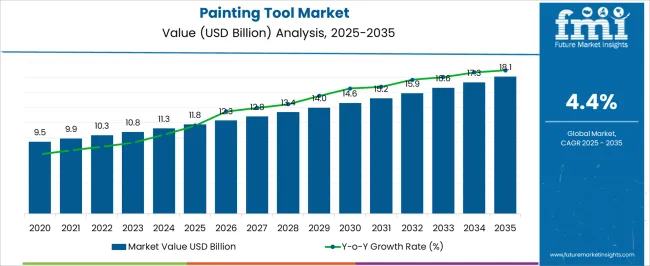

The painting tool market is projected to grow from USD 11.8 billion in 2025 to USD 18.1 billion by 2035, reflecting a CAGR of 4.4%. This growth represents an absolute dollar opportunity of USD 6.3 billion over the decade. Starting at USD 9.5 billion in the early years, the market experiences steady expansion, reaching USD 14.6 billion by 2030. For companies in home improvement, construction, and industrial painting sectors, this growth indicates reliable revenue potential.

By aligning production, distribution, and marketing strategies with market trends, businesses can capture incremental value and strengthen their position in the gradually expanding painting tool market. The absolute dollar opportunity from 2025 to 2035 emphasizes annual gains that rise from USD 12.3 billion in 2026 to USD 17.3 billion in 2034, culminating at USD 18.1 billion in 2035. This predictable expansion allows companies to plan capacity, partnerships, and sales strategies effectively. Capturing market share during this period ensures meaningful revenue gains while reducing investment risk. Companies entering or scaling operations in alignment with these trends can maximize returns and establish a strong foothold in the evolving painting tool market.

| Metric | Value |

|---|---|

| Painting Tool Market Estimated Value in (2025 E) | USD 11.8 billion |

| Painting Tool Market Forecast Value in (2035 F) | USD 18.1 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

A breakpoint analysis of the painting tool market highlights periods of steady and moderately accelerated growth. From 2025 to 2028, the market grows from USD 11.8 billion to USD 12.8 billion, with annual increments of around USD 0.5 billion. This early-stage period represents a stable phase where companies can establish operations, optimize supply chains, and evaluate demand trends.

Recognizing this initial breakpoint allows businesses to allocate resources efficiently, test marketing and distribution strategies, and build market presence. Early engagement during this period provides a foundation for capturing higher-value opportunities as the market continues to expand steadily in subsequent years. The next breakpoint occurs between 2030 and 2035, as the market expands from USD 14.6 billion to USD 18.1 billion, reflecting larger annual increments averaging USD 0.7–0.9 billion. This stage represents accelerated growth and meaningful absolute dollar opportunity, making strategic positioning essential for maximizing market share. Companies entering or scaling operations during this phase can capture significant revenue gains while strengthening competitive positioning.

The painting tool market is expanding steadily, driven by rising construction activity, infrastructure development, and increasing interest in home improvement projects. Industry updates and trade publications have pointed to continuous product innovation, with manufacturers introducing ergonomically designed tools and advanced bristle technologies to enhance application efficiency and finish quality.

Growth in residential and commercial renovation activity, particularly in emerging economies, has broadened the customer base for both professional and DIY segments. Additionally, sustainability trends have influenced the adoption of eco-friendly materials in handles, bristles, and roller covers, appealing to environmentally conscious buyers.

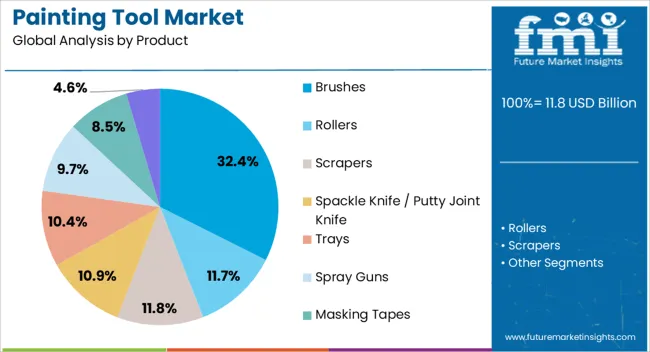

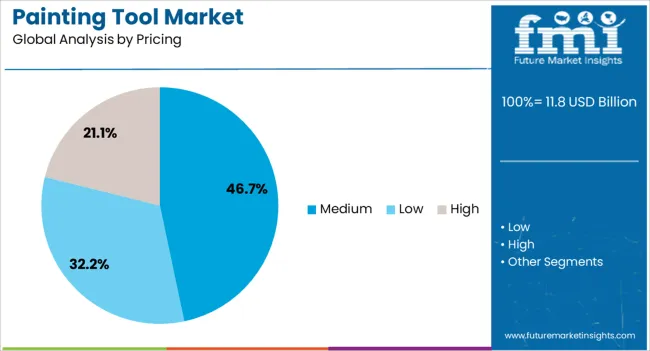

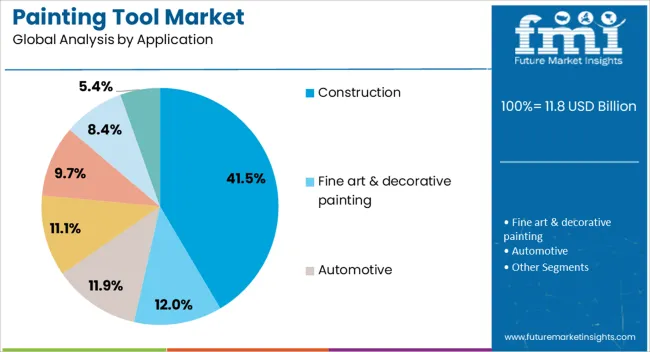

Distribution networks have also evolved, with e-commerce platforms expanding product accessibility and providing direct-to-consumer sales opportunities. Looking ahead, the market is expected to benefit from ongoing urbanization, the rising popularity of decorative finishes, and investments in construction projects. Segmental leadership is projected to remain with brushes in the product category, medium-priced tools in the pricing category, and construction in the application category, supported by their widespread use and strong alignment with market demand patterns.

The painting tool market is segmented by product, pricing, application, distribution channel, and geographic regions. By product, the painting tool market is divided into Brushes, Rollers, Scrapers, Spackle knives / Putty Joint knives, Trays, Spray Guns, Masking Tapes, and Others (Paint mixers, Wall Cleaners, etc.). In terms of pricing, the painting tool market is classified into Medium, Low, and High.

Based on application, the painting tool market is segmented into Construction, Fine art & decorative painting, Automotive, Appliances, Furniture, Industrial machinery & equipment, and Others (utilities, government marking, restoration & conversion, etc.). By distribution channel, the painting tool market is segmented into Offline and Online. Regionally, the painting tool industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Brushes segment is projected to hold 32.4% of the painting tool market revenue in 2025, maintaining its leading position among product types. This segment’s strength has been reinforced by the versatility of brushes across a wide range of painting applications, from fine detailing to large surface coverage.

Professional painters and DIY users alike continue to favor brushes for their precision, ease of control, and compatibility with various paint types. Product advancements, including synthetic bristle technology and ergonomic handle designs, have improved durability, paint pickup, and application smoothness.

Additionally, brushes require minimal setup and cleanup compared to other tools, making them a cost-effective and convenient option. The segment’s growth is further supported by steady demand in both residential and industrial painting projects, as well as its essential role in surface preparation and touch-up work. With consistent innovations in bristle quality and handle ergonomics, the Brushes segment is expected to retain its prominent share in the painting tool market.

The Medium pricing segment is projected to account for 46.7% of the painting tool market revenue in 2025, leading due to its balance between affordability and product quality. This segment caters to both professional contractors seeking reliable tools and homeowners looking for durable yet cost-effective solutions.

Market demand in this price range has been driven by the availability of well-constructed tools that offer extended usability without the premium cost associated with high-end products. Retailers have strategically stocked medium-priced options to appeal to a broad customer base, ensuring consistent sales volumes.

Manufacturers in this category often emphasize performance features such as improved paint absorption, ergonomic grips, and versatile design while maintaining competitive pricing. Seasonal promotions and value packs in the medium price segment have further boosted adoption among budget-conscious buyers who still prioritize quality. Given its ability to meet diverse consumer needs, the Medium pricing category is expected to sustain its leading market position.

The Construction segment is projected to contribute 41.5% of the painting tool market revenue in 2025, establishing itself as the largest application category. This dominance has been driven by the extensive use of painting tools in both new construction projects and large-scale renovations.

Global construction industry growth, fueled by infrastructure investments and urban housing demand, has ensured steady consumption of painting tools in this segment. Contractors and construction firms prioritize tools that deliver consistent finishes, withstand prolonged use, and enhance application speed, making high-quality brushes, rollers, and sprayers essential.

Additionally, regulations and quality standards in the building sector have encouraged the use of professional-grade painting tools to meet durability and aesthetic requirements. The rise in commercial building projects, public infrastructure works, and industrial facility construction has further reinforced demand. As global construction activities continue to expand, the construction segment is expected to remain the primary driver of the painting tool market revenues.

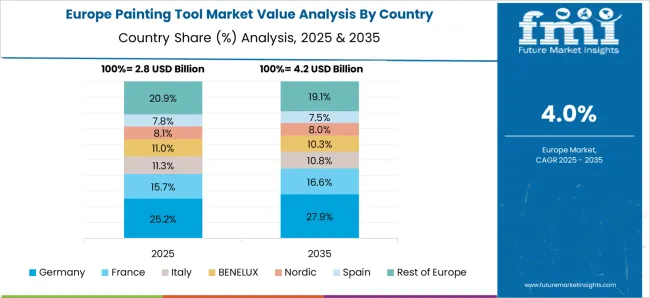

The painting tool market is expanding due to increasing residential and commercial construction, rising DIY trends, and growth in industrial coatings. North America and Europe lead in adoption of advanced roller, spray, and brush systems for precision, efficiency, and ergonomic use, whereas Asia-Pacific shows rapid growth driven by large-scale infrastructure projects and growing home improvement markets. Key manufacturers differentiate through tool material quality, innovative design, and product durability. Market growth is fueled by demand for high-quality finishes, ease of application, and multi-purpose tools across professional painters and DIY consumers.

Painting tools differ in material, durability, and finish quality. Europe and North America favor high-quality synthetic bristles, corrosion-resistant metal parts, and ergonomic handles for professional and industrial use. In Asia-Pacific, buyers often prioritize cost-effective tools with standard materials for large-scale construction and home improvement projects. Differences in tool material affect longevity, performance, and ease of application. Established global manufacturers maintain consistent high-grade quality, while regional producers focus on affordability and bulk supply. These contrasts influence adoption patterns, consumer preference, and competitive positioning between professional-grade and cost-sensitive segments in different regions.

Ergonomic design, handle comfort, and tool weight affect usability and efficiency. European and North American professionals prioritize lightweight, anti-slip, and precision-designed tools for extended work periods. Asia-Pacific markets often adopt basic designs suitable for large-scale or DIY use. Differences in design impact painter fatigue, application accuracy, and safety compliance. Manufacturers offering ergonomic, user-friendly tools capture premium professional segments, while regional producers provide standard designs for general-purpose applications. Variations in design and usability drive adoption rates, brand perception, and competitive differentiation across regional markets.

Painting tool production depends on raw material availability, manufacturing capacity, and logistics. Europe and North America operate established facilities with high-quality output and consistent supply, whereas Asia-Pacific relies on high-volume, cost-efficient production lines. Supply chain disruptions, including raw material shortages or transportation delays, affect delivery timelines and pricing. Manufacturers with integrated operations and diversified sourcing ensure consistent availability for both professional and retail markets, while smaller regional producers may experience delays during peak construction periods. Supply chain reliability directly influences market adoption, pricing competitiveness, and long-term supplier credibility.

Painting tool adoption varies by application and region. North America and Europe emphasize professional construction, industrial coatings, and specialized finishes requiring premium tools. Asia-Pacific growth is driven by residential construction, home improvement, and commercial infrastructure projects prioritizing cost-effective solutions. Differences in end-use demand affect product specifications, marketing strategies, and supplier selection. Leading manufacturers tailor products for performance-sensitive applications, while regional producers focus on volume-oriented, standard-grade tools. Understanding these contrasts enables suppliers to optimize production, target specific markets, and maintain competitiveness across professional and mass-market segments.

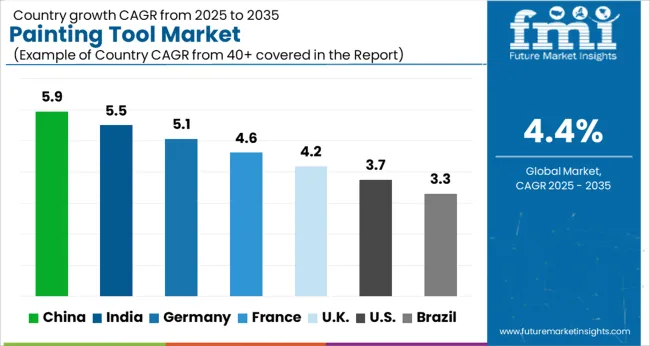

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The global painting tool market was projected to grow at a 4.4% CAGR through 2035, driven by demand in residential, commercial, and industrial painting applications. Among BRICS nations, China recorded 5.9% growth as large-scale production facilities were commissioned and compliance with quality and safety standards was enforced, while India at 5.5% growth saw expansion of manufacturing units to meet rising regional consumption. In the OECD region, Germany at 5.1% maintained substantial output under strict industrial and safety regulations, while the United Kingdom at 4.2% relied on moderate-scale operations for residential and commercial projects. The USA, expanding at 3.7%, remained a mature market with steady demand across industrial, residential, and professional sectors, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Painting tool market in China is growing at a CAGR of 5.9%. Between 2020 and 2024, growth was driven by rising construction, residential and commercial renovation projects, and demand from automotive and industrial sectors. Manufacturers focused on high quality brushes, rollers, spray guns, and application accessories to improve efficiency and precision. In the forecast period 2025 to 2035, growth is expected to accelerate with adoption of advanced painting systems, ergonomic tools, and eco-friendly materials. Urbanization, infrastructure development, and increased DIY painting trends will further support market expansion. China remains a leading market due to large construction sector, industrial activity, and growing demand for high quality painting tools.

Painting tool market in India is growing at a CAGR of 5.5%. Historical period 2020 to 2024 saw growth supported by residential and commercial construction, industrial painting, and DIY painting trends. Manufacturers focused on durable, efficient, and cost effective painting tools. Expansion of real estate, infrastructure, and automotive industries created steady demand. In the forecast period 2025 to 2035, market growth is expected to continue with adoption of advanced application tools, eco-friendly materials, and ergonomic designs. Government initiatives promoting urban housing and infrastructure projects will further support growth. India is projected to maintain strong growth due to expanding construction and industrial sectors.

Painting tool market in Germany is growing at a CAGR of 5.1%. Between 2020 and 2024, growth was supported by industrial coatings, construction, and renovation activities. Manufacturers focused on high quality, precision tools, and eco-friendly materials. In the forecast period 2025 to 2035, market growth is expected to continue steadily with adoption in advanced painting systems, automated application tools, and sustainable products. Regulatory emphasis on eco-friendly coatings, industrial modernization, and innovation in painting equipment will further support adoption. Germany remains a key European market due to strong construction and industrial sectors and demand for high performance painting tools.

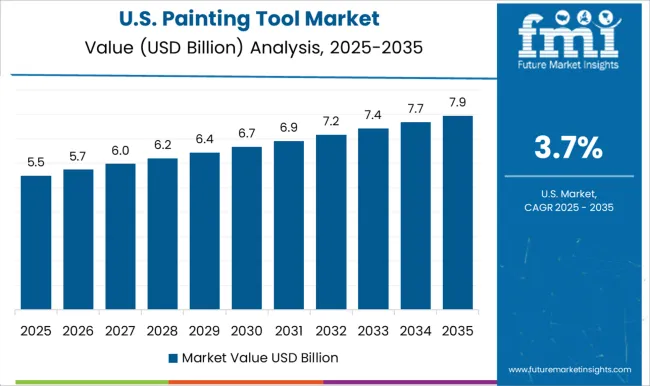

Painting tool market in the United States is growing at a CAGR of 3.7%. Historical period 2020 to 2024 saw growth driven by construction, renovation, automotive painting, and DIY home improvement. Manufacturers focused on high quality, durable, and efficient tools including brushes, rollers, and spray guns. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption of eco-friendly coatings, ergonomic designs, and automated painting systems. Urbanization, home renovation trends, and industrial painting applications will further support market expansion. The United States market demonstrates steady growth with emphasis on durability, efficiency, and sustainability.

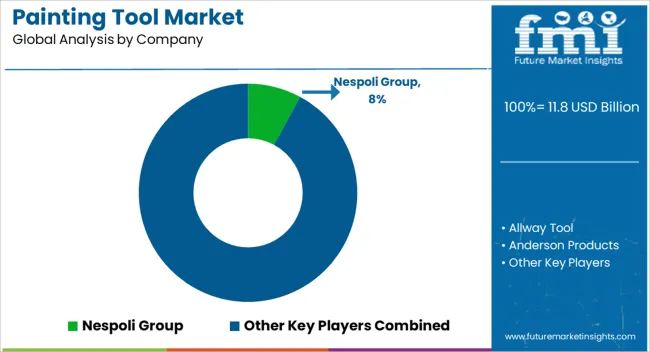

The painting tool market is supplied by Nespoli Group, Allway Tool, Anderson Products, Asian Paints, Braun Brush Co., Durapaintss, EPOS Egypt, Gordon Brush Mfg. Co., Inc, Harbor Freight Tools, JAT Transforming Spaces, MAAN, Milton Brushware, NOUR Trading House Inc, PETA Decorating, Purdy, Richard Tools, S. R. Bristle Products, TechnoChem Industries, The Mill-Rose Company, and Vishwakarma Impex, with competition shaped by brush quality, roller materials, and ergonomic design. Nespoli and Purdy brochures highlight synthetic and natural bristle brushes, roller covers, and specialty applicators, specifying filament stiffness, handle type, and paint load capacity.

Braun Brush and Gordon Brush datasheets detail multi-purpose brushes, precision tips, and durability ratings for industrial and decorative use. Asian Paints and EPOS Egypt provide technical sheets including anti-drip coatings, wear resistance, and temperature tolerance. Observed industry patterns indicate demand for efficient paint transfer, uniform coverage, and tools suitable for both professional contractors and DIY users. Market strategies focus on differentiation through product range, durability, and service support.

Nespoli and Purdy invest in high-quality bristle materials and ergonomic handles to improve control and reduce fatigue. Allway Tool, Milton Brushware, and Richard Tools target contractors and industrial applications with heavy-duty rollers, scrapers, and precision painting kits. Observed trends show suppliers emphasizing customization for paint type, surface, and application technique. Asian Paints and JAT Transforming Spaces provide complementary tool sets for residential and commercial painting projects. MAAN and Vishwakarma Impex focus on regional distribution and localized manufacturing to optimize delivery times.

Harbor Freight Tools emphasizes cost-competitive solutions for large-scale maintenance and repair operations. TechnoChem Industries and The Mill-Rose Company highlight innovative coatings and wear-resistant materials for long-term tool performance. Product brochures and technical datasheets communicate critical specifications including brush width, filament type, roller nap length, frame material, handle ergonomics, durability, and paint compatibility. Nespoli and Purdy provide charts on paint coverage per stroke, cleaning instructions, and load-bearing capacity. Gordon Brush, Braun Brush, and Asian Paints include recommended application techniques, surface compatibility, and performance under repeated use. Allway Tool, Richard Tools, and Milton Brushware highlight resistance to solvent exposure, tip retention, and ergonomic stress testing. Clear technical documentation allows contractors, painters, and hobbyists to evaluate suitability, ensuring adoption based on verified coverage efficiency, durability, and handling performance across diverse painting tasks.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.8 Billion |

| Product | Brushes, Rollers, Scrapers, Spackle Knife / Putty Joint Knife, Trays, Spray Guns, Masking Tapes, and Others (Paint Mixer, Wall Cleaners, etc.) |

| Pricing | Medium, Low, and High |

| Application | Construction, Fine art & decorative painting, Automotive, Appliances, Furniture, Industrial machineries & equipment, and Others (utilities, government marking, restoration & conversion, etc.) |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nespoli Group, Allway Tool, Anderson Products, Asian Paints, Braun Brush Co., Durapaintss, EPOS Egypt, Gordon Brush Mfg. Co., Inc, Harbor Freight Tools, JAT Transforming Spaces, MAAN, Milton Brushware, NOUR Trading House Inc, PETA Decorating, Purdy, Richard Tools, S. R. Bristle Products, TechnoChem Industries, The Mill-Rose Company, and Vishwakarma Impex |

| Additional Attributes | Dollar sales vary by tool type, including brushes, rollers, spray guns, and scrapers; by material, spanning synthetic fibers, natural bristles, metal, and plastic; by application, such as residential, commercial, and industrial painting; by end-use industry, covering construction, automotive, and manufacturing; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising construction activities, DIY trends, and demand for efficient and high-quality painting solutions. |

The global painting tool market is estimated to be valued at USD 11.8 billion in 2025.

The market size for the painting tool market is projected to reach USD 18.1 billion by 2035.

The painting tool market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in painting tool market are brushes, rollers, scrapers, spackle knife / putty joint knife, trays, spray guns, masking tapes and others (paint mixer, wall cleaners, etc.).

In terms of pricing, medium segment to command 46.7% share in the painting tool market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Painting Robots Market Size and Share Forecast Outlook 2025 to 2035

Spray Painting Machine Market Size and Share Forecast Outlook 2025 to 2035

Automotive Robotic Painting Market

Tool Holders Market Size and Share Forecast Outlook 2025 to 2035

Tool Box Market Size and Share Forecast Outlook 2025 to 2035

Tool Tethering Market Size and Share Forecast Outlook 2025 to 2035

Tool Steel Market Size and Share Forecast Outlook 2025 to 2035

Tool Presetter Market Trend Analysis Based on Product, Category, End-Use, and Region 2025 to 2035

Understanding Market Share Trends in the Tool Box Industry

Tool Holder Collets Market

Tool Chest Market

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

CNC Tool Storage System Market

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Key Players in the Hand Tools Market Share Analysis

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Smart Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Industry Analysis in India - Size, Share, and Forecast Outlook 2025 to 2035

Power Tool Gears Market - Growth & Demand 2025 to 2035

Baking Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA