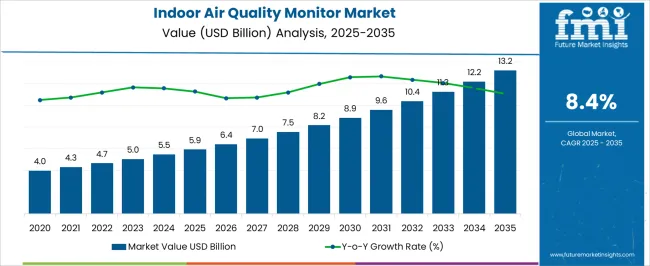

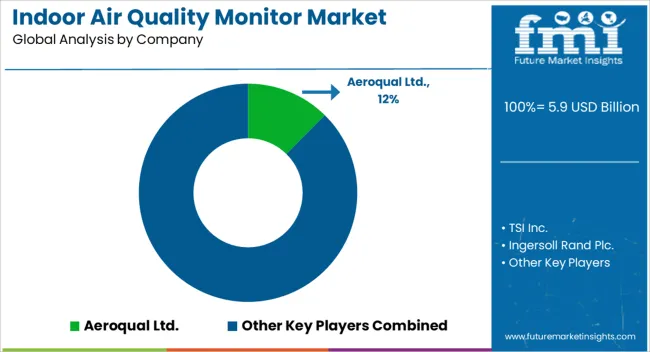

The Indoor Air Quality Monitor Market is estimated to be valued at USD 5.9 billion in 2025 and is projected to reach USD 13.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Indoor Air Quality Monitor Market Estimated Value in (2025 E) | USD 5.9 billion |

| Indoor Air Quality Monitor Market Forecast Value in (2035 F) | USD 13.2 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The indoor air quality (IAQ) monitor market is advancing steadily, supported by heightened awareness of air pollution’s impact on health and regulatory emphasis on safe indoor environments. Industry publications and corporate disclosures have underlined growing concerns about volatile organic compounds, particulate matter, and toxic gases within enclosed spaces, which has prompted widespread adoption of monitoring systems.

Rapid urbanization, coupled with stricter occupational safety standards, has driven demand in industrial, commercial, and residential settings. Technological progress, including integration with IoT platforms and advanced sensor miniaturization, has enhanced the accuracy and real-time monitoring capabilities of IAQ devices.

Additionally, governments and health agencies are increasingly mandating compliance with air quality standards, strengthening the market outlook. Investments in smart building solutions have further broadened the application scope of these monitors, particularly in energy-efficient infrastructures. Looking ahead, sustained growth is anticipated as industries, healthcare facilities, and households prioritize healthier environments, with segmental momentum led by fixed devices, chemical pollutant monitoring, and industrial end users.

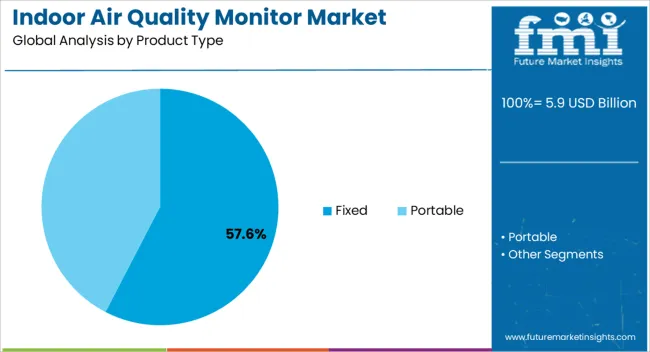

The Fixed segment is projected to contribute 57.60% of the indoor air quality monitor market revenue in 2025, maintaining its lead among product categories. This dominance has been reinforced by the reliability and precision of fixed monitoring systems, which are permanently installed in environments where continuous air quality assessment is required.

Industrial plants, laboratories, and large commercial facilities have favored fixed devices due to their ability to provide uninterrupted data and support compliance reporting with regulatory standards. Manufacturers have advanced fixed monitors with multi-sensor arrays and wireless connectivity, enabling integration with centralized monitoring networks.

Their durability and suitability for long-term deployment have made them indispensable for locations with persistent air quality risks. As organizations prioritize accurate, real-time environmental monitoring to safeguard workforce health and operational efficiency, the Fixed segment is expected to retain its strong market position.

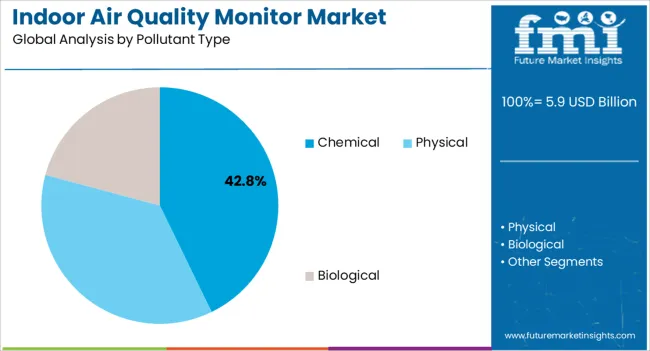

The Chemical segment is projected to account for 42.80% of the indoor air quality monitor market revenue in 2025, establishing it as the largest pollutant monitoring category. Growth in this segment has been driven by the significant health risks associated with exposure to volatile organic compounds, carbon monoxide, and formaldehyde, which are common in industrial, residential, and office settings.

Regulatory bodies and occupational safety agencies have underscored the necessity of chemical pollutant detection to prevent long-term respiratory illnesses and workplace hazards. Technological advancements in electrochemical and infrared sensors have enhanced the sensitivity and selectivity of chemical pollutant monitoring, allowing more precise detection at lower concentrations.

Furthermore, the increasing use of synthetic materials and chemicals in building construction and manufacturing has amplified the need for continuous chemical monitoring. With heightened awareness of indoor chemical exposure and its link to chronic health conditions, the Chemical segment is anticipated to remain the most critical pollutant monitoring category.

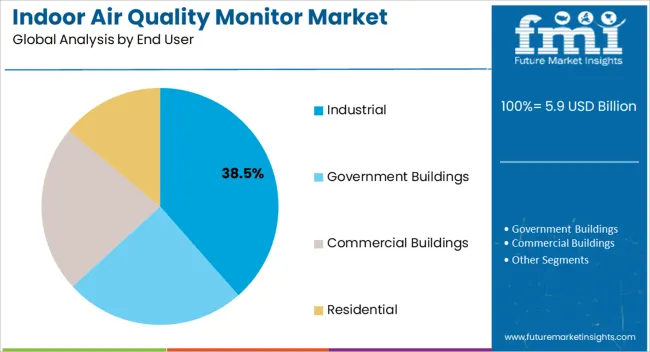

The Industrial segment is projected to capture 38.50% of the indoor air quality monitor market revenue in 2025, holding the leading share among end users. This leadership has been driven by stringent workplace safety standards and the elevated risks of exposure to hazardous gases, fumes, and particulates in industrial operations.

Industries such as manufacturing, mining, and chemical processing have prioritized the installation of IAQ monitors to comply with occupational health regulations and reduce liability risks. Press releases and annual reports from industrial firms have emphasized investments in environmental monitoring systems to enhance workforce protection and ensure regulatory compliance.

Industrial facilities also demand fixed, ruggedized monitoring solutions capable of operating in challenging environments, further boosting adoption. As industrialization expands in emerging economies and safety standards become increasingly stringent worldwide, the Industrial segment is expected to sustain its market leadership, anchored by regulatory enforcement and corporate health and safety commitments.

Particles and contaminants are constantly mixed in with the indoor air, which may affect the overall air quality. These include mold, viruses, bacteria, allergens, and sometimes lint. These require an indoor air quality monitor to detect when thorough cleaning is required indoors.

Smart homes are growing in popularity, along with the concept of ambient assisted living. This is because chemicals such as formaldehyde and particulate matter in the air can lead to lung cancer, systematic hypertension, etc., in people inhaling this air.

A common cause of indoor pollution in residential spaces is fumes from stoves and other fuel-burning combustion appliances, tobacco products, building materials and furnishings, products for cleaning and maintenance, etc. Moreover, high temperatures and moisture from extreme humidity can develop mold growth and enable viruses to linger in the air. These factors are expected to propel the demand for indoor air quality monitors.

It is nearly impossible to prevent the sources of indoor air pollution as these contaminants originate from daily, regular activities. Hence, deploying indoor air quality monitors is crucial as it informs the consumer when harmful air contaminants have reached unsafe levels in certain building areas and require urgent ventilation or cleaning.

The increasing consumption of energy globally surges the issue of pollution and its harmful aftereffects. Hence, people are switching to deploying renewable or green energy, which has become vital. These naturally replenishing renewable energy sources, such as biomass and hydropower, are preferred over indoor air quality monitors, which is expected to hinder the global indoor air quality monitor market growth.

Conversely, businesses are investing in air quality devices that can monitor indoor air quality across a wide range of important parameters to address pressing air quality concerns, such as the inability to manage their HVAC systems by temperature. Moreover, vendors are offering advanced technologies with accurate monitoring capabilities, which aids in enhancing delivery efficiency.

North America, with a global share of 25.6%, is dominating the indoor air quality market. This is attributed to rising public-private funding and increasing adoption of new advanced indoor air quality monitoring technologies.

There have been ongoing technological advancements in particulate sensors and gas analyzers. Furthermore, investments in promoting indoor air pollution monitoring, as well as the presence of supportive government regulations, are expected to drive global market growth.

The Asia Pacific region is set to witness significant growth in the indoor air quality monitor market in the forecast period. The increasing population, and eventually the rapid urbanization and industrial advancement, exposes several regions in the Asia Pacific to increased pollution and raises health concerns associated with poor air quality index not just in an external environment but also in an indoor location. This builds the foundation for the region's indoor air quality monitor market.

With technological advancements in sensor technology, data analytics, and IoT devices, countries in the region can easily access the benefits of indoor air quality monitor technology. Therefore, India is expected to progress at a CAGR of 13.2% by 2035 and China at 10.1%.

Various respiratory illnesses can arise from the prolonged inhalation of fine dust, mold, viruses, or harmful emissions from household appliances. These issues need to be curbed. Hence, start-up companies are adopting smart technologies to promote the sales of indoor air quality monitors.

The indoor air quality monitor market share is highly competitive for many participants. Mergers and acquisitions are likely to aid in market growth and provide significant opportunities for the market players to obtain profit. The growing awareness about the importance of purifying our air is anticipated to accelerate product sales.

Key Market Participants of The Indoor Air Quality Monitor Market:

Recent Developments in the Market:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 8.8% from 2025 to 2035 |

| Base year for estimation | 2025 |

| Historical data | 2020 to 2025 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors and trends, Pricing Analysis, |

| Segments Covered | Product Type, Pollutant Type, End User, and Region |

| Regional scope | North America, Western Europe, Eastern Europe, the Middle East and Africa, ASEAN, South Asia, Rest of Asia, Australia, and New Zealand |

| Country scope | United States, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Siemens AG, Emerson Electric Co., Thermo Fisher Scientific Inc., Google Nest Labs Inc., 3M, Aeroqual Ltd., TSI Inc., Ingersoll Rand plc, Panasonic Corp., Daikin North America LLC, Trane Technologies plc, Lennox International Inc., Zigma Global Environ Solutions, Teledyne Technologies Inc., Horiba Ltd., etc. |

| Customization scope | Free report customization (equivalent to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global indoor air quality monitor market is estimated to be valued at USD 5.9 billion in 2025.

The market size for the indoor air quality monitor market is projected to reach USD 13.2 billion by 2035.

The indoor air quality monitor market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in indoor air quality monitor market are fixed and portable.

In terms of pollutant type, chemical segment to command 42.8% share in the indoor air quality monitor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Indoor Rotary High Voltage Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Indoor Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Indoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Indoor Location Market Size and Share Forecast Outlook 2025 to 2035

Indoor Space Heater Market Size and Share Forecast Outlook 2025 to 2035

Indoor Farming Market Analysis - Size, Share, and Forecast 2025 to 2035

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

A Detailed Global Analysis of Brand Share for the Indoor Farming Market

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Family/Indoor Entertainment Centres Market Report – Forecast 2017-2027

Cat Condos & Indoor Houses Market Insights - Size & Trends 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA