The global airless paint spray system market is projected to reach USD 624.3 million by 2035, recording an absolute increase of USD 173.1 million over the forecast period. The market is valued at USD 451.2 million in 2025 and is set to rise at a CAGR of 3.3% during the assessment period. The overall market size is expected to grow by nearly 1.4 times during the same period, supported by increasing demand for efficient coating solutions in automotive and construction sectors, driving demand for high-performance spraying equipment and increasing investments in industrial automation and surface finishing technologies globally. High initial equipment costs and maintenance requirements may pose challenges to market expansion.

The expansion trajectory reflects fundamental shifts in industrial coating practices, where manufacturers seek productivity improvements through advanced application technologies that reduce material waste and labor requirements. Construction and automotive industries face mounting pressure to implement efficient finishing systems that deliver uniform coating coverage while minimizing overspray and environmental emissions. Advanced airless spray systems typically provide 20-30% reduction in paint consumption compared to conventional air spray methods, making these technologies essential for cost-effective surface finishing operations across industrial and commercial applications.

Regional market dynamics show pronounced variation, with developed markets emphasizing automation integration and operator safety features while emerging economies prioritize basic equipment accessibility and workforce training programs. Automotive manufacturers and construction contractors represent the primary demand centers, where electric and hydraulic airless systems integrate with existing production workflows to standardize coating quality and application efficiency. The technology landscape encompasses various power configurations and pressure delivery systems, creating diverse product offerings tailored to specific application requirements and operational scale considerations.

Investment patterns indicate sustained commitment from coating contractors and industrial facilities toward spraying equipment that supports quality improvement and operational efficiency objectives. Manufacturers pursue systems that reduce coating material costs while improving surface finish consistency, driving adoption of sophisticated airless platforms despite higher capital expenditures. The convergence of environmental regulations, productivity demands, and coating technology advancement establishes favorable conditions for market expansion through 2035, though implementation challenges related to equipment costs and technical training will require ongoing attention from manufacturers and end users to ensure optimal system performance across diverse coating applications and industrial environments.

Between 2025 and 2030, the airless paint spray system market is projected to expand from USD 451.2 million to USD 530.7 million, resulting in a value increase of USD 79.5 million, which represents 45.9% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for efficient coating solutions in automotive and construction applications, product innovation in electric drive systems and pressure control technologies, as well as expanding integration with robotic painting systems and automated finishing lines. Companies are establishing competitive positions through investment in advanced spray gun technologies, electronic control systems, and strategic market expansion across automotive, construction, aerospace, and other industrial coating applications.

From 2030 to 2035, the market is forecast to grow from USD 530.7 million to USD 624.3 million, adding another USD 93.6 million, which constitutes 54.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized spraying systems, including advanced automated platforms and integrated coating solutions tailored for specific industrial finishing requirements, strategic collaborations between equipment manufacturers and coating material suppliers, and an enhanced focus on application efficiency and environmental compliance. The growing emphasis on surface finish quality optimization and sustainable coating practices will drive demand for advanced, high-performance airless paint spray solutions across diverse industrial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 451.2 million |

| Market Forecast Value (2035) | USD 624.3 million |

| Forecast CAGR (2025-2035) | 3.3% |

The airless paint spray system market grows by enabling industrial and commercial users to achieve superior coating efficiency and surface finish quality while reducing material waste and application time. Coating contractors face mounting pressure to improve productivity and cost-effectiveness, with airless spray systems typically providing 50-70% faster application rates compared to brush and roller methods, making these technologies essential for large-scale finishing projects and high-volume production environments. The demand for uniform coating coverage creates requirements for advanced spraying equipment that can deliver consistent material transfer across complex surface geometries and varying substrate conditions.

Government initiatives promoting environmental protection and workplace safety standards drive adoption in automotive, construction, aerospace, and other industrial applications, where coating efficiency has a direct impact on material costs and environmental compliance. The global shift toward low-VOC coatings and sustainable finishing practices accelerates airless system demand as contractors seek equipment optimized for modern coating formulations that require precise pressure control and atomization characteristics. High initial capital investment and ongoing maintenance requirements may limit adoption rates among smaller contractors and regions with limited access to technical support infrastructure.

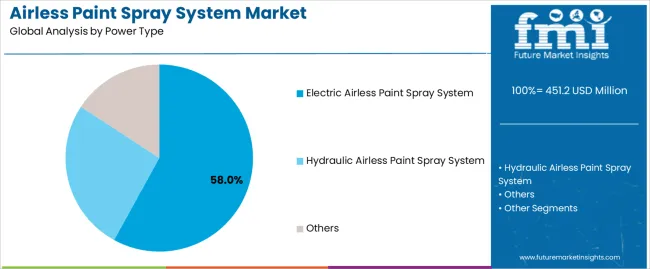

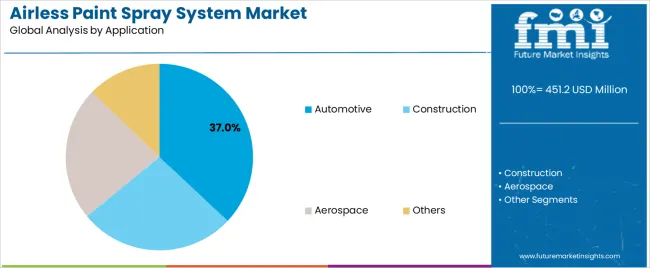

The market is segmented by power type, application, and region. By power type, the market is divided into electric airless paint spray system, hydraulic airless paint spray system, and others. Based on application, the market is categorized into automotive, construction, aerospace, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The electric airless paint spray system segment represents the dominant force in the airless paint spray system market, capturing approximately 58% of total market share in 2025. This category delivers comprehensive coating capabilities with enhanced portability and operational convenience. The electric airless segment's market leadership stems from its widespread adoption in construction and maintenance applications, accessible power infrastructure compatibility, and lower operational complexity compared to hydraulic alternatives.

The hydraulic airless paint spray system segment maintains a substantial 28% market share, serving industrial users who require high-pressure capabilities and continuous operation capacity through centralized pumping systems. The others segment accounts for 14% market share, featuring pneumatic and gas-powered configurations suited for specialized applications.

Key advantages driving the electric airless paint spray system segment include:

Automotive applications dominate the airless paint spray system market with approximately 37% market share in 2025, reflecting the critical need for high-quality surface finishing in vehicle manufacturing and refinishing operations where coating uniformity directly impacts product appearance and corrosion protection. The automotive segment's market leadership is reinforced by widespread adoption across OEM production facilities, body shops, and component coating operations, which require consistent finish quality and efficient material utilization.

The construction segment represents 32% market share through residential and commercial painting contractors who provide exterior and interior coating services for buildings and infrastructure projects. The aerospace segment accounts for 16% market share, featuring specialized coating requirements for aircraft components and maintenance operations. The others segment holds 15% market share, encompassing industrial equipment, marine, and general manufacturing applications.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to productivity and cost optimization. First, construction industry growth creates increasing requirements for efficient coating application equipment, with global construction spending projected to reach USD 15 trillion annually by 2030 according to industry forecasts, requiring reliable spray systems for residential, commercial, and infrastructure finishing projects. Second, labor cost pressures drive contractors toward productivity-enhancing technologies, with airless systems reducing application time by 40-60% compared to traditional methods while enabling single-operator coverage of large surface areas that would otherwise require multiple workers. Third, coating material costs incentivize adoption of high-transfer-efficiency equipment, with airless technology achieving 65-85% material transfer rates compared to 30-50% for conventional air spray methods, resulting in substantial coating savings on large-scale projects.

Market restraints include high equipment acquisition costs affecting adoption decisions and replacement cycles, particularly for professional-grade systems where capital investments can range from USD 1,000 to USD 10,000 per unit, posing financial barriers for smaller contractors and start-up operations operating on limited capital budgets. Technical skill requirements regarding equipment setup, pressure adjustment, and spray technique create additional challenges, as achieving optimal coating results demands operator training and experience to prevent common application defects such as runs, sags, and uneven coverage during production operations.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where infrastructure development programs and manufacturing expansion drive demand for efficient coating equipment through government construction initiatives and industrial facility investments. Technology advancement trends toward brushless electric motors with electronic pressure control, cordless battery-powered systems enabling untethered operation, and integrated flow monitoring capabilities that optimize material usage are enabling next-generation product development. The market could face disruption if alternative coating technologies, such as electrostatic application systems or advanced HVLP equipment with comparable transfer efficiency, achieve cost parity while offering superior finish quality or reduced equipment maintenance requirements compared to current airless spray platforms.

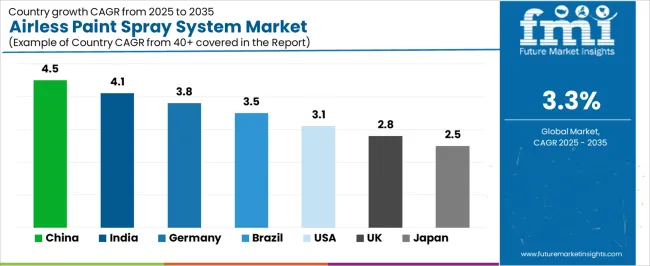

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| Brazil | 3.5% |

| United States | 3.1% |

| United Kingdom | 2.8% |

| Japan | 2.5% |

The airless paint spray system market is gaining momentum worldwide, with China taking the lead thanks to aggressive infrastructure development programs and manufacturing sector expansion initiatives. Close behind, India benefits from construction boom and government housing programs, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where advanced automotive manufacturing and strict coating quality standards strengthen its role in European industrial supply chains.

Brazil demonstrates robust growth through residential construction expansion and infrastructure investment programs, signaling continued development in Latin American coating markets. Meanwhile, the United States maintains steady progress through renovation activity and industrial coating demand, while the United Kingdom and Japan continue to record consistent advancement driven by maintenance and refurbishment projects. Together, China and India anchor the global expansion story, while established markets build stability and technical sophistication into the market's growth path.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

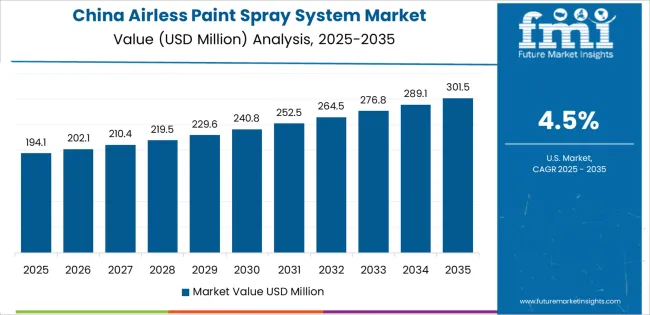

China demonstrates the strongest growth potential in the airless paint spray system market with a CAGR of 4.5% through 2035. The country's leadership position stems from comprehensive infrastructure development programs, intensive construction activity expansion, and aggressive manufacturing sector growth driving adoption of efficient coating application systems. Growth is concentrated in major industrial regions, including Guangdong, Jiangsu, Zhejiang, and Shandong, where construction contractors, automotive manufacturers, and industrial coating operations are implementing airless spray technologies for productivity improvement and quality enhancement.

Distribution channels through industrial equipment distributors, construction supply retailers, and direct manufacturer relationships expand deployment across residential construction, commercial projects, and manufacturing facilities. The country's Made in China 2025 initiative provides policy support for industrial equipment modernization, including investment in advanced coating application technologies.

Key market factors:

In major metropolitan regions, tier-2 cities, and rural development areas, the adoption of airless paint spray systems is accelerating across construction projects, automotive refinishing facilities, and industrial coating operations, driven by infrastructure development programs and government housing initiatives. The market demonstrates strong growth momentum with a CAGR of 4.1% through 2035, linked to comprehensive construction sector expansion and increasing focus on coating quality enhancement solutions.

Indian contractors and manufacturers are implementing efficient spraying equipment and productivity-enhancing technologies to improve project completion rates while meeting rising quality expectations in residential and commercial construction markets. The country's Housing for All initiative creates sustained demand for coating application equipment, while increasing emphasis on industrial productivity drives adoption of advanced spraying systems that enhance operational efficiency.

Germany's advanced manufacturing sector demonstrates sophisticated implementation of airless paint spray systems, with documented integration showing 75-85% automation rates in automotive coating facilities through comprehensive robotic application platforms. The country's industrial infrastructure in major production centers, including Bavaria, Baden-Württemberg, North Rhine-Westphalia, and Lower Saxony, showcases integration of high-pressure spraying technologies with existing manufacturing systems, leveraging expertise in automotive finishing and industrial coating processes.

German manufacturers emphasize coating quality standards and environmental compliance, creating demand for precision spray equipment that supports regulatory requirements and surface finish specifications. The market maintains strong growth through focus on coating efficiency and production excellence, with a CAGR of 3.8% through 2035.

Key development areas:

The Brazilian market demonstrates growing implementation of airless paint spray technologies based on residential construction expansion and commercial building development for enhanced coating productivity. The country shows solid potential with a CAGR of 3.5% through 2035, driven by housing programs and increasing urbanization across major metropolitan regions, including São Paulo, Rio de Janeiro, Minas Gerais, and Paraná.

Brazilian contractors are adopting efficient spraying equipment for compliance with project timeline requirements, particularly in large-scale residential developments requiring rapid coating completion and in commercial construction projects implementing quality finishing standards. Technology deployment channels through construction equipment distributors, coating material suppliers, and rental service providers expand coverage across diverse project scales.

Leading market segments:

The USA market demonstrates mature implementation of airless paint spray technologies based on residential renovation activity and commercial maintenance programs for enhanced coating efficiency. The country shows solid potential with a CAGR of 3.1% through 2035, driven by housing market dynamics and increasing contractor productivity requirements across major regional markets, including California, Texas, Florida, and the Northeast corridor. American contractors are adopting advanced spraying equipment for compliance with environmental regulations, particularly in commercial applications requiring low-VOC coating systems and in residential projects implementing quality finishing standards. Technology deployment channels through home improvement retailers, professional equipment distributors, and manufacturer direct sales programs expand coverage across diverse contractor segments.

Leading market segments:

The United Kingdom's airless paint spray system market demonstrates mature implementation focused on renovation and maintenance applications, with documented adoption across 60-70% of professional painting contractors through established equipment distribution channels. The country maintains steady growth momentum with a CAGR of 2.8% through 2035, driven by housing maintenance requirements and commercial building refurbishment activity aligned with property market conditions. Major regional markets, including London, Southeast England, Scotland, and Northwest regions, showcase consistent deployment of electric airless systems that support residential and commercial coating projects requiring efficient application capabilities and quality finish standards.

Key market characteristics:

Japan's airless paint spray system market demonstrates sophisticated implementation focused on industrial manufacturing and precision coating applications, with documented integration achieving 70-80% equipment utilization rates in automotive and industrial facilities through comprehensive maintenance programs. The country maintains steady growth momentum with a CAGR of 2.5% through 2035, driven by manufacturing sector requirements and maintenance market emphasis on coating quality aligned with industrial standards. Major industrial regions, including Aichi, Kanagawa, Osaka, and Hyogo, showcase advanced deployment of automated spraying systems that integrate with existing production infrastructure and quality control protocols.

Key market characteristics:

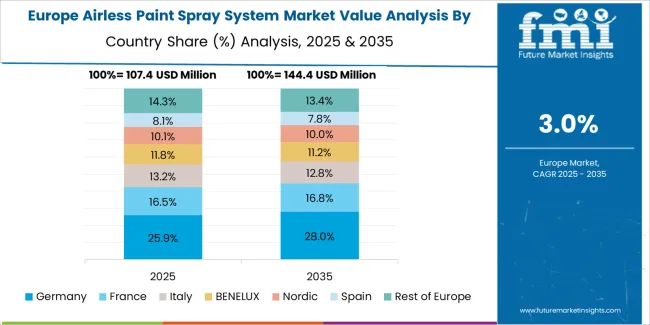

The airless paint spray system market in Europe is projected to grow from USD 171.1 million in 2025 to USD 269.7 million by 2035, registering a CAGR of 4.7% over the forecast period. Germany is expected to maintain its leadership position with a 26.5% market share in 2025, declining slightly to 25.8% by 2035, supported by its extensive automotive manufacturing infrastructure and major industrial centers, including Bavaria, Baden-Württemberg, and North Rhine-Westphalia production regions.

France follows with a 18.2% share in 2025, projected to reach 18.6% by 2035, driven by comprehensive construction activity and automotive sector coating requirements. The United Kingdom holds a 16.4% share in 2025, expected to decrease to 15.9% by 2035 due to mature market conditions. Italy commands a 13.7% share, while Spain accounts for 11.3% in 2025. The Netherlands maintains 5.8% in 2025, reaching 6.1% by 2035 on industrial coating demand. The Rest of Europe region is anticipated to hold 8.1% in 2025, expanding to 8.3% by 2035, attributed to increasing airless spray system adoption in Nordic countries and emerging Central and Eastern European construction and manufacturing programs.

The Japanese airless paint spray system market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of electric spraying equipment and automated coating platforms with existing manufacturing infrastructure across automotive production facilities, industrial coating operations, and professional contractor networks. Japan's emphasis on coating quality and operational efficiency drives demand for reliable spray equipment that supports precision finishing requirements and productivity objectives in manufacturing and maintenance applications.

The market benefits from strong partnerships between international equipment manufacturers and domestic industrial distributors, creating comprehensive service ecosystems that prioritize equipment reliability and technical support programs. Industrial centers in Aichi, Osaka, Kanagawa, and other major production areas showcase advanced coating implementations where spraying systems achieve 95% operational efficiency through comprehensive maintenance management and quality control protocols.

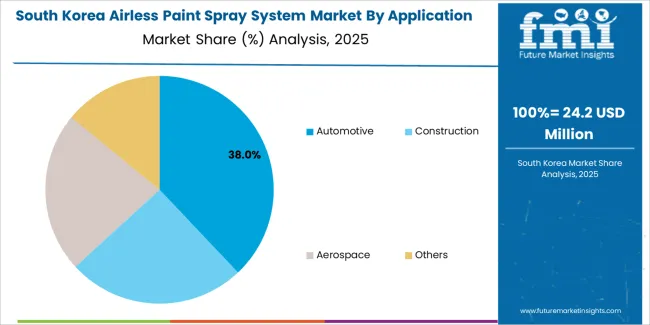

The South Korean airless paint spray system market is characterized by growing international equipment provider presence, with companies maintaining significant positions through comprehensive technical services and product support capabilities for automotive and industrial coating applications. The market demonstrates increasing emphasis on coating quality improvement and manufacturing efficiency initiatives, as Korean facilities increasingly demand advanced spraying equipment that integrates with domestic production systems and sophisticated quality management platforms deployed across major manufacturing complexes.

Regional equipment distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including technical training support and application optimization programs for industrial coating operations. The competitive landscape shows increasing collaboration between multinational equipment companies and Korean industrial technology specialists, creating integrated service models that combine international engineering standards with local manufacturing requirements and precision coating systems.

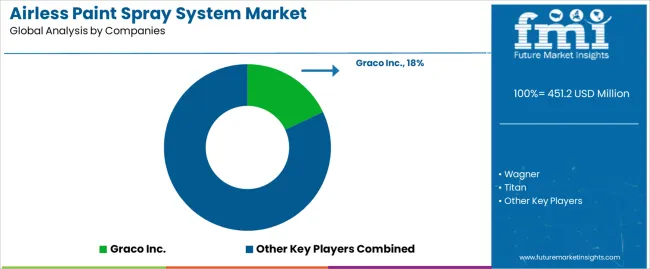

The airless paint spray system market features approximately 30-35 meaningful players with moderate fragmentation, where the top three companies control roughly 42-47% of global market share through established distribution networks and comprehensive product portfolios. Competition centers on equipment reliability, spray pattern quality, and after-sales service capabilities rather than price competition alone. Graco Inc. leads with approximately 18% market share through its comprehensive professional and industrial spray equipment portfolio.

Market leaders include Graco Inc., Wagner, and Titan, which maintain competitive advantages through global distribution infrastructure, extensive technical support networks, and deep expertise in spraying technology development across multiple application segments, creating trust and reliability advantages with professional contractors and industrial coating operations. These companies leverage research and development capabilities in pump technology innovation and ongoing customer training relationships to defend market positions while expanding into automated coating and robotic application systems.

Challengers encompass Wagner SprayTech and Tritech Industries, which compete through specialized product offerings and strong regional presence in key contractor markets. Equipment specialists, including Dürr Systems, Sherwin-Williams Company, and Portland Compressor, focus on specific application segments or industrial markets, offering differentiated capabilities in automated coating systems, integrated finishing solutions, and specialized pump technologies.

Regional players and emerging equipment manufacturers create competitive pressure through localized distribution advantages and rapid response capabilities, particularly in high-growth markets including China and India, where proximity to construction and manufacturing clusters provides advantages in service delivery and contractor relationships. Market dynamics favor companies that combine equipment reliability with comprehensive technical support offerings that address the complete coating application cycle from equipment selection through operator training and maintenance service programs.

| Item | Value |

|---|---|

| Quantitative Units | USD 451.2 million |

| Power Type | Electric Airless Paint Spray System, Hydraulic Airless Paint Spray System, Others |

| Application | Automotive, Construction, Aerospace, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Graco Inc., Wagner, Titan, Wagner SprayTech, Tritech Industries, Dürr Systems, Sherwin-Williams Company, Portland Compressor, HVBAN, DP Airless, Larius, Anest Iwata, Binks |

| Additional Attributes | Dollar sales by power type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with spray equipment manufacturers and distribution networks, equipment specifications and performance requirements, integration with coating material systems and automated finishing programs, innovations in pump technology and pressure control systems, and development of specialized platforms with enhanced transfer efficiency and operational reliability capabilities. |

The global airless paint spray system market is estimated to be valued at USD 451.2 million in 2025.

The market size for the airless paint spray system market is projected to reach USD 624.3 million by 2035.

The airless paint spray system market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in airless paint spray system market are electric airless paint spray system, hydraulic airless paint spray system and others.

In terms of application, automotive segment to command 37.0% share in the airless paint spray system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airless Packaging Market Growth - Demand & Forecast 2025 to 2035

Airless Pumps Market Analysis - Size, Demand & Forecast 2025 to 2035

Market Share Breakdown of Airless Packaging Industry

Competitive Overview of Airless Pumps Market Share

Airless Bottles Market

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Acrylic Airless Bottle Sector

Acrylic Airless Bottle Market Trends - Demand & Forecast 2024 to 2034

Paint Cans Market Size and Share Forecast Outlook 2025 to 2035

Painting Robots Market Size and Share Forecast Outlook 2025 to 2035

Paint Curing Lamp Market Size and Share Forecast Outlook 2025 to 2035

Paint Booth Market Size and Share Forecast Outlook 2025 to 2035

Painting Tool Market Size and Share Forecast Outlook 2025 to 2035

Paint Rollers Market Size and Share Forecast Outlook 2025 to 2035

Paint Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Paint Tester Market Size and Share Forecast Outlook 2025 to 2035

Paint Knife Market Size and Share Forecast Outlook 2025 to 2035

Paint Buckets Market Size, Share & Forecast 2025 to 2035

Paint Mixing Market Analysis - Size, Share, and Forecast Outlook for 2025-2035

Market Share Breakdown of Paint Protection Film Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA