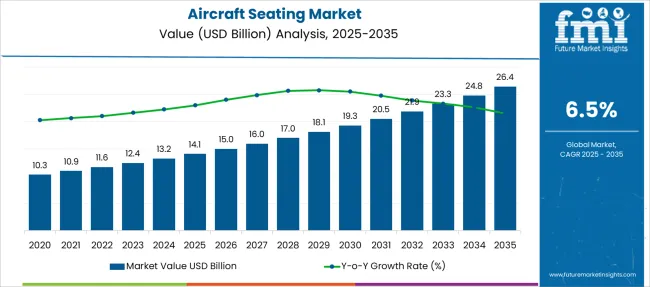

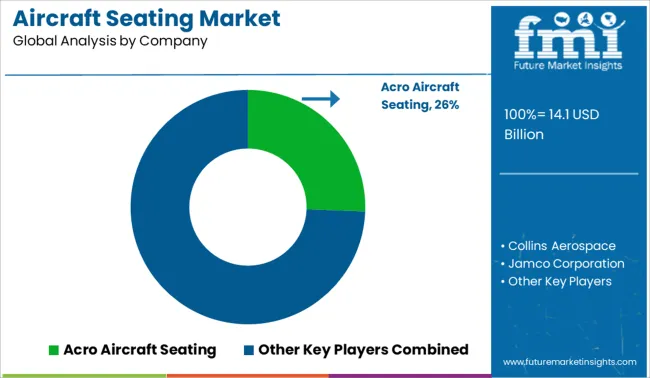

The Aircraft Seating Market is estimated to be valued at USD 14.1 billion in 2025 and is projected to reach USD 26.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Aircraft Seating Market Estimated Value in (2025 E) | USD 14.1 billion |

| Aircraft Seating Market Forecast Value in (2035 F) | USD 26.4 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The aircraft seating market is experiencing a phase of strategic acceleration, fueled by a resurgence in air travel demand, modernization of commercial fleets, and rising focus on fuel efficiency and passenger experience. Airlines are investing in lighter, ergonomically advanced seating solutions to enhance cabin density without compromising comfort. Aircraft manufacturers are increasingly collaborating with seat suppliers to integrate modular designs and smart seat functionalities during the production phase.

Simultaneously, stringent regulatory frameworks and evolving safety standards are prompting the deployment of certified, crash-tested seating systems across both commercial and regional aircraft. Cost-effective seating upgrades are also being prioritized by low-cost carriers to optimize operating margins and reduce turnaround times.

With the expansion of airline networks into emerging regions, the market is poised to benefit from rising aircraft deliveries and refurbishment cycles. Future opportunities are expected in sustainable materials, IoT-enabled seat systems, and customized configurations that cater to evolving passenger preferences and operational needs.

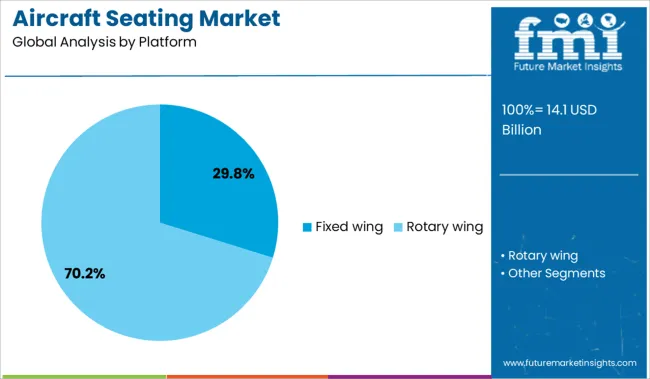

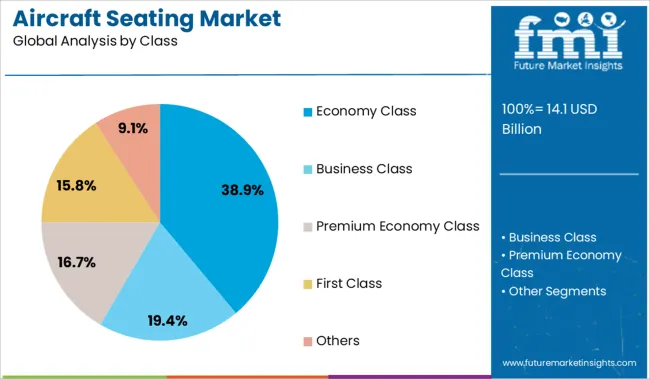

The market is segmented by Platform, Class, and Fit and region. By Platform, the market is divided into Fixed wing, Narrow body, Wide body, Regional Aircraft, Business Jets, Fighter Jets, Rotary wing, Civil Helicopters, and Military Helicopters. In terms of Class, the market is classified into Economy Class, Business Class, Premium Economy Class, First Class, and Others.

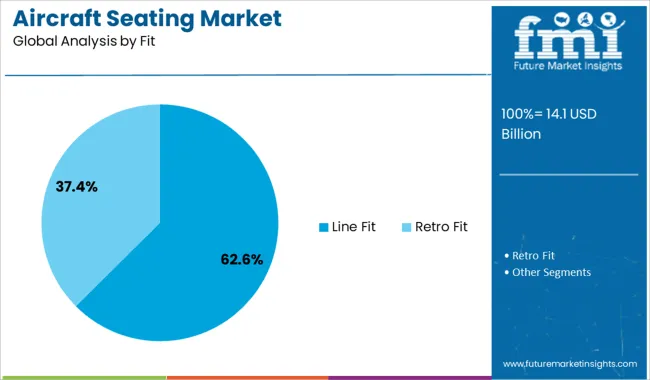

Based on Fit, the market is segmented into Line Fit and Retro Fit. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fixed wing segment is projected to account for 29.8% of the total aircraft seating market revenue in 2025, making it the leading platform category. This dominance is being driven by the extensive deployment of narrow-body and wide-body aircraft across commercial aviation, defense, and business aviation sectors.

Fixed wing aircraft account for the majority of global flight hours and passenger movement, necessitating large-scale seating integration. Seat manufacturers are focused on optimizing weight-to-strength ratios and enhancing compliance with comfort and regulatory standards in fixed wing cabins.

Long-haul and short-haul operations both demand scalable seat solutions that support in-flight entertainment systems, enhanced recline functions, and personal device accommodation. OEM partnerships have enabled seating innovations to be embedded early in the aircraft design and assembly process, reinforcing the fixed wing platform's dominant position.

Economy class seats are expected to hold 38.9% of the overall aircraft seating market revenue in 2025, positioning this segment as the most dominant seating class. This leadership stems from high passenger volumes, especially on domestic and medium-haul routes operated by commercial airlines.

Airlines have increasingly focused on improving pitch, legroom, and cushioning within economy class while maintaining high seating density for profitability. Innovations in lightweight composite materials and slimline designs have enabled the industry to balance passenger comfort with operational efficiency.

Additionally, the rapid rise of low-cost carriers globally has reinforced the demand for affordable, durable, and easily maintainable seating in this class. Economy class retrofits and cabin reconfiguration programs by legacy airlines are further sustaining the segment’s leadership.

Line fit installations are projected to contribute 62.6% of total aircraft seating market revenue in 2025, making it the most dominant fit type. This prominence is attributed to close collaboration between aircraft manufacturers and seating suppliers during initial aircraft assembly.

Airlines are prioritizing line fitment to benefit from integrated cabin design, warranty support, and streamlined certification processes. Line fit seating allows for seamless alignment with aircraft systems and efficient installation schedules, reducing lead times and operational disruptions.

The growth in new aircraft deliveries, particularly in Asia Pacific and Middle Eastern regions, has further driven demand for factory-installed seating solutions. OEM-driven seating innovation, coupled with rising interest in customizable interiors, has solidified line fit as the preferred method of seat integration across global fleets.

The aircraft seating market is pressured by soaring aircraft deliveries and complex cabin customizations, leading to production delays and certification bottlenecks. To counter this, modular seat platforms are being adopted to streamline customization while accelerating rollout. These standardized systems allow faster certification, simplified retrofits, and reduced engineering cycles, benefiting both low-cost and full-service carriers. Suppliers using this approach are achieving shorter lead times and cost efficiencies across new builds and refurbishments.

Aircraft OEMs are escalating output to clear massive delivery backlogs, placing intense pressure on seating system vendors. These vendors face constraints from complex airline customizations, variable class configurations, and an inflexible certification regime. Premium cabin layouts demand modular electronic systems, upholstery variations, and comfort-specific innovations, each requiring individual airworthiness approvals. This has slowed seat production timelines and forced tier-1 suppliers to invest in design simplification and global production hubs. The integration of lightweight alloys, sensor-enabled controls, and modular rail attachment kits is helping to ease final assembly and minimize retrofitting downtime. Airlines now demand seating solutions with fast lead times and consistent performance validation, especially across retrofit-heavy regions like the Middle East and Southeast Asia.

Standardized yet modular seat platforms are now being viewed as a strategic lever to balance customization with production efficiency. By anchoring all seat models to a core structural and functional base, suppliers can meet certification norms faster while tailoring final specifications like upholstery, IFE mounting, or recline mechanics. Such platforms appeal to low-cost carriers as well as legacy airlines pursuing frequent reconfiguration to match evolving cabin mixes. The opportunity lies in balancing certification timelines, airline branding requirements, and MRO compatibility without rebuilding engineering frameworks from scratch. Aircraft interior suppliers adopting this strategy have already shortened turnaround times and reduced cost overheads across new deliveries and mid-life refurbishments.

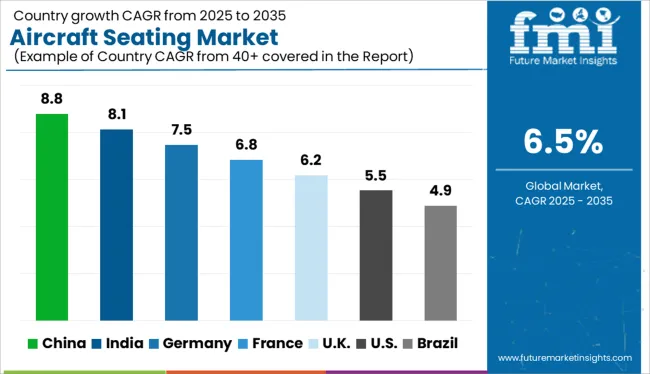

| Country | CAGR |

|---|---|

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global aircraft seating market is advancing at a CAGR of 6.5% from 2025 to 2035, yet sharp contrasts in national trajectories reveal the reshaping of aircraft interiors across BRICS and OECD regions. China leads with 8.8%, surpassing the global average by 2.3 percentage points. Growth is supported by OEM cabin production in Chengdu and Xi'an, where wide-body seating programs are being scaled to meet COMAC’s long-haul ambitions and leasing demand in ASEAN. India follows at 8.1%, backed by rising domestic carriers, narrow-body fleet expansion, and domestic retrofit orders. Suppliers are securing DOA partnerships to offer crash-compliant seats tailored for subcontinental routes. Germany, at 7.5%, is ahead of the global pace, driven by business-class refresh programs across Lufthansa Group and robust aerospace clusters in Hamburg and Munich. France matches the global rate at 6.8%, with investments aimed at ultra-light, sustainable seats for regional fleets. The United Kingdom trails slightly at 6.2%, where limited production agility and slower certification cycles for modular seating are creating rollout delays. These five countries represent strategic benchmarks from a wider 40+ country analysis.

Demand for aircraft seating in China is growing at a CAGR of 8.8%, leading all major economies. Fleet expansion by domestic carriers, coupled with rising procurement of narrow-body aircraft, is generating sustained demand for economy and premium economy seating. Major Chinese airlines are focusing on localized cabin customization, prompting seating suppliers to co-develop modules with regional aviation OEMs. Government-led investment in regional aviation networks has further bolstered domestic seat retrofit contracts. Lightweight seating solutions with modular recline systems are being increasingly specified in new cabin layouts.

Sale of aircraft seating in India is expanding at a CAGR of 8.1%, supported by rising aircraft orders from IndiGo, Air India, and other expanding carriers. Domestic and regional routes are driving demand for modular economy seating with optimized legroom and lightweight materials. Aircraft cabin refurbishment initiatives are on the rise, especially in Tier-1 airports. Suppliers are customizing seating for high-frequency routes, focusing on ease of cleaning and high durability. International seat manufacturers are exploring JVs with local fabricators to gain procurement leverage and reduce lead times.

Demand for aircraft seating in Germany is projected to register a CAGR of 7.5%, driven by innovations in ergonomic design and sustainability-compliant materials. Lufthansa’s seating upgrades and MRO contracts are contributing to demand in both retrofit and new delivery channels. Business and first-class seating for long-haul aircraft remains a premium demand segment, with German design firms at the forefront of configuration optimization. Seatback IFE integration and powered recline features are being redefined as standard across transcontinental fleets. Domestic MRO hubs are seeing increased seating overhaul contracts from EU carriers.

France is expected to witness a CAGR of 6.8% in its aircraft seating sector, aided by Airbus’ continuous production activity and growing aftermarket demand. Domestic suppliers are working closely with Airbus on next-gen seat designs that emphasize modularity and reduced installation time. The market has seen a shift toward cabin differentiation strategies by European airlines, leading to increased orders for hybrid cabin configurations. French seat manufacturers are also innovating in composite frame materials and integrated inflight wellness features. Export orders from Africa and the Middle East are sustaining factory utilization.

The UK aircraft seating market is estimated to grow at a CAGR of 6.2%, supported by specialist aerospace firms focusing on business jet interiors and premium seating solutions. Lightweight composite seats are gaining acceptance among low-cost carriers operating short-haul EU routes. Cabin upgrade programs by British Airways and Virgin Atlantic are sustaining high-value orders for premium recliners and integrated control units. Seating R&D in the UK is being shaped by comfort-engineering initiatives and crashworthiness compliance. Cross-border sourcing from Eastern Europe is helping control production costs.

The aircraft seating market shows a consolidated yet functionally diverse competitive landscape shaped by airline preferences, cabin class dynamics, and aircraft configuration cycles. Collins Aerospace, Safran SA, and Stelia Aerospace hold dominant positions through end-to-end cabin integration, premium seating development, and fleet-wide deployment programs. Their offerings emphasize weight savings, in-flight comfort, and modular design for long-haul fleets. Recaro Aircraft Seating and Thompson Aero Seating remain highly competitive in economy and business-class segments by focusing on ergonomics, space efficiency, and ease of installation. Jamco Corporation and Martin-Baker concentrate on specialized formats, particularly for cockpit and military-grade installations. Aviointeriors, Acro, and Airgo Design support low-cost carriers and aftermarket refurbishments by offering cost-competitive, rapid-deployment seating solutions. Embraer integrates seating systems with its regional jet production, streamlining compatibility, certification, and delivery logistics.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.1 Billion |

| Platform | Fixed wing, Narrow body, Wide body, Regional Aircraft, Business Jets, Fighter Jets, Rotary wing, Civil Helicopters, and Military Helicopters |

| Class | Economy Class, Business Class, Premium Economy Class, First Class, and Others |

| Fit | Line Fit and Retro Fit |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Acro Aircraft Seating, Collins Aerospace, Jamco Corporation, Martin-Baker Aircraft Co., Ltd., Recaro Aircraft Seating, Safran SA, Stelia Aerospace, Thompson Aero Seating Ltd., Aviointeriors SpA, Airgo Design Pte Ltd., and Embraer S/A. |

| Additional Attributes | Dollar sales by aircraft class and platform, modularity and certification trends driving OEM selections, adoption of premium seating configurations in wide-body cabins, regional fleet upgrades accelerating retrofitting cycles, cabin densification strategies fueling narrow-body seating optimization, increased demand for lightweight materials and ergonomic recline mechanisms |

The global aircraft seating market is estimated to be valued at USD 14.1 billion in 2025.

The market size for the aircraft seating market is projected to reach USD 26.4 billion by 2035.

The aircraft seating market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in aircraft seating market are fixed wing, narrow body, wide body, regional aircraft, business jets, fighter jets, rotary wing, civil helicopters and military helicopters.

In terms of class, economy class segment to command 38.9% share in the aircraft seating market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA