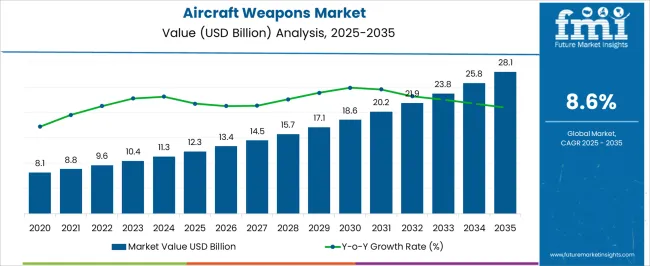

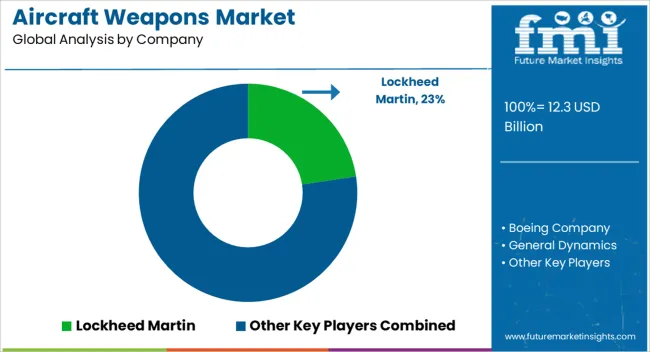

The aircraft weapons market is valued at USD 12.3 billion in 2025 and is expected to reach USD 28.1 billion by 2035, with a CAGR of 8.6%. The market is expected to exhibit a steady and continuous rise over the forecast period, with no significant downturns anticipated. From 2021 to 2025, it grows from USD 8.1 billion to USD 12.3 billion, progressing through USD 8.8 billion, USD 9.6 billion, USD 10.4 billion, and USD 11.3 billion. This early growth phase is driven by military fleet modernization and the integration of advanced weapon systems. Between 2026 and 2030, the market is projected to accelerate from USD 12.3 billion to USD 17.1 billion, with incremental growth to USD 13.4 billion, USD 14.5 billion, USD 15.7 billion, and USD 17.1 billion.

This phase reflects strong demand for advanced aircraft weaponry, including precision-guided munitions and smart bombs, driven by increasing defense budgets globally. From 2031 to 2035, the market is expected to expand further, reaching USD 28.1 billion, with intermediate values of USD 18.6 billion, USD 20.2 billion, USD 21.9 billion, and USD 23.8 billion. This period marks sustained growth, driven by the continued development of new defense technologies and the growing demand for military enhancements worldwide. The market’s trajectory shows consistent growth with no significant dips, indicating a positive outlook for the aircraft weapons sector.

| Metric | Value |

|---|---|

| Aircraft Weapons Market Estimated Value in (2025 E) | USD 12.3 billion |

| Aircraft Weapons Market Forecast Value in (2035 F) | USD 28.1 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

The defense and military market is the largest contributor, accounting for approximately 50-55% of the market. Aircraft weapons are primarily developed for military applications, including fighter jets, bombers, and surveillance aircraft, providing capabilities for air-to-air and air-to-ground combat. The aerospace and defense manufacturing market contributes around 20-25%, as the development and production of aircraft weapons are closely tied to the manufacturing of advanced military aircraft, with constant advancements in weapon systems to enhance the effectiveness and precision of air-based combat.

The security and defense technology market holds about 15-18%, driven by innovations in guided missiles, smart bombs, and precision strike capabilities, where technology plays a significant role in enhancing the accuracy and targeting efficiency of aircraft weapons. The military simulation and training market is expected to grow by approximately 5-8%, as aircraft weapon systems are often incorporated into simulation programs and training exercises to prepare military personnel for combat scenarios, thereby improving operational readiness. The global defense expenditure market contributes around 5-8%, as defense budgets, particularly in countries with significant military spending, influence the procurement and upgrading of aircraft and weapon systems.

The aircraft weapons market is expanding steadily, supported by heightened defense modernization programs and sustained investments in aerial combat capabilities by both developed and emerging economies. The current landscape is characterized by increased demand for precision, range flexibility, and multi-role adaptability in weapon systems, enabling air forces to address a broad spectrum of strategic and tactical requirements. Growth is further influenced by the integration of advanced guidance systems, modular designs, and improved interoperability with next-generation aircraft platforms.

Geopolitical tensions and evolving warfare doctrines have amplified procurement initiatives, ensuring continuous replenishment and technological upgrades in national arsenals. Furthermore, the market benefits from the shift toward network-centric warfare, where intelligence-driven targeting and minimized collateral damage are prioritized.

With ongoing innovations in propulsion technologies, stealth integration, and enhanced payload efficiency, the sector is positioned for sustained expansion. Over the forecast period, the market is expected to maintain strong momentum as air forces seek to enhance mission versatility, operational reach, and strike precision through advanced aircraft weapon solutions.

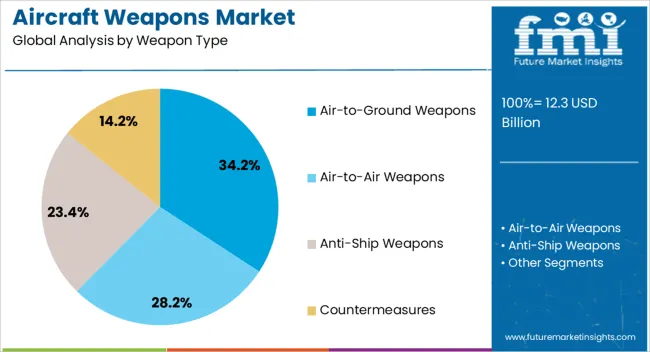

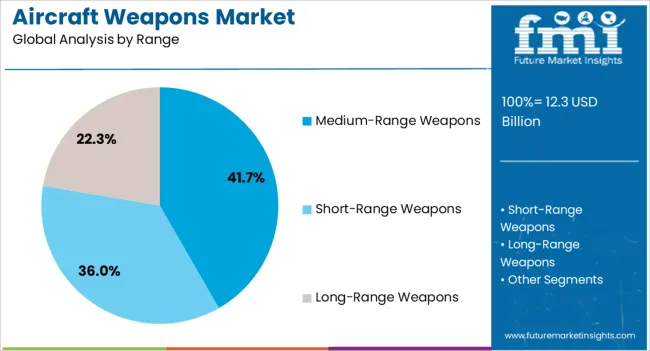

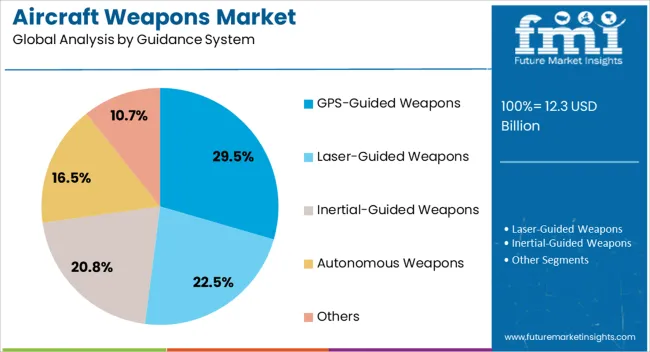

The aircraft weapons market is segmented by weapon type, range, guidance system, end use, and geographic regions. By weapon type, aircraft weapons market is divided into Air-to-Ground Weapons, Air-to-Air Weapons, Anti-Ship Weapons, and Countermeasures. In terms of range, aircraft weapons market is classified into Medium-Range Weapons, Short-Range Weapons, and Long-Range Weapons. Based on guidance system, aircraft weapons market is segmented into GPS-Guided Weapons, Laser-Guided Weapons, Inertial-Guided Weapons, Autonomous Weapons, and Others. By end use, aircraft weapons market is segmented into Military, Army, Navy, Civilian, Law Enforcement, and Security Agencies. Regionally, the aircraft weapons industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The air-to-ground weapons segment holds the largest share within the weapon type category, accounting for approximately 34.2% of the market. This dominance is attributed to the segment’s critical role in modern aerial operations, where precision strike capabilities against surface targets are essential. Air-to-ground systems have been widely adopted due to their operational flexibility, enabling engagement across both strategic and tactical missions.

The segment's growth is further driven by advancements in seeker technologies, warhead effectiveness, and compatibility with a variety of aircraft platforms. Increased deployment in counterinsurgency operations and suppression of enemy air defenses has reinforced their demand. Additionally, the ability to conduct standoff attacks from safe distances without compromising aircraft survivability enhances operational effectiveness.

Ongoing integration with advanced targeting pods and networked command systems ensures the segment’s continued relevance. Given these factors, the air-to-ground weapons segment is expected to sustain its leadership position in the forecast period, underpinned by consistent defense procurement and capability upgrades.

Medium-range weapons account for approximately 41.7% of the range category share, reflecting their strategic balance between engagement flexibility and platform compatibility. This range class has been favored for providing effective strike capabilities without necessitating close proximity to hostile environments, thereby enhancing aircraft survivability. The segment benefits from continuous enhancements in propulsion efficiency, aerodynamic designs, and fuel optimization, which collectively improve operational reach and precision.

Medium-range systems have been extensively integrated into multi-role fighter aircraft and unmanned aerial platforms, supporting diverse mission profiles from interdiction to close air support. Their versatility across various theaters of operation, including maritime and urban warfare environments, further strengthens their adoption.

Additionally, advancements in modular warhead configurations and guidance options have expanded their tactical utility. Supported by ongoing military modernization programs and demand for balanced cost-performance solutions, medium-range weapons are anticipated to maintain a leading position in the coming years.

GPS-guided weapons represent approximately 29.5% of the guidance system category, driven by their unparalleled accuracy and adaptability in diverse operational scenarios. This segment’s strength lies in its ability to deliver precision strikes under varying weather conditions and in GPS-denied environments when integrated with complementary navigation aids. Widespread adoption is attributed to reduced collateral damage, enhanced mission success rates, and cost-effectiveness compared to fully autonomous seekers.

Military forces worldwide have prioritized GPS-guided munitions for both strategic deterrence and tactical engagement, benefiting from seamless integration with modern avionics and targeting infrastructure. The segment is further supported by advancements in anti-jamming technologies, encrypted signal usage, and multi-constellation compatibility, which collectively improve reliability in contested environments.

With defense strategies increasingly emphasizing precision engagement and resource efficiency, GPS-guided weapons are expected to retain significant relevance. Ongoing upgrades in satellite navigation systems and integration with next-generation aircraft platforms are poised to strengthen this segment’s market presence over the forecast period.

The aircraft weapons market is expanding rapidly as defense and military sectors around the world invest in advanced technologies to enhance combat capabilities. Demand is driven by increasing defense budgets, modernization programs, and the growing need for precision-guided munitions (PGMs) and air-to-ground, air-to-air missile systems. Challenges in the market include stringent regulatory requirements, high development and procurement costs, and the need for ongoing technological innovation to maintain combat superiority. Opportunities lie in the development of more efficient and precise weapons systems, particularly in the areas of unmanned aerial vehicle (UAV) integration, hypersonic weapons, and advanced radar systems. Trends also indicate a growing focus on multi-role, adaptable weapon platforms capable of addressing diverse threats in complex combat scenarios.

The aircraft weapons market is being driven by the increasing demand for precision-guided munitions (PGMs) and advanced missile systems capable of delivering greater accuracy and minimizing collateral damage. Modern air forces are increasingly adopting PGMs to enhance strike capabilities and ensure precision in highly complex combat environments. Additionally, the growing use of air-to-ground, air-to-air, and air-to-sea missile systems is spurring the demand for more advanced and versatile weapons. As geopolitical tensions rise and defense budgets increase, nations are investing in aircraft weapons to strengthen their military forces and maintain combat readiness. This growing reliance on precision-guided and versatile munitions is expected to continue driving market growth.

The aircraft weapons market faces several challenges, primarily the high costs associated with research and development, procurement, and maintenance of advanced weapons systems. The development of cutting-edge munitions requires significant investment in technology, testing, and validation. Regulatory complexities, especially related to international arms treaties, export controls, and military standards, can delay procurement and increase compliance costs. Technical challenges related to the integration of aircraft weapons with advanced avionics, targeting systems, and radar require ongoing innovation and expertise. Manufacturers must address these constraints while maintaining the performance and cost-effectiveness of the weapons systems. Suppliers that can overcome these challenges and offer high-performance, compliant, and cost-effective solutions will be well-positioned in the market.

Opportunities in the aircraft weapons market lie in the integration of unmanned aerial vehicles (UAVs) and hypersonic weapons, as well as the development of multi-role, adaptable weapon platforms. UAVs, particularly those designed for precision strikes and surveillance, are increasingly being integrated with advanced weapon systems, enabling more flexible and cost-effective operations. Hypersonic weapons, which can travel at speeds greater than Mach 5, are gaining traction due to their ability to penetrate modern air defense systems, providing a new level of deterrence. The demand for multi-role, versatile weapon systems that can be adapted to different mission types—such as counter-terrorism, air superiority, and anti-shipping operations is expected to grow. Companies developing these next-generation weapon systems are well-positioned to capitalize on this demand.

The aircraft weapons market is witnessing trends towards multi-role platforms and the integration of artificial intelligence (AI) for enhanced targeting and decision-making. Modern military aircraft are increasingly being designed to carry out multiple missions, with the ability to switch between air-to-air, air-to-ground, and air-to-sea operations depending on the mission’s requirements. The integration of AI into aircraft weapons systems is improving targeting accuracy, optimizing weapon selection, and enabling real-time tactical decision-making in complex combat scenarios. Modular weapon systems that can be easily adapted to different aircraft types and mission profiles are gaining popularity, offering enhanced flexibility and cost-effectiveness. These trends are driving innovation and efficiency in the aircraft weapons market.

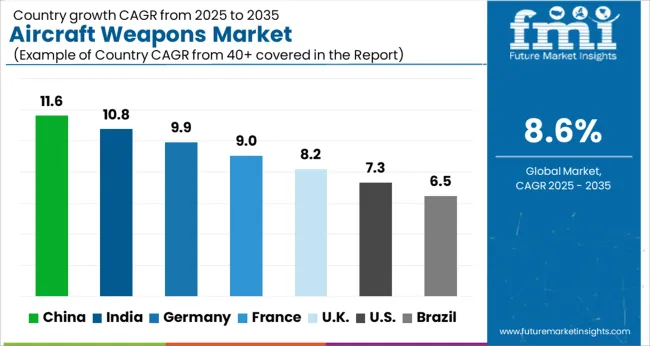

| Country | CAGR |

|---|---|

| China | 11.6% |

| India | 10.8% |

| Germany | 9.9% |

| France | 9.0% |

| UK | 8.2% |

| USA | 7.3% |

| Brazil | 6.5% |

Global Food Dietary Fibers Market is projected to grow at a CAGR of 9.5% from 2025 to 2035. China leads with a CAGR of 12.8%, followed by India at 11.9%. France shows a growth rate of 10.0%, while the UK and the USA are growing at 9.0% and 8.1%, respectively. The strong growth in China and India can be attributed to the increasing awareness of dietary fibers' health benefits, particularly in managing weight and improving digestive health. France is witnessing growing demand in both the food and pharmaceutical sectors, while the UK and the USA show steady growth due to increasing consumption of fiber-rich foods and supplements as part of a healthy lifestyle. The analysis spans over 40+ countries, with the leading markets shown below.

The aircraft weapons market is projected to grow at a CAGR of 11.6% from 2025 to 2035, driven by the country’s growing focus on modernizing its military capabilities and expanding its defense industry. As one of the leading military powers globally, China is increasing its investment in advanced aircraft weapons, including precision-guided munitions, air-to-air and air-to-ground missiles, and electronic warfare systems. The Chinese government has been heavily investing in the research and development of indigenous weapons systems, aiming to reduce reliance on foreign suppliers. China’s increasing military budget and the strategic importance of strengthening its air force for regional dominance are propelling market growth. China continues to advance its aerospace technologies, demand for high-performance weapons systems is on the rise. The market is also supported by China's participation in global defense trade, with aircraft weapons being a significant part of its defense exports.

The aircraft weapons market in India is expected to grow at a CAGR of 10.8% from 2025 to 2035, fueled by the country’s ongoing efforts to modernize its defense infrastructure and strengthen its air combat capabilities. India has been actively upgrading its air force, acquiring state-of-the-art aircraft, and integrating advanced weapons systems to meet both national and regional security challenges. The market for aircraft weapons in India is primarily driven by increasing demand for precision-guided munitions, air-to-air missiles, and surveillance systems. India’s defense modernization plans, including the induction of newer fighter jets like the Rafale, along with rising defense budgets, are expected to further enhance market growth. India’s growing collaboration with global defense manufacturers and its emphasis on indigenous defense production are also boosting the demand for aircraft weapons.

The aircraft weapons marketin France is projected to grow at a CAGR of 9.0% from 2025 to 2035, supported by the country's strong aerospace and defense sector. France is one of Europe’s leading defense powers, and its air force is equipped with state-of-the-art fighter jets and advanced weapons systems. The country’s participation in international defense alliances, such as NATO, and its commitment to maintaining a strategic defense posture is driving the demand for advanced aircraft weapons, including precision-guided munitions and air-to-ground missiles. France’s ongoing investment in the development of next-generation fighter jets and air combat systems, such as the Future Combat Air System (FCAS), is expected to further accelerate the market. France’s significant presence in global defense exports also contributes to the demand for advanced aircraft weapons.

The UK aircraft weapons market is expected to grow at a CAGR of 8.2% from 2025 to 2035, fueled by continued investment in advanced military technologies and the modernization of its air force. The UK has been enhancing its air combat capabilities by integrating cutting-edge aircraft weapons systems, including air-to-air and air-to-ground missiles, advanced targeting systems, and electronic warfare equipment. The country’s participation in international defense programs, such as the Eurofighter Typhoon and F-35, and its growing commitment to defense spending are key factors contributing to the market’s growth. Furthermore, the UK’s military doctrine, which emphasizes rapid response and strategic air superiority, is increasing the need for advanced aircraft weapons systems.

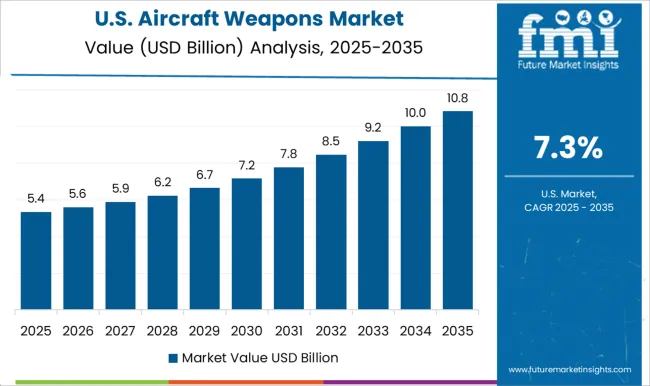

The USA aircraft weapons market is expected to grow at a CAGR of 7.3% from 2025 to 2035, driven by the ongoing modernization of the USA military and the country’s focus on maintaining technological superiority in air combat. As a global leader in defense technologies, the USA military continues to invest heavily in the development and procurement of advanced aircraft weapons, including next-generation fighter jets, smart munitions, and air defense systems. The USA defense budget, along with its commitment to air dominance in both conventional and asymmetrical warfare, fuels demand for cutting-edge weapons systems. The growing demand for weapons to support both strategic and tactical air operations is expected to drive further market growth. The USA also plays a significant role in global defense exports, providing advanced aircraft weapons to allied nations.

In the aircraft weapons market, competition is defined by cutting-edge technology, precision, and integration with defense systems. Lockheed Martin stands out as a market leader, offering a wide array of advanced weaponry systems for both military and defense aircraft. The company is known for developing air-to-air and air-to-ground missile systems, along with smart weapons, such as the Joint Strike Missile, integrating them into platforms like the F-35 fighter jet. Boeing Company competes by offering precision-guided munitions, missile systems, and direct energy weapons, alongside its expertise in airframe design. Boeing focuses on improving weapon payload delivery and survivability for tactical and strategic aircraft.

General Dynamics competes with a portfolio that includes advanced missile defense systems, guided artillery shells, and air-to-surface missiles. Their focus is on high-precision, multi-role weapons that can be integrated into existing and future aircraft platforms. MBDA, a European leader, specializes in missile systems for aircraft, particularly in the design of air-to-air and air-to-ground missiles. The company’s solutions are known for their versatility, with integration into various military aircraft like the Eurofighter Typhoon and Rafale. Northrop Grumman provides advanced integrated weapon systems, including precision-guided munitions and tactical missiles.

Northrop Grumman focuses on systems that enhance the lethality and survivability of military aircraft. SAAB competes by offering modular weapon systems for fighters like the Gripen, integrating air-to-air and air-to-ground weapons with advanced targeting and tracking capabilities. Thales Group specializes in advanced weapon electronics, radar systems, and targeting pods, helping improve weapon accuracy, survivability, and integration with modern combat aircraft. Strategies in this market emphasize innovation in smart weapons, multi-role capabilities, and modular design, allowing weapons systems to be easily adapted to various aircraft platforms. Product brochures highlight precision-guided munitions, advanced targeting systems, enhanced payload capacity, and integrated electronic warfare solutions, emphasizing the need for speed, accuracy, and flexibility in modern air combat.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.3 Billion |

| Weapon Type | Air-to-Ground Weapons, Air-to-Air Weapons, Anti-Ship Weapons, and Countermeasures |

| Range | Medium-Range Weapons, Short-Range Weapons, and Long-Range Weapons |

| Guidance System | GPS-Guided Weapons, Laser-Guided Weapons, Inertial-Guided Weapons, Autonomous Weapons, and Others |

| End Use | Military, Army, Navy, Civilian, Law Enforcement, and Security Agencies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin, Boeing Company, General Dynamics, MDBA, Northrop Grumman, SAAB, and Thales Group |

| Additional Attributes | Dollar sales by weapon type (missiles, bombs, precision-guided munitions, electronic warfare), aircraft type (fighter jets, bombers, drones), and application (offensive, defensive, surveillance). Demand dynamics are driven by increased defense spending, the development of next-generation aircraft, and the rising need for precision strike capabilities in modern warfare. Regional growth is strong in North America, Europe, and Asia-Pacific, with ongoing investments in military modernization, advanced defense systems, and strategic airpower capabilities. |

The global aircraft weapons market is estimated to be valued at USD 12.3 billion in 2025.

The market size for the aircraft weapons market is projected to reach USD 28.1 billion by 2035.

The aircraft weapons market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in aircraft weapons market are air-to-ground weapons, air-to-air weapons, anti-ship weapons and countermeasures.

In terms of range, medium-range weapons segment to command 41.7% share in the aircraft weapons market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Micro Turbine Engines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA