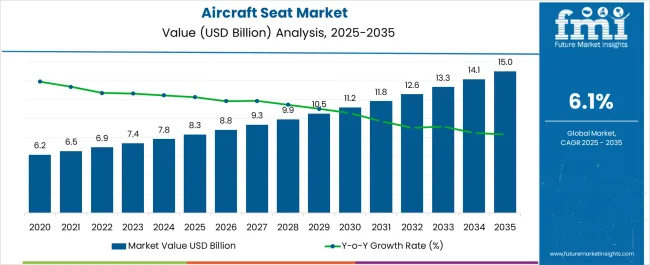

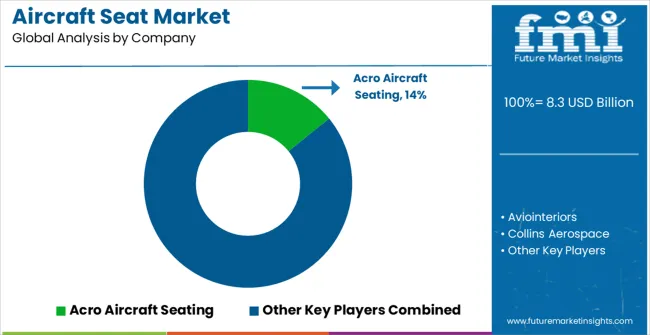

The Aircraft Seat Market is estimated to be valued at USD 8.3 billion in 2025 and is projected to reach USD 15.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Aircraft Seat Market Estimated Value in (2025 E) | USD 8.3 billion |

| Aircraft Seat Market Forecast Value in (2035 F) | USD 15.0 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The Aircraft Seat market is experiencing significant growth, driven by the increasing demand for air travel, fleet expansion, and cabin modernization initiatives across commercial and private airlines. Airlines are focusing on enhancing passenger comfort, safety, and operational efficiency, which is leading to increased adoption of advanced seating solutions. Technological advancements, including lightweight materials, ergonomic design, and modular seat configurations, are enabling airlines to optimize cabin layouts and fuel efficiency.

Rising investment in narrow-body and wide-body aircraft, coupled with the growing focus on premium services, is further shaping market demand. The integration of smart features, such as in-seat power, entertainment systems, and adjustable ergonomics, is enhancing passenger experience and creating differentiation for airline operators.

Regulatory emphasis on safety, fire resistance, and crashworthiness is driving the adoption of certified seating solutions As airline networks expand and passenger expectations evolve, the market is expected to sustain long-term growth, supported by innovation in materials, comfort, and customization options.

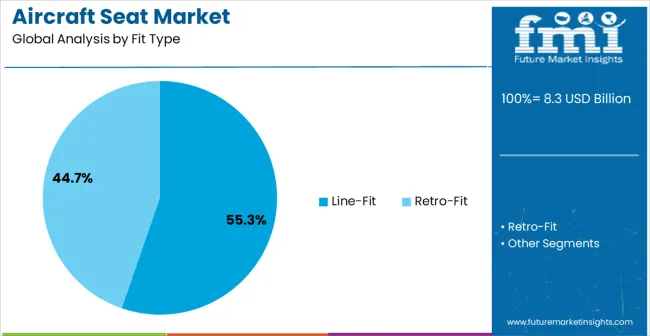

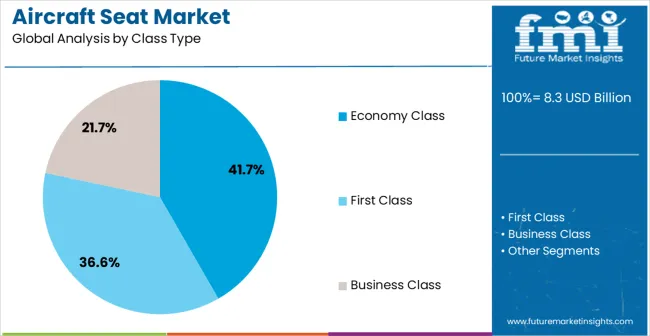

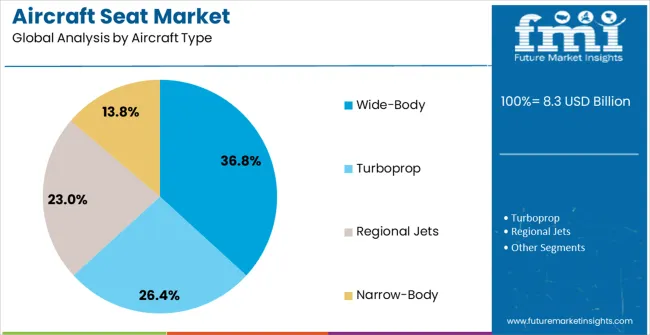

The aircraft seat market is segmented by fit type, class type, aircraft type, and geographic regions. By fit type, aircraft seat market is divided into Line-Fit and Retro-Fit. In terms of class type, aircraft seat market is classified into Economy Class, First Class, and Business Class. Based on aircraft type, aircraft seat market is segmented into Wide-Body, Turboprop, Regional Jets, and Narrow-Body. Regionally, the aircraft seat industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The line-fit fit type segment is projected to hold 55.3% of the market revenue in 2025, establishing it as the leading fit type. Its dominance is driven by airlines’ preference for factory-installed seating solutions that ensure consistency, safety compliance, and integration with aircraft design standards. Line-fit seats provide seamless installation during aircraft manufacturing, reducing retrofitting costs and minimizing operational disruptions.

Advanced materials and modular designs enable ergonomic comfort, weight optimization, and compliance with regulatory requirements. The ability to integrate in-flight entertainment systems, power outlets, and other passenger-centric features enhances adoption in new aircraft fleets.

Airlines benefit from reduced maintenance costs and improved operational efficiency, which reinforces preference for line-fit seating As aircraft manufacturers focus on modernizing fleets and meeting stringent safety and comfort regulations, the line-fit segment is expected to maintain its leadership, supported by the reliability, scalability, and customization capabilities offered by factory-installed seating solutions.

The economy class segment is anticipated to account for 41.7% of the market revenue in 2025, making it the leading class type. Its growth is driven by the increasing number of passengers traveling on budget and short-to-medium-haul flights, which has created strong demand for high-density, cost-effective seating solutions. Economy class seats are designed to maximize space utilization while ensuring compliance with safety regulations, fire resistance, and ergonomic requirements.

Lightweight and modular designs allow airlines to adjust cabin configurations efficiently, enhancing operational flexibility. Integration of features such as adjustable headrests, personal entertainment systems, and charging ports has improved passenger experience without significantly increasing costs.

Airlines increasingly prioritize comfort, durability, and efficiency to maintain customer satisfaction and reduce fuel consumption, which reinforces adoption in this segment As global air travel continues to grow, economy class seating is expected to remain the dominant revenue contributor, supported by rising passenger volumes, fleet expansions, and airline focus on cost-efficient cabin management.

The wide-body aircraft type segment is projected to hold 36.8% of the market revenue in 2025, establishing it as the leading aircraft type. Growth is being driven by the increasing demand for long-haul flights and higher passenger capacities, which require spacious seating configurations to enhance comfort and operational efficiency. Wide-body aircraft allow for multiple class arrangements, enabling airlines to optimize cabin layouts for premium and economy seating.

Advanced seat designs with modularity, lightweight materials, and integrated passenger amenities improve flight experience while maintaining fuel efficiency. Airlines benefit from reduced operational costs per seat due to high-density seating options and optimized cabin utilization.

Growing investments in fleet modernization, along with increasing passenger preference for long-haul travel, are further supporting adoption of wide-body aircraft seating As global aviation networks expand and airline operators prioritize both comfort and efficiency, the wide-body segment is expected to maintain its leading share, driven by technological innovation and evolving passenger expectations.

The global aviation industry has been witnessing high competition, thereby influencing airlines in expanding airplane seats with high-quality comfort. Efforts are taken to offer premium airplane seats with extended space and entertainment systems. Manufacturers are pumping in heavy investments in R&D of the energy absorbing technology aircraft seat. One of the major challenges faced by the aviation industry for introducing design innovations is restrictive cost fuelled by certification and safety requirements.

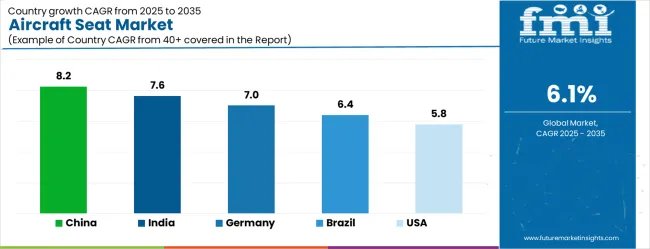

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| Brazil | 6.4% |

| USA | 5.8% |

| UK | 5.2% |

| Japan | 4.6% |

The Aircraft Seat Market is expected to register a CAGR of 6.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.2%, followed by India at 7.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.6%, yet still underscores a broadly positive trajectory for the global Aircraft Seat Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.0%. The USA Aircraft Seat Market is estimated to be valued at USD 3.1 billion in 2025 and is anticipated to reach a valuation of USD 3.1 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 404.5 million and USD 229.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.3 Billion |

| Fit Type | Line-Fit and Retro-Fit |

| Class Type | Economy Class, First Class, and Business Class |

| Aircraft Type | Wide-Body, Turboprop, Regional Jets, and Narrow-Body |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Acro Aircraft Seating, Aviointeriors, Collins Aerospace, Elevate Aircraft Seating, Expliseat, Geven, Hong Kong Aircraft Engineering Company, Ipeco Holdings, Jamco Corporation, LifePort, Martin-Baker Aircraft, Mirus Aircraft Seating, and Recaro Aircraft Seating |

The global aircraft seat market is estimated to be valued at USD 8.3 billion in 2025.

The market size for the aircraft seat market is projected to reach USD 15.0 billion by 2035.

The aircraft seat market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in aircraft seat market are line-fit and retro-fit.

In terms of class type, economy class segment to command 41.7% share in the aircraft seat market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Seat Actuation Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seating Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Frames Market

Seatbelt Polyester Yarn Market Size and Share Forecast Outlook 2025 to 2035

Seat Control Module (SCM) Market Forecast and Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA