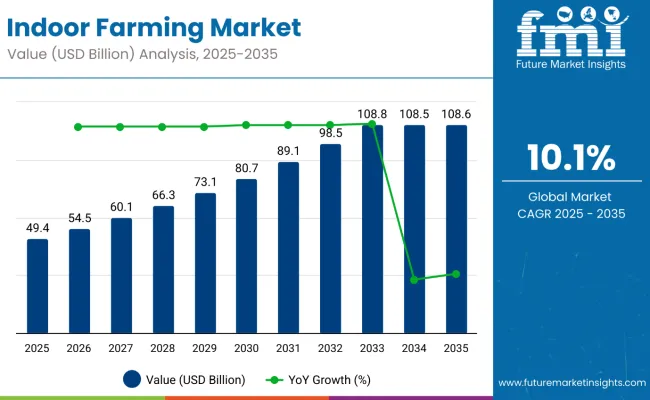

The global indoor farming market is expected to be expanded from USD 49.4 billion in 2025 to USD 108.6 billion by 2035, growing at a CAGR of 10.1%. In 2024, a value of USD 44.7 billion was recorded, marking a steady rise supported by food security concerns and a shrinking supply of arable land. Urban populations have driven the need for locally produced food, and this demand is being addressed through advanced indoor systems. By utilizing less land and water, these methods are being increasingly favored for sustainable agriculture in cities.

In 2025, broader crop varieties such as leafy greens, berries, tomatoes, and herbs are being cultivated through vertical farming and hydroponics. LED lighting tailored to plant growth stages is being deployed to reduce energy consumption. Nutrient delivery and irrigation systems are being automated using artificial intelligence, allowing continuous monitoring and efficient resource management. These solutions are being installed in urban centers to shorten the supply chain, maintain consistent quality, and increase overall agricultural resilience regardless of climate conditions.

Technological innovations have also been introduced in substrates and modular units. Soil-free biodegradable growth media are being used to enhance moisture retention and reduce root stress. Modular stacking solutions are being placed in urban warehouses, schools, and grocery facilities to grow food close to the point of consumption. Smart climate control technologies powered by machine learning are being piloted to reduce manual labor and improve operational efficiency. In addition, seed genetics designed specifically for indoor conditions are being utilized to maximize yield and reduce time to harvest.

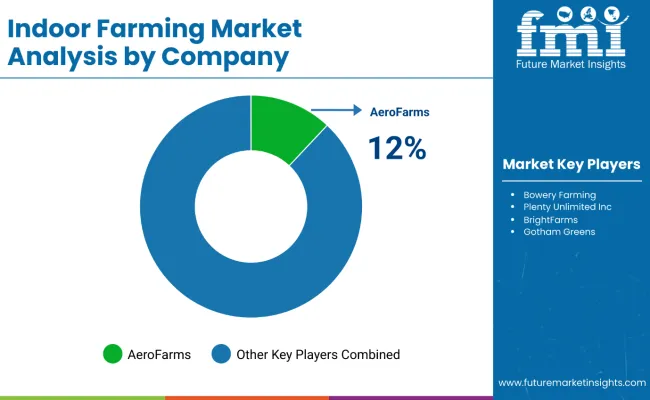

Several companies are playing a key role in advancing the industry. AeroFarms has deployed vertical farms across the USA and Gulf countries. Plenty Unlimited Inc. has entered into partnerships with major logistics firms to grow fresh produce at distribution centers. Bowery Farming is supplying pesticide-free produce to retailers.

Freight Farms is distributing containerized solutions for localized farming, while Infarm has scaled its modular growing units throughout Europe. These efforts are being aligned with sustainability policies and clean food initiatives. As global food systems are pressured by urbanization and climate change, indoor farming is being positioned as a reliable, tech-enabled solution expected to remain essential through 2035.

Per capita spending on indoor farming is witnessing steady growth worldwide, fueled by the need for sustainable food production, urbanization, and environmental concerns. Developed regions are leading the way with significant investments in advanced farming technologies, supported by strong policy frameworks and consumer demand for fresh, local produce. Meanwhile, emerging markets are rapidly catching up, as governments and private players invest in resilient food systems to address climate challenges, reduce reliance on imports, and optimize limited agricultural land.

The global trade of indoor farming technologies and solutions is expanding rapidly, driven by increasing demand for sustainable agriculture, food security, and year-round crop production. Trade in this sector includes equipment, systems, inputs, and technologies such as hydroponics, LED grow lights, climate control systems, and nutrient solutions.

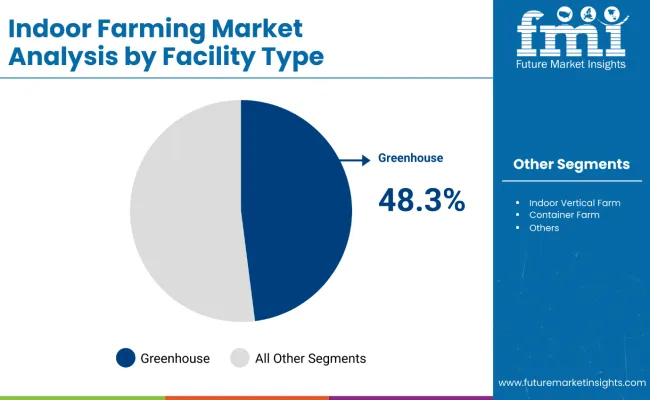

Greenhouses are expected to account for 48.3% of the controlled environment agriculture (CEA) market by 2025, leading the facility type segment due to their scalability, cost efficiency, and adaptability across climates. They offer year-round growing conditions using sunlight, supplemented by smart technologies such as AI-driven climate control, automated irrigation, and energy-efficient systems. This allows growers to significantly reduce resource consumption while enhancing yields.

Companies like AppHarvest are pioneering smart greenhouse farms that integrate hydroponic systems to meet growing consumer demand for pesticide-free, sustainably grown produce. These facilities are increasingly popular in regions facing climate instability or limited arable land. In-house systems also support clean-label marketing, aligning with retailer sustainability goals.

Major supermarket chains are beginning to source fresh vegetables directly from greenhouse operations, recognizing the benefit of localized, high-quality crops. With strong support from public and private investors, and incentives focused on food security and climate resilience, greenhouse agriculture continues to be a dominant force in the CEA market. Expansion is particularly strong in North America, Europe, and Asia, where climate-smart farming practices are gaining policy traction and commercial momentum.

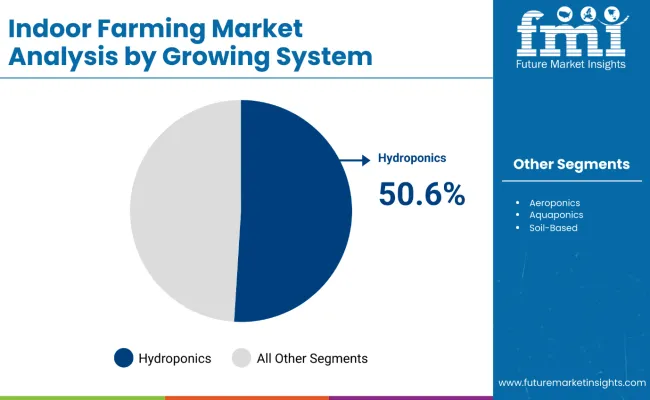

Hydroponics is projected to lead the growing system segment of the controlled environment agriculture (CEA) market in 2025, with a 50.6% share. This soil-free method uses nutrient-rich water to grow crops, reducing water usage by up to 90% compared to traditional farming while delivering higher yields and faster growth cycles. It is particularly well-suited for leafy greens, herbs, and tomatoes-crops that are in high demand in urban settings.

Companies such as BrightFarms and LettUs Grow have successfully scaled hydroponic operations to supply retailers like Whole Foods and Kroger, enabling reliable local produce delivery with minimal environmental impact. Hydroponic farms are highly adaptable to indoor environments, making them ideal for year-round production regardless of external weather conditions. Advanced systems integrated with AI and IoT technology allow precise control over nutrients, pH, and lighting, improving efficiency while reducing labor.

Hydroponics supports sustainability goals through reduced land use and pesticide-free cultivation. As food security and urban agriculture rise to global importance, hydroponics stands out as a cost-effective, scalable, and future-proof solution, drawing substantial investment from both public and private sectors worldwide.

Sustainability, fast urbanization, and food security have become the main drivers of the vigorous growth of the industry. Yield efficiency and high-tech solutions, such as hydroponics and geoponics, are the main concerns of commercial farms for boosting the output.

Technology adoption and sustainability are the main focuses of the research institutions that aim for innovating controlled-environment agriculture. Residential growers are on the lookout for low-cost systems and small-sized devices; thus, cost is the primary factor.

Restaurants and retail shops mainly emphasize the freshness of the local produce by integrating the vertical farming concept to be space efficient. The increasing concern for organic and pesticide-free products has led industry players to come up with environmentally friendly and energy-efficient alternative products.

Besides this, automation, IoT-enabled monitoring, and LED-based grow lights are transforming facilities systems making indoor agriculture easier for different end-user segments. Companies that prioritize sustainability, lower energy consumption, and use of smart farming technologies will have a competitive advantage in this dynamic industry.

The industry is exposed to some risks such as high startup costs because it requires advanced technology, large investments, and automation. Since vertical farms, hydroponics, and aeroponics are expensive to set up, new businesses may hesitate to enter, and existing ones may expand more slowly.

The energy consumption is another risk. As indoor farms require permanent artificial lighting, climate control, and irrigation systems, they incur high operational costs thereby reducing profitability. Increased reliance on fossil fuels raises concerns about price fluctuation and sustainability risks.

Regulatory compliance is another risk in the industry. The governments impose strict food safety and labelling standards, particularly on chemically altered and pesticide-free products. Facing the risks of recalls, lawsuits, and the consequent reputational loss are the companies failing to comply.

Supply chain interruptions remain a major concern. Indoor farms depend on unique machinery, nutrient solutions, and high-tech equipment. The lack of or delay in the delivery of raw materials can lead to reduced production and scarce products in the industry.

In addition, the acceptance of the industry and the preferences of the customers create risks. Though the industry guarantees produce free of pesticides, customers frequently give priority to the price over sustainability.

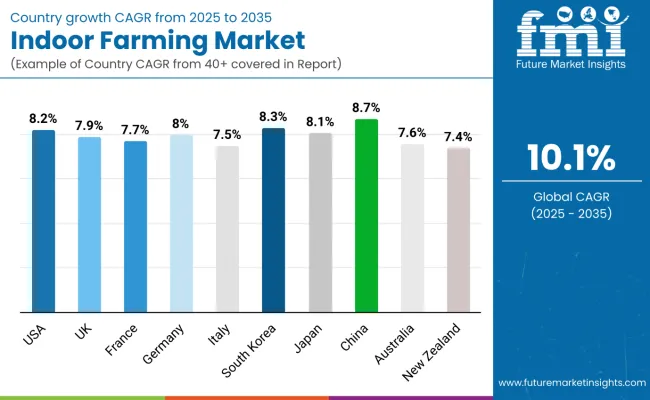

| Countries | Estimated CAGR |

|---|---|

| USA | 8.2% |

| UK | 7.9% |

| France | 7.7% |

| Germany | 8.0% |

| Italy | 7.5% |

| South Korea | 8.3% |

| Japan | 8.1% |

| China | 8.7% |

| Australia | 7.6% |

| New Zealand | 7.4% |

The USA industry is developing at a high rate, driven by the rise in demand for local, chemical-free produce. Sustainability appeals to consumers, encouraging companies to incorporate controlled environment agriculture (CEA) technology. Hydroponics and vertical farms are spreading to cities, reducing the demand for traditional land. LED lighting, climate control, and automation technology improve efficiency with fewer resources. The convergence of AI-based monitoring technologies and robots is providing increased efficiency on all sides.

Leading players are increasing production levels to meet growing industry demand. State government programs and private investment sustain research and innovation of smart agriculture practices. Year-round indoor cultivation stabilizes supply chains and diminishes import dependence. Increasing urbanization continues to keep the USA industry at the forefront of the world industry, setting the stage for future technological achievements.

The UK indoor agriculture industry is shifting with increased emphasis on food availability and supply chain loss. Controlled environment agriculture (CEA) is increasing, and it is encouraged by government policy to embrace sustainable agriculture. LED hydroponic farms and intelligent greenhouses are gaining popularity, enhancing production efficiency through lower inputs. Urban agriculture is increasing, particularly in urban areas where land for traditional farming is scarce.

Private equity funding in indoor agriculture start-ups and premium infrastructure construction by private stakeholders is driving growth in the industry. Advances in AI-driven monitoring systems and automation boost productivity levels in plants. Retailers are forced to purchase fresh, pesticide-free local products from indoor agriculture. With advancing innovation, the UK will establish its dominance in international indoor agriculture, with high-quality food production on a consistent basis at lower environmental expenses.

France's indoor agriculture is increasing at a rapid rate with increasing customer demand for fresh and organic foods. Shifting away from chemically based farming placed hydroponics and aeroponics in overdrive for growth. Urban agriculture is catching on, and big cities are embracing vertical farming as an alternative for traditionally farmed land. Financial yield and government subsidies to green farmers are also propelling growth in the industry.

Greater application of AI-driven monitoring systems and automation enhances indoor farm productivity. Retailers and supermarket chains are making investments in indoor farming technology locally developed to respond to heightened consumer demand for sustainable products. Private research institutions and centers work together to create energy-efficient greenhouse technology and improve scalability and profitability. France's focus on sustainability and innovation has established it as a future potential industry leader in the European industry.

Germany's industry is growing with increasing demand for organic produce and sustainable farming. Vertical farming and LED greenhouses are revolutionizing urban farming, cutting dependence on imported fruits and vegetables. Energy-saving agriculture practices and policies supporting sustainable agriculture increase the use of controlled environment agriculture (CEA). Robotics and artificial intelligence-based automation are enhancing efficiency and yield quality.

Big-box retailers are investing in community-based indoor agriculture projects to fulfill increasing consumer demand. The increase in demand by consumers for carbon-neutral agricultural produce has been driven by growth in the use of renewable energy sources in indoor agrarian operations. Cities are seeing increases in hydroponic and aeroponic farms at a high rate, maximizing food yield in city borders. With increased innovation in technology, Germany continues to be the country at the forefront of safe indoor agriculture.

The Italian indoor agriculture industry for farming is increasing slowly with urbanization expansion and the demand for pesticide-free high-quality products. Hydroponics and aeroponic systems have become increasingly popular in organic crop cultivation in Italy. Vertical agriculture technology is rapidly being adopted worldwide by city municipalities to supply new produce with no environmental destruction.

Intelligent greenhouses with energy-efficient technology and AI-based monitoring systems are propelling Italy's industry efficiency. Indoor farms are being stocked more and more by restaurants and supermarkets, cutting reliance on seasonal crops. Government-backed programs for sustainable farming and intelligent farming technology also enhance industry size. Italy's industry will play a pivotal role in maintaining long-term food security.

South Korea's industry is also increasing with the development of urban agriculture and smart farming. South Korea's high-rise urban culture requires additional space-saving and therefore hydroponics and vertical farming are practiced. AI and automation monitoring enhance the efficient use of resources as well as wastage of yields.

Government initiatives toward agricultural innovation and independence are propelling development in indoor agriculture. LED hydroponic farms and smart greenhouses are being increasingly used to provide continuous crop yield. With huge R&D investment and sophisticated technological uptake, South Korea is becoming a powerhouse in the global indoor agriculture industry.

Japan's indoor agriculture sector is expanding, and the food supply and land available for farming are becoming major concerns. Hydroponics and vertical farms that provide a constant source of fresh vegetables and fruits, regardless of space, have been welcomed in urban cities. Climate control and LED light technology using AI are the promoters of efficiency and sustainability.

State-sponsored modernization of agriculture promotes the use of controlled environment agriculture (CEA). Large retailers are establishing industry to provide customers with locally produced pesticide-free fruits and vegetables. Japan remains at the cutting edge of high-tech technology in light of ongoing advancements in automation and robotics.

The Chinese indoor agriculture industry is growing at a fast pace as a result of food safety concerns and extensive agri-tech investment. AI-powered smart artificial-lit greenhouses and robotically managed vertical farms are revolutionizing the production of food with the possibility of pesticide-free affordable produce. Hydroponic and aeroponic systems are being implemented in cities to increase maximum food security.

Government initiatives for sustainable agriculture and technological advancements drive industry growth. Large farm corporations are investing heavily in automation and IoT-based crop monitoring technologies. With continuous innovation, China is a force to be reckoned with in the global indoor agriculture industry.

Australia's industry is growing with climatic concerns and water scarcity driving demand for alternative farming practices. Vertical farming and hydroponics are becoming increasingly popular, encouraging water-conserving techniques. AI-enabled intelligent greenhouses are optimizing production and sustainability.

Government support for agri-tech start-ups and green farming is driving innovation. Consumers are demanding more and more locally produced pesticide-free organic fruits and vegetables, driving the demand for industry solutions. With increased automation and energy-efficient farming, Australia's industry is expected to grow increasingly.

New Zealand's domestic agriculture sector is expanding as consumers increasingly look for locally grown and organic fruits and vegetables. Hydroponic cultivation and smart greenhouse technology are offsetting climate uncertainty, and production is assured throughout the year. Energy-efficient LED lighting and AI-powered monitoring enhance productivity.

Government policies that are favorable to sustainable agriculture are driving industry adoption. Urban agriculture is picking up steam, cutting the country's dependence on imported produce. With growing investment in agri-tech, New Zealand's indoor agriculture sector is set to expand steadily.

The industry is accelerating speeds owing to the ever-increasing demand among consumers for fresh, pesticide-free produce and regarding the sustainable, resource-efficient agricultural solutions that this industry offers. Hydroponics, aeroponics, and vertical farming, as advanced cultivation techniques, facilitate productivity and year-round cultivation with fewer land and water use.

Top players include AeroFarms, Bowery Farming, Plenty, BrightFarms, and Gotham Greens, who are applying computerization with artificial intelligence technologies, LED-based grow to light, and Internet of Things monitoring systems to maximize yield and operational efficiency. New and niche companies are also embracing localized urban farming as well as customized crop solutions to target regional demands.

Industry evolution will be induced further through increasing investments, partnerships with retailers and food service providers, and government initiatives pushing sustainable agriculture. Cloud-based farm management and plant phenotyping plus other alternative energy solutions will continue redefining competition.

Strategic factors influencing the landscape include very high initial setup costs, energy efficiency concerns, and regulatory compliance associated with food safety and environmental impact. As the competition gets fiercer, companies will have to grow their operation scales, push their cost efficiencies, and maximize the benefits of advanced technology to maintain healthy growth and profitability in leading the industry.

AeroFarms (12%)

AeroFarms is a leader in vertical farming technology, employing aeroponic systems that provide nutrients directly to plant roots without the need for soil. Its emphasis on sustainability and effective use of resources places it well in the industry.

Bowery Farming (10%)

Bowery Farming combines technology and farming, employing data-driven strategies to maximize crop yields as well as quality. Its emphasis on pesticide-free produce resonates with health-aware consumers.

Plenty Unlimited Inc. (9%)

Plenty Unlimited focuses on technological innovation to cultivate varied crops with better taste and nutrition. Substantial investments have helped them grow and innovate in the indoor agriculture industry.

BrightFarms (7%)

BrightFarms' approach of siting hydroponic farms close to urban areas minimizes transport emissions and provides fresher products. Sourcing partnerships with supermarkets have solidified their supply chain.

Gotham Greens (6%)

Gotham Greens uses city space for cultivation, converting roofs into functional greenhouses. Their environmentally friendly approach and local production align with green consumers.

Other Key Players

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 49.4 billion |

| Projected Market Size (2035) | USD 108.6 billion |

| CAGR (2025 to 2035) | 10.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million square feet for facility volume |

| Facility Types Analyzed (Segment 1) | Greenhouse, Indoor Vertical Farm, Container Farm, Indoor Deep Water Culture System, Other Facility Types |

| Growing Systems Analyzed (Segment 2) | Hydroponics, Aeroponics, Aquaponics, Soil-based, Hybrid |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players Influencing the Market | AeroFarms, Bowery Farming, Plenty Unlimited Inc., BrightFarms, Gotham Greens, AppHarvest, Infarm, Nordic Harvest, Netled, Agricool |

| Additional Attributes | Rising demand for pesticide-free food, Climate-resilient agriculture, Technological innovations in controlled-environment farming |

| Customization and Pricing | Customization and Pricing Available on Request |

By facility type, the industry is segmented into greenhouse, indoor vertical farm, container farm, indoor deep water culture system, and other facility types, with greenhouses leading due to their efficiency in controlled-environment agriculture.

By growing system, the industry includes aeroponics, hydroponics, aquaponics, soil-based, and hybrid methods, with hydroponics being the most widely adopted due to its water efficiency and high crop yield potential.

By region, the industry spans North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA), with North America leading due to strong investments in advanced farming technologies and urban agriculture initiatives.

The industry is expected to reach USD 49.4 billion in 2025.

The industry is projected to reach USD 108.6 billion by 2035, growing at a CAGR of 10.1%.

Key players include AeroFarms, Bowery Farming, Plenty Unlimited Inc., BrightFarms, Gotham Greens, AppHarvest, Infarm, Nordic Harvest, Netled, and Agricool.

North America and Europe, driven by increasing demand for locally grown, pesticide-free produce and advancements in vertical farming technology.

Hydroponics-based farming dominates due to its efficient water usage, faster plant growth, and ability to maximize crop yield in urban environments.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Facility Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Growing System, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Component Type , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Crop Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Facility Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Growing System, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Component Type , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Crop Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Facility Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Growing System, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Component Type , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Crop Type, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Facility Type, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Growing System, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Component Type , 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Crop Type, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Facility Type, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Growing System, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Component Type , 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Crop Type, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Facility Type, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Growing System, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Component Type , 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Crop Type, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Facility Type, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Growing System, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Component Type , 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Crop Type, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Facility Type, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Growing System, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Component Type , 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Crop Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Facility Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Growing System, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Component Type , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Crop Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Facility Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Facility Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Facility Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Growing System, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Growing System, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Growing System, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Component Type , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Component Type , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Component Type , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Crop Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Crop Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Crop Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Facility Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Growing System, 2023 to 2033

Figure 23: Global Market Attractiveness by Component Type , 2023 to 2033

Figure 24: Global Market Attractiveness by Crop Type, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Facility Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Growing System, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Component Type , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Crop Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Facility Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Facility Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Facility Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Growing System, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Growing System, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Growing System, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Component Type , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Component Type , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Component Type , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Crop Type, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Crop Type, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Crop Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Facility Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Growing System, 2023 to 2033

Figure 48: North America Market Attractiveness by Component Type , 2023 to 2033

Figure 49: North America Market Attractiveness by Crop Type, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Facility Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Growing System, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Component Type , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Crop Type, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Facility Type, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Facility Type, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Facility Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Growing System, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Growing System, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Growing System, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Component Type , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Component Type , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Component Type , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Crop Type, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Crop Type, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Crop Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Facility Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Growing System, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Component Type , 2023 to 2033

Figure 74: Latin America Market Attractiveness by Crop Type, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Facility Type, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Growing System, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Component Type , 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by Crop Type, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Facility Type, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Facility Type, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Facility Type, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Growing System, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Growing System, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Growing System, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Component Type , 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Component Type , 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Component Type , 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by Crop Type, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Crop Type, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Crop Type, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Facility Type, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Growing System, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Component Type , 2023 to 2033

Figure 99: Western Europe Market Attractiveness by Crop Type, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Facility Type, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Growing System, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Component Type , 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by Crop Type, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Facility Type, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Facility Type, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Facility Type, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Growing System, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Growing System, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Growing System, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Component Type , 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Component Type , 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Component Type , 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Crop Type, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Crop Type, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Crop Type, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Facility Type, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Growing System, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Component Type , 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by Crop Type, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Facility Type, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Growing System, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Component Type , 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by Crop Type, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Facility Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Facility Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Facility Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Growing System, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Growing System, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Growing System, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Component Type , 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component Type , 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component Type , 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Crop Type, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Crop Type, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Crop Type, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Facility Type, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Growing System, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Component Type , 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by Crop Type, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Facility Type, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Growing System, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Component Type , 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Crop Type, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Facility Type, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Facility Type, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Facility Type, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Growing System, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Growing System, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Growing System, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Component Type , 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Component Type , 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Component Type , 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by Crop Type, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Crop Type, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Crop Type, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Facility Type, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Growing System, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Component Type , 2023 to 2033

Figure 174: East Asia Market Attractiveness by Crop Type, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Facility Type, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Growing System, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Component Type , 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by Crop Type, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Facility Type, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Facility Type, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Facility Type, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Growing System, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Growing System, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Growing System, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Component Type , 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Component Type , 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component Type , 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Crop Type, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Crop Type, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Crop Type, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Facility Type, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Growing System, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Component Type , 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by Crop Type, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

A Detailed Global Analysis of Brand Share for the Indoor Farming Market

Indoor Rotary High Voltage Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Indoor Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Indoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Indoor Air Quality Monitor Market Size and Share Forecast Outlook 2025 to 2035

Indoor Location Market Size and Share Forecast Outlook 2025 to 2035

Indoor Space Heater Market Size and Share Forecast Outlook 2025 to 2035

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Family/Indoor Entertainment Centres Market Report – Forecast 2017-2027

Cat Condos & Indoor Houses Market Insights - Size & Trends 2025 to 2035

Farming Sack and Tote Market Report – Trends, Size & Forecast 2024 to 2034

Seafood Farming Chillers Market Forecast and Outlook 2025 to 2035

Poultry Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Vertical Farming Market Size and Share Forecast Outlook 2025 to 2035

Horse Drawn Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

AI for Hydroponic Farming Market Size and Share Forecast Outlook 2025 to 2035

Precision Livestock Farming Market - Trends & Forecast 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA