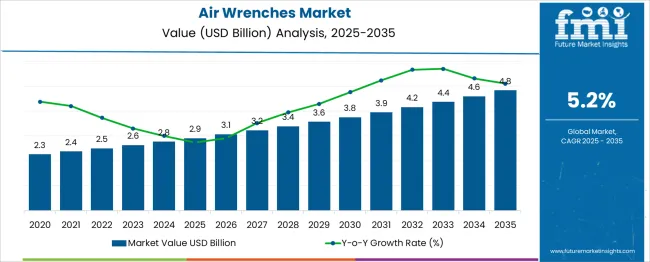

The Air Wrenches Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 4.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. The decade-long progression is marked by stable, incremental increases, suggesting a steady gain in addressable demand rather than volatile movements.

When observed through a competitive lens, this growth trajectory supports a picture of sustained market share retention with the potential for gradual share gain, especially if smaller players or adjacent tool categories experience stagnation or saturation. Between 2025 and 2030, the market increases from USD 2.9 billion to USD 3.8 billion, adding USD 0.9 billion in five years.

The second half of the forecast period adds a slightly larger USD 1.0 billion, from USD 3.8 billion in 2030 to USD 4.8 billion by 2035. These gains are uniform and avoid signs of deceleration, implying that the segment is not under competitive pressure strong enough to cause share erosion.

If competing tool categories fail to match this rate of growth, air wrenches could strengthen their proportional share within the broader pneumatic tools industry. As no steep declines or cyclical troughs are evident, the market share trajectory favors stability and incremental dominance. The data points to a durable footprint supported by predictable adoption rates and low churn.

| Metric | Value |

|---|---|

| Air Wrenches Market Estimated Value in (2025 E) | USD 2.9 billion |

| Air Wrenches Market Forecast Value in (2035 F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The air wrenches market is witnessing consistent growth, driven by rising demand for efficient fastening tools across automotive, construction, and industrial sectors. Increased adoption of air tools in high-torque applications, along with greater emphasis on lightweight and low-maintenance equipment, has improved market penetration globally.

Pneumatic systems are being favored in heavy-duty operations due to their reliability, minimal heat buildup, and consistent performance in high-cycle environments. Advancements in composite housing materials and torque-limiting features have enhanced tool ergonomics and operational safety, making air wrenches preferable in both OEM and aftermarket settings.

Regulatory focus on worker safety and productivity improvements is encouraging the replacement of traditional hand tools with high-precision powered options. Future growth is expected to be supported by integration of smart air tools with torque tracking and monitoring capabilities, especially in assembly lines and fleet maintenance operations.

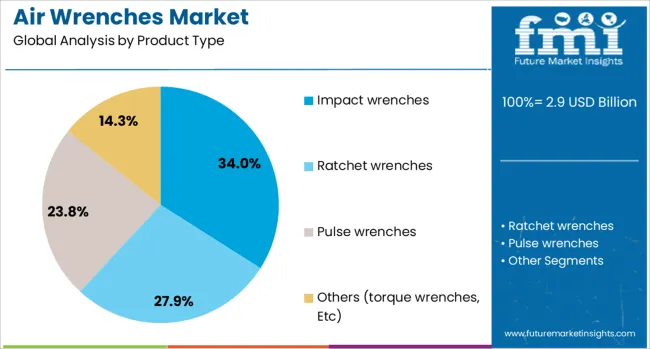

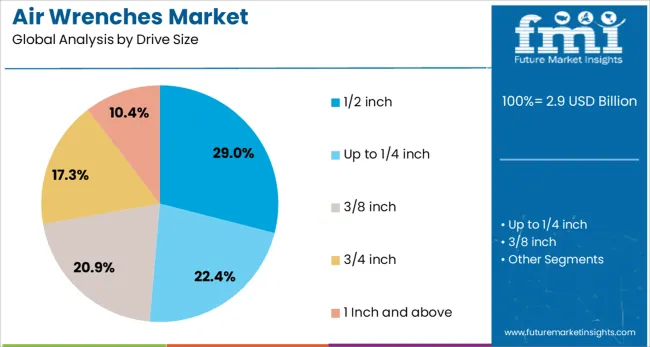

The air wrenches market is segmented by product type, drive size, power source, application, end-use, distribution channel, and geographic regions. By product type, the air wrenches market is divided into Impact wrenches, Ratchet wrenches, Pulse wrenches, and others (torque wrenches, etc.). In terms of drive size, the air wrench market is classified into 1/2 inch, up to 1/4 inch, 3/8 inch, 3/4 inch Inch and above.

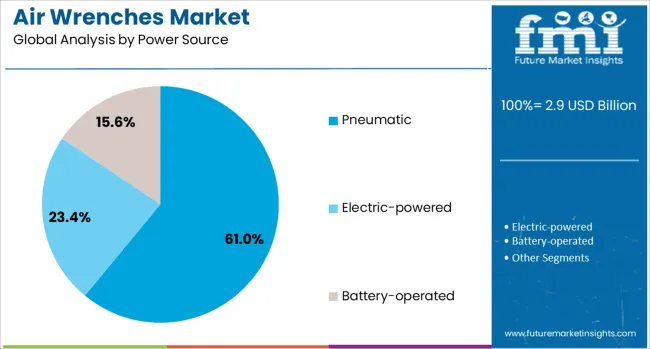

Based on power source of the air wrenches market is segmented into Pneumatic, Electric-poweredBattery-operated. By application, the air wrench market is segmented into Automotive repair and maintenance, Construction, Industrial assembly, Home repair and DIY, and others (Aerospace and Defense, etc.).

The end-use of the air wrenches market is segmented into Automotive, Manufacturing, Construction, Aerospace & defense, Energy & utilities, and others (Marine, Mining, Agriculture, etc.). The distribution channel of the air wrenches market is segmented into indirect and direct. Regionally, the air wrenches industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Impact wrenches are projected to account for 34.00% of the total revenue in the air wrenches market in 2025, making them the leading product type. Their dominance is being driven by their ability to deliver high torque output with minimal operator effort, enabling fast removal and tightening of bolts in time-critical applications.

Their design, which includes hammering mechanisms for torque multiplication, has made them essential in automotive service centers, aerospace maintenance, and industrial assembly operations. Growing availability of compact and lightweight impact models, along with enhanced noise and vibration control, is increasing their adoption.

Their versatility across multiple end-use environments and compatibility with various socket configurations further strengthen their position in the market.

The 1/2 inch segment is expected to contribute 29.00% of the overall air wrenches market revenue by 2025, ranking it as the top drive size in use. Its prominence is attributed to its balanced power-to-size ratio, making it suitable for a wide range of fastening and disassembly tasks in vehicle repair and light industrial applications.

The segment has benefited from increased use in tire-changing, suspension work, and assembly lines where moderate torque is sufficient. Its widespread compatibility with industry-standard sockets and accessories has enhanced operational flexibility and inventory efficiency for tool operators.

As demand rises for portable and ergonomic tools without compromising torque delivery, the 1/2 inch drive size remains a preferred choice across both professional and DIY segments.

Pneumatic air wrenches are forecast to account for 61.00% of the total market revenue in 2025, positioning them as the leading power source segment. Their sustained leadership is being supported by their low cost of ownership, ability to operate continuously without overheating, and reduced maintenance complexity compared to electric alternatives.

Pneumatic models are widely deployed in workshops and manufacturing plants where access to compressed air is readily available, ensuring reliable performance in repetitive, high-volume operations. The absence of electronic components also enhances their durability in harsh environments.

As automation expands in industrial sectors and air-powered infrastructure becomes more standardized, pneumatic air wrenches are expected to retain a stronghold in both existing and emerging applications.

The air wrenches market has provided a critical tool category for torque-intensive operations across automotive, aerospace, heavy machinery, and industrial assembly applications. These pneumatic tools have delivered consistent torque output, reduced operator fatigue, and increased productivity in both repair and production environments. Demand has been sustained by the rising need for precision fastening, improved assembly-line efficiency, and advancements in compressor-powered tooling systems. Compact design, ease of maintenance, and long service life have further solidified their use in workshops and production facilities.

Automotive repair workshops and assembly plants have served as the primary users of air wrenches due to their high rotational force and reliability under continuous use. Tire replacement, engine disassembly, and chassis repairs have necessitated consistent torque application, which pneumatic wrenches have delivered efficiently. In production lines, torque-controlled air wrenches have been installed to reduce cycle time and operator strain while meeting tightening specifications. The widespread availability of compressed air systems in automotive environments has made these tools a preferred choice over electric alternatives. Light-duty impact wrenches and heavy-duty models with torque limiting features have both seen deployment, depending on task complexity and part tolerance.

Precision torque delivery offered by air wrenches has been favored in the industrial assembly of machinery, appliances, and fabricated structures. Fastening of large bolts and repetitive joint installation tasks have required tools that maintain accuracy over prolonged usage. Torque multipliers and pulse tools have been used in applications where vibration and over-tightening must be avoided. In manufacturing operations where operator productivity is tied to cycle time, the lightweight and compact design of air wrenches has allowed for greater efficiency. Their use has been prominent in sectors such as electronics enclosures, HVAC equipment, and heavy equipment subassemblies, where consistent fastening is critical to product performance and warranty compliance.

Growing focus on workplace safety and operator well-being has resulted in the development of ergonomically enhanced air wrenches with vibration-dampening grips, reduced trigger force, and balanced weight distribution. Manufacturers have redesigned housing structures to reduce noise levels generated during torque application, meeting occupational noise exposure standards. Compact models have been introduced for use in confined spaces such as engine bays or aircraft interiors. These enhancements have addressed long-term usage discomfort and repetitive strain concerns, particularly in environments with continuous fastening operations. Advanced air motor designs and composite materials have further contributed to noise reduction and tool longevity, aligning with workshop health and efficiency expectations.

The longevity and continued performance of air wrenches have depended heavily on accessible spare parts, service kits, and routine calibration. Tool distributors and aftermarket service providers have offered reconditioning, seal replacements, and lubrication services to reduce downtime and prolong equipment life. Training on tool handling, torque setting, and compressor calibration has been provided to ensure correct usage and minimize wear. Maintenance services have been bundled with tool leasing or bulk procurement agreements, supporting large-scale workshop operations and industrial users. This ongoing support ecosystem has increased user confidence and enabled extended tool utilization cycles, thereby reinforcing market retention and repeat demand across user segments.

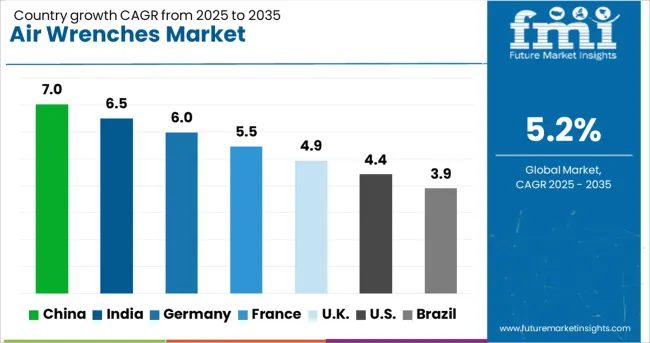

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

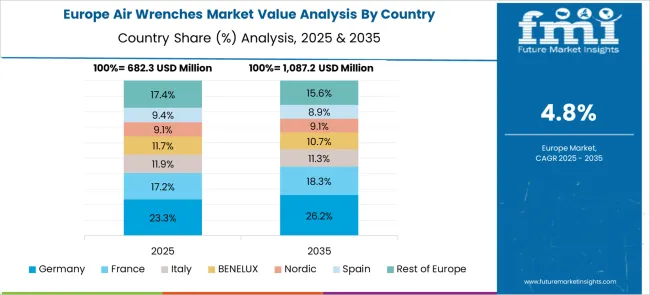

The air wrenches market is projected to register a CAGR of 5.2% between 2025 and 2035, influenced by ongoing automation trends, vehicle repair activities, and growing industrial maintenance requirements. China leads with a growth rate of 7.0%, owing to mass-scale production and broader application in its industrial sector. India follows at 6.5%, supported by rising auto servicing demand and the spread of pneumatic tools in manufacturing clusters. Germany, expanding at 6.0%, benefits from increased factory automation and the preference for energy-efficient torque tools. The UK market is estimated to grow at 4.9%, propelled by workshop modernization and tool replacement cycles. The USA trails with a 4.4% growth, driven by consistent demand across aerospace, automotive, and energy industries. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to expand at a CAGR of 7.0% in the air wrenches market between 2025 and 2035, driven by industrial automation across machinery, electronics, and automotive sectors. Pneumatic tools are increasingly preferred in Tier-1 factories for their reliability in high-volume fastening tasks. Integration with programmable torque control systems has elevated productivity in smart assembly environments. Domestic brands have begun offering compact high-torque variants for electronic equipment lines, while demand from EV component factories is rising.

India is expected to register a CAGR of 6.5% due to rising deployment in automobile workshops, metal fabrication centers, and general engineering units. Lightweight air wrench models are being preferred in SMEs for repetitive tasks under variable air supply conditions. Domestic distributors are expanding reach across industrial parks in Pune, Chennai, and Rajkot. Government-backed skilling programs have improved technician familiarity with advanced pneumatic tools. Shift toward high-precision assembly in export-focused auto hubs is accelerating market demand.

Germany is forecasted to grow at a CAGR of 6.0%, driven by the demand for low-maintenance, torque-calibrated air wrenches in automotive and aerospace manufacturing. German assembly lines are adopting energy-efficient pneumatic systems with torque traceability and digital air flow control. Regulatory standards on tool ergonomics and noise emission have influenced preference for compact, quiet-running models. Local OEMs are integrating air tools with factory data networks to optimize real-time torque accuracy and minimize joint failure rates.

The United Kingdom is anticipated to post a CAGR of 4.9%, with adoption driven by maintenance operations in rail, shipping, and heavy vehicle fleets. Air wrenches are widely used in depot workshops and field service vans for bolt tightening under high-load conditions. Mobile toolkits with composite-bodied wrenches have become common in rental and service firms. Integration of digital pressure regulators in newer models has improved reliability across fluctuating compressed air systems.

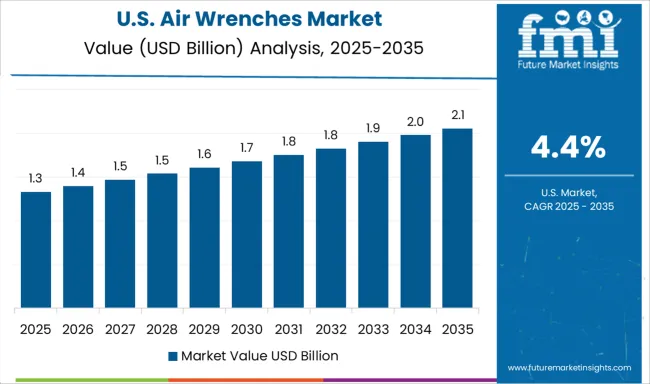

The United States is projected to grow at a CAGR of 4.4% with demand emerging from defense contractors, construction equipment manufacturers, and aircraft maintenance units. Use of calibrated air wrenches in torque-critical assemblies is rising in the Midwest and Pacific regions. American firms have increased investment in noise-reduced models for confined spaces and aircraft hangars. Third-party service providers are offering maintenance contracts bundled with tool upgrades and real-time calibration checks.

The air wrenches market is defined by its reliance on high-performance pneumatic technologies essential for heavy-duty fastening and loosening applications in automotive, aerospace, construction, and manufacturing sectors. Demand is shaped by the need for compact yet powerful tools capable of withstanding prolonged industrial use while ensuring torque precision, low vibration, and operator safety.

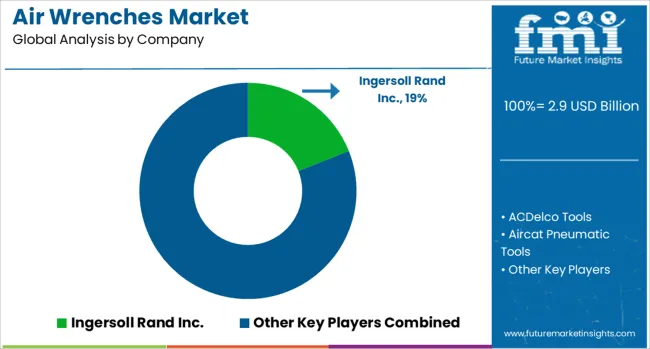

The competitive landscape includes a mix of legacy tool manufacturers and niche pneumatic system specialists offering tools across both professional and commercial repair channels. Ingersoll Rand Inc., Snap-on Incorporated, and Matco Tools hold significant positions across automotive and maintenance workshops, supported by their established distribution networks and durable product lines.

Stanley Black & Decker, Inc. and Bosch Tools Corporation serve both consumer and industrial markets with a wide range of pneumatic tools catering to volume-centric environments. Makita Corporation and Hitachi Koki Co., Ltd. (HiKOKI) continue to expand global reach by introducing ergonomic, low-noise impact wrenches for construction and facility services.

Atlas Copco AB and Chicago Pneumatic remain strong in factory automation, focusing on energy-efficient systems suited for repetitive torque tasks. Aircat Pneumatic Tools and ACDelco Tools differentiate through performance-centric innovation and ease of maintenance. Campbell Hausfeld and SP Air Corporation maintain visibility in niche air tool applications, while Kawasaki Heavy Industries, Ltd. and Hindustan Tools offer value-focused solutions in regional markets. Product evolution increasingly focuses on lightweight materials, modular maintenance, and integration with air management systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Product Type | Impact wrenches, Ratchet wrenches, Pulse wrenches, and Others (torque wrenches, Etc) |

| Drive Size | 1/2 inch, Up to 1/4 inch, 3/8 inch, 3/4 inch, and 1 Inch and above |

| Power Source | Pneumatic, Electric-powered, and Battery-operated |

| Application | Automotive repair and maintenance, Construction, Industrial assembly, Home repair and diy, and Others (Aerospace and Defense, Etc) |

| End-Use | Automotive, Manufacturing, Construction, Aerospace & defense, Energy & utilities, and Others (Marine, Mining, Agriculture, Etc) |

| Distribution Channel | Indirect and Direct |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ingersoll Rand Inc., ACDelco Tools, Aircat Pneumatic Tools, Atlas Copco AB, Bosch Tools Corporation, Campbell Hausfeld, Chicago Pneumatic, Hindustan Tools, Hitachi Koki Co., Ltd. (HiKOKI), Kawasaki Heavy Industries, Ltd., Makita Corporation, Matco Tools, Snap-on Incorporated, SP Air Corporation, and Stanley Black & Decker, Inc. |

| Additional Attributes | Dollar sales by wrench type and end-use industry, demand dynamics across automotive repair, aerospace maintenance, heavy machinery assembly, and industrial production lines, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in torque control systems, ergonomic grip designs, and lightweight composite housing, environmental impact of compressed air usage, noise emissions, and lifecycle servicing, and emerging use cases in battery-integrated hybrid models, automated torque verification, and remote-controlled pneumatic tool systems. |

The global air wrenches market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the air wrenches market is projected to reach USD 4.8 billion by 2035.

The air wrenches market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in air wrenches market are impact wrenches, ratchet wrenches, pulse wrenches and others (torque wrenches, etc).

In terms of drive size, 1/2 inch segment to command 29.0% share in the air wrenches market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA