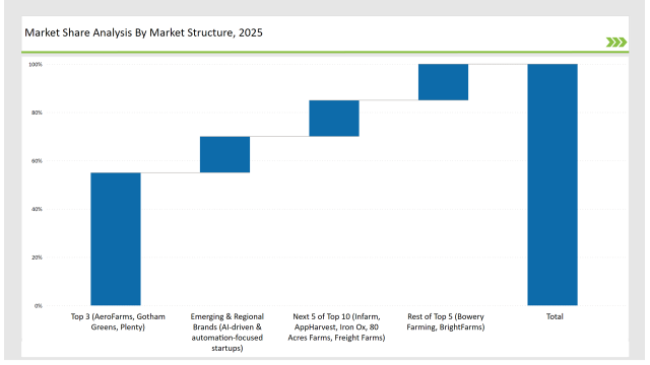

Controlled-environment agriculture is the growing phenomenon in the global indoor farming market because of factors attributed to urbanization, food insecurity, and climate changes. The industry's pattern changes due to betterments in hydroponics, aeroponics, vertical farming, and LED lighting solutions. The key players dominating the market include AeroFarms, Gotham Greens, and Plenty. Altogether, these companies account for a market share of 55%. Regional players as well as agricultural startups comprise the remaining share that is 30%, and the AI-driven firms and automation players have the smallest proportion that is 15%.

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (AeroFarms, Gotham Greens, Plenty) | 55% |

| Rest of Top 5 (Bowery Farming, BrightFarms) | 15% |

| Next 5 of Top 10 (Infarm, AppHarvest, Iron Ox, 80 Acres Farms, Freight Farms) | 15% |

| Emerging & Regional Brands (AI-driven & automation-focused startups) | 15% |

The indoor farming market in 2025 is moderately concentrated, with the top players controlling 40% to 60% of the total market share. Companies like AeroFarms, Plenty, and Gotham Greens dominate, while regional farms and new entrants fuel competition. The increasing demand for sustainable and locally grown produce continues to drive investment and innovation in the sector.

Indoor farming produce and solutions are distributed through various sales channels. Supermarkets and grocery chains lead with 50% of sales as consumers increasingly demand fresh, locally grown produce. E-commerce and DTC platforms account for 30% by enabling consumers to purchase directly from indoor farms. Restaurants and food service providers comprise 15%, seeking farm-to-table produce for premium dining experiences. Corporate partnerships and institutional buyers comprise the remaining 5%, focusing on sustainability-driven farming collaborations.

Leafy greens, microgreens, vine crops, and medicinal plants are categorized under the indoor farming market. Leafy greens comprise 40% of the market share, as it is an efficient crop that can thrive well in a hydroponic and vertical farming system. The microgreens hold a 25% market share, as they are observed to have great benefits for nutrition and cooking uses. These vines take 20% of market share since it's an in-house production to have tomatoes, cucumbers, and pepper plants perform efficiently. Medicinal plants is taking 15% due to increased pharmaceutical, herbal supplement orders.

2024 is the revolution year for Indoor farming. Among the features set in this stage include; technical growth, environmentally friendly, urban growth. Its such companies steering the course thus;

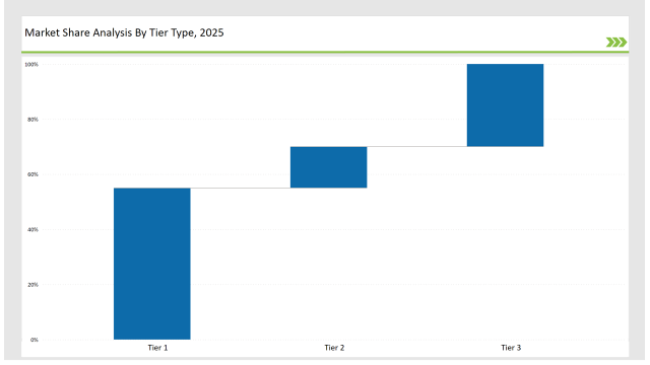

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | AeroFarms, Gotham Greens, Plenty |

| Market Share % | 55% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Bowery Farming, BrightFarms |

| Market Share % | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, AI-driven farming startups |

| Market Share % | 30% |

| Brand | Key Focus Areas |

|---|---|

| AeroFarms | Aeroponic vertical farming with minimal water usage |

| Gotham Greens | Urban greenhouse expansion for fresh local produce |

| Plenty | AI-driven, high-yield, climate-smart farming |

| Bowery Farming | Smart automation & robotics in indoor farming |

| BrightFarms | Hybrid indoor-traditional farming integrations |

| Emerging Brands | Fully automated, AI-powered climate farming |

The indoor farm market will continue to rise with the advancement in smart technology, urban integration, and sustainable agriculture. With increasing food demands all over the world, indoor farms will play a pivotal role for ensured food security while minimizing the environment footprint of food production. It can only be but for the sake of time for now, though to be reckoned with would come modular hydroponic systems, fully automated growing facilities and AI-powered techniques. Controlled Environment Agriculture is ready for regulatory boost in the pipeline. This brings forth tax breakage and even agritech funding to innovations which make the difference between efficiency and sustainability in achieving an efficient redefined food culture. Contents

Leading players such as AeroFarms, Plenty, and Gotham Greens collectively hold around 55% of the market.

Regional indoor farms and hydroponic growers contribute approximately 30% of the market by catering to local food supply chains and sustainable agriculture initiatives.

Startups focusing on vertical farming, AI-powered agriculture, and controlled environment agriculture (CEA) hold about 10% of the market.

Private labels from grocery retailers and farm-to-table businesses hold around 5% of the market.

High for companies controlling 55%+, medium for 40-55%, and low for those under 30%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Indoor Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Indoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Indoor Air Quality Monitor Market Size and Share Forecast Outlook 2025 to 2035

Indoor Location Market Size and Share Forecast Outlook 2025 to 2035

Indoor Space Heater Market Size and Share Forecast Outlook 2025 to 2035

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

Indoor Farming Market Analysis - Size, Share, and Forecast 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Family/Indoor Entertainment Centres Market Report – Forecast 2017-2027

Cat Condos & Indoor Houses Market Insights - Size & Trends 2025 to 2035

Farming Sack and Tote Market Report – Trends, Size & Forecast 2024 to 2034

Poultry Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Vertical Farming Market Size and Share Forecast Outlook 2025 to 2035

Horse Drawn Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

AI for Hydroponic Farming Market Size and Share Forecast Outlook 2025 to 2035

Precision Livestock Farming Market - Trends & Forecast 2034

Sales Analysis of Tourism Industry in the Middle East Size and Share Forecast Outlook 2025 to 2035

Semen Analysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Stone Analysis Software Market – Trends & Forecast 2025 to 2035

Water Analysis Instrumentation Market Analysis – Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA