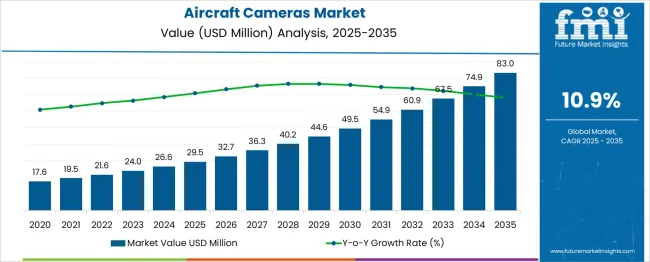

The aircraft cameras market is estimated to be valued at USD 29.5 million in 2025 and is projected to reach USD 83.0 million by 2035, registering a compound annual growth rate (CAGR) of 10.9% over the forecast period. Between 2025 and 2030, the market grows from USD 29.5 billion to USD 49.5 billion. During this early curve, absolute gains rise gradually from USD 3.2 billion to USD 4.9 billion per year.

Growth is steady, supported by expanding requirements for cockpit monitoring, navigation visibility, and onboard surveillance across passenger and cargo fleets. In the 2030 to 2035 phase, the market advances from USD 49.5 billion to USD 83.0 billion. This later curve sees sharper annual increases, reaching USD 8.1 billion in the final year.

Integration of analytics-ready imaging tools and expanding usage in autonomous systems contribute to larger annual additions. Although the multiplying factor remains consistent across both phases at approximately 1.68x, the second half displays faster compounding in value terms. The early curve shows gradual adoption across primary platforms.

The late phase, in contrast, benefits from higher system integration levels and fleet-wide upgrades. The changing curve slope across both intervals confirms long-term structural expansion without distortion or plateauing across either civil or defense aviation segments.

| Metric | Value |

|---|---|

| Aircraft Cameras Market Estimated Value in (2025 E) | USD 29.5 million |

| Aircraft Cameras Market Forecast Value in (2035 F) | USD 83.0 million |

| Forecast CAGR (2025 to 2035) | 10.9% |

The aircraft cameras market draws demand from five distinct parent sectors, each driving different applications and standards. Roughly 30% originates in commercial aviation, where cameras support cockpit monitoring, passenger safety, and external surveillance. Military and defense platforms account for about 25%, deploying ruggedized imaging systems for reconnaissance, navigation, and targeting.

Close to 20% stems from unmanned aerial systems-drones used in mapping, inspection, and surveying-where high-resolution sensors and lightweight design are essential. About 15% of demand is driven by business and private aviation, often integrating cabin cameras and external views for enhanced situational awareness.

Finally, special-mission aircraft-including air ambulances and scientific research platforms-make up approximately 10%, requiring specialized thermal, IR, or high-speed imaging modules. The market is expanding as airlines and defense sectors enhance safety, surveillance, and situational awareness.

Major system providers include FLIR Systems, Teledyne DALSA, Panasonic Avionics, and Leonardo. Key trends include integration of high-definition infrared and visible spectrum sensors for night operations, thermal imaging for obstacle detection, and AI-driven object recognition. Compact multispectral camera modules support unmanned aerial vehicles and cockpit monitoring.

Manufacturers focus on lightweight, rugged designs with high vibration tolerance and compliance with aviation certifications. Demand grows for enhanced vision systems in commercial aviation, rotorcraft, and military platforms. Expansion is supported by regulatory requirements for low visibility operations and adoption of onboard analytics for proactive maintenance.

Increased air traffic, growing fleet sizes, and emphasis on operational safety are prompting aircraft manufacturers and operators to integrate advanced camera systems across various aircraft platforms. Technological advancements in lightweight, high-resolution camera systems that can withstand extreme conditions are enabling their widespread application in both fixed-wing and rotary-wing aircraft.

In addition, the growing need for real-time monitoring of external aircraft environments during ground maneuvers, taxiing, and take-off phases has heightened the demand for intelligent camera systems. Regulatory compliance regarding onboard safety and data logging requirements is also reinforcing the uptake of integrated camera solutions.

With rising investments in next-generation aircraft programs and retrofit upgrades for legacy fleets, the market outlook remains favorable. The ability of modern aircraft cameras to offer software-based enhancements, without hardware modification, is expected to accelerate their deployment across both commercial and defense aviation sectors.

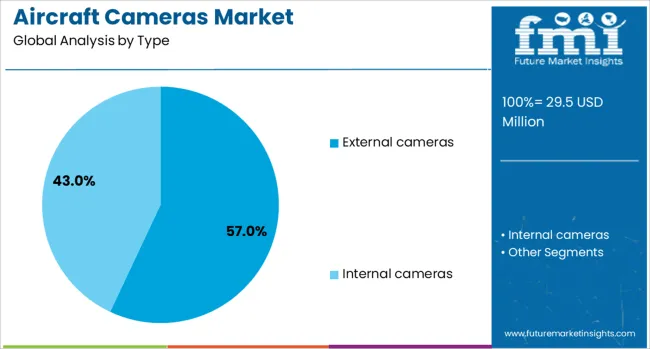

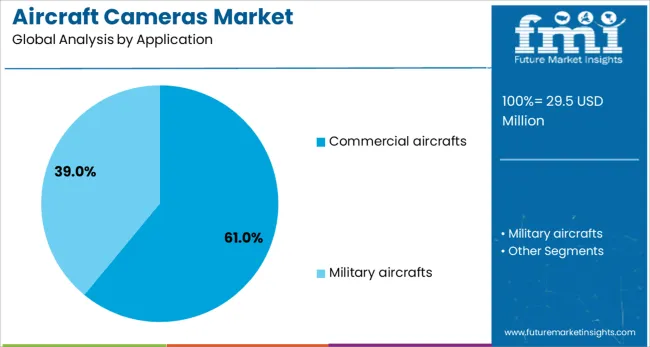

The aircraft cameras market is segmented by type, application, and geographic regions. By type, the aircraft cameras market is divided into External cameras and Internal cameras. In terms of application, the aircraft cameras market is classified into Commercial aircraft and Military aircraft. Regionally, the aircraft cameras industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The external cameras segment is projected to hold 57% of the Aircraft Cameras market revenue share in 2025, making it the leading camera type. This dominance has been driven by increasing emphasis on real-time aircraft environment monitoring during taxiing, take-off, and landing operations. External cameras have been adopted extensively due to their ability to provide situational awareness to pilots and ground control, thereby improving safety and operational efficiency.

The growth of wide-body and next-generation aircraft platforms, which rely heavily on external imaging systems for seamless operations, has significantly contributed to the expansion of this segment. Moreover, improvements in aerodynamic design and miniaturization of cameras have allowed for seamless integration without compromising aircraft performance.

The integration of night vision, thermal imaging, and 360-degree views in external camera systems has also enabled more comprehensive surveillance capabilities. Airlines and manufacturers have continued to invest in camera-based solutions to meet regulatory expectations and enhance passenger safety, thereby solidifying the external cameras segment’s leading position in the market.

The commercial aircrafts segment is expected to account for 61% of the Aircraft Cameras market revenue share in 2025, establishing it as the dominant application segment. This growth has been supported by heightened focus on onboard security, regulatory compliance, and enhanced pilot awareness in commercial aviation. Airlines have increasingly deployed camera systems to monitor both the internal cabin and external environment, particularly during gate operations, pushback, and in-flight monitoring.

The rising number of global air passengers and aircraft deliveries has fueled consistent investment in advanced surveillance and imaging systems. In-flight entertainment systems have also begun to integrate live external camera feeds as part of the passenger experience, which has further elevated the demand for such technologies.

As newer aircraft models are being equipped with factory-installed camera infrastructure, retrofit demand has also risen across older fleets to match evolving safety standards. These factors, combined with increasing operational complexity and airspace density, have positioned the commercial aircraft segment as the primary driver of market revenue in the forecast period.

In 2024, over 42% of newly produced medium-altitude surveillance aircraft were delivered with integrated high-resolution imaging systems. The use of cockpit situational awareness contributed another 28% of installations, especially where forward-looking and infrared camera combinations were specified. UAV platforms accounted for approximately 35% of volume growth across reconnaissance and mapping drones. Growth was strongest in Asia Pacific and Western Europe, where defense modernization and commercial drone inspection services drove procurement. Onboard video capture for hull inspection and landing zone monitoring has supported market expansion.

Camera deployment has been driven by increasing reliance on visual surveillance for safety and operational monitoring. In airplane fleets and inspection drones, nearly 46% of operators specified thermal, infrared, or multispectral cameras to support night vision and obstacle detection. In-field use cases such as hull and landing gear inspections now utilize forward‑looking cameras in 38% of maintenance cycles to reduce manual checks. Real-time cockpit video links are included in 21% of situational awareness upgrades for enhanced situational data. Urban air mobility prototypes and eVTOL testbeds adopted vision systems in over 29% of their flight development programs. These systems are enabling greater automation, hazard detection, and mission data logging in modern aircraft.

Despite widespread utility, aircraft camera adoption faces regulatory and certification challenges. Aviation authorities require stringent qualification protocols, including vibration resistance, EMI shielding, and aviation-grade firmware compliance, which delay approval processes in approximately 22% of new installations. Certification costs are nearly 24% higher for cameras intended for civil aviation use compared to general industrial equivalents. Weight and cabin space limitations constrain camera selection; approximately 15 % of retrofit projects have opted for lower-resolution modules to ensure weight budgets are maintained. Firmware updates and requalifications add complexity. Interlock testing requirements extend maintenance or replacement cycles. These constraints slow adoption among regional carriers and general aviation segments.

Rapid adoption is being observed in UAVs and drone services for agriculture, infrastructure, and emergency response applications. Approximately 38% of new mapping and inspection drone systems now integrate stabilized multi-camera arrays. Integration of edge processing modules allows AI-based anomaly detection in 28% of camera-equipped drone fleets used for pipeline and powerline monitoring. Service providers now offer post-flight analytics packages based on high-resolution imagery, making predictive maintenance viable. Hybrid camera platforms combining RGB, LiDAR, and thermal sensors are gaining share. Aircraft manufacturers are bundling camera systems with telemetry and data-link capabilities for turnkey inspection solutions. Integration of vision modules is enabling scalable operations for industrial surveillance applications.

Trends show rapid miniaturization of high-resolution camera modules for compact aircraft systems; modules under 300 g now account for 33% of new aviation payloads. Smart streaming integration supporting live HD video and low-latency feed is included in 27% of cockpit display systems. Edge-based analytics, such as object tracking and obstruction warning, are being embedded in 24% of newer camera packages. Inner‑plane inspection cameras are being controlled through central avionics networks in 21% of retrofit configurations. The remote firmware upgrade capability and encrypted telemetry are becoming standard in 19% of premium camera offerings, improving system security and compliance with aviation protocols.

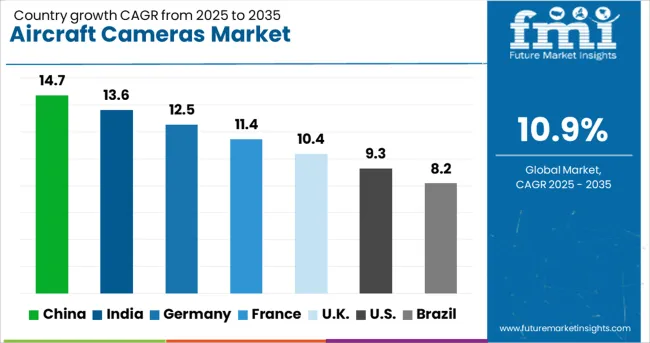

| Country | CAGR |

|---|---|

| China | 14.7% |

| India | 13.6% |

| Germany | 12.5% |

| France | 11.4% |

| UK | 10.4% |

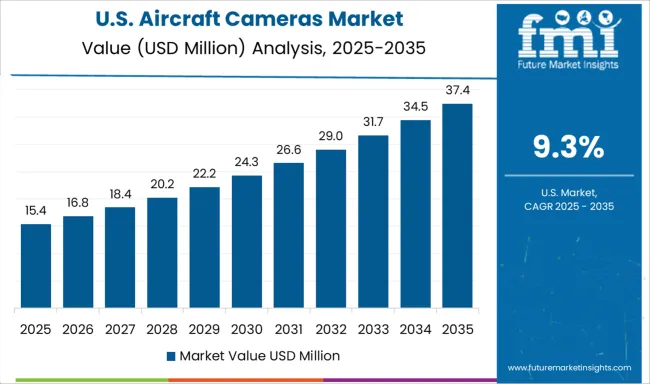

| USA | 9.3% |

| Brazil | 8.2% |

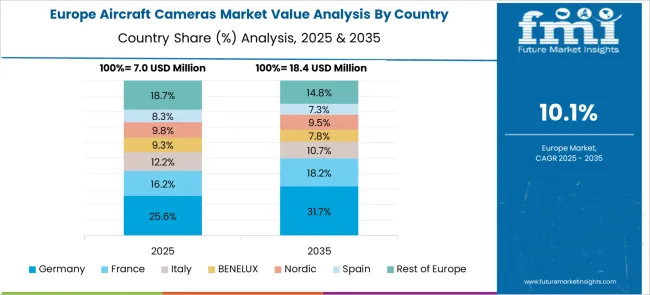

The aircraft cameras market is expanding with a global CAGR of 10.9% between 2025 and 2035. China has outpaced the global average with a CAGR of 14.7%, indicating strong defense and commercial aerospace integration. India follows at 13.6%, driven by fleet modernization and increasing indigenous manufacturing.

Germany is advancing at 12.5%, propelled by retrofitting programs and aviation-grade optical component innovation. In the UK, the CAGR stands at 10.4%, nearly matching the global average due to growth in UAV surveillance applications. The USA trails slightly behind at 9.3%, impacted by market saturation yet stable demand in security and civil aviation. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China is projected to record a CAGR of 14.7% between 2025 and 2035 in the aircraft cameras market. Expansion of the domestic commercial aviation fleet has increased the demand for onboard monitoring systems. Flight data acquisition units are being integrated with wide-angle surveillance cameras to support regulatory traceability.

Twin-lens configurations are now deployed in narrow-body aircraft for real-time pilot assistance and enhanced visibility. Military orders for multi-spectral vision systems have surged due to border patrolling upgrades. System integrators in China are emphasizing AI-enabled thermal cameras for reconnaissance drones and UAVs used in aerial inspections. Domestic OEMs are focused on increasing local production of cockpit image recorders to reduce reliance on imported avionics. Installations in next-gen aircraft platforms are expected to support dual-video analytics feeds.

India is forecasted to expand at a CAGR of 13.6% in the aircraft cameras market from 2025 to 2035. Regional jet operators are deploying wingtip and vertical stabilizer-mounted cameras to enhance landing operations on short airstrips. Civil aviation modernization initiatives have mandated the use of visual monitoring devices within new aircraft procurement contracts.

Domestic avionics firms are increasingly focused on producing high-resolution flight deck cameras with data encryption features. Surveillance camera adoption has risen within border security aircraft, driven by growing aerial reconnaissance operations. Demand for forward-looking infrared (FLIR) and night vision cameras has also increased within paramilitary fixed-wing fleets. Retrofit activity in legacy aircraft is being incentivized by safety directives aimed at improving pilot situational awareness in low-visibility zones.

Germany is projected to grow at a CAGR of 12.5% through 2035 in the aircraft cameras space. Aerospace OEMs are focusing on 360-degree panoramic vision systems for flight test instrumentation. Cabin surveillance upgrades are gaining traction within European short-haul carriers to improve passenger behavior tracking and emergency response. Research aircraft are deploying high-speed recording cameras for structural integrity tests during experimental flight phases.

Infrared-enhanced cameras are being used in unmanned systems for all-weather navigation. In commercial aviation, cockpit recording technologies with automatic failure detection overlays are being standardized. Manufacturers are embedding vibration-absorbing mounts to reduce distortion and enhance visual precision. Integration with flight data monitoring dashboards is being prioritized by fleet operators across regional and charter services.

The United Kingdom is expected to register a CAGR of 10.4% in the aircraft cameras market from 2025 to 2035. Flight training institutions are increasingly equipping cockpits with recording systems to improve pilot debriefing accuracy. Light aircraft manufacturers are integrating mid-range external surveillance cameras to support taxiing and runway alignment. Royal Air Force modernization programs have created strong demand for dual-sensor targeting pods and EO/IR camera systems.

Commercial airlines are investing in onboard surveillance setups optimized for passenger incident documentation and compliance. Remotely piloted aircraft used in maritime operations are being fitted with gyro-stabilized zoom cameras for coastal monitoring. Integration with digital flight recorders has improved post-flight analytics across several training and military airframes.

The United States is projected to grow at a CAGR of 9.3% in the aircraft cameras market from 2025 to 2035. Commercial airliners are integrating forward and downward-facing cameras to support autonomous taxi operations. The defense sector is deploying ultra-low-light cameras in reconnaissance UAVs for high-altitude surveillance. Airlines are standardizing wide-field cabin cameras to enhance security and document safety incidents.

Private jet manufacturers are embedding custom video capture systems for premium passenger experience and flight performance analytics. Regulatory recommendations have increased cockpit video logging across general aviation fleets. Military helicopters are being equipped with high-dynamic-range (HDR) camera modules for night maneuvers. Image processing enhancements are being co-developed with avionics software firms to boost system interoperability.

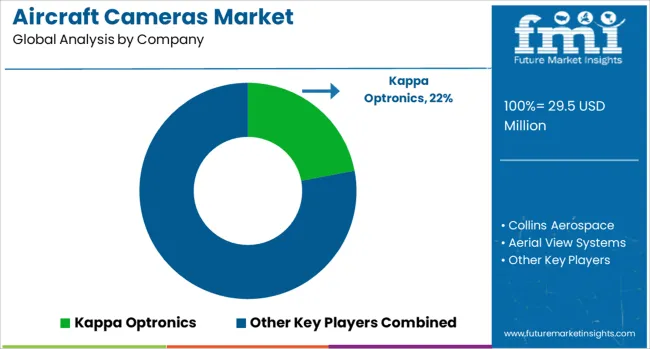

The aircraft cameras market involves specialized imaging systems installed for navigation, surveillance, cabin monitoring, and situational awareness. Kappa Optronics supplies high-resolution external and cockpit cameras optimized for civil and military applications, offering lightweight, compact designs with resistance to temperature shifts and vibrations.

Collins Aerospace provides integrated vision and cabin surveillance solutions for commercial jets and business aircraft, including cockpit door monitoring and external taxi cameras. Aerial View Systems develops ultra-wide-angle optical systems that assist pilots during takeoff, taxiing, and landing, especially for wide-body and VIP-configured aircraft with limited visibility zones.

AD Aerospace specializes in certified aircraft video surveillance systems for real-time monitoring and in-flight security. Their systems are installed on both narrow- and wide-body platforms and include crash-protected video storage. Imperx supplies ruggedized cameras for exterior monitoring and in-flight inspection, offering digital interfaces compatible with mission-critical avionics systems.

Competitive differentiation in this market stems from compliance with aviation standards, data encryption, onboard integration, and minimal latency for live viewing. Use cases now extend beyond security into passenger comfort and ground operations, with expanding interest in lightweight, low-power units for next-generation electric and hybrid aircraft.

Collins Aerospace and Meggitt expanded avionics-compatible surveillance for external and cabin views. AD Aerospace secured contracts for cockpit and cargo monitoring across commercial fleets.

Rosen Aviation and Kappa Optronics introduced lightweight, high-resolution solutions tailored for business jets and military platforms. Retrofit demand rose in Asia-Pacific and Europe as safety mandates tightened. Defense and unmanned segments favored multi-spectral, modular payloads for mission-critical visibility.

| Item | Value |

|---|---|

| Quantitative Units | USD 29.5 Million |

| Type | External cameras and Internal cameras |

| Application | Commercial aircrafts and Military aircrafts |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kappa Optronics, Collins Aerospace, Aerial View Systems, AD Aerospace, and Imperx |

| Additional Attributes | Dollar sales by camera type (EO/IR, multispectral, hyperspectral) and application (surveillance, navigation, inspection), demand across defense, aerospace, and industrial UAVs, led by Asia‑Pacific with North America catching up, innovation in high-resolution multi‑sensor fusion, lightweight compact modules. |

The global aircraft cameras market is estimated to be valued at USD 29.5 million in 2025.

The market size for the aircraft cameras market is projected to reach USD 83.0 million by 2035.

The aircraft cameras market is expected to grow at a 10.9% CAGR between 2025 and 2035.

The key product types in aircraft cameras market are external cameras and internal cameras.

In terms of application, commercial aircrafts segment to command 61.0% share in the aircraft cameras market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA