traction for risk management.

The farm management software market in the United States is projected to grow at 9.9% CAGR, reflecting strong adoption in large-scale farming and agri-businesses. Advanced analytics platforms with machine learning capabilities dominate demand for crop modeling and resource optimization. Farmers invest in platforms integrating telematics and variable rate technology (VRT) for precision nutrient and pesticide application. Sustainability-focused agriculture and carbon credit programs further accelerate the use of farm data for reporting and compliance. Expansion of smart irrigation systems adds momentum.

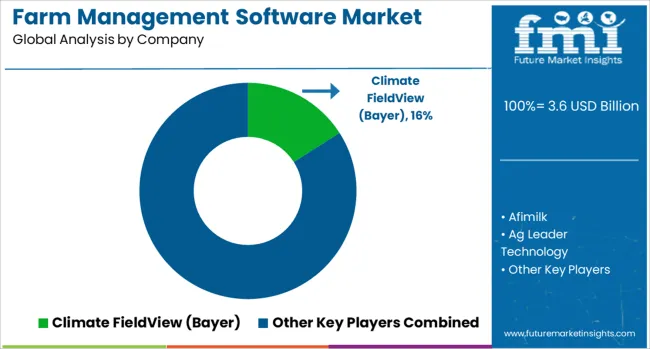

The farm management software market is dominated by Climate FieldView (Bayer), which secures its leadership through a robust platform integrating advanced data analytics, precision farming tools, and cloud-based solutions for crop monitoring and yield optimization. Climate FieldView’s dominance is supported by its strong presence in North America and Europe, strategic partnerships, and continuous innovation in AI-driven agronomic insights. Key players such as Ag Leader Technology, DeLaval, Afimilk, Conservis, and CropX hold significant shares by delivering software solutions focused on livestock monitoring, irrigation control, and end-to-end farm operations management. These companies emphasize interoperability with sensors, automation systems, and third-party applications to enhance decision-making for large and mid-sized farms.

Emerging players including Agrivi, AgriWebb, Boumatic, and eAgronom are expanding their market presence by offering user-friendly, cost-effective platforms targeting small and medium-scale farmers. Their strategies involve providing real-time insights through mobile apps, integration with IoT devices, and specialized tools for compliance reporting and sustainability metrics. Market growth is driven by the increasing adoption of precision farming practices, demand for resource optimization, and rising emphasis on data-driven decision-making to enhance productivity. Continuous advancements in cloud computing, predictive analytics, and remote monitoring technologies are expected to shape competitive dynamics, creating opportunities for both established players and emerging innovators in global markets.

The integration of AI, IoT, and advanced sensors in farm management software is accelerating market growth. These technologies enable real-time analytics and sustainability monitoring, helping farmers optimize operations. Productivity gains of up to 30% are reported, highlighting the efficiency benefits of digital farming solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 Billion |

| Farm Size | Medium farms (50-1,000 hectares), Small farms ( < 50 hectares), and Large farms (> 1000 hectares) |

| Deployment | Cloud, On-premises, and Hybrid |

| Agriculture Type | Precision farming, Livestock farming, Fish farming, Smart greenhouse farming, Orchard farming, and Forestry |

| Application | Crop management, Soil management, Financial management, Inventory management, Weather forecasting, Farm equipment tracking, Data analysis, and Others |

| End-user | Corporate farms, Individual farmers, Farm managers, Agricultural consultants, and Government organizations |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Climate FieldView (Bayer), Afimilk, Ag Leader Technology, Agrivi, AgriWebb, Boumatic, Conservis, Cropx, DeLaval, and eAgronom |

| Additional Attributes | Dollar sales by deployment model (cloud, on-premise, hybrid) and solution modules (crop planning, livestock tracking, financial tools). Adoption driven by precision ag and IoT integration. Buyers seek AI-driven analytics, ESG compliance, and equipment interoperability. Innovations include agritech-as-a-service, predictive modeling, and modular platforms for indoor farming and scalable digital farm management. |

The global farm management software market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the farm management software market is projected to reach USD 10.8 billion by 2035.

The farm management software market is expected to grow at a 11.6% CAGR between 2025 and 2035.

The key product types in farm management software market are medium farms (50-1,000 hectares), small farms ( < 50 hectares) and large farms (> 1000 hectares).

In terms of deployment, cloud segment to command 52.0% share in the farm management software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Farming Sack and Tote Market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Farm Animal Drug Market Size and Share Forecast Outlook 2025 to 2035

Farm Tire Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Indoor Farming Market Analysis - Size, Share, and Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Indoor Farming Market

Seafood Farming Chillers Market Forecast and Outlook 2025 to 2035

Poultry Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Vertical Farming Market Size and Share Forecast Outlook 2025 to 2035

Horse Drawn Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

AI for Hydroponic Farming Market Size and Share Forecast Outlook 2025 to 2035

Precision Livestock Farming Market Size and Share Forecast Outlook 2025 to 2035

Internet Of Things In Farm Management Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Disinfectant for Pets and Farms Market - Outlook 2025 to 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA